Professional Documents

Culture Documents

Scheme of Corporate Accounting

Scheme of Corporate Accounting

Uploaded by

BCom 2 A RPD CollegeOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Scheme of Corporate Accounting

Scheme of Corporate Accounting

Uploaded by

BCom 2 A RPD CollegeCopyright:

Available Formats

Scheme of corporate accounting (4th sem) 1st internal test 2021 capital ratio =

Solution :

Section A

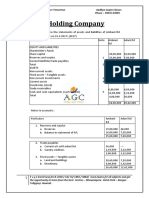

1. Holding Company : A company which acquires directly or indirectly all the shares or

more than 50% of shares, or acquires higher degree of controlling power or voting power

in other company is known as holding company.

2. . Cost of control / goodwill : Excess value paid over the nominal value of share and

capital reserve is called cost of control or goodwill.

Cost of control/ goodwill = Investment – Nominal Value of Shares – Capital Reserve.

3. Minority Interest : The amount of shares held by outside shareholders other than holding

company are called as minority group of shareholders. The aggregate of share capital,

proportionate share in the pre/post acquisition reserves, profits, and any profit on

appreciation in the value of fixed assets is considered as minority interest. The amount of

minority interest is shown on liability side of balance sheet.

Section B

I.

1 Share capital = 1,00,000

i. Anand (H) Ltd acquired 80% of shares = 80/100 X 1,00,000 =80,000/-

ii. Ashoka Ltd share capital= 1,00,000 - 80,000 = 20,000/-

Therefore share capital ratio = 80,000 : 20,000 = 4 : 1

2. Reserve fund :

Reserve fund on 31-12-2020 = 17,000

Reserve fund on 1-1- 2020 = 5,000

Reserve created during the year = 17,000 – 5,000 =12,000

I. Pre acquisition reserve

Reserve on 1-1-2020 = 5,000

Add : Proportion of reserve prior to the acquisition

( from 1-1-2020 to 1-5-2020= 4 months )

4/12 X 12,000 = 4,000

Total pre acquisition reserve = 9,000

This should be shared by both the companies in their share capital ratio i.e. 4:1

i. Anand Ltd = 4/5 X 9,000 = 7,200

ii. Ashoka Ltd = 1/5 X 9,000 = 1,800

II. Post acquisition reserve ;

= Reserve during the year – pre acquisition reserve

= 17,000 – 9,000 = 8,000

This should be share by both the companies in their share capital ratio.

Anand Ltd = 4/5 x 8,000 = 6,400

Ashoka Ltd = 1/5 X 8,000 = 1,600

3. Profit and loss A/c:

P& L A/c balance on 31-12-2020 = 30,000

P & L A/c Balance on 1-1-2020 = 6,000

Profit earned during the year = 24,000

i. Pre acquisition profit op bal = 6,000

Proportionate profit prior to acquisition

( 4/12 x 24,000) =8,000

Total pre acquisition profit =14,000

This should be share by both the companies in their share capital ratio i.e. 4 : 1

Anand Ltd = 4/5 X 14,000 =11,200

Ashoka Ltd = 1/5 X 14,000 = 2,800

ii. Post acquisition profit :

= profit on 31-12-2020 – pre acquisition profit

=30,000 – 14,000 = 16,000

This should be shared by both the companies in their share capital ratio i.e. 4 : 1

Anand Ltd = 4/5 X 16,000 = 12,800

Ashoka Ltd = 1/5 X 16,000 = 3,200

Chart showing holding co and subsidiary co interest.

Particulars Total Anand Ltd Ashoka ltd

1. Share capital (3:1) 1,00,000 80,000 20,000

2. Reserve fund

Pre acquisition reserve 9,000 7,200 1,800

Psot acquisition reserve 8,000 6,400 1,600

3. Profit and loss a/c

Pre acquisition profit 14,000 11,200 2,800

Post acquisition profit 16,000 12,800 3,200

Total 1,47,000 1,17,600

Section c

1.working notes :

1. share capital = sarvesh Ltd : Mahesh Ltd

=60,000 : 40,000

= 3:2

1. General reserve

i. Pre acquisition reserve =40,000

Sarevesh Ltd = 3/5 X 40,000 =24,000

Mahesh Ltd = 2/5 X 40,000 = 16,000

ii. Post acquisition reserve = nil

3 . P & L A/c

i. Pre acquisition = opening balance = 20,000

+ (3/12 X 50,000) =12,500

= 32,500

Sarrvesh Ltd = 3/5 X 32,500 = 19,500

Mahesh Ltd = 2/5 32,500 = 13,000

ii. Post acquisition = profit during the year =50,000

Less portion of pre acquisition =12,500

Post acquisition profit = 37,500

Sarvesh Ltd = 3/5 X 37,500 =22,500

Mahesh Ltd = 2/5 X 37,500 = 15,000

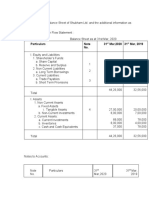

Calculation of minority interest ;

Particulars Total Sarvesh Ltd Mahesh Ltd

1. Share capital 1,00,000 60,000 40,000

2. General reserve

Pre acquisition 40,000 16,000

Post acquisition - - -

3. P&L A/c 32,500 19,500 13,000

Pre acquisition 37,500 22,500 15,000

Total 2,10,000 1,26,000 84,000

Notes to accounts :

Note, Particulars, Amount

1 Share capital

Shares @ 10 each 400,000

2 Reserves & Surplus

i. Capital Reserves -

ii. General reserve

Sarvesh Ltd = 60,000

+ share of S Ltd post Acquisition = 60,000

iii. P&L A/c

Sarvesh Ltd = (80,000+1,00,000) =1,80,000

Share in post acquisition = 22,500 =2,02,500 2,62,500

3 Minority Interest as per chart 84,000

4. Trade payable Sarvesh Ltd – 90,000

Mahesh Ltd -20,000 1,10,000

5 Tangible Fixed Assets , Sarvesh Ltd – 5,20,000

Mahesh Ltd – 1,00,000 6,20,000

6. Inventories:

Stock - Sarvesh Ltd – 20,000

Mahesh Ltd - 80,000 1,00,000

7 .Trade receivables: Drs : Sarvesh Ltd – 20,000

Mahesh Ltd – 20,000 40,000

8. cash and cash equivalents : Sarvesh Ltd – 20,000

Mahesh Ltd – 30,000 50,000

Particulars Note Amount

Equity and liabilities

1.shareholders funds

Share capital 1 4,00,000

Reserve and surplus 2 2,62,500 6,62,500

2. 2 .Minority interest 3 84,000

3.Current liabilities

Trade payables 4 1,10,000

Total equity and liabilities 8,56,500

Assets

1. Non current assets

Tangible fixed assets 5 6,20,000

Intangible fixed assets 46,500

2. Current assets

Inventories 6 1,00,000

Trade receivables 7 40,000

Cash and cash equivalents 8 50,000 1,90,000

Total assets 8,56,500

Consolidated Balance sheet of Anand Ltd with its subsidiary Ashoka Ltd as

You might also like

- Business PlanDocument32 pagesBusiness PlanArvind Sanu Misra100% (5)

- Disbur Form Series 100-500, 800 & 801Document12 pagesDisbur Form Series 100-500, 800 & 801Geno GottschallNo ratings yet

- Financial Management Midtem ExamDocument4 pagesFinancial Management Midtem Examzavria100% (1)

- Consolidated Financial StatementDocument6 pagesConsolidated Financial StatementUdit RajNo ratings yet

- Manual For Finance QuestionsDocument56 pagesManual For Finance QuestionssamiraZehra85% (13)

- Financial ManagementDocument65 pagesFinancial Managementshekharnishu96% (27)

- Corporate Accounting - IIDocument2 pagesCorporate Accounting - IISiva KumarNo ratings yet

- Chartered Accountancy Professional Ii (Cap-Ii) : Revision Test Paper Group I December 2021Document81 pagesChartered Accountancy Professional Ii (Cap-Ii) : Revision Test Paper Group I December 2021Arpan ParajuliNo ratings yet

- CMA Volume 2 MergedDocument153 pagesCMA Volume 2 MergedShyaambhavi NsNo ratings yet

- Cap III Group I RTP Dec 2023Document111 pagesCap III Group I RTP Dec 2023meme.arena786No ratings yet

- MA Assignment IVDocument16 pagesMA Assignment IVJaya BharneNo ratings yet

- Management Accouting Assignment4 Manish Chauhan (09-1128) .Document17 pagesManagement Accouting Assignment4 Manish Chauhan (09-1128) .manishNo ratings yet

- BBS 1st Year QuestionDocument2 pagesBBS 1st Year Questionsatya100% (1)

- Unit - 4: Amalgamation and ReconstructionDocument54 pagesUnit - 4: Amalgamation and ReconstructionAzad AboobackerNo ratings yet

- Ratio Analysis - Advanced QuestionsDocument5 pagesRatio Analysis - Advanced Questionsrobinkapoor100% (2)

- UNIT (24) 2.08 CONSOLIDATED bALANCE SHEET PROBLEMDocument4 pagesUNIT (24) 2.08 CONSOLIDATED bALANCE SHEET PROBLEMAaryan K MNo ratings yet

- Class 12 Accountancy CBSE Cash Flow StatementDocument7 pagesClass 12 Accountancy CBSE Cash Flow StatementSarvesh SreedharNo ratings yet

- 232 FM AssignmentDocument17 pages232 FM Assignmentbhupesh joshiNo ratings yet

- 54232bos43539cp4 U4Document53 pages54232bos43539cp4 U4Akash KamathNo ratings yet

- 3 Solution Q.5Document4 pages3 Solution Q.5Aayush AgrawalNo ratings yet

- Corporate Accounting ProblemDocument6 pagesCorporate Accounting ProblemparameshwaraNo ratings yet

- Notes Holding CompanyDocument4 pagesNotes Holding CompanySaurav NasaNo ratings yet

- III - 5th Sem - AmalgamationDocument34 pagesIII - 5th Sem - AmalgamationAysha RiyaNo ratings yet

- Module-2 Equity Valuation Numerical For StudentsDocument11 pagesModule-2 Equity Valuation Numerical For Studentsgaurav supadeNo ratings yet

- Accounts Home Test 2Document7 pagesAccounts Home Test 2Ashish RaiNo ratings yet

- Answer For Exercises Online Learning 1Document4 pagesAnswer For Exercises Online Learning 1Xiao Yun YapNo ratings yet

- Holding CompanyDocument3 pagesHolding CompanySundarNo ratings yet

- B326 MTA Fall 2017-2018 MGLDocument7 pagesB326 MTA Fall 2017-2018 MGLmjlNo ratings yet

- Dwaraka Doss Goverdhan Doss Vaishnav College (Autonomous) Arumbakkam, Chennai - 600 106. Department of Corporate Secretaryship Core Paper V-Corporate AccountingDocument4 pagesDwaraka Doss Goverdhan Doss Vaishnav College (Autonomous) Arumbakkam, Chennai - 600 106. Department of Corporate Secretaryship Core Paper V-Corporate AccountingNeeraj DNo ratings yet

- PDF RemoverDocument6 pagesPDF RemoversurajNo ratings yet

- Fund Flow Statement-FR FSADocument27 pagesFund Flow Statement-FR FSADãrk LïghtNo ratings yet

- Bus Com 3Document11 pagesBus Com 3Shiela Mae RedobleNo ratings yet

- AmalgamationDocument15 pagesAmalgamationTejasree SaiNo ratings yet

- Abyas Amalgamation IPCC G 1 & 2Document34 pagesAbyas Amalgamation IPCC G 1 & 2Caramakr ManthaNo ratings yet

- 5238 - Year - M.Com. (With Credits) - Regular-Semester 2012 Sem IV (Old) Subject - MCOM241 - Advanced Management Accounting PDFDocument5 pages5238 - Year - M.Com. (With Credits) - Regular-Semester 2012 Sem IV (Old) Subject - MCOM241 - Advanced Management Accounting PDFUnplanned VideosNo ratings yet

- FR (New) A MTP Final Mar 2021Document17 pagesFR (New) A MTP Final Mar 2021ritz meshNo ratings yet

- Company Acc B.com Sem Iv...Document8 pagesCompany Acc B.com Sem Iv...Sarah ShelbyNo ratings yet

- Advanced AccountingDocument12 pagesAdvanced AccountingmayuriNo ratings yet

- Cash Flow Statement Activity Wise 05-02-24Document7 pagesCash Flow Statement Activity Wise 05-02-24navyabindra28No ratings yet

- CASH FLOW Revision-1 PDFDocument12 pagesCASH FLOW Revision-1 PDFBHUMIKA JAINNo ratings yet

- Advanced AccountingDocument68 pagesAdvanced AccountingOsamaNo ratings yet

- Work Book of Corporate Financial Accounting 23-04-2022Document33 pagesWork Book of Corporate Financial Accounting 23-04-2022SWAPNIL JADHAVNo ratings yet

- FINMAN MIDTERMS FinalDocument5 pagesFINMAN MIDTERMS FinalJennifer RasonabeNo ratings yet

- Admission Capital AdjustmentsDocument6 pagesAdmission Capital AdjustmentsHamza MudassirNo ratings yet

- ConsolidationDocument7 pagesConsolidationNURUL ISTIQOMAH -No ratings yet

- Ca QP ModelDocument3 pagesCa QP Modelmahabalu123456789No ratings yet

- 3054 Faca-V L 8Document8 pages3054 Faca-V L 8ab6154951No ratings yet

- AFM Q-BankDocument42 pagesAFM Q-Banks BNo ratings yet

- Unit-5 Mefa.Document12 pagesUnit-5 Mefa.Perumalla AkhilNo ratings yet

- Paper18 Solution PDFDocument24 pagesPaper18 Solution PDFI'm Just FunnyNo ratings yet

- Particulars Note No. 31 Mar, 2020 31 Mar, 2019: ST STDocument5 pagesParticulars Note No. 31 Mar, 2020 31 Mar, 2019: ST STAmit sinhaNo ratings yet

- Module 2 Shareholders Equity Students ReferenceDocument7 pagesModule 2 Shareholders Equity Students ReferencecynangelaNo ratings yet

- Financial Reporting & Financial Statement Analysis: Time - 3 Hours Group - ADocument6 pagesFinancial Reporting & Financial Statement Analysis: Time - 3 Hours Group - Atanmoy sardarNo ratings yet

- 5th Sem Accounts Previous Year PapersDocument25 pages5th Sem Accounts Previous Year PapersViratNo ratings yet

- Xii Acc Worksheetss-30-55Document26 pagesXii Acc Worksheetss-30-55Unknown patelNo ratings yet

- Financial Statement Analysis Probs On Funds Flow Analysis PDFDocument15 pagesFinancial Statement Analysis Probs On Funds Flow Analysis PDFSAITEJA ANUGULANo ratings yet

- Chapter 4 Partnership Liquidation Review QuestionsDocument7 pagesChapter 4 Partnership Liquidation Review QuestionsRea Odyth BunquinNo ratings yet

- DocumentDocument4 pagesDocumentTûshar ThakúrNo ratings yet

- Business Combination Accounted For Under The Equity MethodDocument4 pagesBusiness Combination Accounted For Under The Equity MethodMixx MineNo ratings yet

- Cash Flow Statement Numericals QDocument3 pagesCash Flow Statement Numericals QDheeraj BholaNo ratings yet

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- ACCA F1/ CAT FAB - Chapter 7 Corporate Governance and Corporate Social ResponsibilityDocument20 pagesACCA F1/ CAT FAB - Chapter 7 Corporate Governance and Corporate Social ResponsibilityNick Kai Chong Wong100% (3)

- Advertising and Public RelationsDocument34 pagesAdvertising and Public RelationsTahmidur Rahman TonmoyNo ratings yet

- Corruption Within International Engineering-Construction ProjectsDocument21 pagesCorruption Within International Engineering-Construction Projectskeemyhint5659100% (1)

- Master Time Factor TradingDocument52 pagesMaster Time Factor Tradingpaparock34100% (1)

- Financial Management and PolicyDocument658 pagesFinancial Management and PolicyJovana Veselinović100% (1)

- Achievements: Dhiru Bhai Ambani Built India's Largest Private Sector CompanyDocument3 pagesAchievements: Dhiru Bhai Ambani Built India's Largest Private Sector CompanyM Maisam SultaniNo ratings yet

- Merged Excel Prac QuestionDocument26 pagesMerged Excel Prac QuestionhibaNo ratings yet

- Introduction To: Capital MarketsDocument57 pagesIntroduction To: Capital MarketsTharun SriramNo ratings yet

- Ch03 (1) ExampleDocument7 pagesCh03 (1) ExampleShrey MangalNo ratings yet

- Cashflow AnalysisDocument3 pagesCashflow AnalysisAyeshaKhalidNo ratings yet

- Britannia Report and Financial Statements 2023Document58 pagesBritannia Report and Financial Statements 2023Bansari mehtaNo ratings yet

- Stock Valuation Part 1 Handout - 9-10Document4 pagesStock Valuation Part 1 Handout - 9-10Angela BonifeNo ratings yet

- Synopsis On: Submitted in Partial Fulfilment of The Award of The Degree ofDocument7 pagesSynopsis On: Submitted in Partial Fulfilment of The Award of The Degree ofMahaveer ChoudharyNo ratings yet

- PNB v. MegaprimeDocument2 pagesPNB v. MegaprimeMarjolaine De CastroNo ratings yet

- Inventory OptimizationDocument21 pagesInventory OptimizationAritra SenNo ratings yet

- Kepler Nova RETDocument2 pagesKepler Nova RETKepler NovaNo ratings yet

- Wallstreetjournal 20160105 The Wall Street JournalDocument40 pagesWallstreetjournal 20160105 The Wall Street JournalstefanoNo ratings yet

- An Efficient Frontier For Retirement IncomeDocument12 pagesAn Efficient Frontier For Retirement IncomeJulian RestrepoNo ratings yet

- Best Practices For A Board's Role in Risk Oversight: August 2006Document8 pagesBest Practices For A Board's Role in Risk Oversight: August 2006christelleNo ratings yet

- Session 6-7 Debit and Credit Rule - MIDTERMDocument13 pagesSession 6-7 Debit and Credit Rule - MIDTERMAnge BoboNo ratings yet

- MCHF 2 Investment MemorandumDocument44 pagesMCHF 2 Investment MemorandumwutNo ratings yet

- A Report On Accounting by Farhana Foysal SatataDocument12 pagesA Report On Accounting by Farhana Foysal SatataFarhana Foysal SatataNo ratings yet

- Asset Reconstruction CompanyDocument55 pagesAsset Reconstruction CompanyDhananjaya NaikNo ratings yet

- Exercises in English - VatelDocument18 pagesExercises in English - VatelQUYNHNo ratings yet

- Brochure FlexFundsDocument8 pagesBrochure FlexFundsRonny CastilloNo ratings yet

- Mercury - Case SOLUTIONDocument36 pagesMercury - Case SOLUTIONSwaraj DharNo ratings yet

- FIN250S ReportDocument13 pagesFIN250S Reportfairylucas708No ratings yet