Professional Documents

Culture Documents

MSAc103 Reflection 4 Theoretical Framework For CSR Practices

Uploaded by

Narcy Lyn Vendillo-MertolaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

MSAc103 Reflection 4 Theoretical Framework For CSR Practices

Uploaded by

Narcy Lyn Vendillo-MertolaCopyright:

Available Formats

VENDILLO, Narcy Lyn T.

MS Accountancy

Corporate Social Responsibility (CSR) in not new to the ears of Business majors and to the eyes of people. We have heard it

from our Ethics subjects in the undergrad or have seen a couple of school buildings adorned with the SM logo. But the theories

concerning the what, why, and how of CSR are a quite unfamiliar. To be honest, it was only during my first semester in this program that

I’ve learned about Legitimacy Theory and Stakeholder Theory in relation with Sustainability Reporting. Legitimacy theory points out

that Sustainability Reporting is a corporate communication mechanism to influence stakeholders’ image of the company; while the st-

akeholder theory is focused on the accountability of organizations.

The given journal selected social and political theories namely legitimacy, stakeholder, and institutional theories over economic

theories to explain CSR practices of companies. Fernando argues that the aforementioned social and political theories have more ability

to provide insightful perspectives on CSR practices rather than economic theories do. I agree with his contention because the three

enumerated theories touch the psychological side of CSR practices. First is the legitimacy theory suggesting that for organizations to

continue existence, they must meet the expectations of the society. This makes me think that companies do CSR activities not because of

their golden hearts for charity but in order to legitimize their operations. CSR therefore is not a mechanism that aims to benefit the

society but to create a good reputation for the organization. Second is the stakeholder theory that highlights the organizational

accountability beyond simple economic or financial performance. Unlike CSR in relation to legitimacy theory which I construed as

something done by companies to justify their existence, in stakeholder theory the conduct of CSR activities are considered as an

obligation of the organization towards its stakeholders. However, on my perspective in stakeholder theory, the organization answering to

its stakeholders is also a part of legitimization activities. The journal puts emphasis that in the managerial perspective of the stakeholder

theory, an organization is expected to be more answerable to the economically powerful stakeholders rather than all stakeholders.

Therefore most companies are giving more importance to demands of financially powerful stakeholders, the investors, critical suppliers,

among others setting aside the clamor of the minority. Favoring the powerful at times lead to companies’ unethical actions further

affecting their legitimacy if uncovered. The third theory tackled was the institutional theory which embraces the need for organizations to

conform to social norms and practices to enhance their legitimacy. Therefore, organizations are being pressured to conform to what other

organizations are applying or using in order to not lose their legitimacy or lose the competitive edge. Since most companies are

voluntarily engaging in CSR activities or disclosure, other organizations have no choice but to also do it, unless suffer the consequences.

These consequences may come in profit loss or activism from disvalued stakeholders among others.

On the process of going over the journal, I realized that these theories are also applicable to accountants in their practice. In

relation to legitimacy theory for example, accountants need to maintain an image of integrity, competence and professionalism. I order to

legitimize our image we exert effort from practicing honesty at work and stringency in applying the standards, to attending various

trainings so we can improve our level of competence. Meanwhile, with stakeholder theory we are accountable not only to the

organization where we work or its stakeholders, we are answerable to the public who expect us to do our jobs correctly and honestly in

accordance with the standards. We are answerable to almost everyone because they rely to the reports we produce, the analysis we give.

With the institutional theory, I realized that accountants face all these nerve-wracking pressures to stay afloat. We are pressured by the

practice to gain 120 Continuing Professional Development (CPD) units within three years; pressured by the overseeing regulatory bodies

to follow the generally accepted accounting principles as well as the tax laws not mentioning the reporting required by the management;

pressured by fellow accountants who have already furthered their studies; pressured by our families because of our measly income; and a

lot more pressures that we needed to comply. We have no choice to comply unless we lose our license, be reprimanded, or be left behind.

Given a deeper meaning about the three theories, I appreciate more the accounting practice. That despite all of the difficulties

and pressures, we are remaining sane and “okay” whatever that means. We are tough. Accountants are tough kinds of people. However,

despite the invested time responding to all these expectations and pressures we must also learn to give time for ourselves. Spend time

with family or hang out with friends. Amidst all the pressure, take that coffee break, book that flight, attend that concert, binge-watch that

series. Yes, it is more than important to harness oneself for the profession but leaving the other facets of life unattended is another story.

Accounting is our profession, not our entire life.

You might also like

- MSAc103 Reflection 5 Philosophy vs. TheoriesDocument2 pagesMSAc103 Reflection 5 Philosophy vs. TheoriesNarcy Lyn Vendillo-MertolaNo ratings yet

- Corporate CitizenshipDocument4 pagesCorporate CitizenshipRahma FarhatNo ratings yet

- GG 4,5,6Document6 pagesGG 4,5,6Jourdanette TarucanNo ratings yet

- Explain The Purpose of Business Organization and Their Role in SocioeconomicsDocument3 pagesExplain The Purpose of Business Organization and Their Role in SocioeconomicsJulliena BakersNo ratings yet

- Types of Corporate Social ResponsibilityDocument10 pagesTypes of Corporate Social Responsibilityrinky_trivedi100% (1)

- Academic Essay-Mohamed Falah Dawood MIC06S37-5034Document2 pagesAcademic Essay-Mohamed Falah Dawood MIC06S37-5034David D FalassNo ratings yet

- Business Ethics Individual Assignment - 1 Topic "Corporate Social Responsibility"Document7 pagesBusiness Ethics Individual Assignment - 1 Topic "Corporate Social Responsibility"Dev YaniNo ratings yet

- Business Ethics and Social ResponsibilityDocument38 pagesBusiness Ethics and Social Responsibilityparthsavani750No ratings yet

- Assignment BBCG3103 Corporate Governance Wan ZulhilmeDocument12 pagesAssignment BBCG3103 Corporate Governance Wan ZulhilmeWan ZulhilmeNo ratings yet

- Managing Ethical Issues in Human Resource ManagementDocument20 pagesManaging Ethical Issues in Human Resource ManagementSimran Barnwal0% (1)

- Reaction Paper DENSING - CSR or SEDocument3 pagesReaction Paper DENSING - CSR or SEArt Virgel DensingNo ratings yet

- MGT 7 Lesson 8Document6 pagesMGT 7 Lesson 8Puti TaeNo ratings yet

- Module 1 Ethics and BusinessDocument7 pagesModule 1 Ethics and BusinessCristeta BaysaNo ratings yet

- Social Responsibility and EthicsDocument3 pagesSocial Responsibility and EthicsRaella FernandezNo ratings yet

- Coca-Cola Case Study FaithDocument10 pagesCoca-Cola Case Study FaithLyanne Eire LopezNo ratings yet

- Reflection 1Document3 pagesReflection 1edelleevangelistaNo ratings yet

- Business Ethics - NotesDocument6 pagesBusiness Ethics - NotesLindiweNo ratings yet

- Demonstrating Ethical Behavior and Social ResponsibilityDocument10 pagesDemonstrating Ethical Behavior and Social ResponsibilityNusrat Azim BorshaNo ratings yet

- Expectation To and From Business & SocietyDocument9 pagesExpectation To and From Business & SocietySopno Bilas Sayed67% (3)

- Pwpt-111ethical Roots and Responsibility of BusinessDocument55 pagesPwpt-111ethical Roots and Responsibility of BusinessAZ AliNo ratings yet

- ValuesDocument16 pagesValuesHan HanNo ratings yet

- Amul InternshipDocument37 pagesAmul InternshipSOPANDEO NAIKWARNo ratings yet

- Midterm EssaysDocument2 pagesMidterm EssaysNathoNo ratings yet

- Business EthicsDocument12 pagesBusiness EthicsKamuniom PrakashNo ratings yet

- 382754.soukopova Duskova Bakic-TomicDocument5 pages382754.soukopova Duskova Bakic-TomicErra PeñafloridaNo ratings yet

- NSU-104 Lecture 19 & 20Document36 pagesNSU-104 Lecture 19 & 20rifat hasanNo ratings yet

- Chapter 1Document7 pagesChapter 1AmrertaNo ratings yet

- Profesional EthicsDocument8 pagesProfesional EthicsMohd FadzlyNo ratings yet

- CSR - Are For-Profit Business Responsible To The Society? Why or Why Not and To What Extent?Document3 pagesCSR - Are For-Profit Business Responsible To The Society? Why or Why Not and To What Extent?Tanya YablonskayaNo ratings yet

- What Compliance Is?: Reyes, Tricia Ann MDocument3 pagesWhat Compliance Is?: Reyes, Tricia Ann Mrysii gamesNo ratings yet

- Business Ethics Chapter 1 NotesDocument8 pagesBusiness Ethics Chapter 1 NotesEvan RouzesNo ratings yet

- Social Responsibility ReportDocument10 pagesSocial Responsibility ReportArianne MacaalayNo ratings yet

- Session 2017-18 1 (A) What Is Social Responsibility? Concept of CSR?Document10 pagesSession 2017-18 1 (A) What Is Social Responsibility? Concept of CSR?Shakil SaikotNo ratings yet

- Legitimacy TheoryDocument6 pagesLegitimacy TheoryFakoyede OluwapamilerinNo ratings yet

- CSR TCSDocument35 pagesCSR TCSAniket SawantNo ratings yet

- Business Ethics (Also Corporate Ethics) Is A Form of Applied Ethics or ProfessionalDocument21 pagesBusiness Ethics (Also Corporate Ethics) Is A Form of Applied Ethics or ProfessionalSanket Jadhav100% (1)

- Professional EthicsDocument15 pagesProfessional Ethicskaranij2No ratings yet

- Business Ethics and Social ResponsibilityDocument56 pagesBusiness Ethics and Social ResponsibilityAntónio SoeiroNo ratings yet

- Analyzing The Barriers To CSRDocument16 pagesAnalyzing The Barriers To CSRPriyanka SharmaNo ratings yet

- Q1 Business Ethics m2 w2Document13 pagesQ1 Business Ethics m2 w2sarah fojasNo ratings yet

- BUS SOC Chapter 1: The Corporation and Its StakeholdersDocument14 pagesBUS SOC Chapter 1: The Corporation and Its StakeholdersRaiyan JavedNo ratings yet

- Business Ethics ModuleDocument8 pagesBusiness Ethics ModuleSharina PaorNo ratings yet

- Critical Reflection On Corporate Social Responsibility Projects Accounting EssayDocument3 pagesCritical Reflection On Corporate Social Responsibility Projects Accounting Essaysoutheast1No ratings yet

- Chapter 2:stakeholder Relationships, Social Responsibility, and Corporate GovernanceDocument43 pagesChapter 2:stakeholder Relationships, Social Responsibility, and Corporate GovernanceKhoai TâyNo ratings yet

- Academic Script PDFDocument11 pagesAcademic Script PDFShihab ChiyaNo ratings yet

- Module 9Document1 pageModule 9joffer idagoNo ratings yet

- 1 Business EthicsDocument5 pages1 Business EthicsSydney CagatinNo ratings yet

- Midterm Test - EthicsDocument16 pagesMidterm Test - EthicsKristiantoWicaksanaNo ratings yet

- Corporate Social ResponsibilityDocument10 pagesCorporate Social ResponsibilityGarima AgrawalNo ratings yet

- Benefits of CSRDocument7 pagesBenefits of CSRManraj kaurNo ratings yet

- Corporate Social Responsibility (CSR) : By: Ms. Rona Sarah C. Fernandez, MBADocument10 pagesCorporate Social Responsibility (CSR) : By: Ms. Rona Sarah C. Fernandez, MBAronski17No ratings yet

- CC FileDocument26 pagesCC FileRiddhi BansalNo ratings yet

- Chapter The Ethical and Social EnvironmentDocument4 pagesChapter The Ethical and Social EnvironmentShahriar MatinNo ratings yet

- What Is Good For Individuals and SocietyDocument7 pagesWhat Is Good For Individuals and Societysarita sahooNo ratings yet

- The Role of Business in SocietyDocument4 pagesThe Role of Business in SocietyEmil BarengNo ratings yet

- Research Method AmirDocument15 pagesResearch Method AmirFida HussainNo ratings yet

- The Entrepreneurial Establishment of A Nonprofit OrganizationDocument19 pagesThe Entrepreneurial Establishment of A Nonprofit OrganizationkarusmanNo ratings yet

- Ethics Assignment 3Document2 pagesEthics Assignment 3amir azamNo ratings yet

- Can Profitability & Morality Co-ExistDocument38 pagesCan Profitability & Morality Co-ExistRohit Pillai75% (4)

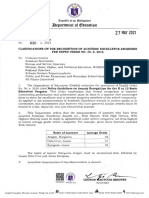

- DM - s2021 - 030 Clarifications On Acad Excellence AwardDocument2 pagesDM - s2021 - 030 Clarifications On Acad Excellence AwardLavander BlushNo ratings yet

- Police Operational PlanningDocument140 pagesPolice Operational PlanningChristopher PerazNo ratings yet

- US ConstitutionDocument73 pagesUS Constitutionliz kawiNo ratings yet

- Sustainable Development: Meaning, Principles, Pillars, and Implications For Human Action: Literature ReviewDocument30 pagesSustainable Development: Meaning, Principles, Pillars, and Implications For Human Action: Literature ReviewAda AlapaNo ratings yet

- OGP Emcee ScriptDocument4 pagesOGP Emcee ScriptLn Grasheey100% (1)

- CB LICENCE IS LIFE TIME Circular-No-17-2021-rDocument2 pagesCB LICENCE IS LIFE TIME Circular-No-17-2021-rganeshNo ratings yet

- Delinquent Tax Sale: Real EstateDocument3 pagesDelinquent Tax Sale: Real EstateUSA TODAY100% (2)

- Sample - Principle of Management MCQsDocument4 pagesSample - Principle of Management MCQsAsad Ali100% (2)

- Gender Mainstreaming and Equality Concepts, Theories and PracticesDocument27 pagesGender Mainstreaming and Equality Concepts, Theories and Practicesaamino abdirahmanNo ratings yet

- International Business Class No 2Document46 pagesInternational Business Class No 2JavidNo ratings yet

- DPSPS: The Advices of The ConstitutionDocument11 pagesDPSPS: The Advices of The ConstitutionNisha DixitNo ratings yet

- International Finance Corporation - Corporate Governance Manual, Second Edition - IFC (2010) PDFDocument618 pagesInternational Finance Corporation - Corporate Governance Manual, Second Edition - IFC (2010) PDFSamael LightbringerNo ratings yet

- Socialscience PDFDocument101 pagesSocialscience PDFSterling VasconcellosNo ratings yet

- Making Food StandardsDocument13 pagesMaking Food StandardssornarajendranNo ratings yet

- Habitat International: Nor'Aini Yusof, Mohd Wira Mohd Shafiei, Sofri Yahya, Marwani RidzuanDocument6 pagesHabitat International: Nor'Aini Yusof, Mohd Wira Mohd Shafiei, Sofri Yahya, Marwani RidzuanZahin SamsudinNo ratings yet

- Herwig C. H. Hofmann, Alexander H. Türk - Legal Challenges in EU Administrative Law - Towards An Integrated Administration-Edward Elgar Pub (2009)Document408 pagesHerwig C. H. Hofmann, Alexander H. Türk - Legal Challenges in EU Administrative Law - Towards An Integrated Administration-Edward Elgar Pub (2009)Andreea Irina100% (1)

- Panchayati Raj - 73rd Constitutional Amendment ActDocument7 pagesPanchayati Raj - 73rd Constitutional Amendment ActSania SharmaNo ratings yet

- Bayan Muna v. ErmitaDocument6 pagesBayan Muna v. ErmitaLESTERROHN ASERONNo ratings yet

- In This Chapter, Look For The Answers To These Questions:: Chapter 11 Public Goods and Common ResourcesDocument20 pagesIn This Chapter, Look For The Answers To These Questions:: Chapter 11 Public Goods and Common Resourcesco lamNo ratings yet

- Research Project On Kross CycleDocument18 pagesResearch Project On Kross CycleRAJAN SINGHNo ratings yet

- Self-Check Activities: Thinking BeyondDocument3 pagesSelf-Check Activities: Thinking BeyondAngelie Shan NavarroNo ratings yet

- Piyush Soni SMDocument60 pagesPiyush Soni SMPiyush SoniNo ratings yet

- Bsbops504 - 922327959Document16 pagesBsbops504 - 922327959Anushtha singhNo ratings yet

- PR ProjectDocument44 pagesPR ProjectbvenugopalnaiduNo ratings yet

- A Guide To Implementing The POPIADocument21 pagesA Guide To Implementing The POPIABheki TshimedziNo ratings yet

- Taxation and Fiscal Policy: First Semester 2020/2021Document33 pagesTaxation and Fiscal Policy: First Semester 2020/2021emeraldNo ratings yet

- Grp-3 Case Study 6 China-IndiaDocument3 pagesGrp-3 Case Study 6 China-IndiaRoisu De KuriNo ratings yet

- Notes in Constitutional Law: Villavicencio vs. Lukban, GR L-14639, March 25, 1919Document3 pagesNotes in Constitutional Law: Villavicencio vs. Lukban, GR L-14639, March 25, 1919vj hernandezNo ratings yet

- Death Certificate Format in BangladeshDocument25 pagesDeath Certificate Format in BangladeshAnkan DasNo ratings yet

- Udhr PDFDocument8 pagesUdhr PDFRea OrocNo ratings yet

- The Coaching Habit: Say Less, Ask More & Change the Way You Lead ForeverFrom EverandThe Coaching Habit: Say Less, Ask More & Change the Way You Lead ForeverRating: 4.5 out of 5 stars4.5/5 (186)

- Scaling Up: How a Few Companies Make It...and Why the Rest Don't, Rockefeller Habits 2.0From EverandScaling Up: How a Few Companies Make It...and Why the Rest Don't, Rockefeller Habits 2.0Rating: 5 out of 5 stars5/5 (1)

- Transformed: Moving to the Product Operating ModelFrom EverandTransformed: Moving to the Product Operating ModelRating: 4 out of 5 stars4/5 (1)

- Spark: How to Lead Yourself and Others to Greater SuccessFrom EverandSpark: How to Lead Yourself and Others to Greater SuccessRating: 4.5 out of 5 stars4.5/5 (131)

- The 7 Habits of Highly Effective PeopleFrom EverandThe 7 Habits of Highly Effective PeopleRating: 4 out of 5 stars4/5 (2564)

- How to Talk to Anyone at Work: 72 Little Tricks for Big Success Communicating on the JobFrom EverandHow to Talk to Anyone at Work: 72 Little Tricks for Big Success Communicating on the JobRating: 4.5 out of 5 stars4.5/5 (36)

- The First Minute: How to start conversations that get resultsFrom EverandThe First Minute: How to start conversations that get resultsRating: 4.5 out of 5 stars4.5/5 (57)

- Unlocking Potential: 7 Coaching Skills That Transform Individuals, Teams, & OrganizationsFrom EverandUnlocking Potential: 7 Coaching Skills That Transform Individuals, Teams, & OrganizationsRating: 4.5 out of 5 stars4.5/5 (28)

- How to Lead: Wisdom from the World's Greatest CEOs, Founders, and Game ChangersFrom EverandHow to Lead: Wisdom from the World's Greatest CEOs, Founders, and Game ChangersRating: 4.5 out of 5 stars4.5/5 (95)

- The Introverted Leader: Building on Your Quiet StrengthFrom EverandThe Introverted Leader: Building on Your Quiet StrengthRating: 4.5 out of 5 stars4.5/5 (35)

- Transformed: Moving to the Product Operating ModelFrom EverandTransformed: Moving to the Product Operating ModelRating: 4 out of 5 stars4/5 (1)

- The E-Myth Revisited: Why Most Small Businesses Don't Work andFrom EverandThe E-Myth Revisited: Why Most Small Businesses Don't Work andRating: 4.5 out of 5 stars4.5/5 (709)

- 300+ PMP Practice Questions Aligned with PMBOK 7, Agile Methods, and Key Process Groups - 2024: First EditionFrom Everand300+ PMP Practice Questions Aligned with PMBOK 7, Agile Methods, and Key Process Groups - 2024: First EditionNo ratings yet

- The 12 Week Year: Get More Done in 12 Weeks than Others Do in 12 MonthsFrom EverandThe 12 Week Year: Get More Done in 12 Weeks than Others Do in 12 MonthsRating: 4.5 out of 5 stars4.5/5 (411)

- Billion Dollar Lessons: What You Can Learn from the Most Inexcusable Business Failures of the Last Twenty-five YearsFrom EverandBillion Dollar Lessons: What You Can Learn from the Most Inexcusable Business Failures of the Last Twenty-five YearsRating: 4.5 out of 5 stars4.5/5 (52)

- The 4 Disciplines of Execution: Revised and Updated: Achieving Your Wildly Important GoalsFrom EverandThe 4 Disciplines of Execution: Revised and Updated: Achieving Your Wildly Important GoalsRating: 4.5 out of 5 stars4.5/5 (48)

- Work the System: The Simple Mechanics of Making More and Working Less (4th Edition)From EverandWork the System: The Simple Mechanics of Making More and Working Less (4th Edition)Rating: 4.5 out of 5 stars4.5/5 (23)

- Work Stronger: Habits for More Energy, Less Stress, and Higher Performance at WorkFrom EverandWork Stronger: Habits for More Energy, Less Stress, and Higher Performance at WorkRating: 4.5 out of 5 stars4.5/5 (12)

- The Lean Product Playbook: How to Innovate with Minimum Viable Products and Rapid Customer FeedbackFrom EverandThe Lean Product Playbook: How to Innovate with Minimum Viable Products and Rapid Customer FeedbackRating: 4.5 out of 5 stars4.5/5 (81)

- 25 Ways to Win with People: How to Make Others Feel Like a Million BucksFrom Everand25 Ways to Win with People: How to Make Others Feel Like a Million BucksRating: 5 out of 5 stars5/5 (36)

- Good to Great by Jim Collins - Book Summary: Why Some Companies Make the Leap...And Others Don'tFrom EverandGood to Great by Jim Collins - Book Summary: Why Some Companies Make the Leap...And Others Don'tRating: 4.5 out of 5 stars4.5/5 (63)

- The Friction Project: How Smart Leaders Make the Right Things Easier and the Wrong Things HarderFrom EverandThe Friction Project: How Smart Leaders Make the Right Things Easier and the Wrong Things HarderNo ratings yet

- How the World Sees You: Discover Your Highest Value Through the Science of FascinationFrom EverandHow the World Sees You: Discover Your Highest Value Through the Science of FascinationRating: 4 out of 5 stars4/5 (7)

- The Power of People Skills: How to Eliminate 90% of Your HR Problems and Dramatically Increase Team and Company Morale and PerformanceFrom EverandThe Power of People Skills: How to Eliminate 90% of Your HR Problems and Dramatically Increase Team and Company Morale and PerformanceRating: 5 out of 5 stars5/5 (22)

- Agile: The Insights You Need from Harvard Business ReviewFrom EverandAgile: The Insights You Need from Harvard Business ReviewRating: 4.5 out of 5 stars4.5/5 (34)

- Trillion Dollar Coach: The Leadership Playbook of Silicon Valley's Bill CampbellFrom EverandTrillion Dollar Coach: The Leadership Playbook of Silicon Valley's Bill CampbellRating: 4.5 out of 5 stars4.5/5 (626)