Professional Documents

Culture Documents

Module 6 IAS 40 ADDITIONAL NOTES

Uploaded by

siobhan margaret0 ratings0% found this document useful (0 votes)

15 views4 pagesCopyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

15 views4 pagesModule 6 IAS 40 ADDITIONAL NOTES

Uploaded by

siobhan margaretCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 4

IAS 40 - Additional Notes

* owner-occupied property (OOP) *Transfers of investment proper

*examples of investment property (IP) 1. IP -> OOP (owner occupation)

1. Land 2. IP -> Inventory (development w

2. Building - operating lease 3. OOP -> IP (end of owner occup

3. Property being constructed for future use 4. OOP -> IP (lease out)

*Partly investment and partly owner occupied *Measurement of transfers

-should be accounted for separately

@ COST MODEL

*Property leased to an affiliate measurement = carrying amount

on the perspective of consolidated financial statements - OOP

on the perspective of individual entity - IP

@ FAIR VALUE MODEL

*Initial measurement - cost 1. IP @ fair value -> OOP

*Subsequent measurement fair value = cost for accounting th

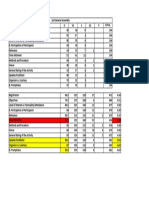

IAS 40 - Sample Illustration 2. OOP -> IP @ fair value

carrying amount -> fair value

The construction was completed and placed in service on January 1, 2020. changes = revaluation of PPE

The cost of the construction of the shopping malll was P100,000,000. 3. Inventory -> IP @ fair value

carrying amount -> fair value

The useful life of the shopping mall is 10 years and residual value is P10,000,000. changes = remeasurement in P/L

31-Dec-20 120,000,000 4. IP under construction & compl

31-Dec-21 125,000,000

31-Dec-22 115,000,000

*DERECOGNITION OF INVESTME

The entity decided to use cost model. a. On disposal

b. When IP is permanently withd

Investment Property 100,000,000 c. When no future economic ben

Cash 100,000,000

*Disposal

Acquisition cost 100,000,000 carrying amount of IP

Residual value ( (10,000,000) (net proceeds of IP)

Depreciable amount 90,000,000 gain or loss from disposal of IP

Annual depreciation ( 9,000,000)

*DISCLOSURES

Depreciation ( 9,000,000) 1. model adopted or used in mea

Accumulated Depreciation ( 9,000,000) 2. amount of rental income & its

3. restictions on IP

4. contractual obligations related

The entity decided to use fair value model.

Investment Property 100,000,000

rs of investment property

OOP (owner occupation)

nventory (development with a view to sale)

> IP (end of owner occupation)

> IP (lease out)

rement of transfers

ment = carrying amount

VALUE MODEL

air value -> OOP

e = cost for accounting the OOP

> IP @ fair value

amount -> fair value

= revaluation of PPE

ory -> IP @ fair value

amount -> fair value

= remeasurement in P/L

er construction & completed -> @ fair value

OGNITION OF INVESTMENT PROPERTY

IP is permanently withdrawn from use

no future economic benefits are expected from the IP

amount of IP

oss from disposal of IP

adopted or used in measuring IP

nt of rental income & its expenses

ctual obligations related to IP

Cash 100,000,000

Investment Property 20,000,000

Gain from change in fair value 20,000,000

2021

Investment Property 5,000,000

Gain from change in fair value 5,000,000

2022

Loss from change in fair value 10,000,000

Investment property 10,000,000

You might also like

- Investment Property Answer KeyDocument4 pagesInvestment Property Answer KeyC/PVT DAET, SHAINA JOYNo ratings yet

- Auditing Theory Test BankDocument32 pagesAuditing Theory Test BankJane Estrada100% (2)

- JUST IN TIME AND BACKFLUSH COSTING With Illustrative ProblemDocument7 pagesJUST IN TIME AND BACKFLUSH COSTING With Illustrative Problemenzo0% (1)

- Chapter 7 Investment PropertyDocument8 pagesChapter 7 Investment PropertyKrissa Mae Longos100% (2)

- Donated CapitalDocument2 pagesDonated CapitalQueen ValleNo ratings yet

- 100 Golden Grammar Rules for Better WritingDocument15 pages100 Golden Grammar Rules for Better WritingMeng Why LaiNo ratings yet

- CIA2001 Lecture Notes Investment PropertyDocument18 pagesCIA2001 Lecture Notes Investment PropertySatthya PeterNo ratings yet

- Paper 4 Financial ManagementDocument321 pagesPaper 4 Financial ManagementExcel Champ0% (2)

- Chapter 11 SolutionsDocument9 pagesChapter 11 Solutionsbellohales0% (2)

- Chapter 2 Intellectual Revolutions That Defined SocietyDocument33 pagesChapter 2 Intellectual Revolutions That Defined Societysiobhan margaretNo ratings yet

- Incremental AnalysisDocument32 pagesIncremental AnalysisLindaLindy0% (1)

- Chapter 21 - Investment PropertyDocument3 pagesChapter 21 - Investment PropertyXiena67% (3)

- Accounting for Investment PropertyDocument7 pagesAccounting for Investment PropertyRey HandumonNo ratings yet

- Equity Valuation: Models from Leading Investment BanksFrom EverandEquity Valuation: Models from Leading Investment BanksJan ViebigNo ratings yet

- Advanced Accounting Guerrero Peralta Volume 1 Solution Manual PDFDocument189 pagesAdvanced Accounting Guerrero Peralta Volume 1 Solution Manual PDFRegina Fuertes Padilla100% (2)

- Chapter 15&16 Problems and AnswersDocument22 pagesChapter 15&16 Problems and AnswersMa-an Maroma100% (10)

- PPE NotesDocument4 pagesPPE Notesaldric taclanNo ratings yet

- Ch10 - Soal Dan LatihanDocument29 pagesCh10 - Soal Dan Latihanevelyn aleeza100% (3)

- ACC 203 - Module 6. Activity 1 (IAS 16 & IAS 40)Document5 pagesACC 203 - Module 6. Activity 1 (IAS 16 & IAS 40)siobhan margaret50% (2)

- Absorption Vs VariableDocument10 pagesAbsorption Vs VariableRonie Macasabuang CardosaNo ratings yet

- Notes - Investment Property BookDocument2 pagesNotes - Investment Property BookJake AustriaNo ratings yet

- Ch3 IAS40 Investment PropertyDocument31 pagesCh3 IAS40 Investment Propertyxu l100% (1)

- Investment PropertyDocument26 pagesInvestment PropertyKimivy BusaNo ratings yet

- Chapter 9 - Lecture Notes - DungDocument56 pagesChapter 9 - Lecture Notes - DungThanh UyênNo ratings yet

- Ch04 - Property, Plant and Equipment - v2Document38 pagesCh04 - Property, Plant and Equipment - v2Davy KHSCNo ratings yet

- Investment PropertyDocument5 pagesInvestment PropertyKristine PerezNo ratings yet

- CH 09Document37 pagesCH 09Gaurav KarkiNo ratings yet

- Accounting for Investment Property and Non-Current Assets Held for SaleDocument83 pagesAccounting for Investment Property and Non-Current Assets Held for SaleK59 Vo Doan Hoang AnhNo ratings yet

- Module 9Document9 pagesModule 9Althea mary kate MorenoNo ratings yet

- Chapter 9 - Lecture Notes - Co HDDocument41 pagesChapter 9 - Lecture Notes - Co HDminhndn21405No ratings yet

- Chapter 14 Investment Property StudentsDocument38 pagesChapter 14 Investment Property StudentsBình QuốcNo ratings yet

- Vol 3 Chapter 6Document5 pagesVol 3 Chapter 6Mary Claudette UnabiaNo ratings yet

- Activity Chapter 5 1Document11 pagesActivity Chapter 5 1Rocelle MalinaoNo ratings yet

- Investment Property (Ias 40) : Initial MeasurementDocument8 pagesInvestment Property (Ias 40) : Initial MeasurementBea charmillecapiliNo ratings yet

- Property Plant Tutorials Number OneDocument46 pagesProperty Plant Tutorials Number OneNatalie SerranoNo ratings yet

- IAS 16 Property, Plant and EquipmentDocument18 pagesIAS 16 Property, Plant and EquipmentMuhammad Umar IqbalNo ratings yet

- AFE B Tutorial 3 SolutionDocument6 pagesAFE B Tutorial 3 SolutionDiana TuckerNo ratings yet

- PPE - FinalDocument71 pagesPPE - FinalKristen KooNo ratings yet

- Introduction To Financial Accounting: Long-Lived AssetsDocument58 pagesIntroduction To Financial Accounting: Long-Lived AssetsShubham Kaushik100% (1)

- AEC 118 - L1 - Investment Property FinalDocument35 pagesAEC 118 - L1 - Investment Property FinalRoi PeñalesNo ratings yet

- MFRS 140 Investment Properties GuideDocument14 pagesMFRS 140 Investment Properties GuideNUR HASWANIE MOHD SALMINo ratings yet

- Property and Equipment CostsDocument8 pagesProperty and Equipment CostsXNo ratings yet

- Sol. Man. - Chapter 20 - Investment Property - Ia Part 1bDocument7 pagesSol. Man. - Chapter 20 - Investment Property - Ia Part 1bMiguel AmihanNo ratings yet

- Materi Aset TetapDocument52 pagesMateri Aset TetapRamadhan HadisaputroNo ratings yet

- IAS 16 Property, Plant and EquipmentDocument7 pagesIAS 16 Property, Plant and EquipmentEric Agyenim-BoatengNo ratings yet

- Lecture 11 - Investment PropertyDocument17 pagesLecture 11 - Investment PropertyYogeswari RavindranNo ratings yet

- Capital BudgetingDocument4 pagesCapital Budgetingprincessjaminelizardo9No ratings yet

- Solution - (Ust-Jpia) Ca51016 Ia3 Mock Preliminary Examination ReviewerDocument11 pagesSolution - (Ust-Jpia) Ca51016 Ia3 Mock Preliminary Examination Reviewerhpp academicmaterialsNo ratings yet

- Solutions-IAS 40Document7 pagesSolutions-IAS 40Blitz KaizerNo ratings yet

- Acfn 2082 Ch01-Part IDocument96 pagesAcfn 2082 Ch01-Part IbikilahussenNo ratings yet

- Lecture 3 Costing and Costing TechniquesDocument43 pagesLecture 3 Costing and Costing TechniquesehsanNo ratings yet

- IAS 40 Investment Property GuideDocument26 pagesIAS 40 Investment Property GuideziyuNo ratings yet

- Investment Property Journal EntriesDocument5 pagesInvestment Property Journal EntriesPrince PierreNo ratings yet

- INTACC2 Wasting AssetsDocument10 pagesINTACC2 Wasting Assetsbobo tangaNo ratings yet

- Revision Question 1 2023Document13 pagesRevision Question 1 2023Diana MamoNo ratings yet

- Total 11.020.000Document4 pagesTotal 11.020.000Thiện PhátNo ratings yet

- IAS-40 Investment Property RevisedDocument22 pagesIAS-40 Investment Property RevisedMarym MalikNo ratings yet

- CA IPCC Accounting Guideline Answers May 2015Document24 pagesCA IPCC Accounting Guideline Answers May 2015Prashant PandeyNo ratings yet

- Understanding Long-Lived AssetsDocument14 pagesUnderstanding Long-Lived AssetsmostakNo ratings yet

- Just in Time and Backflush Costing With Illustrative Problem Docx Compress 1Document7 pagesJust in Time and Backflush Costing With Illustrative Problem Docx Compress 1Danica Kaye MorcellosNo ratings yet

- Module 3 Real Estate Worksheet 5Yj89ZvoPADocument12 pagesModule 3 Real Estate Worksheet 5Yj89ZvoPANAMAN JAINNo ratings yet

- IAS 40 - INVESTMENT PROPERTY - 2Document53 pagesIAS 40 - INVESTMENT PROPERTY - 2penehafoshilengifaNo ratings yet

- Chapter 3 Property, Plant and EquipmentDocument70 pagesChapter 3 Property, Plant and Equipmentmikiyas zeyedeNo ratings yet

- Chapter 3 Property, Plant and EquipmentDocument70 pagesChapter 3 Property, Plant and EquipmentAlex HaymeNo ratings yet

- CH 09Document94 pagesCH 09Nessrine NebliNo ratings yet

- CH 2 PPEDocument71 pagesCH 2 PPEhassen mustefaNo ratings yet

- FA II Chapter 1 - 1Document53 pagesFA II Chapter 1 - 1Nahum DaichaNo ratings yet

- Accounts CompilerDocument827 pagesAccounts CompilerKarthik RamNo ratings yet

- Capital and Revenue ExpendituresDocument7 pagesCapital and Revenue ExpendituresAbiha FatimaNo ratings yet

- Ifrs Edition: Prepared by Coby Harmon University of California, Santa Barbara Westmont CollegeDocument57 pagesIfrs Edition: Prepared by Coby Harmon University of California, Santa Barbara Westmont CollegeAhmed El KhateebNo ratings yet

- Investment Property ProblemsDocument3 pagesInvestment Property ProblemsAbigail TalusanNo ratings yet

- Activity # 3 Define As A Photographer For This Activity, You Need To Use The Microsoft Word and Any Web Browser. 1. Open Any Web BrowserDocument1 pageActivity # 3 Define As A Photographer For This Activity, You Need To Use The Microsoft Word and Any Web Browser. 1. Open Any Web Browsersiobhan margaretNo ratings yet

- Basic Camera Movements and Perspective: By: Raymund Rex D. DimaandalDocument17 pagesBasic Camera Movements and Perspective: By: Raymund Rex D. Dimaandalsiobhan margaretNo ratings yet

- By: Raymund Rex D - DimaandalDocument19 pagesBy: Raymund Rex D - Dimaandalsiobhan margaretNo ratings yet

- For ComputerDocument7 pagesFor Computersiobhan margaretNo ratings yet

- Sci7-Fa1 2Document1 pageSci7-Fa1 2siobhan margaretNo ratings yet

- FX Markets GuideDocument30 pagesFX Markets Guidesiobhan margaretNo ratings yet

- 2 - Genres of ViewingDocument36 pages2 - Genres of Viewingsiobhan margaretNo ratings yet

- Activity 3: Richard Jallores J. Merillo Grade 7 JoyDocument2 pagesActivity 3: Richard Jallores J. Merillo Grade 7 Joysiobhan margaretNo ratings yet

- We ask that you guide our steps andhelp us apply what we've learned. May our livesreflect your light and bring honor to your name.In Jesus' name, AmenDocument39 pagesWe ask that you guide our steps andhelp us apply what we've learned. May our livesreflect your light and bring honor to your name.In Jesus' name, AmenMendoza EmmaNo ratings yet

- Evaluation FormDocument1 pageEvaluation Formsiobhan margaretNo ratings yet

- Help poor students pursue education through SPES programDocument11 pagesHelp poor students pursue education through SPES programsiobhan margaretNo ratings yet

- Module 6 IAS 38 ADDTL NOTESDocument1 pageModule 6 IAS 38 ADDTL NOTESsiobhan margaretNo ratings yet

- Module 6 IAS 23 BORROWING COST ILLUSTRATIONDocument3 pagesModule 6 IAS 23 BORROWING COST ILLUSTRATIONsiobhan margaretNo ratings yet

- Batangas State University: Republic of The PhilippinesDocument1 pageBatangas State University: Republic of The Philippinessiobhan margaretNo ratings yet

- The DILF (18 Only) (COMPLETED) - TEXT (WATTPAD2ANY)Document133 pagesThe DILF (18 Only) (COMPLETED) - TEXT (WATTPAD2ANY)siobhan margaretNo ratings yet

- Documented Template ResearchDocument1 pageDocumented Template Researchsiobhan margaretNo ratings yet

- Ratio AnalysisDocument32 pagesRatio AnalysisVignesh NarayananNo ratings yet

- Ch12 Harrison 8e GE SMDocument87 pagesCh12 Harrison 8e GE SMMuh BilalNo ratings yet

- Financial Performance of EmamiDocument83 pagesFinancial Performance of EmamiMeena SivasubramanianNo ratings yet

- Operations Management-Cost Measurement Methods & TechniquesDocument6 pagesOperations Management-Cost Measurement Methods & TechniquesjbphamNo ratings yet

- Analyze Costs Using Marginal CostingDocument13 pagesAnalyze Costs Using Marginal CostingmohitNo ratings yet

- KIST-FIN 3420-Course Syllabus Final April 2013Document138 pagesKIST-FIN 3420-Course Syllabus Final April 2013Tommy Kyen'de BilNo ratings yet

- Dividends and stockholders' equity quizDocument3 pagesDividends and stockholders' equity quizLLYOD FRANCIS LAYLAYNo ratings yet

- Accounting ReviewerDocument6 pagesAccounting ReviewerFictional PlayerNo ratings yet

- Investment in Equity Securities - SeatworkDocument2 pagesInvestment in Equity Securities - SeatworkLester ColladosNo ratings yet

- Think of Words That Best Describe Revenues. Expenses Statement of Comprehensive IncomeDocument30 pagesThink of Words That Best Describe Revenues. Expenses Statement of Comprehensive IncomeJasy Nupt GilloNo ratings yet

- Serba Dinamik Holdings Outperform : Upstream DiversificationDocument5 pagesSerba Dinamik Holdings Outperform : Upstream DiversificationAng SHNo ratings yet

- Fabm Group 4. Closing EntriesDocument11 pagesFabm Group 4. Closing Entriesjoel phillip GranadaNo ratings yet

- Dysas - Fin Acc - 3rdDocument5 pagesDysas - Fin Acc - 3rdJao FloresNo ratings yet

- Assignment 6Document1 pageAssignment 6aafNo ratings yet

- Chapter 10 Test Bank Subsidiary Preferred Stock, Cosolidated Earnings Per Share, and Consolidated Income TaxationDocument27 pagesChapter 10 Test Bank Subsidiary Preferred Stock, Cosolidated Earnings Per Share, and Consolidated Income TaxationAlfi Wahyu TifaniNo ratings yet

- Greenergy Holdings Incorporated - SEC Form 17-Q - 17 May 2021Document66 pagesGreenergy Holdings Incorporated - SEC Form 17-Q - 17 May 2021John AzellebNo ratings yet

- Far 360Document24 pagesFar 360Kirana SofeaNo ratings yet

- Quiz Advanced Accounting 2 - Anggelina Ariresta 008201900008Document4 pagesQuiz Advanced Accounting 2 - Anggelina Ariresta 008201900008anggelina arirestaNo ratings yet

- ch08 InventoryDocument8 pagesch08 InventoryJayca Jade MoranoNo ratings yet

- SP Setia Corporate PresentationDocument64 pagesSP Setia Corporate PresentationSya NmjNo ratings yet

- Financial Accounting 2Document31 pagesFinancial Accounting 2Umurbey GençNo ratings yet

- VISHAL Business PlanDocument30 pagesVISHAL Business PlanNagarjuna FeliNo ratings yet

- BCSVDocument8 pagesBCSVjam linganNo ratings yet

- Capital Contribution: Stockholder TINDocument17 pagesCapital Contribution: Stockholder TINEddie ParazoNo ratings yet