Professional Documents

Culture Documents

Test Series: March, 2021 Mock Test Paper - 1 Foundation Course Paper - 1: Principles and Practice of Accounting

Test Series: March, 2021 Mock Test Paper - 1 Foundation Course Paper - 1: Principles and Practice of Accounting

Uploaded by

Vamshi KrishnaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Test Series: March, 2021 Mock Test Paper - 1 Foundation Course Paper - 1: Principles and Practice of Accounting

Test Series: March, 2021 Mock Test Paper - 1 Foundation Course Paper - 1: Principles and Practice of Accounting

Uploaded by

Vamshi KrishnaCopyright:

Available Formats

Test Series: March, 2021

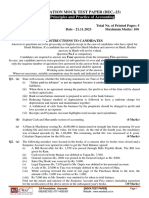

MOCK TEST PAPER - 1

FOUNDATION COURSE

PAPER – 1: PRINCIPLES AND PRACTICE OF ACCOUNTING

Question No. 1 is compulsory.

Answer any four questions from the remaining five questions.

Wherever necessary, suitable assumptions should be made and disclosed

by way of note forming part of the answer.

Working Notes should form part of the answer.

(Time allowed: 3 Hours) (100 Marks)

1. (a) State with reasons, whether the following statements are true or false:

1 The balance in petty cash book represents an asset.

2. Finished goods are normally valued at cost or market price whichever is higher.

3 Subscriptions received for the current year shall be shown in the balance sheet as a current

asset.

4 When shares are forfeited, the share capital account is debited with called up capital of shares

forfeited and the share forfeiture account is credited with Calls in arrear of shares forfeited.

5 Discount at the time of retirement of a bill is a gain for the drawee.

6. Bills receivable and bills payable books are type of subsidiary books.

(6 statements x 2 Marks= 12 Marks)

(b) Discuss the limitations which must be kept in mind while evaluating the Financial Statements.

(4 Marks)

(c) The following errors were committed by the Accountant of Hari Om Toys.

(i) Purchase of Rs. 1620 from Anupam & Co. passed through Sales Day Book as Rs. 1260

(ii) Credit sale of Rs. 1600 to Soni & Co. was posted to the credit of their account.

How would you rectify the errors assuming that :

(a) they were detected before preparation of Trial Balance.

(b) they were detected after preparation of Trial Balance but before preparing Final Accounts, the

difference was taken to Suspense A/c.

(c) they were detected after preparing Final Accounts. (4 Marks)

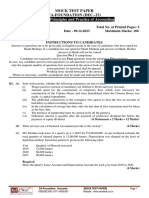

2. (a) M/s. JP Wires Co. purchased a second-hand machine on 1st January, 2017 for Rs. 3,20,000.

Overhauling and erection charges amounted to Rs. 80,000.

Another machine was purchased for Rs. 1,60,000 on 1 st July, 2017.

On 1st July, 2019, the machine installed on 1st January, 2017 was sold for Rs. 1,60,000. Another

machine amounted to Rs. 60,000 was purchased and was installed on 30 th September, 2019.

Under the existing practice the company provides depreciation @ 20% p.a. on original cost. However,

from the year 2020 it decided to adopt WDV method and to charge depreciation @ 15% p.a. You are

required to prepare Machinery account for the years 2017 to 2020.

© The Institute of Chartered Accountants of India

(b) Universe Ltd. keeps no stock records but a physical inventory of stock is made at the end of each

quarter and the valuation is taken at cost. The company’s year ends on 31 st March, 2021 and their

accounts have been prepared to that date. The stock valuation taken on 31 st March, 2021 was

however, misleading and you have been advised to value the closing stocks as on 31st March,

2021 with the stock figure as on 31st December, 2020 and some other information is available to

you:

(i) The cost of stock on 31 st December, 2020 as shown by the inventory sheet was Rs. 2,40,000.

(ii) On 31st December, stock sheet showed the following discrepancies:

(a) A page total of Rs. 15,000 had been carried to summary sheet as Rs. 18,000.

(b) The total of a page had been undercast by Rs. 600.

(iii) Invoice of purchases entered in the Purchase Book during the quarter from January to March,

2021 totalled Rs. 2,10,000. Out of this Rs. 9,000 related to goods received prior to

31st December, 2020. Invoices entered in April, 2021 relating to goods received in March,

2021 totalled Rs. 12,000.

(iv) Sales invoiced to customers totalled Rs. 2,70,000 from January to March, 2021. Of this

Rs. 15,000 related to goods dispatched before 31 st December, 2020. Goods dispatched to

customers before 31 st March, 2021 but invoiced in April, 2021 totalled Rs. 12,000.

(v) During the final quarter, credit notes at invoiced value of Rs. 3,000 had been issued to

customers in respect of goods returned during that period. The gross margin earned by the

company is 25% of cost.

You are required to prepare a statement showing the amount of stock at cost as on

31st March, 2021. (10 +10 = 20 Marks)

3. (a) Mr. Z accepted a bill for Rs. 50,000 drawn on him by Mr. Y on 1st August, 2020 for 3 months. This

was for the amount which Z owed to Y. On the same date Mr. Y got the bill discounted at his bank

for Rs. 49,000.

On the due date, Z approached Y for renewal of the bill. Mr. Y agreed on condition that Rs. 10,000

be paid immediately along with interest on the remaining amount at 12% p.a. for 3 months and that

for the remaining balance Z should accept a new bill for 3 months. These arrangements were

carried through. On 31st December, 2020, Z became insolvent and his estate paid 40%.

Prepare Journal Entries in the books of Mr. Y. (10 Marks)

(b) On 31st March, 2021 goods sold at a sale price of Rs. 30,000 were lying with customer, Sapan to

whom these goods were sold on ‘sale or return basis’ were recorded as actual sales. Since no

consent has been received from Sapan, you are required to pass adjustment entries presuming

goods were sent on approval at a profit of cost plus 25%. Present market price is 20% less than

the cost price. (5 Marks)

(c) Meera purchases goods on credit. His due dates for payments are given below. You are required

to calculate average due date.

Transaction Date Rs. Due Date

August 5 600 Sept. 08

Sept. 15 400 Oct. 18

Oct. 10 550 Nov. 13

Nov. 5 800 Dec. 10

(5 Marks)

2

© The Institute of Chartered Accountants of India

4. From the following data, prepare an Income and Expenditure Account for the year ended

31st December 2020, and Balance Sheet as at that date of the New Max Hospital:

Receipts and Payments Account for the

year ended 31 December, 2020

RECEIPTS Rs. PAYMENTS Rs.

To Balance b/d By Salaries:

Cash 400 (Rs. 3,600 for 2019) 15,600

Bank 2,600 3,000 By Hospital Equipment 8,500

To Subscriptions: By Furniture purchased 3,000

For 2019 2,550 By Additions to Building 25,000

For 2020 12,250 By Printing and Stationery 1,200

For 2021 1,200 By Diet expenses 7,800

To Government Grant: By Rent and rates (Rs. 150 for 1,000

For building 40,000 2021)

For maintenance 10,000 By Electricity and water charges 1,200

Fees from sundry 2,400 By Office expenses 1,000

Patients By Investments 10,000

To Donations (not to be 4,000 By Balances:

capitalized) Cash 700

To Net collections from 3,000 Bank 3,400 4,100

benefit shows

78,400 78,400

Additional information : Rs.

Value of building under construction as on 31.12.2020 70,000

Value of hospital equipment on 31.12.2020 25,500

Building Fund as on 1.1. 2020 40,000

Subscriptions in arrears as on 31.12.2019 3,250

Investments in 8% Govt. securities were made on 1st July, 2020.

(20 Marks)

5. (a) The following are the balances as at 31st March, 2021 extracted from the books of Mr. Vijay.

Particulars Rs. Particulars Rs.

Plant and Machinery 39,100 Bad debts recovered 900

Furniture and Fittings 20,500 Salaries 45,100

Bank Overdraft 1,60,000 Salaries payable 4,900

Capital Account 1,30,000 Prepaid rent 600

Drawings 16,000 Rent 8,600

Purchases 3,20,000 Carriage inward 2,250

Opening Stock 64,500 Carriage outward 2,700

Wages 24,330 Sales 4,30,600

Provision for doubtful debts 6,400 Advertisement Expenses 6,700

3

© The Institute of Chartered Accountants of India

Provision for Discount on debtors 2,750 Printing and Stationery 2,500

Sundry Debtors 2,40,000 Cash in hand 2,900

Sundry Creditors 95,000 Cash at bank 6,250

Bad debts 2,200 Office Expenses 20,320

Interest paid on loan 6,000

Additional Information:

1. Purchases include sales return of Rs. 5,150 and sales include purchases return of

Rs. 3,450.

2. Free samples distributed for publicity costing Rs. 1,650.

3. Goods withdrawn by Mr. Vijay for own consumption Rs. 7,000 included in purchases.

4. Wages paid in the month of April for installation of plant and machinery amounting to Rs. 900

were included in wages account.

5. Create a provision for doubtful debts @ 5% and provision for discount on debtors

@ 2.5%.

6. Depreciation is to be provided on plant and machinery @ 15% p.a. and on furniture and fittings

@ 10% p.a.

7. Closing stock as on 31 st March, 2021 is Rs. 2,50,000.

Prepare a Trading and Profit and Loss Account for the year ended 31st March, 2021, and a Balance

Sheet as on that date.

(b) The following is the Balance Sheet of M/s. Krishna Bros as at 31st March, 2021, they share profit

and losses equally:

Balance Sheet as at 31st March, 2021

Liabilities Rs. Assets Rs.

Capital Amit 24,600 Machinery 30,000

Lalit 24,600 Furniture 16,800

Sumit 27,000 Fixture 12,600

General Reserve 9,000 Cash 9,000

Trade payables 14,100 Inventories 5,700

Trade receivables 27,000

Less: Provision for 1,800 25,200

Doubtful debts

99,300 99,300

Sumit died on 1st April, 2021 and the following agreement was to be put into effect.

(a) Assets were to be revalued: Machinery to Rs. 35,100; Furniture to Rs. 13,800; Inventory to

Rs. 4,500.

(b) Goodwill was valued at Rs. 18,000 and was to be credited with his share, without using a

Goodwill Account.

(c) Rs. 6,000 is to be paid to the executors of the dead partner on 5th April, 2021.

(d) After death of Sumit, Amit and Lalit share profit equally.

4

© The Institute of Chartered Accountants of India

You are required to prepare:

(i) Journal Entry for Goodwill adjustment.

(ii) Revaluation Account and Capital Accounts of the partners. (12 + 8 = 20 Marks)

6. (a) Deepak Chemicals Ltd. invited applications for 10 lakhs shares of Rs. 100 each payable as follows:

Rs.

On Application 10

On Allotment (on 1st June, 2020) 30

On First Call (on 1st Nov., 2020) 30

On Final Call (on 1st March., 2021) 30

All the shares were applied for and allotted. A shareholder holding 15,000 shares paid the whole

of the amount due along with allotment.

You are required to prepare the journal entries for the above-mentioned transactions, assuming all

sums due were received. Interest was paid to the shareholder concerned on 1 st March, 2021.

(10 Marks)

(b) Tim Tim Limited issued 10,000 8% Debentures of the nominal value of Rs.10,00,000 as follows:

(a) To sundry persons for cash at 90% of nominal value of Rs. 5,00,000.

(b) To a vendor for purchase of fixed assets worth Rs. 2,00,000 – Rs. 2,50,000 nominal value.

(c) To the banker as collateral security for a loan of Rs. 2,00,000 – Rs. 2,50,000 nominal value.

You are required to prepare necessary Journal Entries. (5 Marks)

(c) State the causes of difference between the balance shown by the pass book and the cash book.

OR

Which subsidiary books are normally used in a business? (5 Marks)

© The Institute of Chartered Accountants of India

You might also like

- Mock 1 - Afternoon - AnswersDocument27 pagesMock 1 - Afternoon - Answerspagis31861No ratings yet

- Goloso Bamboo Project ReportDocument51 pagesGoloso Bamboo Project ReportDipankar Kalita100% (1)

- Computerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionFrom EverandComputerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionNo ratings yet

- Assignment-Code 438Document5 pagesAssignment-Code 438Alice JasperNo ratings yet

- Case 3 Report - 1208 2056Document26 pagesCase 3 Report - 1208 2056api-3748540No ratings yet

- Test Paper Ca FoundDocument5 pagesTest Paper Ca FoundSarangapani KaliyamoorthyNo ratings yet

- 21.11.23 CA-FOUNDATION MOCK TEST PAPER ACCOUNTS Dec. 23Document5 pages21.11.23 CA-FOUNDATION MOCK TEST PAPER ACCOUNTS Dec. 23RohitNo ratings yet

- J.K Shah Full Course Practice Question PaperDocument7 pagesJ.K Shah Full Course Practice Question PapermridulNo ratings yet

- QuestionsDocument5 pagesQuestionsmonster gamerNo ratings yet

- Accounting: Page 1 of 3Document3 pagesAccounting: Page 1 of 3Laskar REAZNo ratings yet

- CA Foundation MTP 2020 Paper 1 QuesDocument6 pagesCA Foundation MTP 2020 Paper 1 QuesSaurabh Kumar MauryaNo ratings yet

- © The Institute of Chartered Accountants of India: TH ST THDocument15 pages© The Institute of Chartered Accountants of India: TH ST THGaurav KumarNo ratings yet

- Account Test 2Document5 pagesAccount Test 2klaw6048No ratings yet

- Test Series: August, 2018 Foundation Course Mock Test Paper - 1 Paper - 1: Principles and Practice of Accounting (Time Allowed: 3 Hours) (100 Marks)Document118 pagesTest Series: August, 2018 Foundation Course Mock Test Paper - 1 Paper - 1: Principles and Practice of Accounting (Time Allowed: 3 Hours) (100 Marks)Gaming king 02 officialNo ratings yet

- 07 - Mock Paper 1Document6 pages07 - Mock Paper 1monster gamerNo ratings yet

- © The Institute of Chartered Accountants of India: TH ST THDocument6 pages© The Institute of Chartered Accountants of India: TH ST THomkar sawantNo ratings yet

- 2231 Accounts Full CourseDocument6 pages2231 Accounts Full Coursebkbalaji110No ratings yet

- Test Series: March, 2019 Foundation Course Mock Test Paper Paper - 1: Principles and Practice of AccountingDocument4 pagesTest Series: March, 2019 Foundation Course Mock Test Paper Paper - 1: Principles and Practice of AccountingabhimanyuNo ratings yet

- Paper 5 Accountancy PDFDocument4 pagesPaper 5 Accountancy PDFvyg946859No ratings yet

- 20uafam01 BM01 20ubmam01 Principles of Financial AccountingDocument3 pages20uafam01 BM01 20ubmam01 Principles of Financial AccountingArshath KumaarNo ratings yet

- Accountancy Master Test 4 PDFDocument5 pagesAccountancy Master Test 4 PDFRaghav PrajapatiNo ratings yet

- Class XI Acc SM Arya Annual 2023-24Document5 pagesClass XI Acc SM Arya Annual 2023-24pandeyansh962No ratings yet

- TaxationDocument6 pagesTaxationPrathmesh JambhulkarNo ratings yet

- RTP Dec 2020 QnsDocument13 pagesRTP Dec 2020 QnsbinuNo ratings yet

- Chartered Accountancy Professional Ii (CAP-II) : Education Division The Institute of Chartered Accountants of NepalDocument81 pagesChartered Accountancy Professional Ii (CAP-II) : Education Division The Institute of Chartered Accountants of NepalPrashant Sagar GautamNo ratings yet

- 650d55c860e827001812a329 - ## - Accountancy Master Test - 2 - Questions - 650d55c860e827001812a329Document4 pages650d55c860e827001812a329 - ## - Accountancy Master Test - 2 - Questions - 650d55c860e827001812a329sushil262004No ratings yet

- UntitledDocument269 pagesUntitledvijaypeketiNo ratings yet

- Test Series: March, 2022 Mock Test Paper 1 Foundation Course Paper - 1: Principles and Practice of AccountingDocument5 pagesTest Series: March, 2022 Mock Test Paper 1 Foundation Course Paper - 1: Principles and Practice of AccountingVinithaNo ratings yet

- Vidya Sagar: Foundation Major Test - 1 (Series - 3) Nov - 20 "Principles and Practice of Accounting"Document5 pagesVidya Sagar: Foundation Major Test - 1 (Series - 3) Nov - 20 "Principles and Practice of Accounting"sonubudsNo ratings yet

- Acc Full Test 3Document6 pagesAcc Full Test 3Periyanan VNo ratings yet

- XI Pre-BoardDocument7 pagesXI Pre-BoardSamar Singh Rathore0% (1)

- Accounting Questions 27.04.2022Document5 pagesAccounting Questions 27.04.2022psree7281No ratings yet

- MTP May19 QDocument4 pagesMTP May19 Qomkar sawantNo ratings yet

- Qus. MTP Accounts - 09.12.23Document5 pagesQus. MTP Accounts - 09.12.23karann021003No ratings yet

- +1 Accountancy ONLINE Final Examination 2021Document5 pages+1 Accountancy ONLINE Final Examination 2021Rajwinder BansalNo ratings yet

- MTP 2Document5 pagesMTP 2Arpit GuptaNo ratings yet

- BFC 3125 Financial Accounting IDocument5 pagesBFC 3125 Financial Accounting Ikorirenock764No ratings yet

- PAC All CAF Subjects Mocks With Solutions Regards Saboor AhmadDocument164 pagesPAC All CAF Subjects Mocks With Solutions Regards Saboor AhmadTajammal CheemaNo ratings yet

- CA Foundation Paper 1 Principles and Practice of Accounting SADocument24 pagesCA Foundation Paper 1 Principles and Practice of Accounting SAavula Venkatrao100% (1)

- Test 3Document8 pagesTest 3govarthan1976No ratings yet

- Test 3Document8 pagesTest 3govarthan1976No ratings yet

- Test Series: November, 2022 Mock Test Paper 2 Foundation Course Paper - 1: Principles and Practice of AccountingDocument5 pagesTest Series: November, 2022 Mock Test Paper 2 Foundation Course Paper - 1: Principles and Practice of AccountingRajesh MondewadNo ratings yet

- Class 11 Acc FinalDocument3 pagesClass 11 Acc Finalmnmehta1990No ratings yet

- Test 5 Principles and Practice of AccountingDocument6 pagesTest 5 Principles and Practice of Accountingshreya shettyNo ratings yet

- Accounts Prelim Paper 28-11-23Document4 pagesAccounts Prelim Paper 28-11-23roshanchoudhary4350No ratings yet

- Accounts - Full Test 1Document6 pagesAccounts - Full Test 1Shushaanth SanthoshNo ratings yet

- Nov - 19 - Question and AnswersDocument15 pagesNov - 19 - Question and AnswersVidhi AgrawalNo ratings yet

- UCO1501Document4 pagesUCO1501PRIYA LAKSHMANNo ratings yet

- Test Series: April, 2021 Mock Test Paper 2 Intermediate (New) : Group - I Paper - 1: AccountingDocument7 pagesTest Series: April, 2021 Mock Test Paper 2 Intermediate (New) : Group - I Paper - 1: AccountingHarsh KumarNo ratings yet

- Test Series: March, 2022 Mock Test Paper 1 Foundation Course Paper - 1: Principles and Practice of AccountingDocument5 pagesTest Series: March, 2022 Mock Test Paper 1 Foundation Course Paper - 1: Principles and Practice of AccountingDeepak YadavNo ratings yet

- Accounts Q MTP 1 Foundation May22Document5 pagesAccounts Q MTP 1 Foundation May22Abhay PratapNo ratings yet

- CA Inter Accounting Full Test 1 Nov 2022 Unscheduled Test PaperDocument18 pagesCA Inter Accounting Full Test 1 Nov 2022 Unscheduled Test Papersinku123No ratings yet

- Tutorial 8Document6 pagesTutorial 8Waruna PrabhaswaraNo ratings yet

- शिक्षा निदेिालय राष्ट्रीय राजधािी क्षेत्र ददल्ली Directorate of Education, GNCT of DelhiDocument4 pagesशिक्षा निदेिालय राष्ट्रीय राजधािी क्षेत्र ददल्ली Directorate of Education, GNCT of DelhiAshish ChNo ratings yet

- Accounts Specimen QP Class XiDocument7 pagesAccounts Specimen QP Class XiAnju TomarNo ratings yet

- Allama Iqbal Open University, Islamabad: (Department of Commerce)Document4 pagesAllama Iqbal Open University, Islamabad: (Department of Commerce)ilyas muhammadNo ratings yet

- Sanskriti School Dr. S. Radhakrishnan Marg New DelhiDocument7 pagesSanskriti School Dr. S. Radhakrishnan Marg New DelhiAVNEET XII-CNo ratings yet

- CA Inter Accounts Q MTP 2 Nov 2022Document6 pagesCA Inter Accounts Q MTP 2 Nov 2022smartshivenduNo ratings yet

- MTP 2 AccountsDocument8 pagesMTP 2 AccountssuzalaggarwalllNo ratings yet

- XII Accountancy in Eng QPDocument6 pagesXII Accountancy in Eng QPSarang KrishnanNo ratings yet

- Paper - 1: Principles & Practice of Accounting Questions True and FalseDocument25 pagesPaper - 1: Principles & Practice of Accounting Questions True and Falsegargee thakareNo ratings yet

- Sample IA QuestionDocument3 pagesSample IA QuestionElisa Ferrer RamosNo ratings yet

- One Year of Living with COVID-19: An Assessment of How ADB Members Fought the Pandemic in 2020From EverandOne Year of Living with COVID-19: An Assessment of How ADB Members Fought the Pandemic in 2020No ratings yet

- Maruti Udyog LTD: Financing StrategyDocument6 pagesMaruti Udyog LTD: Financing StrategyAbhishek Mukherjee0% (1)

- Question Bank With Answer Key Two Mark Questions With Answer Key Unit-I 1. What Do You Mean by Financial System?Document25 pagesQuestion Bank With Answer Key Two Mark Questions With Answer Key Unit-I 1. What Do You Mean by Financial System?J. KNo ratings yet

- Duterte's Ambitious 'Build, Build, Build' Project To Transform The Philippines Could Become His LegacyDocument15 pagesDuterte's Ambitious 'Build, Build, Build' Project To Transform The Philippines Could Become His LegacyHannah SantosNo ratings yet

- Infrastructure Finance Project Design and Appraisal: Professor Robert B.H. Hauswald Kogod School of Business, AUDocument2 pagesInfrastructure Finance Project Design and Appraisal: Professor Robert B.H. Hauswald Kogod School of Business, AUAida0% (1)

- The Risk and Term Structure of Interest RateDocument7 pagesThe Risk and Term Structure of Interest RatestixNo ratings yet

- محطة معالجة مياه الصرف الصحي الجديدة بالقاهرة 1Document30 pagesمحطة معالجة مياه الصرف الصحي الجديدة بالقاهرة 1minayakoub585No ratings yet

- Unit 3: AnnuitiesDocument15 pagesUnit 3: AnnuitiesRicky Thanmai100% (1)

- SC Upholds 2016 Note Ban: Markets Cheer The New Year Edge Up 0.5%Document14 pagesSC Upholds 2016 Note Ban: Markets Cheer The New Year Edge Up 0.5%Unnati MishraNo ratings yet

- Loan Granting ProcedureDocument3 pagesLoan Granting ProcedurerakotoarimananaNo ratings yet

- Trial BalanceDocument4 pagesTrial BalanceHARIKIRAN PRNo ratings yet

- CSIS, Innovations in Guarantees For Development, 2019Document61 pagesCSIS, Innovations in Guarantees For Development, 2019yogesh parajuliNo ratings yet

- Fair Value: T I V ADocument11 pagesFair Value: T I V AHarryNo ratings yet

- Briones vs. CammayoDocument1 pageBriones vs. CammayoChicoRodrigoBantayog100% (1)

- UK Lloyds BankDocument3 pagesUK Lloyds BankflaviofernandezfigueiredoNo ratings yet

- Investment BankingDocument64 pagesInvestment BankinganuragchogtuNo ratings yet

- Ratio AnalysisDocument7 pagesRatio AnalysisDEEPA KUMARINo ratings yet

- Intermediate Accounting, 11th Edition - Chapter 05 - Balance Sheet and Statement of Cash FlowsDocument149 pagesIntermediate Accounting, 11th Edition - Chapter 05 - Balance Sheet and Statement of Cash Flowsdemolition3636No ratings yet

- FFA QA Addendum Presentation HardDocument170 pagesFFA QA Addendum Presentation HardKevinOhlandtNo ratings yet

- Indian Financial SystemDocument4 pagesIndian Financial SystemShafaq AlamNo ratings yet

- Aud Sample UpdatedDocument36 pagesAud Sample Updatedreynald john dela cruzNo ratings yet

- Biden Racial Economic Equity PlanDocument26 pagesBiden Racial Economic Equity PlanCNBC.com100% (1)

- Nunelon R. Marquez v. Elisan Credit CorporationDocument3 pagesNunelon R. Marquez v. Elisan Credit CorporationmltoqueroNo ratings yet

- 52 Pablo Garcia V Yolanda Valdez VillarDocument3 pages52 Pablo Garcia V Yolanda Valdez VillarPaolo SomeraNo ratings yet

- Leverage: Prepared by Sumit Goyal-LPUDocument22 pagesLeverage: Prepared by Sumit Goyal-LPUthkrarun100No ratings yet

- Current Ratio: Interpretation and Evaluation of The Ratio Analysis of People's Insurance Company (PICL)Document50 pagesCurrent Ratio: Interpretation and Evaluation of The Ratio Analysis of People's Insurance Company (PICL)HR CHRNo ratings yet

- Abd Question Paper BankDocument96 pagesAbd Question Paper BankRahul Ghosale100% (1)

- Accounting For Bonds PayableDocument10 pagesAccounting For Bonds PayableAdeel Ur Rehman GorayaNo ratings yet