Professional Documents

Culture Documents

20210716025409prepaid Brochure - 2021-07 (July 02)

Uploaded by

danica gregorioOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

20210716025409prepaid Brochure - 2021-07 (July 02)

Uploaded by

danica gregorioCopyright:

Available Formats

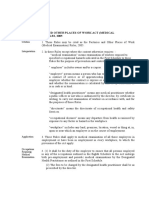

SELECT PREPAID

INSURANCE PLANS

Affordable plans that will allow you to avail of

cash assistance for emergencies, dengue and

prescribed medicines.

With Pacific Cross, you’ll have peace of mind that

comes from knowing that you and your loved ones

are protected in every way.

We offer you our Select Prepaid Insurance Plans

Get yours today and avail of cash assistance for medical emergencies,

dengue and prescribed medicines.

Select ER

Enjoy cashless medical treatment or cash assistance worth

PHP 5,000 and PHP 20,000 (depending on the card variant

bought) for emergencies due to illness or accident.

Select DengueGuard

Receive cash assistance worth PHP 10,000 for

medically diagnosed Dengue. No hospitalization

required.

Select MedSecure

Reimburse up to PHP 2,000 worth

of prescribed medicines post-

hospitalization.

Pacific Cross | Select Prepaid Insurance Plans Page 2 of 8

Overview | Plan Benefits

Please read your Policy for the full terms, conditions and limitations.

• Get coverage for medical • Enjoy cash assistance worth • Avail of one-time

treatment for emergency PHP 10,000 for medically reimbursement for the

condition as Out-Patient or diagnosed Dengue. actual amount of prescribed

In-Patient in any hospital. • Available to persons of all medicines, vitamins and

• Available to persons age 15 ages. supplements of the Insured

days old up to 65 years old • Symptoms for Dengue Person as part of a follow-

upon registration. should have occurred after up care within 90 days post

• Gives you the option to 15 days from the date hospitalization.

avail of no-cash-outlay of activation in order to • Hospitalization should have

emergency out-patient successfully avail of this occurred after 15 days from

treatment using our benefit. date of activation.

accredited network • Symptoms, consultations • Available to persons age 15

of hospitals, or file and laboratory tests related days old up to 60 years old

your eligible claims for to Dengue should have upon registration.

reimbursement in the event occurred after 15 days from • Motor vehicular accidents

that you choose not to go the date of activation in are covered provided that

to an accredited medical order to successfully avail the incident happened

provider. of this benefit. during the coverage period

• Receive a lump sum • Hospitalization is not plus 15 days from date of

cash assistance for required. Medical activation.

emergency cases leading to document/s indicating • The reimbursement can

confinement regardless of proof of contracting amount up to PHP 2,000.

the incurred amount. Dengue is needed.

Premiums

Select ER Select DengueGuard Select MedSecure

(In Philippine Peso) (In Philippine Peso) (In Philippine Peso)

Maximum Benefit Limit (MBL) ₱ 20,000.00 ₱ 5,000.00 ₱ 10,000.00 ₱ 2,000.00

Premium

₱ 1,199.00 ₱ 499.00 ₱ 325.00 ₱ 549.00

ISSUE AGE

Select ER Select DengueGuard Select MedSecure

15 days old to 65 years old Available to persons of all ages 15 days old to 60 years old

Pacific Cross | Select Prepaid Insurance Plans Page 3 of 8

Important Notes

• Pre-Existing Conditions • Coverage will begin • Coverage will begin

(PEC) are covered, with 15 calendar days after 15 calendar days after

7 calendar days waiting successful registration. successful registration.

period upon sucessful • Use of Select DengueGuard • Pre-Existing Conditions

registration. is subject to one-time (PEC) are covered, with

• For Select ER Out-patient availment for one (1) 15 calendar days waiting

availment, it is required that Dengue case, per coverage period upon purchase of

the client is accommodated year. Select MedSecure.

for treatment in the • Coverage will be exhausted • Use of Select MedSecure

Emergency Room after one (1) year of non- is subject to one-time

Department of a hospital. usage or immediately upon availment of all medicines,

• Use of Select ER is subject approval of eligible claims, vitamins and supplements

to one-time availment for whichever occurs first. prescribed within 90 days

one (1) emergency case/ • Multiple purchases are immediately following the

condition at a time. allowed. However, only one discharge from Hospital

• Coverage will be exhausted (1) Select DengueGuard can Confinement of a covered

after one (1) year of non- be registered and activated illness as a follow-up care.

usage or immediately upon per individual at a time. • Coverage will be exhausted

approval of eligible claims, after one (1) year of non-

whichever occurs first. usage or immediately upon

• This benefit can be used on approval of eligible claims,

top of your PhilHealth and/ whichever occurs first.

or any other HMO/Medical • Multiple purchases are

Plans. allowed. However, only one

• Multiple purchases are (1) Select MedSecure can

allowed but can register be registered and activated

the succeding coverage per individual at a time.

after two (2) months or 60

days interval period from

prior availment.

Pacific Cross | Select Prepaid Insurance Plans Page 4 of 8

Step-by-Step Guide in Buying

a Pacific Cross Select Prepaid Insurance Plan Online

1

Go to

https://www.medexpress.com.ph

and click on Order Online button.

2

Choose your preferred option

on how you want your order to

be served. Indicate your City

and/or Barangay.

3

Search for the product.

In the blank field, type in

“PACIFIC CROSS”.

Choose your preferred prepaid

4

insurance plan, decide on the

number of plans you want to

purchase, and click on Add to

Basket.

5

After checking your order/s,

click on Checkout.

6

Indicate your mobile number

in the Mobile No. field.

7

Provide your Personal

Details.

There are other ways to get

a Pacific Cross Select Prepaid

8 Choose your preferred Insurance Plan, you can also

Payment Option. buy via over the counter at

select MedExpress Drugstores

or call the MedExpress Call

9

Check order details and click Center through telephone

on Submit to confirm your

purchase. number +63 2 8333-3333.

Pacific Cross | Select Prepaid Insurance Plans Page 5 of 8

FREQUENTLY ASKED QUESTIONS

Q: What is the eligibility age in order to avail of a Select Prepaid Insurance Plan?

A: For Select ER, issue age is 15 days old to 65 years old, while for Select MedSecure issue age is 15 days old

to 60 years old. For Select DengueGuard, no eligibility age is required.

Q: Can I use my Select Prepaid Insurance Plan immediately right after successful registration?

A: No. An Activation Period will follow upon successful registration. For Select ER, 7 calendar days waiting

period will be observed. For Select MedSecure and Select DengueGuard, 15 calendar days waiting period

will be applied.

Q: Can I buy more than one (1) Select Prepaid Insurance Plan and register all under my name?

A: The Client may purchase more than one (1) prepaid insurance of the same product from other Pacific

Cross partners. However, only one (1) prepaid insurance of the same product can be registered and

activated per Individual at a given time. For Select ER, the Client may only register the second prepaid

insurance under his/her name 60 calendar days after the claim has been approved. If the claim is denied,

the prepaid insurance will still remain to be active.

Q: I already used my previous prepaid insurance, can I still buy and register for the same Select Prepaid

Insurance Plan?

A: No. For Select ER, the Client may only register the second prepaid insurance under his/her name 60

calendar days after the claim has been approved. For Select MedSecure and Select DengueGuard, once

the claim has been approved or the Policy expires, the second prepaid insurance can be registered

immediately after the previous policy.

Q: Will I be able to utilize the remaining balance of my coverage if my availment did not reach the maximum

benefit limit?

A: No. A Select Prepaid Insurance Plan is subject to one-time use only. Coverage will be terminated once

claim is approved. For Select MedSecure, it is suggested that receipts are collated for one-time submission

for a particular confinement. An initial submission of receipt will be considered as a one-time use already,

even if the succeeding receipts are related to the same illness.

Q: How do I file a claim?

A: Please submit the necessary claims requirements to Pacific Cross Customer Services team via e-mail

claims@pacificcross.com.ph.

Q: What are the requirements when filing for a claim?

A: A completely filled out and submitted Notification of Claim (NOC) Form together with the submission

of necessary Claims Requirements as outlined in the NOC Form. A copy of the NOC Form is available at

www.pacificcross.com.ph.

Q: Can I submit photocopy/ies of Official Receipt/s (OR) only?

A: For Select ER Out-Patient with claims worth PHP 10,000 and below the maximum benefit limit, an original

O.R. is not required. For Select ER Out-Patient with claims worth above PHP 10,000 and with an O.R. amount

higher than PHP 10,000, original O.R. is required. For Select MedSecure, original O.R. is not required.

Q: What happens to my coverage if my claim was denied?

A: If the claim was denied, the Select Prepaid Insurance will remain active within its validity period.

Q: Where can I inquire about the status of my claim?

A: Please get in touch with the Pacific Cross Customer Services team via e-mail client_services@pacificcross.

com.ph or call the Pacific Cross Hotline at +63 2 8230-8511.

Q: How will I receive my claims reimbursements?

A: Pacific Cross will credit the approved claims reimbursement of the Client to his/her nominated bank account.

Pacific Cross | Select Prepaid Insurance Plans Page 6 of 8

EXCLUSIONS

Please read your Policy for the complete list of exclusions.

1. Confinement required wholly for executive check-ups, routine medical examinations or

check-ups or Confinement purely for diagnostic purposes, hearing test or any service

and treatment that are deemed unnecessary by the Company to the physical and

mental conditions involve.

2. Screening and treatment of congenital, heredo-familial, developmental abnormalities,

birth defect and complications arising therefrom.

3. Screening and treatments for Sexually Transmitted Diseases (STD), Acquired

Immunodeficiency Syndrome (AIDS), AIDS-Related Complex (ARC), Erectile Dysfunction

Syndrome and all complications arising therefrom.

4. Pregnancy related expenses and screening, childbirth, surgical delivery, miscarriage,

abortion including its complications, pre-natal or post-natal care as well as nursing care

for a newborn child.

5. Psychotic, mental or nervous/anxiety disorders, degenerative brain disorder including

any neuroses and their physiological or psychosomatic manifestations.

6. Injury or Illness arising directly or indirectly out of excessive consumption of alcohol,

misuse or irrational use of drugs/medications, solvent/substance or any addicting and

habit-forming drugs which cause complications that will require treatment or medical

intervention. Excessive consumption of alcohol is characterized by the Insured Person’s

alcohol level being above the normal range of such alcohol test.

7. Treatments or services arising from suicide, attempted suicide or intentionally self-

inflicted Injury.

8. Natural Catastrophes; Injuries or Illness arising out of epidemics including military/

paramilitary epidemics which are declared by any local, regional or international agency

or organization authorized to address health issues in the local and national geographical

area or country.

9. Injury or disease arising out of duties of employment or professions with physical hazard.

10. Participating in, but not limited to, the following activities including the practice and

actual competition: Auto racing, professional sports, Contact Sports, winter sports

except recreational skiing within authorized tracks, racing other than foot racing,

motorcycling (except daily use for transportation on a paved road), dressage, skydiving,

parasailing, hang gliding, flying (other than as a fare paying passenger on a duly licensed

commercial aircraft), caving, rock or mountain climbing (with or without the use of

ropes or other equipment), bungee jumping, polo, steeplechasing, hitchhiking, sport

diving, non-Recreational Scuba Diving as defined in the Policy, or any hazardous activity,

unless declared to and accepted by the Company.

Pacific Cross | Select Prepaid Insurance Plans Page 7 of 8

Our Companies

Pacific Cross Insurance, Inc. and

Pacific Cross Health Care, Inc.

Pacific Cross is EXCELLENCE.

We are committed to bringing nothing but

the best to our clients. Our decisions are based on

an intricate understanding of our clients’ needs,

demands and expectations. We strive to create

and innovate programs that will best serve our

To learn more,

customers.

call +63 2 8230-8511 or

Pacific Cross is STABILITY.

visit www.pacificcross.com.ph

We are one of the leading and most financially

stable companies in the industry today. Our To buy online, please visit

Premiums Earned in recent years put us in the top www.medexpress.com.ph

10 non-life insurance companies in the Philippines.

HEAD OFFICE

Pacific Cross Center, 8000 Makati Avenue, 1200 Makati City,

Pacific Cross is EXPERIENCE. Metro Manila, Philippines

We draw from over 70 years of experience in Tel. No.: +63 2 8230-8511 Fax No.: +63 2 8230-8572

the insurance industry. Our actions are guided by E-mail: info@pacificcross.com.ph

a deep insight brought about by the knowledge we CEBU

have gained through the years. Units 102 & 202, Avagar Building,

No. 09 Escario corner Molave Streets,

Lahug, Cebu City

Pacific Cross is CUSTOMER SERVICE. Tel. Nos.: +63 32 233-5812, +63 32 233-5816,

We are rooted in a commitment to ever +63 32 416-4468

improving customer service. We aim to be Fax No.: +63 32 233-5814

E-mail: cebu@pacificcross.com.ph

continuously progressive and professional. Our

commendable track record and competent support CLARK

2nd Floor, The Medical City Clark, 100 Gatwick Gateway,

staff ensure that you are given immediate and

Clark Global City, Clark Freeport Zone,

excellent service at all times. Pampanga, 2023, Philippines

Mobile Nos.: +63 917 174-0149, +63 956 759-6256,

+63 928 348-1907

Pacific Cross is a PARTNERSHIP OF TRUST. E-mail: markanthony_gabriel@pacificcross.com.ph,

We build and value enduring relationships. We kevin_ilagan@pacificcross.com.ph

consistently prove that we are worthy of the highest

DAVAO

confidence — by our strict standards, the integrity 2nd Floor, Left Wing, Door No. 6 Matina Town Square,

of our promises and the results we deliver. In the Mac Arthur Highway, Matina, Davao City

event of a crisis, we assure you that Pacific Cross Tel. No.: +63 82 297-7314 Telefax: +63 82 297-7151

E-mail: davao@pacificcross.com.ph

will be your friend and ally.

We also have Agency Offices in:

Luzon: Cavite | Laguna | Manila | Naga | Palawan | Pampanga | Taguig

VisMin: Bacolod | Bohol | Butuan | Cagayan de Oro | Dumaguete | General Santos

V07.21

You might also like

- Dengue BrochureDocument3 pagesDengue BrochureDr Ankit PardhiNo ratings yet

- 20210326092901select Brochure Full - 01 April 2021Document12 pages20210326092901select Brochure Full - 01 April 2021iqbal_anggaraNo ratings yet

- BandhanDocument31 pagesBandhanCNo ratings yet

- MARIUS CALDERON - Global Health Access Gold Lite Plus WorldwideDocument7 pagesMARIUS CALDERON - Global Health Access Gold Lite Plus WorldwideJULIUS TIBERIONo ratings yet

- 01-Select Brochure Full - 2023-10Document16 pages01-Select Brochure Full - 2023-10Juliet CoNo ratings yet

- Bupa CarePro Consolidated 2017Document30 pagesBupa CarePro Consolidated 2017SSNo ratings yet

- Pacific Cross - 2020-10 (October 01)Document12 pagesPacific Cross - 2020-10 (October 01)Eeza OrtileNo ratings yet

- Healthpremia BroucherDocument18 pagesHealthpremia BroucherAmit DeswalNo ratings yet

- Select Brochure Full - 2022 10 (October 01)Document12 pagesSelect Brochure Full - 2022 10 (October 01)Erl D. MelitanteNo ratings yet

- HDFC Ergo Health Optima Super BrochureDocument8 pagesHDFC Ergo Health Optima Super BrochureKobusNo ratings yet

- TARCILA DUMALUS - Global Health Access Gold Lite Plus Worldwide Ex UDocument7 pagesTARCILA DUMALUS - Global Health Access Gold Lite Plus Worldwide Ex UJULIUS TIBERIONo ratings yet

- Murali Mama Health IssurenceDocument9 pagesMurali Mama Health Issurence10ashvikaaNo ratings yet

- Premier: A Medical Insurance Plan For Senior CitizensDocument8 pagesPremier: A Medical Insurance Plan For Senior CitizensStefNo ratings yet

- Specific Disease Plans: Group MembersDocument17 pagesSpecific Disease Plans: Group MembersSheshadri HkNo ratings yet

- MedisurePlusbrochure PDFDocument18 pagesMedisurePlusbrochure PDFcrejocNo ratings yet

- MediclaimDocument21 pagesMediclaimjkscalNo ratings yet

- 20191016094353lifestyle Brochure October V09.19Document7 pages20191016094353lifestyle Brochure October V09.19Volume Prints PhilippinesNo ratings yet

- SmartCare Optimum Brochure - Eng PDFDocument6 pagesSmartCare Optimum Brochure - Eng PDFTomNo ratings yet

- PRUlink One EngDocument11 pagesPRUlink One Engsabrewilde29No ratings yet

- 20230117032741premier Brochure Full - 2023-01 (January 17)Document8 pages20230117032741premier Brochure Full - 2023-01 (January 17)jadetorresNo ratings yet

- Dengue Care BrochureDocument3 pagesDengue Care BrochureRobin VermaNo ratings yet

- Citibank Insurance Services - Know All About InsuranceDocument26 pagesCitibank Insurance Services - Know All About InsurancekartheekbeeramjulaNo ratings yet

- 1 Health ProtectorDocument1 page1 Health ProtectorKhairul RafiziNo ratings yet

- Bupa Care Kid Consolidate 2017Document27 pagesBupa Care Kid Consolidate 2017SSNo ratings yet

- Cin: U66010pn2000plc015329, Uin: Bajhlip21005v022021 1Document20 pagesCin: U66010pn2000plc015329, Uin: Bajhlip21005v022021 1rajeshmsitNo ratings yet

- Digit Coronavirus Product (Indemnity) - Faqs: ND RDDocument2 pagesDigit Coronavirus Product (Indemnity) - Faqs: ND RDVishal MandlikNo ratings yet

- Corona Kavach PolicyDocument27 pagesCorona Kavach PolicyMichaelNo ratings yet

- Proposal For: Insurer: Date Created: Class Name:: Enhanced Plan - CareDocument7 pagesProposal For: Insurer: Date Created: Class Name:: Enhanced Plan - CareUSMAN MIRNo ratings yet

- Whonsi Info Descrcover Consult enDocument28 pagesWhonsi Info Descrcover Consult enjol15No ratings yet

- S. NO. Title Description: Group Health (Floater) InsuranceDocument4 pagesS. NO. Title Description: Group Health (Floater) Insurancejay rawatNo ratings yet

- Health Wallet BrochureDocument8 pagesHealth Wallet BrochureKanchan ChoudhuryNo ratings yet

- Medi Claim FAQsDocument9 pagesMedi Claim FAQsMOVIES BRONo ratings yet

- Hospital CashDocument5 pagesHospital CashShakil RubaniNo ratings yet

- A Heart Surgery Will Not Stop You From Getting A Health InsuranceDocument8 pagesA Heart Surgery Will Not Stop You From Getting A Health Insurancepriyanka shahNo ratings yet

- Care HeartDocument8 pagesCare HeartrahulbihaniNo ratings yet

- Services PVT LTD Scheme Doc CareDocument30 pagesServices PVT LTD Scheme Doc CareEarly Learning ZoneNo ratings yet

- Corona Kavach Policy - HO UIICDocument39 pagesCorona Kavach Policy - HO UIICamit_264No ratings yet

- HeathGuard BrochureDocument2 pagesHeathGuard BrochureKumud GandhiNo ratings yet

- Health Guard Brochure A5 R6Document31 pagesHealth Guard Brochure A5 R6Dipak KaleNo ratings yet

- Health Guard BrochureDocument31 pagesHealth Guard BrochurenaguficoNo ratings yet

- Health Guard: Bajaj AllianzDocument20 pagesHealth Guard: Bajaj Allianzgrr.homeNo ratings yet

- Work and Travel Brochure 2021-2022Document11 pagesWork and Travel Brochure 2021-2022Joaquin Soto AlmonacidNo ratings yet

- Health Guard BrochureDocument31 pagesHealth Guard BrochuresuryaNo ratings yet

- Health-Booster BrochureDocument10 pagesHealth-Booster BrochureParasaram SrinivasNo ratings yet

- Digit Illness Group Insurance Cover-Facility For ICSI (Institute of Company Secretaries) Members, Students and EmployeesDocument2 pagesDigit Illness Group Insurance Cover-Facility For ICSI (Institute of Company Secretaries) Members, Students and EmployeesAbhinay KumarNo ratings yet

- FAQ-Go Digit Voluntary Covid PlanDocument4 pagesFAQ-Go Digit Voluntary Covid PlanVenkatesh NarisettyNo ratings yet

- Individual Medical Policy For Dependents - Dmed: Table of BenefitsDocument6 pagesIndividual Medical Policy For Dependents - Dmed: Table of Benefitsrahul sNo ratings yet

- Dis Chem Health - Day To Day - 2023 - Summary of CoverDocument5 pagesDis Chem Health - Day To Day - 2023 - Summary of CoverTalita JonkerNo ratings yet

- Cin: U66010pn2000plc015329, Uin: Bajhlip21005v022021 1Document20 pagesCin: U66010pn2000plc015329, Uin: Bajhlip21005v022021 1patelmitulvNo ratings yet

- Individual Medical Policy For Employees - Emed: Table of BenefitsDocument6 pagesIndividual Medical Policy For Employees - Emed: Table of Benefitsrahul sNo ratings yet

- Icici Lombard: ICICI Lombard GIC Ltd. Is The Largest Private Sector GeneralDocument35 pagesIcici Lombard: ICICI Lombard GIC Ltd. Is The Largest Private Sector Generalabhimanu_sehgalNo ratings yet

- Company Profile: Bajaj Allianz General Insurance Company LinitedDocument27 pagesCompany Profile: Bajaj Allianz General Insurance Company Linitedsidhantha100% (1)

- Whonsi Info Descrcover Consult enDocument20 pagesWhonsi Info Descrcover Consult enyaimarli menciasNo ratings yet

- HDFC ERGO Dengue-Prospectus2Document6 pagesHDFC ERGO Dengue-Prospectus2Anto MichealNo ratings yet

- Health InsuranceDocument25 pagesHealth Insurancepradeep3673No ratings yet

- Brochure Online PDFDocument3 pagesBrochure Online PDFSrikanth MudivarthiNo ratings yet

- HDFC ERGO General Insurance Company Limited: ProspectusDocument12 pagesHDFC ERGO General Insurance Company Limited: ProspectusThats ItNo ratings yet

- Health Guard: Bajaj AllianzDocument35 pagesHealth Guard: Bajaj AllianzAlexNo ratings yet

- Care Senior Leaflet PDFDocument4 pagesCare Senior Leaflet PDFTejinderNo ratings yet

- Mini-CEX Package For WebDocument6 pagesMini-CEX Package For WebMiguel Arévalo-CárdenasNo ratings yet

- G.R. No. 182574Document6 pagesG.R. No. 182574Victor LimNo ratings yet

- Medicine FCPS II Oral ExamDocument3 pagesMedicine FCPS II Oral Examteena6506763No ratings yet

- Medical Examination Rules 2005Document12 pagesMedical Examination Rules 2005MutuajmNo ratings yet

- Preoperative Assessment. Plauntz (2007)Document17 pagesPreoperative Assessment. Plauntz (2007)Dario Cahuaza :VNo ratings yet

- Labor and Delivery AssessmentDocument16 pagesLabor and Delivery AssessmentLizaEllaga100% (1)

- Baxter K-Mod 100 Service ManualDocument32 pagesBaxter K-Mod 100 Service ManualCVL - lpilonNo ratings yet

- ValuCare Accredited Providers v012017Document66 pagesValuCare Accredited Providers v012017aeroren40% (5)

- PEHA 2021 Consent Form (Fillable)Document1 pagePEHA 2021 Consent Form (Fillable)Cedie MacalisangNo ratings yet

- Curriculum Vitae-Eng-202208Document2 pagesCurriculum Vitae-Eng-202208darmawanjoseNo ratings yet

- Rash FeverDocument1 pageRash FeverSyima MnnNo ratings yet

- Patient Admission Dialogue and Showing DirectionDocument4 pagesPatient Admission Dialogue and Showing DirectionRosita HutamiNo ratings yet

- CPRS Handbook - 2023-2024 - 20240110Document94 pagesCPRS Handbook - 2023-2024 - 20240110kongchiyui000medNo ratings yet

- Girls Who Masturbate in Early Infancy: Diagnostics, Natural Course and A Long-Term Follow-UpDocument5 pagesGirls Who Masturbate in Early Infancy: Diagnostics, Natural Course and A Long-Term Follow-UpNurdin Aji IskandarNo ratings yet

- Group Health Insurance (Revised) Policy WordingDocument48 pagesGroup Health Insurance (Revised) Policy WordingSakshi G AwasthiNo ratings yet

- Foundation First Sem PracticalDocument3 pagesFoundation First Sem PracticalShajinsjNo ratings yet

- HOPE PIR Presentation TemplateDocument32 pagesHOPE PIR Presentation Templatejai ebuenNo ratings yet

- FCPSDocument8 pagesFCPSMurtaza Ali ShahNo ratings yet

- The Oral PresentationDocument6 pagesThe Oral PresentationCarlos MellaNo ratings yet

- Drivers ExamDocument18 pagesDrivers ExamEumi Rosse MalabananNo ratings yet

- Imigcs ManualDocument24 pagesImigcs ManualPrinceNo ratings yet

- Step 3 CCS OutlineDocument10 pagesStep 3 CCS OutlineDuncan Jackson100% (2)

- Nursing ProcessDocument21 pagesNursing Processrubycorazon_edizaNo ratings yet

- An Overview of Workplace-Based Assessment: Cees Van Der Vleuten Maastricht University, The NetherlandsDocument45 pagesAn Overview of Workplace-Based Assessment: Cees Van Der Vleuten Maastricht University, The Netherlandsqwerty123No ratings yet

- General Health Profiling TeachersDocument1 pageGeneral Health Profiling TeachersArfan KianiNo ratings yet

- Fmed 09 926573Document17 pagesFmed 09 926573anca_adam_26No ratings yet

- Soal Ujian Akhir Semester Sekolah Tinggi Ilmu Kesehatan Estu Utomo Program Studi Sarjana KeperawatanDocument14 pagesSoal Ujian Akhir Semester Sekolah Tinggi Ilmu Kesehatan Estu Utomo Program Studi Sarjana KeperawatanDewi HastutiNo ratings yet

- NP Test - 350 Items Key AnswerDocument22 pagesNP Test - 350 Items Key AnswerKarol Delagana100% (1)

- навыки 6 курсDocument44 pagesнавыки 6 курсAshish R. JadhavNo ratings yet

- Norcini - Setting Standards On Educational TestsDocument6 pagesNorcini - Setting Standards On Educational TestsSengkhoun LimNo ratings yet

- The Small-Business Guide to Government Contracts: How to Comply with the Key Rules and Regulations . . . and Avoid Terminated Agreements, Fines, or WorseFrom EverandThe Small-Business Guide to Government Contracts: How to Comply with the Key Rules and Regulations . . . and Avoid Terminated Agreements, Fines, or WorseNo ratings yet

- How to Win Your Case In Traffic Court Without a LawyerFrom EverandHow to Win Your Case In Traffic Court Without a LawyerRating: 4 out of 5 stars4/5 (5)

- A Simple Guide for Drafting of Conveyances in India : Forms of Conveyances and Instruments executed in the Indian sub-continent along with Notes and TipsFrom EverandA Simple Guide for Drafting of Conveyances in India : Forms of Conveyances and Instruments executed in the Indian sub-continent along with Notes and TipsNo ratings yet

- Contracts: The Essential Business Desk ReferenceFrom EverandContracts: The Essential Business Desk ReferenceRating: 4 out of 5 stars4/5 (15)

- Learn the Essentials of Business Law in 15 DaysFrom EverandLearn the Essentials of Business Law in 15 DaysRating: 4 out of 5 stars4/5 (13)

- Law of Contract Made Simple for LaymenFrom EverandLaw of Contract Made Simple for LaymenRating: 4.5 out of 5 stars4.5/5 (9)

- Legal Guide to Social Media, Second Edition: Rights and Risks for Businesses, Entrepreneurs, and InfluencersFrom EverandLegal Guide to Social Media, Second Edition: Rights and Risks for Businesses, Entrepreneurs, and InfluencersRating: 5 out of 5 stars5/5 (1)

- How to Win Your Case in Small Claims Court Without a LawyerFrom EverandHow to Win Your Case in Small Claims Court Without a LawyerRating: 5 out of 5 stars5/5 (1)

- The Certified Master Contract AdministratorFrom EverandThe Certified Master Contract AdministratorRating: 5 out of 5 stars5/5 (1)

- The Business of Broadway: An Insider's Guide to Working, Producing, and Investing in the World's Greatest Theatre CommunityFrom EverandThe Business of Broadway: An Insider's Guide to Working, Producing, and Investing in the World's Greatest Theatre CommunityNo ratings yet

- Fundamentals of Theatrical Design: A Guide to the Basics of Scenic, Costume, and Lighting DesignFrom EverandFundamentals of Theatrical Design: A Guide to the Basics of Scenic, Costume, and Lighting DesignRating: 3.5 out of 5 stars3.5/5 (3)

- Crash Course Business Agreements and ContractsFrom EverandCrash Course Business Agreements and ContractsRating: 3 out of 5 stars3/5 (3)

- Contract Law for Serious Entrepreneurs: Know What the Attorneys KnowFrom EverandContract Law for Serious Entrepreneurs: Know What the Attorneys KnowRating: 1 out of 5 stars1/5 (1)

- Digital Technical Theater Simplified: High Tech Lighting, Audio, Video and More on a Low BudgetFrom EverandDigital Technical Theater Simplified: High Tech Lighting, Audio, Video and More on a Low BudgetNo ratings yet