Professional Documents

Culture Documents

AANZFTA Certificate of Origin Form Explained

Uploaded by

Purwanti POriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

AANZFTA Certificate of Origin Form Explained

Uploaded by

Purwanti PCopyright:

Available Formats

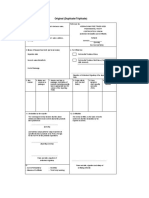

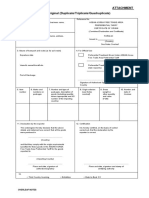

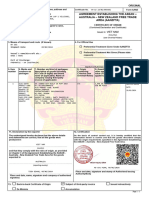

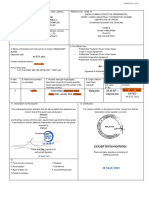

ORIGINAL

1. Goods Consigned from (Exporter’s name, address and Certificate No. Form AANZ

country)

AGREEMENT ESTABLISHING THE ASEAN –

AUSTRALIA–NEW ZEALAND FREE TRADE

AREA (AANZFTA)

2. Goods Consigned to (Importer’s/ Consignee’s name, CERTIFICATE OF ORIGIN

address, country) (Combined Declaration and Certificate)

Issued in ……………………………

(Country)

(see Overleaf Notes)

3. Means of transport and route (if known) 4. For Official Use

Shipment Date: Preferential Treatment Given Under AANZFTA

Vessel’s name/Aircraft etc.:

Preferential Treatment Not Given (Please state

Port of Discharge: reason/s)

………………………………………………………………………………

Signature of Authorised Signatory of the Importing Country

5. Item 6. Marks and 7. Number and kind of packages; 8. Origin 9. Quantity (Gross weight or 10. Invoice

number numbers on description of goods including HS Conferring other measurement), and number(s)

packages Code (6 digits) and brand name (if Criterion (see value (FOB) where RVC is and date of

applicable). Name of company issuing Overleaf applied (see Overleaf Notes) invoice(s)

third party invoice (if applicable) Notes)

11. Declaration by the exporter 12. Certification

The undersigned hereby declares that the above details On the basis of control carried out, it is hereby certified that the

and statements are correct; that all the goods were information herein is correct and that the goods described comply

produced in with the origin requirements specified in the Agreement Establishing

the ASEAN-Australia-New Zealand Free Trade Area.

………………………………………………………………………..

(country)

and that they comply with the rules of origin, as provided in

Chapter 3 of the Agreement Establishing the ASEAN-

Australia-New Zealand Free Trade Area for the goods

exported to

………………………………………………………………………..

(importing country)

…………………………………………………………...................... ……………………………………………………………...................................

Place and date, name, signature and Place and date, signature and stamp of Authorised

company of authorised signatory Issuing Authority/ Body

13. Back-to-back Certificate of Origin Subject of third-party invoice Issued retroactively

De Minimis Accumulation

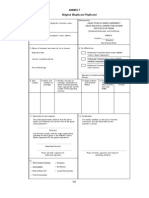

OVERLEAF NOTES

1. Countries which accept this form for the purpose of preferential treatment under the Agreement Establishing the ASEAN-Australia-

New Zealand Free Trade Area (the Agreement):

Australia Brunei Darussalam Cambodia Indonesia Lao PDR Malaysia

Myanmar New Zealand Philippines Singapore Thailand Viet Nam

(herein after individually referred to as a Party)

2. CONDITIONS: To be eligible for the preferential treatment under the AANZFTA, goods must:

a. Fall within a description of products eligible for concessions in the importing Party;

b. Comply with all relevant provisions of Chapter 3 (Rules of Origin) of the Agreement.

3. EXPORTER AND CONSIGNEE: Details of the exporter of the goods (including name, address and country) and consignee (name

and address) must be provided in Box 1 and Box 2, respectively.

4. DESCRIPTION OF GOODS: The description of each good in Box7 must include the Harmonized Commodity Description and

Coding System (HS) subheading at the 6-digit level of the exported product, and if applicable, product name and brand name. This

information should be sufficiently detailed to enable the products to be identified by the customs officer examining them.

5. ORIGIN CRITERIA: For the goods that meet the origin criteria, the exporter should indicate in Box8of this Form, the origin criteria

met, in the manner shown in the following table:

Circumstances of production or manufacture in the country named in Box11of this form: Insert in Box8

(a) Goods wholly produced or obtained satisfying Article 2.1(a) of Chapter 3 of the Agreement WO

(b) Goods produced entirely satisfying Article 2.1(c) of Chapter 3 of the Agreement PE

(c) Not wholly produced or obtained in a Party, provided that the goods satisfy Article 4of

Chapter 3 of the Agreement as amended by the First Protocol i.e., if the good is specified in

Annex 2, all the product specific requirements listed have been met:

- Change in Tariff Classification CTC

- Regional Value Content RVC

“e.g. CTSH + RVC 35%”

- Regional Value Content + Change in Tariff Classification

Other

- Other, including a Specific Manufacturing or Processing Operation

6. EACH GOOD CLAIMING PREFERENTIAL TARIFF TREATMENT MUST QUALIFY IN ITS OWN RIGHT: It should be noted that

all the goods in a consignment must qualify separately in their own right. This is of particular relevance when similar articles of

different sizes or spare parts are exported.

7. FOB VALUE: For Consignments to all Parties where the origin criteria includes a Regional Value Content requirement:

• An exporter from an ASEAN Member State must provide in Box 9 the FOB value of the goods

• An exporter from Australia or New Zealand can complete either Box 9 or provide a separate “Exporter Declaration” stating the

FOB value of the goods.

The FOB value is not required for consignments where the origin criteria does not include a Regional Value Content requirement.

In the case of goods exported from and imported by Cambodia and Myanmar, the FOB value shall be included in the Certificate of

Origin or the back-to-back Certificate of Origin for all goods, irrespective of the origin criteria used, for two (2) years from the date

of entry into force of the First Protocol or an earlier date as endorsed by the Committee on Trade in Goods.

8. INVOICES: Indicate the invoice number and date for each item. The invoice should be the one issued for the importation of the

good into the importing Party.

9. SUBJECT OF THIRD PARTY INVOICE: In cases where invoices used for the importation are issued in a third country, in

accordance with Rule 22 of the Operational Certification Procedures, the “SUBJECT OF THIRD-PARTY INVOICE” box in Box

13should be ticked ()and the name of the company issuing the invoice should be provided in Box 7or, if there is insufficient

space, on a continuation sheet. The number of the invoices issued by the manufacturers or the exporters and the number of the

invoices issued by the trader (if known) for the importation of goods into the importing Party should be indicated in Box 10.

10. BACK-TO-BACK CERTIFICATE OF ORIGIN: In the case of a back-to-back certificate of origin issued in accordance with

paragraph 3 of Rule 10 of the Operational Certification Procedures, the back-to-back certificate of origin in Box 13should be ticked

().

11. CERTIFIED TRUE COPY: In case of a certified true copy, the words “CERTIFIED TRUE COPY” should be written or stamped on

Box 12of the Certificate with the date of issuance of the copy in accordance with Rule 11 of the Operational Certification

Procedures.

12. FOR OFFICIAL USE: The Customs Authority of the Importing Party must indicate () in the relevant boxes in Box4 whether or not

preferential tariff treatment is accorded.

13. BOX 13:The items in Box 13 should be ticked (), as appropriate,in those cases where such items are relevant to the goods

covered by the Certificate.

You might also like

- Online Instructor's Manual: International Economics: Theory and PolicyDocument5 pagesOnline Instructor's Manual: International Economics: Theory and Policybing0% (2)

- Certificate of Origin-Form DDocument2 pagesCertificate of Origin-Form DAdelia Paramitha75% (4)

- Vcufta - Annex - 5 CO EAV PDFDocument5 pagesVcufta - Annex - 5 CO EAV PDFXuchang Shiji Haojia FoodNo ratings yet

- International TradeDocument59 pagesInternational TradeSifan GudisaNo ratings yet

- Factors Affecting Exchange RatesDocument5 pagesFactors Affecting Exchange RatesFahim Jan100% (1)

- Forex Study Material PDFDocument48 pagesForex Study Material PDFGaurav SharmaNo ratings yet

- Form AANZDocument6 pagesForm AANZkatacumiNo ratings yet

- ASEAN-China Free Trade Area Certificate of OriginDocument2 pagesASEAN-China Free Trade Area Certificate of OriginDoni EdwardNo ratings yet

- Form AIDocument8 pagesForm AITrịnh Huyền LinhNo ratings yet

- Form AKDocument6 pagesForm AKkatacumiNo ratings yet

- Goods Consigned CertificateDocument6 pagesGoods Consigned CertificatekatacumiNo ratings yet

- Form AJDocument6 pagesForm AJkatacumiNo ratings yet

- Form S From VietnamDocument6 pagesForm S From Vietnambomcon123456No ratings yet

- Generalized System of Preferences For Goods Under Duty Free/ Quota Free For Least Developed Countries Certificate of Origin (Form DFQF)Document2 pagesGeneralized System of Preferences For Goods Under Duty Free/ Quota Free For Least Developed Countries Certificate of Origin (Form DFQF)Moges TolchaNo ratings yet

- Form VN-CUDocument2 pagesForm VN-CUkatacumiNo ratings yet

- Att. To Appendix 1 To Annex 3 CO Form AK Overleaf ASEAN Version 15may06 FinalDocument2 pagesAtt. To Appendix 1 To Annex 3 CO Form AK Overleaf ASEAN Version 15may06 FinalDINI KUSUMAWATINo ratings yet

- China FJ fj3 enDocument7 pagesChina FJ fj3 enjverdugo272015No ratings yet

- ASEAN India OCP PDFDocument2 pagesASEAN India OCP PDFCha CahNo ratings yet

- Revised Form EDocument3 pagesRevised Form EazkaNo ratings yet

- ASEAN Trade Certificate DetailsDocument2 pagesASEAN Trade Certificate DetailsDustin SangNo ratings yet

- Certificate of Origining Feb WR PDFDocument3 pagesCertificate of Origining Feb WR PDFLucero GonzalesNo ratings yet

- Form E From VietnamDocument6 pagesForm E From Vietnambomcon123456No ratings yet

- Certificate Form AANZ, Certificate No - VN-AU 24-02-003401Document2 pagesCertificate Form AANZ, Certificate No - VN-AU 24-02-0034010667Phạm Thị Thu TrangNo ratings yet

- Form EDocument1 pageForm EHarenNo ratings yet

- Original/ Duplicate/ Triplicate (Additional Page)Document2 pagesOriginal/ Duplicate/ Triplicate (Additional Page)Moges TolchaNo ratings yet

- Certificado de Origen Peru ChinaDocument2 pagesCertificado de Origen Peru ChinaChristianGutierrezSulcaNo ratings yet

- Original: Certificate of Origin Form For China-Peru FTADocument2 pagesOriginal: Certificate of Origin Form For China-Peru FTAMuñoz Sanchez EsthefanyNo ratings yet

- (Ban hành kèm theo Thông tư số 42/2014/TT-BCT ngày 18 tháng 11 năm 2014 của Bộ trưởng Bộ Công Thương sửa đổi, bổ sung một số điều của Thông tư số 21/2010/TT-BCT)Document7 pages(Ban hành kèm theo Thông tư số 42/2014/TT-BCT ngày 18 tháng 11 năm 2014 của Bộ trưởng Bộ Công Thương sửa đổi, bổ sung một số điều của Thông tư số 21/2010/TT-BCT)Thao MacNo ratings yet

- Certificate of OriginDocument3 pagesCertificate of OriginUmair BukhariNo ratings yet

- Phu luc 7 Mẫu CO VJ của Nhật BảnDocument2 pagesPhu luc 7 Mẫu CO VJ của Nhật BảnHiền Vũ NgọcNo ratings yet

- Form AJDocument2 pagesForm AJhongmean2002No ratings yet

- Operational Procedures For Imports Under The Asean-India Free Trade Area (Aifta) Trade in Goods (Tig) AgreementDocument4 pagesOperational Procedures For Imports Under The Asean-India Free Trade Area (Aifta) Trade in Goods (Tig) AgreementDio MaulanaNo ratings yet

- Certificate of Origin: INDIA .Document2 pagesCertificate of Origin: INDIA .Moges TolchaNo ratings yet

- Overleaf IKCEPADocument2 pagesOverleaf IKCEPAsantoso w pratamaNo ratings yet

- CO FROM D- SampleDocument1 pageCO FROM D- SampleDieu NguyenNo ratings yet

- Chile Cert Origen ChinaDocument2 pagesChile Cert Origen ChinamiNo ratings yet

- Global System of Trade Preferences Certificate of Origin (Combined Declaration and Certificate)Document1 pageGlobal System of Trade Preferences Certificate of Origin (Combined Declaration and Certificate)Lim DongseopNo ratings yet

- Certificado de Origen Ingles SofofaDocument2 pagesCertificado de Origen Ingles SofofaCarolina GonzálezNo ratings yet

- Proforma Invoice With General ConditionsDocument6 pagesProforma Invoice With General ConditionsambrosialnectarNo ratings yet

- Co Thailand - ModificadoDocument2 pagesCo Thailand - ModificadoSebastian Aguilar EscalanteNo ratings yet

- North American Free Trade Agreement Certificate of Origin: Please Print or TypeDocument10 pagesNorth American Free Trade Agreement Certificate of Origin: Please Print or TypeMd Jahangir AlamNo ratings yet

- CL FTA Annex I Appendix 3Document9 pagesCL FTA Annex I Appendix 3MaximilianNo ratings yet

- Certificado FORM-A PDFDocument2 pagesCertificado FORM-A PDFAnonymous xtfIrUNo ratings yet

- Certificate of Origin: Form and User GuideDocument10 pagesCertificate of Origin: Form and User Guideovi naNo ratings yet

- Certificate of OriginDocument2 pagesCertificate of OriginRafael ManjarrezNo ratings yet

- Obrasci Uverenja o Kretanju Tekst Izjave Na FakturiDocument14 pagesObrasci Uverenja o Kretanju Tekst Izjave Na FakturiVladimir StojanovicNo ratings yet

- GATT 원산지증명서Document1 pageGATT 원산지증명서Lim DongseopNo ratings yet

- USMCA Certificate of Origin InstructionsDocument3 pagesUSMCA Certificate of Origin InstructionsDaniela VelazquezNo ratings yet

- Certificate of Origin Form F For China-Chile FTADocument2 pagesCertificate of Origin Form F For China-Chile FTAinspectormetNo ratings yet

- Certificate of Origin - FORM ADocument2 pagesCertificate of Origin - FORM ARivanda MilaNo ratings yet

- Movement Certificate Form GuideDocument5 pagesMovement Certificate Form GuidePercy ReyesNo ratings yet

- 1 1 CTN Cold Rolled, Stainless Steel CoilsDocument2 pages1 1 CTN Cold Rolled, Stainless Steel CoilsNgan ThaoNo ratings yet

- NAFTA CertificateDocument2 pagesNAFTA Certificateapi-522706100% (4)

- Goods consigned from exporter's businessDocument1 pageGoods consigned from exporter's businessLim DongseopNo ratings yet

- Co - Canada - ModeloDocument2 pagesCo - Canada - ModeloDavid ChozoNo ratings yet

- North American Free Trade Agreement Certificate of Origin: (Instructions Attached)Document2 pagesNorth American Free Trade Agreement Certificate of Origin: (Instructions Attached)jimmyjayjamesNo ratings yet

- Certificate of OriginDocument2 pagesCertificate of OriginRaja PaluruNo ratings yet

- Certificate of OriginDocument2 pagesCertificate of OriginHimanshu KushwahaNo ratings yet

- 7-co-ttqtDocument2 pages7-co-ttqt719d0011No ratings yet

- Form E: Asean-China Free Trade Area Preferential Tariff Certificate of Origin (Combined Declaration and Certificate)Document1 pageForm E: Asean-China Free Trade Area Preferential Tariff Certificate of Origin (Combined Declaration and Certificate)Azzam YasjudanNo ratings yet

- Form AK - Additional PageDocument3 pagesForm AK - Additional PagekatacumiNo ratings yet

- Korea Modelo - Con AutocertificacionDocument2 pagesKorea Modelo - Con AutocertificacionDavid ChozoNo ratings yet

- Certificado de Origen 1Document3 pagesCertificado de Origen 1Juan GalvisNo ratings yet

- Patent Laws of the Republic of Hawaii and Rules of Practice in the Patent OfficeFrom EverandPatent Laws of the Republic of Hawaii and Rules of Practice in the Patent OfficeNo ratings yet

- List of Currency Symbols and Their CodesDocument10 pagesList of Currency Symbols and Their CodesmihirthakkarNo ratings yet

- Cbse - Class 10 - Economics - Globalisation and The Indian EconomyDocument2 pagesCbse - Class 10 - Economics - Globalisation and The Indian EconomyDibyasha DasNo ratings yet

- G-11-eco-worksheet-unit-5-Trade-and-FinanceDocument7 pagesG-11-eco-worksheet-unit-5-Trade-and-FinanceKifle BerhaneNo ratings yet

- SEZ in IndiaDocument21 pagesSEZ in IndiashahnasheitNo ratings yet

- Exchange Rate: USD, EUR and Romanian LeuDocument11 pagesExchange Rate: USD, EUR and Romanian LeupofokanNo ratings yet

- Major Currency Cross Rates & Liquid PairsDocument5 pagesMajor Currency Cross Rates & Liquid PairsGiandri NugrohoNo ratings yet

- WTO Decision MakingDocument14 pagesWTO Decision MakingDevvrat garhwalNo ratings yet

- Export Promotion and Import Substitution NotesDocument12 pagesExport Promotion and Import Substitution NotesProud IndianNo ratings yet

- Exchange Rate Economy AssignmentDocument2 pagesExchange Rate Economy AssignmentNabin TamangNo ratings yet

- Historical Exchange Rates - OANDA AUD-MYRDocument1 pageHistorical Exchange Rates - OANDA AUD-MYRML MLNo ratings yet

- Globalization's Impact on World EconomicsDocument43 pagesGlobalization's Impact on World EconomicsRaymarc James RodriguezNo ratings yet

- Earning Outcomes: LSPU Self-Paced Learning Module (SLM)Document35 pagesEarning Outcomes: LSPU Self-Paced Learning Module (SLM)Arolf John Michael LimboNo ratings yet

- Official Export Credit Agencies LinksDocument2 pagesOfficial Export Credit Agencies LinksDana Keziah AntizaNo ratings yet

- HW ch15Document5 pagesHW ch15DrewBagel HDNo ratings yet

- Best Times To Trade ForexDocument23 pagesBest Times To Trade ForexInternational Business Times100% (2)

- Week 2 Tutorial QuestionsDocument4 pagesWeek 2 Tutorial QuestionsWOP INVESTNo ratings yet

- What Is Cryptocurrency Tether USDDocument3 pagesWhat Is Cryptocurrency Tether USDNi NeNo ratings yet

- International Trade in India: An Overview of its Evolution and ImportanceDocument11 pagesInternational Trade in India: An Overview of its Evolution and ImportanceAbu BasharNo ratings yet

- International Trade Is Exchange of Capital, Goods, and Services Across International Borders orDocument14 pagesInternational Trade Is Exchange of Capital, Goods, and Services Across International Borders orMithun DeyNo ratings yet

- Paikot Na Daloy NG EkonomiyaDocument8 pagesPaikot Na Daloy NG Ekonomiyarosalinda yapNo ratings yet

- The Monetary System in The International ArenaDocument2 pagesThe Monetary System in The International Arenagian reyesNo ratings yet

- Economic Globalization TodayDocument2 pagesEconomic Globalization TodayAllie LinNo ratings yet

- Foreign Trade 4Document2 pagesForeign Trade 4Reyansh VermaNo ratings yet

- Unit 13 - Lesson 8 1 - Economic IntegrationDocument12 pagesUnit 13 - Lesson 8 1 - Economic Integrationapi-260512563No ratings yet

- Intl Econ: Ch 2-3 Quiz on Comp & Abs AdvDocument5 pagesIntl Econ: Ch 2-3 Quiz on Comp & Abs AdvMaryam MagdyNo ratings yet

- Dealing Room FX SlidesDocument16 pagesDealing Room FX SlidesThanh TrúcNo ratings yet