Professional Documents

Culture Documents

CIR Course Information and Report

Uploaded by

NUR AISYAH BINTINISWADI (BG)Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

CIR Course Information and Report

Uploaded by

NUR AISYAH BINTINISWADI (BG)Copyright:

Available Formats

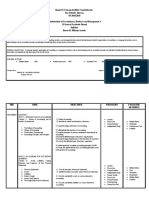

COURSE INFORMATION AND REPORT (CIR)

Session : 1122

Course Code : PAC1163 Course Title : PRINCIPLES OF BUSINESS ACCOUNTING

Course Leader:

Department: ACCOUNTING

MONALIZA BINTI IBERAHIM

Course Lecturer: Office /Room No. : Mobile Phone/Direct Line:

1. MONALIZA BINTI IBERAHIM 207 016-654 3732

2. NORLIZA BINTI RAMLI 219 011-1058 8676

3. AZINA BINTI YAAKOB Pejabat Dekan 019-264 9291

Course Assessment : Course Learning Outcome:

Continuous Assessment Recognise required accounting knowledge, principles, concept, tools and techniques

CLO1

1 Quiz 1 10% in business context. (C2)

2 Test 20% Apply appropriate accounting knowledge, principles, tools and techniques in

CLO2

3 Assignment 30% preparing financial statements for decision making purposes. (C3)

CLO3 Demonstrate effective communications skills. (C3,A3)

Summative Assessment

1 Final Exam 40%

Reference:

1. Weygant, J. J., Kieso, D. E. And Kimmel, P. D. (2020), Accounting Principles. 14th Edition, John Wiley & Sons,

New York: John Wiley & Sons, Inc

2. Norliza, R., Diana, G., Allezawati, I., Norbaizura, H., Shahrul Niza, J., & Nurul Huda, A.S. (2021). Principles of

Financial Accounting - For Non Accounting Students. 2nd Ed., KPTMSB.

3. Drury, C. (2021) Management and Cost Accounting. 11th Ed., Cengage Learning.

4. Garrison R., Noreen E., Brewer P. (2021) Managerial Accounting. 17th Ed., McGraw-Hill Education.

5. Wood, Frank & Sangster, Alan. (2018) Frank Wood's Business Accounting 1. 14th Ed., Pearson.

CONVENTIONAL (PHYSICAL) ONLINE

Report

F2F NF2F F2F (Sync) NF2F (Asynch) TOTAL

Week Topic CLO

SELF- SLT

LEARNIN

L T P O G M AT AS M AT AS

1. INTRODUCTION TO ACCOUNTING

1.1 Definition of Accounting

1 1.2 User and Uses of Accounting Data 1 2 4 2 8

1.3 Types and Characteristics of

Business Organization

2. ACCOUNTING CYCLE AND RECORDING

PROCESS

2.1 Accounting Concepts

2 2.2 Accounting Equation and Transaction 1,2 1 4 3 8

Analysis

2.3 Double Entry System

2.4 Accounting Cycle: Steps in Recording

Process (Journal, Ledger, Trial Balance)

2.5 Introduction to the Accounting Software

3 1,2 2 2 4 8

2.6 Financial Statement

2.6.1 Types of Financial Statement

2.6.2 Adjusting Entries

2.6.3 Statement of Profit or Loss and

Other Comprehensive Income

1,2 2 2 4

2.6.4 Statement of Financial

Position

4 QUIZ 1,2 2 1 3

3. FINANCIAL STATEMENT ANALYSIS

3.1 Tools of Financial Statement Analysis

3.1.1 Trend Analysis (Horizontal and

3 1 2 3

Vertical)

3.1.2 Ratio Analysis

3.2 Apply Ratio Analysis with interpretation

3.2.1 Liquidity Ratio

(Current Ratio, Quick Ratio, Inventory Turnover,

Fixed Asset Turnover, Total Asset Turnover,

Average Collection Period (Receivable) Turnover)

5 3.2.2 Solvency Ratio 3 1 1 4 2 8

(Debt Ratio, Debt to Equity Ratio, Time Interest

Earned)

3.2.3 Profitability Ratio

(Gross Profit Margin, Operating Profit Margin, Net

Profit Margin, Return on Asset, Retun on Equity)

Assignment 3 2 1 2 5 * Breifing on assignment

3.2 Apply Ratio Analysis with interpretation

3.2.1 Liquidity Ratio

(Current Ratio, Quick Ratio, Inventory Turnover,

Fixed Asset Turnover, Total Asset Turnover,

Average Collection Period (Receivable) Turnover)

6

3.2.2 Solvency Ratio

3 3 2 5

(Debt Ratio, Debt to Equity Ratio, Time Interest

Earned)

3.2.3 Profitability Ratio

(Gross Profit Margin, Operating Profit Margin, Net

Profit Margin, Return on Asset, Retun on Equity)

TEST 1,2 2 2 1 5 Student do revision on past year examination questions

3.2 Apply Ratio Analysis with interpretation

3.2.1 Liquidity Ratio

(Current Ratio, Quick Ratio, Inventory Turnover,

Fixed Asset Turnover, Total Asset Turnover,

Average Collection Period (Receivable) Turnover)

7

3.2.2 Solvency Ratio 3 1 1 2 4

(Debt Ratio, Debt to Equity Ratio, Time Interest

Earned)

3.2.3 Profitability Ratio

(Gross Profit Margin, Operating Profit Margin, Net

Profit Margin, Return on Asset, Retun on Equity)

3.2 Apply Ratio Analysis with interpretation

3.2.1 Liquidity Ratio

(Current Ratio, Quick Ratio, Inventory Turnover,

Fixed Asset Turnover, Total Asset Turnover,

Average Collection Period (Receivable) Turnover)

8 3.2.2 Solvency Ratio 3 4 4 8

(Debt Ratio, Debt to Equity Ratio, Time Interest

Earned)

3.2.3 Profitability Ratio

(Gross Profit Margin, Operating Profit Margin, Net

Profit Margin, Return on Asset, Retun on Equity)

3.2 Apply Ratio Analysis with interpretation

3.2.1 Liquidity Ratio

(Current Ratio, Quick Ratio, Inventory Turnover,

Fixed Asset Turnover, Total Asset Turnover,

Average Collection Period (Receivable) Turnover)

3 1 2 3

3.2.2 Solvency Ratio

(Debt Ratio, Debt to Equity Ratio, Time Interest

Earned)

3.2.3 Profitability Ratio

9

(Gross Profit Margin, Operating Profit Margin, Net

Profit Margin, Return on Asset, Retun on Equity)

4. INTRODUCTION TO COST ACCOUNTING

4.1 Function of Cost & Management

Accounting

4.2 Cost and Terminology 1 3 4 7

4.2.1 Direct & Indirect Cost

4.2.2 Manufacturing Cost &

Non Manufacturing Cost

4.3 Cost Behaviour

4.3.1 Fixed Cost

10 1 1 3 4 8

4.3.2 Variable Cost

4.3.3 Mixed Cost

5. COST-VOLUME PROFIT ANALYSIS

11 5.1 Introduction of Cost Volume Profit 2 4 4 8

5.2 Contribution Margin Approach

12 5.2.1 Break Even Point 2 4 4 8

5.2.2 Target Profit

5.2.3 Margin of Safety

13 5.2.4 Changes in Selling Price, Cost and 2 4 4 8

Sales Volumes

14 Revision for Final Examination 4 4 Student do revision on past year examination questions

FINAL ASSESSMENT

2 3 5

Final Examination

14 18 0 11 59 7 0 4 0 7 0

TOTAL Student Learning Time (SLT)hours 102 18 120

PERCENTAGE (%) 85.00 15.00

CONVENTIONAL (PHYSICAL) ONLINE

Note: F2F – Face-to- face, NF2F – Non-Face-to- face

SYN – Synchronous, ASYN – Asynchronous, M – Teaching & Learning (T&L) Materials, AT – T&L Activities, AS – Assessments,

Independent Learning (Asynchronous) in Table 4 is determined by NF2F

First Review Second Review

Prepared by: Prepared by: ______________________ Prepared by: ______________________

( Course Leader) (Lecturer) (Lecturer)

Date: : 2 NOV 2022 Date : ______________________ Date : ______________________

Verified by : ----------------------------------------- Verified by : ------------------------------------ Verified by : -----------------------------------

(Head of Department) (Head of Department) (Head of Department)

Date: :2 NOV 2022 Date: : _______________________ Date: : _______________________

You might also like

- Schaum's Outline of Bookkeeping and Accounting, Fourth EditionFrom EverandSchaum's Outline of Bookkeeping and Accounting, Fourth EditionRating: 5 out of 5 stars5/5 (1)

- Basic Financial Accounting and Reporting: Ishmael Y. Reyes, CPADocument39 pagesBasic Financial Accounting and Reporting: Ishmael Y. Reyes, CPAJonah Marie Therese Burlaza92% (13)

- Financial Accounting .2013 PDFDocument317 pagesFinancial Accounting .2013 PDFhalime100% (1)

- Financian Accounting ModuleDocument277 pagesFinancian Accounting Modulecantona78100% (12)

- Fundamentals of Accounting-I New Course OutlineDocument3 pagesFundamentals of Accounting-I New Course OutlineGedion100% (2)

- Tender Evaluation Template GuideDocument15 pagesTender Evaluation Template Guidedarshantas67% (3)

- Enterprise Portfolio and Project Manag. (EPPM)Document22 pagesEnterprise Portfolio and Project Manag. (EPPM)Rodrigo Prestes100% (1)

- CasesDocument24 pagesCasesXuan LieuNo ratings yet

- Keeling Braves Lawsuit626Document48 pagesKeeling Braves Lawsuit626Michael KingNo ratings yet

- ACTBAS1 SyllabusDocument5 pagesACTBAS1 SyllabustjpalancaNo ratings yet

- Silibus BKAF1023Document6 pagesSilibus BKAF1023denixngNo ratings yet

- Bookkeeping and Accounting For Small Business: Ishmael Y. Reyes Aldon M. FranciaDocument35 pagesBookkeeping and Accounting For Small Business: Ishmael Y. Reyes Aldon M. FranciaTom Vargas0% (1)

- BM04.QT - DT.DGDCCT Actg221Document10 pagesBM04.QT - DT.DGDCCT Actg221irisbeautyariesNo ratings yet

- Financial Accounting Concepts 5Document41 pagesFinancial Accounting Concepts 5Nomfundo GumedeNo ratings yet

- Course Out Line TalilaDocument5 pagesCourse Out Line TalilatalilaNo ratings yet

- 9755 2018Document16 pages9755 2018Naseer SapNo ratings yet

- 2022-30 BOA TOS FinalDocument38 pages2022-30 BOA TOS Finalsara mejiaNo ratings yet

- CRT Learning Module: Introduction to AccountingDocument17 pagesCRT Learning Module: Introduction to AccountingLove Jcw100% (1)

- CRT Learning Module: Subject Code Subject Title Duration Module TitleDocument17 pagesCRT Learning Module: Subject Code Subject Title Duration Module TitleLove Jcw100% (1)

- Course Syllabus-Fundamentals of Accounting IDocument4 pagesCourse Syllabus-Fundamentals of Accounting ITewodrose Teklehawariat BelayhunNo ratings yet

- Course Outline Financial Accounting 1Document5 pagesCourse Outline Financial Accounting 1Nur NabilahNo ratings yet

- 6584financial Accounting 2021Document3 pages6584financial Accounting 2021Najia SalmanNo ratings yet

- 15.IEE3343 - FINANCIAL ACCOUNTING ÀÌÀçÈ P2Document2 pages15.IEE3343 - FINANCIAL ACCOUNTING ÀÌÀçÈ P2sephranesabajoNo ratings yet

- UP Baguio BS Management Economics ACCTG 1 Course OverviewDocument7 pagesUP Baguio BS Management Economics ACCTG 1 Course OverviewConradoNo ratings yet

- Topic/Competency: Pili National High SchoolDocument3 pagesTopic/Competency: Pili National High SchoolJucel MarcoNo ratings yet

- Conceptual Framework For Financial Reporting: Assignment Classification Table (By Topic)Document43 pagesConceptual Framework For Financial Reporting: Assignment Classification Table (By Topic)Ching Yin HoNo ratings yet

- Tp-Btmp1533-Sem 2 2020.2021Document11 pagesTp-Btmp1533-Sem 2 2020.2021Carrot SusuNo ratings yet

- BBFA1103 Introductory Accounting - Eaug20Document336 pagesBBFA1103 Introductory Accounting - Eaug20Vivi50% (2)

- 110101131Document667 pages110101131Santha Kannan100% (1)

- ACFrOgALQf08jqh5ZEEtqZU5rYfl1qdTO66f6u55gStYJt3w6 7ePyecSqyauWSKnuUb4d8dkYdRb8zLpmARWNuSg1goTlGGDRPtQWUn1gLU4WaQo2Jjbar3XG2ZYuI PDFDocument321 pagesACFrOgALQf08jqh5ZEEtqZU5rYfl1qdTO66f6u55gStYJt3w6 7ePyecSqyauWSKnuUb4d8dkYdRb8zLpmARWNuSg1goTlGGDRPtQWUn1gLU4WaQo2Jjbar3XG2ZYuI PDFrathaletchumy100% (2)

- General Accounting L1Document78 pagesGeneral Accounting L1Leila MendjanaNo ratings yet

- Fundamentals of Accountancy SyllabusDocument7 pagesFundamentals of Accountancy SyllabusRichell GomezNo ratings yet

- ch01 Accounting in Action - StudentDocument13 pagesch01 Accounting in Action - StudentVũ Nhật TâmNo ratings yet

- Fundamentalof Accounting I Course OutlineDocument3 pagesFundamentalof Accounting I Course OutlineAbdi Mucee Tube100% (1)

- Accounting Text Book For Year 12Document216 pagesAccounting Text Book For Year 12kautuionatan4No ratings yet

- PI Course Outline AgroDocument2 pagesPI Course Outline AgroMelkamu Dessie TamiruNo ratings yet

- Chapter 1 Accounting Principles OverviewDocument22 pagesChapter 1 Accounting Principles OverviewTony MorganNo ratings yet

- Bbaw 2103Document31 pagesBbaw 2103VignashNo ratings yet

- Syllabus Template SY 2022-2023Document4 pagesSyllabus Template SY 2022-2023Angelo DefensorNo ratings yet

- T05 Tracys Book PDFDocument399 pagesT05 Tracys Book PDFRamer Mbegu100% (2)

- Accountancy, Business, and Management 1 Module 1: Introduction to AccountingDocument19 pagesAccountancy, Business, and Management 1 Module 1: Introduction to AccountingdanelleNo ratings yet

- PRINCIPLES OF ACCOUNTS: UNDERSTANDING FINANCIAL STATEMENTSDocument48 pagesPRINCIPLES OF ACCOUNTS: UNDERSTANDING FINANCIAL STATEMENTSShoaib AslamNo ratings yet

- Financial AccountingDocument2 pagesFinancial AccountingMbu Javis EnowNo ratings yet

- AFM Course Handout 2023Document9 pagesAFM Course Handout 2023anuragagr111No ratings yet

- Exact Globe UserGuide On FinancialsDocument188 pagesExact Globe UserGuide On Financialsaluaman100% (9)

- FAM 2022 - Course Plan - V4Document12 pagesFAM 2022 - Course Plan - V4bharath.bkNo ratings yet

- New SyllabusDocument4 pagesNew SyllabusSiya ChughNo ratings yet

- BB1102-Fundamentals of Financial Accounting Course PlanDocument6 pagesBB1102-Fundamentals of Financial Accounting Course PlanRudraksh DaveNo ratings yet

- FAC1502 - Study Unit 1 - 2021Document26 pagesFAC1502 - Study Unit 1 - 2021Ndila mangalisoNo ratings yet

- Larsons MCH 3Document52 pagesLarsons MCH 3Christopher John NatividadNo ratings yet

- LANADO SHIELA R DLL WEEK 8 FABM1 RECENT Docx1111111Document3 pagesLANADO SHIELA R DLL WEEK 8 FABM1 RECENT Docx1111111Edna MingNo ratings yet

- Econ F212 1120Document6 pagesEcon F212 1120rohit BindNo ratings yet

- Introduction To Bookkeeping and AccountingDocument57 pagesIntroduction To Bookkeeping and Accountingtapera_mangezi100% (1)

- 5038 - ASM1 - Nguyen Phan Thao My - GBD1101Document22 pages5038 - ASM1 - Nguyen Phan Thao My - GBD11011108nguyenphanthaomyNo ratings yet

- Revised LECPA Syllabi Effective May 2019 and October 2022 ComparisonDocument49 pagesRevised LECPA Syllabi Effective May 2019 and October 2022 ComparisonLloyd ReglosNo ratings yet

- 20230103-POA2023 Ch1Document13 pages20230103-POA2023 Ch1chuphamnamphuongNo ratings yet

- Fundamentalof Accounting I Course OutlineDocument3 pagesFundamentalof Accounting I Course OutlineAbdi Mucee TubeNo ratings yet

- 2023 OL Subject ReportDocument133 pages2023 OL Subject ReportSand FossohNo ratings yet

- Conceptual FrameworkDocument125 pagesConceptual FrameworkJonah Marie Therese Burlaza50% (4)

- ACC101 Course Description SyllabusDocument4 pagesACC101 Course Description SyllabusCristina MosaNo ratings yet

- 2023 ACCX 171 Assignment 1Document6 pages2023 ACCX 171 Assignment 1Kgomotso MatabaneNo ratings yet

- Curriculum: Masters in Business Administrat 2020-2022 Term: 1 - Semester Course: MGC1051 - Financial Accounting and AnalysisDocument16 pagesCurriculum: Masters in Business Administrat 2020-2022 Term: 1 - Semester Course: MGC1051 - Financial Accounting and AnalysisAnand BabarNo ratings yet

- The Course Plan Of:: The Instructor: Dr. Rabie EidDocument3 pagesThe Course Plan Of:: The Instructor: Dr. Rabie EidAA BB MMNo ratings yet

- Financial AccountingDocument4 pagesFinancial AccountingprachiNo ratings yet

- UCO BankDocument42 pagesUCO BankLokanath Choudhury100% (1)

- 4319 12366 1 PBDocument10 pages4319 12366 1 PBMaulida FathiaNo ratings yet

- Präsentation Leadership & Intercultural ManagementDocument18 pagesPräsentation Leadership & Intercultural ManagementbellaNo ratings yet

- RN332 Business Process Framework Release Notes R15.0.0Document16 pagesRN332 Business Process Framework Release Notes R15.0.0ibrahim_nfsNo ratings yet

- Letter HeadDocument5 pagesLetter HeadMajho PinggoyNo ratings yet

- To Invest in The Multibagger Parag Milk PDFDocument3 pagesTo Invest in The Multibagger Parag Milk PDFChetan PanchamiaNo ratings yet

- ODFL Dispatch 100Document49 pagesODFL Dispatch 100Вячеслав АкуловNo ratings yet

- ProfileDocument3 pagesProfileManikandan BaskaranNo ratings yet

- MBA B School Survival Guide - Tips From Professors and StudentsDocument33 pagesMBA B School Survival Guide - Tips From Professors and Studentsapi-3734463100% (4)

- All Cases CBDocument37 pagesAll Cases CBnitisharora116No ratings yet

- Lakme - Consumer BehaviourDocument9 pagesLakme - Consumer BehaviourPromila KadyanNo ratings yet

- Financial Authorisations OverviewDocument1,707 pagesFinancial Authorisations OverviewbathinisridharNo ratings yet

- "Effectiveness of Internet AdvertisingDocument74 pages"Effectiveness of Internet Advertisinghotjob12394% (62)

- Minimum Efficient ScaleDocument1 pageMinimum Efficient ScaleJohnlene Louise SaitonNo ratings yet

- Cfas ReviewerDocument10 pagesCfas ReviewershaylieeeNo ratings yet

- INDEXDocument54 pagesINDEXANo ratings yet

- Sap Biztalk IntegrationDocument11 pagesSap Biztalk IntegrationSivaram KrishnaNo ratings yet

- Rectification of Errors Accounting Workbooks Zaheer SwatiDocument6 pagesRectification of Errors Accounting Workbooks Zaheer SwatiZaheer SwatiNo ratings yet

- The Social Function of Business: Lesson IIDocument12 pagesThe Social Function of Business: Lesson IIcj jamesNo ratings yet

- Tange Awbrey ResumeDocument2 pagesTange Awbrey Resumeapi-264168595No ratings yet

- Scopia Capital Presentation On Forest City Realty Trust, Aug. 2016Document19 pagesScopia Capital Presentation On Forest City Realty Trust, Aug. 2016Norman OderNo ratings yet

- Kanban Project Management EbookDocument63 pagesKanban Project Management EbookVasanth Raja100% (2)

- Casebook 2.2 Semi FinalDocument1,015 pagesCasebook 2.2 Semi FinalCarol AnnNo ratings yet

- Honda Atlas Cars Strategic Management ProjectDocument53 pagesHonda Atlas Cars Strategic Management Projectadeelsaadat84% (19)

- FioriApps HCMDocument2 pagesFioriApps HCMJuan ColmeNo ratings yet