Professional Documents

Culture Documents

Practical Problem:: Gross Loans and Leases

Uploaded by

Suraz Thapa MagarOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Practical Problem:: Gross Loans and Leases

Uploaded by

Suraz Thapa MagarCopyright:

Available Formats

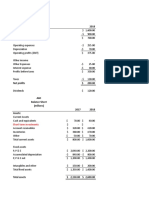

Practical Problem:

5-1. Report of Condition

Total assets $4,000.00

Cash and due from depository institutions 90.00

Securities 535.00

Federal funds sold and reverse repurchase agreements 45.00

Gross loans and leases ????

Loan loss allowance 200.00

Net loans and leases 2,700.00

Trading account assets 20.00

Bank premises and fixed assets

Other real estate owned 15.00

Goodwill and other intangibles 200.00

All other assets 175.00

Total liabilities and capital ??????

Total liabilities ?????

Total deposits ??????

Federal funds purchased and repurchase agreements. 80.00

Trading liabilities 10.00

Other borrowed funds 50.00

Subordinated debt 480.00

All other liabilities 40.00

Total equity capital ????

Perpetual preferred stock 5.00

Common stock 25.00

Surplus 320.00

Undivided profits 70.00

Solution:

Report of Condition

Total assets $4,000.00

Cash and due from depository institutions 90.00

Securities 535.00

Federal funds sold and reverse repurchase agreements 45.00

Gross loans and leases $2,900.00

Loan loss allowance 200.00

Net loans and leases 2,700.00

Trading account assets 20.00

Bank premises and fixed assets 220.00

Other real estate owned 15.00

Goodwill and other intangibles 200.00

All other assets 175.00

Total liabilities and capital 4,000.00c

Total liabilities 3,580.00d

Total deposits 2,920.00e

Federal funds purchased and repurchase agreements. 80.00

Trading liabilities 10.00

Other borrowed funds 50.00

Subordinated debt 480.00

All other liabilities 40.00

Total equity capital 420.00f

Perpetual preferred stock 5.00

Common stock 25.00

Surplus 320.00

Undivided profits 70.00

a. Gross loans and leases = Net loans and leases + Loan loss allowance

($200.00 + $2,700.00)

b. This is the only asset missing and so it is total assets less all of the rest of the assets listed above.

($4,000.00 − $90.00 − $535.00 − $45.00 − $2,700.00 − $20.00 − $15.00 − $200.00 − $175.00)

c. Total liabilities and capital = Total assets ($4,000.00)

d. Total liabilities = Total liabilities and capital − Total equity capital ($4,000.00 − $420.00)

e. Total deposits = Total liabilities − All of the other liabilities ($3,580.00 − $80.00 − $10.00 − $50.00

− $480.00 − $40.00)

f. Total equity capital = Perpetual preferred stock + Common stock + Surplus + Undivided profit ($5.00

+ $25.00 + $320.00 + $70.00)

5.2 Along with the Report of Condition submitted above, Norfolk has also prepared a Report

of Income for the FDIC. Please fill in the missing items from its statement shown below (all

figures in millions of dollars):

Report of Income

Total interest income $200

Total interest expense

Net interest income 60

Provision for loan and lease losses

Total noninterest income 100

Fiduciary activities 20

Service charges on deposit accounts 25

Trading account gains and fees

Additional noninterest income 30

Total noninterest expense 125

Salaries and employee benefits

Premises and equipment expense 10

Additional noninterest expense 20

Pretax net operating income 15

Securities gains (losses) 5

Applicable income taxes 3

Income before extraordinary items

Extraordinary gains—net 2

Net income

Report of Income

Total interest income $200

Total interest expense 140a

Net interest income 60

Provision for loan and lease losses 20b

Total noninterest income 100

Fiduciary activities 20

Service charges on deposit accounts 25

Trading account gains and fees 25c

Additional noninterest income 30

Total noninterest expense 125

Salaries and employee benefits 95d

Premises and equipment expense 10

Additional noninterest expense 20

Pretax net operating income 15

Securities gains (losses) 5

Applicable income taxes 3

Income before extraordinary items 17e

Extraordinary gains—net 2

Net income 19f

a. Total interest expense = Total interest income − Net interest income ($200 − $60)

b. Provision for loan and lease losses = Net interest income + Total noninterest income −

Total noninterest expense − Pretax net operating income (60 + $100 – $125 – $15)

c. There are four areas of Total noninterest income and only one is missing and the total is

given. ($100 − $20 − $25 − $30)

d. There are three areas of Total noninterest expense and only one is missing and the total is

given ($125 – $10 – $20)

e. Income before extraordinary items = Pretax income + Security gains – Taxes ($15 + $5 –

$3)

f. Net income = Income before extraordinary items + Extraordinary gains—net ($17 + $2)

5.3 If

you know the following figures:

Total interest income $140 Provision for loan losses $5

Total interest expenses 100 Income taxes 4

Total noninterest income 75 Increases in bank’s undivided profits 6

Total noninterest expenses 90

Please calculate these items:

Net interest income

Net noninterest income

Pretax net operating income

Net income after taxes

Total operating revenues

Total operating expenses

Dividends paid to common stockholders

You might also like

- Model Policies and Procedures for Not-for-Profit OrganizationsFrom EverandModel Policies and Procedures for Not-for-Profit OrganizationsNo ratings yet

- Report of Condition Total AssetsDocument8 pagesReport of Condition Total AssetsJohn Joshua S. GeronaNo ratings yet

- Chap 005Document10 pagesChap 005Phan AnhNo ratings yet

- Chap 005Document8 pagesChap 005Anass BNo ratings yet

- BNK 603 - Tutorial 2 2020Document3 pagesBNK 603 - Tutorial 2 2020Stylez 2707No ratings yet

- Math Solution - Session 11Document8 pagesMath Solution - Session 11Saoda Feel IslamNo ratings yet

- 21 Problems For CB New 1Document11 pages21 Problems For CB New 1Trần Bảo LyNo ratings yet

- Problem Chapter Iii: Report of Condition Total Assets $2,500Document7 pagesProblem Chapter Iii: Report of Condition Total Assets $2,500Nhựt AnhNo ratings yet

- Section 3 Modified - Ch5+Ch6Document8 pagesSection 3 Modified - Ch5+Ch6Dina AlfawalNo ratings yet

- SESSION 3 Practice TemplateDocument7 pagesSESSION 3 Practice Templateyimin liuNo ratings yet

- Chap 006Document15 pagesChap 006Phan AnhNo ratings yet

- Solved Problem 3.1 Profit & Loss Account For Year Ending 31st MarchDocument65 pagesSolved Problem 3.1 Profit & Loss Account For Year Ending 31st MarchChaitanyaNo ratings yet

- Statement of Cash Flow - Thorstved CoDocument5 pagesStatement of Cash Flow - Thorstved Cotun ibrahimNo ratings yet

- Owners' Equity and Liabilities As On 31.3.20X6 (Rs. in Million) As On 31.3.20X7Document3 pagesOwners' Equity and Liabilities As On 31.3.20X6 (Rs. in Million) As On 31.3.20X7Nithin Duke2499No ratings yet

- Happy Merchants National Bank Income and Expense Statement (Report of Income)Document2 pagesHappy Merchants National Bank Income and Expense Statement (Report of Income)AmmarNo ratings yet

- 1 - Acc 311 Exam II Spring 2015Document9 pages1 - Acc 311 Exam II Spring 2015MUHAMMAD AZAMNo ratings yet

- Financial Statement Analysis: The Information MazeDocument43 pagesFinancial Statement Analysis: The Information MazeJay DaveNo ratings yet

- 89 F 4 EfsaDocument3 pages89 F 4 EfsaabhimussoorieNo ratings yet

- TREASURY MANAGEMENT - TUTORIAL Qs2 - 240417 - 160705Document3 pagesTREASURY MANAGEMENT - TUTORIAL Qs2 - 240417 - 160705John diggleNo ratings yet

- VaderoIncSolution 1546982985052Document6 pagesVaderoIncSolution 1546982985052Dr. Priya VNo ratings yet

- VaderoIncSolution 1546982985052Document6 pagesVaderoIncSolution 1546982985052Maryam KhalidNo ratings yet

- Analysis of Financial StatementDocument10 pagesAnalysis of Financial StatementAli QasimNo ratings yet

- Taxation Solution 2017 SeptemberDocument11 pagesTaxation Solution 2017 Septemberzezu zazaNo ratings yet

- Financial Planning - ForecastingDocument4 pagesFinancial Planning - ForecastingPrathamesh411No ratings yet

- Brewer Chapter 13Document7 pagesBrewer Chapter 13Atif RehmanNo ratings yet

- Far (Semestral Project)Document5 pagesFar (Semestral Project)Diana Rose RioNo ratings yet

- Entity ADocument4 pagesEntity Ataeyung kimNo ratings yet

- Review of Financial StatementsDocument8 pagesReview of Financial StatementsHaseeb AliNo ratings yet

- Buscom - Subsequent-To-The-Date-Of-Acquisition - Cost MethodDocument46 pagesBuscom - Subsequent-To-The-Date-Of-Acquisition - Cost MethodJohn Stephen PendonNo ratings yet

- 7001 Assignment #3Document9 pages7001 Assignment #3南玖No ratings yet

- Commercial Bank c234Document8 pagesCommercial Bank c234Đặng Thị TrâmNo ratings yet

- Prepare Profit & Loss Account and Balance Sheet With The Help of Information Given in The Trial BalanceDocument4 pagesPrepare Profit & Loss Account and Balance Sheet With The Help of Information Given in The Trial BalanceEntertainment StatusNo ratings yet

- Adam's Learning Centre, Lahore: Interpretation of Financial StatementsDocument10 pagesAdam's Learning Centre, Lahore: Interpretation of Financial StatementsMasood Ahmad AadamNo ratings yet

- Adam's Learning Centre, Lahore: Interpretation of Financial StatementsDocument10 pagesAdam's Learning Centre, Lahore: Interpretation of Financial StatementsMasood Ahmad AadamNo ratings yet

- Application QuestionsDocument8 pagesApplication QuestionsAbdelnasir HaiderNo ratings yet

- Vadero Inc SolutionDocument4 pagesVadero Inc SolutionPirvu100% (2)

- IAS 7 With Notes (2021) - GZU MastersDocument16 pagesIAS 7 With Notes (2021) - GZU MastersTawanda Tatenda HerbertNo ratings yet

- SB FM 2 Practical Sem 5Document39 pagesSB FM 2 Practical Sem 5Sohan KhaterNo ratings yet

- ACCT1002 Assignment 3B 2nd S 2021-2022Document16 pagesACCT1002 Assignment 3B 2nd S 2021-2022Zenika PetersNo ratings yet

- F3 Practice Questions1Document10 pagesF3 Practice Questions1Nikesh KunwarNo ratings yet

- BFN202 Seminar Questions SET1Document3 pagesBFN202 Seminar Questions SET1baba cacaNo ratings yet

- Useful Profitability Formulas For Banks and Other Financial-Service CompaniesDocument7 pagesUseful Profitability Formulas For Banks and Other Financial-Service CompaniesKRZ. Arpon Root HackerNo ratings yet

- 2 VaderoIncExerciseDocument2 pages2 VaderoIncExerciseFadillah WSNo ratings yet

- Week 4Document2 pagesWeek 4maybefault1408No ratings yet

- Accounting: Making Sound Decisions: Non-Current AssetsDocument2 pagesAccounting: Making Sound Decisions: Non-Current AssetsAniruddha Rantu40% (5)

- Cost Model To Record Share in Net Income Not ApplicableDocument41 pagesCost Model To Record Share in Net Income Not ApplicableJohn Stephen PendonNo ratings yet

- CHAPTER 7 AnswerDocument7 pagesCHAPTER 7 AnswerKenncy100% (5)

- 4excels On Solved ProblemsDocument2 pages4excels On Solved ProblemsAtushNo ratings yet

- Solutions Ch09Document24 pagesSolutions Ch09KyleNo ratings yet

- FAWCM - Cash Flow 2Document29 pagesFAWCM - Cash Flow 2Jake RoosenbloomNo ratings yet

- f3 AssignmentDocument6 pagesf3 Assignmentnoumanchaudhary902No ratings yet

- Pas 1, Pas 2, Pas 7Document29 pagesPas 1, Pas 2, Pas 7MPCINo ratings yet

- ABC Income Statement (Millons) 2018: Short Term InvestmentsDocument20 pagesABC Income Statement (Millons) 2018: Short Term InvestmentsAlejo valenzuelaNo ratings yet

- DW CorpDocument20 pagesDW CorpAlejo valenzuelaNo ratings yet

- Marico Ltd. (India) : SourceDocument6 pagesMarico Ltd. (India) : SourceSHREY RAJNo ratings yet

- Equity REIT - Sample Balance SheetDocument2 pagesEquity REIT - Sample Balance Sheetmerag76668No ratings yet

- IB Bussiness Management Financial Statements Layout GuideDocument2 pagesIB Bussiness Management Financial Statements Layout GuideBhavish Adwani100% (1)

- Self-Check: Directions: Perform The Task Below. Write Your Answers On The Space Provided. You May AttachDocument2 pagesSelf-Check: Directions: Perform The Task Below. Write Your Answers On The Space Provided. You May AttachTeodorico PelenioNo ratings yet

- Exercise ProfitabilityDocument2 pagesExercise ProfitabilityPhong Nghiêm TấnNo ratings yet

- Kdouy Mae A ChaebDocument2 pagesKdouy Mae A ChaebYean SoramyNo ratings yet

- Analyzing Consumer Markets Analyzing Consumer Markets and Buyer Behavior and Buyer BehaviorDocument39 pagesAnalyzing Consumer Markets Analyzing Consumer Markets and Buyer Behavior and Buyer BehaviorSuraz Thapa MagarNo ratings yet

- 1 Basic Concepts of HRMDocument15 pages1 Basic Concepts of HRMSuraz Thapa MagarNo ratings yet

- P5 Lease HA ProblemDocument2 pagesP5 Lease HA ProblemSuraz Thapa MagarNo ratings yet

- FM 03a Fin Analysis Problems2Document9 pagesFM 03a Fin Analysis Problems2Suraz Thapa MagarNo ratings yet

- McGraw Hill Connect Question Bank Assignment 4Document2 pagesMcGraw Hill Connect Question Bank Assignment 4Jayann Danielle MadrazoNo ratings yet

- 6 CLSP ProspectusDocument5 pages6 CLSP ProspectusSyed Mujtaba HassanNo ratings yet

- Tax 2. QuizDocument2 pagesTax 2. QuizCara SantosNo ratings yet

- LIQUIDITY A-Z SMC For BeginnersDocument5 pagesLIQUIDITY A-Z SMC For BeginnersCaser TOtNo ratings yet

- Wealth Within EbookDocument24 pagesWealth Within EbookKhang Nguyen100% (1)

- Financial Daily: Putrajaya Files Rm680M Forfeiture ActionDocument33 pagesFinancial Daily: Putrajaya Files Rm680M Forfeiture ActionPG ChongNo ratings yet

- Problem 10Document2 pagesProblem 10novyNo ratings yet

- SK Illustrative Problems - For All SessionsDocument6 pagesSK Illustrative Problems - For All SessionsLea Mae JenNo ratings yet

- Corporate Finance Theory and Practice 10th EditionDocument674 pagesCorporate Finance Theory and Practice 10th EditionrahafNo ratings yet

- MSC Finance and Strategy Online BrochureDocument12 pagesMSC Finance and Strategy Online BrochureSiphoKhosaNo ratings yet

- World Bank (IBRD & IDA)Document5 pagesWorld Bank (IBRD & IDA)prankyaquariusNo ratings yet

- Account Statement From 1 Apr 2020 To 31 Mar 2021: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceDocument2 pagesAccount Statement From 1 Apr 2020 To 31 Mar 2021: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceVara Prasad AvulaNo ratings yet

- Reading Gaps in Charts PDFDocument11 pagesReading Gaps in Charts PDFkalelenikhlNo ratings yet

- Research Paper - MN559990 - Batch35 - PDFDocument17 pagesResearch Paper - MN559990 - Batch35 - PDFkhushboo sharmaNo ratings yet

- Quizzer-CAPITAL BUDGETING - Non-Discounted (With Solutions)Document3 pagesQuizzer-CAPITAL BUDGETING - Non-Discounted (With Solutions)Ferb Cruzada80% (5)

- Auditing MCQs Multiple Choice Questions and Answers 2023 - Auditing MCQs For B.Com, CA, CS and CMA ExamsDocument38 pagesAuditing MCQs Multiple Choice Questions and Answers 2023 - Auditing MCQs For B.Com, CA, CS and CMA Examsvenakata3722No ratings yet

- Econ282 F11 PS5 AnswersDocument7 pagesEcon282 F11 PS5 AnswersVishesh GuptaNo ratings yet

- This Study Resource Was: Philippine School of Business AdministrationDocument6 pagesThis Study Resource Was: Philippine School of Business AdministrationGab IgnacioNo ratings yet

- Dispute FormDocument1 pageDispute Formuzair muhdNo ratings yet

- Bill Ackman Value Investing Congress 100112Document103 pagesBill Ackman Value Investing Congress 100112abc_dNo ratings yet

- FX MrktsDocument46 pagesFX MrktsSoe Group 1No ratings yet

- Saln-Eugene Louie G. Ibarra Fy2023Document3 pagesSaln-Eugene Louie G. Ibarra Fy2023eugene louie ibarraNo ratings yet

- Solved Twelve Years Ago Marilyn Purchased Two Lots in An UndevelopedDocument1 pageSolved Twelve Years Ago Marilyn Purchased Two Lots in An UndevelopedAnbu jaromiaNo ratings yet

- Public Sector Accounting and Finance: Ac403 - Lecture 4Document24 pagesPublic Sector Accounting and Finance: Ac403 - Lecture 4Mcdonald NyatangaNo ratings yet

- Beepedia Weekly Current Affairs (Beepedia) 16th-22nd December 2023Document39 pagesBeepedia Weekly Current Affairs (Beepedia) 16th-22nd December 2023BRAJ MOHAN KUIRYNo ratings yet

- AFAR MCQ On BUSINESS COMBINATIONS CONSOLIDATION PDFDocument156 pagesAFAR MCQ On BUSINESS COMBINATIONS CONSOLIDATION PDFJamille Rose PagulayanNo ratings yet

- 11 Actividad #4 Crucigrama Contabilidad VDocument3 pages11 Actividad #4 Crucigrama Contabilidad VMaria F OrtizNo ratings yet

- 347Document2 pages347TarkimNo ratings yet

- Non Face To Face Form With AMB Declaration PDFDocument10 pagesNon Face To Face Form With AMB Declaration PDFrohit.godhani9724No ratings yet

- Perpetual - Financial StatementsDocument4 pagesPerpetual - Financial StatementsJeon Cyrone CuachonNo ratings yet