Professional Documents

Culture Documents

Create Final

Uploaded by

Hey it's RayaCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Create Final

Uploaded by

Hey it's RayaCopyright:

Available Formats

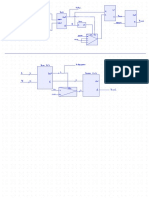

CREATEL

AW

Cor

por

ateRecov

eryandTaxIncent

ivesf

orEnt

erpr

isesAct

Republ

icActNo.11

534

(

Inf

ogr

aphi

csPar

t1)

DOMEST

ICCORPORAT

IONS RESI

DENTFOREI

GNCORPORAT

IONS

Bef

ore CREAT

E Bef

ore CREAT

E

St

art

ingJul

y01

,2020*

-25%;or

25%

30% 30% St

art

ingJul

y01

,2020*

-20% ,subj

ectt

obel

ow

condi

ti

ons: *Note:T

axabl

eincomedeemed

earnedequal

lyforeachmont

h

i

.NetTaxabl

eIncomeofnot

oftheyear

morethanP5M;and

i

i.Totalasset

sofnotmor e

Regul

ar thanP1 00M (

excl

udingland

RegularCor

porate

Corporat

e onwhi chthebusiness IncomeTax(RCIT

)

entit

y’soffice,plant

I

ncomeT ax(RCI

T) andequi pmentaresit

uated)

*Note:T

axabl

eincomedeemed

earnedequal

lyforeachmont

h

oftheyear

2% 1

% 2% 1

%

(

Jul

y01

,2020t

o June30,2023) (

Jul

y01

,2020t

o June30,2023)

Mi

nimum Cor

por

ateI

ncomeT

ax(

MCI

T) Mi

nimum Cor

por

ateI

ncomeT

ax(

MCI

T)

Additi

onal50% deduction Additi

onal50% deduction

Additi

onaldeductionfor Additi

onaldeductionfor

forlabortrai

ningexpense, forlabortrai

ningexpense,

labortrai

ningexpense: labortrai

ningexpense:

subjectt

obelow condit

ions: subjectt

obelow condit

ions:

-None -None

i

.nottoexceed10% ofdi

rect i

.nottoexceed10% ofdi

rect

l

aborwage; l

aborwage;

Non-deductibl

einter

est Non-deductibl

einter

est

i

i.cov

eredbyapprent

ices

hip expense: i

i.cov

eredbyapprent

ices

hip

expense:

agr

eement;and -33% ofint

eresti

ncome agr

eement;and

-33% ofint

eresti

ncome

subj

ectedtofinaltax i

ii

.suppor

tedbyDepEd, subj

ectedtofinaltax i

ii

.suppor

tedbyDepEd,

TESDAorCHEDcert

ificat

ion TESDAorCHEDcert

ificat

ion

Deducti

onsfrom Non-deductibl

einter

est Deducti

onsfrom Non-deductibl

einter

est

GrossIncome expense: GrossIncome expense:

-20% ofint

eres

tincome -20% ofint

eres

tincome

subj

ectedtofinaltax subj

ectedtofinaltax

1

0% Repeal

ed 1

0% -2021

1

0% ofnett

axabl

eincome

25% -Start

ing

January01

,2022

I

mpr

oper

lyAccumul

atedEar

ningsT

ax(

IAET

)

ROHQs

1

0% ofnet 1

%ofnett

axabl

eincome 1

0% ofgr

ossi

nterest

t

axabl

eincome (

Jul

y01

,2020t

o June30,2023)

i

ncomefr

om r

esident

s;

Subj

ecttoRCITand

exemptf

orincomef

rom othert

axes

non-r

esi

dents;

Pr

opr

iet

aryEducat

ionalI

nst

it

uti

onsandHos

pit

als ex

emptf

rom ot

hert

axes

OBUs

Divi

dendsfr

om NRFC -

Divi

dendsfr

om NRFC exemptfr

om incomet ax

-30% RCI

T subj

ecttobelow condit

ions: Int

eres

tonFCDUdeposi

ts Inter

estonFCDUdeposi

ts

i

.rei

nvest

mentint

hedomes

tic -7.

5% -15%

corpor

ation

CGTonunli

stedshar

es CGTonunl

ist

edshar

es

i

i.20% ormor

eowner

shi

p;and -5% /1

0% -1

5%

I

nter

corporat

e i

ii

.2yearsormor

ehol

ding

Di

vidends per

iod.

Fi

nalT

axonPas

siv

eIncome

NON-

RESI

DENTFOREI

GN V

ALUEADDEDT

AX

CORPORATI

ONS

Bef

ore CREAT

E Bef

ore CREAT

E

Exemptprovi

dedit -Requi

rementtoappearat

25% ongr

ossi

ncome appearsatregul

ar regul

arint

erval

sisremoved

30% ongr

ossi

ncome St

art

ingJanuar

y01

,2021 int

erval

s -Digi

talorel

ectr

onicfor

mat

i

ncludedintheexempti

on

-Journal

,oranyeducat i

onal

readi

ngmaterialcover

edby

theUNESCO agreement

i

ncludedintheexemption

Regul

arCor

por

ateI

ncomeT

ax(

RCI

T)

Sal

e,i

mpor

tat

ion,pr

int

ingorpubl

icat

ionofbook

s,anynews

paper

,magaz

ine

CGTonunli

stedshar

es CGTonunl

ist

edshar

es

-5% /1

0% -1

5% VATEx

empt

1

2% VAT (

Jan.01

,2021t

oDec.31

,2023)

Fi

nalT

axonPas

siv

eIncome Saleorimportat

ionofcapi

talequi

pment,itssparepart

sandr

awmat er

ial

s,

necessarytoproducePPEsanddr ugs

,incl

udingthoseforusei

ncl

ini

caltr

ial

s,drugs

,

v

accinesandmedicaldevi

cesforthetreat

mentofCOVID-1

9

Requir

edtaxcredi

tint

he Requir

edtaxcreditinthe

domicil

ecount

ry: domicil

ecountry:

-1

5% -

10% (st

art

ingJuly1,2020) VATexempt VATexempt

Star

ti

ngJanuar

y01

,2023 Star

ti

ngJanuar

y01

,2021

I

nter

cor

por

ateDi

vidends

Sal

eori

mport

ati

onofpr

escr

ipti

ondrugsandmedicinesf

orcancer

,

ment

ali

ll

nes

s,t

ubercul

osi

s,andkidneydi

seases

PERCENT

AGET

AX

Forques

tionsandcl

ari

ficat

ions

,cont

act

:

Bef

ore CREAT

E

LeaRoque

T+63289882288ex t

.550

3% 1

% M +6391753717

46

(

Jul

y01

,2020t

oJune30,2023)

Elea.

roque@ph.

gt.

com

DesPolit

ado-Aclan

Per

sonsEx

emptf

rom V

AT T+63289882288ex t

.523

M +63920971081 8

Edes.pol

it

ado-acl

an@ph.gt.

com

You might also like

- Corporate Recovery and Tax Incentives for Enterprises Act (Part 1Document1 pageCorporate Recovery and Tax Incentives for Enterprises Act (Part 1Makoy BixenmanNo ratings yet

- Create FinalDocument1 pageCreate FinalpierremartinreyesNo ratings yet

- Create-Final RA 11534Document1 pageCreate-Final RA 11534Bernadette PanicanNo ratings yet

- Before Create Before Create: (I Nfographi Cs 1)Document1 pageBefore Create Before Create: (I Nfographi Cs 1)harrygolunaNo ratings yet

- CREATE LAW (Relevant Changes)Document1 pageCREATE LAW (Relevant Changes)Mary Dorothy TalidroNo ratings yet

- CreateDocument1 pageCreategaylaloohNo ratings yet

- Your Account Appli Cati ON: Appl I Cant Det Ai L SDocument1 pageYour Account Appli Cati ON: Appl I Cant Det Ai L Smohamed elmakhzniNo ratings yet

- Your Account Appli Cati ON: Appl I Cant Det Ai L SDocument1 pageYour Account Appli Cati ON: Appl I Cant Det Ai L Smohamed elmakhzniNo ratings yet

- NextGenerationSolution: Unlimited 1D/2D Modeling, Automatic Mesh, Static to Modal AnalysisDocument1 pageNextGenerationSolution: Unlimited 1D/2D Modeling, Automatic Mesh, Static to Modal AnalysisTafadzwa NgaraNo ratings yet

- Resume ManikhdenDocument3 pagesResume ManikhdenLoohga Shree ManikhdenNo ratings yet

- Your Account Appli Cati ON: Appl I Cant Det Ai L SDocument1 pageYour Account Appli Cati ON: Appl I Cant Det Ai L SAmzo YrnNo ratings yet

- Your Account Appli Cati ON: Appl I Cant Det Ai L SDocument1 pageYour Account Appli Cati ON: Appl I Cant Det Ai L Smohamed elmakhzniNo ratings yet

- Purchase Indent Format - Double PageDocument2 pagesPurchase Indent Format - Double Pagedilip9388No ratings yet

- Carboni L L A, Lyl e Robert F.: Contact Experi EnceDocument1 pageCarboni L L A, Lyl e Robert F.: Contact Experi EnceLyle CarbonillaNo ratings yet

- Sova 400 - 72Document2 pagesSova 400 - 72Raison MukkathNo ratings yet

- Your Account Appli Cati ON: Appl I Cant Det Ai L SDocument1 pageYour Account Appli Cati ON: Appl I Cant Det Ai L Smohamed elmakhzniNo ratings yet

- Your Account Appli Cati ON: Appl I Cant Det Ai L SDocument1 pageYour Account Appli Cati ON: Appl I Cant Det Ai L Sosama elNo ratings yet

- Swornstatementofassets, Liabilitiesandnetworth: Gadgets (Cellphones, Laptop) 2016Document3 pagesSwornstatementofassets, Liabilitiesandnetworth: Gadgets (Cellphones, Laptop) 2016samira salamNo ratings yet

- Your Account Appli Cati ON: Appl I Cant Det Ai L SDocument1 pageYour Account Appli Cati ON: Appl I Cant Det Ai L Smohamed elmakhzniNo ratings yet

- Exer Tema4 Circuits - AritmeticsDocument1 pageExer Tema4 Circuits - Aritmeticsjulia margenats duranNo ratings yet

- ApplicationDocument1 pageApplicationnucleya nxsNo ratings yet

- Nsai - Standards Publ I Cati Ons Nsai Date of Publ I Cati On: Al LDocument1 pageNsai - Standards Publ I Cati Ons Nsai Date of Publ I Cati On: Al LalexfordesignNo ratings yet

- Peila2014 - Perméabilité-Slump TestDocument6 pagesPeila2014 - Perméabilité-Slump TestMoez SelmiNo ratings yet

- Technology Equipment System INOX Tank Distilation OenlogyDocument1 pageTechnology Equipment System INOX Tank Distilation Oenlogya clockwork orangeNo ratings yet

- Sheheryar's CVDocument1 pageSheheryar's CVsaad sulemanNo ratings yet

- HR 190 310 Full Application FINAL AnthonyWilloughbyDocument2 pagesHR 190 310 Full Application FINAL AnthonyWilloughbyapi-25835246No ratings yet

- World's Busiest Airports 2018Document1 pageWorld's Busiest Airports 2018fundeyNo ratings yet

- Note 25 Jan BE 2566Document3 pagesNote 25 Jan BE 2566Kanyapathiran PaiNo ratings yet

- Samran CVDocument1 pageSamran CVFaizan AhmedNo ratings yet

- Covid 19 Risk Assessment RegisterDocument8 pagesCovid 19 Risk Assessment RegisterAhmed MoghazyNo ratings yet

- Silicon Chip-1998 04Document100 pagesSilicon Chip-1998 04carlosNo ratings yet

- Your Account Appli Cati ON: Appl I Cant Det Ai L SDocument1 pageYour Account Appli Cati ON: Appl I Cant Det Ai L Smohamed elmakhzniNo ratings yet

- CV Laurentius Adityo Final Sept 21 1Document1 pageCV Laurentius Adityo Final Sept 21 1laurentius adityoNo ratings yet

- Class3 Organization Certificate Registration FormDocument2 pagesClass3 Organization Certificate Registration FormSatyanarayana MurthyNo ratings yet

- Kumar ShoppyDocument1 pageKumar ShoppyManoj DesignsNo ratings yet

- Your Account Appli Cati ON: Appl I Cant Det Ai L SDocument1 pageYour Account Appli Cati ON: Appl I Cant Det Ai L Smohamed elmakhzniNo ratings yet

- Southwest Land Border EncountersDocument1 pageSouthwest Land Border EncountersCory SmithNo ratings yet

- Kolom Panel Pager BrosurDocument1 pageKolom Panel Pager BrosurMuhammad Gandhi LugasviriNo ratings yet

- Your Account Appli Cati ON: Appl I Cant Det Ai L SDocument1 pageYour Account Appli Cati ON: Appl I Cant Det Ai L Smohamed elmakhzniNo ratings yet

- Curriculo LB English CompressedDocument1 pageCurriculo LB English CompressedleticiacbiazuttiNo ratings yet

- Your Account ApplicationDocument1 pageYour Account Applicationmohamed elmakhzniNo ratings yet

- Eco SystemDocument1 pageEco SystemJann AnneNo ratings yet

- Ags MapDocument1 pageAgs Mapaaa aaaNo ratings yet

- Portfolio of Duygu ÖğücüDocument52 pagesPortfolio of Duygu ÖğücüDuygu öğücüNo ratings yet

- Ahmad MaulanaDocument1 pageAhmad MaulanaAgung SaputraNo ratings yet

- Ags MapDocument1 pageAgs Mapaaa aaaNo ratings yet

- Sunnyware 2022 CatalogueDocument20 pagesSunnyware 2022 CatalogueEric ConcepcionNo ratings yet

- Kent Al Bert Rect o Bal Donado: Educati ONDocument1 pageKent Al Bert Rect o Bal Donado: Educati ONBaldonado ThesisNo ratings yet

- Eveliu Illustrator Resume 2021Document1 pageEveliu Illustrator Resume 2021Yan LiuNo ratings yet

- Before Exam SeeDocument4 pagesBefore Exam SeearpanpurkaitpersonalNo ratings yet

- SaleInvoiceSummaryDocument1 pageSaleInvoiceSummaryYonca AhmetNo ratings yet

- Training TableuDocument4 pagesTraining Tableunaruzu.sauraNo ratings yet

- Map5 SouthPole ASMA v10Document1 pageMap5 SouthPole ASMA v10Ricardo Salinas FournierNo ratings yet

- GENERATOR INSPECTION AND PREVENTIVE MAINTENANCE REPORTDocument3 pagesGENERATOR INSPECTION AND PREVENTIVE MAINTENANCE REPORTMoz KamalNo ratings yet

- G.K.S.N.Abenayaka CV PDFDocument1 pageG.K.S.N.Abenayaka CV PDFLasantha JayawicramaNo ratings yet

- Local ShoppingDocument1 pageLocal Shoppingcharles-a-wilson-1179No ratings yet

- 1bf9e1c146b24db996251280a75e720eDocument1 page1bf9e1c146b24db996251280a75e720eTeribo SibanyoniNo ratings yet

- SATEC Catalog 2009 OnlineDocument28 pagesSATEC Catalog 2009 Onlinetunaunaturk turkNo ratings yet

- Final R-0 Archie Mesiona Abay-AbayDocument2 pagesFinal R-0 Archie Mesiona Abay-Abayarchie abay-abayNo ratings yet

- Mangubat - v. - Morga-SevaDocument9 pagesMangubat - v. - Morga-SevaHey it's RayaNo ratings yet

- OP's motion to reconsider ruling on petitions of Deputy Ombudsman and Special ProsecutorDocument46 pagesOP's motion to reconsider ruling on petitions of Deputy Ombudsman and Special ProsecutorHey it's RayaNo ratings yet

- 12 Summers Vs OzaetaDocument14 pages12 Summers Vs OzaetaHey it's RayaNo ratings yet

- 11 Estrada Vs DesiertoDocument79 pages11 Estrada Vs DesiertoHey it's RayaNo ratings yet

- First Division: Retired Spo4 Bienvenido Laud, Petitioner, vs. People of The PHILIPPINES, RespondentDocument14 pagesFirst Division: Retired Spo4 Bienvenido Laud, Petitioner, vs. People of The PHILIPPINES, RespondentHey it's RayaNo ratings yet

- Huibonhoa v. CADocument25 pagesHuibonhoa v. CATin DychiocoNo ratings yet

- Penta - Pacific - Realty - Corp. - v. - LeyDocument10 pagesPenta - Pacific - Realty - Corp. - v. - LeyHey it's RayaNo ratings yet

- SITOY, Stephanie Human Rights Essay On VAWCDocument5 pagesSITOY, Stephanie Human Rights Essay On VAWCHey it's RayaNo ratings yet

- Petitioners Vs VS: Third DivisionDocument8 pagesPetitioners Vs VS: Third DivisionHey it's RayaNo ratings yet

- CarandangDocument11 pagesCarandangHey it's RayaNo ratings yet

- Spouses - Ampeloquio - v. - Court - of - AppealsDocument5 pagesSpouses - Ampeloquio - v. - Court - of - AppealsHey it's RayaNo ratings yet

- 23 Villagracia v. Fifth Shari A District CourtDocument17 pages23 Villagracia v. Fifth Shari A District CourtJose Antonio BarrosoNo ratings yet

- 10 Consolidated Mines, Inc. Vs Commissioner of Internal RevenueDocument21 pages10 Consolidated Mines, Inc. Vs Commissioner of Internal RevenueHey it's RayaNo ratings yet

- 1991 Republic v. SandiganbayanDocument20 pages1991 Republic v. SandiganbayanAriel MolinaNo ratings yet

- 2017-Southern Luzon Drug Corp. v. Department ofDocument56 pages2017-Southern Luzon Drug Corp. v. Department ofRafael Francesco GonzalesNo ratings yet

- 2017-Southern Luzon Drug Corp. v. Department ofDocument56 pages2017-Southern Luzon Drug Corp. v. Department ofRafael Francesco GonzalesNo ratings yet

- 135545-1983-Punsalan Jr. v. Vda. de Lacsamana PDFDocument5 pages135545-1983-Punsalan Jr. v. Vda. de Lacsamana PDF123abc456defNo ratings yet

- People Vs Antonio GR 144933 07032002Document3 pagesPeople Vs Antonio GR 144933 07032002Hey it's RayaNo ratings yet

- MunozDocument6 pagesMunozHey it's RayaNo ratings yet

- Clean Air Act - Position PaperDocument14 pagesClean Air Act - Position PaperHey it's Raya100% (1)

- Court Rules on Tax Refund CaseDocument6 pagesCourt Rules on Tax Refund CaseHey it's RayaNo ratings yet

- Compare and Contrast the Practice of LawDocument7 pagesCompare and Contrast the Practice of LawHey it's RayaNo ratings yet

- Calo Vs RoldanDocument3 pagesCalo Vs RoldanHey it's RayaNo ratings yet

- Dieting Dangers: Why You Should StopDocument2 pagesDieting Dangers: Why You Should StopHey it's RayaNo ratings yet

- 9.1 G.R. Nos. L 50581 50617 Nuñez v. SandiganbayanDocument2 pages9.1 G.R. Nos. L 50581 50617 Nuñez v. SandiganbayanHey it's RayaNo ratings yet

- Calo Vs RoldanDocument3 pagesCalo Vs RoldanHey it's RayaNo ratings yet

- Perez Vs PomarDocument5 pagesPerez Vs PomarHey it's RayaNo ratings yet

- People Vs Rubiso GR 128871 03182003Document4 pagesPeople Vs Rubiso GR 128871 03182003Hey it's RayaNo ratings yet

- Jurisprudence: en BancDocument8 pagesJurisprudence: en BancHey it's RayaNo ratings yet