Professional Documents

Culture Documents

Maintain Accounts-Book Keeping: Evidence Guide

Uploaded by

فوزان علیOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Maintain Accounts-Book Keeping: Evidence Guide

Uploaded by

فوزان علیCopyright:

Available Formats

A SS E S SM E NT

MAT E RI AL

EVIDENCE

GUIDE

Qualification

IT Office Assistant

MAINTAIN ACCOUNTS–BOOK KEEPING

CS Code:

Level: 2

Credit: 15

Version: 1

CONTENTS 1. Assessment Summary and Record

2. Candidate Assessment

3. Assessor Judgment Guide

4. List of required tools/equipment, material and context of assessment

ASSESSMENT AND Competent Not Yet Competent

ASSESSOR

DETAILS

Assessment Re-Assessment

Assessor’s Name Assessor’s Code

Assessor’s Signature Date

DD MM YYYY

CANDIDATE Candidate’s Name

DETAILS F i r s t N am e L a s t N am e

Father’s Name

Institute Name and District

CNIC/BFORM #

Registration Number issued by

Assessment Body

Gender Male Female Transgender

Candidate's Consent I agree to the time and date of the assessment and am aware of the requirements

of the assessment. I fully understand my rights of appeal.

Candidate’s Signature

ASSESSMENT

You can use this coversheet as an Assessment Results Summary Form. Simply post a photocopy of this completed

RESULTS coversheet to NAVTTC

SUMMARY FORM

NAVTTC OFFICE

1. DATE 2. DATE E NTERE D INTO

ONLY FORM DATABASE:

RECEIVED: DD MM YYYY DD MM YYYY

Maintain Accounts–Book Keeping © NAVTTC January 2016 Page 1 of 10

1 ASSESSMENT SUMMARY & RECORD

ACTIVITY METHOD DESIRED OUTCOMES RESULT

OBSERVATION

COMPETENT

COMPETENT

DESIRED OUTCOMES FOR SUCCESSFUL ASSESSMENT OF

PORTFOLIO

NATURE OF

WRITTEN

NOT YET

COMPETENCY STANDARD: MAINTAIN ACCOUNTS–BOOK

ACTIVITY

KEEPING

ORAL

Maintain accounts in Peachtree Complete Accounting

Practical Skill

Demonstration

software.

Enter data and generate graphs in Microsoft Excel.

Answer all questions your Assessor may have during the

Knowledge

Assessment practical assessment.

Other

Requirements N/A

Maintain Accounts–Book Keeping © NAVTTC January 2016 Page 2 of 10

2 CANDIDATE ASSESSMENT

Candidate's Name………………………………………………..... Father’s Name …………………………………………………………………..

ALL WORK ASSESSED IN THIS COMPETENCY STANDARD MUST BE YOUR OWN WORK.

GUIDANCE TO CANDIDATE

To meet this standard you are required to complete the following tasks within two hours timeframe:

Record business transactions in Peachtree Complete Accounting software (Journal and Ledger) and prepare Profit &

Loss statement of the business transactions (Annexures-1 and 2).

Create worksheet in MS-Excel and generate graph against the entries (Annexure-3).

Important Note: The following general performance criteria will be followed and performed in all the tasks ( where applicable by

the candidate in order to meet this standard :

Follow precautionary procedures as per requirements of the given tasks

Select, use and maintain equipment/ tools as per requirement of the task

Report to supervisor in case of any emergency after taking necessary actions

Complete the work by following sequence of the operations

Perform task(s) within standard timeframe

ACTIVITIES CANDIDATE RESPONSE

1. Complete During a practical assessment, under observation by an assessor, I will correctly :

practical task

of maintaining Record business transactions in Peachtree Complete Accounting software (Journal and Ledger) and

accounts– prepare Profit & Loss statement of the business transactions (Annexures-1 and 2)

book keeping Create new dummy company in Peachtree software

under Create and save Charts of Accounts for the dummy company’s business transactions in

observation by Peachtree Complete Accounting software.

an assessor Record the dummy company’s business transactions in General Journal of the Peachtree

Complete Accounting software.

Record the dummy company’s business transactions in General Ledger of the Peachtree

Complete Accounting software.

Prepare Profit & Loss statement of the dummy company’s business transactions in the

Peachtree Complete Accounting software.

Create worksheet in MS-Excel and generate graph against the entries (Annexure-3).

Create MS-Excel worksheet as per format attached in Annexure- 3

Apply format on “sale price” and “Total sale” column in $ currency in MS-Excel worksheet as

per Annexure – 3.

Apply formula to calculate the total sales against the dummy entries in MS-Excel worksheet as

per Annexure – 3.

Apply formula to calculate the sale percentage in “% of sales” column of MS-Excel worksheet

as per Annexure – 3.

Apply formula to sum up “unit sale” and “Total Sales” columns in “Total” field of MS-Excel

worksheet as per Annexure – 3.

Generate 3D bar graph of “product line” against “Total sales” in MS-Excel worksheet as per

Annexure – 3.

General Performance Criteria

Follow precautionary procedures as per requirements of the given tasks

Select, use and maintain equipment/ tools as per requirement of the task

Report to supervisor in case of any emergency after taking necessary actions

Complete the work by following sequence of the operations

Perform task(s) within standard timeframe

2. Other N/A

requirements

Maintain Accounts–Book Keeping © NAVTTC January 2016 Page 3 of 10

3. Answer any My answers to questions are correct and demonstrate my understanding of the topics and their application.

questions your

assessor may

have during

the practical

assessment

Maintain Accounts–Book Keeping © NAVTTC January 2016 Page 4 of 10

3 ASSESSOR JUDGEMENT GUIDE

Candidate’s Name …………………………………………………. Father’s Name.……………………………………………………..

INSTRUCTIONS

This section contains minimum evidence requirements. Oral questioning may be used to clarify

FOR candidate understanding of the topic and its application .

ASSESSOR

ASSESSOR

ACTIVITIES MINIMUM EVIDENCE REQUIRED YES NO

COMMENTS

1. Complete During a practical assessment, under observation by an assessor, the

practical task of candidate correctly carried out the following tasks:

maintaining

accounts–book

keeping under

observation by

an assessor

Record business Created new dummy company in Peachtree software

transactions in

Peachtree Complete Created and saved Charts of Accounts for the dummy company’s

Accounting software business transactions in Peachtree Complete Accounting software.

(Journal and Ledger) Recorded the dummy company’s business transactions in General

and prepare Profit & Journal of the Peachtree Complete Accounting software.

Loss statement of the Recorded the dummy company’s business transactions in General

business transactions Ledger of the Peachtree Complete Accounting software.

(Annexures-1 and 2). Prepared Profit & Loss statement of the dummy company’s business

transactions in the Peachtree Complete Accounting software.

Create worksheet in Created MS-Excel worksheet as per format attached in Annexure- 3

MS-Excel and

generate graph Applied format on “sale price” and “Total sale” column in $ currency in

against the entries MS-Excel worksheet as per Annexure – 3.

(Annexure-3). Applied formula to calculate the total sales against the dummy entries

in MS-Excel worksheet as per Annexure – 3.

Applied formula to calculate the sale percentage in “% of sales”

column of MS-Excel worksheet as per Annexure – 3.

Applied formula to sum up “unit sale” and ”Total Sales” columns in

“Total” field of MS-Excel worksheet as per Annexure – 3.

Generated 3D bar graph of “product line” against “Total sales” in MS-

Excel worksheet as per Annexure – 3.

General Performance Followed precautionary procedures as per requirements of the given

Criteria tasks

Selected, used and maintained equipment/ tools as per requirement

of the task

Reported to supervisor in case of any emergency after taking

necessary actions

Completed the work by following sequence of the operations

Performed task(s) within standard timeframe

2. Other N/A

requirements

Maintain Accounts–Book Keeping © NAVTTC January 2016 Page 5 of 10

3. Answer any Candidate’s answers to questions are correct and demonstrate

questions the understanding of the topics and their application.

assessor may have

during the practical Assessor to document below all questions asked and candidate

assessment answers. Use extra sheets if required and attach.

Maintain Accounts–Book Keeping © NAVTTC January 2016 Page 6 of 10

LIST OF TOOLS, EQUIPMENT, MATERIAL AND

4 CONTEXT OF ASSESSMENT

This section contains information regarding;

INSTRUCTIONS Context of the assessment

List of required tools and equipment.

List of consumable items required during the service

1. Context of

Assessment This task will be performed in real time environment.

2. List of tools and equipment required (for five candidates)

S. No Items Quantity

1 Computer 05

2 Peachtree Accounting software and Microsoft excel 05

3 Printer 05

3. List of consumable items required (for five candidates)

S. No Items Quantity

1 Ball pens, Pencils, Erasers, Sharpeners 05

2 A4 Papers 01 Rim

Maintain Accounts–Book Keeping © NAVTTC January 2016 Page 7 of 10

Annexure-1

Account ID Account Description Active? Account Type

100 IDBP Yes Cash

101 cash on hand Yes Cash

102 petty cash Yes Cash

105 HBL Yes Cash

106 Account Receivable Yes Accounts Receivable

107 Inventory Yes Cash

108 office furniture Yes Fixed Assets

109 Office Computers Yes Fixed Assets

110 Other EQPTS Yes Fixed Assets

111 Office Supplies Yes Other Current Assets

112 Prepaid Expense Yes Other Current Assets

113 Other Assets Yes Other Assets

201 Account Payable Yes Accounts Payable

202 Sales Tax Payable Yes Other Current Liabilities

203 Income Tax Payable Yes Other Current Liabilities

204 Wages Payable Yes Other Current Liabilities

208 Bank Loan Yes Long Term Liabilities

301 Beginning Equity Yes Equity-Retained Earnings

303 Owner's Contribution Yes Equity-gets closed

304 Owner's Draw Yes Equity-gets closed

401 Sales Yes Income

415 Sales Discount Yes Income

419 interest received Yes Income

420 Capital Yes Equity-gets closed

Swiss Miss

501 Perfume(France) Yes Cost of Sales

502 Medora Perfume(China) Yes Cost of Sales

515 Purchase Return Yes Cost of Sales

516 Product Cost Yes Cost of Sales

601 Other Expenses Yes Expenses

602 Rent Expenses Yes Expenses

603 Salaries Expenses Yes Expenses

604 MISC. Expenses Yes Expenses

605 Income Tax Expenses Yes Expenses

Maintain Accounts–Book Keeping © NAVTTC January 2016 Page 8 of 10

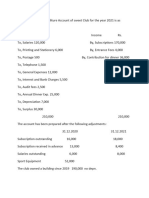

Annexure-2

Account Credit

Date Reference Trans Description Debit Amount Account Description

ID Amount

12/1/08 104 BEGBAL 880,000.00 MCB

12/1/08 105 BEGBAL 990,000.00 HBL

12/1/08 420 BEGBAL 1,870,000.00 Capital

12/1/08 301 BEGBAL Beginning Equity

12/1/08 104 BRV#01 Cheque received from debtors 30,000.00 MCB

12/1/08 106 BRV#01 Cheque received from debtors 30,000.00 Account Receivable

12/1/08 602 CPV#01 Rent paid by cash 1,000.00 Rent Expenses

12/1/08 101 CPV#01 Rent paid by cash 1,000.00 cash on hand

12/1/08 603 CPV#02 Salaries paid by cash 50,000.00 Salaries Expenses

12/1/08 101 CPV#02 Salaries paid by cash 50,000.00 cash on hand

12/1/08 604 CPV#03 Paid Misc. Expenses 15,000.00 MISC. Expenses

12/1/08 101 CPV#03 Paid Misc. Expenses 15,000.00 cash on hand

12/1/08 606 CPV#04 Paid utility bills 10,000.00 Utility Bill Expenses

12/1/08 101 CPV#04 Paid utility bills 10,000.00 cash on hand

12/1/08 108 CPV#06 Purchased Furniture by cash 100,000.00 office furniture

12/1/08 101 CPV#06 Purchased Furniture by cash 100,000.00 cash on hand

12/1/08 109 CPV#07 Purchased Office Computer 60,000.00 Office Computers

12/1/08 101 CPV#07 Purchased Office Computer 60,000.00 cash on hand

12/1/08 101 CRV#01 Cash Receive from debtors 50,000.00 cash on hand

12/1/08 106 CRV#01 Cash Receive from debtors 50,000.00 Account Receivable

12/1/08 101 CRV#02 Cash Received from debtor 20,000.00 cash on hand

12/1/08 106 CRV#02 Cash Received from debtor 20,000.00 Account Receivable

Total 2,206,000.00 2,206,000.00

Maintain Accounts–Book Keeping © NAVTTC January 2016 Page 9 of 10

Annexure-3

Maintain Accounts–Book Keeping © NAVTTC January 2016 Page 10 of 10

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5796)

- SQL Injection Tutorial - W3resourceDocument1 pageSQL Injection Tutorial - W3resourceفوزان علیNo ratings yet

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Building Dynamic Web Apps With Laravel: Eric OuyangDocument15 pagesBuilding Dynamic Web Apps With Laravel: Eric Ouyangفوزان علیNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- IJIBM Vol9No4 Nov2017Document310 pagesIJIBM Vol9No4 Nov2017فوزان علیNo ratings yet

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Using Apache Web Server - INTLDocument286 pagesUsing Apache Web Server - INTLفوزان علیNo ratings yet

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Curl - How To UseDocument84 pagesCurl - How To Useفوزان علیNo ratings yet

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (589)

- Ethical Hacking SkillsDocument3 pagesEthical Hacking Skillsفوزان علیNo ratings yet

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Historical Quranic Manuscripts - Madain Project (En)Document3 pagesHistorical Quranic Manuscripts - Madain Project (En)فوزان علیNo ratings yet

- WDC Assembler LinkerDocument97 pagesWDC Assembler Linkerفوزان علیNo ratings yet

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- X86 AssemblyDocument123 pagesX86 AssemblySneetsher Crispy97% (39)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Data Structures PDFDocument515 pagesData Structures PDFzahiid munirNo ratings yet

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Sequent PDFDocument1 pageSequent PDFTJ CortezNo ratings yet

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Swiss Banking Confidentiality: Perceptions vs. RealityDocument20 pagesSwiss Banking Confidentiality: Perceptions vs. RealityApiez ZiepaNo ratings yet

- TO Interview QuestionsDocument4 pagesTO Interview QuestionsAayushNo ratings yet

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Sample of Fixed Asset ScheduleDocument1 pageSample of Fixed Asset ScheduleAnnie ChewNo ratings yet

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Scott County Completed Sheriff SalesDocument12 pagesScott County Completed Sheriff SalesSheera LaineNo ratings yet

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Income and Expenditure Account of Sweet Club For The Year 2021 Is AsDocument4 pagesThe Income and Expenditure Account of Sweet Club For The Year 2021 Is AsBAZINGANo ratings yet

- Credit Repair Service in IndiaDocument8 pagesCredit Repair Service in IndiaAparnaNo ratings yet

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Data Overview - PBWDDocument3 pagesData Overview - PBWDSahil BeighNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Study of Cash Management at Standard Chartered BankDocument115 pagesStudy of Cash Management at Standard Chartered BankVishnu Prasad100% (2)

- Slide One Afs BbaDocument12 pagesSlide One Afs BbaMaqbool AhmedNo ratings yet

- Module 6 - Asset-Based ValuationDocument42 pagesModule 6 - Asset-Based Valuationnatalie clyde matesNo ratings yet

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1091)

- RK M-Banking Mandiri Adeng Januari 24Document4 pagesRK M-Banking Mandiri Adeng Januari 24Novi LegitaNo ratings yet

- Bab 5 Statement of Financial Position and Statement of Cash Flows (Autosaved)Document99 pagesBab 5 Statement of Financial Position and Statement of Cash Flows (Autosaved)Maha Sarkowi SiranNo ratings yet

- Government ProsDocument42 pagesGovernment ProsLitha MwahlaNo ratings yet

- Staff Paper: March 2015 Illustrative Examples Project Insurance ContractsDocument36 pagesStaff Paper: March 2015 Illustrative Examples Project Insurance Contractsالخليفة دجوNo ratings yet

- Price List As On 18-APR-2022: VariantDocument1 pagePrice List As On 18-APR-2022: VariantKolkata Jyote MotorsNo ratings yet

- Deductible Vs Excess (Insurance)Document1 pageDeductible Vs Excess (Insurance)gopinathan_karuthedaNo ratings yet

- Data Analysis On Financial InclusionDocument21 pagesData Analysis On Financial InclusionHeidi Bell50% (2)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- Non Performing LoansDocument11 pagesNon Performing LoansRogers256No ratings yet

- Illustration 2Document7 pagesIllustration 2Girish Redmi Note11No ratings yet

- Schedule of Fees & ChargesDocument9 pagesSchedule of Fees & ChargesJamesNo ratings yet

- Framework For Business Analysis and Valuation Using Financial StatementsDocument17 pagesFramework For Business Analysis and Valuation Using Financial Statementsnovita sariNo ratings yet

- Part A & BDocument6 pagesPart A & BRiya PrajapatiNo ratings yet

- Desertation Project KaranDocument66 pagesDesertation Project KaranFaheem QaziNo ratings yet

- Raw Materials InventoryDocument4 pagesRaw Materials InventoryYes ChannelNo ratings yet

- Internship Report On General Banking of Agrani Bank LimitedDocument50 pagesInternship Report On General Banking of Agrani Bank Limitedashique50% (4)

- AINS 21 Assignment 9 Insurance PoliciesDocument24 pagesAINS 21 Assignment 9 Insurance PoliciesSiddharth Chakkarwar100% (1)

- Capital One StatementDocument10 pagesCapital One StatementЮлия П73% (11)

- Mishkin Chapter 9Document25 pagesMishkin Chapter 9Damaris Wesly LubisNo ratings yet

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- External Commercial BorrowingsDocument37 pagesExternal Commercial BorrowingsTrisha Agarwala100% (1)