Professional Documents

Culture Documents

Bank Regulatory Capital

Uploaded by

Dristi PoddarOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Bank Regulatory Capital

Uploaded by

Dristi PoddarCopyright:

Available Formats

Commercial Banks: From the Balance Sheet to the Income Statement and Cash Flow Statement

($ in Millions)

Assumptions:

Taxes, Regulatory Capital, and Operating Assumptions:

Tax Rate: 25.0%

Minimum Common Equity Tier 1 Ratio: 7.0%

Minimum Tier 1 Capital Ratio: 8.5%

Minimum Total Capital Ratio: 10.5%

Minimum Tier 1 Leverage Ratio: 4.0%

% of Allowance for Loan Losses in Tier 2 Capital: 50.0%

Loan Additions in Period Shown: $ 100.0

Commercial Bank - Balance Sheet:

Interest Interest Risk

ASSETS: Beginning: Ending: Rate: Income: Weight:

Cash: $ 100.0 $ 30.0 0.0% $ - 0.0%

Available for Sale Securities: 100.0 100.0 3.0% 3.0 100.0%

Other Securities: 200.0 200.0 2.5% 5.0 100.0%

Gross Loans: 1,000.0 1,100.0 10.0% 100.0 90.0%

Allowance for Loan Losses: (50.0) (55.0)

Net Loans: 950.0 1,045.0

Goodwill & Other Intangible Assets: 30.0 30.0 0.0% - 0.0%

Other Assets: 40.0 40.0 5.0% 2.0 100.0%

Total Assets: $ 1,420.0 $ 1,445.0 $ 110.0

Interest Interest

LIABILITIES & EQUITY: Beginning: Ending: Rate: Expense:

Liabilities:

Deposits: $ 1,000.0 $ 1,000.0 2.5% $ 25.0

Senior Debt: 100.0 100.0 4.0% 4.0

Subordinated Notes: 50.0 50.0 8.0% 4.0

Other Borrowings: 80.0 80.0 5.0% 4.0

Convertible Bonds: 20.0 20.0 0.0% -

Total Liabilities: 1,250.0 1,250.0

Equity:

Common Stockholders' Equity: 120.0 145.0

Preferred Stock: 50.0 50.0 10.0% 5.0

Total Equity: 170.0 195.0

Total Liabilities & Equity: $ 1,420.0 $ 1,445.0 $ 42.0

BALANCE CHECK: OK! OK!

REGULATORY CAPITAL:

Common Equity Tier 1 (CET 1): $ 90.0 $ 115.0

(+) Preferred Stock: 50.0 50.0

Tier 1 Capital: 140.0 165.0

Tier 2 Capital:

(+) Convertible Bonds: 20.0 20.0

(+) Subordinated Notes: 50.0 50.0

(+) Qualifying Allowance for LLs: 25.0 27.5

Total Tier 2 Capital: 95.0 97.5

Total Capital: $ 235.0 $ 262.5

Total Risk-Weighted Assets: 1,325.0 1,415.0

Total Tangible Assets: 1,390.0 1,415.0

Tangible Common Equity Ratio: 6.5% 8.1%

Common Equity Tier 1 Ratio: 6.8% 8.1%

Tier 1 Capital Ratio: 10.6% 11.7%

Total Capital Ratio: 17.7% 18.6%

Tier 1 Leverage Ratio: 10.1% 11.7%

Net Loans / Total Assets: 66.9% 72.3%

Deposits / Total Liabilities & Equity: 70.4% 69.2%

Net Loans / Deposits: 95.0% 104.5%

Cash Flow Statement

Commercial Bank - Income Statement: Loan Loss Reserve Calculations:

Annual Period: Annual Period:

(+) Interest Income: $ 110.0 Beginning Reserve Balance: $ 50.0

(-) Interest Expense: (37.0)

Net Interest Income: 73.0 Net Charge-Offs Calculation:

(-) Gross Charge-Offs: -

Net Fee & Commission Income: 12.0 (+) Recoveries: -

Net Charge-Offs: -

Provisions for Credit Losses: (5.0)

(+) Additions to Provisions: 5.0

Non-Interest Expenses: (40.0)

Ending Reserve Balance: $ 55.0

Pre-Tax Income: 40.0

(-) Income Taxes: (10.0) Key Operating Metrics and Ratios:

Net Income: 30.0

(-) Preferred Stock Dividend: (5.0) Net Charge-Off Ratio: 0.0%

Net Income to Common: $ 25.0 Net Charge-Offs / Reserves: 0.0%

Reserve Ratio: 5.0%

Commercial Bank - Cash Flow Statement:

Annual Period: Return on Common Equity: 18.9%

Cash Flow from Operations: Return on Tangible Common Equity: 24.4%

Net Income to Common: $ 25.0 Return on Assets: 2.1%

Provisions for Credit Losses: 5.0 Return on Tangible Assets: 2.1%

Changes in Operating Assets & Liabilities:

Additions to Gross Loans: (100.0) Net Interest Margin: 5.3%

Changes in Other Securities: - Average Interest Rate on IEA: 7.9%

Changes in Other Assets: - Average Interest on IBL: 3.0%

Changes in Deposits: - Spread: 4.9%

Total Cash Flow from Operations: (70.0)

Net Interest Income / Revenue: 85.9%

Cash Flow from Investing: Overhead Ratio: 47.1%

Sales / (Purchases) of AFS Securities: - Dividend Payout Ratio: 0.0%

(Purchases) of Intangible Assets: -

Total Cash Flow from Investing: -

Cash Flow from Financing:

Changes in Senior Debt: -

Changes in Subordinated Notes: -

Changes in Other Borrowings: -

Changes in Convertible Bonds: -

Preferred Issuances: -

Common Stock Issuances: -

Dividends to Common: -

Total Cash Flow from Financing: -

Net Change in Cash: $ (70.0)

Off-Balance Sheet Assets

Conversion

Balance: Factor:

Unused Commitments: $ 50.0 0.0%

< 1-Year Commitments 50.0 20.0%

> 1-Year Commitments 50.0 50.0%

Non-Sec. Guarantees: 50.0 100.0%

Total: $ 200.0

Silicon Valley Bank - Balance Sheet and Regulatory Capital:

($ in Millions)

Assumptions:

Regulatory Capital Minimums:

Minimum Common Equity Tier 1 Ratio: 7.0%

Minimum Tier 1 Capital Ratio: 8.5%

Minimum Total Capital Ratio: 10.5%

Minimum Tier 1 Leverage Ratio: 4.0%

Commercial Bank - Balance Sheet:

ASSETS: FY 21 FY 22

Cash: $ 14.6 $ 13.8

Available for Sale Securities: 27.2 26.1 <-- Recorded at fair market value, so there are no unrealized losses or gains.

Held to Maturity Securities: 98.2 91.3 <-- Massive unrealized losses here!

Other Securities: 2.5 2.7

Gross Loans: 66.3 74.3

Allowance for Loan Losses: (0.4) (0.6)

Net Loans: 65.9 73.6

Goodwill & Other Intangible Assets: 0.5 0.5

Other Assets: 2.4 3.8

Total Assets: $ 211.3 $ 211.8

LIABILITIES & EQUITY: FY 21 FY 22

Liabilities:

Deposits: $ 189.2 $ 173.1

Senior Debt: 2.6 18.9

Other Liabilities: 2.9 3.5

Total Liabilities: 194.7 195.5

Equity:

Common Stockholders' Equity: 12.6 12.4

Preferred Stock: 3.6 3.6

Noncontrolling Interests: 0.4 0.3

Total Equity: 16.6 16.3

Total Liabilities & Equity: $ 211.3 $ 211.8

BALANCE CHECK: OK! OK!

REGULATORY CAPITAL:

Common Stockholders' Equity: $ 12.6 $ 12.4

(-) Goodwill & Intangibles: (0.5) (0.5)

(+) Certain DTAs: - (0.1)

(+/-) Other Adjustments: 0.1 2.0

Common Equity Tier 1 (CET 1): 12.2 13.7

(+) Preferred Stock: 3.6 3.6

(+) Qualifying NCI: 0.4 0.3

(+/-) Other Adjustments: - (0.1)

Tier 1 Capital: 16.2 17.5

Total Risk-Weighted Assets: 100.8 113.6

Total Tangible Assets: 210.8 211.3

RWAs / Tangible Assets: 47.8% 53.8%

Tangible Common Equity Ratio: 5.7% 5.6%

Common Equity Tier 1 Ratio: 12.1% 12.1%

Tier 1 Capital Ratio: 16.1% 15.4%

Tier 1 Leverage Ratio: 7.7% 8.3%

Net Loans / Total Assets: 31.2% 34.8%

Deposits / Total Liabilities & Equity: 89.5% 81.7%

Net Loans / Deposits: 34.8% 42.5%

Credit Suisse - Balance Sheet and Regulatory Capital:

($ in Millions)

Assumptions:

Regulatory Capital Minimums:

Minimum Common Equity Tier 1 Ratio: 9.3%

Minimum Tier 1 Capital Ratio: 13.6%

Minimum Total Capital Ratio: 27.2%

Minimum Tier 1 Leverage Ratio: 4.8%

Commercial Bank - Balance Sheet:

ASSETS: FY 21 FY 22

Cash & Due from Banks: CHF 270.0 CHF 127.7

Available for Sale Securities: 111.1 65.5

Held to Maturity Securities: 1.0 1.7

Other Securities: 20.8 8.5

Gross Loans: 293.0 265.6

Allowance for Loan Losses: (1.3) (1.4)

Net Loans: 291.7 264.2

Goodwill & Other Intangible Assets: 3.2 3.4

Other Assets: 57.9 60.4

Total Assets: CHF 755.8 CHF 531.4

LIABILITIES & EQUITY: FY 21 FY 22

Liabilities:

Deposits: CHF 392.8 CHF 233.2

Debt & Borrowings: 186.3 169.6

Due to Banks & Central Bank Funds: 54.2 32.2

Other Liabilities: 78.3 51.0

Total Liabilities: 711.6 486.1

Equity:

Common Stockholders' Equity: 44.0 45.1

Preferred Stock: - -

Noncontrolling Interests: 0.3 0.2

Total Equity: 44.2 45.3

Total Liabilities & Equity: CHF 755.8 CHF 531.4

BALANCE CHECK: OK! OK!

REGULATORY CAPITAL:

Common Stockholders' Equity: CHF 44.0 CHF 45.1

(-) Goodwill & Intangibles: (3.2) (3.4)

(+) Certain DTAs: (0.9) (0.1)

(+/-) Other Adjustments: (1.4) (6.3)

Common Equity Tier 1 (CET 1): 38.5 35.3

(+) Preferred Stock: - -

(+) AT1 Capital: 15.8 14.7

(+) Qualifying NCI: - -

(+/-) Other Adjustments: - -

Tier 1 Capital: 54.4 50.0

Total Risk-Weighted Assets: 267.8 250.5

Total Tangible Assets: 752.6 528.1

RWAs / Tangible Assets: 35.6% 47.4%

Tangible Common Equity Ratio: 5.4% 7.9%

Common Equity Tier 1 Ratio: 14.4% 14.1%

Tier 1 Capital Ratio: 20.3% 20.0%

Tier 1 Leverage Ratio: 7.2% 9.5%

Liquid Assets: 227.2 120.0

% Cash: 84.1% 93.9%

Stress Net Cash Outflows: 112.2 83.2

% Deposits: 28.6% 35.7%

Liquidity Coverage Ratio (LCR): 202.6% 144.2%

Net Loans / Total Assets: 38.6% 49.7%

Deposits / Total Liabilities & Equity: 52.0% 43.9%

Net Loans / Deposits: 74.3% 113.3%

You might also like

- Interrogatories DivorceDocument29 pagesInterrogatories DivorceBlanca BlancaNo ratings yet

- Debt Policy and ValueDocument7 pagesDebt Policy and ValueMuhammad Nabil EzraNo ratings yet

- Private Companies (Very Small Businesses) Key Financial DifferencesDocument50 pagesPrivate Companies (Very Small Businesses) Key Financial DifferencesFarhan ShafiqueNo ratings yet

- Accounting and Finance Formulas: A Simple IntroductionFrom EverandAccounting and Finance Formulas: A Simple IntroductionRating: 4 out of 5 stars4/5 (8)

- LBO Model Template - PE Course (Spring 08)Document18 pagesLBO Model Template - PE Course (Spring 08)chasperbrown100% (11)

- Breaking Into Wall Street - Understanding Financial StatementsDocument4 pagesBreaking Into Wall Street - Understanding Financial StatementsCristina Bejan100% (1)

- Valuation - DCF+LBO - Master - VS - 09-01-2012 EB CommentsDocument89 pagesValuation - DCF+LBO - Master - VS - 09-01-2012 EB CommentsJames MitchellNo ratings yet

- Debt and Policy Value CaseDocument6 pagesDebt and Policy Value CaseUche Mba100% (2)

- Loan Agreement: This Agreement Is Made and Entered Into BetweenDocument5 pagesLoan Agreement: This Agreement Is Made and Entered Into BetweenWasif Mehmood100% (5)

- Sample DCF Valuation TemplateDocument2 pagesSample DCF Valuation TemplateTharun RaoNo ratings yet

- 02 24 Free Cash FlowDocument10 pages02 24 Free Cash FlowSharon BolañosNo ratings yet

- Case 26 An Introduction To Debt Policy ADocument5 pagesCase 26 An Introduction To Debt Policy Amy VinayNo ratings yet

- 02 24 Free Cash FlowDocument17 pages02 24 Free Cash FlowAnil RatnaniNo ratings yet

- Build a Simple DCF ModelDocument19 pagesBuild a Simple DCF ModelaliNo ratings yet

- Frequently Asked Questions in International Standards on AuditingFrom EverandFrequently Asked Questions in International Standards on AuditingRating: 1 out of 5 stars1/5 (1)

- Sample DCF Valuation TemplateDocument2 pagesSample DCF Valuation TemplateTharun RaoNo ratings yet

- Chattel Mortgage Law (Act No. 1508)Document5 pagesChattel Mortgage Law (Act No. 1508)Heberdon LitaNo ratings yet

- APECS Financial Modelling Test (Updated) - DarrenDocument22 pagesAPECS Financial Modelling Test (Updated) - DarrenDarren WongNo ratings yet

- Case 7 - An Introduction To Debt Policy and ValueDocument5 pagesCase 7 - An Introduction To Debt Policy and ValueAnthony Kwo100% (2)

- Marketing Strategies For Mortgage Lenders and BrokersDocument2 pagesMarketing Strategies For Mortgage Lenders and BrokersTodd Lake100% (7)

- LBO Model Cash Flow AnalysisDocument38 pagesLBO Model Cash Flow AnalysisBobbyNicholsNo ratings yet

- Analysis of CRISIL Credit Rating AgencyDocument105 pagesAnalysis of CRISIL Credit Rating AgencySubhash Bajaj100% (1)

- Capital StructureDocument41 pagesCapital Structure/jncjdncjdnNo ratings yet

- Portable Alpha Theory and Practice: What Investors Really Need to KnowFrom EverandPortable Alpha Theory and Practice: What Investors Really Need to KnowNo ratings yet

- ObliconDocument9 pagesObliconchubbybunbunNo ratings yet

- Topic 1 - Activity 2 (APPLICATION)Document2 pagesTopic 1 - Activity 2 (APPLICATION)Sharmin ReulaNo ratings yet

- Assumptions: Commercial Bank - Income Statement Loan Loss Reserve CalculationsDocument2 pagesAssumptions: Commercial Bank - Income Statement Loan Loss Reserve CalculationsziuziNo ratings yet

- 60 06 RegulationsDocument5 pages60 06 Regulationsmerag76668No ratings yet

- 60 05 CL Provisions AfterDocument4 pages60 05 CL Provisions Aftermerag76668No ratings yet

- Chapter 4: Analysis of Financial StatementsDocument8 pagesChapter 4: Analysis of Financial StatementsSafuan HalimNo ratings yet

- Week 1 - Broadway ProformaDocument34 pagesWeek 1 - Broadway ProformashivangiNo ratings yet

- Lbo DCF ModelDocument38 pagesLbo DCF ModelKaran PatelNo ratings yet

- Bài TậpDocument7 pagesBài TậpThùyy VyNo ratings yet

- DCF Valuation TemplateDocument9 pagesDCF Valuation TemplateSatyam1771No ratings yet

- Chapter 12 Mini Case SolutionsDocument10 pagesChapter 12 Mini Case SolutionsFarhanie NordinNo ratings yet

- Discounted Cash Flow Valuation ExcelDocument8 pagesDiscounted Cash Flow Valuation ExcelGomv ConsNo ratings yet

- Sample DCF Valuation TemplateDocument2 pagesSample DCF Valuation TemplateTharun RaoNo ratings yet

- Food Distribution LBO Deleverage AnalysisDocument12 pagesFood Distribution LBO Deleverage AnalysismartinsiklNo ratings yet

- Sample Balance Sheet and Net Asset Value Model for Equity REITDocument2 pagesSample Balance Sheet and Net Asset Value Model for Equity REITmerag76668No ratings yet

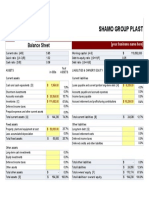

- Shamo Group Plast: Balance SheetDocument1 pageShamo Group Plast: Balance SheetEng MatanaNo ratings yet

- Apple Inc. Financial StatementsDocument4 pagesApple Inc. Financial StatementsRohan BahriNo ratings yet

- MBA 570 Min Case CHP 14 WK 2Document11 pagesMBA 570 Min Case CHP 14 WK 2chastityc2001No ratings yet

- DW CorpDocument20 pagesDW CorpAlejo valenzuelaNo ratings yet

- ABC Income Statement (Millons) 2018: Short Term InvestmentsDocument20 pagesABC Income Statement (Millons) 2018: Short Term InvestmentsAlejo valenzuelaNo ratings yet

- Bank Modeling TryoutDocument11 pagesBank Modeling Tryoutcharlotte.zibautNo ratings yet

- 02 24 Free Cash Flow (1)Document6 pages02 24 Free Cash Flow (1)cherifsambNo ratings yet

- How leverage affects firm valueDocument5 pagesHow leverage affects firm valuevinneNo ratings yet

- IBIG 06 01 Three Statements 30 Minutes CompleteDocument12 pagesIBIG 06 01 Three Statements 30 Minutes CompletedarylchanNo ratings yet

- Ratio Analysis AssessmentDocument2 pagesRatio Analysis AssessmentShyam SNo ratings yet

- 3.1 Balance Sheet Management TemplateDocument3 pages3.1 Balance Sheet Management TemplateChristian Cedrick OlmonNo ratings yet

- Whole Industry (Reliability) Bottom Quartile (25%) Lower Middle (25%) Upper Middle (25%) Top Quartile (25%)Document4 pagesWhole Industry (Reliability) Bottom Quartile (25%) Lower Middle (25%) Upper Middle (25%) Top Quartile (25%)Mohamed SururrNo ratings yet

- Financial Analysis & ForecastDocument7 pagesFinancial Analysis & ForecastSussi HizbullahNo ratings yet

- Income Statement - Apple Balance Sheet - Apple Personal "Balance Sheet"Document4 pagesIncome Statement - Apple Balance Sheet - Apple Personal "Balance Sheet"jitenNo ratings yet

- Consolidation Accounting For Noncontrolling Interests - IntroductionDocument10 pagesConsolidation Accounting For Noncontrolling Interests - IntroductionManeeshNo ratings yet

- Financial Forecasting SamarakoonDocument33 pagesFinancial Forecasting SamarakoonEyael ShimleasNo ratings yet

- Mergers and Acquisitions ValuationDocument9 pagesMergers and Acquisitions ValuationindahNo ratings yet

- Valiant - 4q22 - Presentation For Analysts and Media RepresentativesDocument32 pagesValiant - 4q22 - Presentation For Analysts and Media RepresentativesMiguel RamosNo ratings yet

- Diagnosing Profitability, Risk, and Growth: Hawawini & Viallet 1Document29 pagesDiagnosing Profitability, Risk, and Growth: Hawawini & Viallet 1Imelda Gonzalez MedinaNo ratings yet

- APECS Financial Modelling Test (Updated) - by Keng YangDocument16 pagesAPECS Financial Modelling Test (Updated) - by Keng YangDarren WongNo ratings yet

- PART I: Discussion Ques Ons: Submission Date: On or Before Final Examination Total Weight: 30%Document5 pagesPART I: Discussion Ques Ons: Submission Date: On or Before Final Examination Total Weight: 30%jaNo ratings yet

- Solutions To Chapters 7 and 8 Problem SetsDocument21 pagesSolutions To Chapters 7 and 8 Problem SetsAn Ngoc CồNo ratings yet

- Global Financial Management: Debt Policy, Capital Structure, and Capital BudgetingDocument40 pagesGlobal Financial Management: Debt Policy, Capital Structure, and Capital BudgetingahmedmtNo ratings yet

- Section 3 Modified - Ch5+Ch6Document8 pagesSection 3 Modified - Ch5+Ch6Dina AlfawalNo ratings yet

- Introduction To Debt PolicyDocument8 pagesIntroduction To Debt PolicyRatnesh DubeyNo ratings yet

- Personal Money Management Made Simple with MS Excel: How to save, invest and borrow wiselyFrom EverandPersonal Money Management Made Simple with MS Excel: How to save, invest and borrow wiselyNo ratings yet

- Ares 10 KDocument10 pagesAres 10 KDristi PoddarNo ratings yet

- Ih 31 9838Document2 pagesIh 31 9838Dristi PoddarNo ratings yet

- 18 11 22 161626 7397708413113 PDFDocument1 page18 11 22 161626 7397708413113 PDFDristi PoddarNo ratings yet

- Online Booking - Air IndiaDocument1 pageOnline Booking - Air IndiaDristi PoddarNo ratings yet

- Things To DoDocument1 pageThings To DoDristi PoddarNo ratings yet

- PeDocument1 pagePeDristi PoddarNo ratings yet

- Project Financing Model - Dristi PoddarDocument16 pagesProject Financing Model - Dristi PoddarDristi PoddarNo ratings yet

- Room Booking - RadheDocument1 pageRoom Booking - RadheDristi PoddarNo ratings yet

- Interim Rules of Procedure On Corporate RehabilitationDocument11 pagesInterim Rules of Procedure On Corporate RehabilitationChrissy SabellaNo ratings yet

- Debt 31-05-2008Document3,870 pagesDebt 31-05-2008bipinpowerNo ratings yet

- TAX2 3RD ED Solutions Manual 1Document51 pagesTAX2 3RD ED Solutions Manual 1Nadine Isabelle OsisNo ratings yet

- Glosar Termeni ComercialiDocument37 pagesGlosar Termeni ComercialiMaithun100% (1)

- Pangea Mortgage Capital Closes $8.5 Million LoanDocument3 pagesPangea Mortgage Capital Closes $8.5 Million LoanPR.comNo ratings yet

- Causes and Consequences of The Spanish Economic Crisis - University of Minho Portugal EssayDocument20 pagesCauses and Consequences of The Spanish Economic Crisis - University of Minho Portugal EssayMichael KNo ratings yet

- Chapter One ProjectDocument11 pagesChapter One ProjectDickson Tk Chuma Jr.No ratings yet

- Soriano vs. Ubat, G.R. No. L-11633, January 31, 1961.Document2 pagesSoriano vs. Ubat, G.R. No. L-11633, January 31, 1961.Lourdes LorenNo ratings yet

- Cairn India Financial InfoDocument4 pagesCairn India Financial Infohirenchavla93No ratings yet

- Annamalai University: Directorate of Distance EducationDocument164 pagesAnnamalai University: Directorate of Distance Educationsilky friendsNo ratings yet

- Asmt - Acc 501 PDFDocument21 pagesAsmt - Acc 501 PDFChhorvy KhanNo ratings yet

- B291 TMA - Fall - 2022-2023 (AutoRecovered)Document12 pagesB291 TMA - Fall - 2022-2023 (AutoRecovered)Reham AbdelazizNo ratings yet

- 30 Bank of The Philippine Islands v. Intermediate Appellate CourtDocument13 pages30 Bank of The Philippine Islands v. Intermediate Appellate CourtKaiiSophieNo ratings yet

- ReadingDocument205 pagesReadingHiền ThuNo ratings yet

- Quick Documentation GuideDocument43 pagesQuick Documentation GuideHimanshu MishraNo ratings yet

- CA Inter Paper 8 Compiler 8-8-22Document496 pagesCA Inter Paper 8 Compiler 8-8-22Pratim Baheti100% (1)

- 01 MMDocument21 pages01 MMNaoman Ch100% (1)

- Ch 7: Financial Markets OverviewDocument9 pagesCh 7: Financial Markets OverviewArly Kurt TorresNo ratings yet

- Section B - Group 2 - DHFL Governance Failure - Final ReportDocument14 pagesSection B - Group 2 - DHFL Governance Failure - Final Reportpgdm22srijanbNo ratings yet

- Account Must Do List!! Nov - 2022 - 220911 - 200510Document259 pagesAccount Must Do List!! Nov - 2022 - 220911 - 200510KartikNo ratings yet

- Neelmangala-Tumkur Bot Project Vol IDocument102 pagesNeelmangala-Tumkur Bot Project Vol IAnil Kumar K MorabadNo ratings yet

- Personal Financial Planning 14th Edition Billingsley Solutions Manual 1Document30 pagesPersonal Financial Planning 14th Edition Billingsley Solutions Manual 1elizabeth100% (55)

- Dra New QuestionDocument8 pagesDra New QuestionHarsh PatelNo ratings yet