Professional Documents

Culture Documents

CA Inter Accounts Q MTP 2 Nov 2022

Uploaded by

smartshivendu0 ratings0% found this document useful (0 votes)

45 views6 pagesCopyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

45 views6 pagesCA Inter Accounts Q MTP 2 Nov 2022

Uploaded by

smartshivenduCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 6

Downloaded From www.castudynotes.

com

Test Series: October, 2022

MOCK TEST PAPER – 2

INTERMEDIATE: GROUP – I

PAPER – 1: ACCOUNTING

Question No. 1 is compulsory.

Answer any four questions from the remaining Five questions.

Wherever necessary suitable assumptions may be made and disclosed by way of a note.

Working Notes should form part of the answer.

(Time allowed: three hours) (Maximum Marks: 100)

1. (a) Mohan Ltd. has an existing freehold factory property, which it intends to knock down and

redevelop. During the redevelopment period the company will move its production facilities to

another (temporary) site.

The following incremental costs will be incurred:

Setup costs of ` 5,00,000 to install machinery in the new location.

Rent of ` 15,00,000.

Removal costs of ` 3,00,000 to transport the machinery from the old location to the temporary

location.

Mohan Ltd. wants to seek your guidance as whether these costs can be capitalized into the cost

of the new building. You are required to advise in line with AS 10 “Property, Plant and

Equipment”.

(b) U.S.A Ltd. purchased raw material @ ` 400 per kg. Company does not sell raw material but uses

in production of finished goods. The finished goods in which raw material is used are expected to

be sold at below cost. At the end of the accounting year, company is having 10,000 kg of raw

material in inventory. As the company never sells the raw material, it does not know the selling

price of raw material and hence cannot calculate the realizable value of the raw material for

valuation of inventories at the end of the year. However replacement cost of raw material is ` 300

per kg. How will you value the inventory of raw material?

(c) How you will deal with following in the financial statements of the Paridhi Electronics Ltd. as on

31.3.22 with reference to AS-13?

(i) Paridhi Electronics Ltd. invested in the shares of another unlised company on 1 st May 2018

at a cost of ` 3,00,000 with the intention of holding more than a year. The published

accounts of unlisted company received in January, 2022 reveals that the company has

incurred cash losses with decline in market share and investment of Paridhi Electronics Ltd.

may not fetch more than ` 45,000.

(ii) Also Paridhi Electronics Ltd. has current investment (X Ltd.’s shares) purchased for ` 5

lakhs, which the company want to reclassify as long term investment. The market value of

these investments as on date of Balance Sheet was ` 2.5 lakhs.

(d) Suhana Ltd. issued 12% secured debentures of ` 100 Lakhs on 01.05.2021, to be utilized as

under:

Particulars Amount (` in lakhs)

Construction of factory building 40

Purchase of Machinery 35

Working Capital 25

1

Join Us on Telegram http://t.me/canotes_ipcc

© The Institute of Chartered Accountants of India

Downloaded From www.castudynotes.com

In March 2022, construction of the factory building was completed and machinery was installed

and ready for it intended use. Total interest on debentures for the financial year ended

31.03.2022 was ` 11,00,000. During the year 2021-22, the company had invested idle fund out of

money raised from debentures in banks' fixed deposit and had earned an interest of

` 2,00,000.

Explain the treatment of interest under Accounting Standard 16 and also explain nature of assets.

(4 Parts x 5 Marks = 20 Marks)

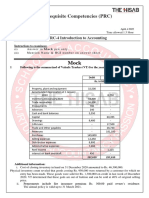

2. (a) Gopal holds 2,000, 15% Debentures of ` 100 each in Ritu Industries Ltd. as on April 1, 2021 at a

cost of ` 2,10,000. Interest is payable on June, 30 th and December, 31 st each year. On May 1,

2021, 1,000 debentures are purchased cum-interest at ` 1,07,000. On November 1, 2021, 1,200

debentures are sold ex-interest at ` 1,14,600. On November 30, 2021, 800 debentures are

purchased ex-interest at ` 76,800. On December 31, 2021, 800 debentures are sold cum-interest

for ` 1,10,000.

You are required to prepare the Investment Account showing value of holdings on March 31,

2022 at cost, using FIFO Method.

(b) The premises of Vani Ltd. caught fire on 22 nd January 2022, and the stock was damaged. The

firm makes account up to 31st March each year. On 31 st March, 2021 the stock at cost was

` 13,27,200 as against ` 9,62,200 on 31st March, 2020.

Purchases from 1st April, 2021 to the date of fire were ` 34,82,700 as against ` 45,25,000 for the

full year 2020-21 and the corresponding sales figures were ` 49,17,000 and ` 52,00,000

respectively. You are given the following further information:

(i) In July, 2021, goods costing ` 1,00,000 were given away for advertising purposes, no

entries being made in the books.

(ii) During 2021-22, a clerk had misappropriated unrecorded cash sales. It is estimated that the

defalcation averaged ` 2,000 per week from 1 st April, 2021 until the clerk was dismissed on

18th August, 2021.

(iii) The rate of gross profit is constant.

From the above information calculate the stock in hand on the date of fire. (10 +10 = 20 Marks)

3. (a) M/s Heera & Co. has head office at U.S.A. and branch in Patna(India). Patna branch is an

integral foreign operation of Heera & Co.

Patna branch furnishes you with its trial balance as on 31 st March, 2022 and the additional

information given thereafter:

Dr. Cr.

(Rupees in thousands)

Stock on 1 st April, 2021 300

Purchases and Sales 800 1,200

Sundry Debtors & Creditors 400 300

Bills of Exchange 120 240

Wages & Salaries 560 -

Rent, Rates & Taxes 360 -

Sundry Charges 160 -

Plant 240 -

Bank Balance 420 -

U.S.A. Office A/c - 1,620

3,360 3,360

Join Us on Telegram http://t.me/canotes_ipcc

© The Institute of Chartered Accountants of India

Downloaded From www.castudynotes.com

Information:

(a) Plant was acquired from a remittance of US $ 6,000 received from USA head office and paid

to the suppliers. Depreciate Plant at 60% for the year.

(b) Unsold stock of Patna branch was worth ` 4,20,000 on 31 st March, 2022.

(c) The rates of exchange may be taken as follows:

- On 01.04.2021 @ ` 55 per US $

- On 31.03.2022 @ ` 60 per US $

- Average exchange rate for the year @ ` 58 per US $

- Conversion in $ shall be made up to two decimal accuracy.

You are asked to prepare in US dollars the revenue statement for the year ended

31st March, 2022 and the balance sheet as on that date of Patna branch as would appear in the

books of USA head office of Heera & Co. You are informed that Patna branch account showed a

debit balance of US $ 29845.35 on 31.3.2022 in USA books and there were no items pending

reconciliation.

(b) The following balances were extracted from the books of M/s Division. You are required to

prepare Departmental Trading Account and Profit and Loss account for the year ended

31st December, 2021 after adjusting the unrealized department profits if any.

Deptt. A Deptt. B

` `

Opening Stock 50,000 40,000

Purchases 6,50,000 9,10,000

Sales 10,00,000 15,00,000

General expenses incurred for both the departments were ` 1,25,000 and you are also supplied

with the following information: (a) Closing stock of Department A ` 1,00,000 including goods from

Department B for ` 20,000 at cost of Department A. (b) Closing stock of Department B

` 2,00,000 including goods from Department A for ` 30,000 at cost to Department B. (c) Opening

stock of Department A and Department B include goods of the value of ` 10,000 and

` 15,000 taken from Department B and Department A respectively at cost to transferee

departments. (d) The rate of gross profit is uniform from year to year. (12 + 8 = 20 Marks)

4. (a) From the following information in respect of Mr. Preet, prepare Trading and Profit and Loss

Account for the year ended 31 st March, 2022 and a Balance Sheet as at that date:

31-03-2021 31-03-2022

(1) Liabilities and Assets ` `

Stock in trade 1,60,000 1,40,000

Debtors for sales 3,20,000 ?

Bills receivable - ?

Creditors for purchases 2,20,000 3,00,000

Furniture at written down value 1,20,000 1,27,000

Expenses outstanding 40,000 36,000

Prepaid expenses 12,000 14,000

Cash on hand 4,000 3,000

Bank Balance 20,000 1,500

3

Join Us on Telegram http://t.me/canotes_ipcc

© The Institute of Chartered Accountants of India

Downloaded From www.castudynotes.com

(2) Receipts and Payments during 2021-22:

Collections from Debtors

(after allowing 2-1/2% discount) 11,70,000

Payments to Creditors

(after receiving 2% discount) 7,84,000

Proceeds of Bills receivable discounted at 2%) 1,22,500

Proprietor’s drawings 1,40,000

Purchase of furniture on 30.09.2021 20,000

12% Government securities purchased on 1-10-2021 2,00,000

Expenses 3,50,000

Miscellaneous Income 10,000

(3) Sales are effected so as to realize a gross profit of 50% on the cost.

(4) Capital introduced during the year by the proprietor by cheques was omitted to be

recorded in the Cash Book, though the bank balance on 31 st March, 2022 (as shown

above), is after taking the same into account.

(5) Purchases and Sales are made only on credit.

(6) During the year, Bills Receivable of ` 2,00,000 were drawn on debtors. Out of these,

Bills amount to ` 40,000 were endorsed in favour of creditors. Out of this latter

amount, a Bill for ` 8,000 was dishonoured by the debtor.

(b) Moon Ltd. was incorporated on 1 st August, 2021 to take over the running business of a

partnership firm w.e.f. 1st April, 2021. The information for the year ended 31 st March, 2022 is as

under:

Amount (`)

Gross Profit 6,30,000

Less: Salaries 1,56,000

Rent, Rates & Taxes 72,000

Commission on sales 40,600

Depreciation 60,000

Interest on Debentures 36,000

Director's fees 24,000

Advertisement 48,000 4,36,600

Net Profit for the year 1,93,400

Moon Ltd. initiated an advertising campaign which resulted in increase of monthly sales by 25%

post incorporation.

You are required to prepare a statement showing the profit for the year between pre -

incorporation and post-incorporation. Also, explain how these profits are to be treated in the

accounts? (15 + 5 = Marks)

5. (a) J Ltd. presents you the following information for the year ended 31 st March, 2022:

(` in lacs)

Net profit before tax provision 36,000

Dividend paid 10,202

Join Us on Telegram http://t.me/canotes_ipcc

© The Institute of Chartered Accountants of India

Downloaded From www.castudynotes.com

Income-tax paid 5,100

Book value of assets sold 222

Loss on sale of asset 48

Depreciation debited to P & L account 24,000

Book value of investment sold 33,318

Profit on sale of investment 120

Interest income from investment credited to P & L A/c 3,000

Interest expenditure debited to P & L A/c 11,990

Interest actually paid (Financing activity) 13,042

Increase in working capital 67,290

[Excluding cash and bank balance]

Purchase of fixed assets 22,092

Expenditure on construction work 41,688

Long term borrowings from banks 55,884

Provision for Income-tax debited to P & L A/c 6,000

Cash and bank balance on 1.4.2021 6,000

Cash and bank balance on 31.3.2022 8,000

You are required to prepare a cash flow statement as per AS-3 (Revised).

(b) Futura Ltd. had the following items under the head “Reserves and Surplus” in the Balance Sheet

as on 31st March, 2022:

Amount ` in lakhs

Securities Premium Account 80

Capital Reserve 60

General Reserve 90

The company had an accumulated loss of ` 250 lakhs on the same date, which it has disclosed

under the head “Statement of Profit and Loss” as asset in its Balance Sheet. Comment on

accuracy of this treatment in line with Schedule III to the Companies Act, 2013.

(c) The following is the information of Mudra Ltd., the year ended 31 st March, 2022:

Gross profit 40,25,365

Subsidies received from Govt. 2,73,925

Administrative, Selling and distribution expenses 8,22,542

Directors fees 1,34,780

Interest on debentures 31,240

Managerial remuneration 2,85,350

Depreciation on fixed assets 5,22,543

Provision for Taxation 12,42,500

Transfer to General Reserve 4,00,000

Depreciation on fixed assets as per Schedule II of the Companies Act, 2013 was ` 5,75,345. You

are required to calculate the maximum limits of the managerial remuneration as per Companies

Act, 2013. (12 + 4 + 4 = 20 Marks)

Join Us on Telegram http://t.me/canotes_ipcc

© The Institute of Chartered Accountants of India

Downloaded From www.castudynotes.com

6. Answer any four of the following:

(a) How would you treat the following in the accounts in accordance with AS 12 'Government Grants'?

(i) ` 35 Lakhs received from the Local Authority for providing Medical facilities to the

employees.

(ii) ` 100 Lakhs received as Subsidy from the Central Government for setting up a unit in a

notified backward area.

(iii) ` 10 Lakhs Grant received from the Central Government on installation of anti-pollution

equipment.

(b) Following is the extract of the Balance Sheet of Manoj Ltd. as at 31st March, 2022

Authorised capital: `

30,000 12% Preference shares of ` 10 each 3,00,000

3,00,000 Equity shares of ` 10 each 30,00,000

33,00,000

Issued and Subscribed capital:

24,000 12% Preference shares of ` 10 each fully paid 2,40,000

2,70,000 Equity shares of ` 10 each, ` 8 paid up 21,60,000

Reserves and surplus:

General Reserve 3,60,000

Capital Redemption Reserve 1,20,000

Securities premium (collected in cash) 75,000

Profit and Loss Account 6,00,000

On 1st April, 2022, the Company has made final call @ ` 2 each on 2,70,000 equity shares. The

call money was received by 20 th April, 2022. Thereafter, the company decided to capitalise its

reserves by way of bonus at the rate of one share for every four shares held.

Prepare necessary journal entries in the books of the company.

(c) Kumar Ltd. had made a rights issue of shares in 2022. In the offer document to its members, it

had projected a surplus of ` 40 crores during the accounting year to end on 31 st March, 2022.

The draft results for the year, prepared on the hitherto followed accounting policies and

presented for perusal of the board of directors showed a deficit of ` 10 crores. The board in

consultation with the managing director, decided not to provide for “after sales expense s” during

the warranty period. Till the last year, provision at 2% of sales used to be made under the

concept of “matching of costs against revenue” and actual expenses used to be charged against

the provision. The board now decided to account for expenses as and when actually incurred.

Sales during the year total to ` 600 crores.

As chief accountant of the company, you are asked by the managin g director to draft the notes

on accounts for inclusion in the annual report for 2021-22.

(d) Assets and liabilities and income and expenditure items in respect of integral foreign operations

are translated into Indian rupees at the prevailing rate of exc hange at the end of the year. The

resultant exchange differences in the case of profit, is carried to other Liabi lities Account and the

Loss, if any, is charged to revenue. You are required to comment in line with AS 11.

(e) M/s X & Co. (a partnership firm) had a turnover of ` 5 crores (excluding other income) and

borrowings of ` 1.5 crores in the previous year. It wants to avail the exemptions available in

application of Accounting Standards to non-corporate entities for the year ended 31.3.2022.

Advise the management of M/s X & Co in respect of the exemptions of provisions of ASs, as per

the directive issued by the ICAI. (4 Parts x 5 Marks = 20 Marks)

6

Join Us on Telegram http://t.me/canotes_ipcc

© The Institute of Chartered Accountants of India

You might also like

- TaxationDocument6 pagesTaxationPrathmesh JambhulkarNo ratings yet

- CA Inter Accounts Q MTP 1 Nov 2022Document7 pagesCA Inter Accounts Q MTP 1 Nov 2022smartshivenduNo ratings yet

- 71592bos57621 Inter p1qDocument7 pages71592bos57621 Inter p1qRahul MishraNo ratings yet

- Test Series: March, 2021 Mock Test Paper - 1 Foundation Course Paper - 1: Principles and Practice of AccountingDocument5 pagesTest Series: March, 2021 Mock Test Paper - 1 Foundation Course Paper - 1: Principles and Practice of AccountingUmang AgrawalNo ratings yet

- Test Series: April, 2021 Mock Test Paper - 2 Intermediate (New) : Group - Ii Paper - 5: Advanced AccountingDocument6 pagesTest Series: April, 2021 Mock Test Paper - 2 Intermediate (New) : Group - Ii Paper - 5: Advanced AccountingOcto ManNo ratings yet

- Advanced Accounts MTP M21 S2Document19 pagesAdvanced Accounts MTP M21 S2Harshwardhan PatilNo ratings yet

- Test Series: April, 2022 Mock Test Paper 2 Intermediate: Group - I Paper - 1: AccountingDocument7 pagesTest Series: April, 2022 Mock Test Paper 2 Intermediate: Group - I Paper - 1: AccountingVishal MehraNo ratings yet

- Ilovepdf MergedDocument23 pagesIlovepdf MergedSubhahan BashaNo ratings yet

- Test Series: March 2022 Mock Test Paper 1 Intermediate: Group - Ii Paper - 5: Advanced AccountingDocument7 pagesTest Series: March 2022 Mock Test Paper 1 Intermediate: Group - Ii Paper - 5: Advanced AccountingShrwan SinghNo ratings yet

- MTP1 May2022 - Paper 5 Advanced AccountingDocument24 pagesMTP1 May2022 - Paper 5 Advanced AccountingYash YashwantNo ratings yet

- Full Syllabus Test 1 q1672987668Document11 pagesFull Syllabus Test 1 q1672987668Sachin SHNo ratings yet

- Ita MockDocument8 pagesIta MockAyyan SheikhNo ratings yet

- Test Series: March, 2021 Mock Test Paper 1 Intermediate (New) : Group - I Paper - 1: AccountingDocument7 pagesTest Series: March, 2021 Mock Test Paper 1 Intermediate (New) : Group - I Paper - 1: AccountingHarsh KumarNo ratings yet

- CAF 1 FAR1 Autumn 2022Document6 pagesCAF 1 FAR1 Autumn 2022QasimNo ratings yet

- Test Series: April, 2021 Mock Test Paper 2 Intermediate (New) : Group - I Paper - 1: AccountingDocument7 pagesTest Series: April, 2021 Mock Test Paper 2 Intermediate (New) : Group - I Paper - 1: AccountingHarsh KumarNo ratings yet

- QuestionsDocument5 pagesQuestionsmonster gamerNo ratings yet

- MTP 2 AccountsDocument8 pagesMTP 2 AccountssuzalaggarwalllNo ratings yet

- Test Series: March 2023 Mock Test Paper 1 Intermediate: Group - I Paper - 1: AccountingDocument75 pagesTest Series: March 2023 Mock Test Paper 1 Intermediate: Group - I Paper - 1: AccountingKartik GuptaNo ratings yet

- Caf-01 Far-01 Skans Mock QPDocument8 pagesCaf-01 Far-01 Skans Mock QPTaha MalikNo ratings yet

- Vidya Sagar Career Institute Limited Mobile: 93514 - 68666 Phone: 7821821250 / 51 / 52 / 53 / 54Document9 pagesVidya Sagar Career Institute Limited Mobile: 93514 - 68666 Phone: 7821821250 / 51 / 52 / 53 / 54shrenik bhuratNo ratings yet

- Mock Test Paper 2: Key Financial StatementsDocument5 pagesMock Test Paper 2: Key Financial StatementsRajesh MondewadNo ratings yet

- Caf-01 Far-I (Mah SS)Document4 pagesCaf-01 Far-I (Mah SS)Abdullah SaberNo ratings yet

- CA Inter Accounting Full Test 1 Nov 2022 Unscheduled Test PaperDocument18 pagesCA Inter Accounting Full Test 1 Nov 2022 Unscheduled Test Papersinku123No ratings yet

- Accounts - 12Document8 pagesAccounts - 12Md TariqueNo ratings yet

- Management Accounting and Finance: Level Iii Examination - January 2021Document9 pagesManagement Accounting and Finance: Level Iii Examination - January 2021Rajendran KajananthanNo ratings yet

- Paper 1Document180 pagesPaper 1Please Ok0% (1)

- Paper - 1: Principles and Practice of Accounting: © The Institute of Chartered Accountants of IndiaDocument24 pagesPaper - 1: Principles and Practice of Accounting: © The Institute of Chartered Accountants of IndiaVijayasri KumaravelNo ratings yet

- FAR-2 Mock September 2021 FinalDocument8 pagesFAR-2 Mock September 2021 FinalMuhammad RahimNo ratings yet

- Far-I Autumn 2021 TsaDocument3 pagesFar-I Autumn 2021 TsaUsman AhmedNo ratings yet

- © The Institute of Chartered Accountants of IndiaDocument7 pages© The Institute of Chartered Accountants of IndiaJayaprakash VenkatesanNo ratings yet

- Test Series: March, 2022 Mock Test Paper 1 Foundation Course Paper - 1: Principles and Practice of AccountingDocument5 pagesTest Series: March, 2022 Mock Test Paper 1 Foundation Course Paper - 1: Principles and Practice of AccountingVinithaNo ratings yet

- 67078bos54071-inter-gp1Document115 pages67078bos54071-inter-gp1senthilNo ratings yet

- UntitledDocument269 pagesUntitledvijaypeketiNo ratings yet

- Auditing Problems Finals Exam 2020Document9 pagesAuditing Problems Finals Exam 2020VictorioLazaro0% (1)

- Test Series: October, 2020 Mock Test Paper Intermediate (New) : Group - I Paper - 1: AccountingDocument7 pagesTest Series: October, 2020 Mock Test Paper Intermediate (New) : Group - I Paper - 1: AccountingIndhuNo ratings yet

- Final FAR-2 Mock Q. PaperDocument6 pagesFinal FAR-2 Mock Q. PaperAli OptimisticNo ratings yet

- MTP 2Document5 pagesMTP 2Arpit GuptaNo ratings yet

- BFC 3125 Financial Accounting IDocument5 pagesBFC 3125 Financial Accounting Ikorirenock764No ratings yet

- CBCS BCOM HONS Sem-3 COMMERCEDocument5 pagesCBCS BCOM HONS Sem-3 COMMERCEbittughNo ratings yet

- Test 3Document8 pagesTest 3govarthan1976No ratings yet

- Inp 2211 Accounts Question Paper PDFDocument8 pagesInp 2211 Accounts Question Paper PDFSachin ChourasiyaNo ratings yet

- Test Series: April 2023 Mock Test Paper - 2 Intermediate: Group - I Paper - 1: AccountingDocument7 pagesTest Series: April 2023 Mock Test Paper - 2 Intermediate: Group - I Paper - 1: AccountingKartik GuptaNo ratings yet

- 1 2 3 4 5 6 7 8 MergedDocument78 pages1 2 3 4 5 6 7 8 MergedKartik GuptaNo ratings yet

- National Management College Revision Test PaperDocument8 pagesNational Management College Revision Test Papergovarthan1976No ratings yet

- Acctg 205A Quiz NOV. 6,2020Document3 pagesAcctg 205A Quiz NOV. 6,2020Rheu ReyesNo ratings yet

- Test Series: November, 2021 Mock Test Paper - 2 Intermediate (New) : Group - I Paper - 1: AccountingDocument8 pagesTest Series: November, 2021 Mock Test Paper - 2 Intermediate (New) : Group - I Paper - 1: Accountingsunil1287No ratings yet

- Accounts Q MTP 1 Foundation May22Document5 pagesAccounts Q MTP 1 Foundation May22Abhay PratapNo ratings yet

- Chartered Accountancy Professional Ii (CAP-II) : Education Division The Institute of Chartered Accountants of NepalDocument81 pagesChartered Accountancy Professional Ii (CAP-II) : Education Division The Institute of Chartered Accountants of NepalPrashant Sagar GautamNo ratings yet

- RTP Dec 2020 QnsDocument13 pagesRTP Dec 2020 QnsbinuNo ratings yet

- CA-Inter-Adv-Account-Q-MTP-2-Nov23-castudynotes-comDocument7 pagesCA-Inter-Adv-Account-Q-MTP-2-Nov23-castudynotes-comkuvira LodhaNo ratings yet

- Accountancy Set 3 QPDocument6 pagesAccountancy Set 3 QPKunal Gaurav100% (2)

- 5 6305198873144984587 PDFDocument112 pages5 6305198873144984587 PDFNbut ddgfNo ratings yet

- Caf 8 Cma Spring 2021Document5 pagesCaf 8 Cma Spring 2021Hassnain SardarNo ratings yet

- CA Inter Adv Accounts Suggested Answer May 2022Document30 pagesCA Inter Adv Accounts Suggested Answer May 2022BILLU-YTNo ratings yet

- 71844bos Interp5qDocument7 pages71844bos Interp5qMayank RajputNo ratings yet

- Mock Test QuestionsDocument36 pagesMock Test QuestionsKish VNo ratings yet

- Accounting Test 1 CH 1 Nov 2022 Test PaperDocument5 pagesAccounting Test 1 CH 1 Nov 2022 Test PaperGaurav JhaNo ratings yet

- FIA132 - Supplementary and Special Assessment NOVEMBER 2022Document8 pagesFIA132 - Supplementary and Special Assessment NOVEMBER 2022kaityNo ratings yet

- IMP 2225 Advance Accounts Prelims QUESTION PAPERDocument8 pagesIMP 2225 Advance Accounts Prelims QUESTION PAPERArnik AgarwalNo ratings yet

- E-Books - Buyback of SecuritiesDocument22 pagesE-Books - Buyback of SecuritiessmartshivenduNo ratings yet

- 5 AmalgamationDocument52 pages5 AmalgamationsmartshivenduNo ratings yet

- E-Books - Cash Flow StatementDocument38 pagesE-Books - Cash Flow StatementsmartshivenduNo ratings yet

- 5 AmalgamationDocument52 pages5 AmalgamationsmartshivenduNo ratings yet

- E-Books - AS 13 Accounting For InvestmentsDocument32 pagesE-Books - AS 13 Accounting For InvestmentssmartshivenduNo ratings yet

- 9 Framework For Preparation - Presentation of Financial StatementsDocument13 pages9 Framework For Preparation - Presentation of Financial StatementssmartshivenduNo ratings yet

- 8 As 21 Consolidated Financial StatementsDocument26 pages8 As 21 Consolidated Financial StatementssmartshivenduNo ratings yet

- Lec 01 CH 1 Nature, Objectives & Scope of Audit Auditing & AssuranceDocument41 pagesLec 01 CH 1 Nature, Objectives & Scope of Audit Auditing & AssurancesmartshivenduNo ratings yet

- E-Books - Cash Flow StatementDocument38 pagesE-Books - Cash Flow StatementsmartshivenduNo ratings yet

- 1 Financial Statement of CompaniesDocument27 pages1 Financial Statement of CompaniessmartshivenduNo ratings yet

- E-Books - Buyback of SecuritiesDocument22 pagesE-Books - Buyback of SecuritiessmartshivenduNo ratings yet

- 60 Days Master Study Plan For CA Exams 2021 Clear CA & Get AIRDocument4 pages60 Days Master Study Plan For CA Exams 2021 Clear CA & Get AIRsmartshivenduNo ratings yet

- Audit SamplingDocument35 pagesAudit SamplingsmartshivenduNo ratings yet

- 13 - Audit of Different Types of EntititesDocument85 pages13 - Audit of Different Types of EntititessmartshivenduNo ratings yet

- Joint Products & by ProductsDocument56 pagesJoint Products & by Productsanon_67206536267% (3)

- Comparing and Analysis Financial Statement of Automobile Sector BYDocument110 pagesComparing and Analysis Financial Statement of Automobile Sector BYSamina MominNo ratings yet

- KPMG IFRS Notes IndAS PDFDocument13 pagesKPMG IFRS Notes IndAS PDFJagadish ChaudharyNo ratings yet

- CADocument30 pagesCAZulfa Aulia Nurul PutriNo ratings yet

- Focus Areas 2020-21 Accountancy CA PDFDocument4 pagesFocus Areas 2020-21 Accountancy CA PDFRanjith R NairNo ratings yet

- (Key) - HOC THUAT CHUYEN NGANH NGUYEN LY KE TOANDocument8 pages(Key) - HOC THUAT CHUYEN NGANH NGUYEN LY KE TOANLê Cung NhưNo ratings yet

- Business Revenue Calculations, Costs, Profit & Break EvenDocument89 pagesBusiness Revenue Calculations, Costs, Profit & Break EvenJoyNo ratings yet

- Chapter 1Document20 pagesChapter 1Momentum PressNo ratings yet

- Ebook Economics 1St Edition Karlan Test Bank Full Chapter PDFDocument67 pagesEbook Economics 1St Edition Karlan Test Bank Full Chapter PDFErikKeithnwmp100% (8)

- Cost Accounting, Financial Reporting and Management Accounting DifferencesDocument5 pagesCost Accounting, Financial Reporting and Management Accounting DifferencesPrabhakar RaoNo ratings yet

- IAS 19 - Employee BenefitsDocument1 pageIAS 19 - Employee BenefitsClarize R. MabiogNo ratings yet

- Annual Report 2007Document52 pagesAnnual Report 2007rafayahmad02No ratings yet

- Managerial Accounting Case StudyDocument19 pagesManagerial Accounting Case StudyAnutaj NagpalNo ratings yet

- Practical example of IAS 29 restatementDocument51 pagesPractical example of IAS 29 restatementCem SamurcayNo ratings yet

- FINANCIAL ANALYSIS COURSE OUTLINE TOPICSDocument5 pagesFINANCIAL ANALYSIS COURSE OUTLINE TOPICSjamalzareenNo ratings yet

- Desai Foods Private Limited 2021-22 Financial Statement - XMLDocument142 pagesDesai Foods Private Limited 2021-22 Financial Statement - XMLSarah AliceNo ratings yet

- TUI AG Bericht 2019 ENDocument48 pagesTUI AG Bericht 2019 ENgoggsNo ratings yet

- COOP UPDATESDocument52 pagesCOOP UPDATESnelsonpm81No ratings yet

- Materi Setelah UTS Prak AK RemedDocument14 pagesMateri Setelah UTS Prak AK Remedannisa rochmahNo ratings yet

- ch20 (改)Document21 pagesch20 (改)林義哲No ratings yet

- Review Notes #2 PDFDocument9 pagesReview Notes #2 PDFJha Ya100% (3)

- Itc Financial ReportDocument65 pagesItc Financial ReportSunny TeelaniNo ratings yet

- BAB 11 - SubramanyamDocument8 pagesBAB 11 - SubramanyamServitalle100% (1)

- Correction of ErrorsDocument9 pagesCorrection of ErrorsJaneNo ratings yet

- Concept CheckersDocument9 pagesConcept CheckersAnh Óng ÁnhNo ratings yet

- Trend AnlysisDocument7 pagesTrend AnlysisPradnya HingeNo ratings yet

- Dashboard Template 2 - Complete: Strictly ConfidentialDocument2 pagesDashboard Template 2 - Complete: Strictly ConfidentialKshitize GuptaNo ratings yet

- Accounting..... All Questions & Answer.Document13 pagesAccounting..... All Questions & Answer.MehediNo ratings yet

- List of All Account in This System 00-100-000 TO 90-900-500Document32 pagesList of All Account in This System 00-100-000 TO 90-900-500margonoNo ratings yet

- Mba I Accounting For Management (14mba13) NotesDocument58 pagesMba I Accounting For Management (14mba13) NotesAnonymous 4lXDgDUkQ100% (2)