Professional Documents

Culture Documents

BIR Form 0605 guide for nature of payments and tax codes

Uploaded by

잔돈0 ratings0% found this document useful (0 votes)

124 views1 pageOriginal Title

0605(july 1999)

Copyright

© © All Rights Reserved

Available Formats

DOC, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as DOC, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

124 views1 pageBIR Form 0605 guide for nature of payments and tax codes

Uploaded by

잔돈Copyright:

© All Rights Reserved

Available Formats

Download as DOC, PDF, TXT or read online from Scribd

You are on page 1of 1

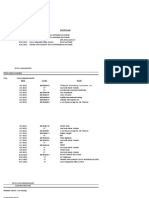

BIR Form 0605 (ENCS) - PAGE 2

A TC NA TUR E OF P A YME NT A TC NA TUR E OF P A YME NT A TC NA TUR E OF P A YM ENT

II 011 P ure Compensation Income Tobacco P roducts XP 120 Avturbo J et Fuel

II 012 P ure Business Income XT010 & XT020 Smoking and Chewing Tobacco XP 130 & XP 131 Kerosene

II 013 M ixed (Compensation and Business) XT030 Cigars XP 170 Asphalts

M C 180 Vat/Non-Vat Registration Fee XT040 Cigarettes P acked B y Hand XP 150 & XP 160 LP G Gas

M C 190 Travel Tax XT050-XT130 Cigarettes P acked B y M achine XP 010, XP 020 & Basetocks, Lubes and

M C 090 Tin Card F ees Tobacco Inspection Fees XP 190 Greases

M C010 & M C020 Tax A mnesty XT080 Cigars XP 040 Waxes and P etrolatum

M C 040 Income from Forfeited P roperties XT090 Cigarettes XP 030 P rocessed Gas

M C 050 P roceeds from Sale of Rent Estate XT100 & XT110 Leaf Tobacco & Other M anufactured Tobacco M iscellaneous P roducts/Articles

M C 060 Energy Tax on Electric P ower Consumption XT120 M onitoring F ees XG020-XG090 Automobiles

M C 031 Deficiency Tax P etroleum P roducts XG100-XG120 Non Essential Goods

M C 030 Delinquent Accounts/Accounts Receivable XP 070 P remium (Leaded) Gasoline M ineral P roducts

FP 010 - FP 930 Fines and P enalties XP 060 P remium (Unleaded) Gasoline XM 010 Coal & Coke

M C 200 Others XP 080 Regular Gasoline XM 020 Non M etallic & Quarry Resources

Excise Tax on Goods XP 090 & XP 100 Naptha & Other Similar P roducts XM 030 Gold and Chromite

Alcohol P roducts XP 110 Aviation Gasoline XM 040 Copper & Other M etallic M inerals

XA010-XA040 Distilled Spirits XP 140 Diesel Gas XM 050 Indigenous P etroleum

XA061-XA090 Wines XP 180 Bunker Fuel Oil XM 051 Others

XA051-XA053 Fermented Liquor

T A X T Y P E

C ode Descriptio n C ode Description C ode Description

RF REGISTRATION FEE CS CAPITAL GAINS TAX - Stocks WC WITHHOLDING TAX-COM PENSATION

TR TRAVEL TAX-PTA ES ESTATE TAX WE WITHHOLDING TAX-EXPANDED

ET ENERGY TAX DN DONOR'S TAX WF WITHHOLDING TAX-FINAL

QP QUALIFY ING FEES-PAGCOR VT VALUE-ADDED TAX WG WITHHOLDING TAX - VAT AND OTHER

MC M ISCELLANEOUS TAX PT PERCENTAGE TAX PERCENTAGE TAXES

XV EXCISE-AD VALOREM ST PERCENTAGE TAX - STOCKS WO WITHHOLDING TAX-OTHERS (ONE-TIM E TRAN-

XS EXCISE-SPECIFIC SO PERCENTAGE TAX - STOCKS (IPO) SACTION NOT SUBJ ECT TO CAPITAL

XF TOBACCO INSPECTION AND SL PERCENTAGE TAX - SPECIAL LAWS GAINS TAX)

M ONITORING FEES DS DOCUM ENTARY STAM P TAX WR WITHHOLDING TAX - FRINGE BENEFITS

IT INCOM E TAX WB WITHHOLDING TAX-BANKS AND OTHER WW WITHHOLDING TAX - PERCENTAGE TAX

CG CAPITAL GAINS TAX - Real Property FINANCIAL INSTITUTIONS ON WINNING AND PRIZES

BIR Form No. 0605 - Paym ent Form

Guidelines and Instructions

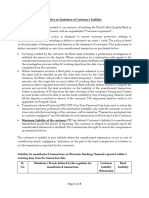

Who Shall File

One set of form shall be filled-up for each kind

Every taxpayer shall use this form, in triplicate, to

of tax and for each taxable period.

pay taxes and fees which do not require the use of a tax

return such as second installment payment for income tax, Note:

deficiency tax, delinquency tax, registration fees, All background information must be properly

penalties, advance payments, deposits, installment filled-up.

payments, etc. For voluntary payment of taxes, BIR Form 0605

shall be signed by the taxpayer or his authorized

When and Where to File and Pay representative.

This form shall be accomplished: For payment of deficiency taxes at the Revenue

1. Everytime a tax payment or penalty is due or District Office level and other investigating

an advance payment is to be made; offices prior to the issuance of Preliminary

2. Upon receipt of a demand letter/assessment Assessment Notice (PAN)/Final Assessment

notice and/or collection letter from the BIR; and Notice (FAN), BIR Form 0605 shall be approved

3. Upon payment of annual registration fee for and signed by the Revenue District Officer

new business and for renewals on or before (RDO) or Head of the investigating offices.

January 31 of every year. For payment of deficiency taxes with issued

This form shall be filed and the tax shall be paid Preliminary Assessment Notice/Final

with any Authorized Agent Bank (AAB) under the Assessment Notice, BIR Form 0605 shall be

jurisdiction of the Revenue District Office where the signed by the taxpayer or his authorized

taxpayer is required to register/conducting representative.

business/producing articles subject to excise tax/having The last 3 digits of the 12-digit TIN refers to the

taxable transactions. In places where there are no branch code.

AABs, this form shall be filed and the tax shall be paid Attachments

directly with the Revenue Collection Officer or duly For Voluntary Payment:

Authorized City or Municipal Treasurer of the Revenue 1. Duly approved Tax Debit Memo, if

District Office where the taxpayer is required to applicable;

register/conducting business/producing articles subject to 2. Xerox copy of the return (ITR)/

excise tax/having taxable transactions, who shall Reminder Letter in case of payment of

issue Revenue Official Receipt (BIR Form No. 2524) second installment on income tax.

therefor. For Payment of Deficiency Taxes from Audit/

Where the return is filed with an AAB, the lower Delinquent Accounts

portion of the return must be properly machine-validated 1. Duly approved Tax Debit Memo, if

and stamped by the Authorized Agent Bank to serve as applicable;

the receipt of payment. The machine validation shall 2. Preliminary Assessment Notice (PAN)/

reflect the date of payment, amount paid and transaction Final Assessment Notice (FAN)’ Letter of

code, and the stamp mark shall show the name of the Demand;

bank, branch code, teller’s name and teller’s initial. The 3. Post Reporting Notice, if applicable;

AAB shall also issue an official receipt or bank debit 4. Collection letter of Delinquent/ Accounts

advice or credit document, whichever is applicable, as Receivable

additional proof of payment. ENCS

You might also like

- 0605version1999 09.02.2022Document1 page0605version1999 09.02.2022jomarNo ratings yet

- 0605 Master EditDocument3 pages0605 Master Editray acainNo ratings yet

- 1 7 6 5 8 5 8 3 7 0 0 0 0 3 3 X ProfessionalDocument3 pages1 7 6 5 8 5 8 3 7 0 0 0 0 3 3 X ProfessionalArgielJedTabalBorrasNo ratings yet

- Book international flight from Bogota to Cancun with taxes and feesDocument4 pagesBook international flight from Bogota to Cancun with taxes and feesMartín Elias Plaza VegaNo ratings yet

- Wingo Logo PlaceholderDocument6 pagesWingo Logo PlaceholderAlexa ContrerasNo ratings yet

- Manish Srivastava-TDS ConfigrationDocument14 pagesManish Srivastava-TDS ConfigrationTaneesha YadavNo ratings yet

- BookingReceipt XF8S89Document4 pagesBookingReceipt XF8S89lina marcela cardona mayaNo ratings yet

- CGT Tomanda AntokDocument1 pageCGT Tomanda AntokNvision PresentNo ratings yet

- Bir Form 1600Document3 pagesBir Form 1600Joseph Rod Allan AlanoNo ratings yet

- Important NotesssDocument1 pageImportant NotesssGolo GNo ratings yet

- Vuelo No. Hora de Salida Hora de Llegada DuraciónDocument2 pagesVuelo No. Hora de Salida Hora de Llegada DuraciónZAMIRNo ratings yet

- Jesus Maria Romero Perez-Anticipo MarzoDocument2 pagesJesus Maria Romero Perez-Anticipo MarzoJesus RomeroNo ratings yet

- 500 AmendDocument1 page500 AmendCharlie GabalesNo ratings yet

- 01 03 16 106 057 588 000 000863 958 243 New Morales Glass Supply 03 31 16 01 05 16 102 214 389 000 000863 958 243 New Kent Lumber & Hardware 05 31 16Document15 pages01 03 16 106 057 588 000 000863 958 243 New Morales Glass Supply 03 31 16 01 05 16 102 214 389 000 000863 958 243 New Kent Lumber & Hardware 05 31 16Jobel Sibal CapunfuerzaNo ratings yet

- Onett Developer TemplateDocument6 pagesOnett Developer Templatejoeye louieNo ratings yet

- Voucher - November 2019Document18 pagesVoucher - November 2019Kirby ReyesNo ratings yet

- Challan Status Query For Tax PayerDocument1 pageChallan Status Query For Tax PayerArjun VermaNo ratings yet

- 2307 Jan 2018 ENCS v3 BIRDocument2 pages2307 Jan 2018 ENCS v3 BIRlnbsanclementeNo ratings yet

- SL No. 1 NX9-00: QuoteDocument1 pageSL No. 1 NX9-00: Quote2003vinayNo ratings yet

- It 000142942160 2024 09Document1 pageIt 000142942160 2024 09tayyabNo ratings yet

- Tax Tor In: Return MineralDocument1 pageTax Tor In: Return MineralLhance BabacNo ratings yet

- Pal Ratesheet NRT 2021Document2 pagesPal Ratesheet NRT 2021Joanna MagalongNo ratings yet

- 01 - Salary RegisterDocument16 pages01 - Salary RegisterragininikamNo ratings yet

- Aura Emergency Systems: PLG Power LTDDocument4 pagesAura Emergency Systems: PLG Power LTDJeffery RamosNo ratings yet

- Barangay Seminar With TrainDocument31 pagesBarangay Seminar With TrainMarcial BonifacioNo ratings yet

- Daftar Penjualan 3 Hari Terakhir Toko Bangunan Sukses Bersama By: MasterexcelidDocument5 pagesDaftar Penjualan 3 Hari Terakhir Toko Bangunan Sukses Bersama By: MasterexcelidJeryNo ratings yet

- Duty SheetDocument525 pagesDuty Sheetrafi ud dinNo ratings yet

- Sepco Online BillDocument2 pagesSepco Online Billmuneer.paydiamond786No ratings yet

- CPE Revsisar SUNAT Versión2_Atualización 10.04.24_EditDocument42 pagesCPE Revsisar SUNAT Versión2_Atualización 10.04.24_Editpaul ruizNo ratings yet

- AST2267 Generic Tax Filing and Payment Table ENDocument1 pageAST2267 Generic Tax Filing and Payment Table ENGhepo GhoruiNo ratings yet

- Type/Description: - G/L Account For Down Payment Requests (Vendors) : With Some Critical Settings BeingDocument17 pagesType/Description: - G/L Account For Down Payment Requests (Vendors) : With Some Critical Settings Beingrajesh1978.nair2381No ratings yet

- Income Tax Calulator With Computation of IncomeDocument18 pagesIncome Tax Calulator With Computation of IncomeSurendra DevadigaNo ratings yet

- GFS Codes For Income TaxesDocument1 pageGFS Codes For Income TaxesDunstan MasasiNo ratings yet

- Jumbo East Realty v. CIR, CTA Case No. 8380, March 16, 2015Document31 pagesJumbo East Realty v. CIR, CTA Case No. 8380, March 16, 2015SGNo ratings yet

- Catching the Cooperative Tax TrainDocument163 pagesCatching the Cooperative Tax TrainDeirdre Mae Pitpitunge100% (1)

- Pacific Customs Debit Note for Cartage ServicesDocument1 pagePacific Customs Debit Note for Cartage ServicesRoneel SinghNo ratings yet

- Goods & Services Tax (GST) - ServicesDocument4 pagesGoods & Services Tax (GST) - ServicesImti RahmanNo ratings yet

- Sample Statement For Insurance CarDocument2 pagesSample Statement For Insurance CarRajesh Mukkavilli57% (14)

- One and Done 2307Document2 pagesOne and Done 2307Maricris LegaspiNo ratings yet

- Adobe Scan 30 Oct 2022Document1 pageAdobe Scan 30 Oct 2022Partha TungNo ratings yet

- Armscor Official ReceiptsDocument6 pagesArmscor Official Receipts16michaelaganaNo ratings yet

- Language Chart of Accts G/L Account Short TextDocument12 pagesLanguage Chart of Accts G/L Account Short TextTushar YadavNo ratings yet

- Overseas Purchase Order: VEN OR ..: San DR LL CanadaDocument1 pageOverseas Purchase Order: VEN OR ..: San DR LL CanadaRimal ButtNo ratings yet

- Abdul Ghaffar 14-10-19 PDFDocument1 pageAbdul Ghaffar 14-10-19 PDFAyan BNo ratings yet

- Taxation Tax AdministrationDocument234 pagesTaxation Tax AdministrationmahmoudfatahabukarNo ratings yet

- 4.2023 MNA 2551Q 001Document1 page4.2023 MNA 2551Q 001LABORDO JOHN-JOHNNo ratings yet

- Nirmal Singh Comp2Document2 pagesNirmal Singh Comp2ca.lakshaykhannaNo ratings yet

- Receipt of Import Declaration 1 / 2Document2 pagesReceipt of Import Declaration 1 / 2Thant ZinNo ratings yet

- Cert 2307V2018 Global MirakelDocument2 pagesCert 2307V2018 Global MirakelLeo BagtasNo ratings yet

- Service Charges Popcorn Service ProviderDocument3 pagesService Charges Popcorn Service ProviderRajesh SharmaNo ratings yet

- Viewdoc - Aspx 2Document9 pagesViewdoc - Aspx 2Ashley John PereiraNo ratings yet

- Digit Two-Wheeler Package Policy Schedule/Certificate SummaryDocument2 pagesDigit Two-Wheeler Package Policy Schedule/Certificate Summarykhanafzaal2576100% (1)

- TDS RATE CHART FY 2015-16 AY 16-17: Major Sections of The Income Tax Act That Outline TDS Deductions AreDocument1 pageTDS RATE CHART FY 2015-16 AY 16-17: Major Sections of The Income Tax Act That Outline TDS Deductions ArekajalNo ratings yet

- BG 1Document2 pagesBG 1farhad khanNo ratings yet

- 2551Q Quarterly Percentage Tax Return: 947 257 352 000 Lopez, MaricrisDocument1 page2551Q Quarterly Percentage Tax Return: 947 257 352 000 Lopez, MaricrisJmarc JubiladoNo ratings yet

- INPUT - OUTPUT TAX PROCEDUREDocument23 pagesINPUT - OUTPUT TAX PROCEDURELipu MohapatraNo ratings yet

- Voucher - October 2019Document10 pagesVoucher - October 2019Kirby ReyesNo ratings yet

- Fill in All Applicable Spaces. Mark All Appropriate Boxes With An "X"Document5 pagesFill in All Applicable Spaces. Mark All Appropriate Boxes With An "X"May Joy DepalomaNo ratings yet

- Storytelling and Chamber ReadingDocument12 pagesStorytelling and Chamber Reading잔돈No ratings yet

- Pedagogical Grammar ReportDocument19 pagesPedagogical Grammar Report잔돈No ratings yet

- Activity Parts of Speech Mellany SiapoDocument1 pageActivity Parts of Speech Mellany Siapo잔돈No ratings yet

- Sociolinguistci Concept Report MELLANY SIAPODocument21 pagesSociolinguistci Concept Report MELLANY SIAPO잔돈No ratings yet

- Mellany Siapo-Basic Grammar RulesDocument2 pagesMellany Siapo-Basic Grammar Rules잔돈No ratings yet

- 2nd Year 1st Sem 2021 ScheduleDocument1 page2nd Year 1st Sem 2021 Schedule잔돈No ratings yet

- Executive Order No. 017 Organizing BVTDocument1 pageExecutive Order No. 017 Organizing BVT잔돈No ratings yet

- Executive Order No. 016 Organizing SapbmtDocument2 pagesExecutive Order No. 016 Organizing Sapbmt잔돈No ratings yet

- Teaching Literature - An Overview REPORTDocument4 pagesTeaching Literature - An Overview REPORT잔돈No ratings yet

- Executive Order No. 012 Reorganizing VawcDocument1 pageExecutive Order No. 012 Reorganizing Vawc잔돈No ratings yet

- Executive Order No. 013 Strengthening BadacDocument2 pagesExecutive Order No. 013 Strengthening Badac잔돈No ratings yet

- Executive Order No. 015 Organizing BhertDocument2 pagesExecutive Order No. 015 Organizing Bhert잔돈100% (1)

- Executive Order No. 001 Creation of ELCACDocument2 pagesExecutive Order No. 001 Creation of ELCAC잔돈No ratings yet

- Executive Order No. 014 Organizing BSRTDocument1 pageExecutive Order No. 014 Organizing BSRT잔돈No ratings yet

- Executive Order No. 009 Reorganizing BfarmcDocument1 pageExecutive Order No. 009 Reorganizing Bfarmc잔돈0% (2)

- Executive Order No. 005 Reorganizing BadacDocument2 pagesExecutive Order No. 005 Reorganizing Badac잔돈79% (14)

- Executive Order No. 004 Creating BPFSDCDocument2 pagesExecutive Order No. 004 Creating BPFSDC잔돈100% (6)

- Executive Order No. 006 Reorganizing BarcDocument2 pagesExecutive Order No. 006 Reorganizing Barc잔돈100% (3)

- Executive Order No. 010 Reorganizing BpocDocument1 pageExecutive Order No. 010 Reorganizing Bpoc잔돈100% (5)

- Executive Order No. 002 Creating BeswmcDocument2 pagesExecutive Order No. 002 Creating Beswmc잔돈100% (2)

- Executive Order No. 008 Reorganizing BDRRMCDocument1 pageExecutive Order No. 008 Reorganizing BDRRMC잔돈75% (8)

- Request Tent Bong GoDocument1 pageRequest Tent Bong Go잔돈100% (3)

- Executive Order No. 007 Reorganizing BCPCDocument2 pagesExecutive Order No. 007 Reorganizing BCPC잔돈100% (6)

- SGLGB Annex A DCF No 1 MapalacDocument5 pagesSGLGB Annex A DCF No 1 Mapalac잔돈No ratings yet

- Executive Order No. 011 Reorganizing Devt CouncilDocument1 pageExecutive Order No. 011 Reorganizing Devt Council잔돈No ratings yet

- Executive Order No. 003 Creating BNCDocument1 pageExecutive Order No. 003 Creating BNC잔돈87% (15)

- Request Sand GOV and MAYORDocument2 pagesRequest Sand GOV and MAYOR잔돈86% (7)

- (Check Appropriate Column) : Mrs. Marietta M. Muñoz Hon. Jonar T. LimosDocument2 pages(Check Appropriate Column) : Mrs. Marietta M. Muñoz Hon. Jonar T. Limos잔돈No ratings yet

- SAP CertificationDocument2 pagesSAP Certification잔돈No ratings yet

- Barangay Mapalad Officials ListDocument2 pagesBarangay Mapalad Officials List잔돈No ratings yet

- General Terms and ConditionsDocument8 pagesGeneral Terms and ConditionsSudhanshu JainNo ratings yet

- Corporate Financial AccountingDocument4 pagesCorporate Financial AccountinghareshNo ratings yet

- Oe Cash Flow 06.20.2022Document52 pagesOe Cash Flow 06.20.2022Ian Jasper NamocNo ratings yet

- Customer Perception Towards Banking ServicesDocument57 pagesCustomer Perception Towards Banking ServicespujaskawaleNo ratings yet

- Customer Protection PolicyDocument3 pagesCustomer Protection PolicyJorden BelfortNo ratings yet

- Summer Training Project On HDC Bank Varanasi SHISH MBA SAMS IBM VaranasiDocument85 pagesSummer Training Project On HDC Bank Varanasi SHISH MBA SAMS IBM VaranasiShish ChoudharyNo ratings yet

- Ocean Carriers FinalDocument4 pagesOcean Carriers FinalBilal AsifNo ratings yet

- 141 14 513Document53 pages141 14 513Pik PokNo ratings yet

- GSFM7514 Assignment Master Budget QuestionsDocument3 pagesGSFM7514 Assignment Master Budget Questionsnoorfazirah9196No ratings yet

- Investment AvenuesDocument35 pagesInvestment AvenuesJoshua Stalin SelvarajNo ratings yet

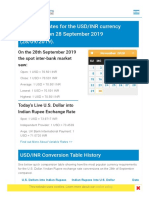

- U.S. Dollar To Indian Rupee Exchange Rate History - 28 September 2019 (28 - 09 - 2019) UsdDocument6 pagesU.S. Dollar To Indian Rupee Exchange Rate History - 28 September 2019 (28 - 09 - 2019) UsdAnish KumarNo ratings yet

- Assignment 3 Consolidation. Subsequent To The Date of AcquisitionDocument4 pagesAssignment 3 Consolidation. Subsequent To The Date of AcquisitionAivan De LeonNo ratings yet

- ACC 124 Discussion - Dec. 11, 2023Document6 pagesACC 124 Discussion - Dec. 11, 2023racquelcamatchoNo ratings yet

- Starting A BusinessDocument9 pagesStarting A BusinessPaulNo ratings yet

- Unit 5 - Business StrategyDocument12 pagesUnit 5 - Business StrategyABRIL TANIA PATI TORREZNo ratings yet

- RMGB Statement Kakndwala PDFDocument5 pagesRMGB Statement Kakndwala PDFRny buriaNo ratings yet

- Depreciation Accounting 101: Calculating and Journalizing MethodsDocument12 pagesDepreciation Accounting 101: Calculating and Journalizing MethodsHikmatkhan NooraniNo ratings yet

- DCF ModelDocument14 pagesDCF ModelmfaisalidreisNo ratings yet

- Archdiocese Phila Off Finan Svcs FS 15 14 FinalDocument41 pagesArchdiocese Phila Off Finan Svcs FS 15 14 FinalKody LeibowitzNo ratings yet

- R PDFDocument2 pagesR PDFmariana tkachNo ratings yet

- CHP 6 Internal ReconstructionDocument60 pagesCHP 6 Internal ReconstructionRonak ChhabriaNo ratings yet

- Module 5 Using Mathematical TechniquesDocument57 pagesModule 5 Using Mathematical Techniquessheryl_morales100% (5)

- Kyodai Remittance - IME RatesDocument1 pageKyodai Remittance - IME Ratesharmeeksingh01No ratings yet

- Pro SoccerTipDocument13 pagesPro SoccerTipNamoryNo ratings yet

- New 301 Presentation-2Document26 pagesNew 301 Presentation-2api-636032198No ratings yet

- Case (Renminbi) - Discussion QuestionsDocument2 pagesCase (Renminbi) - Discussion QuestionsAnimesh ChoubeyNo ratings yet

- The Role of Bangko Sentral NG PilipinasDocument7 pagesThe Role of Bangko Sentral NG PilipinasEden Lour IINo ratings yet

- Chapter - Ii Review of Literature Working Capital Management Meaning and Definition of Working CapitalDocument9 pagesChapter - Ii Review of Literature Working Capital Management Meaning and Definition of Working CapitalDavid jsNo ratings yet

- Causes of Poverty in Pakistan (HILAL)Document21 pagesCauses of Poverty in Pakistan (HILAL)S.M.HILAL89% (19)

- Fabozzi Ch15 BMAS 7thedDocument42 pagesFabozzi Ch15 BMAS 7thedAbby PalomoNo ratings yet