Professional Documents

Culture Documents

7 Co TTQT

Uploaded by

719d0011Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

7 Co TTQT

Uploaded by

719d0011Copyright:

Available Formats

lOMoARcPSD|40199616

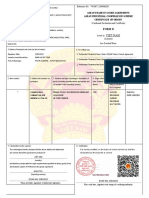

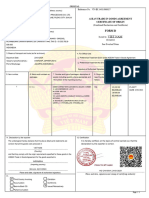

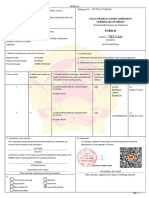

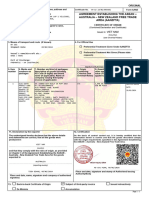

ORIGINAL

1. Goods consigned from (Exporter's business name, address, Reference No. 13789 -H

country) ASEAN COMMON EFFECTIVE PREFERENTIAL

BAHRU STAINLESS SDN BHD TARIFF / ASEAN INDUSTRIAL COOPERATION SCHEME

PTD 4069 (PLO 108), JALAN RUMBIA 4 CERTIFICATE OF ORIGIN

TANJUNG LANGSAT INDUSTRIAL COMPLEX, (Combined Declaration and Certificate)

81700 PASIR GUDANG, JOHOR, MY

FORM D

2. Goods consigned to (Consignee's name, address, country) Issued in MALAYSIA

TRUONG GIANG SERVICE & TRADING CO., LTD (Country)

51, NO. 7 STREET, WARD 10, TAN BINH DISTRICT, See Overleaf Notes

HOCHIMINH CITY, VIETNAM

4. For Official Use

3. Means of transport and route (as far as known) FROM PORT Preferential Treatment Given Under Asean

KLANG Trade in Goods Agreement

Departure date x Preferential Treatment Given Under Asean

04 JUN, 2022 Industrial Cooperation Agreement

Preferential Treatment Not Given (Please state reason/s)

Vessel's name/Aircraft etc

JPO TARU

Port of Discharge

CAT LAI PORT, HO CHI MINH CITY, VIETNAM

Signature of Authorised Signatory of the Importing

Country

5. Item 6. Marks and numbers 7. Number and type of packages, 8. Origin criterion 9. Gross weight 10. Number and

number on packages description of goods (including quantity (see Notes or other quantity date of

where appropriate and HS number of the overleaf) and value invoices

importing country) (FOB)

1 1 CTN Cold rolled, stainless steel Malaysian 20.85 MT – BHS – NO - 1249

coils,304L and/or 304, 2 finish USD35,000 DATED

04 JUN, 2022

11. Declaration by the exporter 12. Certification

The undersigned hereby declares that the above details and statement are It is hereby certified, on the basis of control carried out, that the

correct; that all the goods were produced in declaration by the exporter is correct.

Malaysia

(Country)

and that they comply with the origin requirements specified for these goods

in the ASEAN Common Effective Preferential Tariff Scheme for the goods

exported to

Vietnam

(Importing Country)

.............................................................

Place and date, signature of

authorised signatory Place and date, signature and stamp of

certifying authority

29 MAY 2022

13.

□ Third-Country Invoicing □ Exibition

□ Accumulation □ De Minimis

□ Back-to-Back CO x Issued Retroactively

29 MAY 2022

□ Partial Cumulation

lOMoARcPSD|40199616

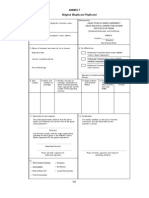

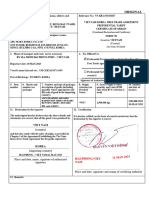

OVERLEAF NOTES

1. Member States which accept this form for the purpose of preferential treatment under the ASEAN Common Effective Preferential Tariff (CEPT) Scheme or

the ASEAN Industrial Cooperation (AICO) Scheme:

BRUNEI DARUSSALAM CAMBODIA INDONESIA

LAOS MALAYSIA MYANMAR

PHILIPPINES SINGAPORE THAILAND

VIETNAM

2. CONDITIONS: The main conditions for admission to the preferential treatment under the CEPT Scheme or the AICO Scheme are that goods sent to any

Member States listed above must:

(i) fall within a description of products eligible for concessions in the country of destination;

(ii) comply with the consignment conditions in accordance with Article 7 of Rules of Origin for the Agreement on the Common Effective Preferential Tariff

Scheme for the ASEAN Free Trade Area (CEPT-AFTA ROO); and

(iii) comply with the origin criteria set out in CEPT-AFTA ROO.

3. ORIGIN CRITERIA: For goods that meet the origin criteria, the exporter and/or producer must indicate in Box 8 of this Form, the origin criteria met, in

the manner shown in the following table:

Circumstances of production or manufacture in the first country named in Box 11 Insert in Box 8

of this form

(a) Goods wholly obtained or produced in the country of exportation ÒWOÓ

satisfying Article 3 of CEPT-AFTA ROO

(b) Goods satisfying Article 4(1)(a), 4(1)(b) or 5(1) of CEPT-AFTA ROO

¥ Regional Value Content Percentage of ASEAN value content, example Ò40%Ó

¥ Change in Tariff Classification The actual CTC rule, example ÒCCÓ or ÒCTHÓ or ÒCTSHÓ

¥ Specific Processes ÒSPÓ

(c) Goods satisfying Article 5(2) of CEPT-AFTA ROO ÒPC x%Ó, where x would be the percentage of ASEAN value content of

less than 40%, example ÒPC 25%Ó

4. EACH ARTICLE MUST QUALIFY: It should be noted that all the goods in a consignment must qualify separately in their own right. This is of

particular relevance when similar articles of different sizes or spare parts are sent.

5. DESCRIPTION OF PRODUCTS: The description of products must be sufficiently detailed to enable the products to be identified by the Customs

Officers examining them. Name of manufacturer, any trade mark shall also be specified.

6. HARMONISED SYSTEM NUMBER: The Harmonised System number shall be that of in ASEAN Harmonised Tariff Nomenclature (AHTN) Code of

the importing Member State.

7. EXPORTER: The term ÒExporterÓ in Box 11 may include the manufacturer or the producer.

8. FOR OFFICIAL USE: The Customs Authority of the importing Member State must indicate (Ö) in the relevant boxes in column 4 whether or not

preferential treatment is accorded.

9. MULTIPLE ITEMS: For multiple items declared in the same Form D, if preferential treatment is not granted to any of the items, this is also to be

indicated accordingly in box 4 and the item number circled or marked appropriately in box 5.

10. THIRD COUNTRY INVOICING: In cases where invoices are issued by a third country, Òthe Third Country InvoicingÓ box should be ticked (√) and

such information as name and country of the company issuing the invoice shall be indicated in box 7.

11. BACK-TO-BACK CERTIFICATE OF ORIGIN: In cases of Back-to-Back CO, in accordance with Article 10(2) of the Operational Certification

Procedures, the ÒBack-to-Back COÓ box should be ticked (√).

12. EXHIBITIONS: In cases where goods are sent from the territory of the exporting Member State for exhibition in another country and sold during or after

the exhibition for importation into the territory of a Member State, in accordance with Article 19 of the Operational Certification Procedures, the ÒExhibitionsÓ

box should be ticked (√) and the name and address of the exhibition indicated in box 2.

13. ISSUED RETROACTIVELY: In exceptional cases, due to involuntary errors or omissions or other valid causes, the Certificate of Origin (Form D) may

be issued retroactively, in accordance with Article 10(3) of the Operational Certification Procedures, the ÒIssued RetroactivelyÓ box should be ticked (√).

14. ACCUMULATION: In cases where originating in a Member State is used in another Member State as materials for a finished good, in accordance with

Article 5(1) of the CEPT-AFTA ROO, the ÒAccumulationÓ box should be ticked (√).

15. PARTIAL CUMULATION (PC): If the Regional Value Content of material is less than 40%, the Certificate of Origin (Form D) may be issued for

cumulation purposes, in accordance with Article 5(2) of the CEPT-AFTA ROO, the ÒPartial CumulationÓ box should be ticked (√).

16. DE MINIMIS: If a good that does not undergo the required change in tariff classification does not exceed 10% of the FOB value, in accordance with

Article 8 of the CEPT-AFTA ROO, the ÒDe MinimisÓ box should be ticked (√).

You might also like

- BL + CO + Inv + Pack 113485709Document10 pagesBL + CO + Inv + Pack 113485709Đàn NguyễnNo ratings yet

- Euphoria 2021 F K Anyone Whos Not A Sea Blob Part 2 Jules Script Teleplay Written by Sam Levinson and Hunter SchaferDocument40 pagesEuphoria 2021 F K Anyone Whos Not A Sea Blob Part 2 Jules Script Teleplay Written by Sam Levinson and Hunter SchaferMadalena Duarte7No ratings yet

- Value Investors Club - Treasure ASA (TRE ASA)Document9 pagesValue Investors Club - Treasure ASA (TRE ASA)Lukas Savickas100% (1)

- Viet Nam: Referenceno. Vn-MyDocument1 pageViet Nam: Referenceno. Vn-MyLe NhungNo ratings yet

- (Electronic Copy) : Asean-India Free Trade Area Preferential Tariff Certificate of OriginDocument10 pages(Electronic Copy) : Asean-India Free Trade Area Preferential Tariff Certificate of OriginKenneth EscamillaNo ratings yet

- Arts - 9 - Quarter 3 Module 1Document4 pagesArts - 9 - Quarter 3 Module 1John Mark Prestoza100% (3)

- The Law of Construction Contracts in the Sultanate of Oman and the MENA RegionFrom EverandThe Law of Construction Contracts in the Sultanate of Oman and the MENA RegionNo ratings yet

- BL + CO + Inv + Pack 113586568Document10 pagesBL + CO + Inv + Pack 113586568Đàn NguyễnNo ratings yet

- Contract of LeaseDocument4 pagesContract of LeaseIelBarnachea100% (5)

- Comptia Linux Xk0 004 Exam Objectives (1 0)Document16 pagesComptia Linux Xk0 004 Exam Objectives (1 0)mueramon100% (1)

- PDFDocument1 pagePDFRamuni GintingNo ratings yet

- Contoh COODocument1 pageContoh COOBiirruu LaannggiittNo ratings yet

- Certificate Form DDocument4 pagesCertificate Form DLan NhiNo ratings yet

- BL + CO + Inv + Pack 113477877Document11 pagesBL + CO + Inv + Pack 113477877Đàn NguyễnNo ratings yet

- Form Ai: Preferential Tariff Certificate of OriginDocument1 pageForm Ai: Preferential Tariff Certificate of OriginIpons PonaryoNo ratings yet

- Đề Vip 4 - Phát Triển Đề Minh Họa Tham Khảo Bgd Môn Anh Năm 2024 (Vn2) - orh1srj5obDocument16 pagesĐề Vip 4 - Phát Triển Đề Minh Họa Tham Khảo Bgd Môn Anh Năm 2024 (Vn2) - orh1srj5obnguyenhoang210922100% (1)

- Rev 2nd Coo Pli Date 09.2020Document2 pagesRev 2nd Coo Pli Date 09.2020Muhammad YunusNo ratings yet

- Form E: Asean-China Free Trade Area Preferential Tariff Certificate of Origin (Combined Declaration and Certificate)Document1 pageForm E: Asean-China Free Trade Area Preferential Tariff Certificate of Origin (Combined Declaration and Certificate)saipul anwarNo ratings yet

- Certificate Of Origin: Công Ty Tnhh Đại Lý Vận Tải EvergreenDocument3 pagesCertificate Of Origin: Công Ty Tnhh Đại Lý Vận Tải EvergreenFeng KrissNo ratings yet

- Form AkDocument1 pageForm AkCUSTOMS LBJNo ratings yet

- Charleon Pokphand Thailand Krung Thep Maha Nakhon, Bangkok 10110, ThailandDocument2 pagesCharleon Pokphand Thailand Krung Thep Maha Nakhon, Bangkok 10110, ThailandIF GAME100% (1)

- Asean Trade in Goods Agreement Asean Industrial Cooperation Scheme Certificate of Origin (Combined Declaration and Certificate) Form DDocument1 pageAsean Trade in Goods Agreement Asean Industrial Cooperation Scheme Certificate of Origin (Combined Declaration and Certificate) Form DFatkhurrohmanNo ratings yet

- CO Form D AtigaDocument2 pagesCO Form D AtigaDustin SangNo ratings yet

- Form DDocument1 pageForm DHologlamNo ratings yet

- Torq Aifta 070 IssuedDocument11 pagesTorq Aifta 070 IssuedSuraj KapseNo ratings yet

- Mau D CoDocument2 pagesMau D CoLinh LêNo ratings yet

- ECOODocument1 pageECOOYohanes LimbongNo ratings yet

- 1 1 CTN Cold Rolled, Stainless Steel CoilsDocument2 pages1 1 CTN Cold Rolled, Stainless Steel CoilsNgan ThaoNo ratings yet

- Viet Nam: Form DDocument4 pagesViet Nam: Form DĐạt NguyễnNo ratings yet

- Draft COO Pasir Gudang 23 April 2018Document1 pageDraft COO Pasir Gudang 23 April 2018anissanrlNo ratings yet

- ASEAN India OCP PDFDocument2 pagesASEAN India OCP PDFCha CahNo ratings yet

- Revised Form EDocument3 pagesRevised Form EazkaNo ratings yet

- Att. To Appendix 1 To Annex 3 CO Form AK Overleaf ASEAN Version 15may06 FinalDocument2 pagesAtt. To Appendix 1 To Annex 3 CO Form AK Overleaf ASEAN Version 15may06 FinalDINI KUSUMAWATINo ratings yet

- Asean Trade in Goods Agreement Asean Industrial Cooperation Scheme Certificate of Origin (Combined Declaration and Certificate) Form DDocument1 pageAsean Trade in Goods Agreement Asean Industrial Cooperation Scheme Certificate of Origin (Combined Declaration and Certificate) Form Dsuseno yudiNo ratings yet

- Form AIDocument8 pagesForm AITrịnh Huyền LinhNo ratings yet

- Form D Cels ChocoDocument2 pagesForm D Cels ChocoIF GAMENo ratings yet

- Form D Cels ChocoDocument2 pagesForm D Cels ChocoIF GAMENo ratings yet

- Form Ai: Preferential Tariff Certificate of OriginDocument1 pageForm Ai: Preferential Tariff Certificate of OriginIpons PonaryoNo ratings yet

- Form EDocument2 pagesForm EDoni EdwardNo ratings yet

- (Combined Declaration and Certificate) : Asean-China Free Trade Area Preferential Tariff Certificate of OriginDocument1 page(Combined Declaration and Certificate) : Asean-China Free Trade Area Preferential Tariff Certificate of OriginborneoperkasanusantaraNo ratings yet

- Surat Hasil RapatDocument1 pageSurat Hasil Rapatsaiful anwarNo ratings yet

- MV. TIAN HE - Final Draft COO Rev1Document1 pageMV. TIAN HE - Final Draft COO Rev1Haute FitNo ratings yet

- Certificate Form AANZ, Certificate No - VN-AU 24-02-003401Document2 pagesCertificate Form AANZ, Certificate No - VN-AU 24-02-0034010667Phạm Thị Thu TrangNo ratings yet

- Torq Aifta 068 IssuedDocument11 pagesTorq Aifta 068 IssuedSuraj KapseNo ratings yet

- 1953 Flipbook PDFDocument1 page1953 Flipbook PDFMohamed RaafatNo ratings yet

- Form AKDocument6 pagesForm AKkatacumiNo ratings yet

- Operational Procedures For Imports Under The Asean-India Free Trade Area (Aifta) Trade in Goods (Tig) AgreementDocument4 pagesOperational Procedures For Imports Under The Asean-India Free Trade Area (Aifta) Trade in Goods (Tig) AgreementDio MaulanaNo ratings yet

- Form E: Asean-China Free Trade Area Preferential Tariff Certificate of Origin (Combined Declaration and Certificate)Document1 pageForm E: Asean-China Free Trade Area Preferential Tariff Certificate of Origin (Combined Declaration and Certificate)Azzam YasjudanNo ratings yet

- Bill of LadingDocument1 pageBill of LadingSandeep RevliyaNo ratings yet

- All Certified Equipment Trading Corp.-National Highway, Cauayan Isabela 3305 PhilippinesDocument1 pageAll Certified Equipment Trading Corp.-National Highway, Cauayan Isabela 3305 PhilippinesMauza ZuanNo ratings yet

- Asean Trade in Goods Agreement Asean Industrial Cooperation Scheme Certificate of Origin (Combined Declaration and Certificate) Form DDocument1 pageAsean Trade in Goods Agreement Asean Industrial Cooperation Scheme Certificate of Origin (Combined Declaration and Certificate) Form Dismail100% (1)

- Z20230918097-1 Form eDocument1 pageZ20230918097-1 Form epjutsbaratNo ratings yet

- Form AJDocument6 pagesForm AJkatacumiNo ratings yet

- Form EDocument1 pageForm EHarenNo ratings yet

- Agreement Establishing The Asean - Australia-New Zealand Free Trade Area (Aanzfta)Document2 pagesAgreement Establishing The Asean - Australia-New Zealand Free Trade Area (Aanzfta)Purwanti PNo ratings yet

- Form AANZDocument6 pagesForm AANZkatacumiNo ratings yet

- Form S From VietnamDocument6 pagesForm S From Vietnambomcon123456No ratings yet

- CO FROM D - SampleDocument1 pageCO FROM D - SampleDieu NguyenNo ratings yet

- Asean Trade in Goods Agreement Asean Industrial Cooperation Scheme Certificate of Origin (Combined Declaration and Certificate) Form DDocument1 pageAsean Trade in Goods Agreement Asean Industrial Cooperation Scheme Certificate of Origin (Combined Declaration and Certificate) Form DAndrew NatanaelNo ratings yet

- AANZDocument1 pageAANZBiirruu LaannggiittNo ratings yet

- Form A 1324172 20240205084257782Document1 pageForm A 1324172 20240205084257782va.morghulisjNo ratings yet

- China FJ fj3 enDocument7 pagesChina FJ fj3 enjverdugo272015No ratings yet

- Co Form VKDocument1 pageCo Form VKphuong88146No ratings yet

- Qdraft FeDocument1 pageQdraft Feimam faodjiNo ratings yet

- SMR 2023Document1 pageSMR 2023info.diptamaNo ratings yet

- CHAPTER 8 - Regional Economic IntegrationDocument44 pagesCHAPTER 8 - Regional Economic Integration719d0011No ratings yet

- Bo Chung Tu Xuat Nhap KhauDocument17 pagesBo Chung Tu Xuat Nhap Khau719d0011No ratings yet

- What Is An Automated Teller MachineDocument9 pagesWhat Is An Automated Teller Machine719d0011No ratings yet

- (123doc) - The-Case-Study-Applies-Between-Masan-And-Vingroup-In-Vietnam-MarketDocument47 pages(123doc) - The-Case-Study-Applies-Between-Masan-And-Vingroup-In-Vietnam-Market719d0011No ratings yet

- Group 4 - Ngô Lê Quốc Bảo - Exercise 3Document5 pagesGroup 4 - Ngô Lê Quốc Bảo - Exercise 3719d0011No ratings yet

- Syllabus Integrated Skill 3 - k63Document8 pagesSyllabus Integrated Skill 3 - k63Lê Hồng NhungNo ratings yet

- Tourism in India: Service Sector: Case StudyDocument16 pagesTourism in India: Service Sector: Case StudyManish Hemant DatarNo ratings yet

- Marxist - Political Science IGNOUDocument15 pagesMarxist - Political Science IGNOUDesi Boy100% (2)

- PE-3-badminton ModuleDocument24 pagesPE-3-badminton ModuleBob Dominic DolunaNo ratings yet

- CHN ReportingDocument24 pagesCHN ReportingMatth N. ErejerNo ratings yet

- PMLS 2 Unit 9Document3 pagesPMLS 2 Unit 9Elyon Jirehel AlvarezNo ratings yet

- Summer ReadingDocument1 pageSummer ReadingDonna GurleyNo ratings yet

- Latihan Soal Dan Evaluasi Materi ComplimentDocument6 pagesLatihan Soal Dan Evaluasi Materi ComplimentAvildaAfrinAmmaraNo ratings yet

- Baughman Don Marianne 1977 NigeriaDocument11 pagesBaughman Don Marianne 1977 Nigeriathe missions networkNo ratings yet

- David Acheson - The Digital Defamation Damages DilemmaDocument16 pagesDavid Acheson - The Digital Defamation Damages DilemmaDavid AchesonNo ratings yet

- CHAPTER - 7 Managing Growth and TransactionDocument25 pagesCHAPTER - 7 Managing Growth and TransactionTesfahun TegegnNo ratings yet

- Rabe 1 Reviewer 2022 2023Document174 pagesRabe 1 Reviewer 2022 2023Dencel BarramedaNo ratings yet

- COMMUNICABLEDocument6 pagesCOMMUNICABLEAngeline TaghapNo ratings yet

- Nine Competencies For HR Excellence Cheat Sheet: by ViaDocument1 pageNine Competencies For HR Excellence Cheat Sheet: by ViaRavi KumarNo ratings yet

- 13 Datasheet Chint Power Cps Sca5ktl-Psm1-EuDocument1 page13 Datasheet Chint Power Cps Sca5ktl-Psm1-EuMARCOS DANILO DE ALMEIDA LEITENo ratings yet

- Pengembangan Transferable Skills Dalam PembelajaraDocument12 pagesPengembangan Transferable Skills Dalam PembelajaraKesat RiyanNo ratings yet

- 2017 - Hetherington - Physiology and Behavior - Understanding Infant Eating BehaviourDocument8 pages2017 - Hetherington - Physiology and Behavior - Understanding Infant Eating BehaviourJuan P. CortésNo ratings yet

- Lguvisitation-Municipality of CaintaDocument23 pagesLguvisitation-Municipality of CaintaDaniel BulanNo ratings yet

- UNIT-5 ppspNOTESDocument29 pagesUNIT-5 ppspNOTESEverbloom EverbloomNo ratings yet

- Unit 19-20Document10 pagesUnit 19-20Wulan AnggreaniNo ratings yet

- Cherrylene Cabitana: ObjectiveDocument2 pagesCherrylene Cabitana: ObjectiveMark Anthony Nieva RafalloNo ratings yet

- Wimod Ic iC880A: DatasheetDocument26 pagesWimod Ic iC880A: DatasheetJulian CamiloNo ratings yet

- General Rules ICT Lab Rules PE & Gym RulesDocument1 pageGeneral Rules ICT Lab Rules PE & Gym Rulestyler_froome554No ratings yet

- Present Perfect TestDocument6 pagesPresent Perfect TestMárta FábiánNo ratings yet