Professional Documents

Culture Documents

Inter Penalty Amendments Nov 2021

Uploaded by

The ProCACopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Inter Penalty Amendments Nov 2021

Uploaded by

The ProCACopyright:

Available Formats

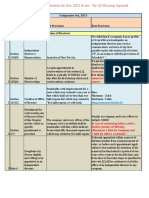

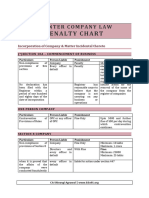

Chapter CA Inter Penalties for Nov 2021

CA Inter LAW 1.1

Penalties Applicable for

NOV 2021

Sr. Section Old Penalty New Penalty

No

1. 8 If Company makes any default in If Company makes any default in

complying any provisions of the section complying any provisions of the section

then the company will be liable to: then the company will be liable to:

a) Fine of minimum 10 lakhs up to Rs. 1 a) Fine of minimum 10 lakhs up to Rs. 1

crores, and crores, and

b) Every director and any other officer b) Every director and any other officer

who is found guilty for such default who is found guilty for such default will

will be punishable with: be punishable with:

i. Imprisonment to the maximum of Fine of Rs. 25000 to 25 lakhs

3 years, or

ii. Fine of Rs. 25000 to 25 lakhs or

with Both.

2. 16 If a company makes default in If a company is in default in complying

complying with any direction given with any direction given under sub-section

under sub-section (1), the company (1), the Central Government shall allot a

shall be punishable with fine of one new name to the company in such manner

thousand rupees for every day during as may be prescribed and the Registrar

which the default continues and every shall enter the new name in the register of

officer who is in default shall be companies in place of the old name and

punishable with fine which shall not be issue a fresh certificate of incorporation

less than five thousand rupees but with the new name, which the company

which may extend to one lakh rupees. shall use thereafter:

Provided that nothing in this sub-section

shall prevent a company from

subsequently changing its name in

accordance with the provisions of section

13.

3. 26 If a prospectus is issued in If a prospectus is issued in contravention

contravention of the provisions of of the provisions of section 26,

section 26, Company shall be punishable with fine

Company shall be punishable with fifty thousand rupees to three lakh.

imprisonment for a term which may Every person who is knowingly a party to

extend to three years or with fine which the issue of such prospectus shall be

shall not be less than fifty thousand punishable with fine which shall not be

rupees but which may extend to three less than fifty thousand rupees but which

lakh rupees, or with both. may extend to three lakh rupees.

4. 40 Penalty for default will be as under- Penalty for default will be as under-

For Company-Rs.5,00,000 ≤ Fine ≤ For Company-Rs.5,00,000 ≤ Fine ≤

Rs.50,00,000 Rs.50,00,000

© CA Darshan D. Khare’s WowClass.com

Chapter CA Inter Penalties for Nov 2021

1.2 For every officer in default – For every officer in default –

With imprisonment for a term which Rs.50,000 ≤ Fine ≤ Rs.3,00,000.

may extend to one year or

Rs.50,000 ≤ Fine ≤ Rs.3,00,000 or with

both.

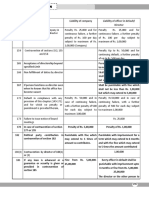

5. 56 where any default is made in complying Where any default is made in complying

with the provisions of sub-sections (1) with the provisions of sub-sections (1) to

to (5), the punishment shall be as (5), the company and every officer of the

under: company who is in default shall be liable

a) company: It shall be punishable with to a penalty of fifty thousand rupees.".

fine varying from 25,000 rupees to 5

lakh rupees

every officer of the company who is in

default: He shall be punishable with

minimum fine of 10,000 rupees and

maximum of one lakh rupees.

6. 64 Where any company fails to comply Where any company fails to comply with

with the provisions of sub-section (1), the provisions of sub-section (1), such

such company and every officer who is company and every officer who is in

in default shall be liable to a penalty default shall be liable to a penalty

of Rs.1000 for each day during which of Rs.500 for each day during which such

such default continues, or five lakh default continues, subject to a maximum

rupees whichever is less. of five lakh rupees in case of a company

and one lakh rupees in case of an officer

who is in default.

7. 68 If a company makes any default in If a company makes any default in

complying with the provisions of this complying with the provisions of this

section or with SEBI regulations, section or with SEBI regulations, penalty

penalty shall be as under- shall be as under-

For Company- For Company-

Rs.1,00,000 ≤ Fine ≤ Rs.3,00,000 Rs.1,00,000 ≤ Fine ≤ Rs.3,00,000

For Every officer in default- For Every officer in default-

With Imprisonment for term which Rs.1,00,000 ≤ Fine ≤ Rs.3,00,000

extends to 3 years or

Rs.1,00,000 ≤ Fine ≤ Rs.3,00,000

8. 86 if a company contravenes any of the If any company is in default in complying

provisions relating to the registration of with any of the provisions of this Chapter,

charges or modification or satisfaction the company shall be liable to a penalty of

of charges, the punishment shall be as five lakh rupees and every officer of the

under: company who is in default shall be liable

a) the company shall be punishable to a penalty of fifty thousand rupees.".

with minimum fine of ` one lakh and

maximum fine of ` ten lakhs; and

every defaulting officer of the company

shall be punishable with imprisonment

maximum up to six months or with

minimum fine of ` twenty-five thousand

and maximum of ` one lakh, or with

both.

9. 88 Section 88(5) of the Act provides that Section 88(5) If a company does not

© CA Darshan D. Khare’s WowClass.com

Chapter CA Inter Penalties for Nov 2021

company and every officer of the maintain a register of members or

company who is in default shall be debenture-holders or other security 1.3

punishable with fine which shall not be holders or fails to maintain them in

less than ` 50,000 but which may extend accordance with the provisions of sub-

to ` 3,00,000 and where the failure is a section (1) or sub-section (2), the company

continuing one, with a further fine shall be liable to a penalty of three lakh

which may extend to ` 1,000 per day. rupees and every officer of the company

who is in default shall be liable to a

penalty of fifty thousand rupees.".

10. 89(5) If any person fails to make a declaration If any person fails to make a declaration as

as required under section 89, without required under sub-section (1) or sub-

any reasonable cause, he shall be section (2) or sub-section (3), he shall be

punishable with fine which may extend liable to a penalty of fifty thousand rupees

to fifty thousand rupees and where the and in case of continuing failure, with a

failure is a continuing one, with a further penalty of two hundred rupees for

further fine which may extend to one each day after the first during which such

thousand rupees for every day after the failure continues, subject to a maximum of

first during which the failure continues. five lakh rupees.";

11. 89(7) If a company, required to file a return If a company, required to file a return

u/s 89(6), fails to do so within 30 days under sub-section (6), fails to do so before

of receipt of declaration by it, the the expiry of the time specified therein,

company and every officer of the the company and every officer of the

company who is in default shall be company who is in default shall be liable

punishable with fine which shall not be to a penalty of one thousand rupees for

less than five hundred rupees but which each day during which such failure

may extend to one thousand rupees continues, subject to a maximum of five

and where the failure is a continuing lakh rupees in the case of a company and

one, with a further fine which may two lakh rupees in case of an officer who

extend to one thousand rupees for is in default.";

every day after the first during which

the failure continues.

12. 90(10) If any person fails to make a declaration If any person fails to make a declaration as

as required under sub-section (1), he required under sub-section (1), he shall be

shall be liable for : liable to a penalty of fifty thousand rupees

a) Imprisonment for a term which may and in case of continuing failure, with a

extend to one year or further penalty of one thousand rupees for

b) With fine which shall not be less than each day after the first during which such

one lakh rupees but which may failure continues, subject to a maximum of

extend to ten lakh rupees or two lakh rupees.";

c) With both

Where the failure is continuous, with a

further fine which may extend to one

thousand rupees for every day after the

first day during which the failure

continues.

13. 90(11) If a company, required to maintain If a company, required to maintain

register under sub-section (2) and file register under sub-section (2) and file the

the information under sub-section (4) or information under sub-section (4) or

required to take necessary steps required to take necessary steps under

under sub-section (4A) fails to do so or sub-section (4A), fails to do so or denies

© CA Darshan D. Khare’s WowClass.com

Chapter CA Inter Penalties for Nov 2021

denies inspection as provided therein, inspection as provided therein then :

1.4 the company and every officer of the a) The company shall be liable to a penalty

company who is in default shall be of one lakh rupees and in case of

punishable with fine which shall not be continuing failure, with a further

less than ten lakh rupees but which may penalty of five hundred rupees for each

extend to fifty lakh rupees and where day, after the first during which such

the failure is a continuing one, with a failure continues, subject to a maximum

further fine which may extend to one of five lakh rupees and

thousand rupees for every day after the every officer of the company who is in

first during which the failure continues. default shall be liable to a penalty of

twenty-five thousand rupees and in case

of continuing failure, with a further

penalty of two hundred rupees for each

day, after the first during which such

failure continues, subject to a maximum of

one lakh rupees.".

14. 92(5) Where company fails to file even within Where company fails to file even within

270 days from the expiry of 60days time 270days from the expiry of 60days time

limit (i.e., fails to file within 330 days of limit (i.e., fails to file within 330 days of

date of holding AGM/date on which date of holding AGM/date on which AGM

AGM should have been held),penalty should have been held),penalty shall be as

shall be as under- under-

such company and its every officer who such company and its every officer who is

is in default shall be liable to a penalty in default shall be liable to a penalty of ten

of fifty thousand rupees and in case of thousand rupees and in case of continuing

continuing failure, with further penalty failure, with further penalty of one

of one hundred rupees for each day hundred rupees for each day during which

during which such failure continues, such failure continues, subject to a

subject to a maximum of five lakh maximum of two lakh rupees in case of a

rupees. company and fifty thousand rupees in case

of an officer who is in default.

15. 92(6) If a company secretary in practice, When a Company Secretary in practice

certifies the annual return which is not certifies an Annual Return which is not in

in conformity with the requirements of conformity with the requirements of this

this section or the applicable rules, he section or the applicable rules, he shall be

shall be punishable with fine which liable to a penalty of two lakh rupees

shall not be less than ` 50,000 but which punishable.

may extend to ` 5,00,000

16. 105(5) When, for the purpose of meeting, When, for the purpose of meeting,

invitations to appoint as proxy are sent invitations to appoint as proxy are sent at

at the company`s expense to any the company`s expense to any member

member entitled to have a notice of the entitled to have a notice of the meeting,

meeting, Then every officer of the company who

Every officer of the company who knowingly issues the invitations or permits

knowingly issues the invitations as such issue shall be punishable with fine up

aforesaid or willfully authorises or to Rs.50,000.

permits their issue shall be punishable

with fine which may extend to

Rs.100,000.

17. 117 If filed after 30 days but within 300 If filed after 30 days but within 300 days,

© CA Darshan D. Khare’s WowClass.com

Chapter CA Inter Penalties for Nov 2021

days, additional filing fee as prescribed additional filing fee as prescribed shall be

shall be payable as per sec 403. payable as per sec 403. 1.5

Penalty for filing beyond 300 days -For Penalty for filing beyond 300 days -For the

the Company- Company-

penalty of One lakh rupees and in case penalty of ten thousand rupees and in

of continuing failure, with further case of continuing failure, with further

penalty of five hundred rupees for each penalty of one hundred rupees for each

day after the first during which such day after the first during which such

failure continues, subject to a maximum failure continues, subject to a maximum of

of twenty five lakhs rupees. two lakh rupees.

For every officer in default(including For every officer in default(including

liquidator if any)- penalty of fifty liquidator if any)- penalty of ten thousand

thousand rupees and in case of rupees and in case of continuing failure,

continuing failure, with further penalty with further penalty of one hundred

of five hundred rupees for each day rupees for each day after the first during

after the first during which such failure which such failure continues, subject to a

continues, subject to a maximum of five maximum of fifty thousand rupees

lakh rupees

18. 124 If a company fails to comply with any of If a company fails to comply with any of

the requirements relating to unpaid the requirements of this section, such

dividend account, it shall be punishable company shall be liable to a penalty of one

with minimum fine of rupees five lakhs lakh rupees and in case of continuing

which may extend to rupees twenty- failure, with a further penalty of five

five lakhs. hundred rupees for each day after the first

Further, every officer of the company during which such failure continues,

who is in default shall be punishable subject to a maximum of ten lakh rupees

with minimum fine of rupees one lakh and every officer of the company who is in

which may extend to rupees five lakhs. default shall be liable to a penalty of

twenty-five thousand rupees and in case

of continuing failure, with a further

penalty of one hundred rupees for each

day after the first during which such

failure continues, subject to a maximum of

two lakh rupees.".

19. 128 Normally the duty of maintenance of Normally the duty of maintenance of

books of accounts is of the MD / WTD / books of accounts is of the MD / WTD /

BOD. But if they feel so they can BOD. But if they feel so they can transfer

transfer the duty to CFO / any other the duty to CFO / any other qualified

qualified person. person.

In case of contravention the officer in In case of contravention the officer in

default will be as follows: default will be as follows:

a. MD,WTDin charge of finance/ a. MD,WTDin charge of finance/ BOD

BOD (if qualified person or CFO (if qualified person or CFO is not

is not appointed). appointed).

b. CFO / Qualified person b. CFO / Qualified person appointed.

appointed. (in case if the CFO / (in case if the CFO / Qualified

Qualified Person is appointed for Person is appointed for

maintenance of books.) maintenance of books.)

The officer in default in above case will The officer in default in above case will be

be liable to the following penalty of liable to the following penalty of

with imprisonment for a term which with imprisonment for a term which may

© CA Darshan D. Khare’s WowClass.com

Chapter CA Inter Penalties for Nov 2021

may extend to one year or extend to one year or

1.6 Fine of Rs. 50,000 – Rs. 5,00,000 Fine of Rs. 50,000 – Rs. 5,00,000

[or with both]

20. 134 If a company contravenes the If a company is in default in complying

provisions of this section, the company with the provisions of this section, the

shall be punishable with fine which company shall be liable to a penalty of

shall not be less than fifty thousand three lakh rupees and every officer of

rupees but which may extend to the company who is in default shall be

twenty-five lakh rupees and every liable to a penalty of fifty thousand

officer of the company who is in default rupees.

shall be punishable with imprisonment

for a term which may extend to three

years or with fine which shall not be

less than fifty thousand rupees but

which may extend to five lakh rupees,

or with both

21. 135(7) If a company contravenes the If a company is in default in complying

provisions of sub-section (5) or sub- with the provisions of sub-section (5) or

section (6), the company shall be sub-section (6), the company shall be

punishable with fine which shall not be liable to a penalty of twice the amount

less than fifty thousand rupees but required to be transferred by the company

which may extend to twenty-five lakh to the Fund specified in Schedule VII or the

rupees and every officer of such Unspent Corporate Social Responsibility

company who is in default shall be Account, as the case may be, or one crore

punishable with imprisonment for a rupees, whichever is less, and every officer

term which may extend to three years of the company who is in default shall be

or with fine which shall not be less than liable to a penalty of one-tenth of the

fifty thousand rupees but which may amount required to be transferred by the

extend to five lakh rupees, or with company to such Fund specified in

both. Schedule VII, or the Unspent Corporate

Social Responsibility Account, as the case

may be, or two lakh rupees, whichever is

less.

22. 140 If the auditor fails to file form ADT-3 If the auditor fails to file form ADT-3

statement of resignation as stated statement of resignation as stated above

above the auditor will be liable for the the auditor will be liable for the penalty of

penalty of Rs. 50,000 or an amount Rs. 50,000 or an amount equal to the

equal to the remuneration of the remuneration of the auditor, whichever is

auditor, whichever is less. And in case less. And in case of continuing failure, with

of continuing failure, with further further penalty of five hundred rupees for

penalty of five hundred rupees for each each day after the first during which such

day after the first during which such failure continues, subject to a maximum of

failure continues, subject to a maximum two lakh rupees.

of Five lakh rupees.

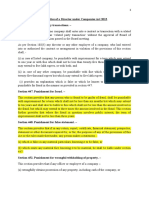

23. 143(15) If any auditor, cost auditor or the If any auditor, cost accountant or company

Secretarial auditor, as mentioned secretary in practice do not comply with

above, do not comply with the the provisions of sub-section (12), he shall

provisions of this section (i.e. section a) in case of a listed company, be liable to

143(12), he shall be punishable with a penalty of five lakh rupees; and

fine which shall not be less than `1 lac in case of any other company, be liable to

but which may extend to `25 lakhs. a penalty of one lakh rupees.

© CA Darshan D. Khare’s WowClass.com

Chapter CA Inter Penalties for Nov 2021

24. 147(1) If any provision of section 139 – 146 is If any provision of section 139 – 146 is

contravened the consequences will be contravened the consequences will be as 1.7

as follows. follows.

a) The company will be punishable for a) The company will be punishable for

the fine of Rs.25000 to Rs.5 lakhs; the fine of Rs.25000 to Rs.5 lakhs; and

and b) Every officer in default will be liable-

b) Every officer in default will be liable- i. with imprisonment for a term which

i. with imprisonment for a term may extend to one year or

which may extend to one year or ii. For fine which shall not be less than

ii. For fine which shall not be less ten thousand rupees but which may

than ten thousand rupees but extend to one lakh rupees

which may extend to one lakh or with both

rupees

or with both

25. 148(8) If any provision of this section is If any provision of section this is

contravened the consequences will be contravened the consequences will be as

as follows. follows.

a) The company will be punishable for a) The company will be punishable for

the fine of Rs.25000 to Rs.5 lakhs; the fine of Rs.25000 to Rs.5 lakhs; and

and b) Every officer in default will be liable-

b) Every officer in default will be liable- i. with imprisonment for a term

i. with imprisonment for a term which may extend to one year or

which may extend to one year or ii. For fine which shall not be less than

ii. For fine which shall not be less ten thousand rupees but which may

than ten thousand rupees but extend to one lakh rupees

which may extend to one lakh or with both

rupees

or with both

© CA Darshan D. Khare’s WowClass.com

You might also like

- Important Penalties For Cs Executive JUNE 2020 New Syllabus: About The AuthorDocument9 pagesImportant Penalties For Cs Executive JUNE 2020 New Syllabus: About The Authorarti chowdhryNo ratings yet

- CA Final Law Amendments Dec 21 - Except IBCDocument18 pagesCA Final Law Amendments Dec 21 - Except IBCShruthi SNo ratings yet

- Final LawDocument35 pagesFinal LawSakshiK ChaturvediNo ratings yet

- CA Inter Amendments For Nov 2021: Chapter 1: PreliminaryDocument12 pagesCA Inter Amendments For Nov 2021: Chapter 1: PreliminarySona GuptaNo ratings yet

- Important Penalties in Company LawDocument9 pagesImportant Penalties in Company LawLokesh RoongtaNo ratings yet

- MAJOR PENALTIES UNDER COMPANIES ACT 2013Document36 pagesMAJOR PENALTIES UNDER COMPANIES ACT 2013Vanshika BhedaNo ratings yet

- CA Final Audit AmendmentsDocument9 pagesCA Final Audit AmendmentsAneek JainNo ratings yet

- Amendments in CA Final Law For Nov 2018-2Document22 pagesAmendments in CA Final Law For Nov 2018-2RashikaNo ratings yet

- Important PenaltiesDocument3 pagesImportant PenaltiesBLACK LOVERNo ratings yet

- Ca Inter PenaltiesDocument9 pagesCa Inter Penaltiesvijayan.babu.byNo ratings yet

- PenaltiesDocument4 pagesPenaltiesAneek JainNo ratings yet

- A009 - Kartik Dabas - FMRDocument6 pagesA009 - Kartik Dabas - FMRKARTIK DABASNo ratings yet

- Provisions in Pakistani labor lawsDocument35 pagesProvisions in Pakistani labor lawsMomina NadeemNo ratings yet

- Supplement For: Executive Programme (Old Syllabus)Document17 pagesSupplement For: Executive Programme (Old Syllabus)janardhan CA,CSNo ratings yet

- Payment of Gratuity The Payment of GratuityDocument4 pagesPayment of Gratuity The Payment of Gratuitysubhasishmajumdar100% (1)

- Companies Act 2013 PenaltiesDocument43 pagesCompanies Act 2013 PenaltiesyashsinhaNo ratings yet

- Wage Code BillDocument12 pagesWage Code Bill2K19/UMBA/25 VIDHI SARAFFNo ratings yet

- Wage Code BillDocument12 pagesWage Code Billsrinivas rajuNo ratings yet

- Compliance by LLPDocument2 pagesCompliance by LLPSavoir PenNo ratings yet

- Directors Liabilities Under Various LawsDocument2 pagesDirectors Liabilities Under Various LawsrockyrrNo ratings yet

- CA Final Law Penalties ChartDocument5 pagesCA Final Law Penalties ChartPankaj PathakNo ratings yet

- GM Test Series: Auditing and AssuranceDocument10 pagesGM Test Series: Auditing and AssuranceAryanAroraNo ratings yet

- 66097bos53354 Fnew p4Document57 pages66097bos53354 Fnew p4priyankaNo ratings yet

- RTP Compiler May 2018 To Nov 2021Document443 pagesRTP Compiler May 2018 To Nov 2021Tanny KhatriNo ratings yet

- Section Name Section No. As Per New Companies Act, 2013 Section No. As Per Old Companies Act, 1956Document5 pagesSection Name Section No. As Per New Companies Act, 2013 Section No. As Per Old Companies Act, 1956Rohan KhatriNo ratings yet

- CA Final Company Law Amendments SummaryDocument12 pagesCA Final Company Law Amendments SummaryAneek JainNo ratings yet

- Penalties Under Indian Companies ActDocument8 pagesPenalties Under Indian Companies ActabmainkyakaruNo ratings yet

- Chapter 8 - Payment of Gratuity Act, 1972Document16 pagesChapter 8 - Payment of Gratuity Act, 1972Hyma TennetiNo ratings yet

- © The Institute of Chartered Accountants of IndiaDocument12 pages© The Institute of Chartered Accountants of Indiaamanaggarwal1708No ratings yet

- Labour LawDocument12 pagesLabour Lawjoy hadassahNo ratings yet

- RA 10022 Amends Labor Laws for Overseas Filipino WorkersDocument4 pagesRA 10022 Amends Labor Laws for Overseas Filipino WorkersnoonalawNo ratings yet

- Payment of Gratuity ActDocument2 pagesPayment of Gratuity ActAarthi PadmanabhanNo ratings yet

- Penalties Payment of WagesDocument3 pagesPenalties Payment of WagessushmaNo ratings yet

- Payment of Gratuity Act 1972 ExplainedDocument22 pagesPayment of Gratuity Act 1972 ExplainedAastha GoyalNo ratings yet

- Amalgamation Is An Arrangement or ReconstructionDocument11 pagesAmalgamation Is An Arrangement or ReconstructionVyas LalitNo ratings yet

- Liabilities and Duties of A Director Under Companies Act 2013Document2 pagesLiabilities and Duties of A Director Under Companies Act 2013anvit seemanshNo ratings yet

- ICAI LLP Act Amendments for Dec 2022 ExamsDocument11 pagesICAI LLP Act Amendments for Dec 2022 ExamsRAHUL CHOUHANNo ratings yet

- Employees' Provident Fund Act SummaryDocument17 pagesEmployees' Provident Fund Act Summarysmit2512No ratings yet

- Republic Act No. 8188Document2 pagesRepublic Act No. 8188Al RxNo ratings yet

- Payment of Gratuity ActDocument21 pagesPayment of Gratuity Actprathu601No ratings yet

- Corporate Law Workbook SectionsDocument9 pagesCorporate Law Workbook SectionsPushkar PriyamNo ratings yet

- 64 Amendmntnotes 10 18 PDFDocument9 pages64 Amendmntnotes 10 18 PDFkhusbu jainNo ratings yet

- Governing Laws On MLM in MalaysiaDocument1 pageGoverning Laws On MLM in Malaysiamaxx1116No ratings yet

- Company BackupDocument3 pagesCompany BackupsaajedaNo ratings yet

- Adjudication of Disputes and Claims under ESI Act,1948Document4 pagesAdjudication of Disputes and Claims under ESI Act,1948AkshayNo ratings yet

- RA 11711 amends Contractors' License LawDocument3 pagesRA 11711 amends Contractors' License LawRavenclaws91No ratings yet

- Payment of Wages ActDocument4 pagesPayment of Wages ActMayuri YadavNo ratings yet

- Important Penalty - CA Inter LawDocument14 pagesImportant Penalty - CA Inter Lawnagaraj9032230429100% (1)

- Subsidiary Legislation (The Civil Aviation (Remotely Piloted Aircraft Systems) (Amendment) Regulations, 2020)Document4 pagesSubsidiary Legislation (The Civil Aviation (Remotely Piloted Aircraft Systems) (Amendment) Regulations, 2020)shangitikomboNo ratings yet

- PresentationDocument9 pagesPresentationRamani RanjanNo ratings yet

- Professional Programme (Old Syllabus) Advanced Company Law and PracticeDocument50 pagesProfessional Programme (Old Syllabus) Advanced Company Law and PracticeRitu JhambNo ratings yet

- Industrial Employment (Standing Orders) Act, 1946Document47 pagesIndustrial Employment (Standing Orders) Act, 1946Dhaval Patel0% (1)

- As 20 Earning Per Share Full NotesDocument37 pagesAs 20 Earning Per Share Full NotesKumar SwamyNo ratings yet

- Describe The Scope of Payment of Gratuity Act 1972Document3 pagesDescribe The Scope of Payment of Gratuity Act 1972Jaspreet SinghNo ratings yet

- Allotment of Securities: (Sec.39 - Sec.40)Document5 pagesAllotment of Securities: (Sec.39 - Sec.40)Neha RohillaNo ratings yet

- Company Law Executive Programme (Old Syllabus) : Supplement ForDocument46 pagesCompany Law Executive Programme (Old Syllabus) : Supplement ForKarsin ManochaNo ratings yet

- Company Law AmendmentDocument6 pagesCompany Law AmendmentharshitNo ratings yet

- General Manager: 4. Balance Sheet To Be Sent To The Labour OfficeDocument7 pagesGeneral Manager: 4. Balance Sheet To Be Sent To The Labour OfficeAnkit Jung RayamajhiNo ratings yet

- West Bengal Act - Labour - Bonus - ActDocument4 pagesWest Bengal Act - Labour - Bonus - ActRankit AlbelaNo ratings yet

- ICAI Board of Studies Academic document for November 2021 examsDocument8 pagesICAI Board of Studies Academic document for November 2021 examsThe ProCANo ratings yet

- ICAI Board of Studies Academic document for November 2021 examsDocument8 pagesICAI Board of Studies Academic document for November 2021 examsThe ProCANo ratings yet

- ICAI Board of Studies Academic document for November 2021 examsDocument8 pagesICAI Board of Studies Academic document for November 2021 examsThe ProCANo ratings yet

- Bos 49180Document46 pagesBos 49180The ProCANo ratings yet

- CA INTER BANK AUDIT CHAPTER KEY POINTSDocument20 pagesCA INTER BANK AUDIT CHAPTER KEY POINTSThe ProCANo ratings yet

- ICAI Board of Studies Academic document for November 2021 examsDocument8 pagesICAI Board of Studies Academic document for November 2021 examsThe ProCANo ratings yet

- Bos 070821 BDocument1 pageBos 070821 BThe ProCANo ratings yet

- Bos 53668Document8 pagesBos 53668The ProCANo ratings yet

- ICAI Board of Studies Academic document for November 2021 examsDocument8 pagesICAI Board of Studies Academic document for November 2021 examsThe ProCANo ratings yet

- LRA process applicationDocument18 pagesLRA process applicationJhomel Delos ReyesNo ratings yet

- Batong Buhay Goldmines Inc Vs de La Serna 1999 DigestDocument3 pagesBatong Buhay Goldmines Inc Vs de La Serna 1999 DigestEmmanuel Ortega0% (2)

- G.R. No. 131482 - Samartino Vs RaonDocument5 pagesG.R. No. 131482 - Samartino Vs Raonkim domingoNo ratings yet

- Smith v. Aramark Food Service - Document No. 5Document9 pagesSmith v. Aramark Food Service - Document No. 5Justia.comNo ratings yet

- Legal Forms SummaryDocument18 pagesLegal Forms Summaryryan100% (2)

- Aguila v. CA, 310 SCRA 246Document2 pagesAguila v. CA, 310 SCRA 246arcale JNo ratings yet

- Garcia-Rueda vs. Pascasio, G.R. No. 118141, September 5, 1997Document7 pagesGarcia-Rueda vs. Pascasio, G.R. No. 118141, September 5, 1997Irish Asilo PinedaNo ratings yet

- Gammo-R (Sent Mem)Document5 pagesGammo-R (Sent Mem)WXYZ-TV Channel 7 DetroitNo ratings yet

- Notice and Declaration 1-22-2019Document194 pagesNotice and Declaration 1-22-2019TRUMPET OF GODNo ratings yet

- Jacome v. Spirit Airlines, IncDocument16 pagesJacome v. Spirit Airlines, IncMario TNo ratings yet

- Legal Nature of CompaniesDocument6 pagesLegal Nature of CompaniesSashidar50% (2)

- Willex Plastic Industries Ordered to Pay DebtDocument11 pagesWillex Plastic Industries Ordered to Pay DebtRose Mary G. EnanoNo ratings yet

- United States Court of Appeals, Eighth CircuitDocument5 pagesUnited States Court of Appeals, Eighth CircuitScribd Government DocsNo ratings yet

- Voluntary SurrenderDocument7 pagesVoluntary SurrenderraviNo ratings yet

- People Vs PitocDocument2 pagesPeople Vs PitocDivina Gracia Hinlo0% (1)

- LTD Part 9, 13, 16, 17 Digest - Format2Document16 pagesLTD Part 9, 13, 16, 17 Digest - Format2JacobNo ratings yet

- People V PalanasDocument1 pagePeople V PalanasNikita BayotNo ratings yet

- Washington State v. CLA & Mitchell JohnsonDocument38 pagesWashington State v. CLA & Mitchell JohnsonKOMO NewsNo ratings yet

- A4V Perfecting Setoff NotesDocument3 pagesA4V Perfecting Setoff NotesKonan Snowden82% (11)

- MCRO - 69VI CV 20 346 - Complaint Civil - 2020 08 13 - 20210601170805Document16 pagesMCRO - 69VI CV 20 346 - Complaint Civil - 2020 08 13 - 20210601170805Duluth News TribuneNo ratings yet

- COL 1st Meeting CasesDocument10 pagesCOL 1st Meeting CasesWinston Mao TorinoNo ratings yet

- First 10 Cases - CommrevDocument179 pagesFirst 10 Cases - CommrevStephen JacoboNo ratings yet

- College Assurance Plan Vs Belfrant Devt IncDocument11 pagesCollege Assurance Plan Vs Belfrant Devt IncShela L LobasNo ratings yet

- Philippines v. Grande rape case credibilityDocument2 pagesPhilippines v. Grande rape case credibilityTootsie GuzmaNo ratings yet

- Francisco Vs Francisco-AlfonsoDocument1 pageFrancisco Vs Francisco-Alfonsopja_14No ratings yet

- The Insurance Code: History of Insurance in PhilippinesDocument1 pageThe Insurance Code: History of Insurance in PhilippinesRIZA WOLFENo ratings yet

- 24.Sps Barredo Vs Sps Leano, GR #156627, June 4, 2004Document2 pages24.Sps Barredo Vs Sps Leano, GR #156627, June 4, 2004Rebuild BoholNo ratings yet

- Philippines Supreme Court Upholds Land Title RegistrationDocument4 pagesPhilippines Supreme Court Upholds Land Title RegistrationKen ChaseMasterNo ratings yet

- King of Kings Transport, Inc v. MamacDocument7 pagesKing of Kings Transport, Inc v. MamacKennethQueRaymundoNo ratings yet

- Gashem Shookat Baksh vs. Court of Appeals G.R. No. 97336Document13 pagesGashem Shookat Baksh vs. Court of Appeals G.R. No. 97336Therese ElleNo ratings yet