Professional Documents

Culture Documents

1

Uploaded by

Aaron Josua AboyOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

1

Uploaded by

Aaron Josua AboyCopyright:

Available Formats

1. WHAT ARE THE BASIC PRINCIPLES OF RISK MANAGEMENT?

According to ISO 31000, there are around 11 risk management principles which

refer to the fundamental idea, rule, or fact about a focus. ISO 31000 risk principles

serve as the standard, process, reason, plan, and execution ofthe risk management

framework and its processes. ISO 31000 is appropriate to all organizations and

may be utilized with any product or service. The basic principles, DIRECTLY

according to the standard, are enumerated below:

• Risk management is tailored;

• Risk management is dynamic, iterative, and responsive to change;

• Risk management is an integral part of all organizational processes;

• Risk management is part of decision making;

• Risk management facilitates continual improvement of the

. Moreover, it is an

environment where people are committed to following an organization’s policies

and procedures, and its ethical and behavioral standards. Additionally, a control

environment incorporates technical aptitude and ethical commitment.

3. DISTINGUIS BETWEEN THE TERMS ERROR AND FRAUD.

The distinctive characteristics that differentiate fraud and error lies on the

circumstances whether the underlying situation that leads to the inputting

untruthful information in the financial statements is planned (intentional) or

unintentional. AS contrasted to error, fraud is intentional and typically includes

deliberate concealment of the facts. Error refers to an unintentional misstatement

in the financial statements, including the omission of an amount or disclosure.

4. DESCRIBE HOW EACH ELEMENTS OF FRAUD TRIANGLE IS NECESSARY FOR

FRAUD TO OCCUR.

• Incentives – The bigger the incentive, the greater the chance an

individual will be able to rationalize the acceptability of committing

fraud.

• Opportunities –the absence of control or the ability of management to

override controls provide an opportunity for a fraud to be perpetrated.

• Rationalization – individuals may be able to rationalize committing

fraudulent act. Some individuals possess an attitude, character or set of

ethical values that allow them knowingly and intentionally to commit a

dishonest act.

In accordance to the Fraud Triangle Theory, all the three (3) elements must coexist

for fraud to occur. Incentive becomes the motive of the committer.

Opportunities are necessary to commit fraud as it is the incident where

committers take advantage of anything weak in the control of the business. And

finally, rationalization serves as the mind-set that the fraud that will be done

would be justified. This mind-set would be the fraudster stand and justification to

his/her acts. All these three has different roles in motivating the perpetrator to

commit fraud and that made them equally important in the situation.

5. DEFINE AND ILLUSTRATE KITING. WHAT CONTROLS SHOULD THE CLIENT

INSTITUTE TO PREVENT IT?

Kiting occurs by overstating the cash balance by the use of checks floats. It is done

by making transfers near year-end from one bank account to another bank

account, recording the deposit in the second account but not recording the

disbursement on the first division’s accou

Bal. P15M

is still

P10M. So, the total cash balance is still P10M at BDO

and P20M at PNB, which has a total of P30M.

You might also like

- Chapter 2Document23 pagesChapter 2Thomas T.R HokoNo ratings yet

- Beyond Play: A Down-To-Earth Approach to Governance, Risk and ComplianceFrom EverandBeyond Play: A Down-To-Earth Approach to Governance, Risk and ComplianceNo ratings yet

- Unit 0 Unit-UNIT-10: Fraud Prevention Fraud Prevention Fraud PreventionDocument15 pagesUnit 0 Unit-UNIT-10: Fraud Prevention Fraud Prevention Fraud PreventiontomalobitoNo ratings yet

- An Introduction to Anti-Bribery Management Systems (BS 10500): Doing right thingsFrom EverandAn Introduction to Anti-Bribery Management Systems (BS 10500): Doing right thingsNo ratings yet

- CH 14Document5 pagesCH 14Kurt Del RosarioNo ratings yet

- Internal Control System On Fraud Detection: Nigeria ExperienceDocument12 pagesInternal Control System On Fraud Detection: Nigeria ExperiencejokoNo ratings yet

- What Is FraudDocument8 pagesWhat Is FraudVeneranda AtriaNo ratings yet

- Fraud in Government - Prevention and DetectionDocument3 pagesFraud in Government - Prevention and DetectionKaye Garcia Hamid0% (1)

- Chap 14 Corp Gov Biasura Jhazreel 2 BDocument6 pagesChap 14 Corp Gov Biasura Jhazreel 2 BJhazreel BiasuraNo ratings yet

- Fraud Risk ManagementDocument18 pagesFraud Risk Managementammwenje100% (4)

- Manatad - Corporate Governance - Fraud and ErrorDocument3 pagesManatad - Corporate Governance - Fraud and ErrorPring PringNo ratings yet

- Fraud Is Something That Is Done With Intent.: For Classroom Discussion Purposes OnlyDocument12 pagesFraud Is Something That Is Done With Intent.: For Classroom Discussion Purposes OnlyKim EllaNo ratings yet

- CH 03Document5 pagesCH 03goerginamarquezNo ratings yet

- Chapter 3 - Assignment - Marcellana, Ariel P. - Bsa-31Document5 pagesChapter 3 - Assignment - Marcellana, Ariel P. - Bsa-31Marcellana ArianeNo ratings yet

- All About Forensic AuditDocument8 pagesAll About Forensic AuditDinesh ChoudharyNo ratings yet

- The Marketing Finance Interface: Cgma ReportDocument48 pagesThe Marketing Finance Interface: Cgma ReportChristie RochaNo ratings yet

- 08 Risiko FraudDocument57 pages08 Risiko Frauddowney_tengengNo ratings yet

- Chapter 8 Illustrative SolutionsDocument14 pagesChapter 8 Illustrative Solutionsreuni akbarNo ratings yet

- Chapter 14Document4 pagesChapter 14Jomer FernandezNo ratings yet

- Chapter 2 Note Audit From The Book. Learning Object 1 Define The Various Types of Fraud That Affect OrganizationDocument12 pagesChapter 2 Note Audit From The Book. Learning Object 1 Define The Various Types of Fraud That Affect OrganizationkimkimNo ratings yet

- Chapter 3 - Auditors' ResponsibilityDocument51 pagesChapter 3 - Auditors' ResponsibilityddddddaaaaeeeeNo ratings yet

- Exam 3 NotesDocument20 pagesExam 3 NotesVince Cinco ParconNo ratings yet

- Effective Fraud Management: Fraud - Its Extent, Patterns and CausesDocument40 pagesEffective Fraud Management: Fraud - Its Extent, Patterns and CausesAfan AliNo ratings yet

- AIS Module 3Document44 pagesAIS Module 3Nishanthini 2998No ratings yet

- Distinguish Between Ethical Issues and Legal IssuesDocument4 pagesDistinguish Between Ethical Issues and Legal IssuesSharmaine manobanNo ratings yet

- 04 - Fraud Risk Management A Guide To GOOD PRACTICEDocument48 pages04 - Fraud Risk Management A Guide To GOOD PRACTICEEd Gonzales GonzalesNo ratings yet

- PG Engagement Planning Assessing Fraud RisksDocument23 pagesPG Engagement Planning Assessing Fraud RisksRoland Val100% (1)

- Combating The Risky Business of FraudDocument4 pagesCombating The Risky Business of FraudishwarcNo ratings yet

- Solution Manual For Auditing and Assurance Services 17th Edition Alvin A Arens Randal J Elder Mark S Beasley Chris e HoganDocument31 pagesSolution Manual For Auditing and Assurance Services 17th Edition Alvin A Arens Randal J Elder Mark S Beasley Chris e HoganMeredithFleminggztay100% (79)

- Rodriguez Zyra-Denelle 09 JournalDocument9 pagesRodriguez Zyra-Denelle 09 JournalDaena NicodemusNo ratings yet

- Effectiveness of External Audit in Detecting and Preventing Fraudulent Activities in An Organisation REVISIONDocument18 pagesEffectiveness of External Audit in Detecting and Preventing Fraudulent Activities in An Organisation REVISIONDavid OnditiNo ratings yet

- AML Compliance Program GuideDocument11 pagesAML Compliance Program GuidelarissarovaneNo ratings yet

- Solution Manual For Auditing and Assurance Services 17th by ArensDocument32 pagesSolution Manual For Auditing and Assurance Services 17th by ArensMeredithFleminggztay99% (81)

- ACCT1111 Topic 5 v2Document7 pagesACCT1111 Topic 5 v2Mariann Jane GanNo ratings yet

- Ceswp2009 I1 Che PDFDocument8 pagesCeswp2009 I1 Che PDFnoordin MukasaNo ratings yet

- Controlling Fraud and Resolving Ethical IssuesDocument10 pagesControlling Fraud and Resolving Ethical IssueshannknotNo ratings yet

- Ethics, Fraud and Internal ControlDocument7 pagesEthics, Fraud and Internal Controljudel ArielNo ratings yet

- Arens Auditing16e SM 10Document30 pagesArens Auditing16e SM 10김현중100% (1)

- Final Assessment 4Document11 pagesFinal Assessment 4Mamphasa MoetiNo ratings yet

- Fraud Risk Article - May 2008Document7 pagesFraud Risk Article - May 2008Carl BurchNo ratings yet

- FraudDocument10 pagesFraudHershey ReyesNo ratings yet

- Audit 09 JournalDocument6 pagesAudit 09 Journalkris salacNo ratings yet

- Assessing and Responding To Fraud RisksDocument7 pagesAssessing and Responding To Fraud RisksRisal EfendiNo ratings yet

- Dafd Unit-1Document33 pagesDafd Unit-1NIKHIL kUMARNo ratings yet

- Tactics For Preventing and Detecting FraudDocument3 pagesTactics For Preventing and Detecting Fraudharikrishna_rsNo ratings yet

- This Study Resource Was: Individual Assignment Contemporary Issues of AuditingDocument5 pagesThis Study Resource Was: Individual Assignment Contemporary Issues of AuditingThuy LinhNo ratings yet

- CFDG Fraud Policy PDFDocument6 pagesCFDG Fraud Policy PDFSanath FernandoNo ratings yet

- Fraud Auditing PPR - EditedDocument3 pagesFraud Auditing PPR - EditedalexNo ratings yet

- Aeb SM CH11 1Document15 pagesAeb SM CH11 1Crytal AbubakarNo ratings yet

- Chapter 12Document5 pagesChapter 12Anonymous fBY2wwTcNo ratings yet

- 6 Strategies For Fraud Prevention in Your BusinessDocument6 pages6 Strategies For Fraud Prevention in Your BusinessEli KagothoNo ratings yet

- 01 Forensic AuditingDocument30 pages01 Forensic AuditingSRIVISHNU BNo ratings yet

- AML CTF ComplianceDocument17 pagesAML CTF ComplianceajayNo ratings yet

- CPP Flash CardsDocument511 pagesCPP Flash CardsKhairul Daren OthmanNo ratings yet

- Fraud Policy Template-Pdf-2Document13 pagesFraud Policy Template-Pdf-2Ranjeet DongreNo ratings yet

- Module 9 FraudDocument4 pagesModule 9 FraudYnah ForwardNo ratings yet

- Ethics, Fraud, and Internal ControlDocument32 pagesEthics, Fraud, and Internal ControlMonica Ferrer100% (2)

- Summative Assessment 2 - Part IIIDocument3 pagesSummative Assessment 2 - Part IIIElyjah Thomas AvilaNo ratings yet

- IA Case 2Document2 pagesIA Case 2rhezaNo ratings yet

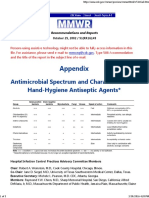

- Antimicrobial Spectrum and Characteristics of Hand-Hygiene Antiseptic AgentsDocument3 pagesAntimicrobial Spectrum and Characteristics of Hand-Hygiene Antiseptic AgentsdonsterthemonsterNo ratings yet

- Edna-Mode ScriptDocument2 pagesEdna-Mode ScriptNikkay Gepanaga CejarNo ratings yet

- Etiqa MozGuard Dengue Mosquito Insurance BrochureDocument3 pagesEtiqa MozGuard Dengue Mosquito Insurance BrochureHihiNo ratings yet

- Thesis On Cybercrime in IndiaDocument8 pagesThesis On Cybercrime in Indiakarinathomasdenver100% (2)

- AFST - Oct 17Document9 pagesAFST - Oct 17kimkimNo ratings yet

- Bipolar MembraneDocument3 pagesBipolar MembranepriyaNo ratings yet

- Federico Giusfredi - Syntax of The Luwian LanguageDocument229 pagesFederico Giusfredi - Syntax of The Luwian LanguageLucySky7No ratings yet

- Pili Danica - Dyners Corporation - Case Analysis #1Document2 pagesPili Danica - Dyners Corporation - Case Analysis #1DANICA DANIELA PILINo ratings yet

- Worksheet BURNSDocument6 pagesWorksheet BURNSRiza Angela BarazanNo ratings yet

- 1best Practices For Migrating SAP Systems To Ora... - Oracle CommunityDocument4 pages1best Practices For Migrating SAP Systems To Ora... - Oracle CommunitymethukupallyNo ratings yet

- Chapter 1 and Chapter 2 PowerpointDocument14 pagesChapter 1 and Chapter 2 Powerpointapi-252892423No ratings yet

- MCAD ManualDocument38 pagesMCAD ManualsureshrnalNo ratings yet

- Volkswagen 2010 Maintenance ScheduleDocument4 pagesVolkswagen 2010 Maintenance ScheduleWillNo ratings yet

- On Tap Giua Ky 2 MoiDocument9 pagesOn Tap Giua Ky 2 MoiPhương LêNo ratings yet

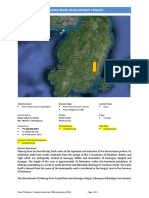

- Sibunag River Development Project: Industry Sector: Business Type: Location TypeDocument4 pagesSibunag River Development Project: Industry Sector: Business Type: Location Typeemma gallosNo ratings yet

- MT Rating Sheet COTDocument3 pagesMT Rating Sheet COTAilah Mae Dela CruzNo ratings yet

- Sun OBPDocument30 pagesSun OBPgoyaltcsNo ratings yet

- Beamray 50R100R Data SheetDocument2 pagesBeamray 50R100R Data Sheethassan elgamriNo ratings yet

- Catalogo Lowara DomoDocument6 pagesCatalogo Lowara DomoSergio ZegarraNo ratings yet

- BS EN 1992 PART 4-2018 Design of Concrete Structures - Design of Fastenings For Use in ConcreteDocument132 pagesBS EN 1992 PART 4-2018 Design of Concrete Structures - Design of Fastenings For Use in Concrete陈辕100% (2)

- Каталог гидромолот JCB HM385Document2 pagesКаталог гидромолот JCB HM385бекиров эрнестNo ratings yet

- Reaction of Rhodium With AirDocument2 pagesReaction of Rhodium With AirVhandy RamadhanNo ratings yet

- Master Teacher Developmental Plan Real2021 2022Document6 pagesMaster Teacher Developmental Plan Real2021 2022Roygvib Clemente MontañoNo ratings yet

- Scope of Work For FEED - Table of ContentsDocument5 pagesScope of Work For FEED - Table of ContentsFaizal Sattu100% (7)

- SDH PDFDocument370 pagesSDH PDFClaudia GafencuNo ratings yet

- RequirementsDocument14 pagesRequirementsJeannezelle Anne Mariz GazaNo ratings yet

- Language Assessment in Year 2 KSSRDocument13 pagesLanguage Assessment in Year 2 KSSRCahaya Hati100% (1)

- AGILE MCQsDocument51 pagesAGILE MCQsAmaan RazaNo ratings yet

- Buckthorn Pullover & Cardigan: by Susan MillsDocument3 pagesBuckthorn Pullover & Cardigan: by Susan MillsTatu AradiNo ratings yet