Professional Documents

Culture Documents

Dispensers of California

Uploaded by

riya lakhotiaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Dispensers of California

Uploaded by

riya lakhotiaCopyright:

Available Formats

DISPENSERS OF CALIFORNIA, INC.

Peter Hynes created a working model of a new and improved commercial paint spray, which he had

patented. The patent had a legal life of 16 years remaining.

Hynes was eager to exploit his patent commercially, but he had no funds of his own. Several of Hynes’

friends, who had used prototypes of Hynes’ paint spray, offered to invest in a new corporation with a

capitalization of $200,000 par value capital stock to further develop, manufacture, and market the spray

and its related equipment. Before making their investment, the investors asked Hynes to prepare a profit

plan projecting the company’s revenues and expenses for the company’s initial year of operation along

with an end-of-first-year balance sheet.

Hynes agreed to prepare the requested information incorporating the following projected transactions:

1. In return for signing his patent over the new company, which was to be called Dispensers of

California, Inc., Hynes would receive 60 percent of the company’s stock capital stock. For their

part, the investors would contribute $80,000 cash for a 40 percent interest in the company.

2. Incorporation costs, $2,500

3. Equipment to be used in assembling the paint spray dispensers, $85,000.

4. Out-of-packet labor and development costs to redesign the paint spray dispenser to facilitate more

efficient assembling, $25,000

5. Component part purchases, $212,100.

6. Short-term loan from local bank, $30,000. (Loan to be repaid before the end of the year with $500

interest)

7. Manufacturing payroll, $145,000

8. Other manufacturing costs (excluding component part costs), $62,000.

9. Selling, general and administration costs, $63,000.

10. Ending component parts inventory cost, $15,100.

11. Sales, $5,98,500 (all received in cash)

12. All incorporation costs and product redesign costs expensed as incurred.

13. Depreciation $8,500. (Hynes estimated the useful life of the equipment was 10 years, with no

salvage value).

14. Patent cost charged income over a six-year period (Hynes anticipated technology developments

incorporating digital flow controls would significantly reduce the current products sales in about

six years’ time)

15. No inventory of unsold or partially completed dispensers at the end.

16. Cash dividends, $5,000

17. Income tax expense, $22,500 (due to be paid during the next year)

18. All amounts due to employees, suppliers, and others, except for income taxes, paid in cash.

(Hynes made this assumption because he wanted to present a “conservative” balance sheet to the

investors.)

Questions:

a. How might Hynes and the investors use the profit-plan in managing the business?

b. How might the projected transactions impact the company’s balance sheet? (Think about the each

transaction in terms of its impact on both the basic accounting equation and specific accounts.)

c. Prepare a Profit plan in the form of an income statement for the first year of operations.

d. Hynes made a number of accounting decisions. Do you agree with these decisions?

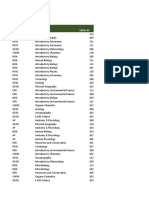

You might also like

- Dispensers California, IncDocument2 pagesDispensers California, IncRiturajPaulNo ratings yet

- Accounting For Intangible Assets and R and DDocument5 pagesAccounting For Intangible Assets and R and DChloe OberlinNo ratings yet

- Intangible AssetsDocument4 pagesIntangible AssetsMarc Eric RedondoNo ratings yet

- AE24 Lesson 6: Analysis of Capital Investment DecisionsDocument17 pagesAE24 Lesson 6: Analysis of Capital Investment DecisionsMajoy BantocNo ratings yet

- Capital BudgetDocument46 pagesCapital BudgetJohn Rick DayondonNo ratings yet

- 333333Document3 pages333333Levi OrtizNo ratings yet

- Managerial Accounting Practice Problems2 PDFDocument9 pagesManagerial Accounting Practice Problems2 PDFFrank Lovett100% (1)

- Quizzer - IaDocument2 pagesQuizzer - IajeffreeNo ratings yet

- Prep Quiz 8Document6 pagesPrep Quiz 8karol nicole valero melo100% (1)

- Instructions: Choose The Letter That Corresponds To Your Answer and Write Them On A Crosswise YellowDocument8 pagesInstructions: Choose The Letter That Corresponds To Your Answer and Write Them On A Crosswise YellowRoseNo ratings yet

- fm2 mq1Document4 pagesfm2 mq1Ramon Jonathan SapalaranNo ratings yet

- KTTC Quiz 1 & 2Document15 pagesKTTC Quiz 1 & 2nhuphan31221021135No ratings yet

- STR 581 Capstone Final Examination, Part Two - Transweb E TutorsDocument10 pagesSTR 581 Capstone Final Examination, Part Two - Transweb E Tutorstranswebetutors3No ratings yet

- BSBFIM601 Hints For Task 2Document32 pagesBSBFIM601 Hints For Task 2Marwan Issa71% (7)

- Major AssumptionsDocument3 pagesMajor AssumptionsLj Neroz Meslo100% (1)

- Case Analysis NATODocument5 pagesCase Analysis NATOTalha SiddiquiNo ratings yet

- CMA Part 1 Hock Essay QuestionsDocument74 pagesCMA Part 1 Hock Essay QuestionsAbhishek Goyal100% (5)

- 2-4 2004 Jun QDocument11 pages2-4 2004 Jun QAjay TakiarNo ratings yet

- CASE STUDYCapital BudgetingDocument4 pagesCASE STUDYCapital BudgetingSumit KhilariNo ratings yet

- Homework PDFDocument8 pagesHomework PDFTracey NguyenNo ratings yet

- Fin622 McqsDocument25 pagesFin622 McqsShrgeel HussainNo ratings yet

- Finacc4 Assignment 4 Intangible Assets Submit All Your Answers in An Excel File. Use One Worksheet (Not File) For Each Problem. Problem 1Document4 pagesFinacc4 Assignment 4 Intangible Assets Submit All Your Answers in An Excel File. Use One Worksheet (Not File) For Each Problem. Problem 1Hazel Rose CabezasNo ratings yet

- Select The Best Answer For Each of The Following 1 WhatDocument2 pagesSelect The Best Answer For Each of The Following 1 WhatFreelance WorkerNo ratings yet

- Capital BudgetingDocument13 pagesCapital BudgetingBridge VillacuraNo ratings yet

- CH 08Document12 pagesCH 08AlJabir KpNo ratings yet

- CH 4Document12 pagesCH 4Miftahudin Miftahudin0% (1)

- AE109 Activity 1Document2 pagesAE109 Activity 1Geraldine Mae DamoslogNo ratings yet

- Intangible Assets Assignment - No Answers - For PostingDocument2 pagesIntangible Assets Assignment - No Answers - For Postingemman neriNo ratings yet

- Personnel No. of Personnels Monthly SalaryDocument3 pagesPersonnel No. of Personnels Monthly SalaryMarc Thirthone LeccionesNo ratings yet

- Financial AspectDocument10 pagesFinancial AspectEvone Jane P. Torregoza100% (1)

- BSBFIM601 Hints For Task 2Document32 pagesBSBFIM601 Hints For Task 2Mohammed MGNo ratings yet

- Prelimx No AnswersDocument7 pagesPrelimx No Answerscarl fuerzasNo ratings yet

- Capital Budgeting Report FinalDocument15 pagesCapital Budgeting Report FinalCezar SabladNo ratings yet

- CE & HW On Intangible AssetsDocument5 pagesCE & HW On Intangible AssetsAmy SpencerNo ratings yet

- Assessment Activities Module 1: Intanible AssetsDocument16 pagesAssessment Activities Module 1: Intanible Assetsaj dumpNo ratings yet

- M12 Titman 2544318 11 FinMgt C12Document80 pagesM12 Titman 2544318 11 FinMgt C12marjsbarsNo ratings yet

- Accountancy and Auditing 2-2011Document7 pagesAccountancy and Auditing 2-2011Muhammad BilalNo ratings yet

- ROMARES. Accounting For Special Transactions - Semi FinalsDocument4 pagesROMARES. Accounting For Special Transactions - Semi Finalsadarose romaresNo ratings yet

- Financial Accounting NotesDocument25 pagesFinancial Accounting NotesNamish GuptaNo ratings yet

- Esperenza Bakeshop, IncDocument3 pagesEsperenza Bakeshop, IncKizziah ClaveriaNo ratings yet

- Applied Auditing Audit of Intangibles and Correction of ErrorsDocument2 pagesApplied Auditing Audit of Intangibles and Correction of ErrorsCar Mae La67% (3)

- Fin622 McqsDocument25 pagesFin622 McqsIshtiaq JatoiNo ratings yet

- 2.98 IAS 38 Intangibles Questions 22 - 23Document11 pages2.98 IAS 38 Intangibles Questions 22 - 23armaan ryanNo ratings yet

- Basic Financial Accounting and Reporting 2nd Sem AY 2020 2021 Institutional Mock Board ExamDocument10 pagesBasic Financial Accounting and Reporting 2nd Sem AY 2020 2021 Institutional Mock Board ExamBai Dianne BagundangNo ratings yet

- C. The Results of Operations, Cash Flow, and The Balance Sheet As If The Parent and Subsidiary Were A Single EntityDocument13 pagesC. The Results of Operations, Cash Flow, and The Balance Sheet As If The Parent and Subsidiary Were A Single EntityAlijah MercadoNo ratings yet

- Accounting For Special TransactionsDocument3 pagesAccounting For Special TransactionsnovyNo ratings yet

- For Students Capital BudgetingDocument3 pagesFor Students Capital Budgetingwew123No ratings yet

- F402 In-Class Exercise - Capital Budgeting September 8, 2020Document3 pagesF402 In-Class Exercise - Capital Budgeting September 8, 2020Harrison Galavan0% (1)

- School of Accounting and Finance Af201 M PDFDocument15 pagesSchool of Accounting and Finance Af201 M PDFKing FaisalNo ratings yet

- Accounting Chapter 1Document5 pagesAccounting Chapter 1EthanNo ratings yet

- Iacademy Basicfin: Basic Finance and Financial Management Final RequirementDocument5 pagesIacademy Basicfin: Basic Finance and Financial Management Final RequirementClarisse AlimotNo ratings yet

- Lebanese Association of Certified Public Accountants - IFRS August Exam 2017Document10 pagesLebanese Association of Certified Public Accountants - IFRS August Exam 2017jad NasserNo ratings yet

- Exercise QuestionsDocument8 pagesExercise QuestionsShahrukhNo ratings yet

- Management Accounting 2 Handout #2 TheoriesDocument4 pagesManagement Accounting 2 Handout #2 TheoriesCyrille MananghayaNo ratings yet

- AUD02 - 10 - Audit of Other Assests - Illustrative ProblemsDocument3 pagesAUD02 - 10 - Audit of Other Assests - Illustrative ProblemsRenelyn FiloteoNo ratings yet

- Principles of Financial Accounting PDFDocument5 pagesPrinciples of Financial Accounting PDFJia SNo ratings yet

- AA March June 2019 Q18Document2 pagesAA March June 2019 Q180135914No ratings yet

- Accounts Key IssuesDocument3 pagesAccounts Key Issues9646039026No ratings yet

- Reviewer - Intangible AssetsDocument7 pagesReviewer - Intangible AssetsKim Nicole Reyes100% (4)

- ITB 2021-22 - Session 5-6 - Cybersecurity and PrivacyDocument54 pagesITB 2021-22 - Session 5-6 - Cybersecurity and Privacyriya lakhotiaNo ratings yet

- ITB 2021-22 - Session 4 - Ethical and Social IssuesDocument20 pagesITB 2021-22 - Session 4 - Ethical and Social Issuesriya lakhotiaNo ratings yet

- ITB 2021-22 - Session 1-2 - IT in Organizations IT As A StrategyDocument44 pagesITB 2021-22 - Session 1-2 - IT in Organizations IT As A Strategyriya lakhotiaNo ratings yet

- ITB 2021-22 - Session 5-6 - Cybersecurity and PrivacyDocument54 pagesITB 2021-22 - Session 5-6 - Cybersecurity and Privacyriya lakhotiaNo ratings yet

- ITB 2021-22 - Session 3 - IT InfraDocument36 pagesITB 2021-22 - Session 3 - IT Infrariya lakhotiaNo ratings yet

- 06 Blending and PPlanningDocument19 pages06 Blending and PPlanningriya lakhotiaNo ratings yet

- 05 Make or Buy Investment PlanningDocument12 pages05 Make or Buy Investment Planningriya lakhotiaNo ratings yet

- Q1 AtlanticDocument2 pagesQ1 Atlanticriya lakhotiaNo ratings yet

- 02 Introduction To OptimizationDocument14 pages02 Introduction To Optimizationriya lakhotiaNo ratings yet

- 04 Spreadsheet SolversDocument11 pages04 Spreadsheet Solversriya lakhotiaNo ratings yet

- E09 and E10 ScriptDocument8 pagesE09 and E10 Scriptriya lakhotiaNo ratings yet

- Social EntrepreneurshipDocument1 pageSocial EntrepreneurshipShilpi GuptaNo ratings yet

- 03 Graphical MethodDocument20 pages03 Graphical Methodriya lakhotiaNo ratings yet

- CCT Mini Excel TestDocument9 pagesCCT Mini Excel Testriya lakhotiaNo ratings yet

- Ingersoll RandDocument14 pagesIngersoll Randakadityakapoor100% (1)

- SRME - Power PointDocument25 pagesSRME - Power Pointriya lakhotiaNo ratings yet

- Assignment - 1 Q.PDocument1 pageAssignment - 1 Q.Priya lakhotiaNo ratings yet

- Input Area One-Variable Data Table: APR: Calculated Results For Each APRDocument2 pagesInput Area One-Variable Data Table: APR: Calculated Results For Each APRriya lakhotiaNo ratings yet

- Sample Essay (Analyze An Argument)Document1 pageSample Essay (Analyze An Argument)riya lakhotiaNo ratings yet

- Session 09 - 10Document32 pagesSession 09 - 10riya lakhotiaNo ratings yet

- Employee ID Criteria: Quick Search Results: Last Day of Year Manager Salary ThresholdDocument7 pagesEmployee ID Criteria: Quick Search Results: Last Day of Year Manager Salary Thresholdriya lakhotiaNo ratings yet

- E05 Script Data Hoe4Document10 pagesE05 Script Data Hoe4riya lakhotiaNo ratings yet

- IimsDocument1 pageIimsriya lakhotiaNo ratings yet

- Q1 AtlanticDocument2 pagesQ1 Atlanticriya lakhotiaNo ratings yet

- MbaDocument2 pagesMbariya lakhotiaNo ratings yet

- SopDocument1 pageSopriya lakhotiaNo ratings yet

- GEP Gameplan 2021 BschoolDocument12 pagesGEP Gameplan 2021 Bschooljai kunwarNo ratings yet

- UtilizationDocument1 pageUtilizationriya lakhotiaNo ratings yet

- DSP Chap 7Document21 pagesDSP Chap 7riya lakhotiaNo ratings yet

- Accounts Case LetDocument7 pagesAccounts Case Letriya lakhotiaNo ratings yet

- Members Remedies - 2016Document70 pagesMembers Remedies - 2016Zafry TahirNo ratings yet

- Research Paper in Financial ManagementDocument6 pagesResearch Paper in Financial Managementgw10yvwg100% (1)

- Advanced Accounting 13th Edition Hoyle Solutions Manual Full Chapter PDFDocument60 pagesAdvanced Accounting 13th Edition Hoyle Solutions Manual Full Chapter PDFanwalteru32x100% (13)

- 17-4 Pondy OxidesDocument13 pages17-4 Pondy Oxidesvra_p100% (1)

- Indigo-Leverage AnalysisDocument3 pagesIndigo-Leverage Analysisgokul9rovNo ratings yet

- LK September 2020 PT PP Persero TBKDocument173 pagesLK September 2020 PT PP Persero TBKMuhammad Fajar12100% (1)

- Audit of SHEDocument13 pagesAudit of SHEChristian QuintansNo ratings yet

- Last Three Drawn Salary Slips - PAY SLIP MAY-23Document1 pageLast Three Drawn Salary Slips - PAY SLIP MAY-23platonic amigo100% (1)

- Advanced Financial Accounting 6th Edition Beechy Test BankDocument38 pagesAdvanced Financial Accounting 6th Edition Beechy Test Bankpottpotlacew8mf1t100% (15)

- Tutorial Letter 202/2/2014: Selected Accounting Standards and Simple Group StructuresDocument11 pagesTutorial Letter 202/2/2014: Selected Accounting Standards and Simple Group StructuresJerome ChettyNo ratings yet

- Management Accounting MCQDocument9 pagesManagement Accounting MCQbub12345678100% (15)

- BERNARDO - BSA 3101 - 1M - Prelim Exam ComputationDocument1 pageBERNARDO - BSA 3101 - 1M - Prelim Exam ComputationRobin James Cunanan BernardoNo ratings yet

- Paper 4 Financial ManagementDocument321 pagesPaper 4 Financial ManagementExcel Champ0% (2)

- A Case Study of Ratio Analysis of Garima Bikas Bank LimitedDocument31 pagesA Case Study of Ratio Analysis of Garima Bikas Bank LimitedThe onion factory67% (3)

- Fedex Vs UpsDocument8 pagesFedex Vs Upskevin316No ratings yet

- Tutorial Letter 102/3/2021: Financial Accounting ReportingDocument57 pagesTutorial Letter 102/3/2021: Financial Accounting ReportingAbdullah SalieNo ratings yet

- Topic 2 Financial Information ProcessDocument45 pagesTopic 2 Financial Information ProcessStunning AinNo ratings yet

- Minimum Alternate Tax MAT PDFDocument6 pagesMinimum Alternate Tax MAT PDFmuskan khatriNo ratings yet

- Inventory MangementDocument58 pagesInventory MangementRazita RathoreNo ratings yet

- 64561bos260421 Inter p4Document10 pages64561bos260421 Inter p4GowriNo ratings yet

- Atmanirbhar Bharat (Part 1)Document19 pagesAtmanirbhar Bharat (Part 1)Bhavneshsingh BhadauriyaNo ratings yet

- Adjusting Entries TLE 9Document6 pagesAdjusting Entries TLE 9ian naNo ratings yet

- Case ch5 ScottDocument3 pagesCase ch5 Scottwilda anabiaNo ratings yet

- Greece Macro PDFDocument85 pagesGreece Macro PDFchetan choudhariNo ratings yet

- Tax CPAR Final Pre Board2Document5 pagesTax CPAR Final Pre Board2Floyd delMundo100% (1)

- Good Corporate Governance and Earnings Management in IndonesiaDocument9 pagesGood Corporate Governance and Earnings Management in IndonesiaShania AngellaNo ratings yet

- Q2Document37 pagesQ2Hilario, Jana Rizzette C.No ratings yet

- GB-AGM-2020 FINAL CFO SlidesDocument67 pagesGB-AGM-2020 FINAL CFO SlidesMICHAELG3000No ratings yet

- MASDocument2 pagesMASClarisse AlimotNo ratings yet

- Zeal Pak Cement Factory Ltd. Project Feasibility StudyDocument38 pagesZeal Pak Cement Factory Ltd. Project Feasibility StudyIrfan NasrullahNo ratings yet