Professional Documents

Culture Documents

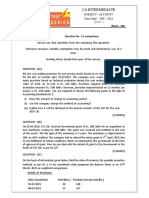

Test Series: April, 2022 Mock Test Paper 2 Intermediate: Group - I Paper - 1: Accounting

Uploaded by

Vishal MehraOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Test Series: April, 2022 Mock Test Paper 2 Intermediate: Group - I Paper - 1: Accounting

Uploaded by

Vishal MehraCopyright:

Available Formats

Test Series: April, 2022

MOCK TEST PAPER 2

INTERMEDIATE: GROUP – I

PAPER – 1: ACCOUNTING

Question No. 1 is compulsory.

Answer any four questions from the remaining five questions.

Wherever necessary suitable assumptions may be made and disclosed by way of a note.

Working Notes should form part of the answer.

(Time allowed: Three hours) (Maximum Marks: 100)

1. (a) Mohan Ltd. has an existing freehold factory property, which it intends to knock down and redevelop.

During the redevelopment period the company will move its production facilities to another

(temporary) site.

The details of the incremental costs which will be incurred are: Setup costs of ` 5,00,000 to install

machinery in the new location; Rent of ` 15,00,000; Removal costs of ` 3,00,000 to transport the

machinery from the old location to the temporary location.

Mohan Ltd. wants to seek your guidance as whether these costs can be capitalized into the cost

of the new building. You are required to advise in line with AS 10 “Property, Plant and Equipment”.

(b) Ram Ltd. purchased machinery for ` 80 lakhs (useful life 4 years and residual value ` 8 lakhs).

Government grant received was ` 32 lakhs. The grant had to be refunded at the beginning of third

year. Show the Journal Entry to be passed at the time of refund of grant and the value of the fixed

assets in the third year and the amount of depreciation for remaining two years, if the g rant had

been credited to Deferred Grant A/c.

(c) In a production process, normal waste is 5% of input. 5,000 MT of input were put in process

resulting in wastage of 300 MT. Cost per MT of input is ` 1,000. The entire quantity of waste and

finished output is in stock at the year end. State with reference to Accounting Standard, how will

you value the inventories in this case? What will be treatment for normal and abnormal waste?

(d) HIL Ltd. was making provision for non-moving stocks based on no issues having occurred for the

last 12 months upto 31.03.2019. The company now wants to change it and make provision based

on technical evaluation during the year ending 31.03.2020. Total value of stock on 31.3.20 is

` 120 lakhs. Provision required based on technical evaluation amounts ` 3.00 lakhs. However,

provision required based on 12 months (no issues) is ` 4.00 lakhs. You are required to discuss

the following points in the light of Accounting Standard (AS)-1:

(i) Does this amount to change in accounting policy?

(ii) Can the company change the method of accounting?

(iii) Explain how it will be disclosed in the annual accounts of HIL Ltd. for the year 2019 -20.

(4 parts x 5 Marks = 20 Marks)

2. (a) A Ltd. purchased on 1 st April, 2020 8% convertible debenture in C Ltd. of face value of ` 2,00,000

@ ` 108. On 1st July, 2020 A Ltd. purchased another ` 1,00,000 debentures @ ` 112 cum interest.

On 1st October, 2020 ` 80,000 debentures were sold @ ` 105. On 1st December, 2020, C Ltd. give

option for conversion of 8% convertible debentures into equity share of ` 10 each. A Ltd. received

5,000 equity shares in C Ltd. in conversion of 25% debentures held on that date. The market price

of debenture and equity share in C Ltd. on 31 st December, 2020 is ` 110 and ` 15 respectively.

Interest on debenture is payable each year on 31 st March, and 30 th September. Prepare investment

account in the books of A Ltd. on average cost basis for the accounting year ended 31 st December,

2020.

© The Institute of Chartered Accountants of India

(b) A fire engulfed the premises of a business of M/s Kite in the morning, of 1 st October, 2021. The

entire stock was destroyed except, stock salvaged of ` 50,000. Insurance Policy was for

` 5,00,000 with average clause.

Stock in hand on 31st March, 2021 ` 3,50,000

The following information was obtained from the records saved for the period from

1st April to 30th September, 2021:

`

Sales 27,75,000

Purchases 18,75,000

Carriage inward 35,000

Carriage outward 20,000

Wages 40,000

Salaries 50,000

Additional Information:

(1) Sales upto 30th September, 2021, includes ` 75,000 for which goods had not been

dispatched.

(2) On 1stJune, 2021, goods worth ` 1,98,000 sold to Hari on approval basis which was included

in sales but no approval has been received in respect of 2/3rd of the goods sold to him till

30th September, 2021.

(3) Purchases upto 30th September, 2021 did not include ` 1,00,000 for which purchase invoices

had not been received from suppliers, though goods have been received in godown.

(4) Past records show the gross profit rate of 25% on sales.

You are required to prepare the statement of claim for loss of stock for submission to the In surance

Company.

(c) Identify four differences between Hire Purchase and Installment Payment agreement.

(8 + 8 + 4 = 20 Marks)

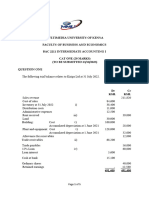

3. (a) DM Delhi has a branch in London which is an integral foreign operation of DM. At the end of the

year 31st March, 2021, the branch furnishes the following trial balance in U.K. Pound:

Particulars £ £

Dr. Cr.

Fixed assets (Acquired on 1 st April, 2017) 24,000

Stock as on 1 st April, 2020 11,200

Goods from head Office 64,000

Expenses 4,800

Debtors 4,800

Creditors 3,200

Cash at bank 1,200

Head Office Account 22,800

Purchases 12,000

Sales 96,000

1,22,000 1,22,000

© The Institute of Chartered Accountants of India

In head office books, the branch account stood as shown below:

London Branch A/c

Particulars Amount Particulars Amount

` `

To Balance b/d 20,10,000 By Bank A/c 52,16,000

To Goods sent to branch 49,26,000 By Balance c/d 17,20,000

69,36,000 69,36,000

The following further information is given:

(a) Fixed assets are to be depreciated @ 10% p.a. on WDV.

(b) On 31st March, 2021:

Expenses outstanding - £ 400

Prepaid expenses - £ 200

Closing stock - £ 8,000

(c) Rate of Exchange:

1st April, 2017 - ` 70 to £ 1

1st April, 2020 - ` 76 to £ 1

31st March, 2021 - ` 77 to £ 1

Average - ` 75 to £ 1

You are required to prepare: (1) Trial balance, incorporating adjustments of outstanding and

prepaid expenses, converting U.K. pound into Indian rupees; and (2) Trading and profit and loss

account for the year ended 31 st March, 2021 of London branch as would appear in the books of

Delhi head office of DM.

(b) Archana Enterprises maintain their books of accounts under single entry system. The Balance -

Sheet as on 31st March, 2020 was as follows :

Liabilities Amount (`) Assets Amount (`)

Capital A/c 6,75,000 Furniture & fixtures 1,50,000

Trade creditors 7,57,500 Stock 9,15,000

Outstanding expenses 67,500 Trade debtors 3,12,000

Prepaid insurance 3,000

Cash in hand & at bank 1,20,000

15,00,000 15,00,000

The following was the summary of cash and bank book for the year ended 31 st March, 2021:

Receipts Amount (`) Payments Amount (`)

Cash in hand & at Bank on 1,20,000 Payment to trade creditors 1,24,83,000

1st April, 2020

Cash sales 1,10,70,000 Sundry expenses paid 9,31,050

Receipts from trade 27,75,000 Drawings 3,60,000

debtors

Cash in hand & at Bank on

31st March, 2021 1,90,950

1,39,65,000 1,39,65,000

3

© The Institute of Chartered Accountants of India

Additional Information:

(i) Discount allowed to trade debtors and received from trade creditors amounted to

` 54,000 and ` 42,500 respectively (for the year ended 31 st March, 2021).

(ii) Annual fire insurance premium of ` 9,000 was paid every year on 1 st August for the renewal

of the policy.

(iii) Furniture & fixtures were subject to depreciation @ 15% p.a. on diminishing balance method.

(iv) The following are the balances as on 31 st March, 2021:

Stock ` 9,75,000

Trade debtors ` 3,43,000

Outstanding expenses ` 55,200

(v) Gross profit ratio of 10% on sales is maintained throughout the year.

You are required to prepare Trading and Profit & Loss account for the year ended

31st March, 2021, and Balance Sheet as on that date. (8 + 12 = 20 Marks)

4. (a) X Ltd has three departments A, B and C. From the particulars given below compute: (i) the values

of stock as on 31st Dec. 2020 and (ii) the departmental results showing actual amount of gross

profit.

A B C

` ` `

Stock (on 1.1. 2020) 24,000 36,000 12,000

Purchases 1,46,000 1,24,000 48,000

Actual sales 1,72,500 1,59,400 74,600

Gross Profit on normal selling price 20% 25% 33 1/3%

During the year ended 31st Dec. 2020, certain items were sold at discount and these discounts

were reflected in the value of sales shown above. The items sold at discount were:

A B C

` ` `

Sales at normal price 10,000 3,000 1,000

Sales at actual price 7,500 2,400 600

(b) Surya Limited (a listed company) recently made a public issue in respect of which the following

information is available:

(a) No. of partly convertible debentures issued- 2,00,000; face value and issue price- ` 100 per

debenture.

(b) Convertible portion per debenture- 60%, date of conversion- on expiry of 6 months from the

date of closing of issue.

(c) Date of closure of subscription lists- 1.5.2020, date of allotment- 1.6.2020, rate of interest on

debenture- 15% payable from the date of allotment, value of equity share for the purpose of

conversion- ` 60 (Face Value ` 10).

(d) Underwriting Commission- 2%.

(e) No. of debentures applied for- 1,50,000.

(f) Interest payable on debentures half-yearly on 30th September and 31st March.

© The Institute of Chartered Accountants of India

Write relevant journal entries for all transactions arising out of the above during the year ended

31st March, 2021 (including cash and bank entries).

(c) Manu Ltd. gives the following information as at 31 st March, 2021:

`

Issued and Subscribed capital:

24,000 12% Preference shares of ` 10 each fully paid 2,40,000

2,70,000 Equity shares of ` 10 each, ` 8 paid up 21,60,000

Reserves and surplus:

General Reserve 3,60,000

Capital Redemption Reserve 1,20,000

Securities premium (collected in cash) 75,000

Profit and Loss Account 6,00,000

On 1st April, 2021, the Company has made final call @ ` 2 each on 2,70,000 equity shares. The

call money was received by 20 th April, 2021. Thereafter, the company decided to capitalize its

reserves by way of bonus at the rate of one share for every four shares held. You are required to

prepare necessary journal entries in the books of the company on 30th April, 2021 for these

transactions. (6 + 10 +4 = 20 Marks)

5. (a) You are required to prepare a Balance Sheet as at 31 st March 2020, as per Schedule III of the

Companies Act, 2013, from the following information of Mehar Ltd.:

Particulars Amount (`) Particulars Amount

(`)

Term Loans (Secured) 40,00,000 Investments (Non-current) 9,00,000

Trade payables 45,80,000 Profit for the year 32,00,000

Cash and Bank Balances 38,40,000 Trade receivables 49,00,000

Staff Advances 2,20,000 Miscellaneous Expenses 2,32,000

Other advances (given by Co.) 14,88,000 Loan from other parties 8,00,000

Provision for Taxation 10,20,000 Provision for Doubtful Debts 80,000

Securities Premium 19,00,000 Stores 16,00,000

Loose Tools 2,00,000 Finished Goods 30,00,000

General Reserve 62,00,000 Plant and Machinery (WDV) 2,14,00,000

Additional Information: -

1. Share Capital consists of-

(a) 1,20,000 Equity Shares of ` 100 each fully paid up.

(b) 40,000, 10% Redeemable Preference Shares of ` 100 each fully paid up.

2. Write off the amount of Miscellaneous Expenses in full, amounting ` 2,32,000.

(b) Sneha Ltd. was incorporated on 1 st July, 2019 to acquire a running business of Atul Sons with

effect from 1st April, 2019.

During the year 2019-20, the total sales were ` 24,00,000 of which ` 4,80,000 were for the first six

months. The Gross profit of the company for the year was ` 3,90,800. The expenses charged to

the Statement of Profit & Loss Account included the following:

(i) Director's fees ` 30,000

© The Institute of Chartered Accountants of India

(ii) Bad debts ` 7,200

(iii) Advertising ` 24,000 (under a contract amounting to ` 2,000 per month)

(iv) Salaries and General Expenses ` 1,28,000

(v) Preliminary Expenses written off ` 10,000

(vi) Donation to a political party given by the company ` 10,000.

Prepare a statement showing pre-incorporation and post-incorporation profit for the year ended

31st March, 2020. (14 + 6 = 20 Marks)

6. (a) A company incorporated in June 2020, has setup a factory within a period of 8 months with

borrowed funds. The construction period of the assets had reduced drastically due to usage of

technical innovations by the company and the company is able to justify the reasons for the same.

Whether interest on borrowings for the period prior to the date of setting up the factory should be

capitalized although it has taken less than 12 months for the assets to get ready for use. You are

required to comment on the necessary treatment with reference to AS 16.

(b) XYZ Ltd. proposes to declare 10% dividend out of General Reserves due to inadequacy of profits

in the year ending 31-03-2020.

From the following particulars ascertain the amount that can be utilized from general reserves,

according to the Companies Rules, 2014: (`)

8,00,000 Equity Shares of ` 10 each fully paid up 80,00,000

General Reserves 25,00,000

Revaluation Reserves 6,50,000

Net profit for the year 1,42,500

Average rate of dividend during the last five years has been 12%.

OR

The following extract of Balance Sheet of X Ltd. (a non-investment company) was obtained:

Balance Sheet (Extract) as on 31st March, 2020

Liabilities `

Issued and subscribed capital:

20,000, 14% preference shares of ` 100 each fully paid 20,00,000

1,20,000 Equity shares of ` 100 each, ` 80 paid-up 96,00,000

Capital reserves (` 1,50,000 is revaluation reserve) 1,95,000

Securities premium 50,000

15% Debentures 65,00,000

Unsecured loans: Public deposits repayable after one year 3,70,000

Investment in shares, debentures, etc. 75,00,000

Profit and Loss account (debit balance) 15,00,000

You are required to compute Effective Capital as per the provisions of Schedule V to Companies

Act, 2013.

© The Institute of Chartered Accountants of India

(c) Prepare cash flow from investing activities as per AS 3 of Subham Creative Limited for year ended

31.3.2021.

Particulars Amount (`)

Machinery acquired by issue of shares at face value 2,00,000

Claim received for loss of machinery in earthquake 55,000

Unsecured loans given to associates 5,00,000

Interest on loan received from associate company 70,000

Pre-acquisition dividend received on investment made 52,600

Debenture interest paid 1,45,200

Term loan repaid 4,50,000

Interest received on investment (TDS of ` 8,200 was deducted on the 73,800

above interest)

Book value of plant & machinery sold (loss incurred ` 9,600) 90,000

(d) Opening Balance Sheet of Mr. A is showing the aggregate value of assets, liabilities and equity

` 8 lakh, ` 3 lakh and ` 5 lakh respectively. During accounting period, Mr. A has the following

transactions:

(1) Earned 10% dividend on 2,000 equity shares held of ` 100 each

(2) Paid ` 50,000 to creditors for settlement of ` 70,000

(3) Rent of the premises is outstanding ` 10,000

(4) Mr. A withdrew ` 9,000 for his personal use.

You are required to show the effect of above transactions on Balance Sheet in the form of Assets-

Liabilities = Equity after each transaction. (4 Parts x 5 Marks = 20 Marks)

© The Institute of Chartered Accountants of India

You might also like

- Computerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionFrom EverandComputerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionNo ratings yet

- Corporate Bonds and Structured Financial ProductsFrom EverandCorporate Bonds and Structured Financial ProductsRating: 5 out of 5 stars5/5 (1)

- Test Series: April, 2021 Mock Test Paper 2 Intermediate (New) : Group - I Paper - 1: AccountingDocument7 pagesTest Series: April, 2021 Mock Test Paper 2 Intermediate (New) : Group - I Paper - 1: AccountingHarsh KumarNo ratings yet

- © The Institute of Chartered Accountants of IndiaDocument7 pages© The Institute of Chartered Accountants of IndiaJayaprakash VenkatesanNo ratings yet

- 71592bos57621 Inter p1qDocument7 pages71592bos57621 Inter p1qRahul MishraNo ratings yet

- CA Inter Accounts Q MTP 1 Nov 2022Document7 pagesCA Inter Accounts Q MTP 1 Nov 2022smartshivenduNo ratings yet

- MTP 2Document5 pagesMTP 2Arpit GuptaNo ratings yet

- Test Series: November, 2022 Mock Test Paper 2 Foundation Course Paper - 1: Principles and Practice of AccountingDocument5 pagesTest Series: November, 2022 Mock Test Paper 2 Foundation Course Paper - 1: Principles and Practice of AccountingRajesh MondewadNo ratings yet

- CBCS BCOM HONS Sem-3 COMMERCEDocument5 pagesCBCS BCOM HONS Sem-3 COMMERCEbittughNo ratings yet

- Inp 2211 Accounts Question Paper PDFDocument8 pagesInp 2211 Accounts Question Paper PDFSachin ChourasiyaNo ratings yet

- Test Series: March 2023 Mock Test Paper 1 Intermediate: Group - I Paper - 1: AccountingDocument75 pagesTest Series: March 2023 Mock Test Paper 1 Intermediate: Group - I Paper - 1: AccountingKartik GuptaNo ratings yet

- CAF Test2 Accounts June23 R2 (Que)Document4 pagesCAF Test2 Accounts June23 R2 (Que)AISHWARYA DESHMUKHNo ratings yet

- Bac 2211 Cat&assignment Sep 2023Document5 pagesBac 2211 Cat&assignment Sep 2023toniruii98No ratings yet

- Test Series: March, 2021 Mock Test Paper 1 Intermediate (New) : Group - I Paper - 1: AccountingDocument7 pagesTest Series: March, 2021 Mock Test Paper 1 Intermediate (New) : Group - I Paper - 1: AccountingHarsh KumarNo ratings yet

- Test Series: November, 2021 Mock Test Paper - 2 Intermediate (New) : Group - I Paper - 1: AccountingDocument8 pagesTest Series: November, 2021 Mock Test Paper - 2 Intermediate (New) : Group - I Paper - 1: Accountingsunil1287No ratings yet

- © The Institute of Chartered Accountants of IndiaDocument7 pages© The Institute of Chartered Accountants of IndiaJayaprakash VenkatesanNo ratings yet

- CU Leaked Paper Financial Accounting-IDocument5 pagesCU Leaked Paper Financial Accounting-Idarindainsaan420No ratings yet

- 73507bos59335 Inter p1qDocument7 pages73507bos59335 Inter p1qRaish QURESHINo ratings yet

- CA INTER ACCOUNTING MAY-2023 ROUND-1 (Que)Document6 pagesCA INTER ACCOUNTING MAY-2023 ROUND-1 (Que)PizzareadNo ratings yet

- CA Inter Accounting Full Test 1 Nov 2022 Unscheduled Test PaperDocument18 pagesCA Inter Accounting Full Test 1 Nov 2022 Unscheduled Test Papersinku123No ratings yet

- MTP1 May2022 - Paper 5 Advanced AccountingDocument24 pagesMTP1 May2022 - Paper 5 Advanced AccountingYash YashwantNo ratings yet

- Test Series: March 2022 Mock Test Paper 1 Intermediate: Group - Ii Paper - 5: Advanced AccountingDocument7 pagesTest Series: March 2022 Mock Test Paper 1 Intermediate: Group - Ii Paper - 5: Advanced AccountingShrwan SinghNo ratings yet

- Sem3 14 Bcom Hons Sem-3 Financial Accounting II CC 3.1ch - 1201Document5 pagesSem3 14 Bcom Hons Sem-3 Financial Accounting II CC 3.1ch - 1201ruPAM DeyNo ratings yet

- Accountancy & Auditing Paper - 1-2015Document3 pagesAccountancy & Auditing Paper - 1-2015Qasim IbrarNo ratings yet

- 2019491243256731WHTRateCardupdated09 03 19FinSupSecAmendAct2019Document5 pages2019491243256731WHTRateCardupdated09 03 19FinSupSecAmendAct2019Shoaib AhmedNo ratings yet

- Intermediate Group I Test Papers PDFDocument88 pagesIntermediate Group I Test Papers PDFkrishna PNo ratings yet

- Contentitemfile Clakzwt9mx9sk0a212lma0ytv PDFDocument4 pagesContentitemfile Clakzwt9mx9sk0a212lma0ytv PDFJoseph OndariNo ratings yet

- B. Com I All PapersnDocument14 pagesB. Com I All Papersnrahim Abbas aliNo ratings yet

- TaxationDocument6 pagesTaxationPrathmesh JambhulkarNo ratings yet

- MBAP - AF101-Accounting and Finance - 10 Nov 23Document6 pagesMBAP - AF101-Accounting and Finance - 10 Nov 23aqueelahadam786No ratings yet

- Cdee Worksheet #3Document4 pagesCdee Worksheet #3ሔርሞን ይድነቃቸው100% (1)

- 7 July 2021Document32 pages7 July 2021Aditya PrajapatiNo ratings yet

- Test Series: April 2023 Mock Test Paper - 2 Intermediate: Group - I Paper - 1: AccountingDocument7 pagesTest Series: April 2023 Mock Test Paper - 2 Intermediate: Group - I Paper - 1: AccountingKartik GuptaNo ratings yet

- 1 2 3 4 5 6 7 8 MergedDocument78 pages1 2 3 4 5 6 7 8 MergedKartik GuptaNo ratings yet

- MTP 3 14 Questions 1680520270Document7 pagesMTP 3 14 Questions 1680520270Umar MalikNo ratings yet

- Full Syllabus Test 1 q1672987668Document11 pagesFull Syllabus Test 1 q1672987668Sachin SHNo ratings yet

- RTP Dec 2020 QnsDocument13 pagesRTP Dec 2020 QnsbinuNo ratings yet

- Chartered Accountancy Professional Ii (CAP-II) : Education Division The Institute of Chartered Accountants of NepalDocument81 pagesChartered Accountancy Professional Ii (CAP-II) : Education Division The Institute of Chartered Accountants of NepalPrashant Sagar GautamNo ratings yet

- Paper - 1: Principles and Practice of Accounting: © The Institute of Chartered Accountants of IndiaDocument24 pagesPaper - 1: Principles and Practice of Accounting: © The Institute of Chartered Accountants of IndiaVijayasri KumaravelNo ratings yet

- Paper 1Document180 pagesPaper 1Please Ok0% (1)

- Topic Wise Test Accounting From Incomplete RecordsDocument4 pagesTopic Wise Test Accounting From Incomplete RecordsChinmay GokhaleNo ratings yet

- Mock Questions ICAiDocument7 pagesMock Questions ICAiPooja GalaNo ratings yet

- Guideline Answers For Accounting Group - IDocument14 pagesGuideline Answers For Accounting Group - ITrisha IyerNo ratings yet

- Accountancy Set BDocument4 pagesAccountancy Set BPatanjal kumarNo ratings yet

- UntitledDocument269 pagesUntitledvijaypeketiNo ratings yet

- Test Series: March, 2022 Mock Test Paper 1 Foundation Course Paper - 1: Principles and Practice of AccountingDocument5 pagesTest Series: March, 2022 Mock Test Paper 1 Foundation Course Paper - 1: Principles and Practice of AccountingVinithaNo ratings yet

- RE Exam FA Sem I MFM MMM MHRDMDocument4 pagesRE Exam FA Sem I MFM MMM MHRDMPARAM CLOTHINGNo ratings yet

- 71844bos Interp5qDocument7 pages71844bos Interp5qMayank RajputNo ratings yet

- FDN J22 - TS 2 - P1 Account - QueDocument5 pagesFDN J22 - TS 2 - P1 Account - QueShantanu JadhavNo ratings yet

- Financial AccountingDocument2 pagesFinancial AccountingKartik GurmuleNo ratings yet

- 640 / 240 / 260: Advanced Financial Accounting (New Regulations)Document7 pages640 / 240 / 260: Advanced Financial Accounting (New Regulations)Emind Annamalai JPNagarNo ratings yet

- Test Series: October, 2020 Mock Test Paper Intermediate (New) : Group - Ii Paper - 5: Advanced AccountingDocument7 pagesTest Series: October, 2020 Mock Test Paper Intermediate (New) : Group - Ii Paper - 5: Advanced AccountingAruna RajappaNo ratings yet

- 11 QP Final (2021-22)Document4 pages11 QP Final (2021-22)Flick OPNo ratings yet

- Mock-Iv AccountsDocument6 pagesMock-Iv AccountsAnsh UdainiaNo ratings yet

- Paper - 2 Accounting SyllabusDocument40 pagesPaper - 2 Accounting SyllabusNguyen Dac ThichNo ratings yet

- 2accounting Questions Nov Dec 2019 CL PDFDocument3 pages2accounting Questions Nov Dec 2019 CL PDFRazib Das RaazNo ratings yet

- Account - 1Document6 pagesAccount - 1kakajumaNo ratings yet

- Question No.1 Is Compulsory. Candidates Are Required To Answer Any Four Questions From The Remaining Five QuestionsDocument9 pagesQuestion No.1 Is Compulsory. Candidates Are Required To Answer Any Four Questions From The Remaining Five QuestionsayushiNo ratings yet

- Mock TestDocument7 pagesMock TestShivaji hariNo ratings yet

- Cambridge International AS & A Level: ACCOUNTING 9706/31Document4 pagesCambridge International AS & A Level: ACCOUNTING 9706/31caiexpertcontactNo ratings yet

- © The Institute of Chartered Accountants of India: ST STDocument6 pages© The Institute of Chartered Accountants of India: ST STVishal MehraNo ratings yet

- Undertaking by The Student: (In Case of MinorDocument1 pageUndertaking by The Student: (In Case of MinorXee Shaun Ali BhatNo ratings yet

- New Economic Reforms INDIAN ECO. DEVLOPMENT CBSEDocument40 pagesNew Economic Reforms INDIAN ECO. DEVLOPMENT CBSEVishal MehraNo ratings yet

- Business ServicesDocument25 pagesBusiness ServicesVishal MehraNo ratings yet

- Bank Regulatory CapitalDocument9 pagesBank Regulatory CapitalDristi PoddarNo ratings yet

- Jan 21Document87 pagesJan 21Menuka SiwaNo ratings yet

- Girnar CaseDocument6 pagesGirnar CaseBidisha GhoshalNo ratings yet

- Icai CocDocument50 pagesIcai CocHarsha OjhaNo ratings yet

- Saligram Ruplal Khanna V Kanwar RajnathDocument7 pagesSaligram Ruplal Khanna V Kanwar RajnathJashan RNo ratings yet

- Managerial RemunerationDocument7 pagesManagerial RemunerationM SameerNo ratings yet

- B2 2022 May AnsDocument15 pagesB2 2022 May AnsRashid AbeidNo ratings yet

- Ivalue Advisors Pvt. LTD Vs Srinagar Banihal Expressway LTD On 13 January, 2020Document4 pagesIvalue Advisors Pvt. LTD Vs Srinagar Banihal Expressway LTD On 13 January, 2020AAKASH BHATIANo ratings yet

- Company Analysis (IHH Healthcare Berhad)Document78 pagesCompany Analysis (IHH Healthcare Berhad)Nurulain100% (4)

- Revision Pack EOT - 2 Grade 9Document49 pagesRevision Pack EOT - 2 Grade 9R4iDNo ratings yet

- Business Accounting .Document11 pagesBusiness Accounting .sivasamy Sundara MorthiNo ratings yet

- Case 3 PRISMA Construction and Development Corporation vs. Menchavez. GR No. 160545. March 9, 2010Document2 pagesCase 3 PRISMA Construction and Development Corporation vs. Menchavez. GR No. 160545. March 9, 2010eUG SACLONo ratings yet

- The Republic of Uganda: As BorrowerDocument5 pagesThe Republic of Uganda: As BorrowerBaguma IshaNo ratings yet

- FICAAADocument4 pagesFICAAAYash GuptaNo ratings yet

- Article 1156-1162Document5 pagesArticle 1156-1162Kim JennieNo ratings yet

- Promotion Material 2023-2024-1-10Document10 pagesPromotion Material 2023-2024-1-10CREDIT BHARATPURNo ratings yet

- Government Accounting Quiz 1 Write The Letter Pertaining To Best AnswerDocument4 pagesGovernment Accounting Quiz 1 Write The Letter Pertaining To Best AnswerWilliam DC RiveraNo ratings yet

- Xii Mcqs CH - 5 Admission of Partner and RetirementDocument6 pagesXii Mcqs CH - 5 Admission of Partner and RetirementJoanna GarciaNo ratings yet

- General-Power-of-AttorneyDocument4 pagesGeneral-Power-of-AttorneyChristian Jade HensonNo ratings yet

- Ts Grewal Solutions For Class 11 Accountancy Chapter 10 TrialDocument22 pagesTs Grewal Solutions For Class 11 Accountancy Chapter 10 TrialMantejNo ratings yet

- Financial Statements - Tata Steel & JSW SteelDocument10 pagesFinancial Statements - Tata Steel & JSW Steelrohit5saoNo ratings yet

- Chapter 2Document42 pagesChapter 2Ira Dian UbatayNo ratings yet

- Birth Certificates ExplainedDocument7 pagesBirth Certificates ExplainedKenny100% (2)

- List Down The Terminologies Which Were Mentioned in The Movie and Define Each Based On Your Own Research and UnderstandingDocument5 pagesList Down The Terminologies Which Were Mentioned in The Movie and Define Each Based On Your Own Research and UnderstandingvonnevaleNo ratings yet

- Comaker Policy PDFDocument10 pagesComaker Policy PDFAko C IanNo ratings yet

- The Nature of Auction For The Execution of Underwriting Rights Objects in The Law of GuaranteesDocument18 pagesThe Nature of Auction For The Execution of Underwriting Rights Objects in The Law of GuaranteesSuhana HanaNo ratings yet

- Buslaw 1: de La Salle University Comlaw DepartmentDocument33 pagesBuslaw 1: de La Salle University Comlaw DepartmentGasper BrookNo ratings yet

- Case Study Dominion ResourcesDocument21 pagesCase Study Dominion ResourcesKanoknad KalaphakdeeNo ratings yet

- Mba775 - ACF 5 - Calculating Cashflows For DCF ValuationDocument17 pagesMba775 - ACF 5 - Calculating Cashflows For DCF Valuationshubhtandon123No ratings yet

- Chapter 3 Source of Capital - Handout - 404263880Document22 pagesChapter 3 Source of Capital - Handout - 404263880JAN RAY CUISON VISPERASNo ratings yet