Professional Documents

Culture Documents

CA Inter Adv Account Q MTP 2 Nov23 Castudynotes Com

Uploaded by

kuvira LodhaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

CA Inter Adv Account Q MTP 2 Nov23 Castudynotes Com

Uploaded by

kuvira LodhaCopyright:

Available Formats

Downloaded From www.castudynotes.

com

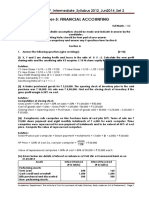

Test Series: October, 2023

MOCK TEST PAPER -2

INTERMEDIATE GROUP – II

PAPER – 5: ADVANCED ACCOUNTING

Question No. 1 is compulsory.

Answer any four questions from the remaining five questions.

Wherever necessary suitable assumptions may be made and disclosed by way of a note.

Working Notes should form part of the answer.

Time Allowed: 3 Hours Maximum Marks: 100

1. (a) (i) Mr. Arnav a relative of key management personnel received remuneration of

` 3,00,000 for his services in the company for the period April 1, 2022 to June 30, 2022. On

July 1, 2022 he left the job.

Should Mr. Arnav be identified as Related Party at the closing date i.e. March 31, 2023 for

the purposes of AS 18?

(ii) A limited company sold goods to its associate company for the 1 st quarter ending June 30,

2023. After that, the related party relationship ceased to exist. However, goods were supplied

continuously even after June 30, 2023 as was supplied to another ordinary customer. Does

this require disclosure as related party transaction for the entire financial year?

(b) Saharsh Ltd. is engaged in manufacturing of electric home appliances. The company is in the

process of finalizing its accounts for the year ended 31.3.2023 and needs your expert advice on

the following issues in line with the provisions of AS 29:

(i) A case has been filed against the company in the consumer court and a notice for lev y of a

penalty of ` 20 lakhs has been received. The company has appointed a lawyer to defend the

case for a fee of ` 2 lakhs. 50% of the fees has been paid and balance 50% will be paid after

finalisation of the case. There are 75% chances that the penalty may not be levied.

(ii) The company had committed to supply a consignment worth ` 1 crore to one of its dealers by

the year-end. As per the contract, if delivery is not made on time, a compensation of 15% is

to be paid on the value of delayed/lost consignment. While the consignment was in transit,

one of the trucks carrying goods worth ` 30 lakhs met with an accident. It was however

covered by Insurance. According to the surveyor's report, the policy amount is collectable,

subject to 10% deduction. Before closing the books of accounts, the company has received

the information that the policy amount has been processed and the dealer has also claimed

the compensation for the consignment of goods worth ` 30 lakhs which was in transit.

(c) Akar Ltd. signed on 01/04/22, a construction contract for ` 1,50,00,000. Following particulars are

extracted in respect of contract, for the period ending 31/03/23.

- Materials used ` 71,00,000

- Labour charges paid ` 36,00,000

- Hire charges of plant ` 10,00,000

- Other contract cost incurred ` 15,00,000

- Labour charges of ` 2,00,000 are still outstanding on 31.3.23.

- It is estimated that by spending further ` 33,50,000 the work can be completed in all respect.

You are required to compute profit/loss for the year to be taken to Profit & Loss Account and

additional provision for foreseeable loss to be recognized as per AS 7.

1

Join Us on Telegram http://t.me/canotes_ipcc

Downloaded From www.castudynotes.com

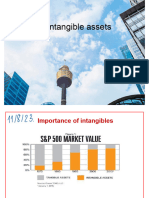

(d) Sudesh Ltd. acquired a patent at a cost of ` 2,40,00,000 for a period of 5 years and the product

life-cycle was also 5 years. The company capitalized the cost and started amortizing the asset at

` 48,00,000 per annum. After two years it was found that the product life-cycle may continue for

another 5 years from then. The net cash flows from the product during these 5 years were expected

to be ` 36,00,000, ` 46,00,000, ` 44,00,000, ` 40,00,000 and ` 34,00,000. Find out the

amortization cost of the patent for each of the years if the patent was renewable and Sudesh Ltd.

got it renewed after expiry of five years. (4 Parts x 5 Marks = 20 Marks)

2. (a) M, N and O were Partners sharing Profits and Losses in the ratio of 5:3:2 respectively. The Trial

Balance of the Firm as on 31st March, 2023was the following:

Particulars ` `

Machinery at Cost 2,00,000

Inventory 1,37,400

Trade receivables 1,24,000

Trade payables 1,69,400

Capital A/cs:

M 1,36,000

N 90,000

O 46,000

Drawing A/cs:

M 50,000

N 46,000

O 34,000

Depreciation on Machinery 80,000

Profit for the year ended 31 st March 2,48,600

Cash at Bank 1,78,600

7,70,000 7,70,000

Interest on Capital Accounts at 10% p.a. on the amount standing to the credit of Partners' Capital

Accounts at the beginning of the year, was not provided before preparing the above Trial Balance.

On the above date, they formed MNO Private Limited Company with an Authorized Share Capital

of 2,00,000 in shares of ` 10 each to be divided in different classes to take over the business of

Partnership firm.

You are given terms and conditions as under:

1. Machinery is to be transferred at ` 1,40,000.

2. Shares in the Company are to be issued to the partners, at par, in such numbers, and in such

classes as will give the partners, by reason of their shareholdings alone, the same rights as

regards interest on capital and the sharing of profit and losses as they had in the partnership.

3. Before transferring the business, the partners wish to draw from the partnership prof its to

such an extent that the bank balance is reduced to ` 1,00,000. For this purpose, sufficient

profits of the year are to be retained in profit-sharing ratio.

4. Assets and liabilities except Machinery and Bank, are to be transferred at their book valu e as

on the above date.

You are required to prepare:

(i) Statement showing the workings of the Number of Shares of each class to be issued by the

company, to each partner.

2

Join Us on Telegram http://t.me/canotes_ipcc

Downloaded From www.castudynotes.com

(ii) Capital Accounts showing all adjustments required to dissolve the Partnership.

(iii) Balance Sheet of the Company immediately after acquiring the business of the Partnership

and Issuing of Shares.

(b) A Ltd. holds 80% of the equity capital and voting power in B Ltd. A Ltd sells inventories costing

` 180 lacs to B Ltd at a price of ` 200 lacs. The entire inventories remain unsold with B Ltd at the

financial year end i.e. 31 March 2023. What will be the accounting treatment for this transaction

in the consolidated financial statements of A Ltd? (16+4 = 20 Marks)

3. (a) Two companies named Alex Ltd. and Beta Ltd. provide you the following summary of ledger

balances as on 31 st March, 2023:

Alex Ltd. (`) Beta Ltd. (`)

Goodwill 1,40,000 70,000

Building 8,40,000 2,80,000

Machinery 14,00,000 4,20,000

Inventory 7,00,000 4,90,000

Trade receivables 5,60,000 2,80,000

Cash at Bank 1,40,000 56,000

Equity Shares of ` 10 each 28,00,000 8,40,000

8% Preference Shares of ` 100 each 2,80,000 –

10% Preference Shares of ` 100 each – 2,80,000

General Reserve 1,96,000 1,96,000

Retirement Gratuity fund 1,40,000 56,000

Trade payables 3,64,000 2,24,000

Beta Ltd. is absorbed by Alex Ltd. on the following terms:

(a) 10% Preference Shareholders are to be paid at 10% premium by issue of 8% Preference

Shares of Alex Ltd.

(b) Goodwill of Beta Ltd. is valued at ` 1,40,000, Buildings are valued at ` 4,20,000 and the

Machinery at ` 4,48,000.

(c) Inventory to be taken over at 10% less value and Provision for Doubtful Debts to be created

@ 7.5%.

(d) Equity Shareholders of Beta Ltd. will be issued Equity Shares of Alex Ltd. @ 5% premium.

You are required to:

(i) Prepare necessary Ledger Accounts to close the books of Beta Ltd.

(ii) Show the acquisition entries in the books of Alex Ltd.

(iii) Also draft the Balance Sheet after absorption as at 31 st March, 2023.

(b) Explain the difference between pooling of interest and purchase method of accounting for

amalgamations. (16 + 4 = 20 Marks)

4. (a) Astha Bank has the following Capital Funds and Assets as at 31 st March, 2023:

` in crores

Capital Funds:

Equity Share Capital 600.00

3

Join Us on Telegram http://t.me/canotes_ipcc

Downloaded From www.castudynotes.com

Statutory Reserve 470.00

Profit and Loss Account (Dr. Balance) 30.00

Capital Reserve [out of which ` 25 crores were due to revaluation of assets 130.00

(on which discount of 55% is to be provided) and balance due to sale of

assets]

Assets:

Balance with other banks 15.00

Cash balance with RBI 35.50

Claim on Banks 52.50

Other Investments 70.00

Loans and Advances:

(i) Guaranteed by Government 22.50

(ii) Guaranteed by PSUs of Central Government 110.00

(iii) Other 9,365.00

Premises, furniture and fixtures 92.50

Leased assets 40.00

You are required to: (i) Segregate the capital funds into Tier I and Tier II capitals; and (ii) Find

out the risk-adjusted assets.

(b) XYZ Finance Ltd. is a non-banking finance company. It provides the following information:

(` in lakhs)

Amount

Equity and Liabilities

Paid-up equity capital 200

General Reserve 600

Non-Current Liabilities

Loans 500

Deposits 600

Assets

Non-current assets

Property Plant and Equipment 900

Investments:

In shares of subsidiaries 250

In debentures of group companies 400

Current Assets

Cash and bank balances 350

You are required to compute ‘Net Owned Fund’ of XYZ Finance Ltd. as per Non -Banking Financial

Company – Systemically Important Non-Deposit taking company and Deposit taking company

(Reserve Bank) Directions, 2016.

(c) The following details are provided by Bhoomi Ltd. as on 31 st March, 2023:

` (in lakhs)

Issued Capital:

Equity Shares of `10 each Fully Paid up 64,000

4

Join Us on Telegram http://t.me/canotes_ipcc

Downloaded From www.castudynotes.com

10% Redeemable Preference Shares of 10 each, Fully Paid Up 20,000

Capital Redemption Reserve 8,000

Securities Premium 6,400

General Reserve 48,000

Profit & Loss Account 2,400

9% Debentures 40,000

Trade Payables 26,400

Property, plant and equipment 1,12,000

Investments 24,000

Cash at Bank 13,200

Trade Receivables 66,000

On 1st April,2023 the Company redeemed all its Preference Shares at a Premium of 10% and

bought back 25% of its Equity Shares at `20 per Share. In order to make cash available, Bhoomi

Ltd. sold all the Investments for `25,000 Lakhs and raised a Bank Loan amounting to `16,000 lakh

on the Security of the Company's Plant.

Give the necessary Journal Entries considering that the buy back is authorised by the articles of

company and necessary resolution is passed by the company for this. The amount of Securities

premium may be utilized to the maximum extent allowed by law. (8 + 4 + 8 = 20 Marks)

5. (a) Consider the following information of subsidiary MNT Ltd.-

Liabilities 2021-22 2022-23

Amount in ` Amount in `

Issued and subscribed: 7,500 Equity Shares of ` 100 each 7,50,000 7,50,000

Revenue Reserve 2,14,000 5,05,000

Securities Premium 72,000 2,07,000

Trade Payables 2,90,000 2,46,000

Bank Overdraft - 1,70,000

Provision for Taxation 2,62,000 4,30,000

Property, plant and equipment (Cost) 9,20,000 9,20,000

Less: Accumulated Depreciation (1,70,000) (2,82,500)

7,50,000 6,37,500

Investment (at cost) - 5,30,000

Inventory 4,12,300 6,90,000

Trade Receivable 2,95,000 3,43,000

Prepaid expenses 78,000 65,000

Cash at Bank 52,700 42,500

Other Information:

(1) MNT Ltd. is a subsidiary of LTC Ltd.

(2) LTC Ltd. values inventory on FIFO basis, while MNT Ltd. used LIFO basis. To bring MNT

Ltd.'s inventories values in line with those of LTC Ltd., its value of inventory is required to be

reduced by ` 5,000 at the end of 2021-2022 and increased by ` 12,000 at the end of

2022-2023. (Inventory of 2021-22 has been sold out during the year 2022-23)

Join Us on Telegram http://t.me/canotes_ipcc

Downloaded From www.castudynotes.com

(3) MNT Ltd. deducts 2% from Trade Receivables as a general provision against doubtful debts.

(4) Prepaid expenses in MNT Ltd. include Sales Promotion expenditure carried forward of

` 25,000 in 2021-22 and ` 12,500 in 2022-23 being part of initial Sales Promotion expenditure

of ` 37,500 in 2021-22, which is being written off over three years. Similar nature of Sales

Promotion expenditure of LTC Ltd. has been fully written off in 2021-22.

Restate the balance sheet of MNT Ltd. as on 31 st March, 2023 after considering the above

information for the purpose of consolidation. Such restatement is necessary to make the accounting

policies adopted by LTC Ltd. and MNT Ltd. uniform.

(b) A Ltd. had acquired 80% shares of B Ltd. for ` 15 lakhs at the beginning of year. During the year,

A Ltd. sold the investment for ` 30 lakhs and net assets of B Ltd. on the date of disposal was ` 35

lakhs. Calculate the profit or loss on disposal of this investment to be recognized in the Financial

Statements of A Ltd. (16 + 4 = 20 Marks)

6. (a) On 1st April, 2022 a company had 6,00,000 equity shares of ` 10 each (` 5 paid up by all

shareholders). On 1 st September, 2022 the remaining ` 5 was called up and paid by all

shareholders except one shareholder having 60,000 equity shares. The net profit for the year

ended 31st March, 2023 was ` 21,96,000 after considering dividend on preference shares and

dividend distribution tax on such dividend totalling to ` 3,40,000.

You are required to compute Basic EPS for the year ended 31 st March, 2023 as per Accounting

Standard 20 "Earnings Per Share".

(b) Tee Ltd. closes its books of accounts every year on 31st March. The financial statements for the

year ended 31 March 2023 are to be approved by the approving authority on

30 June 2023. During the first quarter of 2023-2024, the following events / transactions has taken

place. The accountant of the company seeks your guidance for the following:

(i) Tee Ltd. has an inventory of 50 stitching machines costing at ` 5,500 per machine as on 31

March 2023. On 31 March 2023 the company is expecting a heavy decline in the demand in

next year. The inventories are valued at cost or net realisable value, whichever is lower.

During the month of April 2023, due to fall in demand, the prices have gone down drastically.

The company has sold 5 machines during this month at a price of ` 4,000 per machine.

(ii) A fire has broken out in the company's godown on 15 April 2023. The company has estimated

a loss of ` 25 lakhs of which 75% is recoverable from the Insurance company.

(iii) The company has entered into a sale agreement on 30 March 2023 to sell a property for a

consideration of ` 7,50,000 which is being carried in the books at ` 5,50,000 at the year end.

The transfer of risk and reward and sale is complete in the month of May 2023 when

conveyance and posfreconsession get completed.

(iv) The company has received, during the year 2021-2022, a government grant of

` 15 lakhs for purchase of a machine. The company has received a notice for refund of the

said grant on 15 June, 2023 due to violation of some of the conditions of grant during the year

2022-2023.

You are required to state with reasons, how the above transactions will be dealt with in the financial

statement for the year ended 31st March 2023.

(c) New Era Publications publishes a monthly magazine on 15 th of every month. It sells advertising

space in the magazine to advertisers on the terms of 80% sale value payable in advance and the

balance within 30 days of the release of the publication. The sale of space for the March 2023

issue was made in February 2023. The magazine was published on its scheduled date. It received

` 2,40,000 on 10.3.2023 and ` 60,000 on 10.4.2023 for the March, 2023 issue.

Join Us on Telegram http://t.me/canotes_ipcc

Downloaded From www.castudynotes.com

Discuss in the context of AS 9 the amount of revenue to be recognized and the treatment of the

amount received from advertisers for the year ending 31.3.2023. What will be the treatment if the

publication is delayed till 2.4.2023?

(d) A Liquidator is entitled to receive remuneration at 2% on the assets realized, 3% on the amount

distributed to Preferential Creditors and 3% on the payment made to Unsecured Creditors. The

assets were realized for ` 25,00,000 against which payment was made as follows:

Liquidation expenses ` 25,000

Secured Creditors ` 10,00,000

Preferential Creditors ` 75,000

The amount due to Unsecured Creditors was ` 15,00,000. You are asked to calculate the total

Remuneration payable to Liquidator. Calculation shall be made to the nearest multiple of a rupee.

(e) Suvidhi Ltd. offered 50 stock options to each of its 1500 employees on 1 st April 2022 for ` 30.

Option was exercisable within a year it was vested. The shares issued under this plan shall be

subject to lock-in on transfer for three years from the grant date. The market price of shares of the

company is ` 50 per share on grant date. Due to post vesting restrictions on transfer, the fair value

of shares issued under the plan is estimated at ` 38 per share. On 31 st March, 2023,1200

employees accepted the offer and paid ` 30 per share purchased. Nominal value of each share is

` 10. Record the issue of shares in the books of the company under the aforesaid plan.

(4 Parts x 5 Marks = 20 Marks)

Join Us on Telegram http://t.me/canotes_ipcc

You might also like

- Computerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionFrom EverandComputerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionNo ratings yet

- Adv Accounts - QuestionsDocument7 pagesAdv Accounts - QuestionsKhushi AggarwalNo ratings yet

- Industrial Enterprises Act 2020 (2076): A brief Overview and Comparative AnalysisFrom EverandIndustrial Enterprises Act 2020 (2076): A brief Overview and Comparative AnalysisNo ratings yet

- Test Series: October, 2020 Mock Test Paper Intermediate (New) : Group - Ii Paper - 5: Advanced AccountingDocument7 pagesTest Series: October, 2020 Mock Test Paper Intermediate (New) : Group - Ii Paper - 5: Advanced AccountingAruna RajappaNo ratings yet

- Harmonization and Standardization of Bond Market Infrastructures in ASEAN+3: ASEAN+3 Bond Market Forum Sub-Forum 2 Phase 3 ReportFrom EverandHarmonization and Standardization of Bond Market Infrastructures in ASEAN+3: ASEAN+3 Bond Market Forum Sub-Forum 2 Phase 3 ReportNo ratings yet

- Mock TestDocument7 pagesMock TestShivaji hariNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionNo ratings yet

- MTP1 May2022 - Paper 5 Advanced AccountingDocument24 pagesMTP1 May2022 - Paper 5 Advanced AccountingYash YashwantNo ratings yet

- Test Series: March 2022 Mock Test Paper 1 Intermediate: Group - Ii Paper - 5: Advanced AccountingDocument7 pagesTest Series: March 2022 Mock Test Paper 1 Intermediate: Group - Ii Paper - 5: Advanced AccountingShrwan SinghNo ratings yet

- 73601bos59426 Inter p5qDocument7 pages73601bos59426 Inter p5qKali KhannaNo ratings yet

- MAY 15 ADV ACC Merged - Document - 2mtps PDFDocument43 pagesMAY 15 ADV ACC Merged - Document - 2mtps PDFMohit KaundalNo ratings yet

- Ilovepdf MergedDocument23 pagesIlovepdf MergedSubhahan BashaNo ratings yet

- CA Inter Accounts Q MTP 1 Nov 2022Document7 pagesCA Inter Accounts Q MTP 1 Nov 2022smartshivenduNo ratings yet

- TtryuiopDocument6 pagesTtryuiopNAVEENNo ratings yet

- MTP-5 QuestionDocument6 pagesMTP-5 Questionvirat rajputNo ratings yet

- 12 Accounts 2020 21 Practice Paper 2Document8 pages12 Accounts 2020 21 Practice Paper 2Vijey RamalingamNo ratings yet

- 4 CO4CRT11 - Corporate Accounting II (T)Document5 pages4 CO4CRT11 - Corporate Accounting II (T)emildaraisonNo ratings yet

- Test Series: April, 2022 Mock Test Paper 2 Intermediate: Group - I Paper - 1: AccountingDocument7 pagesTest Series: April, 2022 Mock Test Paper 2 Intermediate: Group - I Paper - 1: AccountingVishal MehraNo ratings yet

- Accounts Mock Test May 2019Document18 pagesAccounts Mock Test May 2019poojitha reddyNo ratings yet

- CA Inter Accounting Full Test 1 Nov 2022 Unscheduled Test PaperDocument18 pagesCA Inter Accounting Full Test 1 Nov 2022 Unscheduled Test Papersinku123No ratings yet

- Inp 2211 Accounts Question Paper PDFDocument8 pagesInp 2211 Accounts Question Paper PDFSachin ChourasiyaNo ratings yet

- RTP Dec 2020 QnsDocument13 pagesRTP Dec 2020 QnsbinuNo ratings yet

- Chartered Accountancy Professional Ii (CAP-II) : Education Division The Institute of Chartered Accountants of NepalDocument81 pagesChartered Accountancy Professional Ii (CAP-II) : Education Division The Institute of Chartered Accountants of NepalPrashant Sagar GautamNo ratings yet

- Test Series: April, 2021 Mock Test Paper - 2 Intermediate (New) : Group - Ii Paper - 5: Advanced AccountingDocument6 pagesTest Series: April, 2021 Mock Test Paper - 2 Intermediate (New) : Group - Ii Paper - 5: Advanced AccountingOcto ManNo ratings yet

- Advanced Accounts MTP M21 S2Document19 pagesAdvanced Accounts MTP M21 S2Harshwardhan PatilNo ratings yet

- Accounting Problems With SolutionsDocument63 pagesAccounting Problems With Solutionssumit_sagar69% (13)

- CA Final FR Q MTP 1 May 2024 Castudynotes ComDocument11 pagesCA Final FR Q MTP 1 May 2024 Castudynotes Compabitrarijal1227No ratings yet

- MQP Accountancy WMDocument14 pagesMQP Accountancy WMRithik PoojaryNo ratings yet

- Test Series: November, 2021 Mock Test Paper - 2 Intermediate (New) : Group - I Paper - 1: AccountingDocument8 pagesTest Series: November, 2021 Mock Test Paper - 2 Intermediate (New) : Group - I Paper - 1: Accountingsunil1287No ratings yet

- Accountancy Set 3 QPDocument6 pagesAccountancy Set 3 QPKunal Gaurav100% (2)

- RTP PDFDocument45 pagesRTP PDFsumanmehtaNo ratings yet

- 71844bos Interp5qDocument7 pages71844bos Interp5qMayank RajputNo ratings yet

- 1Document5 pages1firoozdasmanNo ratings yet

- © The Institute of Chartered Accountants of IndiaDocument7 pages© The Institute of Chartered Accountants of IndiaJayaprakash VenkatesanNo ratings yet

- Accountancy QP-Term II-Pre Board 1 - Class XIIDocument6 pagesAccountancy QP-Term II-Pre Board 1 - Class XIIRaunofficialNo ratings yet

- Date: 06-03-2021 Subject:Book Keeping & Time: 3 Hrs. Class:XII Com Marks: 80 Syllabus: Full SyllabusDocument5 pagesDate: 06-03-2021 Subject:Book Keeping & Time: 3 Hrs. Class:XII Com Marks: 80 Syllabus: Full SyllabusPranit PanditNo ratings yet

- Solution 5Document29 pagesSolution 5HariNo ratings yet

- Test Series: March, 2021 Mock Test Paper 1 Intermediate (New) : Group - I Paper - 1: AccountingDocument7 pagesTest Series: March, 2021 Mock Test Paper 1 Intermediate (New) : Group - I Paper - 1: AccountingHarsh KumarNo ratings yet

- Adv Acc MTPO1 PDFDocument18 pagesAdv Acc MTPO1 PDFuma shankarNo ratings yet

- Question No.1 Is Compulsory. Candidates Are Required To Answer Any Four Questions From The Remaining Five QuestionsDocument7 pagesQuestion No.1 Is Compulsory. Candidates Are Required To Answer Any Four Questions From The Remaining Five Questionsritz meshNo ratings yet

- Cainterseries 2 CompleteDocument70 pagesCainterseries 2 CompleteNishanthNo ratings yet

- Adv Accounts MTP M19 S2Document22 pagesAdv Accounts MTP M19 S2Harshwardhan PatilNo ratings yet

- 858 Accounts Sem II SpecimenDocument7 pages858 Accounts Sem II SpecimenDia JacobNo ratings yet

- Syjc - B. K. - Prelim Exam No. 7Document4 pagesSyjc - B. K. - Prelim Exam No. 7karkeraadiyaNo ratings yet

- MTP 14 28 Questions 1700718781Document5 pagesMTP 14 28 Questions 1700718781aim.cristiano1210No ratings yet

- Test Series: April 2023 Mock Test Paper - 2 Intermediate: Group - I Paper - 1: AccountingDocument7 pagesTest Series: April 2023 Mock Test Paper - 2 Intermediate: Group - I Paper - 1: AccountingKartik GuptaNo ratings yet

- 1 2 3 4 5 6 7 8 MergedDocument78 pages1 2 3 4 5 6 7 8 MergedKartik GuptaNo ratings yet

- CBSE Class 12 Accountancy Sample Papers 2014 - 15Document7 pagesCBSE Class 12 Accountancy Sample Papers 2014 - 15Karthick KarthickNo ratings yet

- 71592bos57621 Inter p1qDocument7 pages71592bos57621 Inter p1qRahul MishraNo ratings yet

- Partnership QsDocument3 pagesPartnership QsJAYARAJALAKSHMI IlangoNo ratings yet

- 73507bos59335 Inter p1qDocument7 pages73507bos59335 Inter p1qRaish QURESHINo ratings yet

- Questions Isc AccDocument52 pagesQuestions Isc Accrajc080805No ratings yet

- (In Lakhs) : © The Institute of Chartered Accountants of IndiaDocument17 pages(In Lakhs) : © The Institute of Chartered Accountants of Indiaarihant bokdiaNo ratings yet

- PartnershipDocument10 pagesPartnershipOm JainNo ratings yet

- MTP 3 14 Questions 1680520270Document7 pagesMTP 3 14 Questions 1680520270Umar MalikNo ratings yet

- Full Syllabus Test 1 q1672987668Document11 pagesFull Syllabus Test 1 q1672987668Sachin SHNo ratings yet

- Sample Question Paper-Ii Accountancy Class Xii Maximum Marks: 80 Time Allowed: 3 Hrs. General InstructionsDocument38 pagesSample Question Paper-Ii Accountancy Class Xii Maximum Marks: 80 Time Allowed: 3 Hrs. General Instructionsmohit pandeyNo ratings yet

- Aid To Accountants UDocument171 pagesAid To Accountants UPiya SabooNo ratings yet

- Acc Sample Paper 4 Typed by DhairyaDocument6 pagesAcc Sample Paper 4 Typed by DhairyaMaulik ThakkarNo ratings yet

- CA Inter Adv Account A MTP 1 Nov23 Castudynotes ComDocument16 pagesCA Inter Adv Account A MTP 1 Nov23 Castudynotes Comkuvira LodhaNo ratings yet

- Instructions - Dos and DontsDocument2 pagesInstructions - Dos and Dontskuvira LodhaNo ratings yet

- Itinerary at TrivandrumDocument1 pageItinerary at Trivandrumkuvira LodhaNo ratings yet

- Section 10aaDocument4 pagesSection 10aakuvira LodhaNo ratings yet

- 14 Marks AnswersDocument42 pages14 Marks Answerskuvira LodhaNo ratings yet

- CFAP AAFR Winter 2021 AnswersDocument7 pagesCFAP AAFR Winter 2021 AnswersHassanNo ratings yet

- IAS 38 Intangible AssetsDocument29 pagesIAS 38 Intangible Assetsdương nguyễn vũ thùyNo ratings yet

- Step by Step AcquisitionDocument6 pagesStep by Step Acquisitionbenjy woodNo ratings yet

- Akl Soal 3 - Kelompok 2Document9 pagesAkl Soal 3 - Kelompok 2M KhairiNo ratings yet

- Advanced Tax Laws Practice PDFDocument188 pagesAdvanced Tax Laws Practice PDFavsharika100% (1)

- This Study Resource Was: Quiz 14Document7 pagesThis Study Resource Was: Quiz 14kakeguruiNo ratings yet

- Lib by Sample Chapter 5Document58 pagesLib by Sample Chapter 5nazagame157794No ratings yet

- IFRS in Practice CommonErrors Share Based Payment (Print) PDFDocument20 pagesIFRS in Practice CommonErrors Share Based Payment (Print) PDFnik100% (1)

- 055 AccountancyDocument15 pages055 AccountancyHari prakarsh NimiNo ratings yet

- Slides - Module 4Document48 pagesSlides - Module 4Sunena KumariNo ratings yet

- Afar First Take 2Document16 pagesAfar First Take 2Pau CaisipNo ratings yet

- 3-Statement Model PracticeDocument6 pages3-Statement Model PracticeWill SkaloskyNo ratings yet

- p2 Long SeatworkDocument6 pagesp2 Long SeatworkLeisleiRagoNo ratings yet

- CS Executive Company Accounts Notes FinalDocument41 pagesCS Executive Company Accounts Notes FinalShivam GuptaNo ratings yet

- Chapter 07 IMSMDocument38 pagesChapter 07 IMSMAbdullah A. Buhamad50% (2)

- P2Document40 pagesP2Michiko Kyung-soonNo ratings yet

- Fa - 6 Amalgamation & LLPDocument10 pagesFa - 6 Amalgamation & LLPalokchowdhury111No ratings yet

- FTME Key To CorrectionDocument12 pagesFTME Key To CorrectionABMAYALADANO ,ErvinNo ratings yet

- Chapter 3 Partnership DissolutionDocument32 pagesChapter 3 Partnership DissolutionmochiNo ratings yet

- Sfs Sample Manufacturing Company Limited Consolidated Financial StatementsDocument36 pagesSfs Sample Manufacturing Company Limited Consolidated Financial StatementsSusanto Ario100% (1)

- CFA 2 NotesDocument44 pagesCFA 2 NotesEdmundSiauNo ratings yet

- Chapter 5 Consolidated Financial Statements of Group Companies PDFDocument103 pagesChapter 5 Consolidated Financial Statements of Group Companies PDFSamson SeiduNo ratings yet

- Top 100 Questions of AccountsDocument75 pagesTop 100 Questions of Accountschauhanthakur554No ratings yet

- 1575 Tania SultanaDocument34 pages1575 Tania SultanaTania SultanaNo ratings yet

- Chapter 4 - Assigment 2Document4 pagesChapter 4 - Assigment 2Kryzzel Anne JonNo ratings yet

- CHAP 29gDocument17 pagesCHAP 29gYen YenNo ratings yet

- ACCA - Advanced Audit and Assurance (AAA) - Course Exam 2 Answers - 2019Document18 pagesACCA - Advanced Audit and Assurance (AAA) - Course Exam 2 Answers - 2019Ruddhi JainNo ratings yet

- Admission of A PartnerDocument21 pagesAdmission of A PartnerHarmohandeep singhNo ratings yet

- Process For Cash Flow StatementsDocument33 pagesProcess For Cash Flow StatementsP3 PowersNo ratings yet

- Ifrs 31Document5 pagesIfrs 31John Rey Batandolo ManatadNo ratings yet

- The Masters of Private Equity and Venture Capital: Management Lessons from the Pioneers of Private InvestingFrom EverandThe Masters of Private Equity and Venture Capital: Management Lessons from the Pioneers of Private InvestingRating: 4.5 out of 5 stars4.5/5 (17)

- 2019 Business Credit with no Personal Guarantee: Get over 200K in Business Credit without using your SSNFrom Everand2019 Business Credit with no Personal Guarantee: Get over 200K in Business Credit without using your SSNRating: 4.5 out of 5 stars4.5/5 (3)

- The Six Secrets of Raising Capital: An Insider's Guide for EntrepreneursFrom EverandThe Six Secrets of Raising Capital: An Insider's Guide for EntrepreneursRating: 4.5 out of 5 stars4.5/5 (8)

- These are the Plunderers: How Private Equity Runs—and Wrecks—AmericaFrom EverandThese are the Plunderers: How Private Equity Runs—and Wrecks—AmericaRating: 4.5 out of 5 stars4.5/5 (14)

- Summary of The Black Swan: by Nassim Nicholas Taleb | Includes AnalysisFrom EverandSummary of The Black Swan: by Nassim Nicholas Taleb | Includes AnalysisRating: 5 out of 5 stars5/5 (6)

- Finance Basics (HBR 20-Minute Manager Series)From EverandFinance Basics (HBR 20-Minute Manager Series)Rating: 4.5 out of 5 stars4.5/5 (32)

- 7 Financial Models for Analysts, Investors and Finance Professionals: Theory and practical tools to help investors analyse businesses using ExcelFrom Everand7 Financial Models for Analysts, Investors and Finance Professionals: Theory and practical tools to help investors analyse businesses using ExcelNo ratings yet

- Financial Risk Management: A Simple IntroductionFrom EverandFinancial Risk Management: A Simple IntroductionRating: 4.5 out of 5 stars4.5/5 (7)

- Ready, Set, Growth hack:: A beginners guide to growth hacking successFrom EverandReady, Set, Growth hack:: A beginners guide to growth hacking successRating: 4.5 out of 5 stars4.5/5 (93)

- Burn the Boats: Toss Plan B Overboard and Unleash Your Full PotentialFrom EverandBurn the Boats: Toss Plan B Overboard and Unleash Your Full PotentialRating: 4.5 out of 5 stars4.5/5 (32)

- Value: The Four Cornerstones of Corporate FinanceFrom EverandValue: The Four Cornerstones of Corporate FinanceRating: 4.5 out of 5 stars4.5/5 (18)

- The Six Secrets of Raising Capital: An Insider's Guide for EntrepreneursFrom EverandThe Six Secrets of Raising Capital: An Insider's Guide for EntrepreneursRating: 4.5 out of 5 stars4.5/5 (34)

- The Caesars Palace Coup: How a Billionaire Brawl Over the Famous Casino Exposed the Power and Greed of Wall StreetFrom EverandThe Caesars Palace Coup: How a Billionaire Brawl Over the Famous Casino Exposed the Power and Greed of Wall StreetRating: 5 out of 5 stars5/5 (2)

- The 17 Indisputable Laws of Teamwork Workbook: Embrace Them and Empower Your TeamFrom EverandThe 17 Indisputable Laws of Teamwork Workbook: Embrace Them and Empower Your TeamNo ratings yet

- How to Measure Anything: Finding the Value of Intangibles in BusinessFrom EverandHow to Measure Anything: Finding the Value of Intangibles in BusinessRating: 3.5 out of 5 stars3.5/5 (4)

- Joy of Agility: How to Solve Problems and Succeed SoonerFrom EverandJoy of Agility: How to Solve Problems and Succeed SoonerRating: 4 out of 5 stars4/5 (1)

- Venture Deals, 4th Edition: Be Smarter than Your Lawyer and Venture CapitalistFrom EverandVenture Deals, 4th Edition: Be Smarter than Your Lawyer and Venture CapitalistRating: 4.5 out of 5 stars4.5/5 (73)

- Private Equity and Venture Capital in Europe: Markets, Techniques, and DealsFrom EverandPrivate Equity and Venture Capital in Europe: Markets, Techniques, and DealsRating: 5 out of 5 stars5/5 (1)

- Financial Intelligence: A Manager's Guide to Knowing What the Numbers Really MeanFrom EverandFinancial Intelligence: A Manager's Guide to Knowing What the Numbers Really MeanRating: 4.5 out of 5 stars4.5/5 (79)

- Venture Deals: Be Smarter Than Your Lawyer and Venture CapitalistFrom EverandVenture Deals: Be Smarter Than Your Lawyer and Venture CapitalistRating: 4 out of 5 stars4/5 (32)

- Value: The Four Cornerstones of Corporate FinanceFrom EverandValue: The Four Cornerstones of Corporate FinanceRating: 5 out of 5 stars5/5 (2)

- Burn the Boats: Toss Plan B Overboard and Unleash Your Full PotentialFrom EverandBurn the Boats: Toss Plan B Overboard and Unleash Your Full PotentialNo ratings yet

- Financial Modeling and Valuation: A Practical Guide to Investment Banking and Private EquityFrom EverandFinancial Modeling and Valuation: A Practical Guide to Investment Banking and Private EquityRating: 4.5 out of 5 stars4.5/5 (4)

- Startup CEO: A Field Guide to Scaling Up Your Business (Techstars)From EverandStartup CEO: A Field Guide to Scaling Up Your Business (Techstars)Rating: 4.5 out of 5 stars4.5/5 (4)

- The Synergy Solution: How Companies Win the Mergers and Acquisitions GameFrom EverandThe Synergy Solution: How Companies Win the Mergers and Acquisitions GameNo ratings yet