Professional Documents

Culture Documents

IJIRT150532 - PAPER International

Uploaded by

piyushOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

IJIRT150532 - PAPER International

Uploaded by

piyushCopyright:

Available Formats

© December 2020| IJIRT | Volume 7 Issue 7 | ISSN: 2349-6002

Impact of Covid-19 on Digital Payment System: With

Special Reference to Women Customers of Mangalore

City

Dr. Sowmya Praveen K1, Dr. C.K. Hebbar2

1

Post Doctoral Fellow in commerce, Srinivas University, Mangalore

2

Research Professor, Srinivas University, Mangalore

Abstract - This paper highlights the Impact of Covid-19 People prefer these different kinds of payment modes

on digital payment system. After the effect of Covid-19, mainly because convenient, easy to use, saves time, no

the economy is started using more on digital payment need of going to bank branches, cashless transactions,

system compared to pre Covid-19 era. This occurred

no fear of losing cash, 24x7 service, non-banking

mainly because, people afraid of going outside. They fear

hours also one can get the banking facilities,

about the pandemic which spread drastically throughout

the economy. Most of the people were forced to move flexibility. But these digital payment systems are not

towards the digitalization. The main aim of preparing free from difficulties. The major issues of digital

this paper is to, study the impact of Covid-19 on digital payment systems are highlighted as follows, fear of

payment system. For the study researcher has selected fraud, hidden charges, technical issues, connectivity

the women respondents who uses different digital problems, server problems, network issues, lack of

payment modes to do their financial transactions. The knowledge, fear of data leakage, complicated

area selected for the study is in and around Mangalore instructions, non- availability of up to date information

city. The sample size selected to conduct this research is

from the bank staffs, lack of trust and so on.

50 women respondents.

Index Terms - Covid-19, digital payment, benefits, 2. OBJECTIVES

problems

1.INTRODUCTION The objectives of the study are as follows.

• To study the concept of digital payment system

Covid-19 pandemic has adversely affected the entire • To know the usages of digital payments

economy, even the Indian economy as well very badly. • To highlight the issues of digital payment systems

From March 24th onwards, throughout the nation

Lockdown are started. This affected almost all the 3. METHODOLOGY

sectors, all the offices, malls, temples, schools,

colleges, hotels were shut down. People stopped going For the present study, the researcher has used both

out from their leaving places. This has given a major primary and secondary data to collect the necessary

effect on the digital payment system. Before Covid- information’s. Primary data is collected from

19, people prefer to use digital payment systems, but structured questionnaire and interview method and

after the pandemic effect the number of user’s has secondary data are collected from peer reviewed

increased drastically. journals, books and relevant websites. The study is

There are many digital payment modes are available conducted in Mangalore City, the sample size chosen

in India as well a throughout the world. The major for the study is 50 women respondents, who uses

payment modes are ATM/ Debit card, credit card, digital payments to do their banking transactions.

Google pay, phone pay, different banking apps, Statistical tools used for the study are frequency,

Paytm, NEFT, RTGS, POS, IMPS, Mobile wallets, percentage, and mean method. Likert’s five scale

Internet banking and many more. method is used to frame the frequencies.

IJIRT 150532 INTERNATIONAL JOURNAL OF INNOVATIVE RESEARCH IN TECHNOLOGY 124

© December 2020| IJIRT | Volume 7 Issue 7 | ISSN: 2349-6002

4. STATEMENT OF THE PROBLEM 24% of the respondents were single, this shows that

majority of the married women respondents were

In today’s highly technical world, technology plays a using digital payment systems.

vital role. Most of the people prefer latest technology Study reveals that, 50% of the respondents were

rather than manual systems. This gives a major impact graduates, 30% of the respondents were PG holders

on information and technology field. Even in banking and remaining 20% of the respondents having the

sector also many changes have occurred from the past educational qualification of Diploma and PUC.

few years. Majority of the customers prefer online 36% of the respondents were salaried people, 24% of

payment modes instead of traditional payment the respondents belongs to professional category, 22%

method. Due to Covid-19, the usage of digital payment of the respondents were self-employed and 18% of the

system has increased tremendously. The impact of respondents belongs to other category i.e. home

Covid-19 has forced many of the customers to go for makers.

online payments rather than direct payment systems. 12% of the respondents belongs to less-than 20 years

Digital payment system is very useful to all of the of age, 40% of the respondents belongs to 20-30 years

users. There will be lot of benefits from digital of age, 30% of the respondents belongs to 30-40 years

payment system, but at the same time, customers also of age and 18% of the respondents were in the age of

face some difficulties from this system. Hence, this above 40 years.

gave me an opportunity to study the impact of Covid-

19 on digital payment system: with special reference 4.2Survey Questionnaire

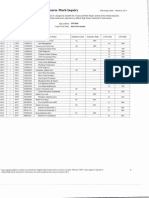

to women customers of Mangalore City. Table 2: Duration of using digital payment system

PARTICULARS NO OF PERCENTAGE

4.1 Data Analysis and Interpretation RESPONDENTS

Table 1; Demographic profile of the respondents Less than 1 year 2 4%

PARTICULARS NO OF PERCENTAGES 1-5 years 18 36%

RESPONDENTS 5-10 years 20 40%

A. GENDER More than 10 years 10 20%

Female 50 100%

Total 50 100%

Total 50 100%

B. Marital status Source: Primary data

Single 12 24%

Married 38 76% Figure 1: Duration of using digital payment system

Total 50 100% Study shows that, 4% of the respondents were using

C. Educational

Qualification digital payments from less than 1 year, 36% of the

UG 25 50% respondents were using digital payments from 1-5

PG 15 30% years, 40% of the respondents were using it from 5-10

Others 10 20% years and 20% of the respondents were using from

Total 50 100%

more than 10 years. This shows that majority of the

D. Occupation

Salaried 18 36% customers are preferring online payment systems

Professional 12 24% compared traditional banking payment modes.

Self employed 11 22%

Others 9 18% Table 3: Different digital payment methods used by

Total 50 100%

AGE

the customers.

Below 20 years 6 12% PARTICULARS NO OF RESPONDENTS

20-30 years 20 40% ATM/ Debit card 50

30-40 years 15 30% Credit card 10

Above 40 years 9 18% Google pay 40

Total 50 100% Phone pay 15

Source: Primary data Paytm 13

The study shows that, all the 100% of the respondents Internet banking 24

were women customers who uses digital payment Source: Primary data

systems. 76% of the respondents were married and

IJIRT 150532 INTERNATIONAL JOURNAL OF INNOVATIVE RESEARCH IN TECHNOLOGY 125

© December 2020| IJIRT | Volume 7 Issue 7 | ISSN: 2349-6002

The study shows that, all the 50 respondents were payment includes water bill, electricity bill, grocery

using ATM/ Debit card for online payment, 10 bills and many more kinds of bills.

respondents were using credit card, 40 respondents PARTICUL SCOR SCOR SCOR SCOR SCOR

were using Google Pay, 15 respondents were using AR E1 E2 E3 E4 E5

Bill -- -- 5 35 10

phone pay, 13 respondents were preferred Paytm, and

payment

24 respondents were preferred internet banking

shopping -- -- 2 40 8

system. This shows that ATM card users are more

Source: Primary data

compared to other methods of payment systems.

The above table shows that, after the impact of Covid-

Table 4: After the impact of Covid-19, the usage rate

19, the usage rate of digital payments has increased in

of digital payments for the following transactions.

large numbers. Study shows that 35 respondents agree

For the below table score 1 indicates very less, score 2

that they use online payment modes for bill payment

indicates less, score 3 indicates neutral, score 4

and 40 respondents agree that they were using digital

indicates high and score 5 indicates very high. Bill

payment systems for shopping purposes.

Table 5: The benefits of using digital payment systems to the customers

PARTICULARS STRONGLY AGREE NEUTRAL DISAGREE STRONGLY MEAN

AGREE DISAGREE

Convenient 30 18 2 -- -- 4.56

Saves time 35 15 -- - - 4.7

24x7 service 40 10 -- -- -- 4.8

Easy to use 30 10 5 5 -- 4.3

Flexibility 20 20 8 2 -- 4.16

Increase prestige 20 17 13 - - 4.14

Cash less transaction 40 10 -- - - 4.8

Non-banking hours also can get the benefit 40 10 - - - 4.8

Source: Primary data

The data shows that 30 each respondent were strongly each respondents were strongly agree towards

agree towards the convenient factor and easy to use flexibility and increases prestige.

points, 35 respondents were strongly agree towards The mean value for these different points is convenient

saves time, 40 each respondents were strongly agree (4.56), saves time (4.7), 24x7 service (4.8), easy to use

towards 24x7 service, cash-less transaction and non- (4.3), flexibility (4.16), increase prestige (4.14), cash

banking hours also one can get the benefits and 20 less transaction (4.8), non-banking hours also one can

get the benefits (4.8).

Table 6: The difficulties faced by the customers from digital payment systems

PARTICULAR STRONGLY DISAGREE NEUTRAL AGREE STRONGLY MEAN

DISAGREE AGREE

Server problems - 4 6 30 10 3.92

Lack to knowledge - 15 10 20 5 3.3

Technical errors - - 5 35 10 4.1

Fear of fraud - 5 15 20 10 3.7

Hidden charges - - 10 35 5 3.9

Connectivity issues - 1 10 35 4 4.24

Lack of up-to-date information - 3 12 32 3 3.7

Lack of security - 4 12 34 - 3.6

Fear of losing money - - 11 35 4 3.86

Complicated instructions - 11 10 27 2 3.4

Source: Primary data

The study shows that respondents are strongly agree like server problems, lack of knowledge, fear of fraud,

towards the problems like technical error and hidden charges, lack of up-to-date information, lack of

connectivity issues. As well respondents are agreed security, fear of losing money and complicated

towards the other problems of digital payment systems instructions.

IJIRT 150532 INTERNATIONAL JOURNAL OF INNOVATIVE RESEARCH IN TECHNOLOGY 126

© December 2020| IJIRT | Volume 7 Issue 7 | ISSN: 2349-6002

The mean values are server problems (3.92), lack of modes are available in India, but most of the customers

knowledge (3.3), technical error (4.1), fear of fraud prefer only few digital payment modes. Because they

(3.7), hidden charges (3.9), connectivity issues (4.24), were not having enough information of all the

lack of up-to-date information (3.7), lack of security available digital payment systems. Hence the bank

(3.6), fear of losing money (3.86), complicated should give proper awareness programs, so that

instructions (3.4). customers will get the latest information and they can

Table 7: Do you want to continue using digital make use of all the available facilities.

payment systems.

PARTICULARS NO OF PERCENTAGE REFERENCE

RESPONDENTS

Yes 50 100

[1] Yathish K and Sowmya K. (2017). “Customer

No -- --

satisfaction factors towards E-Banking services:

Total 50 100

study with reference to Axis bank of Mangalore

Source: Primary data

City”. International Journal of scientific

Study shows that, all the 50 respondents wants to

engineering and research, 5(11), 87-89.

continue with using digital payment systems for the

[2] Sowmya K and Yathish K. (2017). Customer

banking transactions. This shows that, even though

perception towards E-Banking services: A study

there are some difficulties from online payment

with reference to ICICI Bank of Mangalore City.

systems, still people prefer to use digital payment

Journal of commerce, management and social

modes. This shows that benefits are more compared

science, 6(1), 36-39.

with the problems.

[3] Sumi F. R., & Safiullah A. B. (2014). Problems

and Prospects of Plastic Money in

5. SUGGESTIONS

Bangladesh. IOSR Journal of Business &

Management, 16 (12), 31-38.

The few suggestions of the study are as follows:

[4] Gautam, L., & Khare, S. K. (2014). E-Banking in

• Bank should concentrate more on server and

India: Issues and challenges. Scholar Journal of

connectivity related issues. So that without any

Economics, Business and Management, 1(2), 54-

problem, one can get the benefits.

56.

• If any new techniques are installed, same should

[5] Kumar Yathish and K Sowmya (2017). E-

be educated to the customers. Hence, they will get

Banking implications: A study of employee’s

the up-to-date information.

perceptions with reference to SBI Bank of

• Bank should conduct some workshops to their Mangalore City. International society for green,

customers, this helps the customers to discuss sustainable engineering and management, 4(8),

their problems and they will get the solutions at 28-33.

the right time. [6] Kumar Yathish and K Sowmya (2017). E-

• Customers are having the fear of frauds (hackers); Banking technology: A study of factors

hence the banking system should give awareness influencing job satisfaction with reference to

to the customers, not to share their banking Canara Bank of Mangalore City. International

details, pin numbers, OTP and so on. society for green, sustainable engineering and

• The number of credit card users are very less management, 4(8), 34-39.

compared to debit card, because of the fear of [7] Kazmi S. S. A., & Hashim, M. (2015). E-banking

hidden charges, hence the bank should give in Pakistan: issues and challenges. International

detailed instructions of the bank charges Journal of Academic Research in Business and

applicable to credit cards. Social Sciences, 5(3), 50-54

[8] Vimala, V., & Sarala, K. S. (2013). Usage and

6.CONCLUSIONS perception of plastic money among the customers

of bank of India: An empirical study. Asian

This study highlights the impact of Covid-19 on digital Journal of Research in business Economics and

payment system. There are many digital payment Management, 3(4), 24-37.

IJIRT 150532 INTERNATIONAL JOURNAL OF INNOVATIVE RESEARCH IN TECHNOLOGY 127

© December 2020| IJIRT | Volume 7 Issue 7 | ISSN: 2349-6002

[9] Sowmya PK and Hebbar CK. (2020). Employees

perceptions and challenges: with regards to core

banking solutions- A study with reference to

Canara bank of Mangalore City. Juni Khyat UGC

Care group I Listed Journal, 10(11), 76-81.

[10] Sowmya PK and Hebbar CK. (2020). Customer

Perception on the usage of ATM – A study with

reference to Mangalore City. International Journal

of Multidisciplinary Educational Research, 9(11-

5), 126-131.

IJIRT 150532 INTERNATIONAL JOURNAL OF INNOVATIVE RESEARCH IN TECHNOLOGY 128

You might also like

- The Definition, Identification, and Measurement of Cash Flows Relevant To Project EvaluationDocument11 pagesThe Definition, Identification, and Measurement of Cash Flows Relevant To Project EvaluationpiyushNo ratings yet

- Capital Budgeting DecisionsDocument50 pagesCapital Budgeting DecisionspiyushNo ratings yet

- Introduction To Corporate FinanceDocument42 pagesIntroduction To Corporate FinancepiyushNo ratings yet

- Impact of Covid 19 On Digital Transaction in IndiaDocument55 pagesImpact of Covid 19 On Digital Transaction in IndiapiyushNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- ADocument54 pagesActyvteNo ratings yet

- Philodendron Plants CareDocument4 pagesPhilodendron Plants CareSabre FortNo ratings yet

- RCA LCD26V6SY Service Manual 1.0 PDFDocument33 pagesRCA LCD26V6SY Service Manual 1.0 PDFPocho Pochito100% (1)

- Practice Problems - Electrochemical CellDocument5 pagesPractice Problems - Electrochemical CellYehia IbrahimNo ratings yet

- Practice - Test 2Document5 pagesPractice - Test 2Nguyễn QanhNo ratings yet

- AIIMS 2015 Solved PaperDocument436 pagesAIIMS 2015 Solved PaperSurya TejaNo ratings yet

- The Chemistry of The Colorful FireDocument9 pagesThe Chemistry of The Colorful FireHazel Dela CruzNo ratings yet

- FHWA Guidance For Load Rating Evaluation of Gusset Plates in Truss BridgesDocument6 pagesFHWA Guidance For Load Rating Evaluation of Gusset Plates in Truss BridgesPatrick Saint-LouisNo ratings yet

- Img 20150510 0001Document2 pagesImg 20150510 0001api-284663984No ratings yet

- Origin ManualDocument186 pagesOrigin ManualmariaNo ratings yet

- Reference Paper Literature ReviewDocument5 pagesReference Paper Literature ReviewAani RashNo ratings yet

- Caterpillar Cat C7 Marine Engine Parts Catalogue ManualDocument21 pagesCaterpillar Cat C7 Marine Engine Parts Catalogue ManualkfsmmeNo ratings yet

- John DrydenDocument3 pagesJohn DrydenDunas SvetlanaNo ratings yet

- WWW Studocu Com in N 29646569 Sid 01682568219Document1 pageWWW Studocu Com in N 29646569 Sid 01682568219Nivetha SelvamuruganNo ratings yet

- Perdarahan Uterus AbnormalDocument15 pagesPerdarahan Uterus Abnormalarfiah100% (1)

- European Asphalt Standards DatasheetDocument1 pageEuropean Asphalt Standards DatasheetmandraktreceNo ratings yet

- DirectionDocument1 pageDirectionJessica BacaniNo ratings yet

- Iguard® LM SeriesDocument82 pagesIguard® LM SeriesImran ShahidNo ratings yet

- Mushroom Project - Part 1Document53 pagesMushroom Project - Part 1Seshadev PandaNo ratings yet

- A.meaning and Scope of Education FinalDocument22 pagesA.meaning and Scope of Education FinalMelody CamcamNo ratings yet

- 18 Composition Rules For Photos That ShineDocument20 pages18 Composition Rules For Photos That Shinemahfuzkhan100% (1)

- Work Breakdown StructureDocument8 pagesWork Breakdown StructurerenshagullNo ratings yet

- CG Photo Editing2Document3 pagesCG Photo Editing2Mylene55% (11)

- Tangerine - Breakfast Set Menu Wef 16 Dec UpdatedDocument3 pagesTangerine - Breakfast Set Menu Wef 16 Dec Updateddeveloper louNo ratings yet

- Imabalacat DocuDocument114 pagesImabalacat DocuJänrëýMåmårìlSälängsàngNo ratings yet

- Zomato Restaurant Clustering & Sentiment Analysis - Ipynb - ColaboratoryDocument27 pagesZomato Restaurant Clustering & Sentiment Analysis - Ipynb - Colaboratorybilal nagoriNo ratings yet

- CATaclysm Preview ReleaseDocument52 pagesCATaclysm Preview ReleaseGhaderalNo ratings yet

- PD3 - Strategic Supply Chain Management: Exam Exemplar QuestionsDocument20 pagesPD3 - Strategic Supply Chain Management: Exam Exemplar QuestionsHazel Jael HernandezNo ratings yet

- Mission and VisionDocument5 pagesMission and VisionsanjedNo ratings yet

- Culture 2007 2013 Projects Overview 2018-03-18Document133 pagesCulture 2007 2013 Projects Overview 2018-03-18PontesDeboraNo ratings yet