Professional Documents

Culture Documents

1 7 6 5 8 5 8 3 7 0 0 0 0 3 3 X Professional

Uploaded by

ArgielJedTabalBorrasOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

1 7 6 5 8 5 8 3 7 0 0 0 0 3 3 X Professional

Uploaded by

ArgielJedTabalBorrasCopyright:

Available Formats

X

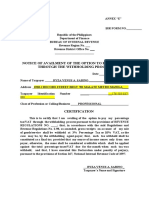

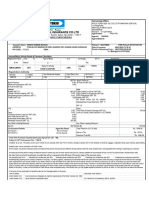

12 2021 01 31 2021 MC180

12 31 2021 RF PROFESSIONAL

176 585 837 000 033 X PROFESSIONAL

SABINO, RAYZA VENUS ALMERO

3311

X

X REGISTRATION FEE

500 00

500 00

RAYZA VENUS A. C. SABINO INTELLIGENCE AGENT II

BIR Form 0605 (ENCS) - PAGE 2

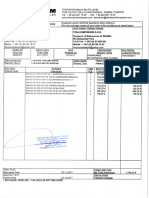

ATC NATURE OF PAYMENT ATC NATURE OF PAYMENT ATC NATURE OF PAYMENT

II 011 Pure Compensation Income Tobacco Products XP120 Avturbo Jet Fuel

II 012 Pure Business Income XT010 & Smoking and Chewing Tobacco XP130 & Kerosene

XT020 XP131

II 013 Mixed (Compensation and XT030 Cigars XP170 Asphalts

Business)

MC 180 Vat/Non-Vat Registration Fee XT040 Cigarettes Packed By Hand XP150 & LPG Gas

XP160

MC 190 Travel Tax XT050-XT130 Cigarettes Packed By Machine XP010, Basetocks, Lubes and

XP020 & Greases

XP190

MC 090 Tin Card Fees Tobacco Inspection Fees

MC010 & Tax Amnesty XT080 Cigars XP040 Waxes and Petrolatum

MC020

MC 040 Income from Forfeited Properties XT090 Cigarettes XP030 Processed Gas

MC 050 Proceeds from Sale of Rent Estate XT100 & Leaf Tobacco & Other Manufactured Tobacco Miscellaneous

XT110 Products/Articles

MC 060 Energy Tax on Electric Power ti XT120 Monitoring Fees XG020- Automobiles

Consump o XG090

n

MC 031 Deficiency Tax Petroleum Products XG100- Non Essential Goods

XG120

MC 030 Delinquent Accounts/Accounts bl XP070 Premium (Leaded) Gasoline Mineral Products

Receiva e

FP 010 - FP Fines and Penalties XP060 Premium (Unleaded) Gasoline XM010 Coal & Coke

930

MC 200 Others XP080 Regular Gasoline XM020 Non Metallic & Quarry

Resources

Excise Tax on Goods XP090 & Naptha& Other Similar Products XM030 Gold and Chromite

XP100

Alcohol Products XP110 Aviation Gasoline XM040 Copper & Other Metallic

Minerals

XA010- Distilled Spirits XP140 Diesel Gas XM050 Indigenous Petroleum

XA040

XA061- Wines XP180 Bunker Fuel Oil XM051 Others

XA090

XA051- Fermented Liquor

XA053

TAX TYPE

Code Description Code Description Code Description

RF REGISTRATION FEE CS CAPITAL GAINS TAX - Stocks WC WITHHOLDING TAX-COMPENSATION

TR TRAVEL TAX-PTA ES ESTATE TAX WE WITHHOLDING TAX-EXPANDED

ET ENERGY TAX DN DONOR'S TAX WF WITHHOLDING TAX-FINAL

QP QUALIFYING FEES-PAGCOR VT VALUE-ADDED TAX WG WITHHOLDING TAX - VAT AND OTHER

MC MISCELLANEOUS TAX PT PERCENTAGE TAX PERCENTAGE TAXES

XV EXCISE-AD VALOREM ST PERCENTAGE TAX - STOCKS WO WITHHOLDING TAX-OTHERS (ONE-TIME TRAN-

XS EXCISE-SPECIFIC SO PERCENTAGE TAX - STOCKS (IPO) SACTION NOT SUBJECT TO CAPITAL

XF TOBACCO INSPECTION AND SL PERCENTAGE TAX - SPECIAL LAWS GAINS TAX)

MONITORING FEES DS DOCUMENTARY STAMP TAX WR WITHHOLDING TAX - FRINGE BENEFITS

IT INCOME TAX WB WITHHOLDING TAX-BANKS AND WW WITHHOLDING TAX - PERCENTAGE TAX

OTHER

CG CAPITAL GAINS TAX - Real FINANCIAL INSTITUTIONS ON WINNING AND PRIZES

Property

BIR Form No. 0605 - Payment Form

Guidelines and Instructions

Who Shall Use Authorized Agent Bank (AAB)

under the jurisdiction of the

Every taxpayer shall use this Revenue District Office where the

form, in triplicate, to pay taxes and taxpayer is required to

fees which do not require the use of register/conducting

a tax return such as second business/producing articles subject

installment payment for income to excise tax/having taxable

tax, deficiency tax, delinquency transactions. In places where there

tax, registration fees, penalties, are no AABs, this form shall be

advance payments, deposits, filed and the tax shall be paid

installment payments, etc. directly with the Revenue

Collection Officer or duly

When and Where Authorized City Or Municipal

to File and Treasurer of the Revenue District

Pay This form Office where the taxpayer is

shall be required to register/conducting

accomplished: business/producing articles subject

to excise tax/having taxable

1. Everytime a tax payment transactions, who shall issue

or penalty is due or an Revenue Official Receipt (BIR

advance payment is to be Form No. 2524) therefor.

made; Where the return is filed with

2. Upon receipt of a demand an AAB, the lower portion of the

letter/assessment notice return must be properly machine-

and/or collection letter validated and stamped by the

from the BIR; and Authorized Agent Bank to serve as

3. Upon payment of annual the receipt of payment. The

registration fee for new machine validation shall reflect the

business and for renewals date of payment, amount paid and

on or before January 31 of transaction code, and the stamp

every year. mark shall show the name of the

bank, branch code, teller’s name

This form shall be filed and and teller’s initial. The AAB shall

the tax shall be paid with any also issue an official receipt or

bank debit advice or credit

document, whichever is applicable,

as additional proof of payment.

One set of form shall be filled-

up for each kind of tax and for each

taxable period.

Attachments

1. Duly approved Tax Debit

Memo, if applicable;

2. Copy of letter or notice from

the BIR for which this

payment form is

accomplished and the tax is

paid whichever is applicable:

a. Pre-Assessment /

Final Assessment

Notice/Letter of Demand

b. Post Reporting Notice

c. Collection Letter of

Delinquent/

Accounts Receivable

d. Xerox copy of the return

(ITR)/Reminder Letter in

case of payment of

second installment on

income tax.

Note: All background

information must be properly

filled up.

The last 3 digits of the 12-digit

TIN refers to the branch code.

You might also like

- Webster's New Dictionary of Synonyms (1984)Document945 pagesWebster's New Dictionary of Synonyms (1984)Diana Elena98% (61)

- Example - Complete Model of Eng Management ReportDocument38 pagesExample - Complete Model of Eng Management ReportSyah RullacmarNo ratings yet

- Aclu List Research Export 20160810050210Document2 pagesAclu List Research Export 20160810050210api-285701682100% (1)

- Piano Sonata No. 17 Tempest 1. Largo - AllegroDocument10 pagesPiano Sonata No. 17 Tempest 1. Largo - AllegroOtrebor ImlesNo ratings yet

- Periodic Maintenance Service Menu DetailsDocument1 pagePeriodic Maintenance Service Menu DetailsJerry Corpuz Lanorio100% (3)

- TR100 Mining Truck Maintenance Manual: Click Here For of ContentsDocument528 pagesTR100 Mining Truck Maintenance Manual: Click Here For of ContentsKot878100% (1)

- Lubricants Comparision Between Brands PDFDocument6 pagesLubricants Comparision Between Brands PDFbdsisiraNo ratings yet

- 12 December 1996Document116 pages12 December 1996Monitoring Times100% (1)

- Commercial Invoice: Bylog (Pty) LTDDocument2 pagesCommercial Invoice: Bylog (Pty) LTDAlmiro Boavida NhancaleNo ratings yet

- Procedures For Drill String Design Engineering EssayDocument16 pagesProcedures For Drill String Design Engineering EssayGerardy Cantuta AruniNo ratings yet

- Easier English Basic SynonymsDocument129 pagesEasier English Basic SynonymsIsabel Matta100% (1)

- Gen Bir Annex B2Document1 pageGen Bir Annex B2ArgielJedTabalBorrasNo ratings yet

- pdf246 Jf009eDocument4 pagespdf246 Jf009eVis ShyNo ratings yet

- Quiz 1 Answers Fusionné CompresséDocument161 pagesQuiz 1 Answers Fusionné CompresséSlim Charni100% (1)

- TR60 1Document526 pagesTR60 1vlak100% (2)

- Book 1Document6 pagesBook 1Dhanush S TNo ratings yet

- Civil ReviewerDocument73 pagesCivil ReviewerMarie Joy EngayNo ratings yet

- Verbal Ability Set 2: Contextual Meaning PracticeDocument7 pagesVerbal Ability Set 2: Contextual Meaning PracticeArgielJedTabalBorrasNo ratings yet

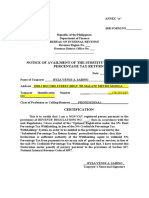

- Notice of Availment of The Option To Pay The Tax Through The Withholding ProcessDocument2 pagesNotice of Availment of The Option To Pay The Tax Through The Withholding ProcessArgielJedTabalBorrasNo ratings yet

- Madison Williams - Pamelas Pies Part 2 - 21-22Document10 pagesMadison Williams - Pamelas Pies Part 2 - 21-22api-634527561No ratings yet

- Gen Bir Annex B2Document2 pagesGen Bir Annex B2ArgielJedTabalBorras100% (2)

- People v. ChuaDocument1 pagePeople v. ChuaErnie Gultiano100% (1)

- 0605version1999 09.02.2022Document1 page0605version1999 09.02.2022jomarNo ratings yet

- BIR Form 0605 guide for nature of payments and tax codesDocument1 pageBIR Form 0605 guide for nature of payments and tax codes잔돈No ratings yet

- 0605 Master EditDocument3 pages0605 Master Editray acainNo ratings yet

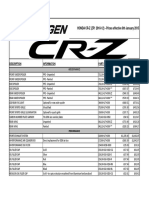

- CR-Z ZF1 Uk RRP Jan 2015Document3 pagesCR-Z ZF1 Uk RRP Jan 2015Damien GobelNo ratings yet

- Smita FY2023Document5 pagesSmita FY2023cursed.apurvaNo ratings yet

- MUGEN K20 CN WTCC FIA Parts 2013 3 PDFDocument1 pageMUGEN K20 CN WTCC FIA Parts 2013 3 PDFJdkdkd KddkfkNo ratings yet

- Regional Schemes - Feb 24 KeralaDocument8 pagesRegional Schemes - Feb 24 KeralaanascrrNo ratings yet

- PC2Document11 pagesPC2Yunus HeryNo ratings yet

- Material ListDocument4 pagesMaterial ListJayakumar SambandamurthyNo ratings yet

- Inventario de Stock: Comaort, S.LDocument1 pageInventario de Stock: Comaort, S.LENCARNANo ratings yet

- Schedule of Rates: in NGN SL No Item No Short Description QTY UOM Rate AmountDocument5 pagesSchedule of Rates: in NGN SL No Item No Short Description QTY UOM Rate AmountAdekanmi RaphaelNo ratings yet

- Special Steels CB10FF: For Cold Deformation and BearingsDocument1 pageSpecial Steels CB10FF: For Cold Deformation and BearingsRollpass DesignNo ratings yet

- Book international flight from Bogota to Cancun with taxes and feesDocument4 pagesBook international flight from Bogota to Cancun with taxes and feesMartín Elias Plaza VegaNo ratings yet

- TriTech AjDocument1 pageTriTech AjRajat KumarNo ratings yet

- Ribbon An' Bow Inc. Profit & Loss StatementDocument7 pagesRibbon An' Bow Inc. Profit & Loss StatementAnurita PariraNo ratings yet

- Soldering Welding GluingDocument114 pagesSoldering Welding Gluingyepewi9989No ratings yet

- Engineering: WWW - Skcengineering.inDocument1 pageEngineering: WWW - Skcengineering.inumeshchandra yadavNo ratings yet

- Ev Price List - 01.02.2024Document1 pageEv Price List - 01.02.2024ketantadaNo ratings yet

- Trater Trattamenti Termici Industriali: Trattamento Termico #2019040807K Del 08/04/2019 Cliente OggettoDocument1 pageTrater Trattamenti Termici Industriali: Trattamento Termico #2019040807K Del 08/04/2019 Cliente OggettoMarcoNo ratings yet

- Diagcar EuDocument1 pageDiagcar Eumosafree1No ratings yet

- Platinum N Ew CCP PriceDocument8 pagesPlatinum N Ew CCP PriceSanjay GuptaNo ratings yet

- Proforma Bolivia SucreDocument1 pageProforma Bolivia SucrejamaidanaingenieriaNo ratings yet

- Calculation of IHTDocument7 pagesCalculation of IHTSooraj p.mNo ratings yet

- 1Hgcp2631Ca626095 Accord 4D 2012 Ky 24lxi Saso Mirror 5at Crystal Black P F E-6 Engine Mounting Bracket (L4)Document1 page1Hgcp2631Ca626095 Accord 4D 2012 Ky 24lxi Saso Mirror 5at Crystal Black P F E-6 Engine Mounting Bracket (L4)zafar.ccna1178No ratings yet

- Mannol #0269Document5 pagesMannol #0269Roman UrdanetaNo ratings yet

- Aluminium Alloy Specification Chart and Physical PropertiesDocument1 pageAluminium Alloy Specification Chart and Physical Propertiespvrk_78No ratings yet

- Wingo Logo PlaceholderDocument6 pagesWingo Logo PlaceholderAlexa ContrerasNo ratings yet

- WCAR TWC Summary Report - 28112022120011Document1 pageWCAR TWC Summary Report - 28112022120011FaizalNo ratings yet

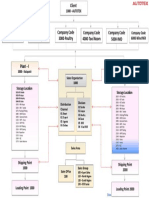

- AUTOTEX client document organization structureDocument1 pageAUTOTEX client document organization structureveeramaniNo ratings yet

- PENDOPODocument5 pagesPENDOPOsafa mediantoNo ratings yet

- Movement Product Cmid 2024Document16 pagesMovement Product Cmid 2024novi cmidNo ratings yet

- Accounting: AssignmentDocument4 pagesAccounting: Assignmentiza khanNo ratings yet

- Icon List EOTE EMSEDocument2 pagesIcon List EOTE EMSELeo CruzNo ratings yet

- TabachoiDocument2 pagesTabachoiadrian arzagaNo ratings yet

- Iffco InsDocument2 pagesIffco Insgauravk00068No ratings yet

- Tabela PDF Jan 22 FSP 2Document29 pagesTabela PDF Jan 22 FSP 2NicolasNo ratings yet

- Baleno Bs-Vi: Price List With (Karnataka) Registration W.E.F:-06-Sep-2021Document1 pageBaleno Bs-Vi: Price List With (Karnataka) Registration W.E.F:-06-Sep-2021mohit jNo ratings yet

- Xl6 Price List: Must HaveDocument1 pageXl6 Price List: Must HaveanandNo ratings yet

- gx100 Parts ManualDocument9 pagesgx100 Parts Manualristi.kristaqNo ratings yet

- Balco Wef 23.12.2017Document1 pageBalco Wef 23.12.2017SanjayNo ratings yet

- Ribbon N Bows Inc. Income Statement For The Period June 30 Particulars Amount Amount Cost of Goods SoldDocument4 pagesRibbon N Bows Inc. Income Statement For The Period June 30 Particulars Amount Amount Cost of Goods Soldrani rinoNo ratings yet

- Changan Parts List Jan 2020Document4 pagesChangan Parts List Jan 2020samisabakNo ratings yet

- Stock Movement-1Document76 pagesStock Movement-1agus suhendra100% (1)

- Teli+902242671405 Fax:+902242671407 - Teknokomkompresor Proforma Invo:CeDocument3 pagesTeli+902242671405 Fax:+902242671407 - Teknokomkompresor Proforma Invo:CeTonikompresoriZrenjaninNo ratings yet

- JMaurici@20170221114911Document3 pagesJMaurici@20170221114911ToniNo ratings yet

- Consumbles List Section Wise.Document9 pagesConsumbles List Section Wise.engineeringNo ratings yet

- ROHIT ASHOK SHINGADE REVISED Tata AIG COMPARE Quote_3184_QT_24_6203901881_QT_24_6203901885Document2 pagesROHIT ASHOK SHINGADE REVISED Tata AIG COMPARE Quote_3184_QT_24_6203901881_QT_24_6203901885rohitNo ratings yet

- Inter DT Day-38Document11 pagesInter DT Day-38Akshita BansalNo ratings yet

- 200KVA Costing NepalDocument1 page200KVA Costing NepalAzad RahmanNo ratings yet

- Report Fuel Periode February 2021Document13 pagesReport Fuel Periode February 2021Procurement PTMNo ratings yet

- Notice of Availment of The Substituted Filing of Percentage Tax ReturnDocument1 pageNotice of Availment of The Substituted Filing of Percentage Tax ReturnArgielJedTabalBorras100% (1)

- Notice of Availment of The Substituted Filing of Percentage Tax ReturnDocument1 pageNotice of Availment of The Substituted Filing of Percentage Tax ReturnArgielJedTabalBorras100% (1)

- Law Enforcement and Public Safety Academy: "Center For Strategic Thinking"Document2 pagesLaw Enforcement and Public Safety Academy: "Center For Strategic Thinking"ArgielJedTabalBorrasNo ratings yet

- Notice of Availment of The Substituted Filing of Percentage Tax ReturnDocument1 pageNotice of Availment of The Substituted Filing of Percentage Tax ReturnArgielJedTabalBorras100% (1)

- 6 CS Form 100 Revised September 2016 PDFDocument2 pages6 CS Form 100 Revised September 2016 PDFNiel Edar Balleza100% (2)

- 1701Q Quarterly Income Tax Return: For Individuals, Estates and TrustsDocument1 page1701Q Quarterly Income Tax Return: For Individuals, Estates and TrustsArgielJedTabalBorrasNo ratings yet

- BIR Form 1701Q Quarterly Income Tax ReturnDocument1 pageBIR Form 1701Q Quarterly Income Tax ReturnMark De JesusNo ratings yet

- Angel Redongga Borras: Career ObjectiveDocument2 pagesAngel Redongga Borras: Career ObjectiveArgielJedTabalBorrasNo ratings yet

- BIR Form 1701Q Quarterly Income Tax ReturnDocument1 pageBIR Form 1701Q Quarterly Income Tax ReturnMark De JesusNo ratings yet

- Verbal Ability Practice Questions: Identifying ErrorsDocument3 pagesVerbal Ability Practice Questions: Identifying ErrorsArgielJedTabalBorrasNo ratings yet

- Daily Time Record Daily Time RecordDocument1 pageDaily Time Record Daily Time RecordNorma Amil-MalangNo ratings yet

- Daily Time Record Daily Time RecordDocument1 pageDaily Time Record Daily Time RecordNorma Amil-MalangNo ratings yet

- mCPD-2 Form4AccreditationOfCPDProgramDocument2 pagesmCPD-2 Form4AccreditationOfCPDProgramArgielJedTabalBorrasNo ratings yet

- Genie Rose Sayson: Position Desired: Welding Career ObjectiveDocument2 pagesGenie Rose Sayson: Position Desired: Welding Career ObjectiveArgielJedTabalBorrasNo ratings yet

- 6 CS Form 100 Revised September 2016 PDFDocument2 pages6 CS Form 100 Revised September 2016 PDFNiel Edar Balleza100% (2)

- mCPD-1 Form4AccreditationAsLocalCPDProviderDocument3 pagesmCPD-1 Form4AccreditationAsLocalCPDProviderArgielJedTabalBorrasNo ratings yet

- CPD Council For - : Professional Regulation CommissionDocument2 pagesCPD Council For - : Professional Regulation CommissionArgielJedTabalBorrasNo ratings yet

- QQQQQQQQ: AaaaaaaDocument1 pageQQQQQQQQ: AaaaaaaArgielJedTabalBorrasNo ratings yet

- City of Pasig - Population Reached Half A Million - Philippine Statistics AuthorityDocument8 pagesCity of Pasig - Population Reached Half A Million - Philippine Statistics AuthorityArgielJedTabalBorrasNo ratings yet

- Philippine Constitution Mock Examination - TOPNOTCHER PHDocument35 pagesPhilippine Constitution Mock Examination - TOPNOTCHER PHArgielJedTabalBorrasNo ratings yet

- Work RelatedDocument2 pagesWork RelatedArgielJedTabalBorrasNo ratings yet

- New Microgdgsdgdgdgsoft Office PowerPoint PresentationDocument1 pageNew Microgdgsdgdgdgsoft Office PowerPoint PresentationArgielJedTabalBorrasNo ratings yet

- Proposed Rule: Employment: Adverse ActionsDocument4 pagesProposed Rule: Employment: Adverse ActionsJustia.comNo ratings yet

- Unit 8 Grammar Short Test 1 A+B Impulse 2Document1 pageUnit 8 Grammar Short Test 1 A+B Impulse 2karpiarzagnieszka1No ratings yet

- Honeywell 393690 Inlet Outlet Flange Kits 69-0256Document2 pagesHoneywell 393690 Inlet Outlet Flange Kits 69-0256Alfredo Castro FernándezNo ratings yet

- The Spanish-American War (History 70)Document11 pagesThe Spanish-American War (History 70)Tine AtaamNo ratings yet

- ) (Significant Digits Are Bounded To 1 Due To 500m. However I Will Use 2SD To Make More Sense of The Answers)Document4 pages) (Significant Digits Are Bounded To 1 Due To 500m. However I Will Use 2SD To Make More Sense of The Answers)JeevikaGoyalNo ratings yet

- Due Diligence InvestmentsDocument6 pagesDue Diligence InvestmentselinzolaNo ratings yet

- 2D IconsDocument8 pages2D IconsJacky ManNo ratings yet

- Geology and age of the Parguaza rapakivi granite, VenezuelaDocument6 pagesGeology and age of the Parguaza rapakivi granite, VenezuelaCoordinador de GeoquímicaNo ratings yet

- Water Supply NED ArticleDocument22 pagesWater Supply NED Articlejulie1805No ratings yet

- Electrical Machine 7-26-2016Document94 pagesElectrical Machine 7-26-2016Engr. Raheel khanNo ratings yet

- COVID-19 Vaccination Appointment Details: Center Preferred Time SlotDocument1 pageCOVID-19 Vaccination Appointment Details: Center Preferred Time SlotRmillionsque FinserveNo ratings yet

- LeCroy 1996 Catalog (Reduced Size) PDFDocument196 pagesLeCroy 1996 Catalog (Reduced Size) PDFpetrocelliNo ratings yet

- Mode D'emploi 2-43 Operating Instructions 44-85 Manual de Instrucciones 86-127Document43 pagesMode D'emploi 2-43 Operating Instructions 44-85 Manual de Instrucciones 86-127Oleksii_ServiceNo ratings yet

- Artificial IntelligenceDocument4 pagesArtificial IntelligencePrax DNo ratings yet

- OriginalDocument4 pagesOriginalJob ValleNo ratings yet

- j00m HD FLV SQL Injection - PyDocument4 pagesj00m HD FLV SQL Injection - PyZeljko PanovicNo ratings yet

- Lesson 3.3: The Third Wave: The Information/Knowledge AgeDocument3 pagesLesson 3.3: The Third Wave: The Information/Knowledge AgeFaith PrachayaNo ratings yet

- Agreement: /ECE/324/Rev.2/Add.127 /ECE/TRANS/505/Rev.2/Add.127Document29 pagesAgreement: /ECE/324/Rev.2/Add.127 /ECE/TRANS/505/Rev.2/Add.127Mina RemonNo ratings yet

- Ok 1889 - PDF PDFDocument40 pagesOk 1889 - PDF PDFIngeniería Industrias Alimentarias ItsmNo ratings yet

- IB Urban Environments Option G (Latest 2024)Document154 pagesIB Urban Environments Option G (Latest 2024)Pasta SempaNo ratings yet

- Control unit checks gas burner valve tightness according to EN 1643Document12 pagesControl unit checks gas burner valve tightness according to EN 1643alfredomamutNo ratings yet

- TD102 Conductor - Standard ConductorsDocument2 pagesTD102 Conductor - Standard ConductorsHFandino1No ratings yet

- Process Costing-FifoDocument8 pagesProcess Costing-FifoMang OlehNo ratings yet