Professional Documents

Culture Documents

IA2 Chapter 7 Activities

Uploaded by

Shaina TorraineCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

IA2 Chapter 7 Activities

Uploaded by

Shaina TorraineCopyright:

Available Formats

Problem 7-1

Jan-01 Cash 6,000,000

Bond Payable 5,000,000

Premium 735,000

Share Warrant Outstanding 265,000

Issue price of bonds with warrants 6,000,000

Market Value of bond without warrants 5,735,000

Residual Amount Allocated to Warrants 265,000

Dec-31 Interest Expense 400,000

Cash 400,000

Premium 55,900

Interest Expense 55,900

Cash 600,000

Share Warrants Outstanding 265,000

Share Capital 500,000

Share Premium 365,000

Problem 7-2

Jan-01 Cash 5,100,000

Discount 343,000

Bond Payable 5,000,000

Share Warrant Outstanding 443,000

Dec-31 Interest Expense 651,980

Cash 600,000

Discount 51,980

Cash 2,500,000

Share Warrants Outstanding 443,000

Share Capital 1,250,000

Share Premium 1,693,000

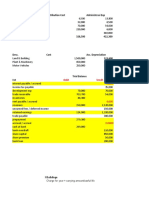

Problem 7-3

Principal 8,000,000

Normal Rate 12% 6%

Effective Rate 10% 5%

Maturity Date - Principal 8,000,000

Period 5 years 10 Interest 480,000

Payable Semi-annually June 30 and December 31

Date Interest Payment Interest ExpenseAmortization Carrying Amount

01/01/20x1 8,585,600

06/30/20x1 480,000 429,280 50,720 8,534,880

12/31/20x1 480,000 426,744 53,256 8,481,624

Jan-01 Cash 9,600,000

Bond Payable 8,000,000

Premium 585,600

Share Warrant Outstanding 1,014,400

Jun-30 Interest Expense 429,280

Premium 50,720

Cash 480,000

Dec-31 Interest Expense 426,744

Premium 50,720

Cash 480,000

Cash 2,400,000

Share Warrants Outstanding 1,014,400

Share Capital 1,600,000

Share Premium 1,814,400

Problem 7-8

PV of Principal 2,000,000 1 1,540,000

PV of Interest 120,000 3 303,600

Total Present Value 1,843,600

Discount on Bonds 2,000,000 1,843,600 156,400

Jan-01 Cash 2,200,000

Discount 156,400

Bond Payable 2,000,000

Share Premium - conversion 356,400

Interest Expense 165,924

Cash 120,000

Discount 45,924

Dec-31 Bond Payable 2,000,000

Share Premium - conversion 356,400

Discount 110,476

Share Capital 1,000,000

Share Premium - Issuance 1,245,924

Problem 7-5

Cash 5,250,000

Discount 300,000

Bond Payable 5,000,000

Share Premium - conversion 550,000

Interest Expense 658,000

Discount 58,000

Cash 600,000

Bond Payable 5,000,000

Discount 242,000

Share Premium - conversion 550,000

Total Consideration 5,308,000

Par Value of Share Capital Issued 4,000,000

Share Premium Issuance 1,308,000

Bond Payable 5,000,000

Share Premium - Conversion 550,000

Discount 242,000

Share Capital 4,000,000

Share premium - Issuance 1,308,000

Problem 7-6

Bond Payable 5,000,000

Share Premium - conversion 500,000

Premium 250,000

Share Capital 2,500,000

Share Premium 3,250,000

Share Premium - Issuance 200,000

Cash 200,000

Problem 7-7

PV of Principal 4,000,000 1 3,160,000

PV of Interest 240,000 3 619,200

Total Present Value 3,779,200

Discount on Bonds 4,000,000 3,779,200 220,800

Issue price of bonds with warrants 4,200,000

Market Value of bond without warrants 3,779,200

Residual Amount Allocated to Warrants 420,800

Cash 4,200,000

Discount 220,800

Bond Payable 4,000,000

Share Premium - Conversion 420,800

Bonds Payable 4,000,000

Interest Expense 240,000

Cash 4,240,000

Share Premium - Conversion 420,800

Share Premium - Issuance 420,800

Problem 7-8

FV w/ conversion privilege 5,550,000

FV w/o conversion privilege 5,400,000

EFV of equity Component 150,000

Carrying Amount 5,178,000

Payment equal to FV w/o CP 5,400,000

Loss on Extinguishment 222,000

Req 1 Cash 6,000,000

Bond Payable 5,000,000

Premium 399,300

Share Premium - Conversion 600,700

Req 2 Bond Payable 5,000,000

Premium 178,000

Share Premium 150,000

Loss on Extinguishment 222,000

Cash 5,550,000

Interest Expense 500,000

Cash 500,000

Share Premium - Conversion 450,700

Share Premium - Issuance 450,700

Present Value

0.61 4,880,000

7.72 3,705,600

8,585,600

You might also like

- Chapter 7 - Compound Financial Instrument (FAR6)Document5 pagesChapter 7 - Compound Financial Instrument (FAR6)Honeylet SigesmundoNo ratings yet

- J.K. Lasser's Small Business Taxes 2007: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2007: Your Complete Guide to a Better Bottom LineNo ratings yet

- Compound Financial InstrumentDocument2 pagesCompound Financial Instrumenthae1234No ratings yet

- 313 314 Financing Cycle CORNEL-MannelleDocument3 pages313 314 Financing Cycle CORNEL-MannelleFaker MejiaNo ratings yet

- HW On Sinking Fund C Solutions and AnswersDocument5 pagesHW On Sinking Fund C Solutions and AnswersAmjad Rian MangondatoNo ratings yet

- AE 16 Solutions To Chapter 5 2 1Document10 pagesAE 16 Solutions To Chapter 5 2 1Miles CastilloNo ratings yet

- Cat 1 SD23Document2 pagesCat 1 SD23HarusiNo ratings yet

- Club A/c's: TopicDocument16 pagesClub A/c's: TopicJames KAGWAPENo ratings yet

- Class Practice - Company Accounting - SolvedDocument7 pagesClass Practice - Company Accounting - SolvedMarcoNo ratings yet

- AccountsDocument4 pagesAccountsVencint LaranNo ratings yet

- Trial Balance Adjustments Profit or Loss Financial Position Account Title Debit Credit Debit Credit Debit Credit Debit CreditDocument2 pagesTrial Balance Adjustments Profit or Loss Financial Position Account Title Debit Credit Debit Credit Debit Credit Debit CreditMichelle BabaNo ratings yet

- IntAcc GroupingsDocument4 pagesIntAcc GroupingsNikka BigtasNo ratings yet

- Mythical Company Requirement A Debit CreditDocument3 pagesMythical Company Requirement A Debit CreditAnonn100% (1)

- The Institute of Chartered Accountants of Bangladesh: Sample Question Paper Certificate Level-AccountingDocument8 pagesThe Institute of Chartered Accountants of Bangladesh: Sample Question Paper Certificate Level-AccountingArif UddinNo ratings yet

- Karkits Corporation Excel Copy PasteDocument2 pagesKarkits Corporation Excel Copy PasteCoke Aidenry SaludoNo ratings yet

- PROBLEM 15-1 FinancialDocument14 pagesPROBLEM 15-1 FinancialKezha Calderon100% (1)

- Audit of Long-Term Liabilities - SDocument6 pagesAudit of Long-Term Liabilities - SEva DagusNo ratings yet

- Audit of LiabilitiesDocument9 pagesAudit of LiabilitiesMichBadilloCalanogNo ratings yet

- Pertemuan 1 - Shareholder EquityDocument11 pagesPertemuan 1 - Shareholder EquityIvonie NursalimNo ratings yet

- Sharon PLC (Long Question)Document4 pagesSharon PLC (Long Question)Jimmy LimNo ratings yet

- Receivables Morning Star Corporation: I Will Manually Check Your Answer For Rounding Off DifferencesDocument3 pagesReceivables Morning Star Corporation: I Will Manually Check Your Answer For Rounding Off DifferencesGlance BautistaNo ratings yet

- FINACC3 Bonds Payable Practice Problem 3Document6 pagesFINACC3 Bonds Payable Practice Problem 3Khevin AlvaradoNo ratings yet

- Final Test - AnswersDocument6 pagesFinal Test - Answersnguyễn hiềnNo ratings yet

- Suggested Answers Assignment Notes PayableDocument4 pagesSuggested Answers Assignment Notes PayableKeikoNo ratings yet

- Project Report For Manufacturing & Trading of Embroidery SareeDocument11 pagesProject Report For Manufacturing & Trading of Embroidery SareeSHRUTI AGRAWALNo ratings yet

- Chapter 1 Case 1 Net Asset AcquisitionDocument4 pagesChapter 1 Case 1 Net Asset AcquisitionANGELI GRACE GALVANNo ratings yet

- Project Report For Manufacturing & Trading of Embroidery SareeDocument11 pagesProject Report For Manufacturing & Trading of Embroidery SareeSHRUTI AGRAWALNo ratings yet

- Fabm Peta 3Document4 pagesFabm Peta 3JEWEL LHIEME ARCILLANo ratings yet

- NC LiabilitiesDocument12 pagesNC LiabilitiesErin LumogdangNo ratings yet

- Issued & Paid Up Capital: 14 Schedual of Fixed AssetsDocument6 pagesIssued & Paid Up Capital: 14 Schedual of Fixed AssetsShoukat KhaliqNo ratings yet

- Company Final Accounts - ProblemsDocument5 pagesCompany Final Accounts - ProblemsDhinesh0% (1)

- Share Warrants: Note: Insert "0" at Quoted Price W/out Warrants If It Is ISSUED WITHOUT WARRANTSDocument15 pagesShare Warrants: Note: Insert "0" at Quoted Price W/out Warrants If It Is ISSUED WITHOUT WARRANTSNickey DickeyNo ratings yet

- Chapter 5Document19 pagesChapter 5Izzy BNo ratings yet

- Acctg Lab 5.Document4 pagesAcctg Lab 5.AngieNo ratings yet

- Competency AssessmentDocument5 pagesCompetency AssessmentMiracle FlorNo ratings yet

- Chapter 7 Up StreamDocument14 pagesChapter 7 Up StreamAditya Agung SatrioNo ratings yet

- IA 2 Chapter 6 ActivitiesDocument14 pagesIA 2 Chapter 6 ActivitiesShaina TorraineNo ratings yet

- Competency Exam Practice-211Document5 pagesCompetency Exam Practice-211marites yuNo ratings yet

- AFE3871 Assingment 2 Memo 1Document45 pagesAFE3871 Assingment 2 Memo 1SoblessedNo ratings yet

- Chapter 3 Problem 6 LenzierDocument25 pagesChapter 3 Problem 6 LenzierJohn Lenzier TurtorNo ratings yet

- Project Report For Manufacturing & Trading of Embroidery SareeDocument11 pagesProject Report For Manufacturing & Trading of Embroidery SareeSHRUTI AGRAWALNo ratings yet

- SolutionsDocument10 pagesSolutionsBillah MagomaNo ratings yet

- Purchase Price and Implied Value Less: Book Value of Equity Acquired: Difference Beetwen Implied and Book Value Record New Goodwil BalanceDocument14 pagesPurchase Price and Implied Value Less: Book Value of Equity Acquired: Difference Beetwen Implied and Book Value Record New Goodwil BalancesallyNo ratings yet

- IA 2 Chapter 5 ActivitiesDocument12 pagesIA 2 Chapter 5 ActivitiesShaina TorraineNo ratings yet

- Chameleon Company Requirement1 Debit CreditDocument3 pagesChameleon Company Requirement1 Debit CreditAnonnNo ratings yet

- Flexible Company Debit Credit 2020Document1 pageFlexible Company Debit Credit 2020AnonnNo ratings yet

- Problem 1 Journal EntryDocument4 pagesProblem 1 Journal EntrySarah Nelle PasaoNo ratings yet

- FM Model - Coffee ParlorDocument11 pagesFM Model - Coffee ParlorPRITESH PATILNo ratings yet

- Corporation: Bonds Issued at A PremiumDocument3 pagesCorporation: Bonds Issued at A Premiumibrahim mohamedNo ratings yet

- Compound Financial Instrument PDFDocument4 pagesCompound Financial Instrument PDFidontcaree123312100% (1)

- Assumptions - Assumptions - Financing: Year - 0 Year - 1 Year - 2 Year - 3 Year - 4Document2 pagesAssumptions - Assumptions - Financing: Year - 0 Year - 1 Year - 2 Year - 3 Year - 4PranshuNo ratings yet

- Westmont PLCDocument5 pagesWestmont PLCmutuamutisya306No ratings yet

- Problem 9-1, 2 & 3Document3 pagesProblem 9-1, 2 & 3Micah April SabularseNo ratings yet

- Jawaban Lat Debt & Equity InvestmentDocument10 pagesJawaban Lat Debt & Equity InvestmentYOPIE CHANDRANo ratings yet

- Problem #1 CDG Partnership Statement Ofliquidation 31-Dec-01 CashDocument8 pagesProblem #1 CDG Partnership Statement Ofliquidation 31-Dec-01 CashEula hahahaNo ratings yet

- CH 27Document4 pagesCH 27Alona MeladNo ratings yet

- Problem 1: Show Your CalculationsDocument14 pagesProblem 1: Show Your CalculationsMaria Christy WoworNo ratings yet

- MAE - P4 Chapter 5Document2 pagesMAE - P4 Chapter 5Leah Mae NolascoNo ratings yet

- Assignment 9 FARDocument23 pagesAssignment 9 FARcha618717No ratings yet

- Chapter 18 Book Value Per ShareDocument2 pagesChapter 18 Book Value Per ShareShaina TorraineNo ratings yet

- IA2 Chapter 20 ActivitiesDocument13 pagesIA2 Chapter 20 ActivitiesShaina TorraineNo ratings yet

- Chapter 25 Share-Based Compensation - Share Appreciation RightDocument2 pagesChapter 25 Share-Based Compensation - Share Appreciation RightShaina TorraineNo ratings yet

- IA2 Chapter 9 ActivitiesDocument7 pagesIA2 Chapter 9 ActivitiesShaina TorraineNo ratings yet

- IA2 Chapter 7 ActivitiesDocument5 pagesIA2 Chapter 7 ActivitiesShaina TorraineNo ratings yet

- IA 2 Chapter 6 ActivitiesDocument14 pagesIA 2 Chapter 6 ActivitiesShaina TorraineNo ratings yet

- IA 2 Chapter 5 ActivitiesDocument12 pagesIA 2 Chapter 5 ActivitiesShaina TorraineNo ratings yet

- IA 2 Chapter 6 ActivitiesDocument14 pagesIA 2 Chapter 6 ActivitiesShaina TorraineNo ratings yet

- IA 2 Chapter 5 ActivitiesDocument12 pagesIA 2 Chapter 5 ActivitiesShaina TorraineNo ratings yet

- (FINANCE) Gabungan Solution Damodaran Book PDFDocument115 pages(FINANCE) Gabungan Solution Damodaran Book PDFJarjitUpinIpinJarjitNo ratings yet

- Public Notice No 1874 - A Guide To Customs AuditDocument3 pagesPublic Notice No 1874 - A Guide To Customs AuditDaris Purnomo JatiNo ratings yet

- Financial Management Strategy FinalDocument24 pagesFinancial Management Strategy FinalsayedhossainNo ratings yet

- Viray and Viola Viray For Petitioner. First Assistant Solicitor General Roberto A. Gianzon and Solicitor Manuel Tomacruz For RespondentDocument13 pagesViray and Viola Viray For Petitioner. First Assistant Solicitor General Roberto A. Gianzon and Solicitor Manuel Tomacruz For RespondentCarren Paulet Villar CuyosNo ratings yet

- The Credit Card Faults, Schemes, Scams, and Extinguishment Related VideosDocument1 pageThe Credit Card Faults, Schemes, Scams, and Extinguishment Related VideosEmanuel CenidozaNo ratings yet

- Planters v. Sps SarmientoDocument8 pagesPlanters v. Sps SarmientoyamaleihsNo ratings yet

- Tata AIA Life Insurance Wealth Maxima: Unit Linked Whole Life Individual Savings PlanDocument14 pagesTata AIA Life Insurance Wealth Maxima: Unit Linked Whole Life Individual Savings PlanShaheryar KhanNo ratings yet

- FIN 600 - Midterm Sample With SolutionsDocument22 pagesFIN 600 - Midterm Sample With SolutionsVipul0% (2)

- A Project Report On Ration Analysis of Hotel IndustryDocument20 pagesA Project Report On Ration Analysis of Hotel IndustrySuvayu ChakrabortyNo ratings yet

- AT Module-7 4th-EdnDocument74 pagesAT Module-7 4th-EdnAnton KhauNo ratings yet

- Marston Marble Corporation Is Considering A Merger With TheDocument1 pageMarston Marble Corporation Is Considering A Merger With TheAmit PandeyNo ratings yet

- Strengths and Weaknesses of Parkson Holdings BerhadDocument2 pagesStrengths and Weaknesses of Parkson Holdings BerhadAnis RushamNo ratings yet

- Financial Accounting: Long-Term Investments and The Time Value of MoneyDocument68 pagesFinancial Accounting: Long-Term Investments and The Time Value of Moneygizem akçaNo ratings yet

- Vault Guide To The Top Financial Services EmployersDocument385 pagesVault Guide To The Top Financial Services EmployersDerek WangNo ratings yet

- Statement of Financial Affairs: United States Bankruptcy Court Southern District of New YorkDocument42 pagesStatement of Financial Affairs: United States Bankruptcy Court Southern District of New YorkChapter 11 DocketsNo ratings yet

- (Maa 1.5) Percentage Change - Financial ApplicationsDocument18 pages(Maa 1.5) Percentage Change - Financial ApplicationsAleya NajihaNo ratings yet

- Interest Rate DerivativesDocument58 pagesInterest Rate DerivativesIndia Forex100% (2)

- Notes On 'Agriculture in India'Document61 pagesNotes On 'Agriculture in India'Learner8467% (3)

- Workbook Anserk Keys Advanced PDFDocument31 pagesWorkbook Anserk Keys Advanced PDFSOFIA REYNA BRAUL PORRASNo ratings yet

- E 02 P 3 Car LoanDocument1 pageE 02 P 3 Car LoanMattNo ratings yet

- Bonds - Cruzat Pentinioguavez 1Document21 pagesBonds - Cruzat Pentinioguavez 1Grace Anne Mae MarasiganNo ratings yet

- Belgium Private Equity FinancingDocument32 pagesBelgium Private Equity FinancingepithomyNo ratings yet

- WQU Financial Engineering M4 SolutionDocument2 pagesWQU Financial Engineering M4 SolutionÜlkem KasapogluNo ratings yet

- Chapter 15Document16 pagesChapter 15Daniele LoFasoNo ratings yet

- CH 18 Saving, Investment, and The Financial System 9eDocument38 pagesCH 18 Saving, Investment, and The Financial System 9e민초율No ratings yet

- Understanding Fixed-Income Risk and Return: © 2016 CFA Institute. All Rights ReservedDocument60 pagesUnderstanding Fixed-Income Risk and Return: © 2016 CFA Institute. All Rights ReservedNam Hoàng ThànhNo ratings yet

- World Economics: Institute ForDocument17 pagesWorld Economics: Institute ForAndrasNo ratings yet

- P3 Time Value of MoneyDocument40 pagesP3 Time Value of MoneyAkshita GroverNo ratings yet

- Curso DE Finanzas Corporativas. Material Tomado De: Financial Statements and Ratio AnalysisDocument58 pagesCurso DE Finanzas Corporativas. Material Tomado De: Financial Statements and Ratio AnalysisCArmen CruzNo ratings yet

- Family BudgetDocument7 pagesFamily BudgetDinesh Hadwale50% (4)

- These are the Plunderers: How Private Equity Runs—and Wrecks—AmericaFrom EverandThese are the Plunderers: How Private Equity Runs—and Wrecks—AmericaRating: 4.5 out of 5 stars4.5/5 (14)

- 7 Financial Models for Analysts, Investors and Finance Professionals: Theory and practical tools to help investors analyse businesses using ExcelFrom Everand7 Financial Models for Analysts, Investors and Finance Professionals: Theory and practical tools to help investors analyse businesses using ExcelNo ratings yet

- Finance Basics (HBR 20-Minute Manager Series)From EverandFinance Basics (HBR 20-Minute Manager Series)Rating: 4.5 out of 5 stars4.5/5 (32)

- Ready, Set, Growth hack:: A beginners guide to growth hacking successFrom EverandReady, Set, Growth hack:: A beginners guide to growth hacking successRating: 4.5 out of 5 stars4.5/5 (93)

- The Caesars Palace Coup: How a Billionaire Brawl Over the Famous Casino Exposed the Power and Greed of Wall StreetFrom EverandThe Caesars Palace Coup: How a Billionaire Brawl Over the Famous Casino Exposed the Power and Greed of Wall StreetRating: 5 out of 5 stars5/5 (2)

- Financial Intelligence: A Manager's Guide to Knowing What the Numbers Really MeanFrom EverandFinancial Intelligence: A Manager's Guide to Knowing What the Numbers Really MeanRating: 4.5 out of 5 stars4.5/5 (79)

- Summary of The Black Swan: by Nassim Nicholas Taleb | Includes AnalysisFrom EverandSummary of The Black Swan: by Nassim Nicholas Taleb | Includes AnalysisRating: 5 out of 5 stars5/5 (6)

- Joy of Agility: How to Solve Problems and Succeed SoonerFrom EverandJoy of Agility: How to Solve Problems and Succeed SoonerRating: 4 out of 5 stars4/5 (1)

- Burn the Boats: Toss Plan B Overboard and Unleash Your Full PotentialFrom EverandBurn the Boats: Toss Plan B Overboard and Unleash Your Full PotentialRating: 4.5 out of 5 stars4.5/5 (32)

- The Masters of Private Equity and Venture Capital: Management Lessons from the Pioneers of Private InvestingFrom EverandThe Masters of Private Equity and Venture Capital: Management Lessons from the Pioneers of Private InvestingRating: 4.5 out of 5 stars4.5/5 (17)

- Venture Deals, 4th Edition: Be Smarter than Your Lawyer and Venture CapitalistFrom EverandVenture Deals, 4th Edition: Be Smarter than Your Lawyer and Venture CapitalistRating: 4.5 out of 5 stars4.5/5 (73)

- How to Measure Anything: Finding the Value of Intangibles in BusinessFrom EverandHow to Measure Anything: Finding the Value of Intangibles in BusinessRating: 3.5 out of 5 stars3.5/5 (4)

- Value: The Four Cornerstones of Corporate FinanceFrom EverandValue: The Four Cornerstones of Corporate FinanceRating: 4.5 out of 5 stars4.5/5 (18)

- Startup CEO: A Field Guide to Scaling Up Your Business (Techstars)From EverandStartup CEO: A Field Guide to Scaling Up Your Business (Techstars)Rating: 4.5 out of 5 stars4.5/5 (4)

- Product-Led Growth: How to Build a Product That Sells ItselfFrom EverandProduct-Led Growth: How to Build a Product That Sells ItselfRating: 5 out of 5 stars5/5 (1)

- Financial Risk Management: A Simple IntroductionFrom EverandFinancial Risk Management: A Simple IntroductionRating: 4.5 out of 5 stars4.5/5 (7)

- The Synergy Solution: How Companies Win the Mergers and Acquisitions GameFrom EverandThe Synergy Solution: How Companies Win the Mergers and Acquisitions GameNo ratings yet

- Financial Modeling and Valuation: A Practical Guide to Investment Banking and Private EquityFrom EverandFinancial Modeling and Valuation: A Practical Guide to Investment Banking and Private EquityRating: 4.5 out of 5 stars4.5/5 (4)

- 2019 Business Credit with no Personal Guarantee: Get over 200K in Business Credit without using your SSNFrom Everand2019 Business Credit with no Personal Guarantee: Get over 200K in Business Credit without using your SSNRating: 4.5 out of 5 stars4.5/5 (3)

- Mastering Private Equity: Transformation via Venture Capital, Minority Investments and BuyoutsFrom EverandMastering Private Equity: Transformation via Venture Capital, Minority Investments and BuyoutsNo ratings yet

- Warren Buffett Book of Investing Wisdom: 350 Quotes from the World's Most Successful InvestorFrom EverandWarren Buffett Book of Investing Wisdom: 350 Quotes from the World's Most Successful InvestorNo ratings yet

- Burn the Boats: Toss Plan B Overboard and Unleash Your Full PotentialFrom EverandBurn the Boats: Toss Plan B Overboard and Unleash Your Full PotentialNo ratings yet

- The Illusion of Innovation: Escape "Efficiency" and Unleash Radical ProgressFrom EverandThe Illusion of Innovation: Escape "Efficiency" and Unleash Radical ProgressNo ratings yet

- Investment Valuation: Tools and Techniques for Determining the Value of any Asset, University EditionFrom EverandInvestment Valuation: Tools and Techniques for Determining the Value of any Asset, University EditionRating: 5 out of 5 stars5/5 (1)