Professional Documents

Culture Documents

#0A1 Topic 2 Outline

#0A1 Topic 2 Outline

Uploaded by

Raine Piliin0 ratings0% found this document useful (0 votes)

19 views13 pagesCopyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

0 ratings0% found this document useful (0 votes)

19 views13 pages#0A1 Topic 2 Outline

#0A1 Topic 2 Outline

Uploaded by

Raine PiliinCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

You are on page 1of 13

Kansas Wesleyan University

BUSINESS FINANCE (BUSA405) - Fall 2011

TOPIC 2: A Review of Accounting

‘TOPIC OUTLINE

ident, unertnd, nd

{CTIVELY and EFFICIENTLY manage ap organizations fnnea esoucos so

rps and go,

‘Accountants, and tho financial stater

purpose and goals.

‘Good information is the foundation of good decisions and good results.

infrmaton a ow

met of Retained

Ines to eganiztions success.

sand Sixtement of Cah

can be applied to baling succesful

sou that yo have read the assigned

sed on this assumption. Ifyou do NOT

ur sd partner or stedy group OR contact

Your Name _

BUISNESS FINANCE ~ FALL 2011

TOPIC 2: A Review of Accounting

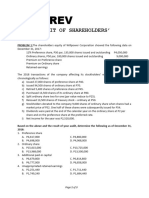

HOMEWORK PROBLEMS 2-1

m0

2) FA frm had the following acount nd finan date for 205,

Seine Fitted $a

receivable Preerred sock dividends 18

Number of common shares

innit or 206,

~ Cast oF goods wT

Totaloper expenses 600

The fm'seamings

‘818195

3) ss16

cy-s2mt

osu

Ja ta for 2005

4/44 Siem hod the fllowing accounts and i

Coat oT goods so ‘S107

Preferred stock dividends 16

Tacrate 0%

Number ofcommen shares 1.000,

utstandin

‘The firms earnings per share rounded othe nearest cont for 2005 was

14) $030

8) sust

3058

0302,

Tableat

(See Table 21)

D)si9a6t

03

585.895,

8) #Noves payable or CEE in 2005 was (See Table 21)

08

Dysavare

9) Net feed assets for CEE in 2008 were (See Table 23)

eamings balances of $50.00) ae $400.00, respectively

in 205, The frm pa dividends in 205 of.

12) 2A corporation had a year en 200 resin earrings balance of $220,000. The firm reported net profits ater

taxes of 850,00 in 2008 and paid dividends in 2005 f $30,000. The e's retained earnings balance a yearend

2005 was

riginally cost $10,000 is being depreciated using 2 5-year normal reovery

14) FUndler MACRS, an ase which originally cost 100,000 & beng depreciated using a 10-year normal recovery

period, The depreciation expense in year

‘Tables

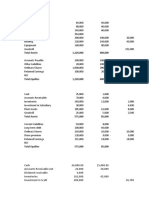

‘Ruff Sandpaper Co.

‘Balance Sheets

For the Yeas Ended 2002 and 2003

2005 m2

0 oo

20 200

1200 1000

2000 i8i0

(see Tablea)

18) #Common stock dividends paid in 2008 amounted to

5) $100

B)si50

oso

sso

18) Inflows of ands for 208 totaled _ (See Table1)

'8) $950

fined aces wort (See Table 31)

21) Fhe firm's cashflow from operations (See Table31)

4) S150

ory of $3000, then the inventory turnover

day your,

BUSINESS FINANCE (BUSA405)

Topic 2: A Review of Accounting

IN-CLASS PROBLEMS

ndeseloped

20,000 |

7,7007060"]

736,000

"700,000

‘What wre se sale fo 2007?

A 200,000 2.500000 © 2.660.000 B. 2700.00

‘Toa equity or 20077

A 668008 3. 675.000 58400 D. 698.00

‘Wat isthe Beginning ofthe Year Reinod Earnings?

A ason0 87.000 © 549.000 D. 351.000

‘Whats the current rato for 2007 base on te end of year nabs? (Round tthe pares x3)

An La6 B18 cist Dey

Whats he inventory tumover for 2007 based oo the er of yest antes? (Roun 1 the nearest 444)

A 800) 3.930 100) D. 1050,

‘Wash iveatry umove in days based om he answer tthe shove gucton? (Round woth eae whole day

nde 4360 day you

A Bday B. sodas . 3dys Di. a2 days

What isthe aocouns recevables turnover for 2007 based on the endef year nubers? (Round othe nearest 44)

A800 950 C1000 D. 1030

‘Wha she accounts receivables turpover ia day base on teaser othe bose question? (Roun 10 Ue nearest

©. dys D. a2days

C26 D. 34628

‘Whats the operasing profit margin percent (Round to the Paes 245)

Nose 3.942% 95% D. 900%

What he eur on les percent for 2007 salon th god of ear umber? (Round othe nearest x5)

AAO Baa C455 De am.

Jats be Teal Ase Toe tr 207 a cal fer names oud te esta)

Arias BL C168

‘Whats he Retuen on Ass percent for 2007 based on he nd of year numbers? (Roo the nearest 2.08%

A 725% Bo Tale C165 D. 1.90%

‘Wha sth return on Total Equity perce! fe 2007 base on the end of year numbers? (Round othe neat

a)

AU tas B 15.95% 16358, D. 7st

$4.0 gin DB. $4.000 oss

300 is ng

$3,200 | $2,200

$2,000 | $1,800

$2,900 | $2,800

‘38,200 | $6,800

‘$29,500 | $28,100

$14,700 | $13,400

$44,000 | $48,000

'$23,000 | $21,800

‘$1,600 | $1,500,

$2,800 | $2,200

‘$200 $300

$4,600 | $4,000

35,000 | $5,000

$5,000 | $5,000

$9,600 | $9,000

'$10,000 | $10,000

30 30

'$10,000 | $10,000

$2,800 T

'$23,000 | $21,000

The firma 0

0% tx rae

© 1580

‘What were the fms NET Cash Flows ftom Operations?

© $2500 source

51200 source

AV HoOsouce™-B. $100uee C200 sure

What was the fn’ EDIT?

A 32200 B. 32380 © $2500

‘Wa was he firs Net Operating Pris after Tate (NOPAT) for 20062

AS s100 B.SL6H0 © 81,760

wu 's Operating Cash Flows (OCF) for 2006?

A 8 $050 C. $3240

What waste fms Free Cash lo (FCF) for 2006?

As20 B si00 © ss80

$2.50 ue

$1200 06

S200 ue

31200

sum

You might also like

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5813)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (348)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1092)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (844)

- Audit of SheDocument3 pagesAudit of ShePrince PierreNo ratings yet

- AbusocmDocument4 pagesAbusocmPrince PierreNo ratings yet

- Decision Under UncertaintyDocument14 pagesDecision Under UncertaintyPrince PierreNo ratings yet

- Integrated SubjectsDocument1 pageIntegrated SubjectsPrince PierreNo ratings yet

- RetentionDocument4 pagesRetentionPrince PierreNo ratings yet

- Exercise On Operational BudgetingDocument3 pagesExercise On Operational BudgetingPrince PierreNo ratings yet

- AccountingDocument1 pageAccountingPrince PierreNo ratings yet

- Years Ago at P 500, 000 With FMV at Date of Donation Equal To P 600, 000 But With Unpaid Mortgage of P 50, 000 Assumed by The Donee?Document4 pagesYears Ago at P 500, 000 With FMV at Date of Donation Equal To P 600, 000 But With Unpaid Mortgage of P 50, 000 Assumed by The Donee?Prince PierreNo ratings yet

- Prelec Post TestDocument3 pagesPrelec Post TestPrince PierreNo ratings yet

- Search Form: Jump To NavigationDocument31 pagesSearch Form: Jump To NavigationPrince PierreNo ratings yet

- Philosophy of ReligionDocument32 pagesPhilosophy of ReligionPrince PierreNo ratings yet

- GmerbicDocument1 pageGmerbicPrince PierreNo ratings yet

- OPMATQMDocument2 pagesOPMATQMPrince PierreNo ratings yet

- Temperature EvaporationDocument1 pageTemperature EvaporationPrince PierreNo ratings yet

- OPMATQMDocument2 pagesOPMATQMPrince PierreNo ratings yet

- RegflibDocument2 pagesRegflibPrince Pierre100% (1)