Professional Documents

Culture Documents

Book Profit: How To Calculate Book Profit From Cash Profit?

Uploaded by

zaheerbdsOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Book Profit: How To Calculate Book Profit From Cash Profit?

Uploaded by

zaheerbdsCopyright:

Available Formats

Book Profit

Book profits refer to the profit earned by the business entity from

its operations and activities and is calculated by deducting all

the business expenses incurred within a financial year from all

the sales revenue and other income generated from the selling of

goods & services within that same financial year.

It refers to money earned by an entity during a financial year by

selling products and services deducted by all the expenses

incurred during the same financial year.

Book Profit = Revenues – Expenses

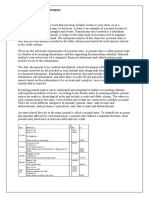

How to Calculate Book Profit from Cash Profit?

Book profit, as we have discussed, is the profit as shown in profit

and loss account of the entity and considered to be the actual

profits because it considered all cash and non-cash

transactions. Like revenue generated through sales made on

credit and charging annual depreciation, in which no actual cash

transaction occurs and are just book entries.

Cash profit is the surplus generated through actual cash flows

occurred within an entity. That means it is calculated by

subtracting all the cash outflows (including all paid expenses like

salary, rent, bills, etc.) from the cash inflows (including cash

sales). Cash profit can also be calculated using book profits by

adding back all the non-cash expenses (like depreciation debited

in Profit and loss account and subtracting the non-cash

revenues (like credit sales).

Cash Profit = Book Profit + Non-Cash Expenses – Non Cash

Revenues

Or Book Profit = Cash Profit – Non-Cash Expenses + Non-Cash

Revenues

Book Profit: Financial Instruments or Investment

Tools

The profits made on investments that have not been realized yet

are called book profits. That means when example, the current

value of securities becomes higher than the actual cost paid, and

the securities are yet not sold but still owned by the holder, then

such profits are termed as book profits.

Note: Generally, such profits on financial instruments are not

taxed until they are actually sold, and profit or loss is realized.

Special Cases

In various countries, the calculation of book value by business

entities is for taxation purposes. Book value is treated as taxable

income, and a specific rate applies to the book value to calculate

the amount of taxes payable.

We are discussing the two major scenarios where the use of such

profits is for taxation purposes:-

#1 – MAT for Companies in India

MAT or Minimum Alternative Tax applied to companies that pay

dividends to its shareholders but not pay taxes under normal

Income tax provisions due to various exemptions and deductions

allowed.

We calculate MAT using book profits. Here it arrives after

applicable additions or deductions made to net profit, as shown in

the statement of profit and loss.

Book Profit = (Net Profit + Additions) – Deductions

#2 – Partnership Firm

In this case, it simply means the profits as computed before

remuneration paid to the partner. In other words, It is calculated

by adding back the salary and commissions paid to the partners

(if debited in P&L account) into the net profit as per profit and

loss account.

Book Profit = Net Profit + Partner’s Remuneration

You might also like

- Understanding Financial Statements (Review and Analysis of Straub's Book)From EverandUnderstanding Financial Statements (Review and Analysis of Straub's Book)Rating: 5 out of 5 stars5/5 (5)

- Wage and Tax Statement: OMB No. 1545-0008Document3 pagesWage and Tax Statement: OMB No. 1545-0008h6bnyrr9mrNo ratings yet

- Financial Accounting - Want to Become Financial Accountant in 30 Days?From EverandFinancial Accounting - Want to Become Financial Accountant in 30 Days?Rating: 5 out of 5 stars5/5 (1)

- The Hidden Wealth Multipliers: Tax-Saving StrategiesDocument19 pagesThe Hidden Wealth Multipliers: Tax-Saving StrategiesShantrece MarshallNo ratings yet

- Fundamentals of PTNGN PDFDocument27 pagesFundamentals of PTNGN PDFEdfrance Delos Reyes0% (1)

- Income StatementDocument3 pagesIncome StatementMamta LallNo ratings yet

- Electronic Apex LocatorDocument13 pagesElectronic Apex LocatorUdara HemathilakaNo ratings yet

- Financial Statement Analysis Ratios SummaryDocument1 pageFinancial Statement Analysis Ratios SummaryAtharva Gore100% (1)

- Introduction To Taxation (Notes)Document21 pagesIntroduction To Taxation (Notes)Tricia Sta TeresaNo ratings yet

- Learning Module (Tax Law Review) - Definition, Nature, Characteristics, Kinds, Sources of Tax, and Tax Laws, Rules, Regulations and Taxpayer's SuitDocument12 pagesLearning Module (Tax Law Review) - Definition, Nature, Characteristics, Kinds, Sources of Tax, and Tax Laws, Rules, Regulations and Taxpayer's Suitjoan mziNo ratings yet

- Your Amazing Itty Bitty® Book of QuickBooks® TerminologyFrom EverandYour Amazing Itty Bitty® Book of QuickBooks® TerminologyNo ratings yet

- Financial Statement PresentationDocument33 pagesFinancial Statement Presentationcyrene jamnagueNo ratings yet

- 13 6 Endodontic Mishaps PDFDocument20 pages13 6 Endodontic Mishaps PDFzaheerbdsNo ratings yet

- 13 6 Endodontic Mishaps PDFDocument20 pages13 6 Endodontic Mishaps PDFzaheerbdsNo ratings yet

- Profit and Loss AccountDocument2 pagesProfit and Loss AccountameliarosminiNo ratings yet

- Accounting DocumentsDocument6 pagesAccounting DocumentsMae AroganteNo ratings yet

- Understanding the Key Elements of an Income StatementDocument19 pagesUnderstanding the Key Elements of an Income StatementFrank HernandezNo ratings yet

- Net Revenue and Net ProfitDocument2 pagesNet Revenue and Net ProfitZahid5391No ratings yet

- FABM 2 Module 3 Statement of Comprehensive IncomeDocument10 pagesFABM 2 Module 3 Statement of Comprehensive IncomebabyjamskieNo ratings yet

- Basis For Comparison Accounting Profit Taxable ProfitDocument5 pagesBasis For Comparison Accounting Profit Taxable ProfitKaif UddinNo ratings yet

- FA1 Notes: Business Transactions and Double Entry AccountingDocument24 pagesFA1 Notes: Business Transactions and Double Entry AccountingWaqas KhanNo ratings yet

- Left Column For Inner Computation - Right Column For Totals - Peso Sign at The Beginning Amount and at Final Answer TwoDocument6 pagesLeft Column For Inner Computation - Right Column For Totals - Peso Sign at The Beginning Amount and at Final Answer Twoamberle smithNo ratings yet

- Fabm1 10Document14 pagesFabm1 10Francis Esperanza0% (1)

- General Ledger Accounts GuideDocument8 pagesGeneral Ledger Accounts GuideAJ ShinuNo ratings yet

- Income Statement: Profit/Loss Account Dr. Satish Jangra (2009A229M)Document14 pagesIncome Statement: Profit/Loss Account Dr. Satish Jangra (2009A229M)Dr. Satish Jangra100% (1)

- Income Statement: Presented by HARI PRIYA - 102114025 JENKINS-102114026 ARVIND-102114027Document47 pagesIncome Statement: Presented by HARI PRIYA - 102114025 JENKINS-102114026 ARVIND-102114027Jenkins Jose Shirley100% (1)

- Income Statement Revenues - Expenses Net IncomeDocument4 pagesIncome Statement Revenues - Expenses Net IncomeTanishaq bindalNo ratings yet

- Unit 3 Trading ConcernDocument13 pagesUnit 3 Trading ConcernBell BottleNo ratings yet

- Statement of Comprehensive IncomeDocument25 pagesStatement of Comprehensive IncomeAngel Nichole ValenciaNo ratings yet

- Statement of Retained Earings and Its Components HandoutDocument12 pagesStatement of Retained Earings and Its Components HandoutRitesh LashkeryNo ratings yet

- Essentials of Financial Accounting - ST (SEM 3Document10 pagesEssentials of Financial Accounting - ST (SEM 3Harshit RajNo ratings yet

- RevenueAccountsWithDefinition,TypesAndExamplesIndeed.comIndia_1710866202575Document7 pagesRevenueAccountsWithDefinition,TypesAndExamplesIndeed.comIndia_1710866202575williamseugine2008No ratings yet

- Accounting GlossaryDocument105 pagesAccounting Glossarykumaravelphd5030No ratings yet

- Short CFS Handout Nov 2009Document6 pagesShort CFS Handout Nov 2009Mohamed Shaffaf Ali RasheedNo ratings yet

- Example Income Statement:: Gross SalesDocument2 pagesExample Income Statement:: Gross Salesabdirahman YonisNo ratings yet

- Accounting Terminologies - Feb 2022Document7 pagesAccounting Terminologies - Feb 202210Mansi ManekNo ratings yet

- 8 Financial StatementDocument11 pages8 Financial StatementLin Latt Wai AlexaNo ratings yet

- Financial Statements - I Class 11 Notes CBSE Accountancy Chapter 9 (PDF)Document7 pagesFinancial Statements - I Class 11 Notes CBSE Accountancy Chapter 9 (PDF)yashwini2827No ratings yet

- Report Finma-9th Presentor!Document3 pagesReport Finma-9th Presentor!Irish DMNo ratings yet

- Income Statement Layouts ExplainedDocument47 pagesIncome Statement Layouts ExplainedRaluca ToneNo ratings yet

- Chapter 5 Notes - Equity, Income StatementDocument15 pagesChapter 5 Notes - Equity, Income StatementNavroopamNo ratings yet

- Trading P&L Balance SheetDocument15 pagesTrading P&L Balance Sheetmdhanjalah08No ratings yet

- Financial Accounting: Salal Durrani 2020Document12 pagesFinancial Accounting: Salal Durrani 2020Rahat BatoolNo ratings yet

- SWIFT Payment GuideDocument7 pagesSWIFT Payment GuideZany KhanNo ratings yet

- A Primer On Financial StatementsDocument11 pagesA Primer On Financial StatementsPranay NarayaniNo ratings yet

- Test of Whether Something Is An Asset IsDocument9 pagesTest of Whether Something Is An Asset IsMehrose AhmedNo ratings yet

- Net Income NI Definition Uses and How To Calculate ItDocument4 pagesNet Income NI Definition Uses and How To Calculate IthieutlbkreportNo ratings yet

- Fin623 GDBDocument14 pagesFin623 GDBparishyazizNo ratings yet

- Comprehensive Income Statement ExplainedDocument8 pagesComprehensive Income Statement ExplainedSalvie Angela Clarette UtanaNo ratings yet

- Income StatementDocument3 pagesIncome StatementPooja SreeNo ratings yet

- Financial Statements Guide: Trading, P&L & Balance Sheet ExplainedDocument35 pagesFinancial Statements Guide: Trading, P&L & Balance Sheet ExplainedBhavik Shah100% (1)

- Questions Financial Accouing 1-Year 1-Sem MbaDocument7 pagesQuestions Financial Accouing 1-Year 1-Sem Mbakingmaker9999No ratings yet

- HR Financial Intelligence Income StatementDocument15 pagesHR Financial Intelligence Income StatementSsssNo ratings yet

- Chapter 1 Vladislav AkermanDocument1 pageChapter 1 Vladislav AkermanVladislav AkermanNo ratings yet

- What Is The Difference Between Job Costing and Process Costing?Document31 pagesWhat Is The Difference Between Job Costing and Process Costing?Muhammad AsimNo ratings yet

- Financial Accounting & AnalysisDocument5 pagesFinancial Accounting & AnalysisSourav SaraswatNo ratings yet

- How to Make a Financial Statement for Small BusinessDocument6 pagesHow to Make a Financial Statement for Small BusinessAaron MushunjeNo ratings yet

- Sole TradersDocument12 pagesSole TradersWei WenNo ratings yet

- Income Statement, Its Elements, Usefulness and LimitationsDocument5 pagesIncome Statement, Its Elements, Usefulness and LimitationsDipika tasfannum salamNo ratings yet

- 02 - Basic Perf MeasuresDocument14 pages02 - Basic Perf MeasureshoalongkiemNo ratings yet

- Finals - Fina 221Document14 pagesFinals - Fina 221MARITONI MEDALLANo ratings yet

- Financial Statements Examples - Amazon Case StudyDocument16 pagesFinancial Statements Examples - Amazon Case Studyjabeenbegum916No ratings yet

- CHAPTER 2-Statement of Comprehensive IncomeDocument4 pagesCHAPTER 2-Statement of Comprehensive IncomeDan GalvezNo ratings yet

- What Is Gross Income - Definition, Formula, Calculation, and ExampleDocument7 pagesWhat Is Gross Income - Definition, Formula, Calculation, and ExampleKapil SharmaNo ratings yet

- Profit and Loss AccountDocument15 pagesProfit and Loss AccountLogesh Waran100% (1)

- Basic Accounting ConceptsDocument12 pagesBasic Accounting ConceptsKhaing26No ratings yet

- GDC RD Clamps Endomotor EndokingDocument1 pageGDC RD Clamps Endomotor EndokingzaheerbdsNo ratings yet

- Protaper NextDocument5 pagesProtaper NextzaheerbdsNo ratings yet

- Review Article: The Antimicrobial Effects of Rifaximin On The Gut MicrobiotaDocument8 pagesReview Article: The Antimicrobial Effects of Rifaximin On The Gut MicrobiotazaheerbdsNo ratings yet

- Dental Procedures and Materials QuestionsDocument2 pagesDental Procedures and Materials QuestionszaheerbdsNo ratings yet

- ProTaper GoldDocument6 pagesProTaper GoldzaheerbdsNo ratings yet

- NiTi Goes Gold "Ten Clinical Distinctions" - Oral Health GroupDocument27 pagesNiTi Goes Gold "Ten Clinical Distinctions" - Oral Health GroupzaheerbdsNo ratings yet

- Zirconia Crowns in PedoDocument8 pagesZirconia Crowns in PedozaheerbdsNo ratings yet

- 11.haj and Umrah EnglishDocument36 pages11.haj and Umrah EnglishzaheerbdsNo ratings yet

- 10 1111@aej 12390Document6 pages10 1111@aej 12390zaheerbdsNo ratings yet

- Tis 5-Suspect - A - Urinary - Tract - Infection - Brochure - MA - Coalition - FinalDocument4 pagesTis 5-Suspect - A - Urinary - Tract - Infection - Brochure - MA - Coalition - FinalzaheerbdsNo ratings yet

- Journal Pre-Proof: Enterococcus FaecalisDocument15 pagesJournal Pre-Proof: Enterococcus FaecaliszaheerbdsNo ratings yet

- Working Length Determination: Prof. Promila Verma Department of Conservative Dentistry & EndodonticsDocument43 pagesWorking Length Determination: Prof. Promila Verma Department of Conservative Dentistry & EndodonticszaheerbdsNo ratings yet

- Restoring Smiles: Treatment Options for Enamel DefectsDocument4 pagesRestoring Smiles: Treatment Options for Enamel DefectszaheerbdsNo ratings yet

- JIntOralHealth94141-7129967 194819Document5 pagesJIntOralHealth94141-7129967 194819zaheerbdsNo ratings yet

- Journal Pre-ProofDocument23 pagesJournal Pre-ProofzaheerbdsNo ratings yet

- 19 ElectronicApexLocators-AnoverviewDocument7 pages19 ElectronicApexLocators-AnoverviewzaheerbdsNo ratings yet

- 10 1111@aej 12390Document6 pages10 1111@aej 12390zaheerbdsNo ratings yet

- Journal Pre-Proof: Enterococcus FaecalisDocument15 pagesJournal Pre-Proof: Enterococcus FaecaliszaheerbdsNo ratings yet

- Peregrination of Endodontic Tools-Past To Present: Hort OmmunicationDocument4 pagesPeregrination of Endodontic Tools-Past To Present: Hort OmmunicationzaheerbdsNo ratings yet

- Section 184 (Modified)Document2 pagesSection 184 (Modified)zaheerbdsNo ratings yet

- 10 1016@j Joen 2019 01 010Document6 pages10 1016@j Joen 2019 01 010zaheerbdsNo ratings yet

- Endo. MicrobiologyDocument7 pagesEndo. MicrobiologyzaheerbdsNo ratings yet

- Nekoofar 2006Document15 pagesNekoofar 2006zaheerbdsNo ratings yet

- Influence of WL and Foraminal Enlargement On (IndianJDentRes)Document7 pagesInfluence of WL and Foraminal Enlargement On (IndianJDentRes)zaheerbdsNo ratings yet

- Kim 2012Document9 pagesKim 2012zaheerbdsNo ratings yet

- AIWF-ePamphlets-Supplications For Attaning KnowledgeDocument2 pagesAIWF-ePamphlets-Supplications For Attaning KnowledgezaheerbdsNo ratings yet

- 99.poultry Breeding and Multiplication Center OkDocument21 pages99.poultry Breeding and Multiplication Center OkMuazNo ratings yet

- Auditing Chapter 6Document20 pagesAuditing Chapter 6Vanadisa SamuelNo ratings yet

- Accounting Theory 6-2023-1Document31 pagesAccounting Theory 6-2023-1Titu magNo ratings yet

- 3 - Income Tax On IndividualsDocument22 pages3 - Income Tax On IndividualsRylleMatthanCorderoNo ratings yet

- Accrued Expenses and Liabilities - FinalDocument3 pagesAccrued Expenses and Liabilities - FinalEunice WongNo ratings yet

- T4Q - TaxationDocument4 pagesT4Q - Taxation吕仙姿No ratings yet

- Gatchalian v. Collector, 67 Phil 666Document2 pagesGatchalian v. Collector, 67 Phil 666Kharol EdeaNo ratings yet

- Acct Project Question 2Document14 pagesAcct Project Question 2grace100% (1)

- Let NDocument3 pagesLet NEllen Mae OlaguerNo ratings yet

- Develop Understanding of TaxationDocument89 pagesDevelop Understanding of TaxationEyob kefle100% (1)

- BSBFIM501 Manage Budgets and Financial Plans Learner Instructions 2 (Implement Financial Management Approaches)Document7 pagesBSBFIM501 Manage Budgets and Financial Plans Learner Instructions 2 (Implement Financial Management Approaches)vipulclasses01 vipulclassNo ratings yet

- Questionnaire For Quiz Bee Level 2 FARDocument10 pagesQuestionnaire For Quiz Bee Level 2 FARJasmin GalacioNo ratings yet

- Mughal Jagirdari and Mansabdari SystemDocument9 pagesMughal Jagirdari and Mansabdari Systemas gamingNo ratings yet

- Corporate Reporting Homework (Day 4)Document8 pagesCorporate Reporting Homework (Day 4)Sara MirchevskaNo ratings yet

- 4 - Itad Bir Ruling No. 005-18Document4 pages4 - Itad Bir Ruling No. 005-18Gino Alejandro SisonNo ratings yet

- How To Know Fraud in AdvanceDocument6 pagesHow To Know Fraud in AdvanceMd AzimNo ratings yet

- AE321 Midterm Quiz 1: Multiple ChoiceDocument9 pagesAE321 Midterm Quiz 1: Multiple ChoiceChaermalyn Bao-idangNo ratings yet

- Cambridge International AS & A Level: Accounting 9706/12Document12 pagesCambridge International AS & A Level: Accounting 9706/12ewgwrgNo ratings yet

- Income Tax CalculatorDocument11 pagesIncome Tax Calculatorsaty_76No ratings yet

- Employee CompensationDocument2 pagesEmployee CompensationVikrantNo ratings yet

- Partnership Operation Quiz 2Document2 pagesPartnership Operation Quiz 2cabbigatcrisanta04No ratings yet

- 5 - CH 4 Accounting Analysis II-w (Color)Document37 pages5 - CH 4 Accounting Analysis II-w (Color)Samantha LaiNo ratings yet

- Correction of Errors IllustrationsDocument3 pagesCorrection of Errors IllustrationsBrian NaderaNo ratings yet

- Commando Test On FM (COC, CSP, DP) : Ranker's ClassesDocument3 pagesCommando Test On FM (COC, CSP, DP) : Ranker's ClassesmuskanNo ratings yet

- Fundamentals of Payroll AccountingDocument25 pagesFundamentals of Payroll AccountingXNo ratings yet