Professional Documents

Culture Documents

Notice of Availment of The Option To Pay The Tax Through The Withholding Process

Uploaded by

ArgielJedTabalBorrasOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Notice of Availment of The Option To Pay The Tax Through The Withholding Process

Uploaded by

ArgielJedTabalBorrasCopyright:

Available Formats

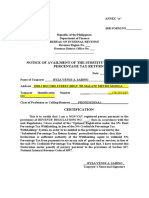

ANNEX “E”

BIR FORM NO.__________

Republic of the Philippines

Department of Finance

BUREAU OF INTERNAL REVENUE

Revenue Region No. ___

Revenue District Office No. ___

__________________________

NOTICE OF AVAILMENT OF THE OPTION TO PAY THE TAX

THROUGH THE WITHHOLDING PROCESS

Date __________________

Name of Taxpayer RYZA VENUS A. SABINO __________________________

Address 1920 J BOCOBO STREET BRGY 702 MALATE METRO MANILA____

Taxpayer Identification Number _______ ___176-585-837-

000____________________

Class of Profession or Calling/Business _____PROFESSIONAL__________________

CERTIFICATION

This is to certify that I am availing of the option to pay my percentage

tax/VAT through the withholding process pursuant to the provisions of REVENUE

REGULATIONS NO. ____; that, in accordance with the said Regulations and

Revenue Regulations No. 2-98, as amended, gross receipts on account of my sale

of goods/service shall be withheld at 3% Percentage Tax or 10% VAT, as the

case may be, by the withholding agent-payor; that, such tax withheld shall be

constituted as a final tax provided that my source of income comes only from one

payor, otherwise, the same shall be considered creditable which shall be applied

against the total percentage taxes/VAT due for the month when such tax was

withheld; and that, I have executed this Declaration under penalty of perjury,

pursuant to the provisions of Section 267, National Internal Revenue Code of 1997.

RYZA VENUS A. SABINO _

Taxpayer’s Name and Signature

You might also like

- Income Payee's Sworn Declaration of Gross ReceiptsDocument1 pageIncome Payee's Sworn Declaration of Gross ReceiptsApril Lynn Ursal-BelciñaNo ratings yet

- Revenue Audit Memorandum 1-98Document5 pagesRevenue Audit Memorandum 1-98Nikos CabreraNo ratings yet

- Local Government CertificationDocument1 pageLocal Government CertificationEtchel Osiam AvilaNo ratings yet

- Authorization Form for Querying Bank RecordsDocument3 pagesAuthorization Form for Querying Bank RecordsLaipe MusaNo ratings yet

- 37-BIR (1945) Certificate of Tax Exemption For CooperativeDocument2 pages37-BIR (1945) Certificate of Tax Exemption For CooperativeEditha Valenzuela67% (3)

- IT - RR 12-2011 LESSOR Reportorial Requirements PDFDocument5 pagesIT - RR 12-2011 LESSOR Reportorial Requirements PDFMark Lord Morales BumagatNo ratings yet

- Decentralized AccountingDocument10 pagesDecentralized AccountingMartin AcantiladoNo ratings yet

- AOM No. 2022-001 (20-22) - Audit of Accounts and Transactions Brgy. Salinas, BambangDocument24 pagesAOM No. 2022-001 (20-22) - Audit of Accounts and Transactions Brgy. Salinas, BambangGilbert D. AfallaNo ratings yet

- Property Return SlipDocument1 pageProperty Return SlipEugene Medina LopezNo ratings yet

- CBA Application Form (BLR Form No. 10-CBA, Series of 2003)Document3 pagesCBA Application Form (BLR Form No. 10-CBA, Series of 2003)aL_2kNo ratings yet

- 05 Bir - SMRDocument1 page05 Bir - SMRMelany Trazo Calvez-EvangelistaNo ratings yet

- Economic Survey2 EditDocument5 pagesEconomic Survey2 Editmary jean apuhinNo ratings yet

- Certificate of Filing of Amended AoiDocument1 pageCertificate of Filing of Amended Aoi安美仁No ratings yet

- COA - Unnumbered - Memo (OJE & JET)Document5 pagesCOA - Unnumbered - Memo (OJE & JET)Kaitou Kuroba100% (1)

- BIR Form 0605Document3 pagesBIR Form 0605rafael soriao0% (1)

- Memorandum No.: 2010-027 Date: October 26, 2010 All COA Officials and EmployeesDocument10 pagesMemorandum No.: 2010-027 Date: October 26, 2010 All COA Officials and EmployeesJOHAYNIENo ratings yet

- COA CIRCULAR NO. 2024 006 March 14 2024Document21 pagesCOA CIRCULAR NO. 2024 006 March 14 2024Jen IgnacioNo ratings yet

- 1601 CDocument6 pages1601 CJose Venturina Villacorta100% (1)

- 1702 NewDocument11 pages1702 NewDIVINE WAGTINGANNo ratings yet

- Tax Bulletin by SGV As of Oct 2014Document18 pagesTax Bulletin by SGV As of Oct 2014adobopinikpikanNo ratings yet

- GSIS Scholarship Program - CertificationDocument2 pagesGSIS Scholarship Program - CertificationCristina Rocas-Bisquera100% (1)

- International Tax Affairs DivisionDocument3 pagesInternational Tax Affairs DivisionGabriel CarumbaNo ratings yet

- 2307Document2 pages2307Nephy Bersales Taberara67% (3)

- Request For Cash Advance: CertificationDocument1 pageRequest For Cash Advance: CertificationEduardo Acero100% (1)

- RMC No 24-2019 Submission of Bir Form 2316Document2 pagesRMC No 24-2019 Submission of Bir Form 2316joelsy100100% (1)

- Electronic Modified Disbursement System (EMDS) User's Manual - Agency MakerDocument29 pagesElectronic Modified Disbursement System (EMDS) User's Manual - Agency MakerChristian Rivera100% (3)

- 10-NHA 2018 Part 2-Observations and RecommendationsDocument69 pages10-NHA 2018 Part 2-Observations and RecommendationsVERA FilesNo ratings yet

- Annex B-3 RR 11-2018Document1 pageAnnex B-3 RR 11-2018Rheneir MoraNo ratings yet

- Educational Assistance FormDocument1 pageEducational Assistance Formpeso bansud100% (1)

- Cover Sheet FSDocument3 pagesCover Sheet FSPanda MimiNo ratings yet

- Landbank WeAccess Enrollment AuthorizationDocument2 pagesLandbank WeAccess Enrollment AuthorizationLowena Anne Palacios-FacunNo ratings yet

- Flow Chart Sa PagfileDocument1 pageFlow Chart Sa PagfileMiscaCruzNo ratings yet

- Illustrative FS - PFRS For Small EntitiesDocument28 pagesIllustrative FS - PFRS For Small EntitiesJessa EspinozaNo ratings yet

- Independent Auditor ReportDocument1 pageIndependent Auditor ReportDaniel Tadeja100% (1)

- Routing SlipDocument12 pagesRouting SlipSean Palacpac-ResurreccionNo ratings yet

- New PDF 2019Document181 pagesNew PDF 2019noel bandaNo ratings yet

- How to File Form 2316, Annex C and Annex F by Feb. 28Document4 pagesHow to File Form 2316, Annex C and Annex F by Feb. 28Ivan Benedicto100% (1)

- Report of Lost, Stolen, Damaged or Destroyed PropertyDocument5 pagesReport of Lost, Stolen, Damaged or Destroyed Propertykristoffer riveraNo ratings yet

- SRC Rule 68 As AmendedDocument51 pagesSRC Rule 68 As AmendedGilYah MoralesNo ratings yet

- RA 7652 Investors Lease ActDocument3 pagesRA 7652 Investors Lease ActPatrick Rommel PajarinNo ratings yet

- Letter of IntentDocument2 pagesLetter of IntentMariam SalongaNo ratings yet

- Board ResolutionDocument2 pagesBoard ResolutionbelteshazzarNo ratings yet

- Job Description of Branch StaffDocument3 pagesJob Description of Branch StaffEleanor JamcoNo ratings yet

- BIR Ruling DA-C-133 431-08Document5 pagesBIR Ruling DA-C-133 431-08Lee Anne YabutNo ratings yet

- Chapter 1Document36 pagesChapter 1Reslee Novillo100% (1)

- Bir Ruling Da C 296 727 09Document3 pagesBir Ruling Da C 296 727 09doraemoanNo ratings yet

- FGEN: Declaration of Cash DividendsDocument2 pagesFGEN: Declaration of Cash DividendsBusinessWorldNo ratings yet

- Ora Ohra Lac Session2018Document23 pagesOra Ohra Lac Session2018Rhoda V. Castañaga100% (1)

- Government AccountingDocument21 pagesGovernment AccountingMichael Jake Mejia TornoNo ratings yet

- 19 ConceptsandTheories CashflowForecasting OkDocument9 pages19 ConceptsandTheories CashflowForecasting OkPrecious J Alolod ImportanteNo ratings yet

- Application Letter-ComelecDocument1 pageApplication Letter-Comelecrogilyn sulimaNo ratings yet

- A.8 Report On The Physical Count of Semi Expendable PropertyDocument9 pagesA.8 Report On The Physical Count of Semi Expendable Propertyjaypee raguroNo ratings yet

- Tax Practitioner Accreditation ApplicationDocument2 pagesTax Practitioner Accreditation Applicationcristian reyesNo ratings yet

- Petty Cash VoucherDocument6 pagesPetty Cash VoucherALMA MORENANo ratings yet

- Cover Sheet For GFFS PDFDocument105 pagesCover Sheet For GFFS PDFMARIA FRANCISCA E. VICTOLERONo ratings yet

- Notice of Availment of The Substituted Filing of Percentage Tax ReturnDocument1 pageNotice of Availment of The Substituted Filing of Percentage Tax ReturnArgielJedTabalBorras100% (1)

- Annex E RR14 - 2003Document1 pageAnnex E RR14 - 2003Jomar Teneza100% (1)

- BIR Form Notice of Availing Percentage Tax Withholding OptionDocument2 pagesBIR Form Notice of Availing Percentage Tax Withholding OptionChristian Sadia0% (1)

- BIR Form Notice Cancellation Substituted Filing Percentage Tax VAT ReturnDocument1 pageBIR Form Notice Cancellation Substituted Filing Percentage Tax VAT ReturnWarlie Zambales DiazNo ratings yet

- Notice of Availment of Substituted Filing of Percentage Tax ReturnsDocument1 pageNotice of Availment of Substituted Filing of Percentage Tax ReturnsJomar TenezaNo ratings yet

- Notice of Availment of The Substituted Filing of Percentage Tax ReturnDocument1 pageNotice of Availment of The Substituted Filing of Percentage Tax ReturnArgielJedTabalBorras100% (1)

- Notice of Availment of The Substituted Filing of Percentage Tax ReturnDocument1 pageNotice of Availment of The Substituted Filing of Percentage Tax ReturnArgielJedTabalBorras100% (1)

- Gen Bir Annex B2Document2 pagesGen Bir Annex B2ArgielJedTabalBorras100% (2)

- Law Enforcement and Public Safety Academy: "Center For Strategic Thinking"Document2 pagesLaw Enforcement and Public Safety Academy: "Center For Strategic Thinking"ArgielJedTabalBorrasNo ratings yet

- Gen Bir Annex B2Document1 pageGen Bir Annex B2ArgielJedTabalBorrasNo ratings yet

- Notice of Availment of The Substituted Filing of Percentage Tax ReturnDocument1 pageNotice of Availment of The Substituted Filing of Percentage Tax ReturnArgielJedTabalBorras100% (1)

- 6 CS Form 100 Revised September 2016 PDFDocument2 pages6 CS Form 100 Revised September 2016 PDFNiel Edar Balleza100% (2)

- 1701Q Quarterly Income Tax Return: For Individuals, Estates and TrustsDocument1 page1701Q Quarterly Income Tax Return: For Individuals, Estates and TrustsArgielJedTabalBorrasNo ratings yet

- 1 7 6 5 8 5 8 3 7 0 0 0 0 3 3 X ProfessionalDocument3 pages1 7 6 5 8 5 8 3 7 0 0 0 0 3 3 X ProfessionalArgielJedTabalBorrasNo ratings yet

- BIR Form 1701Q Quarterly Income Tax ReturnDocument1 pageBIR Form 1701Q Quarterly Income Tax ReturnMark De JesusNo ratings yet

- Angel Redongga Borras: Career ObjectiveDocument2 pagesAngel Redongga Borras: Career ObjectiveArgielJedTabalBorrasNo ratings yet

- BIR Form 1701Q Quarterly Income Tax ReturnDocument1 pageBIR Form 1701Q Quarterly Income Tax ReturnMark De JesusNo ratings yet

- Verbal Ability Practice Questions: Identifying ErrorsDocument3 pagesVerbal Ability Practice Questions: Identifying ErrorsArgielJedTabalBorrasNo ratings yet

- Daily Time Record Daily Time RecordDocument1 pageDaily Time Record Daily Time RecordNorma Amil-MalangNo ratings yet

- Verbal Ability Set 2: Contextual Meaning PracticeDocument7 pagesVerbal Ability Set 2: Contextual Meaning PracticeArgielJedTabalBorrasNo ratings yet

- Daily Time Record Daily Time RecordDocument1 pageDaily Time Record Daily Time RecordNorma Amil-MalangNo ratings yet

- mCPD-2 Form4AccreditationOfCPDProgramDocument2 pagesmCPD-2 Form4AccreditationOfCPDProgramArgielJedTabalBorrasNo ratings yet

- Genie Rose Sayson: Position Desired: Welding Career ObjectiveDocument2 pagesGenie Rose Sayson: Position Desired: Welding Career ObjectiveArgielJedTabalBorrasNo ratings yet

- Civil ReviewerDocument73 pagesCivil ReviewerMarie Joy EngayNo ratings yet

- 6 CS Form 100 Revised September 2016 PDFDocument2 pages6 CS Form 100 Revised September 2016 PDFNiel Edar Balleza100% (2)

- Easier English Basic SynonymsDocument129 pagesEasier English Basic SynonymsIsabel Matta100% (1)

- mCPD-1 Form4AccreditationAsLocalCPDProviderDocument3 pagesmCPD-1 Form4AccreditationAsLocalCPDProviderArgielJedTabalBorrasNo ratings yet

- CPD Council For - : Professional Regulation CommissionDocument2 pagesCPD Council For - : Professional Regulation CommissionArgielJedTabalBorrasNo ratings yet

- Webster's New Dictionary of Synonyms (1984)Document945 pagesWebster's New Dictionary of Synonyms (1984)Diana Elena98% (61)

- QQQQQQQQ: AaaaaaaDocument1 pageQQQQQQQQ: AaaaaaaArgielJedTabalBorrasNo ratings yet

- City of Pasig - Population Reached Half A Million - Philippine Statistics AuthorityDocument8 pagesCity of Pasig - Population Reached Half A Million - Philippine Statistics AuthorityArgielJedTabalBorrasNo ratings yet

- Philippine Constitution Mock Examination - TOPNOTCHER PHDocument35 pagesPhilippine Constitution Mock Examination - TOPNOTCHER PHArgielJedTabalBorrasNo ratings yet

- Work RelatedDocument2 pagesWork RelatedArgielJedTabalBorrasNo ratings yet

- New Microgdgsdgdgdgsoft Office PowerPoint PresentationDocument1 pageNew Microgdgsdgdgdgsoft Office PowerPoint PresentationArgielJedTabalBorrasNo ratings yet