Professional Documents

Culture Documents

2 PART 2 Topics & References

Uploaded by

Hidden Man0 ratings0% found this document useful (0 votes)

19 views1 pageCopyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

19 views1 page2 PART 2 Topics & References

Uploaded by

Hidden ManCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 1

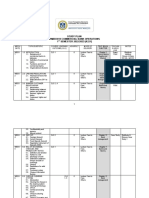

TOPIC COVERED REFERENCES

(AS PER REVIEWERS’ OUTLINE)

Salosagco, Tiu, Roque (2018-2019)

Hermosilla (2018)

AUDITING Audit Planning* Chapters 1, 4, 5 Chapter 4

THEORY Risk Assessment Procedures* Chapter 5, 6, 8 Chapter 5

Audit Evidence & Documentation Chapter 9 Chapter 7

Audit Reports, Completion of Audit, Chapters 10, 11 Chapter 9, 10, 11

Post-Audit Responsibilities

Other Topics (Beyond Outline)

1. Assurance, Auditing, and Chapters 1, 2, 3, 12 Chapter 1

Related Services

2. Accountancy Profession, Code Chapter 13 Chapters 2, 3

of Professional Ethics

3. Auditing in a CIS Environment Chapter 7 Chapter 6

AUDITING Roque (2018-2019)

PROBLEM Audit of Cash Chapter 1

Expenditure Cycle (Audit of Inventories) Chapter 3

Audit of Shareholder’s Equity Chapter 8

Revenue Cycle: (Audit of Receivables) Chapter 2

Investments Chapter 4

Long-Term Liabilities Chapter 7

Banggawan (2019) Tabag (2019)

BASIC PRINCIPLES OF TAXATION Chapters 1, 2, 3, 4 Chapter 1, 8

INCOME Income Taxation

TAXATION 1. Individual Taxpayers, Passive Chapters 5, 7, 10, Chapter 2, 3,

Income 11, 14

2. Corporate Taxpayers Chapter 5, 10, 15 Chapter 4, 5

(A, B)

3. Gross Income Chapters 3, 7, 8, 9 Chapter 6

4. Allowable Deductions Chapter 13 (A, B, Chapter 7

C)

5. Capital Gains Tax (CGT) & Chapter 5, 6, 12 Chapter

Withholding Tax (WHT)

BUSINESS 1. Value-Added Tax Chapters 1, 2, 3, 4, Chapter 12

TAXATION 6, 7, 8, 9, 10

2. Percentage Tax Chapter 5 Chapter 11

TRANSFER 1. Estate Tax Chapters 12, 13, 14, Chapter 9

TAXATION 15

2. Donor’s Tax Chapters 16, 17 Chapter 10

*Auditing Theory

o Introduction to Auditing & Overview of Financial Statements Risk-Based Audit

o Audit Planning: An Overview

o Materiality, Misstatements, Determining Material Accounts & Disclosure, & Audit Risk

o Understanding the Entity and Its Environment

o Identifying and Assessing Risks of Material Misstatements

o Responding to Assessed Risks

You might also like

- Schaum's Outline of Principles of Accounting I, Fifth EditionFrom EverandSchaum's Outline of Principles of Accounting I, Fifth EditionRating: 5 out of 5 stars5/5 (3)

- Payroll DocumentDocument23 pagesPayroll Documentkarthiksainath100% (3)

- SM 06Document146 pagesSM 06karanNo ratings yet

- Sbi Rar 2015Document57 pagesSbi Rar 2015Moneylife FoundationNo ratings yet

- Schaum's Outline of Bookkeeping and Accounting, Fourth EditionFrom EverandSchaum's Outline of Bookkeeping and Accounting, Fourth EditionRating: 5 out of 5 stars5/5 (1)

- Direct TaxDocument632 pagesDirect TaxAnushka SharmaNo ratings yet

- Wireman, Terry - MRO Inventory and Purchasing - Maintenance Strategy Series (2013, Reliabilityweb Com)Document108 pagesWireman, Terry - MRO Inventory and Purchasing - Maintenance Strategy Series (2013, Reliabilityweb Com)Faiza Tariq100% (1)

- CSR Matrix - Issue 2Document6 pagesCSR Matrix - Issue 2normalNo ratings yet

- DBM Dilg Nyc Joint Memorandum Circular No 2019 1 PDFDocument10 pagesDBM Dilg Nyc Joint Memorandum Circular No 2019 1 PDFRoselyn Holgado CelizNo ratings yet

- Solution Manual For Financial Accounting 11th Edition Jerry J Weygandt Paul D Kimmel Donald e Kieso 2Document45 pagesSolution Manual For Financial Accounting 11th Edition Jerry J Weygandt Paul D Kimmel Donald e Kieso 2James Parker100% (37)

- Chapter 2 RRLDocument19 pagesChapter 2 RRLgeorbert abieraNo ratings yet

- Sop HRDocument2 pagesSop HRbinubabu86% (7)

- Whitepaper en Iatf16949Document12 pagesWhitepaper en Iatf16949Archana SinghNo ratings yet

- Cost Management For Just-in-Time EnvironmentsDocument57 pagesCost Management For Just-in-Time EnvironmentsSunny NayakNo ratings yet

- Features of the Government Accounting ManualDocument30 pagesFeatures of the Government Accounting ManualMay Joy ManagdagNo ratings yet

- Accounting Principles Chapter 8 SolutionDocument111 pagesAccounting Principles Chapter 8 SolutionKitchen Useless100% (1)

- Billing Reference ArchitectureDocument37 pagesBilling Reference ArchitectureAnandhababuSNo ratings yet

- GT Strudl BrochureDocument4 pagesGT Strudl BrochureRomeoSánchezNo ratings yet

- SDBHSDVJDocument9 pagesSDBHSDVJJohn Brian D. SorianoNo ratings yet

- Ted Baker RedactedDocument65 pagesTed Baker RedactedWaqar HassanNo ratings yet

- Sample 1 For Accountant ResumeDocument3 pagesSample 1 For Accountant Resume2009tamerNo ratings yet

- Integrated Management System ManualDocument41 pagesIntegrated Management System ManualMikku Katta100% (2)

- FINAL Narrative Report Philippine National BankDocument38 pagesFINAL Narrative Report Philippine National BankTanyelle LouvNo ratings yet

- Economic Capital Allocation with Basel II: Cost, Benefit and Implementation ProceduresFrom EverandEconomic Capital Allocation with Basel II: Cost, Benefit and Implementation ProceduresNo ratings yet

- Part Ii Study Plan: Taxation AuditingDocument3 pagesPart Ii Study Plan: Taxation AuditingHidden ManNo ratings yet

- Conceptual Framework For Financial Reporting: Assignment Classification Table (By Topic)Document43 pagesConceptual Framework For Financial Reporting: Assignment Classification Table (By Topic)Ching Yin HoNo ratings yet

- Course Out Line TalilaDocument5 pagesCourse Out Line TalilatalilaNo ratings yet

- Tos 3RD Year Onboarding Sy2022-2023Document41 pagesTos 3RD Year Onboarding Sy2022-2023W-304-Bautista,PreciousNo ratings yet

- ACCO 20213 Fundamentals of AccountingDocument3 pagesACCO 20213 Fundamentals of AccountingPatrick John AvilaNo ratings yet

- Solution Manual For Accounting Tools For Business Decision Making 5Th Edition Kimmel Weygandt Kieso 1118128168 9781118128169 Full Chapter PDFDocument30 pagesSolution Manual For Accounting Tools For Business Decision Making 5Th Edition Kimmel Weygandt Kieso 1118128168 9781118128169 Full Chapter PDFjohn.twilley531100% (13)

- Financial Accounting Libby 7th Edition Solutions ManualDocument38 pagesFinancial Accounting Libby 7th Edition Solutions Manualpernelturnus6ipv3t100% (11)

- Accounting Tools For Business Decision Making 6th Edition Kimmel Solutions ManualDocument24 pagesAccounting Tools For Business Decision Making 6th Edition Kimmel Solutions ManualBillyBishoptpyc100% (51)

- Institute of Actuaries of Australia Course 2A Life Insurance October 2011 Examinations Marking GuideDocument31 pagesInstitute of Actuaries of Australia Course 2A Life Insurance October 2011 Examinations Marking GuideJeff GundyNo ratings yet

- Final Detailed Test and NotedDocument8 pagesFinal Detailed Test and NotedYash GargNo ratings yet

- Dwnload Full Intermediate Accounting 15th Edition Kieso Solutions Manual PDFDocument35 pagesDwnload Full Intermediate Accounting 15th Edition Kieso Solutions Manual PDFspitznoglecorynn100% (9)

- Ch01 SolutionsDocument41 pagesCh01 SolutionsCông Hoàng ĐìnhNo ratings yet

- Tos 2nd Year Onboarding Sy2022-2023Document13 pagesTos 2nd Year Onboarding Sy2022-2023Kyle Stephen EspañolNo ratings yet

- AP Course OutlineDocument4 pagesAP Course Outlined.pagkatoytoyNo ratings yet

- Full Download Intermediate Accounting 15th Edition Kieso Solutions ManualDocument12 pagesFull Download Intermediate Accounting 15th Edition Kieso Solutions Manualbuscemicelina1008100% (33)

- DOST Form 4 - Financial ReportDocument1 pageDOST Form 4 - Financial ReportSelyun E OnnajNo ratings yet

- DTaxation PDFDocument808 pagesDTaxation PDFcoolmanzNo ratings yet

- UntitledDocument3 pagesUntitledAyush RajakNo ratings yet

- Dwnload Full Intermediate Accounting 2014 Fasb Update 15th Edition Kieso Solutions Manual PDFDocument36 pagesDwnload Full Intermediate Accounting 2014 Fasb Update 15th Edition Kieso Solutions Manual PDFsorbite.bebloodu2hh0j100% (9)

- Accounting For Income Taxes: Assignment Classification Table (By Topic)Document80 pagesAccounting For Income Taxes: Assignment Classification Table (By Topic)Andreas AndreanoNo ratings yet

- Solution Manual For Financial Accounting 11th Edition Jerry J Weygandt Paul D Kimmel Donald e Kieso 2Document37 pagesSolution Manual For Financial Accounting 11th Edition Jerry J Weygandt Paul D Kimmel Donald e Kieso 2stoundjacchusw4jza5100% (14)

- Riftvalley University College of Business and Economics Department of Business Management Program Project ManagementDocument28 pagesRiftvalley University College of Business and Economics Department of Business Management Program Project ManagementRiyaad MandisaNo ratings yet

- STUDY PLAN Commercial Bank OperationsDocument4 pagesSTUDY PLAN Commercial Bank OperationshuzailinsyawanaNo ratings yet

- Krakatau Steel Financial Analysis vs Global CompetitorsDocument7 pagesKrakatau Steel Financial Analysis vs Global Competitorsheda kaleniaNo ratings yet

- FM RTP, MTP, S.Answer Final FileDocument142 pagesFM RTP, MTP, S.Answer Final Filedeepu deepuNo ratings yet

- Financial Accounting Course Outline for PGDM ProgrammeDocument4 pagesFinancial Accounting Course Outline for PGDM ProgrammeAru RanjanNo ratings yet

- TLP Fra 2023 24Document7 pagesTLP Fra 2023 24AnanyaNo ratings yet

- Table of Contents Report on AIBLDocument3 pagesTable of Contents Report on AIBLhasibNo ratings yet

- CH 10Document97 pagesCH 10dsfsdfNo ratings yet

- Intermediate Accounting 2014 Fasb Update 15th Edition Kieso Solutions ManualDocument20 pagesIntermediate Accounting 2014 Fasb Update 15th Edition Kieso Solutions Manualslokekrameriabfofb1100% (22)

- Mba - Sem Ii - CF Syllabus LTPDocument5 pagesMba - Sem Ii - CF Syllabus LTPKanchana GuntupalliNo ratings yet

- Advanced Accounting (CA-IPCC) (Group II) : About The Author Chapter-HeadsDocument13 pagesAdvanced Accounting (CA-IPCC) (Group II) : About The Author Chapter-HeadsRavi TejaNo ratings yet

- Dwnload Full Intermediate Accounting 16th Edition Kieso Solutions Manual PDFDocument6 pagesDwnload Full Intermediate Accounting 16th Edition Kieso Solutions Manual PDFspitznoglecorynn100% (9)

- GR 10 Accounting P2 EngDocument26 pagesGR 10 Accounting P2 Engtapiwamakamure2No ratings yet

- Silibus BKAF1023Document6 pagesSilibus BKAF1023denixngNo ratings yet

- Financial Accounting-II Course OutlineDocument16 pagesFinancial Accounting-II Course OutlinehurmazNo ratings yet

- Insurance Sector Report Q1 2020Document49 pagesInsurance Sector Report Q1 2020Propensity MuyamboNo ratings yet

- Chapter 3 SolutionsDocument137 pagesChapter 3 SolutionsThùy Linh Lê ThịNo ratings yet

- SM 14Document67 pagesSM 14Mai Anh ĐàoNo ratings yet

- Direct Taxation: Study NotesDocument610 pagesDirect Taxation: Study NotesAvneet SinghNo ratings yet

- Financial Accounting: Bharti Airtel LimitedDocument75 pagesFinancial Accounting: Bharti Airtel Limitedadani9No ratings yet

- Canopius Reinsurance AG Financial Condition Report 2017 PDFDocument51 pagesCanopius Reinsurance AG Financial Condition Report 2017 PDFsaxobobNo ratings yet

- ACCT Dire Dawa University Fundamentals of Accounting IIDocument3 pagesACCT Dire Dawa University Fundamentals of Accounting IIAnwar Adem50% (2)

- Ratio Analysis Term PaperDocument26 pagesRatio Analysis Term PapersakibarsNo ratings yet

- 1 CFAP Syllabus Winter 2020Document17 pages1 CFAP Syllabus Winter 2020Kamran UllahNo ratings yet

- PI Course Outline AgroDocument2 pagesPI Course Outline AgroMelkamu Dessie TamiruNo ratings yet

- CH 18Document135 pagesCH 18Afnan EwaisNo ratings yet

- Financial Accounting Tools For Business Decision Making Canadian 7Th Edition Kimmel Solutions Manual Full Chapter PDFDocument67 pagesFinancial Accounting Tools For Business Decision Making Canadian 7Th Edition Kimmel Solutions Manual Full Chapter PDFphongtuanfhep4u100% (11)

- CIR Course Information and ReportDocument4 pagesCIR Course Information and ReportNUR AISYAH BINTINISWADI (BG)No ratings yet

- Ap7 Presentation of Contractual InterestDocument38 pagesAp7 Presentation of Contractual InterestvalcilonNo ratings yet

- Accounting Policies, Changes in Accounting Estimates and ErrorsDocument18 pagesAccounting Policies, Changes in Accounting Estimates and ErrorscindhyNo ratings yet

- Operating Segments: Ifrs 8Document16 pagesOperating Segments: Ifrs 8Kryztel BranzuelaNo ratings yet

- IAS2Document14 pagesIAS2Patrick ArazoNo ratings yet

- 2016 Memo Circular No.19Document42 pages2016 Memo Circular No.19alicianatalialevisteNo ratings yet

- Task PaperDocument2 pagesTask PaperHidden ManNo ratings yet

- Accounting Information System For Mia: Employee Multipurpose Cooperative (Mempc)Document24 pagesAccounting Information System For Mia: Employee Multipurpose Cooperative (Mempc)Julius Michael BalingitNo ratings yet

- The Impact of Financial Management System On Human Resource Utilization (A Case in Gondar Municipality)Document67 pagesThe Impact of Financial Management System On Human Resource Utilization (A Case in Gondar Municipality)meseret sisayNo ratings yet

- Corporate Governance of Eastern Bank LimitedDocument46 pagesCorporate Governance of Eastern Bank LimitedHossain Mohammad ImranNo ratings yet

- SSC CGL Vacancies 2017Document5 pagesSSC CGL Vacancies 2017Tushita92% (12)

- ABC CHAPTERDocument11 pagesABC CHAPTERThezenwayNo ratings yet

- Audit and Internal ReviewDocument7 pagesAudit and Internal ReviewkhengmaiNo ratings yet

- To Secure a challenging roleDocument1 pageTo Secure a challenging roleNidhi BawriNo ratings yet

- Enfield Schools Finance Manual 2011-12Document295 pagesEnfield Schools Finance Manual 2011-12Phillip DawsonNo ratings yet

- Auditing Quiz EssentialsDocument3 pagesAuditing Quiz EssentialsSaif Kamaong AlimNo ratings yet

- Benchmarking Cost Savings and Cost Avoidance PDFDocument41 pagesBenchmarking Cost Savings and Cost Avoidance PDFlsaishankarNo ratings yet

- Code of Ethics For Professional Accountants-2Document25 pagesCode of Ethics For Professional Accountants-2davidwijaya1986100% (1)

- BTEC Level 4 HND Diploma in Business Final Examination FrontsheetDocument5 pagesBTEC Level 4 HND Diploma in Business Final Examination FrontsheetTri HaNo ratings yet

- ChiragBisani (3 2)Document2 pagesChiragBisani (3 2)Akhil GirijanNo ratings yet

- Larson17ce - PPT - V1 - Ch03 (2023 - 01 - 09 00 - 10 - 56 UTC)Document100 pagesLarson17ce - PPT - V1 - Ch03 (2023 - 01 - 09 00 - 10 - 56 UTC)rbasaiti1No ratings yet

- Annual Audit Report: Republic of The Philippines Commission On Audit Regional Office No. IX Zamboanga CityDocument8 pagesAnnual Audit Report: Republic of The Philippines Commission On Audit Regional Office No. IX Zamboanga CityJuan Luis LusongNo ratings yet

- 2020 Integrated Report FinalDocument160 pages2020 Integrated Report FinalIan MutukuNo ratings yet