Professional Documents

Culture Documents

Schedule 1 Schedule of Sales/Receipts and Output Tax (Attach Additional Sheet, If Necessary)

Uploaded by

Francis M. TabajondaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Schedule 1 Schedule of Sales/Receipts and Output Tax (Attach Additional Sheet, If Necessary)

Uploaded by

Francis M. TabajondaCopyright:

Available Formats

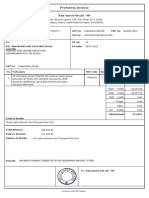

For the Month of (MM/YYYY) 11 - November 2020 Amended Return? Yes No No.

of Sheets Attached 0

4 TIN 445 683 770 000 5 RDO 23B 6 Line of Business CONSTRUCTION

Code

7 Taxpayer's Name ADVANCED FOUNDATION CONSTRUCTION SYSTEM CORP./CHRISTIAN IAN CONSTRUCTION CORP.8JOINT

Telephone No.

VENTURE 000

9 Registered Address #2 BO, BRGY. SOLEDAD, STA ROSA, NUEVA ECIJA 10 Zip Code 3101

11 Are you availing of tax relief under Special Law / International Tax Treaty? Yes No If yes, specify

Sales/Receipts for the Month (Exclusive of VAT) Output Tax Due for the Month

12 Vatable Sales/Receipt - Private ( Sch.

Sch. 11 ) 12A 0.00 12B 0.00

13 Sales to Government 13A 0.00 13B 0.00

14 Zero Rated Sales/Receipts 14 0.00

15 Exempt Sales/Receipts 15 0.00

16 Total Sales/Receipts and Output Tax Due 16A 0.00 16B 0.00

17 Less: Allowable Input Tax

17A Input Tax Carried Over from Previous Period 17A 0.00

17B Input Tax Deferred on Capital Goods Exceeding P1Million from Previous Period 17B 0.00

17C Transitional Input Tax 17C 0.00

17D Presumptive Input Tax 17D 0.00

17E Others 17E 0.00

17F Total (Sum of Item 17A, 17B, 17C, 17D & 17E) 17F 0.00

18 Current Transactions Purchases

18A/B Purchase of Capital Goods not exceeding P1Million (See

18A 0.00 18B 0.00

Sch.

Sch. 22 )

18C/D Purchase of Capital Goods exceeding P1Million (See Sch.

Sch. 18C 0.00 18D 0.00

33 )

18E/F Domestic Purchases of Goods Other than Capital Goods 18E 0.00 18F 0.00

18G/H Importation of Goods Other than Capital Goods 18G 0.00 18H 0.00

18I/J Domestic Purchase of Services 18I 0.00 18J 0.00

18K/L Services rendered by Non-residents 18K 0.00 18L 0.00

18M Purchases Not Qualified for Input Tax 18M 0.00

18N/O Others 18N 0.00 18O 0.00

18P Total Current Purchases (Sum of Item 18A, 18C, 18E, 18G,

18P 0.00

18I, 18K, 18M & 18N)

19 Total Available Input Tax (Sum of Item 17F, 18B, 18D, 18F, 18H, 18J, 18L & 18O) 19 0.00

20 Less: Deductions from Input Tax

20A Input Tax on Purchases of Capital Goods exceeding P1Million deferred for the succeeding period (See Sch.

Sch. 33 )20A 0.00

20B Input Tax on Sale to Gov't. closed to expense ( Sch.

Sch. 44 ) 20B 0.00

20C Input Tax allocable to Exempt Sales ( Sch.

Sch. 55 ) 20C 0.00

20D VAT Refund/TCC claimed 20D 0.00

20E Others 20E 0.00

20F Total (Sum of Item 20A, 20B, 20C, 20D & 20E) 20F 0.00

21 Total Allowable Input Tax (Item 19 less Item 20F) 21 0.00

22 Net VAT Payable (Item 16B less Item 21) 22 0.00

23 Less: Tax Credits/Payments

23A Creditable Value-Added Tax Withheld (See Sch.

Sch. 66 ) 23A 0.00

23B Advance Payment ( Sch.

Sch. 77 ) 23B 0.00

23C VAT withheld on Sales to Government ( Sch. 8 ) 23C 0.00

23D VAT paid in return previously filed, if this is an amended return 23D 0.00

23E Advance Payments made (please attach proof of payments - BIR Form No. 0605) 23E 0.00

23F Others 23F 0.00

23G Total Tax Credits/Payment (Sum of Item 23A, 23B, 23C, 23D & 23E) 23G 0.00

24 Tax Still Payable/(Overpayment) (Item 22 less Item 23F) 24 0.00

25 Add Penalties Surcharge Interest Compromise

25A 0.00 25B 0.00 25C 0.00 25D 0.00

26 Total Amount Payable/ (Overpayment) (Sum of Items 24 & 25D) 26 0.00

I declare, under the penalties of perjury, that this return has been made in good faith, verified by me, and to the best of my knowledge, and

belief, is true and correct, pursuant to the provisions of the National Internal Revenue Code, as amended, and the regulations issued under authority thereof.

27______________________________________________________________________________ 28_____________________________

President/Vice President/Principal Officer/Accredited Tax Agent/ Treasurer/Assistant Treasurer

Authorized Representative/Taxpayer (Signature Over Printed Name)

(Signature Over Printed Name)

_______________________________________ ______________________________________ ______________________________

Title/Position of Signatory TIN of Signatory Title/Position of Signatory

_______________________________________ _______________ _______________ ______________________________

Tax Agent Acc. No./Atty's Roll No.(if applicable) Date of Issuance Date of Expiry TIN of Signatory

Machine Validation/Revenue Official Receipt Details (If not filed with an Authorized Agent Bank)

Schedule 1 Schedule of Sales/Receipts and Output Tax (Attach additional sheet, if necessary)

Amount of Sales/Receipts For

Industry Covered by VAT ATC Output Tax for the Period

the Period

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Conneqt Business Solutions Limited: 88329 M Lakshmi Narasimha SwamyDocument2 pagesConneqt Business Solutions Limited: 88329 M Lakshmi Narasimha SwamyNaganna M0% (1)

- Salary Slip May 2019Document1 pageSalary Slip May 2019Lalsiemlien HmarNo ratings yet

- Payment Detail Inquiry SeptDocument1 pagePayment Detail Inquiry SeptFrancis M. TabajondaNo ratings yet

- Quarterly Remittance Return: of Creditable Income Taxes Withheld (Expanded)Document2 pagesQuarterly Remittance Return: of Creditable Income Taxes Withheld (Expanded)Francis M. TabajondaNo ratings yet

- Quarterly Value-Added Tax ReturnDocument2 pagesQuarterly Value-Added Tax ReturnFrancis M. TabajondaNo ratings yet

- Foreign Investment Act of 1991Document11 pagesForeign Investment Act of 1991Francis M. TabajondaNo ratings yet

- Final Exam PbeDocument3 pagesFinal Exam PbeFrancis M. TabajondaNo ratings yet

- Mba Marketing ExamsDocument8 pagesMba Marketing ExamsFrancis M. Tabajonda100% (1)

- G.R. No. L-25043 J EN BANC J April 26 J 1968 J BENGZON J J.P J JDocument2 pagesG.R. No. L-25043 J EN BANC J April 26 J 1968 J BENGZON J J.P J JarzaianNo ratings yet

- Exemption Certificate - SalesDocument2 pagesExemption Certificate - SalesExecutive F&ADADUNo ratings yet

- Form-Cp502 Year 2024Document1 pageForm-Cp502 Year 2024Peggy NgNo ratings yet

- Computation Draft Shubham RefundDocument5 pagesComputation Draft Shubham RefundShubham JainNo ratings yet

- Ewt Exam - FormareDocument3 pagesEwt Exam - FormareMikaela SalvadorNo ratings yet

- 1606-VAT Regs - Susana D LeeDocument2 pages1606-VAT Regs - Susana D LeeHanabishi RekkaNo ratings yet

- Income Tax Payment Challan: PSID #: 21114984Document1 pageIncome Tax Payment Challan: PSID #: 21114984Zia Sultan AwanNo ratings yet

- ANDSLITEDocument1 pageANDSLITESrishti GaurNo ratings yet

- Imprisonment For Six Months Imprisonment For One Year A Fine Equal To The Amount of Tax PayableDocument2 pagesImprisonment For Six Months Imprisonment For One Year A Fine Equal To The Amount of Tax Payablectgshabbir3604No ratings yet

- Corporation NotesDocument2 pagesCorporation NotesKip PygmanNo ratings yet

- Plotno.14, Rajiv Gandhi Infotech Park, Hinjewadi, Phase-Iii, Midc-Sez, Village Man Taluka Mulshi, Pune, Maharashtra, 411057Document3 pagesPlotno.14, Rajiv Gandhi Infotech Park, Hinjewadi, Phase-Iii, Midc-Sez, Village Man Taluka Mulshi, Pune, Maharashtra, 411057Ravi RanjanNo ratings yet

- Assignment: Mr. Chinmay Dev TiwariDocument4 pagesAssignment: Mr. Chinmay Dev TiwariShanu AggarwalNo ratings yet

- Amendment Bihar Industries DepartmentDocument23 pagesAmendment Bihar Industries DepartmentM MNo ratings yet

- Guide To Taxation of Employee Disability Benefits: Standard Insurance CompanyDocument26 pagesGuide To Taxation of Employee Disability Benefits: Standard Insurance CompanyJacen BondsNo ratings yet

- Paseo Realty and Dev't. Corp. v. CA, 309 SCRA 402Document2 pagesPaseo Realty and Dev't. Corp. v. CA, 309 SCRA 402Jo DevisNo ratings yet

- Form 4029Document2 pagesForm 4029Brett BaldwinNo ratings yet

- PDFDocument1 pagePDFThei WhouhNo ratings yet

- W-9 FormDocument2 pagesW-9 FormTrish HitNo ratings yet

- Clipboard Office Supply S March 31 2014 Balance Sheet FollowsDocument1 pageClipboard Office Supply S March 31 2014 Balance Sheet FollowsAmit PandeyNo ratings yet

- CFWB015Document2 pagesCFWB015Yeshaya DorfmanNo ratings yet

- Room 206Document2 pagesRoom 206Hotel EkasNo ratings yet

- Ganesh PayslipDocument1 pageGanesh PayslipBADI APPALARAJUNo ratings yet

- OID Tax Diagram 3Document2 pagesOID Tax Diagram 3ricetech100% (14)

- Solved Diane and Peter Were Divorced in 2010 The Divorce AgreementDocument1 pageSolved Diane and Peter Were Divorced in 2010 The Divorce AgreementAnbu jaromiaNo ratings yet

- Enabling Assessment 4Document7 pagesEnabling Assessment 4Nicole BatoyNo ratings yet

- Proforma Invoice: Kala Genset PVT LTD - MPDocument1 pageProforma Invoice: Kala Genset PVT LTD - MPRajender KapoorNo ratings yet

- 2022 Chart - Barrister - Family CalculationsDocument3 pages2022 Chart - Barrister - Family CalculationsManit SainiNo ratings yet

- Multiple Choice - Problems Part 1: A. Percentage TaxDocument8 pagesMultiple Choice - Problems Part 1: A. Percentage TaxWearIt Co.No ratings yet