Professional Documents

Culture Documents

Assumptions: Commercial Bank - Income Statement Loan Loss Reserve Calculations

Uploaded by

ziuzi0 ratings0% found this document useful (0 votes)

7 views2 pagesThis document provides financial information for a commercial bank, including income statements, balance sheets, cash flow statements, and calculations of loan loss reserves and regulatory capital ratios. It shows that the bank had $30 million in net income for the annual period. The bank maintained its loan loss reserve at $10 million and met all regulatory capital ratio requirements.

Original Description:

Original Title

Allowance-for-Loan-Losses

Copyright

© © All Rights Reserved

Available Formats

XLSX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document provides financial information for a commercial bank, including income statements, balance sheets, cash flow statements, and calculations of loan loss reserves and regulatory capital ratios. It shows that the bank had $30 million in net income for the annual period. The bank maintained its loan loss reserve at $10 million and met all regulatory capital ratio requirements.

Copyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

7 views2 pagesAssumptions: Commercial Bank - Income Statement Loan Loss Reserve Calculations

Uploaded by

ziuziThis document provides financial information for a commercial bank, including income statements, balance sheets, cash flow statements, and calculations of loan loss reserves and regulatory capital ratios. It shows that the bank had $30 million in net income for the annual period. The bank maintained its loan loss reserve at $10 million and met all regulatory capital ratio requirements.

Copyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

You are on page 1of 2

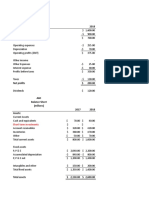

Provisions for Credit Losses & Loan Loss Reserves Calculations

($ in Millions)

Assumptions: Commercial Bank - Income Statement Loan Loss Reserve Calculations:

Annual Period: Annual Period:

Tax Rate: 40.0% Interest Income: $ 100.0 Beginning Reserve Balance: $ 10.0

Minimum Common Equity Tier 1 Ratio: 7.0% Interest Expense: (20.0)

Minimum Tier 1 Capital Ratio: 8.5% Net Interest Income: 80.0 Net Charge-Offs Calculation:

Minimum Total Capital Ratio: 10.5% (-) Gross Charge-Offs:

Minimum Leverage Ratio: 3.0% Provisions for Credit Losses: - (+) Recoveries:

Net Charge-Offs: -

% of Allowance for Loan Losses in Tier 2 Capital: 50.0% Net Fee & Commission Income: 10.0

Loan Additions in Period Shown: (+) Additions to Provisions:

Non-Interest Expenses: (40.0)

Commercial Bank - Balance Sheet Ending Reserve Balance: $ 10.0

ASSETS: Beginning: Ending: Pre-Tax Income: 50.0

Cash: $ 100.0 $ 130.0 Net Income: $ 30.0

Securities: 200.0 200.0

Commercial Bank - Cash Flow Statement

Gross Loans: 1,000.0 1,000.0 Annual Period:

Allowance for Loan Losses: (10.0) (10.0) Net Income: $ 30.0

Net Loans: 990.0 990.0 Provisions for Credit Losses: -

Changes in Assets & Liabilities:

Goodwill & Other Intangible Assets: 50.0 50.0 Additions to Gross Loans: -

Other Assets: 40.0 40.0 Changes in Securities: -

Changes in Goodwill & Intangibles: -

Total Assets: $ 1,380.0 $ 1,410.0 Changes in Other Assets: -

Changes in Deposits: -

LIABILITIES & EQUITY: Changes in Debt: -

Liabilities: Changes in Subordinated Notes: -

Deposits: $ 1,000.0 $ 1,000.0 Changes in Borrowings: -

Senior Debt: 50.0 50.0 Changes in Convertible Bonds: -

Subordinated Notes: 50.0 50.0 Preferred Issuances: -

Other Borrowings: 75.0 75.0 Common Stock Issuances: -

Convertible Bonds: 20.0 20.0 Net Change in Cash: $ 30.0

Total Liabilities: 1,195.0 1,195.0

Equity:

Common Stockholders' Equity: 135.0 165.0

Preferred Stock: 50.0 50.0

Total Equity: 185.0 215.0

Total Liabilities & Equity: $ 1,380.0 $ 1,410.0

BALANCE CHECK: OK! OK!

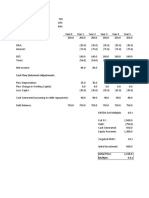

REGULATORY CAPITAL:

Common Equity Tier 1 (CET 1): $ 85.0 $ 115.0

(+) Preferred Stock: 50.0 50.0

Tier 1 Capital: 135.0 165.0

Tier 2 Capital:

(+) Convertible Bonds: 20.0 20.0

(+) Subordinated Notes: 50.0 50.0

(+) Qualifying Allowance for LLs: 5.0 5.0

Total Tier 2 Capital: 75.0 75.0

Total Capital: $ 210.0 $ 240.0

Total Risk-Weighted Assets: 1,240.0 1,240.0

Total Tangible Assets: 1,330.0 1,360.0

Common Equity Tier 1 Ratio: 6.9% 9.3%

Tier 1 Capital Ratio: 10.9% 13.3%

Total Capital Ratio: 16.9% 19.4%

Leverage Ratio: 10.2% 12.1%

You might also like

- Original Issue Discount (OID) : What It Means and How It Works On The Financial StatementsDocument9 pagesOriginal Issue Discount (OID) : What It Means and How It Works On The Financial StatementsziuziNo ratings yet

- Business Financial AnalysisDocument14 pagesBusiness Financial Analysismc limNo ratings yet

- Private Debt: Yield, Safety and the Emergence of Alternative LendingFrom EverandPrivate Debt: Yield, Safety and the Emergence of Alternative LendingNo ratings yet

- Intermediate Accounting 2: a QuickStudy Digital Reference GuideFrom EverandIntermediate Accounting 2: a QuickStudy Digital Reference GuideNo ratings yet

- Balance Sheet Rules SummaryDocument4 pagesBalance Sheet Rules SummaryCristina Bejan100% (1)

- AC216 Unit 4 Assignment 5 - Amortization MorganDocument2 pagesAC216 Unit 4 Assignment 5 - Amortization MorganEliana Morgan100% (1)

- Debt and Policy Value CaseDocument6 pagesDebt and Policy Value CaseUche Mba100% (2)

- Case Study 2Document5 pagesCase Study 2Tabish Iftikhar SyedNo ratings yet

- 02 24 Free Cash FlowDocument10 pages02 24 Free Cash FlowSharon BolañosNo ratings yet

- Discounted Cash Flow Analysis - Uber Technologies, Inc. (Unlevered DCF)Document9 pagesDiscounted Cash Flow Analysis - Uber Technologies, Inc. (Unlevered DCF)Haysam TayyabNo ratings yet

- Corporate Financial Distress, Restructuring, and Bankruptcy: Analyze Leveraged Finance, Distressed Debt, and BankruptcyFrom EverandCorporate Financial Distress, Restructuring, and Bankruptcy: Analyze Leveraged Finance, Distressed Debt, and BankruptcyNo ratings yet

- Case 26 An Introduction To Debt Policy ADocument5 pagesCase 26 An Introduction To Debt Policy Amy VinayNo ratings yet

- 02 24 Free Cash FlowDocument17 pages02 24 Free Cash FlowAnil RatnaniNo ratings yet

- REIT (Real Estate Investment Trust) Valuation 101: Would You Like A Dividend With Your Funds From Operations?Document16 pagesREIT (Real Estate Investment Trust) Valuation 101: Would You Like A Dividend With Your Funds From Operations?ziuziNo ratings yet

- IBIG 06 01 Three Statements 30 Minutes BlankDocument5 pagesIBIG 06 01 Three Statements 30 Minutes BlankSiddesh NaikNo ratings yet

- Debt Policy and ValueDocument7 pagesDebt Policy and ValueMuhammad Nabil EzraNo ratings yet

- Instructors Manual-Corporate Finance and InvestementDocument146 pagesInstructors Manual-Corporate Finance and InvestementLM_S100% (4)

- The Handbook of Credit Risk Management: Originating, Assessing, and Managing Credit ExposuresFrom EverandThe Handbook of Credit Risk Management: Originating, Assessing, and Managing Credit ExposuresNo ratings yet

- Financial ProjectionsDocument23 pagesFinancial ProjectionsPro Business PlansNo ratings yet

- AP 01 - Cash To Accrual BasisDocument11 pagesAP 01 - Cash To Accrual BasisGabriel OrolfoNo ratings yet

- REPE Case 02 45 Milk Street Investment RecommendationDocument20 pagesREPE Case 02 45 Milk Street Investment RecommendationziuziNo ratings yet

- CIV REV 2 - G.Modes of Extinguishment Case Digest - v2Document46 pagesCIV REV 2 - G.Modes of Extinguishment Case Digest - v2Celine GarciaNo ratings yet

- OFTC Lesson 18 - Integrating Order Flow With Traditional Technical AnalysisDocument34 pagesOFTC Lesson 18 - Integrating Order Flow With Traditional Technical AnalysisThanhdat Vo100% (1)

- Case 7 - An Introduction To Debt Policy and ValueDocument5 pagesCase 7 - An Introduction To Debt Policy and ValueAnthony Kwo100% (2)

- Capital StructureDocument41 pagesCapital Structure/jncjdncjdnNo ratings yet

- Confidential Information Memorandum TemplateDocument15 pagesConfidential Information Memorandum TemplateziuziNo ratings yet

- A. Calculate Watkins's Value of OperationsDocument20 pagesA. Calculate Watkins's Value of OperationsNarmeen Khan100% (1)

- Bank Regulatory CapitalDocument9 pagesBank Regulatory CapitalDristi PoddarNo ratings yet

- 60 05 CL Provisions AfterDocument4 pages60 05 CL Provisions Aftermerag76668No ratings yet

- 60 06 RegulationsDocument5 pages60 06 Regulationsmerag76668No ratings yet

- 02 24 Free Cash FlowDocument6 pages02 24 Free Cash FlowcherifsambNo ratings yet

- Equity REIT - Sample Balance SheetDocument2 pagesEquity REIT - Sample Balance Sheetmerag76668No ratings yet

- Managerial Finance AssignmentDocument5 pagesManagerial Finance AssignmentvinneNo ratings yet

- Income Statement - Apple Balance Sheet - Apple Cash Flow StatementDocument4 pagesIncome Statement - Apple Balance Sheet - Apple Cash Flow StatementRohan BahriNo ratings yet

- 60 03 BS To IS AfterDocument10 pages60 03 BS To IS Aftermerag76668No ratings yet

- Introduction To Debt PolicyDocument8 pagesIntroduction To Debt PolicyRatnesh DubeyNo ratings yet

- DW CorpDocument20 pagesDW CorpAlejo valenzuelaNo ratings yet

- ABC Income Statement (Millons) 2018: Short Term InvestmentsDocument20 pagesABC Income Statement (Millons) 2018: Short Term InvestmentsAlejo valenzuelaNo ratings yet

- AfM 6 - Standard Form of Financial AccountsDocument4 pagesAfM 6 - Standard Form of Financial AccountsjaymursalieNo ratings yet

- Shamo Group Plast: Balance SheetDocument1 pageShamo Group Plast: Balance SheetEng MatanaNo ratings yet

- IBIG 06 01 Three Statements 30 Minutes CompleteDocument12 pagesIBIG 06 01 Three Statements 30 Minutes CompletedarylchanNo ratings yet

- 01 09 Inventory Changes Cash DebtDocument4 pages01 09 Inventory Changes Cash DebtShikharNo ratings yet

- Practical Problem:: Gross Loans and LeasesDocument6 pagesPractical Problem:: Gross Loans and LeasesSuraz Thapa MagarNo ratings yet

- Section 3 Modified - Ch5+Ch6Document8 pagesSection 3 Modified - Ch5+Ch6Dina AlfawalNo ratings yet

- Your Company Name: Balance Sheet Projection - Quaterly Fiscal Year End DateDocument10 pagesYour Company Name: Balance Sheet Projection - Quaterly Fiscal Year End DateVochariNo ratings yet

- Tier 1 capital/TA (Tier 1+tier 2) /TA Tier 1 capital/RWA Including OBS Items (Tier 1+tier 2) /RAW Including OBS ItemsDocument10 pagesTier 1 capital/TA (Tier 1+tier 2) /TA Tier 1 capital/RWA Including OBS Items (Tier 1+tier 2) /RAW Including OBS ItemsThảo ĐỗNo ratings yet

- Ratio Analysis AssessmentDocument2 pagesRatio Analysis AssessmentShyam SNo ratings yet

- Report of Condition Total AssetsDocument8 pagesReport of Condition Total AssetsJohn Joshua S. GeronaNo ratings yet

- Horizontal&Vertical Analysis Sample ProblemDocument3 pagesHorizontal&Vertical Analysis Sample ProblemGenner RazNo ratings yet

- 109 04 Simple LBO ModelDocument2 pages109 04 Simple LBO ModelviktorNo ratings yet

- 109 04 Simple LBO ModelDocument2 pages109 04 Simple LBO ModelSatyam MohlaNo ratings yet

- 109 04 Simple LBO ModelDocument2 pages109 04 Simple LBO ModelTrần Bảo YếnNo ratings yet

- 109 04 Simple LBO ModelDocument2 pages109 04 Simple LBO ModelTrần Bảo YếnNo ratings yet

- FRP Rcbs Since 2019Document91 pagesFRP Rcbs Since 2019wilma balandoNo ratings yet

- Integrative ProblemDocument3 pagesIntegrative ProblemImelda AngelesNo ratings yet

- Assignment 2Document5 pagesAssignment 2Ahmad SaleemNo ratings yet

- Balance Sheet: INPUT DATA SECTION: Historical Data Used in The AnalysisDocument8 pagesBalance Sheet: INPUT DATA SECTION: Historical Data Used in The AnalysisMikkoNo ratings yet

- BNK 603 - Tutorial 2 2020Document3 pagesBNK 603 - Tutorial 2 2020Stylez 2707No ratings yet

- Corporate Financing Decision (FIN 502) MBA Kathmandu University School of ManagementDocument20 pagesCorporate Financing Decision (FIN 502) MBA Kathmandu University School of ManagementShreeya SigdelNo ratings yet

- Chap 005Document10 pagesChap 005Phan AnhNo ratings yet

- One Page M&A Simple Model Improved BlankDocument21 pagesOne Page M&A Simple Model Improved BlankAllen FengNo ratings yet

- Ratio Analysis Chapter 9Document5 pagesRatio Analysis Chapter 9natefir719No ratings yet

- How To Consider Excess Cash in Firm ValuationDocument7 pagesHow To Consider Excess Cash in Firm ValuationKizzy Figaro-RamdhanieNo ratings yet

- M&a Numerical - Valuation 1&2Document6 pagesM&a Numerical - Valuation 1&2CHAITANYA KNo ratings yet

- Capital Structure ZX8LJ0G23iDocument7 pagesCapital Structure ZX8LJ0G23iAravNo ratings yet

- PART I: Discussion Ques Ons: Submission Date: On or Before Final Examination Total Weight: 30%Document5 pagesPART I: Discussion Ques Ons: Submission Date: On or Before Final Examination Total Weight: 30%jaNo ratings yet

- DCF Valuation TemplateDocument9 pagesDCF Valuation TemplateSatyam1771No ratings yet

- 05 Test Bank For Business FinanceDocument46 pages05 Test Bank For Business FinanceBabatunde Victor AjalaNo ratings yet

- US Taxation of International Startups and Inbound Individuals: For Founders and Executives, Updated for 2023 rulesFrom EverandUS Taxation of International Startups and Inbound Individuals: For Founders and Executives, Updated for 2023 rulesNo ratings yet

- Jazz Pharmaceuticals PLC - Operating Model and DCF Analysis: AssumptionsDocument30 pagesJazz Pharmaceuticals PLC - Operating Model and DCF Analysis: AssumptionsziuziNo ratings yet

- Axial 5 Minute DCF ToolDocument11 pagesAxial 5 Minute DCF ToolziuziNo ratings yet

- Simple Example of Original Issue Discount (OID) On The Financial StatementsDocument1 pageSimple Example of Original Issue Discount (OID) On The Financial StatementsziuziNo ratings yet

- DCF ModellDocument7 pagesDCF ModellziuziNo ratings yet

- 80 BIWS RE DevelopmentDocument7 pages80 BIWS RE DevelopmentziuziNo ratings yet

- Model Input and Assumptions - Gekko OfficesDocument49 pagesModel Input and Assumptions - Gekko OfficesziuziNo ratings yet

- 45 Milk Street - Investment Analysis: Acquisition OverviewDocument47 pages45 Milk Street - Investment Analysis: Acquisition OverviewziuziNo ratings yet

- Can Enterprise Value Be Negative? Sure!: Discounted Cash Flow (DCF) Analysis - Assumptions and OutputDocument1 pageCan Enterprise Value Be Negative? Sure!: Discounted Cash Flow (DCF) Analysis - Assumptions and OutputziuziNo ratings yet

- The Buyer and Seller, Price (Per Share, or Lump Sum For Private Companies), Type of TransactionDocument6 pagesThe Buyer and Seller, Price (Per Share, or Lump Sum For Private Companies), Type of TransactionziuziNo ratings yet

- 105 11 Inventory LIFO Vs FIFODocument2 pages105 11 Inventory LIFO Vs FIFOziuziNo ratings yet

- FAR2Document8 pagesFAR2Kenneth DiabordoNo ratings yet

- Daftar Akun Pt. Manunggal (Hilma)Document4 pagesDaftar Akun Pt. Manunggal (Hilma)Adhitya RamadhanNo ratings yet

- Bajaj Finance 29072019Document7 pagesBajaj Finance 29072019Pranav VarmaNo ratings yet

- International Finance SyllabusDocument5 pagesInternational Finance Syllabussarathbabu_zeeNo ratings yet

- El Gobierno de Macri, Segundo AñoDocument12 pagesEl Gobierno de Macri, Segundo AñoTélamNo ratings yet

- Phuket BeachDocument7 pagesPhuket Beachaakash3978No ratings yet

- Bills DiscountingDocument9 pagesBills DiscountingChintan JoshiNo ratings yet

- Chapter 6 - Interest Rates FuturesDocument24 pagesChapter 6 - Interest Rates FuturesNatasha GhazaliNo ratings yet

- Bank Course OutlineDocument17 pagesBank Course Outlinemarivic hammidanyNo ratings yet

- Determinants of Budget Deficit in EthiopiaDocument29 pagesDeterminants of Budget Deficit in EthiopiaBereket Desalegn100% (3)

- Financial Risk Management - Case Studies With SKF and Elof HanssonDocument92 pagesFinancial Risk Management - Case Studies With SKF and Elof HanssonHaannaaNo ratings yet

- Power of Commissioner Penalties PDFDocument14 pagesPower of Commissioner Penalties PDFKomal JaiswalNo ratings yet

- Ast Bsma4-1Document4 pagesAst Bsma4-1Acads PurposesNo ratings yet

- Liabilities 2010 2011 Assets 2010 2011Document27 pagesLiabilities 2010 2011 Assets 2010 2011afreen affuNo ratings yet

- BharatPe - Reactivation (OD Flow)Document11 pagesBharatPe - Reactivation (OD Flow)Mahendra SNo ratings yet

- PPT 1Document15 pagesPPT 1GEETI OBEROINo ratings yet

- Perdisco WEEK3Document5 pagesPerdisco WEEK3malhar11100% (2)

- DBB2104 Unit-08Document24 pagesDBB2104 Unit-08anamikarajendran441998No ratings yet

- ACC00724 (Accounting For Managers) S2, 2016 Assignment 1 (20 Marks)Document4 pagesACC00724 (Accounting For Managers) S2, 2016 Assignment 1 (20 Marks)Asfawosen DingamaNo ratings yet

- Teacher: Sellamuthu Prabakaran Student: Juan David Burbano Benavides 1)Document10 pagesTeacher: Sellamuthu Prabakaran Student: Juan David Burbano Benavides 1)BelikovNo ratings yet

- Tax Invoice: BUTI000000859424 Dec. 23, 2017, 5:53 P.MDocument2 pagesTax Invoice: BUTI000000859424 Dec. 23, 2017, 5:53 P.MSridharan VenkatNo ratings yet

- 3415 Corporate Finance Assignment 2: Dean CulliganDocument13 pages3415 Corporate Finance Assignment 2: Dean CulliganAdam RogersNo ratings yet

- Chapter Six Account Group General Fixed Assets Account Group (Gfaag)Document5 pagesChapter Six Account Group General Fixed Assets Account Group (Gfaag)meseleNo ratings yet

- What Is Call Deposit ReceiptDocument5 pagesWhat Is Call Deposit ReceiptMuhammad Haroon KhanNo ratings yet