Professional Documents

Culture Documents

Withholding Tax

Withholding Tax

Uploaded by

CiMa990 ratings0% found this document useful (0 votes)

5 views2 pagesCopyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

0 ratings0% found this document useful (0 votes)

5 views2 pagesWithholding Tax

Withholding Tax

Uploaded by

CiMa99Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

You are on page 1of 2

‘Most Immediate/ By Fax/UMS.

Government of Pakistan

Central Directorate of National Savings,

Islamabad,

F.No. 13(1) (Rules)Sch-3/2004 Vol-II July 2, 2020

Subject AMENDMENT. Is DIVISION 1A OF PART Il OF THE INCOME TAX.

ORDINANCE 2001

| am directed to refer to the subject and to state that amendments have been made

in the subject Section of Income Tax Ordinance, 2001 vide Finance Act 2020, The amended

clause is reproduced as under (copy of relevant page is annexed

In Division 1A, in the proviso, after the word “where”, the expression “the

taxpayer furnishes a certificate to the payer of profit that during the tax year”

shall be inserted:

2, In view of above, all Regional Directors are advised to take necessary action to

censure the compliance of the subject amendment.

Es The issues with the approval of Director General, National Savings.

Encl: As above Prods

(Asad Bilal)

Assistant Director (PD)

1. The Director, Directorate of Audit, National Savings, Islamabad.

2. All Zonal Heads/ Regional Directorates, Regional Directorate of National

Savings with request to distribute among the field offices.

The Director, Accounts Department, SBP BSC, Karachi.

The Director General, Pakistan Post Office, Islamabad

.. The Director (Accounts), Pakistan Post Office, Lahore.

.. The Principal, TINS, Islamabad/ Karacl

. All Zonal Inspection and Accounts Offices, National Savings

. All Regional Accounts Offices, National Savings.

. Assistant Director (Product Marketing), CDNS for necessary action.

|. P.A to Director General, National Savings, Islamabad.

- P.A to Addl: Director General, National Savings, Islamabad.

. All Directors, CDNS, Islamabad.

- The Director (IT) CDNS with the request to incorporate the subject

revision in Software Application.

. All Sections of CDNS.

. The webmaster, MITC, CDNS, Islamabad with the request that the

website may be updated, accordingly.

16. Office Copy,

(a)

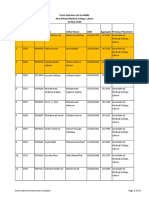

in Division |, after clause (b), the following new clause shall be

added, namely:—

* (ba) 25% in case of a person receiving dividend from a

‘company where no tax is payable by such company, due to

exemption of income or carry forward of business losses

Under Part Vill of Chapter Ill or claim of tax credits under Part

X of Chapter Ill”;

in Division 1A, in the proviso, after the word ‘where’, the

expression “the taxpayer furnishes a certificate to the payer of

profit that during the tax year" shall be inserted;

in Division IB, in clause (a), for the figures "15" the figures "25"

shall be substituted;

in Division 11 —

(in paragraph (5), —

a. for sub-paragraph (i), the following shall be

substituted, namely:~

“(i) 3% of the gross amount payable, in the

cases of transport services, freight forwarding

services, air cargo services, courier services,

manpower outsourcing services, hotel services,

security guard services, software development

services, IT services and IT enabled services as

defined in clause (133) of Part I of the Second

los

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5814)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1092)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (845)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (348)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- PDF Dr. Berg's New Body Type Guide: Get Healthy Lose Weight & Feel Great by Eric Berg AlexandriaDocument3 pagesPDF Dr. Berg's New Body Type Guide: Get Healthy Lose Weight & Feel Great by Eric Berg AlexandriaAli HusnainNo ratings yet

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- University of Health Sciences Lahore: Date SheetDocument1 pageUniversity of Health Sciences Lahore: Date SheetAli HusnainNo ratings yet

- 5 6314140934925713630 PDFDocument12 pages5 6314140934925713630 PDFAli HusnainNo ratings yet

- Join This Telegram Group To Get More Content Like ThisDocument9 pagesJoin This Telegram Group To Get More Content Like ThisAli HusnainNo ratings yet

- Landmarks in The Anatomical Study of The Blood Supply of The SkinDocument11 pagesLandmarks in The Anatomical Study of The Blood Supply of The SkinAli HusnainNo ratings yet

- 10 AzraDocument14 pages10 AzraAli HusnainNo ratings yet

- Brain Rules For Aging Well 10 RulesDocument1 pageBrain Rules For Aging Well 10 RulesAli HusnainNo ratings yet

- Scan 10 Mar 2020Document1 pageScan 10 Mar 2020Ali HusnainNo ratings yet

- Scan 10 Mar 2020Document1 pageScan 10 Mar 2020Ali HusnainNo ratings yet

- RggvyvDocument14 pagesRggvyvAli HusnainNo ratings yet

- Bedside Techniques Methods of Clinical Xamination Muhammad InayatullahDocument6 pagesBedside Techniques Methods of Clinical Xamination Muhammad InayatullahAli HusnainNo ratings yet

- Takhleeq: Dear ParticipantsDocument5 pagesTakhleeq: Dear ParticipantsAli HusnainNo ratings yet

- نماز باجماعت کے فضائل - 1Document10 pagesنماز باجماعت کے فضائل - 1Ali HusnainNo ratings yet

- Medical Students' Use of Facebook For Educational Purposes: Anam AliDocument7 pagesMedical Students' Use of Facebook For Educational Purposes: Anam AliAli HusnainNo ratings yet

- توبہ کرنے والوں کے واقعات - 1Document5 pagesتوبہ کرنے والوں کے واقعات - 1Ali HusnainNo ratings yet