Professional Documents

Culture Documents

Market Risk Management: Supervisor of Banks: Proper Conduct of Banking Business (5) (5/13)

Uploaded by

Aman UllahOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Market Risk Management: Supervisor of Banks: Proper Conduct of Banking Business (5) (5/13)

Uploaded by

Aman UllahCopyright:

Available Formats

Supervisor of Banks: Proper Conduct of Banking Business [5] (5/13)

Market Risk Management Page 339- 1

MARKET RISK MANAGEMENT

Introduction (2/97)

1. (a) Developments in the money and capital markets in Israel, the transition

from financial intermediation to the status of market maker,

globalization and financial innovation, all have an ever-increasing effect

on potential exposure to financial risks inherent in the various aspects of

banking corporations' activities.

(b) Void.

(c) This directive sets out the basic principles for market risk management

and measurement that apply the general fundamental principles set forth

in Directive 310 regarding "Risk Management". Additional guidelines on

the issue of market risk are included in Supervisor of Banks directives on

the issue of capital adequacy and measurement–market risk (Directive

no. 208), dealing with illiquid positions (Directive 209) and

Securitization (Directive no. 205). Likewise, the issue of interest rate risk

management overall, and particularly in the banking portfolio, is dealt

with in a detailed manner in Proper Conduct of Banking Business

Directive no. 333 regarding “Interest rate risk management”.

Application

2. This directive applies to a banking corporation, as defined in the Banking

(Licensing) Law, 5741–1981, excluding a joint services company, and to an auxiliary

corporation which is a credit card company (the two groups will be referred to below

as a “banking corporation”). Notwithstanding the above, the Supervisor is entitled to

establish that certain of the requirements below will not apply to certain banking

corporations.

Definitions (2/97)

2a. "Economic Capital” The difference between the fair value of assets and

liabilities, on- and off-balance-sheet, in a particular

sector (indexed, unindexed, or foreign currency);

ONLY THE HEBREW VERSION IS BINDING

Supervisor of Banks: Proper Conduct of Banking Business [5] (5/13)

Market Risk Management Page 339- 2

"Fair value of a derivative

financial instrument" As defined in the Directives concerning the preparation

of a banking corporation's annual financial statements

(Reporting to the Public Directives);

"Market risk" Risk of a loss in on- and off-balance-sheet positions

deriving from a change in the fair value of a financial

instrument due to a change in market conditions (e.g.,

changes in price levels in different markets, interest

rates, foreign exchange rate, inflation, share and

commodities prices).

"Market maker" A banking corporation which deals in financial

instruments and derivative financial instruments with

customers and other market makers, and which holds a

portfolio of these instruments, and sells and buys them

by quoting selling and buying prices, obtaining income

from the margin between purchases and sales.

The administrative infrastructure (2/97)

3. Void.

The exposure document (2/97)

4. Void.

The board of directors and policy (2/97)

5. Void.

The risks manager (2/97)

6. Void.

Internal audit (2/97)

7. Void.

ONLY THE HEBREW VERSION IS BINDING

Supervisor of Banks: Proper Conduct of Banking Business [5] (5/13)

Market Risk Management Page 339- 3

Interest rate risks (2/97)

8. Void.

Market risk (2/97) (7/99) (6/04)

9. (a) A banking corporation which takes positions in foreign currency, invests

in securities for its own account (nostro), or makes a large-scale market

in derivative financial instruments (as defined in Subsection 9(b) below)

shall manage the market risks deriving from its overall activities by

means of a comprehensive system as detailed in Subsection 9(c) below.

Notwithstanding the above, a banking corporation whose main market

risks are concentrated in relatively few areas of activity shall be allowed

to manage its market risks as set out in this section in those areas only.

(b) The provisions of this section shall apply only to banking corporations

which satisfy at least one of the following criteria:

(1) The portfolio of investments in securities held for resale and for

trading exceeds NIS 3 billion or 50% of the banking corporation’s

capital.

(2) The total limits and authorizations to meet positions in the foreign

currency sector, including existing ceilings of exposure in the

banking corporation’s branches abroad, exceed NIS 500 million or

33 percent of the banking corporation’s capital less nonfinancial

items, net.

(3) Void.

(4) The banking corporation acts as a market maker in derivative

instruments (excluding market making in the two-sided trading in

the foreign currency/NIS market) and it has not received an

exemption from this section from the Supervisor of Banks due to a

low level of activity.

(c) The banking corporations’ market-risk management system must include

all the following components:

ONLY THE HEBREW VERSION IS BINDING

Supervisor of Banks: Proper Conduct of Banking Business [5] (5/13)

Market Risk Management Page 339- 4

(1) An internal model for measuring market risks, based on such

statistical techniques as: variance-covariance, historical

simulations, and Monte Carlo simulations.

(2) Regular measurement (at least monthly, and in the trading book,

daily) of the banking corporation’s exposure to market risks by

estimates of Value at Risk (VAR) based on the corporation’s

internal model. VAR estimates the corporation’s maximum

expected loss in the event of the realization of market risks in a

given time period and with a predetermined degree of statistical

confidence. The use of this method requires regular revaluation of

all the corporation’s positions based on the fair value of assets and

liabilities.

(3) Stress-scenario analyses of market risks.

(4) A model or method of assessing the feasibility of taking positions

in various areas, taking the risks into account.

(5) A market and interest rate risk control unit (as described in Section

10 below).

Market and interest rate risk control unit (2/97)

10. (a) (1) A banking corporation which is required to manage its market risks

according to a model using the VAR method, shall establish an

independent function to control market and interest rate risks that

will be independent of the other functions responsible for

managing and trading in the various instruments.

(2) The risk management unit will be directly subordinate to the

banking corporation's chief risk officer as defined in Proper

Conduct of Banking Business Directive number 310 regarding

"Risk Management".

(b) The risk control unit shall act in accordance with the provisions of

Proper Conduct of Banking Business Directive no. 310 regarding "Risk

Management". Among other things, the risk control unit must assess the

adequacy of the models implemented in the banking corporation for

measuring risk; examine whether actual activity and exposures conform

ONLY THE HEBREW VERSION IS BINDING

Supervisor of Banks: Proper Conduct of Banking Business [5] (5/13)

Market Risk Management Page 339- 5

with the approved principles and exposure limits; periodically check the

actual results against the models’ forecasts; develop and perform stress-

scenario analyses; compile regular reports quantifying the risks; and

report regularly on the results of the examinations.

(c) Void.

* * *

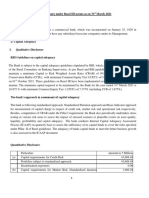

Circular 06 number Version Details Date

1852 1 Original Directive February 23, 1997

1980 2 Update July 14, 1999

2134 3 Update June 13, 2004

2358 4 Update December 27, 2012

2378 5 Update May 30, 2013

ONLY THE HEBREW VERSION IS BINDING

You might also like

- The Essential Handbook For Business WritingDocument62 pagesThe Essential Handbook For Business WritingDandan JiaoNo ratings yet

- Dawood Hercules Analysis ReportDocument40 pagesDawood Hercules Analysis ReportMuneza Naeem0% (1)

- Financial Management II - Case Kopi KenanganDocument4 pagesFinancial Management II - Case Kopi KenanganAzkya Maya Adisti100% (2)

- Basel Committee On Banking Supervision: SRP Supervisory Review ProcessDocument6 pagesBasel Committee On Banking Supervision: SRP Supervisory Review ProcessNikuBotnariNo ratings yet

- Risk Management IDocument2 pagesRisk Management IMuralidhar GoliNo ratings yet

- Management of Interest Rate Risk: Supervisor of Banks: Proper Conduct of Banking Business Directive (1) (5/13)Document42 pagesManagement of Interest Rate Risk: Supervisor of Banks: Proper Conduct of Banking Business Directive (1) (5/13)Kantheti UmanjaniNo ratings yet

- CBM Guideline On Risk Management Practices of Banks Website EngDocument53 pagesCBM Guideline On Risk Management Practices of Banks Website EngRoger100% (1)

- KPMM Risiko Pasar Pbi-5!12!03 - EngDocument19 pagesKPMM Risiko Pasar Pbi-5!12!03 - EngvirzatcNo ratings yet

- Basel Committee On Banking Supervision: MAR Calculation of RWA For Market RiskDocument148 pagesBasel Committee On Banking Supervision: MAR Calculation of RWA For Market RiskRenu MundhraNo ratings yet

- Guidance Note On Market Risk ManagementDocument63 pagesGuidance Note On Market Risk ManagementSonu AgrawalNo ratings yet

- Guidelines On Banks' Asset Liability Management Framework - Interest Rate RiskDocument35 pagesGuidelines On Banks' Asset Liability Management Framework - Interest Rate RiskMouBunchiNo ratings yet

- Master Circular - Prudential Norms On Capital Adequacy - Basel I FrameworkDocument124 pagesMaster Circular - Prudential Norms On Capital Adequacy - Basel I FrameworkMayur JainNo ratings yet

- Financial CIMA F3 CalculationsDocument23 pagesFinancial CIMA F3 CalculationsQasim DhillonNo ratings yet

- MD Oct 21Document74 pagesMD Oct 21Rajeev CHATTERJEENo ratings yet

- 11 Solvency (Following) BBDocument13 pages11 Solvency (Following) BBSyed Ali Haider AbidiNo ratings yet

- Basel Committee On Banking Supervision: MAR Calculation of RWA For Market RiskDocument187 pagesBasel Committee On Banking Supervision: MAR Calculation of RWA For Market RiskSaad RahoutiNo ratings yet

- Basel - I, II, IIIDocument23 pagesBasel - I, II, IIISangram PandaNo ratings yet

- B I T B II T B Iii: A R M J I B: Asel O Asel O Asel ISK Anagement Ourney of Ndian AnksDocument23 pagesB I T B II T B Iii: A R M J I B: Asel O Asel O Asel ISK Anagement Ourney of Ndian Anksprachiz1No ratings yet

- Types of Risk Naviel YunusDocument12 pagesTypes of Risk Naviel Yunusnavil yunusNo ratings yet

- Annex Comprehensive Guidelines On Derivatives 1. Definition of A DerivativeDocument30 pagesAnnex Comprehensive Guidelines On Derivatives 1. Definition of A DerivativeGuru BhaiNo ratings yet

- Basel I To Basel II To Basel III ModifiedDocument16 pagesBasel I To Basel II To Basel III ModifieddrisyasaseendranNo ratings yet

- Basel I To Basel II To Basel III ModifiedDocument16 pagesBasel I To Basel II To Basel III ModifieddrisyasaseendranNo ratings yet

- TreasuryDocument24 pagesTreasuryYugantar GuptaNo ratings yet

- Position Paper 45 (V 3) FINALDocument20 pagesPosition Paper 45 (V 3) FINALjeribi bacemNo ratings yet

- Regulatory ToolboxDocument40 pagesRegulatory ToolboxAtul KapurNo ratings yet

- Market Risk Framework-Revised PDFDocument6 pagesMarket Risk Framework-Revised PDFANKUR PUROHITNo ratings yet

- The New Basel Capital Accord: Glossary of TermsDocument6 pagesThe New Basel Capital Accord: Glossary of TermsNevena BebićNo ratings yet

- Banque Saudi Fransi: Pillar 3-Qualitative Disclosures 31 DECEMBER 2009Document11 pagesBanque Saudi Fransi: Pillar 3-Qualitative Disclosures 31 DECEMBER 2009Habib AntouryNo ratings yet

- Basel IV & CRR II: Revised Standardised Approach For Market RiskDocument52 pagesBasel IV & CRR II: Revised Standardised Approach For Market RiskNasim AkhtarNo ratings yet

- Toolbox FRTB Sba PDFDocument52 pagesToolbox FRTB Sba PDFBhabani Shankar ParidaNo ratings yet

- 3 RBCDocument43 pages3 RBCMonir HossenNo ratings yet

- Risk Management Programme Guidelines: Prudential Supervision Department Non-Bank Deposit Takers Issued: July 2009Document10 pagesRisk Management Programme Guidelines: Prudential Supervision Department Non-Bank Deposit Takers Issued: July 2009bernardchickeyNo ratings yet

- Basel PDFDocument23 pagesBasel PDFPabitra DebnathNo ratings yet

- Basel II 2010Document3 pagesBasel II 2010munyapasiNo ratings yet

- Draft Guidelines On Interest Rate Risk in Banking Book Interest Rate RiskDocument28 pagesDraft Guidelines On Interest Rate Risk in Banking Book Interest Rate RiskPrasad MohanNo ratings yet

- Basic Risk TypesDocument60 pagesBasic Risk TypesSakshi LadNo ratings yet

- Capital AdequecyDocument124 pagesCapital Adequecysushil_raj123No ratings yet

- BNM - Risk-Based Capital Framework For Insurers PDFDocument136 pagesBNM - Risk-Based Capital Framework For Insurers PDFAhmad FakhrullahNo ratings yet

- Prudential Norms On Capital Adequacy - Basel I Framework PDFDocument106 pagesPrudential Norms On Capital Adequacy - Basel I Framework PDFKamalakar GudaNo ratings yet

- SA CCRPaper0718Document20 pagesSA CCRPaper0718Animesh SrivastavaNo ratings yet

- Index: Acknowledgement Executive Summary Chapter-1Document85 pagesIndex: Acknowledgement Executive Summary Chapter-1Kiran KatyalNo ratings yet

- Market Risk SlidesDocument80 pagesMarket Risk SlidesChen Lee Kuen100% (5)

- Disclosure Under Basel III For 31st March 2021Document54 pagesDisclosure Under Basel III For 31st March 2021Nithin YadavNo ratings yet

- Interest Rate Risk Management Procedure - 2022 - 12Document17 pagesInterest Rate Risk Management Procedure - 2022 - 12Ilirjan LigacajNo ratings yet

- 09 178Document22 pages09 178manugeorgeNo ratings yet

- Paper20B Set2 SolDocument17 pagesPaper20B Set2 SolKurauwone MapongaNo ratings yet

- FRM 5 Market Risk Related RisksDocument38 pagesFRM 5 Market Risk Related RisksLoraNo ratings yet

- Basel Committee On Banking Supervision: RBC Risk-Based Capital RequirementsDocument57 pagesBasel Committee On Banking Supervision: RBC Risk-Based Capital RequirementsAgdum BagdumNo ratings yet

- 08h30 Isabelle ThomazeauDocument45 pages08h30 Isabelle ThomazeaujtnylsonNo ratings yet

- Basel 1and 2 NewDocument28 pagesBasel 1and 2 NewnipuntrikhaNo ratings yet

- Management of A Bank's Equity Capital Position: M. Morshed 1Document24 pagesManagement of A Bank's Equity Capital Position: M. Morshed 1ShaNto RaHmanNo ratings yet

- Credit Concentration RiskDocument15 pagesCredit Concentration Riskco samNo ratings yet

- Chapter 12 - Indian Environment in VaR ApplicationsDocument23 pagesChapter 12 - Indian Environment in VaR ApplicationsVishwajit GoudNo ratings yet

- RBC20Document9 pagesRBC20Agdum BagdumNo ratings yet

- Ebrd Risk AppetiteDocument16 pagesEbrd Risk AppetiteleonciongNo ratings yet

- 10 Chapter 2Document49 pages10 Chapter 2Shabreen SultanaNo ratings yet

- Adoption of Basel II NormsDocument5 pagesAdoption of Basel II NormsDivya GoelNo ratings yet

- Risk Management in BanksDocument96 pagesRisk Management in BanksDarshini Thummar-ppmNo ratings yet

- Basel Committee On Banking Supervision: Capitalisation of Bank Exposures To Central CounterpartiesDocument26 pagesBasel Committee On Banking Supervision: Capitalisation of Bank Exposures To Central CounterpartiesChandan KumarNo ratings yet

- 1530266570ECO P11 M28 E-TextDocument12 pages1530266570ECO P11 M28 E-TextMonika SainiNo ratings yet

- BlackRock's Guide to Fixed-Income Risk ManagementFrom EverandBlackRock's Guide to Fixed-Income Risk ManagementBennett W. GolubNo ratings yet

- Aubdul BaseerDocument9 pagesAubdul BaseerAman UllahNo ratings yet

- Auto ParadiseDocument32 pagesAuto ParadiseRidzwan SayyedNo ratings yet

- Chapter No: 03 Classification of Production SystemDocument20 pagesChapter No: 03 Classification of Production SystemAman UllahNo ratings yet

- Chapter No: 02 Types of Production: Bba-7Th Semester University of Turbat Operation and Production ManagementDocument11 pagesChapter No: 02 Types of Production: Bba-7Th Semester University of Turbat Operation and Production ManagementAman UllahNo ratings yet

- Production Planning, Management and ControlDocument32 pagesProduction Planning, Management and ControlAman UllahNo ratings yet

- Production & Operation Management: Bba 7 Semester University of TurbatDocument29 pagesProduction & Operation Management: Bba 7 Semester University of TurbatAman UllahNo ratings yet

- Aztec Food ImportsDocument28 pagesAztec Food ImportsAman UllahNo ratings yet

- Yb3wn I57ilDocument1 pageYb3wn I57ilAman UllahNo ratings yet

- Organizational Risk Management (1) Tugas 3Document14 pagesOrganizational Risk Management (1) Tugas 3sugeng raharjoNo ratings yet

- Session #10: EntrepreneurshipDocument15 pagesSession #10: EntrepreneurshipAman UllahNo ratings yet

- Risk Management in Information Technology Project: An Empirical StudyDocument9 pagesRisk Management in Information Technology Project: An Empirical StudyAman UllahNo ratings yet

- CSR Chapter 2Document19 pagesCSR Chapter 2Aman UllahNo ratings yet

- Session 7Document16 pagesSession 7Aman UllahNo ratings yet

- Acme ConsultingDocument40 pagesAcme ConsultingSILANo ratings yet

- 60 Resume ManagerDocument1 page60 Resume ManagerAman UllahNo ratings yet

- Allensburg Food GasDocument26 pagesAllensburg Food GasAman UllahNo ratings yet

- Multinational Business Finance 12th Edition Slides Chapter 11Document35 pagesMultinational Business Finance 12th Edition Slides Chapter 11Alli TobbaNo ratings yet

- 64 Resume SportsDocument1 page64 Resume SportsDexter UlimNo ratings yet

- Name Last Name: Job You'Re Looking ForDocument1 pageName Last Name: Job You'Re Looking ForAman UllahNo ratings yet

- A Study of Commercial Banks Interest Rate Risk Management Under Interest Rates LiberalizationDocument10 pagesA Study of Commercial Banks Interest Rate Risk Management Under Interest Rates LiberalizationAman UllahNo ratings yet

- Managerial Accounting. Lecture 1Document33 pagesManagerial Accounting. Lecture 1Aman UllahNo ratings yet

- Business Research Methods ZikmundDocument28 pagesBusiness Research Methods ZikmundSyed Rehan AhmedNo ratings yet

- 71 Curriculum Vitae ArchitectureDocument1 page71 Curriculum Vitae ArchitectureAman UllahNo ratings yet

- Multinational Business Finance 12th Edition Slides Chapter 13Document31 pagesMultinational Business Finance 12th Edition Slides Chapter 13Alli Tobba100% (1)

- Overall Literacy Rate Male Female Urban RuralDocument4 pagesOverall Literacy Rate Male Female Urban RuralAman UllahNo ratings yet

- Characteristics and Institutions of Developing CountriesDocument2 pagesCharacteristics and Institutions of Developing CountriesAman UllahNo ratings yet

- The Financial Crisis of 2008: Present To Sir Abdul Aabbar Present by Aman UllahDocument6 pagesThe Financial Crisis of 2008: Present To Sir Abdul Aabbar Present by Aman UllahAman UllahNo ratings yet

- Qualitative Case Studies in Operations Management - Trends ResearDocument93 pagesQualitative Case Studies in Operations Management - Trends ResearAman UllahNo ratings yet

- Bloomberg: by Whom?Document2 pagesBloomberg: by Whom?Aman UllahNo ratings yet

- Mc0 Initial Public OfferingsDocument558 pagesMc0 Initial Public Offeringspetertang2003No ratings yet

- Financial Management Midterm Reviewer 1Document3 pagesFinancial Management Midterm Reviewer 1Margaret Joy SobredillaNo ratings yet

- Valuation Methods - 3Document6 pagesValuation Methods - 3mohd shariqNo ratings yet

- Bear Bear Bear Bear Bear Tightens Tightens Tightens Tightens TightensDocument8 pagesBear Bear Bear Bear Bear Tightens Tightens Tightens Tightens TightenspasamvNo ratings yet

- Login To State Bank of India's Website Click On Payments and Transfers On The Top MenuDocument17 pagesLogin To State Bank of India's Website Click On Payments and Transfers On The Top MenuSiddharth PoreNo ratings yet

- 08-Interim AuditDocument2 pages08-Interim AuditRaima DollNo ratings yet

- Renewable Energy: in RomaniaDocument56 pagesRenewable Energy: in RomaniaIonut AndreiNo ratings yet

- Fund Flow StatementDocument8 pagesFund Flow StatementfastcablesNo ratings yet

- Chapter 6-Earnings Management: Multiple ChoiceDocument22 pagesChapter 6-Earnings Management: Multiple ChoiceLeonardoNo ratings yet

- Garmin International, Inc. Retirement Plan Rollover Contribution Letter of InstructionDocument6 pagesGarmin International, Inc. Retirement Plan Rollover Contribution Letter of InstructionAlex ChenNo ratings yet

- Report On Internship by Arihant Capital: Vikrant Group of Integrated and Advanced StudiesDocument13 pagesReport On Internship by Arihant Capital: Vikrant Group of Integrated and Advanced StudiesMann KatiyarNo ratings yet

- Unit 12Document75 pagesUnit 12AbuShahidNo ratings yet

- Thesis Zaitsev Petr OFFSHORE ZONES AND ITS FUNCTIONING IN LIGHTDocument53 pagesThesis Zaitsev Petr OFFSHORE ZONES AND ITS FUNCTIONING IN LIGHTAngie LoayzaNo ratings yet

- The Deeper The Love, The Deeper The Hate 2017Document7 pagesThe Deeper The Love, The Deeper The Hate 2017Luquiitas LasernaNo ratings yet

- Fi TableDocument5 pagesFi Tablefaiyaz ahmedNo ratings yet

- Project Charter - Waftly Towers Hotel RehabilitationDocument5 pagesProject Charter - Waftly Towers Hotel RehabilitationabdullahNo ratings yet

- Securitization: Financial Engineering UBS ChandigarhDocument21 pagesSecuritization: Financial Engineering UBS Chandigarhtony_njNo ratings yet

- DEPRECIATIONDocument10 pagesDEPRECIATIONJohn Francis IdananNo ratings yet

- Lemons Problems Arise in Capital Markets WhenDocument1 pageLemons Problems Arise in Capital Markets WhenDipak MondalNo ratings yet

- Real Estate Investment in PakistanDocument3 pagesReal Estate Investment in PakistanChaudhary AliNo ratings yet

- Green Marketing: The Revolutionary Road: Abhimanyu Verma, Ritika TanwarDocument6 pagesGreen Marketing: The Revolutionary Road: Abhimanyu Verma, Ritika TanwarinventionjournalsNo ratings yet

- Responsibility Acctg Transfer Pricing GP Analysis PDFDocument21 pagesResponsibility Acctg Transfer Pricing GP Analysis PDFma quenaNo ratings yet

- Company's Profile Presentation (Mauritius Commercial Bank)Document23 pagesCompany's Profile Presentation (Mauritius Commercial Bank)ashairways100% (2)

- United States Court of Appeals Fourth CircuitDocument17 pagesUnited States Court of Appeals Fourth CircuitScribd Government DocsNo ratings yet

- F6 InterimDocument7 pagesF6 InterimSad AnwarNo ratings yet

- Shuffled FinalDocument54 pagesShuffled FinalAllen Robert SornitNo ratings yet

- Accounting For Corporations IIIDocument25 pagesAccounting For Corporations IIIibrahim mohamedNo ratings yet