Professional Documents

Culture Documents

Tax Invoice: Neo Structo Construction Pvt. LTD

Uploaded by

nithinOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Tax Invoice: Neo Structo Construction Pvt. LTD

Uploaded by

nithinCopyright:

Available Formats

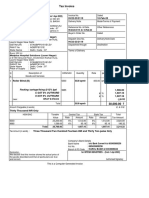

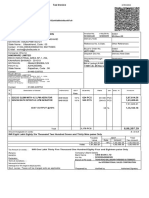

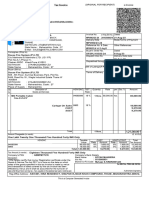

TAX INVOICE (ORIGINAL FOR RECIPIENT)

Billing : Place of Supply of Service :

NEO STRUCTO CONSTRUCTION PVT. LTD. C/O BHARAT PETROLEUM CORPORATION LTD.

2nd Floor, Door No.49/177, Syama Business Certre, KOCHI REFINERY, AMBALAMUGAL, KOCHI,

NH-47, Bypass Road, Vyttila, Cochin, ERNAKULAM

GSTIN/UIN : 32AAACN7717N1Z9 DIST-682302,

PAN/IT No : AAACN7717N

State Name : Kerala, Code : 32

Place of Supply : Kerala

Invoice No : AAPL/20-21/G0261 Invoice Date : 4-Aug-2020

Work Order No : NSC/KL/SO-060/19-20 Equipment Description :

JLG 80 HX, SB80-10

Billing Period : 1-Jul-2020 - 31-Jul-2020

Vendor Code : 10825 No of Worksheets : 1

Equipment Service Charges as Follows :

Particulars HSN/SAC UOM Qty Rate Amount

MONTHLY SERVICE CHARGES 997313 Month 1.000 1,35,000.00 1,35,000.00

OVERTIME CHARGES 997313 Hrs 16.000 432.69 6,923.00

Sub Total 1,41,923.00

IGST 18% OUTPUT 25,546.14

Total 1,67,469.14

Rupees : One Lakh Sixty Seven Thousand Four Hundred Sixty Nine and Fourteen paise Only

HSN/SAC Taxable Integrated Tax Total

Value Rate Amount Tax Amount

997313 1,41,923.00 18% 25,546.14 25,546.14

Total 1,41,923.00 25,546.14 25,546.14

Tax Amount (in words) : INR Twenty Five Thousand Five Hundred Forty Six and Fourteen paise Only

Terms & Condition: Bank Details

1 UAM NO.MH19E0016439 Bank Name : HDFC Bank Ltd-50200019168500

(MSMED Certificates No.27222102020 ) A/c No. : 50200019168500

2 This invoice shall be treated as correct if we do not IFS Code : HDFC0002869

receive any discrepancy in writing within 10 days of Branch : DADAR-E

submission.

3 18% interest shall be payable if this invoice is not

paid within 30 days of submission.

GSTIN/UIN : 27AALCA4003H1ZY for Aria Aerial Platforms Pvt.Ltd

PAN : AALCA4003H

Authorised Signatory

SUBJECT TO MUMBAI JURISDICTION

You might also like

- STEP 1: Setting Up Your UCC Contract Trust Account: (FIRST Package To Treasury)Document2 pagesSTEP 1: Setting Up Your UCC Contract Trust Account: (FIRST Package To Treasury)Jahe El97% (58)

- Greaves Cotton LTD: 4G11TAG23 Diesel Engine CPCB IIDocument55 pagesGreaves Cotton LTD: 4G11TAG23 Diesel Engine CPCB IIteja sri rama murthyNo ratings yet

- Greaves Cotton LTD: 4G11TAG23 Diesel Engine CPCB IIDocument55 pagesGreaves Cotton LTD: 4G11TAG23 Diesel Engine CPCB IIteja sri rama murthyNo ratings yet

- Lakshmi Agencies: Tax Invoice (Cash)Document2 pagesLakshmi Agencies: Tax Invoice (Cash)srinivas kandregulaNo ratings yet

- Job Card Retail - Tax InvoiceDocument2 pagesJob Card Retail - Tax Invoicegeorgy wilsonNo ratings yet

- Tax Invoice: Sunil MotorsDocument3 pagesTax Invoice: Sunil MotorsPrateek YadavNo ratings yet

- Greaves Cotton LTD.: Spare Parts CatalogueDocument62 pagesGreaves Cotton LTD.: Spare Parts CataloguenithinNo ratings yet

- Testing Instruments Manufacturing Co. Pvt. LTD.: Tim CDocument4 pagesTesting Instruments Manufacturing Co. Pvt. LTD.: Tim Cabhjt629No ratings yet

- Strictly no erasures allowedDocument12 pagesStrictly no erasures allowedErwin Labayog MedinaNo ratings yet

- Accounting Voucher DisplayDocument1 pageAccounting Voucher DisplayShubhyansh SinghNo ratings yet

- Ec 02 CHP 009Document1 pageEc 02 CHP 009joelraoNo ratings yet

- Theories of Public BorrowingsDocument64 pagesTheories of Public BorrowingsJester Mabuti50% (2)

- Tax Invoice: Bharat Auto Agency Hero Insurance Broking India Private LimitedDocument1 pageTax Invoice: Bharat Auto Agency Hero Insurance Broking India Private Limitedbharauthero barautNo ratings yet

- Samsung Refrigerator Tax InvoiceDocument1 pageSamsung Refrigerator Tax InvoiceJyoti Sarkar0% (1)

- DNB 2018Document178 pagesDNB 2018Sachidananda KiniNo ratings yet

- E InvoiceDocument5 pagesE InvoiceVinodh KannaNo ratings yet

- TAX INVOICEDocument1 pageTAX INVOICEAnjani KumariNo ratings yet

- Simaa0349 PDFDocument1 pageSimaa0349 PDFUsha Hasini VelagapudiNo ratings yet

- Ajio 1706695193596Document1 pageAjio 1706695193596shaelkmr550No ratings yet

- Ajio 1706695192988Document1 pageAjio 1706695192988shaelkmr550No ratings yet

- Tax Invoice for Betamethasone Base IPDocument1 pageTax Invoice for Betamethasone Base IPjytj1No ratings yet

- AIMTCDocument2 pagesAIMTCPriyanka 2277 -ANo ratings yet

- Bill 1Document1 pageBill 1Shaikh ShamsudNo ratings yet

- 11. TPI ChargesDocument1 page11. TPI ChargesPrem KumarNo ratings yet

- School BillDocument1 pageSchool BillGurpreetSinghNo ratings yet

- SV Roofing-13Document1 pageSV Roofing-13bikkumalla shivaprasadNo ratings yet

- Medplus 2119Document1 pageMedplus 2119Moseen AliNo ratings yet

- Tax Invoice: Tax Amount Amount Rate ValueDocument1 pageTax Invoice: Tax Amount Amount Rate ValueTula rashi videosNo ratings yet

- Barrel Motors PVT LTD Invoice SEPT 22Document1 pageBarrel Motors PVT LTD Invoice SEPT 22Priyadarshan BanjanNo ratings yet

- Tax invoice template for software subscriptionDocument1 pageTax invoice template for software subscriptionrajeev_snehaNo ratings yet

- INVOICE001Document1 pageINVOICE001rumman.saquib2No ratings yet

- Party:: Issan Machinary (Hmy)Document1 pageParty:: Issan Machinary (Hmy)Legal tax & financial servicesNo ratings yet

- Sales 32 2023 24Document1 pageSales 32 2023 24Bharat AutomobileNo ratings yet

- SCFO PI .01Document1 pageSCFO PI .01RiaZ MoHamMaDNo ratings yet

- Tax Invoice: AB Cartridge Private LimitedDocument1 pageTax Invoice: AB Cartridge Private LimitedSunil PatelNo ratings yet

- Tax Invoice: Invoice Number G0057870 Invoice DateDocument1 pageTax Invoice: Invoice Number G0057870 Invoice DateshamNo ratings yet

- Ajio_FN9190504652_1711613479962Document1 pageAjio_FN9190504652_1711613479962Neeraj ManhasNo ratings yet

- Inv G487Document1 pageInv G487ALOK SINGHNo ratings yet

- Mukon Constructions Pvt. LTD.: 1 Manpower Supply For The Month of Aug. 2019 9985 Lum Sum - 16,90,884Document1 pageMukon Constructions Pvt. LTD.: 1 Manpower Supply For The Month of Aug. 2019 9985 Lum Sum - 16,90,884lucky dudeNo ratings yet

- Tax Invoice: Tax Amount Amount Rate ValueDocument4 pagesTax Invoice: Tax Amount Amount Rate ValueaaftabganaiNo ratings yet

- Accounting VoucherDocument1 pageAccounting Vouchersharvesh kumarNo ratings yet

- CN 282Document1 pageCN 282f4m0uqb2riNo ratings yet

- AJPL0602Document1 pageAJPL0602shrungar.ornament1No ratings yet

- Accounting VoucherDocument2 pagesAccounting Vouchervenkat johnNo ratings yet

- Tax InvoiceDocument2 pagesTax Invoiceojasprajapati6No ratings yet

- Bta s1Document1 pageBta s1msNo ratings yet

- Inv G488Document1 pageInv G488ALOK SINGHNo ratings yet

- SidzernDocument1 pageSidzernLp BatNo ratings yet

- Tax Invoice: Medplus Hospital Solutions (Laxmi Nagar)Document1 pageTax Invoice: Medplus Hospital Solutions (Laxmi Nagar)Moseen AliNo ratings yet

- GAILGasInvoice 7404055189 27649Document2 pagesGAILGasInvoice 7404055189 27649raushanjsr18No ratings yet

- Tax InvoiceDocument1 pageTax Invoiceojasprajapati6No ratings yet

- Ani-011Document1 pageAni-011kisaprojectsllpNo ratings yet

- BT Pre3Document1 pageBT Pre3msNo ratings yet

- Authorised SignatoryDocument2 pagesAuthorised Signatorygaurav tanwarNo ratings yet

- 100 Pioneer SteelDocument1 page100 Pioneer SteelRanjan MishraNo ratings yet

- Tax InvoiceDocument2 pagesTax Invoiceojasprajapati6No ratings yet

- 082 Douse FireDocument4 pages082 Douse Firemetalcabin36No ratings yet

- TAX INVOICE for ISP Rental DiscountDocument2 pagesTAX INVOICE for ISP Rental DiscountPiyush AroraNo ratings yet

- PARK_HOSPITALS_TAX_INVOICE__RA-01__NON_SCHEDULEDocument2 pagesPARK_HOSPITALS_TAX_INVOICE__RA-01__NON_SCHEDULEreddyrabadaNo ratings yet

- 119 28-30 SepDocument1 page119 28-30 SepNarender Singh RawatNo ratings yet

- Si No Item Gross Amt PDP Dis% Rebate Rate Qty GST Hsn/Sac: Date: 9-Mar-23 Salesman: BTMDocument1 pageSi No Item Gross Amt PDP Dis% Rebate Rate Qty GST Hsn/Sac: Date: 9-Mar-23 Salesman: BTMVishnu VNo ratings yet

- 056Document1 page056Dipak KotkarNo ratings yet

- ST SupO 2940 2022 23 183214Document1 pageST SupO 2940 2022 23 183214Rajat SharmaNo ratings yet

- F22nb01a00044 Nb01a F2410989Document1 pageF22nb01a00044 Nb01a F2410989HEMANTHNo ratings yet

- Tax Invoice for TyresDocument4 pagesTax Invoice for TyresAkhilaNo ratings yet

- Ajio FN7474407898 1693217649474Document1 pageAjio FN7474407898 1693217649474Varu NayanNo ratings yet

- 10158676953506001Document2 pages10158676953506001LTHCB ITNo ratings yet

- LIST NO. F228 DISC GRINDER PARTS LISTDocument3 pagesLIST NO. F228 DISC GRINDER PARTS LISTnithinNo ratings yet

- SEW-Cust Creation FormDocument1 pageSEW-Cust Creation FormnithinNo ratings yet

- Inspection ReportDocument315 pagesInspection ReportnithinNo ratings yet

- TITUS Water Tank Home ProductsDocument3 pagesTITUS Water Tank Home ProductsnithinNo ratings yet

- Preventive Maintenance 2020 Summary BPCL KochiDocument2 pagesPreventive Maintenance 2020 Summary BPCL KochinithinNo ratings yet

- L&T Lhs PipingDocument8 pagesL&T Lhs PipingnithinNo ratings yet

- Sintex Pure Antibacterial Water Tanks - Sintex Plastics Technology LimitedDocument4 pagesSintex Pure Antibacterial Water Tanks - Sintex Plastics Technology LimitednithinNo ratings yet

- NEO STRUCTO MONTHLY EQPT REPORTDocument3 pagesNEO STRUCTO MONTHLY EQPT REPORTnithinNo ratings yet

- Update L&T JointsDocument2 pagesUpdate L&T JointsnithinNo ratings yet

- Preventive Maintenance 2020 Summary BPCL KochiDocument2 pagesPreventive Maintenance 2020 Summary BPCL KochinithinNo ratings yet

- Monthly Eqpt. Maintenance Report For The Month - 'Sep 2019: Bpcl-KochiDocument1 pageMonthly Eqpt. Maintenance Report For The Month - 'Sep 2019: Bpcl-KochinithinNo ratings yet

- JNK Heaters Co. Ltd. Inspection Notification Request (INR)Document1 pageJNK Heaters Co. Ltd. Inspection Notification Request (INR)nithinNo ratings yet

- JNK Heaters Co. Ltd. Inspection Notification Request (INR)Document1 pageJNK Heaters Co. Ltd. Inspection Notification Request (INR)nithinNo ratings yet

- MMR Report Jan-2020Document10 pagesMMR Report Jan-2020nithinNo ratings yet

- Monthly Eqpt. Maintenance Report For The Month - 'Dec 2019: Bpcl-KochiDocument3 pagesMonthly Eqpt. Maintenance Report For The Month - 'Dec 2019: Bpcl-KochinithinNo ratings yet

- Spare Parts StockDocument1 pageSpare Parts StocknithinNo ratings yet

- Daily Report - Owned Crane HiringDocument3 pagesDaily Report - Owned Crane HiringnithinNo ratings yet

- Split Rim Safety July 17Document1 pageSplit Rim Safety July 17nithinNo ratings yet

- Trouble Shooting Chart Final Drive: Scorts Institute of Farm Mechanisation, BangaloDocument1 pageTrouble Shooting Chart Final Drive: Scorts Institute of Farm Mechanisation, BangalonithinNo ratings yet

- Aria Aerial Platforms Work Log Sheet for JLG 80 HX EquipmentDocument2 pagesAria Aerial Platforms Work Log Sheet for JLG 80 HX EquipmentnithinNo ratings yet

- TROUBLE SHOOTING CHART (Escort/Powertrac 8+2) : Scorts Institute of Farm Mechanisation, BangaloDocument2 pagesTROUBLE SHOOTING CHART (Escort/Powertrac 8+2) : Scorts Institute of Farm Mechanisation, BangalonithinNo ratings yet

- Three-Piece Solid Rim Split Lock Ring Solid Flange-M, CR, 5 DegreeDocument1 pageThree-Piece Solid Rim Split Lock Ring Solid Flange-M, CR, 5 DegreenithinNo ratings yet

- NDT - Request - 2021-04-14T173607.423Document1 pageNDT - Request - 2021-04-14T173607.423nithinNo ratings yet

- NDT - Request - 2021-04-14T173619.097Document1 pageNDT - Request - 2021-04-14T173619.097nithinNo ratings yet

- Corts Institute of Farm Mechanisation, Bangalor: DRIVELINE (Escort/Powertrac 8+2)Document2 pagesCorts Institute of Farm Mechanisation, Bangalor: DRIVELINE (Escort/Powertrac 8+2)nithinNo ratings yet

- Problem Set 2Document2 pagesProblem Set 2Blubb1No ratings yet

- Quickly Track Budget vs Actual SpendingDocument13 pagesQuickly Track Budget vs Actual SpendingMichelle PadillaNo ratings yet

- Boarding Pass For Mr. Alexandru Florian VuteiDocument2 pagesBoarding Pass For Mr. Alexandru Florian VuteiAlex VuteiNo ratings yet

- Case 1 Phuket Beach HotelDocument7 pagesCase 1 Phuket Beach HotelYana Dela CernaNo ratings yet

- Secretary's Certificate (AUB)Document1 pageSecretary's Certificate (AUB)Gerard Nelson ManaloNo ratings yet

- Big data competitive advantages businessesDocument2 pagesBig data competitive advantages businessesDeeana SioufiNo ratings yet

- Loss of Resources and Reputation from Poor Environmental PracticesDocument2 pagesLoss of Resources and Reputation from Poor Environmental PracticesRockNo ratings yet

- SFM FT M-2 PDFDocument31 pagesSFM FT M-2 PDFveenamadhurimeduriNo ratings yet

- Petronet MHB LimitedDocument77 pagesPetronet MHB LimitedDhanraj ParmarNo ratings yet

- Bill of Lading Draft: CarrierDocument2 pagesBill of Lading Draft: Carrierglobal bintan permataNo ratings yet

- SEBI Regulations For Merchant BankersDocument3 pagesSEBI Regulations For Merchant Bankerspraveena DNo ratings yet

- CostDocument3 pagesCostmaria cruzNo ratings yet

- Lcci Level3 Solution Past Paper Series 3-10Document14 pagesLcci Level3 Solution Past Paper Series 3-10tracyduckk67% (3)

- Delegate List - 10th IMRC With Contact Details - Removed (1) - RemovedDocument100 pagesDelegate List - 10th IMRC With Contact Details - Removed (1) - RemovedSharon SusmithaNo ratings yet

- Pakistan Investment Strategy 2020Document50 pagesPakistan Investment Strategy 2020muddasir1980No ratings yet

- Effective Supply Chain ManagementDocument20 pagesEffective Supply Chain ManagementZeusNo ratings yet

- Question 1 - Sale DeedDocument5 pagesQuestion 1 - Sale DeedYamini GurjarNo ratings yet

- Swami Keshvanand Institute of Technology, Management and Gramothan (SKIT Jaipur)Document19 pagesSwami Keshvanand Institute of Technology, Management and Gramothan (SKIT Jaipur)Mayank kumawatNo ratings yet

- Equinor 2019 Annual Report and Form 20fDocument319 pagesEquinor 2019 Annual Report and Form 20fgUIDONo ratings yet

- An Ahp-Based Approach To Credit Risk Evaluation of Mortgage LoansDocument18 pagesAn Ahp-Based Approach To Credit Risk Evaluation of Mortgage Loanslnguyen647No ratings yet

- Strategic Management-Ii: Topic Presented byDocument16 pagesStrategic Management-Ii: Topic Presented bydeepika singhNo ratings yet

- Zero Based BudgetingDocument10 pagesZero Based Budgetingmisbah mohamedNo ratings yet

- Accounting For MaterialsDocument31 pagesAccounting For Materialsmuriithialex2030No ratings yet

- Caiib ABM NumericalsDocument24 pagesCaiib ABM NumericalsVijay Prakash ChittemNo ratings yet

- Sworn Statement of Assets, Liabilities and Net Worth December 31, 2021Document3 pagesSworn Statement of Assets, Liabilities and Net Worth December 31, 2021Catherine RenanteNo ratings yet

- Model Solution: Page 1 of 6Document6 pagesModel Solution: Page 1 of 6ShuvonathNo ratings yet