Professional Documents

Culture Documents

EQUITY METHOD (Full Goodwill)

EQUITY METHOD (Full Goodwill)

Uploaded by

Jeane Mae Boo0 ratings0% found this document useful (0 votes)

10 views2 pagesOriginal Title

Equity method

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

10 views2 pagesEQUITY METHOD (Full Goodwill)

EQUITY METHOD (Full Goodwill)

Uploaded by

Jeane Mae BooCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 2

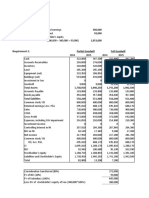

Worksheet for Consolidated FINANCIAL STATEMENTS

EQUITY METHOD (Full Goodwill)

December 31, 2020

Income Statement Parent Subsidiary DR. CR. Consolidated

Sales 1,500,000 730,000 2,230,000

Investment Income 165,720 165,720 0

Total revenue 1,665,720 730,000 2,230,000

Cost of Goods sold 1,000,000 350,000 12,000 1,362,000

Depreciation Expense 38,567 2,500 41,067

Amortization Expense 400 400

Operating Expenses 300,000 150,000 450,000

Goodwill Impairment Loss 7,950 7,950

Total Cost and Expenses 1,338,567 500,000 1,861,417

Net income 327,153 230,000 368,583

NCI in Net Income-Subsidiary 41,197 -41,197

Net income to Retained Earnings 327,153 230,000 327,386

Statament of Retained Earnings

Retained Earnings, 1/1

Parent Co. 198,250 198,250

Subsidiary 11,000 11,000 0

Net Income, from above 327,153 230,000 327,386

Total 525,403 241,000 525,636

Dividends Paid

Parent Co. 210,161 - 210,161

Subsidiary 96,400 96,400 0

Retained Earnings, 12/31 to Balance Sheet 315,242 144,600 315,475

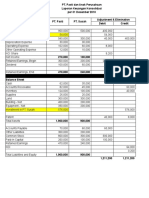

Balance Sheet

Cash 197,859 178,000 375,859

Accounts Receivable 67,850 4,100 71,950

Inventories 22,900 6,100 12,000 12,000 29,000

Store equipment 279,000 24,000 12,000 315,000

Delivery equipment 160,000 8,000 4,000 172,000

Patents 0 10,000 4,000 14,000

Goodwill 0 79,500 7,950 71,550

Investment in Subsidiary 238,600 60,800

89,200

88,600 0

TOTAL 966,209 230,200 1,049,359

Accumulated depreciation-Store eqpt. 195,300 0 0 2,000 197,300

Accumulated depreciation-Delivery eqpt. 106,667 0 0 500 107,167

Accumulated amortization 400 400

Accounts Payable 4,000 20,600 24,600

Bonds Payable 80,000 80,000

Common Stock 127,000 127,000

Common Stock 50,000 50,000 0

Additional Paid In Capital 138,000 138,000

Additional Paid In Capital 15,000 15,000 0

Retained Earnings 315,242 144,600 315,475

Non-controlling Interest 19,280 15,200

22300

41,197 59,417

TOTAL 966,209 230,200 436,547 436,547 1,049,359

Worksheet for Consolidated Financial Statements

EQUITY METHOD (Partial Goodwill)

December 31, 2021

Income Statement Parent Subsidiary DR. CR. Consolidated

Sales 1,800,000 900,000 2,700,000

Investment income 231,320 231,320 0

Total revenue 2,031,320 900,000 2,700,000

Cost of Goods sold 1,000,000 400,000 1,400,000

Depreciation Expense 38567 2,500 41,067

Amortization Expense 400 400

Operating Expenses 300,000 200,000 500,000

Goodwill Impairment Loss 6,360 6,360

Total Cost and Expenses 1,338,567 600,000 1,947,827

Net income 692,753 300,000 752,173

NCI in Net Income-Subsidiary 59,420 -59,420

Net income to Retained Earnings 692,753 300,000 692,753

Statament of Retained Earnings

Retained Earnings, 1/1

Parent Co. 315,242 315,242

Subsidiary 144,600 144,600 0

Net Income, from above 692,753 300,000 692,753

Total 1,007,995 444,600 1,007,995

Dividends Paid

Parent Co. 403,198 - 403,198

Subsidiary 177,840 177,840 0

Retained Earnings, 12/31 to Balance Sheet 604,797 266,760 604,797

Balance Sheet

Cash 436,933 300,160 737,093

Accounts Receivable 67,850 4,100 71,950

Inventories 22,900 6,100 0 29,000

Store equipment 279,000 24,000 10,000 313,000

Delivery equipment 160,000 8,000 3,500 171,500

Patents 0 10,000 3,600 13,600

Goodwill 0 57,240 6,360 50,880

Investment in Subsidiary 327,648 167,680

70,920

89,048 0

TOTAL 1,294,331 352,360 1,387,023

Accumulated depreciation-Store eqpt. 223,200 0 2,000 225,200

Accumulated depreciation-Delivery eqpt. 117,334 0 500 117,834

Accumulated amortization 400 400

Accounts Payable 4,000 20,600 24,600

Bonds Payable 80,000 80,000

Common Stock 127,000 127,000

Common Stock 50,000 50,000 0

Additional Paid In Capital 138,000 138,000

Additional Paid In Capital 15,000 15,000 0

Retained Earnings 604,797 266,760 604,797

Non-controlling Interest 35,568 41,920

3420

59,420 69,192

TOTAL 1,294,331 352,360 619,508 619,508 1,387,023

You might also like

- Acct2015 - 2021 Paper Final SolutionDocument128 pagesAcct2015 - 2021 Paper Final SolutionTan TaylorNo ratings yet

- Schaum's Outline of Principles of Accounting I, Fifth EditionFrom EverandSchaum's Outline of Principles of Accounting I, Fifth EditionRating: 5 out of 5 stars5/5 (3)

- Cfa Chapter 9 Problems: The Capital Asset Pricing ModelDocument7 pagesCfa Chapter 9 Problems: The Capital Asset Pricing ModelFagbola Oluwatobi Omolaja100% (1)

- FI 3300 - Corporation Finance Spring 2015: THPS-1 Solution KeyDocument10 pagesFI 3300 - Corporation Finance Spring 2015: THPS-1 Solution KeySer Ronell0% (1)

- Separate Consolidated FS-Problem 3Document17 pagesSeparate Consolidated FS-Problem 3Jeane Mae BooNo ratings yet

- 1Q2019 Letter To Investor Semper Vic PartnersDocument21 pages1Q2019 Letter To Investor Semper Vic Partnerstempvj100% (1)

- Afar-Chapter 3 AssignmentDocument38 pagesAfar-Chapter 3 AssignmentJeane Mae BooNo ratings yet

- Trial Balance Adjustments Profit or Loss Financial Position Account Title Debit Credit Debit Credit Debit Credit Debit CreditDocument2 pagesTrial Balance Adjustments Profit or Loss Financial Position Account Title Debit Credit Debit Credit Debit Credit Debit CreditMichelle BabaNo ratings yet

- Sukoako Company Statement of Financial Position Current Assets Year 1 Year 2Document5 pagesSukoako Company Statement of Financial Position Current Assets Year 1 Year 2Kevin GarnettNo ratings yet

- AccountsDocument4 pagesAccountsVencint LaranNo ratings yet

- Karkits Corporation Excel Copy PasteDocument2 pagesKarkits Corporation Excel Copy PasteCoke Aidenry SaludoNo ratings yet

- Intercompany Sale of PPE Problem 2: Requirement: January 1, 20x4Document31 pagesIntercompany Sale of PPE Problem 2: Requirement: January 1, 20x4Abegail LibreaNo ratings yet

- The Institute of Chartered Accountants of Bangladesh: Sample Question Paper Certificate Level-AccountingDocument8 pagesThe Institute of Chartered Accountants of Bangladesh: Sample Question Paper Certificate Level-AccountingArif UddinNo ratings yet

- Bac 3 Review QNSDocument16 pagesBac 3 Review QNSsaidkhatib368No ratings yet

- Illustrative Full Set of IFRS For SME Financial StatementsDocument16 pagesIllustrative Full Set of IFRS For SME Financial StatementsGirma NegashNo ratings yet

- MI Worksheet Final LectureDocument3 pagesMI Worksheet Final Lecturethapa_bisNo ratings yet

- Advanced Accounting 2 - Chapter 4 James B. Cantorne Problem 1. T/FDocument7 pagesAdvanced Accounting 2 - Chapter 4 James B. Cantorne Problem 1. T/FJames CantorneNo ratings yet

- FFS - Numericals 2Document3 pagesFFS - Numericals 2Funny ManNo ratings yet

- Er Cla 2Document2 pagesEr Cla 2Sakshi ManotNo ratings yet

- QuestionsDocument13 pagesQuestionsAriaNo ratings yet

- Income Statement Hide Corp. Seek Corp. Dr. CR.: Book Value of Stocholders' Equity of Seek CorpDocument11 pagesIncome Statement Hide Corp. Seek Corp. Dr. CR.: Book Value of Stocholders' Equity of Seek CorpmoreNo ratings yet

- ACC12 - Statement of Cash FlowsDocument1 pageACC12 - Statement of Cash FlowsVimal KvNo ratings yet

- FS Preparation 1Document4 pagesFS Preparation 1Bae Tashnimah Farina BaltNo ratings yet

- Ch5 Additional Q OnlyDocument13 pagesCh5 Additional Q OnlynigaroNo ratings yet

- Sesi 13 & 14Document15 pagesSesi 13 & 14Dian Permata SariNo ratings yet

- Analisis Laporan KeuanganDocument15 pagesAnalisis Laporan KeuanganMhmmd HirziiNo ratings yet

- WorkDocument4 pagesWorkhassan KyendoNo ratings yet

- Template 2 Task 3 Calculation Worksheet - BSBFIM601Document17 pagesTemplate 2 Task 3 Calculation Worksheet - BSBFIM601Writing Experts0% (1)

- Solusi Inventory Downstream-UpstreamDocument19 pagesSolusi Inventory Downstream-UpstreamKurrniadi AndiNo ratings yet

- Latihan P7-4Document6 pagesLatihan P7-4ryuNo ratings yet

- Is Fishing Non Motorized BangkaDocument4 pagesIs Fishing Non Motorized BangkaAnonymous EvbW4o1U7No ratings yet

- Randall Corporation and Sharp Company Consolidation Worksheet December 31, 20X7Document5 pagesRandall Corporation and Sharp Company Consolidation Worksheet December 31, 20X7Diane MagnayeNo ratings yet

- Aisha Steel Mills LTDDocument19 pagesAisha Steel Mills LTDEdnan HanNo ratings yet

- Case FileDocument4 pagesCase Fileabeer alamNo ratings yet

- Complete Financial Statements With SCF Direcdt MethodDocument23 pagesComplete Financial Statements With SCF Direcdt MethodJuja FlorentinoNo ratings yet

- Sesi 13 & 14Document10 pagesSesi 13 & 14Dian Permata SariNo ratings yet

- Worksheet Quiz ExampleDocument5 pagesWorksheet Quiz ExampleFrenzearl ArmadaNo ratings yet

- 8447809Document11 pages8447809blackghostNo ratings yet

- Cat 1 SD23Document2 pagesCat 1 SD23HarusiNo ratings yet

- Financial Analysis - Mini Case-Norbrook-Group BDocument2 pagesFinancial Analysis - Mini Case-Norbrook-Group BErrol ThompsonNo ratings yet

- Lecture - 5 - CFI-3-statement-model-completeDocument37 pagesLecture - 5 - CFI-3-statement-model-completeshreyasNo ratings yet

- Home Depot Final DCFDocument120 pagesHome Depot Final DCFapi-515120297No ratings yet

- UntitledDocument5 pagesUntitledm habiburrahman55No ratings yet

- Case File 2.0Document4 pagesCase File 2.0abeer alamNo ratings yet

- Ice NineDocument4 pagesIce NinePolene GomezNo ratings yet

- Lembar Jawaban Mahesa - SalinDocument10 pagesLembar Jawaban Mahesa - Salinricoananta10No ratings yet

- Chapter 7 Up StreamDocument14 pagesChapter 7 Up StreamAditya Agung SatrioNo ratings yet

- Group Activitity Bus FinDocument8 pagesGroup Activitity Bus FinDavon LopezNo ratings yet

- Capital Budgeting - 2021Document7 pagesCapital Budgeting - 2021Mohamed ZaitoonNo ratings yet

- Ampalaya Ice CreamDocument12 pagesAmpalaya Ice CreamEdhel Bryan Corsiga SuicoNo ratings yet

- AssignmentDocument3 pagesAssignmentililyeshetu116No ratings yet

- Enterprenuership Project For Garments Sticthing Unit Financail Section - Xls 2012, 13Document20 pagesEnterprenuership Project For Garments Sticthing Unit Financail Section - Xls 2012, 13KabeerMalikNo ratings yet

- H and V Anal ExerciseDocument3 pagesH and V Anal ExerciseSummer ClaronNo ratings yet

- Accountin Principals Task 2Document15 pagesAccountin Principals Task 2Thivya KrishnanNo ratings yet

- Acctg110 FinalsDocument21 pagesAcctg110 FinalsRoman Dominic LlanoNo ratings yet

- UntitledDocument11 pagesUntitledKhang ĐặngNo ratings yet

- AK2 13 Kheisya Buku BesarDocument2 pagesAK2 13 Kheisya Buku BesarKheisya Siva Qolbi Kiss PutriXI AKL 2No ratings yet

- REBYUDocument16 pagesREBYUChi EstrellaNo ratings yet

- Yohannes Wibowo - Akuntansi Keuangan Lanjutan I - Akuntansi (E) - Tugas Minggu 9Document10 pagesYohannes Wibowo - Akuntansi Keuangan Lanjutan I - Akuntansi (E) - Tugas Minggu 9YOHANNES WIBOWONo ratings yet

- Midterm Pretest - Cost Model-Partial Goodwill FinalDocument9 pagesMidterm Pretest - Cost Model-Partial Goodwill FinalWinnie LaraNo ratings yet

- Engineering Management 3000/5039: Tutorial Set 5Document5 pagesEngineering Management 3000/5039: Tutorial Set 5SahanNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- Exercise No.4 Bus. Co.Document56 pagesExercise No.4 Bus. Co.Jeane Mae BooNo ratings yet

- Bus. Combination QuizDocument4 pagesBus. Combination QuizJeane Mae BooNo ratings yet

- Exercise No.2Document4 pagesExercise No.2Jeane Mae BooNo ratings yet

- Ramon Magsaysay Memorial Colleges College of AccountancyDocument3 pagesRamon Magsaysay Memorial Colleges College of AccountancyJeane Mae BooNo ratings yet

- Audit Answer Key 2Document1 pageAudit Answer Key 2Jeane Mae BooNo ratings yet

- Works He e T For Cons Olidate D Financial State Me Nts Cos T Mode L (Full Goodwill) de Ce Mbe R 3 1, 2 0 2 0 (1 S T Ye Ar Acquis Ition)Document2 pagesWorks He e T For Cons Olidate D Financial State Me Nts Cos T Mode L (Full Goodwill) de Ce Mbe R 3 1, 2 0 2 0 (1 S T Ye Ar Acquis Ition)Jeane Mae BooNo ratings yet

- Audit Answer Key 3Document2 pagesAudit Answer Key 3Jeane Mae BooNo ratings yet

- Foreign Country Net Gifts X World Net Gifts Philippine Donor's Tax DueDocument3 pagesForeign Country Net Gifts X World Net Gifts Philippine Donor's Tax DueJeane Mae BooNo ratings yet

- Assessments I.Audit of InventoryDocument1 pageAssessments I.Audit of InventoryJeane Mae BooNo ratings yet

- Weighted Average Cost of Capital (WACC) Calculator: Strictly ConfidentialDocument3 pagesWeighted Average Cost of Capital (WACC) Calculator: Strictly ConfidentialJeane Mae Boo0% (1)

- Valuation Final ExamDocument4 pagesValuation Final ExamJeane Mae Boo100% (1)

- Comparable Company AnalysisDocument3 pagesComparable Company AnalysisJeane Mae BooNo ratings yet

- Lets Goat Company AkeyDocument2 pagesLets Goat Company AkeyJeane Mae BooNo ratings yet

- Business Com. Prelim ExamDocument7 pagesBusiness Com. Prelim ExamJeane Mae BooNo ratings yet

- Statement of Financial Position: Horizontal AnalysisDocument12 pagesStatement of Financial Position: Horizontal AnalysisJeane Mae BooNo ratings yet

- Exercise No.2Document4 pagesExercise No.2Jeane Mae BooNo ratings yet

- Kani Na Gid Animal 1Document30 pagesKani Na Gid Animal 1Jeane Mae BooNo ratings yet

- Joselito Cuevas Head, Physical Plant Ramon Magsaysay Memorial CollegesDocument1 pageJoselito Cuevas Head, Physical Plant Ramon Magsaysay Memorial CollegesJeane Mae BooNo ratings yet

- FINA4050 Class 6 Financial Modeling Basics PDFDocument26 pagesFINA4050 Class 6 Financial Modeling Basics PDFJai PaulNo ratings yet

- Sample Practice Exam 10 May Questions - CompressDocument16 pagesSample Practice Exam 10 May Questions - CompressKaycee StylesNo ratings yet

- Midterm SolveDocument3 pagesMidterm SolveMD Hafizul Islam HafizNo ratings yet

- Investment and Portfolio Management Course OutlineDocument3 pagesInvestment and Portfolio Management Course OutlineRichard Kate Ricohermoso100% (1)

- Practice of Cost of Good Sold Statement IIIDocument3 pagesPractice of Cost of Good Sold Statement IIIi200051 Muhammad HassaanNo ratings yet

- Banking Desire IAS Concept Counter Short Notes PDFDocument12 pagesBanking Desire IAS Concept Counter Short Notes PDFTarunkanti SatapathyNo ratings yet

- Group Assignment Cover Sheet: Student DetailsDocument25 pagesGroup Assignment Cover Sheet: Student DetailsMy Le Thi HoangNo ratings yet

- Ind AS 21Document54 pagesInd AS 21Shresty TiwaryNo ratings yet

- DailyDeals TrendlyneDocument32 pagesDailyDeals TrendlyneTarun MondalNo ratings yet

- Cash Flow Statements6Document28 pagesCash Flow Statements6kimuli FreddieNo ratings yet

- Financial Analysis of Kumari Bank Limited: A Case Study OnDocument28 pagesFinancial Analysis of Kumari Bank Limited: A Case Study OnRitu KcNo ratings yet

- Financial Statemnet Part - ADocument5 pagesFinancial Statemnet Part - AZeba LubabaNo ratings yet

- IF Ppt-28069Document7 pagesIF Ppt-28069Rishibha SinglaNo ratings yet

- Itc WaccDocument185 pagesItc WaccvATSALANo ratings yet

- Mirae Factsheet April2017Document16 pagesMirae Factsheet April2017Dashang G. MakwanaNo ratings yet

- XII Accts Re First Board Exam 20-21Document9 pagesXII Accts Re First Board Exam 20-21Sagar SharmaNo ratings yet

- Neraca Lajur P2 JayatamaDocument3 pagesNeraca Lajur P2 JayatamaShula KinantiNo ratings yet

- Chapter Six: Risk Management in Financial InstitutionsDocument22 pagesChapter Six: Risk Management in Financial InstitutionsMikias DegwaleNo ratings yet

- Ca Final Financial Reporting 50 Important Questions 1643352280Document91 pagesCa Final Financial Reporting 50 Important Questions 1643352280Indhumathi ThangaveluNo ratings yet

- Ch.1 Introduction: Taxmann's Company Law, Kapoor G.K., 20 EdnDocument16 pagesCh.1 Introduction: Taxmann's Company Law, Kapoor G.K., 20 Ednnirshan rajNo ratings yet

- Accounts Concepts and ConventionsDocument21 pagesAccounts Concepts and Conventionskarthik karthikNo ratings yet

- Module - 2 Auditor'S Report: Objectives of The AuditorDocument20 pagesModule - 2 Auditor'S Report: Objectives of The AuditorVijay KumarNo ratings yet

- MEC 4312JA-Assignment-2-DepreciationDocument1 pageMEC 4312JA-Assignment-2-Depreciationfady ayadNo ratings yet

- Mergers & AcquisitionsDocument69 pagesMergers & Acquisitionsdhananjay7No ratings yet

- Full Forms - AbbreviationsDocument19 pagesFull Forms - AbbreviationsA SinghNo ratings yet

- Partnership TheoryDocument12 pagesPartnership TheoryAnish MohantyNo ratings yet

- Annual Report 2020Document260 pagesAnnual Report 2020Shivanshu RaizadaNo ratings yet

- Jawaban Akuntansi Keuangan Lanjutan Chapter 09 Debra - JeterDocument28 pagesJawaban Akuntansi Keuangan Lanjutan Chapter 09 Debra - JeterDopin BbplNo ratings yet