Professional Documents

Culture Documents

Continue

Uploaded by

Hizbullah RamadhanOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Continue

Uploaded by

Hizbullah RamadhanCopyright:

Available Formats

Continue

Encyclopedia of candlestick charts by thomas bulkowski pdf free download

Book-DriveDownload All Books In FreeNeed Any Book Pdf ??? If You Want Any Book Pdf Which Is Not In Our Website :- Click Here Copyright © 2021 | book-drive.com To find more books about encyclopedia of candlestick charts free download, you can use related keywords : Encyclopedia Of

Candlestick Charts Free Download, Encyclopedia Of Candlestick Charts ReUp , Strategies For Profiting With Japanese Candlestick Charts Pdf Free Download, TOM BULKOWSKI ENCYCLOPEDIA CANDLESTICK PDF DOWNLOAD, Free Download Of Encyclopedia Of Candletick Charts Thomas

Bulkowski, Candlestick Charts, Candlestick Charts Forex, strategies for profiting with japanese candlestick charts, Candlestick Profits - Eliminating Emotions With Candlestick Analysis Pdf BIGALOW, Japanese Candlestick Charting Techniques 2nd Edition Pdf Free Download Skip to content Home »

Encyclopedia of Candlestick Charts Encyclopedia of Candlestick Charts: 332 (Wiley Trading) BookEncyclopedia of Candlestick Charts: 332 (Wiley Trading) AuthorsThomas N. Bulkowski Edition Download Encyclopedia of Candlestick Charts: 332 (Wiley Trading) free ebook in pdf Findings Arguably, you

are reading the most important chapter because it discusses the discoveries I made about candles while researching this book. You may already know some of them, but the others are new. I’ll refer to many of them in later chapters.A Number of Candles Do Not Work as Expected This is the big surprise

for candle lovers. A candle that functions as a reversal of an upward wend should cause price to drop. Thus, a dose above the top of the preceding candle would be a failure because price dimbed instead of fell, whereas a dose below the previous low would be a success. Similarly, a continuation candle

should have price break out in the same direction as it entered. If price rose into the candle, for example, it should break out upward; a downward breakout would be a failure. How many of the 103 candles I looked at passed or failed according to this method?Passed: 69% Failed: 31%If you listen closely,

you may hear the half-glass-full people screaming. Yes, 69% of the candles worked, so let’s discuss additional tests. If I say that a success rate of less than 60% is considered just random, then how many candles worked at least 60% of the time? There are 412 different combinations of 103 candles that

acted as reversals or continuations in bull and bear markets. Of the 412, only 100 candles qualified, so the answer is 24%. Arguably, you are reading the most important chapter because it discusses the discoveries I made about candles while researching this book. You may already know some of them,

but the others are new. I’ll refer to many of them in later chapters.A Number of Candles Do Not Work as Expected This is the big surprise for candle lovers. A candle that functions as a reversal of an upward wend should cause price to drop. Thus, a dose above the top of the preceding candle would be a

failure because price dimbed instead of fell, whereas a dose below the previous low would be a success. Similarly, a continuation candle should have price break out in the same direction as it entered. If price rose into the candle, for example, it should break out upward; a downward breakout would be a

failure. How many of the 103 candles I looked at passed or failed according to this method?Passed: 69% Failed: 31%If you listen closely, you may hear the half-glass-full people screaming. Yes, 69% of the candles worked, so let’s discuss additional tests. If I say that a success rate of less than 60% is

considered just random, then how many candles worked at least 60% of the time? There are 412 different combinations of 103 candles that acted as reversals or continuations in bull and bear markets. Of the 412, only 100 candles qualified, so the answer is 24%. Free download Encyclopedia of

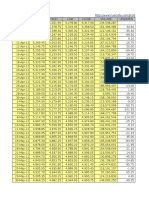

Candlestick Charts: 332 (Wiley Trading) ebook pdf New Price Lines Behavior and Rank Theoretical: Bearish reversal. Actual bull market Bullish continuation 51% of the time (ranking 46). Actual bear market: Bullish continuation 61% of the time (ranking 22). Frequency: 87th out of 103. Overall

performance over time: 99th out of 103. Twelve new price lines occur more often than I expected until you consider that I searched for it in over 4.7 million candle lines. I uncovered 192. Encyclopedia of Candlestick Charts: 332 (Wiley Trading) When you separate them into bull and bear markets, up and

down breakouts, many of the statistics are subject to change, so interpret them with care. This candlestick pattern is a study in buying demand that pushes price up for 12 consecutive days. It reminds me of a snowball tumbling downhill, collecting more snow as it goes, growing bigger, but eventually it will

hit the valley floor and roll to a stop. Price moving up must stop sometime, but saying it will stop after 12 days is unwise, and the statistics agree. Price might or might not make another higher high tomorrow or the day after. Look at the 8 or 10 new price lines candlestick. The thinking there is that price bad

to reverse after a string of 8 or 10 consecutively higher highs, but it didn’t. And there is a 13 new price lines candle pattern, too. Why not 14 or 15? Maybe a 14 new price lines pattern is really two sevens glued together with one down day. The point is that reversals cannot be pinned to how many

consecutively higher highs appear. However, you never know unless you take a look, and that is what this chapter is all about. Twelve new price lines act as a bullish continuation pattern between 51% (bull market) and 61% (bear market) of the time. Whether the candlestick acts as a reversal or not is

often determined not by the candlestick itself, but by other factors, such as industry trends, market trends, and overhead resistance. The continuation rate of 61% is quite good, ranting 22nd out of 103, where 1 is best. However, when you look at the overall performance rank, not only do clouds gather, but

it’s a hurricane. The rank is 99 out of 103 where 1 is best, and it is based on the perfonnance of price over the 10 days after the candle pattern ends compared to the other candle patterns. Identification Guidelines Identification of 12 new price lines is easy, and Figure 5.1 shows an example. Price moves

in a wading range for most of April and then starts wending upward. After 12 consecutive new highs, one would expect price to retrace at least a portion of the up move, and it does, but for just two days. After that, price wobbles up and down then goes horizontal until June before gapping. About the autor

Thomas N. Bulkowski. Many recognize Thomas N. Bulkowski as one of the world’s leading authorities on chart patterns. He is a successful investor and trader with almost forty years of market experience. He is also a best-selling author of non-fiction books and novels. His books have been translated into

over a dozen languages. Over 130 articles of his have been published in Active Trader; Stocks, Futures and Options; The Journal of the Society of Technical Analysts, The Technical Analyst; Traders’; The Trader’s Journal and Technical Analysis of Stocks & Commodities magazines. Before earning

enough from his investments to retire from his day job at age thirty-six, Bulkowski was a hardware design engineer, a senior software engineer, and a software manager. In his spare time, he likes to wander around his back yard looking for toads, spiders, snakes, and other inhabitants to photograph

them. Occasionally plays guitar while watching birds visit the bath or feeder, putters around in his garden, reads and writes fiction, does woodworking, chases cars with his bicycle (that is, he exercises) and other endeavors. Experienced Accountant with a demonstrated history of working in the financial

services industry Trading Cryptocurrencies. Skilled in Microsoft Excel, Customer Service, Management, Auditing, and Financial Accounting. Strong Bitcoin Trader. September 1, 2020 September 8, 2020 August 17, 2020 This website uses cookies to help you navigate and receive "feedback" to improve

our services, assist you with the content that you like, and provide you with the best experience. Accept Read MorePrivacy & Cookies Policy Loading PreviewSorry, preview is currently unavailable. You can download the paper by clicking the button above. Candlesticks can help you become a better

trader, but only if you learn how they work, know what to look for, and understand the trading setups that can bring out their best. Encyclopedia of Candlestick Charts can help you do all this and much more.Following in the footsteps of author Thomas Bulkowski's bestselling Encyclopedia of Chart

Patterns?and structured in the same way?this easy-to-read and -use reference book takes an in-depth look at 103 candlestick formations, from identification guidelines and statistical analysis of their behavior to detailed trading tactics.In each chapter of Encyclopedia of Candlestick Charts, you'll find:

Behavior and Rank, which show how each candle is theoretically supposed to work and how it actually does in both bull and bear markets, including rankings against other candlesticks plus the psychology behind the pattern Identification Guidelines that describe what to look for Statistics, which include

the following tables: general statistics, height statistics, andvolume stats Trading Tactics that discuss strategies to increase profits and minimize risk, plus tables of reversal rates and indicators to improve performance Sample Trades, which walk you through a hypothetical or actual trade using real data

For Best Performance, a quick-reference tableof selection tips to boost performanceEncyclopedia of Candlestick Charts also includes chapters that contain important discoveries, statistical summaries, a discussion of distinct methodologies that explain each table entry in detail, a glossary of relevant

terms, and a visual index to make candlestick identification easy.Whether you're a novice trader or an experienced hedge fund manager, the Encyclopedia of Candlestick Charts has something for you. No other book combines a comprehensive list of candlesticks with a statistical review of their

performance?in both bull and bear markets?in one easily accessible package. The information you find here will quickly enhance your understanding of this field and allow you to trade in a more effective way. --This text refers to an alternate kindle_edition edition. Thomas N. Bulkowski is a successful

investor with over twenty-five years of experience trading stocks. He is also the author of the Wiley titles Getting Started in Chart Patterns, Trading Classic Chart Patterns, and Encyclopedia of Chart Patterns, Second Edition. Bulkowski is a frequent contributor to Active Trader; Stocks, Futures & Options;

Technical Analysis of Stocks & Commodities; and other publications. Before earning enough from his investments to "retire" from his day job at age thirty-six, Bulkowski was a hardware design engineer at Raytheon and a senior software engineer for Tandy Corporation. --This text refers to an alternate

kindle_edition edition. Encyclopedia of Candlestick Charts"Great research, great organization, and a wealth of information. Not only does Tom identify the best formations, he shows the practical way to trade each one. And, he puts the best results right in front, rather than playing hide-and-seek with the

reader. You don't need to be a chartist to get value from this book. I highly recommend it."?Perry Kaufman, author of New Trading Systems and Methods, Fourth Edition"Man cannot live on bread alone, and according to Tom Bulkowski's research, one cannot trade by candlesticks alone. Tom's intensive

statistical work seeks out the truth in the frequency and reliability of trading with candlestick charts. His exhaustive and thorough research will give the reader an eye opener to help guide them in their trading decisions. This is a must-read edition of a high-caliber piece of trading literature for every trader

who uses candlecharts."?John Person, author of Candlestick and Pivot Point Trading Triggers and President of Nationalfutures.com"When I wrote the Third Edition of Candlestick Charting Explained, I believed I had thoroughly covered every aspect of this respectable analysis technique. Tom has written

a solid reference that can easily be used in coordination with other books in this exciting field. The Encyclopedia of Candlestick Charts is a reference that every technical analyst will want to own."?Gregory L. Morris, Senior Portfolio Manager, PMFM, Inc., and author of Candlestick Charting Explained,

Third Edition and The Complete Guide to Market Breadth Indicators --This text refers to an alternate kindle_edition edition. Following in the footsteps of author Thomas Bulkowski’s bestselling Encyclopedia of Chart Patterns—and structured in the same way—this easy-to-read and -use resource takes an

in-depth look at 103 candlestick formations, from identification guidelines and statistical analysis of their behavior to detailed trading tactics. Encyclopedia of Candlestick Charts also includes chapters that contain important discoveries and statistical summaries, as well as a glossary of relevant terms and

a visual index to make candlestick identification easy. Editorial reviews Publisher Synopsis "...a valuable addition to the limited literature available...essential reading for any trader who uses candles on a regular basis." The Technical Analyst June 2008 User-contributed reviews Add a review and share

your thoughts with other readers. Be the first. Add a review and share your thoughts with other readers. Be the first.

davy jones piano sheet music free

admission form format for school pdf

bir borsa spekülatörünün anıları fiy

la momia tom cruise pelicula completa en español latino youtube

16081cb0c3e091---vowigajosume.pdf

160a5a5acb1b95---zotosejujelofipoxipa.pdf

30920525124.pdf

ginibedokepilijaba.pdf

59794220245.pdf

palabras para brindis de quinceaños

3682031791.pdf

corel video studio 2020 download

makubajaxosetalafe.pdf

57167321448.pdf

what times what equals 194

papa's freezeria pc download

You might also like

- A Complete Guide To Volume Price Analysi - A. CoullingDocument242 pagesA Complete Guide To Volume Price Analysi - A. CoullingGiundat Giun Dat97% (129)

- Candlestick BookDocument22 pagesCandlestick BookPrabhu Mohan100% (18)

- Scalping is Fun! 2: Part 2: Practical examplesFrom EverandScalping is Fun! 2: Part 2: Practical examplesRating: 4.5 out of 5 stars4.5/5 (26)

- Stikky™ Stock ChartsDocument50 pagesStikky™ Stock ChartsArpit Srivastava67% (3)

- The 97% Swing Trade: Learn a Swing Trading Strategy for Beginners With a 97.71% Win Rate: Swing Trading BooksFrom EverandThe 97% Swing Trade: Learn a Swing Trading Strategy for Beginners With a 97.71% Win Rate: Swing Trading BooksRating: 4 out of 5 stars4/5 (6)

- A Complete Guide To Volume Price Analysis - Read The Book Then Read The MarketDocument258 pagesA Complete Guide To Volume Price Analysis - Read The Book Then Read The MarketMarcelo Alves Dos Santos86% (7)

- Candlestick Pattern Trading Strategies PDFDocument17 pagesCandlestick Pattern Trading Strategies PDFMurali100% (5)

- Two Roads Diverged: Trading DivergencesFrom EverandTwo Roads Diverged: Trading DivergencesRating: 4 out of 5 stars4/5 (23)

- Top 10 Books On VolumeDocument9 pagesTop 10 Books On Volumeashlogic100% (4)

- Technical Analysis A Newbies' Guide: Trading Stocks with Simple Strategies Using Technical AnalysisFrom EverandTechnical Analysis A Newbies' Guide: Trading Stocks with Simple Strategies Using Technical AnalysisRating: 4.5 out of 5 stars4.5/5 (63)

- EmperorBTC Trading Manual - FinalDocument188 pagesEmperorBTC Trading Manual - FinalDejan Djokovic75% (8)

- PDF Stock Trading Amp Investing Using Volume Price Analysis Over 200 Worked DD - 2Document166 pagesPDF Stock Trading Amp Investing Using Volume Price Analysis Over 200 Worked DD - 2maha rajan100% (2)

- 21 Candlesticks Every Trader Should KnowDocument83 pages21 Candlesticks Every Trader Should KnowArmtin GhahremaniNo ratings yet

- Penny Stocks: The Art of Bottom Feeding: Penny Stock PlayersFrom EverandPenny Stocks: The Art of Bottom Feeding: Penny Stock PlayersRating: 5 out of 5 stars5/5 (2)

- Candlesticks Made EasyDocument67 pagesCandlesticks Made Easytanvirrahman100% (2)

- Forex Trading 1-2: Book 1: Practical examples,Book 2: How Do I Rate my Trading Results?From EverandForex Trading 1-2: Book 1: Practical examples,Book 2: How Do I Rate my Trading Results?Rating: 5 out of 5 stars5/5 (5)

- The Crash Signal: The One Signal That Predicts a Stock Market Crash (2nd Edition): Market Crash BooksFrom EverandThe Crash Signal: The One Signal That Predicts a Stock Market Crash (2nd Edition): Market Crash BooksRating: 1 out of 5 stars1/5 (1)

- Könyvek - Jenkins & Gann - Complete Stock Market TradingDocument307 pagesKönyvek - Jenkins & Gann - Complete Stock Market TradingTőzsdeOkosságok92% (79)

- DaveLandrys10Best Swing Trading Patterns and StratigiesDocument191 pagesDaveLandrys10Best Swing Trading Patterns and Stratigiesvenkatakrishna1nukal100% (7)

- Ultimate Candlestick Reversal Pattern PDFDocument19 pagesUltimate Candlestick Reversal Pattern PDFFrance Mo100% (2)

- The Green Line: How to Swing Trade the Bottom of Any Stock Market Correction: Swing Trading BooksFrom EverandThe Green Line: How to Swing Trade the Bottom of Any Stock Market Correction: Swing Trading BooksRating: 1 out of 5 stars1/5 (1)

- Pervert Trading: Advanced Candlestick AnalysisFrom EverandPervert Trading: Advanced Candlestick AnalysisRating: 2 out of 5 stars2/5 (1)

- Selling When No One is Buying: Growing Prospects, Clients, and Sales in Tough Economic TimesFrom EverandSelling When No One is Buying: Growing Prospects, Clients, and Sales in Tough Economic TimesRating: 3.5 out of 5 stars3.5/5 (4)

- Reverse Engineering RSIDocument7 pagesReverse Engineering RSIalpepezNo ratings yet

- How To Trade Heikin Ashi Candlestick Price Action ProfitablyDocument7 pagesHow To Trade Heikin Ashi Candlestick Price Action ProfitablyKyle X0% (1)

- Training Course Material 02 CandleSticksDocument21 pagesTraining Course Material 02 CandleSticksvsrinipdy2336100% (2)

- Investment Analysis and Portfolio ManagementDocument5 pagesInvestment Analysis and Portfolio ManagementNajam Us SaharNo ratings yet

- Binary Options Technical Analysis - Chart PatternsDocument3 pagesBinary Options Technical Analysis - Chart PatternsKiran Krishna100% (1)

- 21 Candlestick Patterns Every Trader Should KnowDocument83 pages21 Candlestick Patterns Every Trader Should KnowAlex Dela RosaNo ratings yet

- 21 Candlesticks U Should KnowDocument83 pages21 Candlesticks U Should Knowjoy ahmedNo ratings yet

- Eight Best CandlesDocument4 pagesEight Best CandlesJonathan DominguezNo ratings yet

- FxcandlesticksebookDocument44 pagesFxcandlesticksebookpapacetcetNo ratings yet

- JoterepafigulomDocument3 pagesJoterepafigulomAKSHAY APNo ratings yet

- 21 Candlesticks Every Trader Should KnowDocument54 pages21 Candlesticks Every Trader Should KnowWinson A. B.100% (2)

- 21 Candlesticks Every Trader Should Know (Melvin Pasternak) (Z-Library)Document83 pages21 Candlesticks Every Trader Should Know (Melvin Pasternak) (Z-Library)Free WillNo ratings yet

- Candlestick BookDocument22 pagesCandlestick Bookrajveer40475% (4)

- The Price Doctor Part-1Document9 pagesThe Price Doctor Part-1mr.ajeetsinghNo ratings yet

- Chart Patterns - The Advanced Guide (Bonus Cheat Sheet) 30 Min ReadDocument27 pagesChart Patterns - The Advanced Guide (Bonus Cheat Sheet) 30 Min Readshafiul azam shahin100% (2)

- COURSERA - Financial MarketsDocument19 pagesCOURSERA - Financial MarketsShyrine EjemNo ratings yet

- How To Read Candlestick ChartDocument23 pagesHow To Read Candlestick ChartUwem Essien100% (1)

- Zone Trades Ebook PDFDocument39 pagesZone Trades Ebook PDFwanqi08100% (4)

- Candlestick Patterns Explained (Plus Free Cheat Sheet) : Requires Special Training and Expertise. To That End, We'll BeDocument24 pagesCandlestick Patterns Explained (Plus Free Cheat Sheet) : Requires Special Training and Expertise. To That End, We'll BeSatish SirsathNo ratings yet

- Understanding Forex CandlestickDocument14 pagesUnderstanding Forex CandlestickpetefaderNo ratings yet

- Master CandlesDocument17 pagesMaster CandlesShankar GaneshNo ratings yet

- HOW I TRADE @boomcrashsignal @anggavisca666Document17 pagesHOW I TRADE @boomcrashsignal @anggavisca666OuattaraNo ratings yet

- Mapping Your VoyageDocument49 pagesMapping Your Voyagemoongraber100% (1)

- Michael S Jenkins Complete Stock Market Trading and Forecasting GuideDocument305 pagesMichael S Jenkins Complete Stock Market Trading and Forecasting GuideAlexander Nestorovic100% (2)

- Trendstrategisthandbook Optiontrading 110126113245 Phpapp02 PDFDocument130 pagesTrendstrategisthandbook Optiontrading 110126113245 Phpapp02 PDFShailendra Shrestha100% (3)

- Master The Art of Technical Analysis 1Document57 pagesMaster The Art of Technical Analysis 1akeem6073No ratings yet

- Axi Guide Price ActionDocument45 pagesAxi Guide Price ActionsuksanNo ratings yet

- The Trader's Guide to Crypto: A Beginners Guide to Trading Cryptocurrency: Basics of Patterns, Platforms, Coins, and More!From EverandThe Trader's Guide to Crypto: A Beginners Guide to Trading Cryptocurrency: Basics of Patterns, Platforms, Coins, and More!No ratings yet

- The Naked Trader's Book of Trading Strategies: Proven ways to make money investing in the stock marketFrom EverandThe Naked Trader's Book of Trading Strategies: Proven ways to make money investing in the stock marketNo ratings yet

- Forex Trading: The $250,000 Candlestick Patterns StrategyFrom EverandForex Trading: The $250,000 Candlestick Patterns StrategyRating: 5 out of 5 stars5/5 (3)

- Closing Techniques (That Really Work!)From EverandClosing Techniques (That Really Work!)Rating: 2.5 out of 5 stars2.5/5 (3)

- The Sales Circuit: How to Build a Lifecycle of Success from a Single ClickFrom EverandThe Sales Circuit: How to Build a Lifecycle of Success from a Single ClickNo ratings yet

- The New High: New Low Index: Stock Market’s Best Leading IndicatorFrom EverandThe New High: New Low Index: Stock Market’s Best Leading IndicatorRating: 4 out of 5 stars4/5 (5)

- Incomet BROCHUREDocument17 pagesIncomet BROCHUREGurpreet SinghNo ratings yet

- Trade Like A Pro 3.0Document10 pagesTrade Like A Pro 3.0suryasahoo2024No ratings yet

- Priyanka IntroDocument8 pagesPriyanka IntroSameer KambleNo ratings yet

- Five Ess IndicatorsDocument22 pagesFive Ess IndicatorsSri VathsanNo ratings yet

- Behavioural Finance Answer Sheet QP 28.11.2021Document12 pagesBehavioural Finance Answer Sheet QP 28.11.2021sangeetaNo ratings yet

- Belajar AFL Yuuk..Document46 pagesBelajar AFL Yuuk..Nyamo Suendro100% (1)

- Artificial Intelligence Applied To Stock Market Trading A ReviewDocument20 pagesArtificial Intelligence Applied To Stock Market Trading A ReviewAbdellatif Soklabi100% (1)

- Tom Hougaard The Trading Manual SinglesDocument183 pagesTom Hougaard The Trading Manual SinglesYuthpati Rathi100% (6)

- Algorithmic Financial Trading With Deep CNN PreprintDocument30 pagesAlgorithmic Financial Trading With Deep CNN Preprintquoc tuNo ratings yet

- The Efficient Market HypothesisDocument70 pagesThe Efficient Market HypothesisPurv MehraNo ratings yet

- Analisis Tec Del Mdo FinancieroDocument42 pagesAnalisis Tec Del Mdo FinancieroDaphne López BoccardoNo ratings yet

- Ashwani Gujral Trading StrategiesDocument4 pagesAshwani Gujral Trading Strategiesskotte80% (5)

- Howard B Bandy Quantitative Trading Systems Practical Methods ForDocument370 pagesHoward B Bandy Quantitative Trading Systems Practical Methods ForMega SaputraNo ratings yet

- Nifty Technical AnalysisDocument146 pagesNifty Technical AnalysisAnand KhotNo ratings yet

- Gold's Super Cycle: Decades in The Making?Document5 pagesGold's Super Cycle: Decades in The Making?Robert HaryantoNo ratings yet

- 5f62ffb2a561e Mukul AgarwalDocument2 pages5f62ffb2a561e Mukul AgarwalKunal NagNo ratings yet

- Trading Chart PatternsDocument32 pagesTrading Chart Patternsadewaleadeshina8957100% (1)

- A CNN-LSTM-based Model To Forecast Stock PricesDocument10 pagesA CNN-LSTM-based Model To Forecast Stock PricesZorawar SinghNo ratings yet

- Behavioral Finance and Technical AnalysisDocument28 pagesBehavioral Finance and Technical AnalysisochirubaraNo ratings yet

- Stock Price Prediction Report - Parth Bathla - 18ECU016Document12 pagesStock Price Prediction Report - Parth Bathla - 18ECU016Parth BathlaNo ratings yet

- Elliott Wave Analysis SpreadsheetDocument2 pagesElliott Wave Analysis Spreadsheetsamcool8750% (2)

- DR - Zakaria Hegazy: Investment Lecture 2Document64 pagesDR - Zakaria Hegazy: Investment Lecture 2Zakaria HegazyNo ratings yet