Professional Documents

Culture Documents

1 Health Protector

Uploaded by

Khairul RafiziOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

1 Health Protector

Uploaded by

Khairul RafiziCopyright:

Available Formats

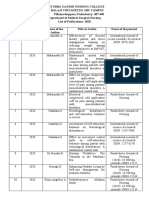

BENEFITS Health Protector (PruBSN Takaful)

Type of Benefits Benefit Amount Type of Benefits Benefit Amount

R&B Benefits 13. Emergency Treatment For Up to 10 times of Hospital Daily

Accidental Injury R&B amount per year

1. Hospital Daily R&B Flexible option between RM100

(up to 150 days per year) and RM600 per day

(Increments in multiples of RM100 14. Emergency Medical Assistance Yes

per day)

15. Second Medical Opinion

Hospital & Surgical Benefits • Consultation and Diagnosis in Malaysia • RM1,000 per year

• Consultation with World Leading Expert • Yes

2. Intensive Care Unit/Cardiac Care Unit As Charged

(up to 90 days per year)

3. In-hospital & Related Services Notes:

1. The Benefit Amount specified above may subject to medical co-payment options.

• Surgical Benefit 2. We shall only reimburse the Reasonable and Customary charges on eligible expenses which are

• Hospital Supplies and Services deemed Medically Necessary.

• Operating Theatre As Charged 3. For Overseas Treatment, if the covered person chooses to have or is referred to be treated outside

Malaysia, the benefits for the treatment are limited to the Reasonable and Customary and Medically

• Anaesthetist Fees Necessary charges for equivalent local treatment in Malaysia and subject to 90 days residence limit.

• In-Hospital Specialist’s Visit

(limit to 2 visits per day)

Outpatient Treatment Benefits MEDICAL CO-PAYMENT OPTIONS:

4. Pre-hospitalisation Treatment HIGH DEDUCTIBLE

(within 60 days before hospitalisation)

5. Post-hospitalisation Treatment If High Deductible is chosen, you must first pay a fixed amount equivalent to deductible

(within 90 days after hospital discharge) selected out of the total accumulated eligible benefits within a year, before PruBSN pays

As Charged the rest of the expenses. The costs of the eligible benefit accumulated for that year will

6. Home Nursing Care

(up to 180 days per lifetime) not be carried forward to the next year.

7. Day Surgery If you already have a medical plan with an annual limit equivalent to (or higher than) the

8. Day Care Procedure deductible amount, the eligible expenses in excess of the High Deductible selected will

be covered by HealthProtector.

9. Outpatient Cancer Treatment As Charged

High Deductible applies to R&B Benefits, Hospital and Surgical Benefits, Outpatient

10. Outpatient Kidney Dialysis Up to 1.5 times of the initial Smart Value

Treatment Benefits, and Other Benefits excluding Second Medical Opinion and Emergency

Point per lifetime (including take home

drugs, examination tests & consultation) Medical Assistance.

Other Benefits

EXISTING

11. Maternity Complications Benefit Medical coverage from your MEDICAL Additional medical coverage

Up to RM5,000 per year

(for female covered person only) existing medical plan PLAN from HealthProtector

LIMIT

12. Intraocular Lens Up to RM6,000 per lifetime

YOUR MEDICAL BILL

You might also like

- PCP Obe-Cbtp Dops Rtp-Acc Form#7Document6 pagesPCP Obe-Cbtp Dops Rtp-Acc Form#7Ko HakuNo ratings yet

- MARIUS CALDERON - Global Health Access Gold Lite Plus WorldwideDocument7 pagesMARIUS CALDERON - Global Health Access Gold Lite Plus WorldwideJULIUS TIBERIONo ratings yet

- TARCILA DUMALUS - Global Health Access Gold Lite Plus Worldwide Ex UDocument7 pagesTARCILA DUMALUS - Global Health Access Gold Lite Plus Worldwide Ex UJULIUS TIBERIONo ratings yet

- Day SurgeryDocument350 pagesDay SurgeryMohamed Fawzy100% (1)

- Boucher: Based On Selective-Pressure TechniqueDocument1 pageBoucher: Based On Selective-Pressure Techniqueeili167% (3)

- 20230117032741premier Brochure Full - 2023-01 (January 17)Document8 pages20230117032741premier Brochure Full - 2023-01 (January 17)jadetorresNo ratings yet

- AIA PlatinumDocument8 pagesAIA PlatinumHihiNo ratings yet

- PolicyDocument10 pagesPolicyKalyaniNo ratings yet

- Family Care Product-DubaiDocument7 pagesFamily Care Product-DubaiatherNo ratings yet

- Aia Platinum Health BrochureDocument8 pagesAia Platinum Health BrochureRaymond AngNo ratings yet

- TOB FCP Dubai Dec 2022Document7 pagesTOB FCP Dubai Dec 2022JeffNo ratings yet

- International Exclusive Individual Pds enDocument7 pagesInternational Exclusive Individual Pds enJeroy TanNo ratings yet

- Get Well in Comfort: Kembali Pulih Dalam KeselesaanDocument10 pagesGet Well in Comfort: Kembali Pulih Dalam KeselesaanonyakNo ratings yet

- International Exclusive Brochure enDocument12 pagesInternational Exclusive Brochure enMeng Seng EngNo ratings yet

- Benefit Manual - DTU PDFDocument26 pagesBenefit Manual - DTU PDFRishabh ChandraNo ratings yet

- Focus On The Ingwe Option: Momentumhealth - Co.zaDocument7 pagesFocus On The Ingwe Option: Momentumhealth - Co.zaRoe Wekwa NyembaNo ratings yet

- Reassurance at Every Step: Keeps Giving You More!Document8 pagesReassurance at Every Step: Keeps Giving You More!hiteshmohakar15No ratings yet

- Get More With HealthprotectorDocument13 pagesGet More With HealthprotectorLim KaixianNo ratings yet

- Pacific Cross - 2020-10 (October 01)Document12 pagesPacific Cross - 2020-10 (October 01)Eeza OrtileNo ratings yet

- Individual Medical Policy For Employees - Emed: Table of BenefitsDocument6 pagesIndividual Medical Policy For Employees - Emed: Table of Benefitsrahul sNo ratings yet

- Prudential - Medical Insurance Benefits - 22112022Document29 pagesPrudential - Medical Insurance Benefits - 22112022Amatsiko PrimahNo ratings yet

- Great Health Direct: A Medical Plan To Protect You Against Life's UncertaintiesDocument9 pagesGreat Health Direct: A Medical Plan To Protect You Against Life's Uncertaintieslulalala8888No ratings yet

- 20210326092901select Brochure Full - 01 April 2021Document12 pages20210326092901select Brochure Full - 01 April 2021iqbal_anggaraNo ratings yet

- InHealth Persona PrimerDocument13 pagesInHealth Persona PrimerEmmanuel Martin Racho AsuntoNo ratings yet

- HDFC ERGO General Insurance Company Limited: ProspectusDocument12 pagesHDFC ERGO General Insurance Company Limited: ProspectusThats ItNo ratings yet

- Category B Emirates Insurance PDFDocument5 pagesCategory B Emirates Insurance PDFDonald HamiltonNo ratings yet

- SamplePDS MHT ENDocument5 pagesSamplePDS MHT ENHifdzul Malik ZainalNo ratings yet

- PDS One Medical (Eng)Document4 pagesPDS One Medical (Eng)abdulhalimdinNo ratings yet

- Select Brochure Full - 2022 10 (October 01)Document12 pagesSelect Brochure Full - 2022 10 (October 01)Erl D. MelitanteNo ratings yet

- Basic Plan Eng 0919Document13 pagesBasic Plan Eng 0919Fabrizio CeccarelliNo ratings yet

- Employee Presentation SilverDocument24 pagesEmployee Presentation Silverkishan310No ratings yet

- Individual Medical Policy For Employees - Emed: Table of BenefitsDocument7 pagesIndividual Medical Policy For Employees - Emed: Table of Benefitskanikak97No ratings yet

- Activ Health - Platinum Enhanced - One PagerDocument2 pagesActiv Health - Platinum Enhanced - One PagerYashNo ratings yet

- NLGI - TOB Cat CDocument6 pagesNLGI - TOB Cat Cshylesh.raveendranNo ratings yet

- PRUValue Med PRUMillion Med Booster Leaflet - ENGDocument14 pagesPRUValue Med PRUMillion Med Booster Leaflet - ENGchau thiranNo ratings yet

- Axa Smartcare Sme BrochureDocument20 pagesAxa Smartcare Sme BrochureNelly HNo ratings yet

- Lifeline 2.0 Policy WordingDocument33 pagesLifeline 2.0 Policy WordingVijay Singh RathourNo ratings yet

- Healthpremia BroucherDocument18 pagesHealthpremia BroucherAmit DeswalNo ratings yet

- HLA MediShield ENG - Updated AUG 18Document16 pagesHLA MediShield ENG - Updated AUG 18Chan SCNo ratings yet

- NLGI CHROME - Hospital AccessDocument4 pagesNLGI CHROME - Hospital Accessmht1No ratings yet

- Axa Smartcare Sme Plus BrochureDocument16 pagesAxa Smartcare Sme Plus BrochureNelly HNo ratings yet

- Student Medical Insc - Product Summary - 170122 To 160123Document8 pagesStudent Medical Insc - Product Summary - 170122 To 160123barungupta5619No ratings yet

- Benefit Manual M&V 23-24 - Jan 1Document22 pagesBenefit Manual M&V 23-24 - Jan 1mdmoosasohail8No ratings yet

- Proposal For: Insurer: Date Created: Class Name:: Enhanced Plan - CareDocument7 pagesProposal For: Insurer: Date Created: Class Name:: Enhanced Plan - CareUSMAN MIRNo ratings yet

- SIM Benefir ScheduleDocument12 pagesSIM Benefir ScheduleHihiNo ratings yet

- Individual Medical Policy For Dependents - Dmed: Table of BenefitsDocument6 pagesIndividual Medical Policy For Dependents - Dmed: Table of Benefitsrahul sNo ratings yet

- I-Medik RIDER Suite: Your One Stop Medical Protection SolutionDocument83 pagesI-Medik RIDER Suite: Your One Stop Medical Protection SolutionainafaqeeraNo ratings yet

- Smart Medic ShieldDocument25 pagesSmart Medic ShieldSpring WaterNo ratings yet

- GSH Zcard Proof2Document2 pagesGSH Zcard Proof2RyanNo ratings yet

- 20210716025409prepaid Brochure - 2021-07 (July 02)Document8 pages20210716025409prepaid Brochure - 2021-07 (July 02)danica gregorioNo ratings yet

- National Mediclaim Policy: BrochureDocument3 pagesNational Mediclaim Policy: Brochureshukla8No ratings yet

- Dnirc Silk Road Plan ADocument4 pagesDnirc Silk Road Plan AMoksh SharmaNo ratings yet

- Health QuotationDocument4 pagesHealth QuotationKasturi SankarNo ratings yet

- Brochure Health Foundation A4Document4 pagesBrochure Health Foundation A4BartoszNo ratings yet

- Premier Medic PartnerDocument2 pagesPremier Medic PartnerHihiNo ratings yet

- Premier: A Medical Insurance Plan For Senior CitizensDocument8 pagesPremier: A Medical Insurance Plan For Senior CitizensStefNo ratings yet

- Smartcare Optimum Plus BrochureDocument12 pagesSmartcare Optimum Plus BrochureMeng Seng EngNo ratings yet

- Extra Care PlusDocument9 pagesExtra Care Plusgrr.homeNo ratings yet

- Option 1 NAS Dependants Enhanced 1Document16 pagesOption 1 NAS Dependants Enhanced 1Sridhar BNo ratings yet

- Health Insurance That Works For YouDocument5 pagesHealth Insurance That Works For YouTrinetra AgarwalNo ratings yet

- Personal Healthcare IpidDocument2 pagesPersonal Healthcare IpidarthurNo ratings yet

- The Best Laid Plans of Dogs and Vets: Transform Your Veterinary Practice Through Pet Health Care PlansFrom EverandThe Best Laid Plans of Dogs and Vets: Transform Your Veterinary Practice Through Pet Health Care PlansNo ratings yet

- 2 Extracorporeal Shock Wave Therapy, Ultrasound-GuidedDocument10 pages2 Extracorporeal Shock Wave Therapy, Ultrasound-GuidedJenny VibsNo ratings yet

- Operating Room Form (Major and Minor) : University of The VisayasDocument16 pagesOperating Room Form (Major and Minor) : University of The VisayasJohn Mitchelle NNo ratings yet

- FILE NO 12 VDocument13 pagesFILE NO 12 VMuthu KumaranNo ratings yet

- 1986-Endodontic Treatment of Root Canals Obstructed by Foreign ObjectsDocument10 pages1986-Endodontic Treatment of Root Canals Obstructed by Foreign ObjectsnagygeNo ratings yet

- Basics of Cardiopulmonary Bypass.10Document8 pagesBasics of Cardiopulmonary Bypass.10Chaaru ShaarmaNo ratings yet

- Pravin Waghmare: Personal DetailsDocument3 pagesPravin Waghmare: Personal DetailsHospital BhiwaniNo ratings yet

- Analgesia For Iliac Crest Bone GraftDocument9 pagesAnalgesia For Iliac Crest Bone GraftDominik Chirito PastorNo ratings yet

- Research and Education: Section EditorDocument12 pagesResearch and Education: Section EditorMayra Ortiz HerreraNo ratings yet

- Simple Narrative Essay ExampleDocument6 pagesSimple Narrative Essay Exampleafabeaida100% (1)

- Beagle 2017 Catalogue LRDocument152 pagesBeagle 2017 Catalogue LRTina SangreaNo ratings yet

- Mancom Resolution December 18, 2023Document4 pagesMancom Resolution December 18, 2023Vicka GuzmanNo ratings yet

- Ahmedabad PPN ListDocument20 pagesAhmedabad PPN ListABHISHEK SHARMANo ratings yet

- Basic Surgical Instruments Print BPDocument6 pagesBasic Surgical Instruments Print BPkrischaniNo ratings yet

- Cummings Hour Exam TrachDocument3 pagesCummings Hour Exam Trachdaniel amparadoNo ratings yet

- Astm F1541 - External Skeletal Fixation DevicesDocument31 pagesAstm F1541 - External Skeletal Fixation DevicesEng. Emílio DechenNo ratings yet

- VPUC-3 - PPE Guidelines For COVID-2019 (Caa 20210311)Document9 pagesVPUC-3 - PPE Guidelines For COVID-2019 (Caa 20210311)krisNo ratings yet

- New Company Profile PT Teknomedika BahariDocument4 pagesNew Company Profile PT Teknomedika BahariRidwan SeftieanNo ratings yet

- SBH/HSC Pre-Angiogram/ Angioplasty/Stent ChecklistDocument2 pagesSBH/HSC Pre-Angiogram/ Angioplasty/Stent ChecklistKena Ben100% (2)

- Silicon Induced LymphoafenopathyDocument5 pagesSilicon Induced LymphoafenopathyDiana RomanovaNo ratings yet

- Journal Homepage: - : IntroductionDocument3 pagesJournal Homepage: - : IntroductionIJAR JOURNALNo ratings yet

- Library Book List - ENDO, CONSE, NEW, JOURNALSDocument10 pagesLibrary Book List - ENDO, CONSE, NEW, JOURNALSMohammed TarekNo ratings yet

- Hospitals List: - (Tpa Vidal Health)Document81 pagesHospitals List: - (Tpa Vidal Health)UDAY GANDHINo ratings yet

- JETIR2402663Document14 pagesJETIR2402663Atul DwivediNo ratings yet

- Driving After Orthopaedic SurgeryDocument11 pagesDriving After Orthopaedic SurgeryHUMBLE EXTENDEDNo ratings yet

- CS Form No. 6, Revised 2020 (Application For Leave) (Secured)Document2 pagesCS Form No. 6, Revised 2020 (Application For Leave) (Secured)MCR TalakagNo ratings yet

- Asuhan Keperawatan Pada Klien Dengan Pasca Operasi Hernia Inguinalis Di Lt.6 Darmawan Rs Kepresidenan Rspad Gatot Soebroto Jakarta Tahun 2019Document7 pagesAsuhan Keperawatan Pada Klien Dengan Pasca Operasi Hernia Inguinalis Di Lt.6 Darmawan Rs Kepresidenan Rspad Gatot Soebroto Jakarta Tahun 2019Ggp Kristus Raja SuliNo ratings yet

- CGHS Rates 2014 - Jaipur3Document26 pagesCGHS Rates 2014 - Jaipur3YogendraNo ratings yet