Professional Documents

Culture Documents

Adopting IFRS: Evidence From Bangladeshi Real Estate Sector: March 2021

Uploaded by

jam linganOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Adopting IFRS: Evidence From Bangladeshi Real Estate Sector: March 2021

Uploaded by

jam linganCopyright:

Available Formats

See discussions, stats, and author profiles for this publication at: https://www.researchgate.

net/publication/349953675

Adopting IFRS: Evidence from Bangladeshi Real Estate Sector

Research · March 2021

CITATIONS READS

0 41

1 author:

Tapos Kumar

Shanto Mariam University of Creative Technology

9 PUBLICATIONS 11 CITATIONS

SEE PROFILE

All content following this page was uploaded by Tapos Kumar on 10 March 2021.

The user has requested enhancement of the downloaded file.

Review of Integrative Business and Economics Research, Vol. 7, Supplementary Issue 3 222

Adopting IFRS: Evidence from Bangladeshi Real

Estate Sector

Tapos Kumar

Department of Accounting & Information System, Faculty of

Management & General Studies, Shanto-Mariam University of

Creative Technology, Dhaka, Bangladesh.

ABSTRACT

The study examines the benefits of adopting IFRS on real estate sector by analyzing some

factors that would include Method of asset valuation, Comparability, Earnings, Book value,

adopting IFRS, financial performance, communication tool & convergence of accounting

standard. Therefore, the purpose of this study is to investigate these factors & empirically

proved the necessity to develop IFRS for real estate sector. A closed-minded questionnaire

had ready for face to face interview to collect data from Employee & Employer of Real

Estate Company. To analyze data, the study has used correlation matrix, KMO and Bartlett's

Test, Total Variance Explained, Component Matrix, Rotated Component Matrix to measure

the suitability of the variables, cross tabulation to measure the association between variables,

Pearson's correlation & Fisher's exact test to tests research hypothesis. Findings reveal that

depending on accounting standard used costing real estate accounting elements will vary.

Adopting internationally accepted accounting standard, for example, IFRS increase

comparability & financial performance. The study has found the necessity to harmonize

national accounting standard & international accounting standards. It is also found that

adopting IFRS increase value relevance of earnings & book value.

Keywords: Accounting, Bangladesh, IFRS, Real Estate

1. INTRODUCTION

Accounting standards regulators in Bangladesh adopted IFRSs through three phases, and

since the full implementation has not completed yet so far, the adoption is in the stage of

allowing certain types of companies to follow IFRSs. In August 1999, the International

Accounting Standards (IASs) adoption process was initiated following a US$200,000 World

Bank grant to the Bangladeshi Government (Mir & Rahaman 2005). By the end of 1999 the

Institute of Chartered Accountants of Bangladesh (ICAB) has adopted 21 IASs, and 16 were

“under consideration for adopting the IASs” (Mir & Rahaman 2005). Starting from 2005, all

local listed companies in Bangladesh were required to use IFRSs (UNCTAD 2006).

Besides, IFRS 3 and 5 were adopted as Bangladesh financial Reporting standard (BFRS)

in December 2005, and IFRS 1, 4, 7 and 8 were followed as BFRS in 2008 (ICAB 2007). In

2009, Bangladesh has accompanied 8 IFRSs and 26 IASs (Shil, Das & Pramanik 2009). The

adoption and implementation of IFRSs is an ongoing application until 2009, and ICAB plans

to maintain this continuing way till June 2010 (ICAB 2009).

Copyright 2018 GMP Press and Printing (http://buscompress.com/journal-home.html)

ISSN: 2304-1013 (Online); 2304-1269 (CDROM); 2414-6722 (Print)

Electronic copy available at: https://ssrn.com/abstract=3222277

Review of Integrative Business and Economics Research, Vol. 7, Supplementary Issue 3 223

Table 1: Summary of adoption of IASs in Bangladesh

Sl. Subject IASs in IASs Number

No. Number

1 Existing number of IASs 34

developed by IASC, IASB

2 Withdrawn by IASB 01 IAS-15

3 IASs not applicable to 01 IAS-29

Bangladesh Context

4 Total effective IAS 32

5 IASs adopted in Bangladesh as 31

1,2,7,8,10,11,12,14,16,17,18,19,20,21,23,2

BAS 4,26,27,28,30,31,32,33,34,35,36,37,38,39,

40 & 41.

Sources: The Institute of Chartered Accountants of Bangladesh (ICAB).

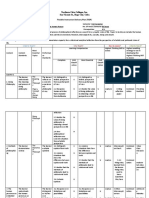

Table 1.2: Adoption status of IFRSs

IFRS No. BFRS No. Effective Date

IFRS 1 BFRS-1: First-Time Adoption An entity shall apply this BFRS if its first

of Bangladesh Financial BFRS financial statements are for a period

Reporting Standards beginning on or after 1 January 2009.

IFRS 2 BFRS-2: Share-based Payment For annual periods beginning on or after 1

January 2007. The effective date of 2008

amendments (paragraph 21A and 28A) will

be 1 January 2010.

IFRS 3 BFRS-3: Business On or after the beginning of the first annual

(supersedes Combination reporting period beginning on or after 1

IAS 22) January 2010. If an entity applies this BFRS

before 1 January 2010, it shall disclose that

fact and apply BAS 27 (as amended in 2008)

at the same time.

IFRS 4 BFRS-4: Insurance Contracts For annual periods beginning on or after 1

January 2010.

IFRS 5 BFRS-5: Non-current Assets For annual periods beginning on or after 1

Held for Sale and Discontinued January 2007.

Operations

IFRS 6 BFRS-6: Exploration for and For annual periods beginning on or after 1

Evaluation of Mineral January 2007.

Resources

IFRS 7 BFRS-7: Financial Instrument: On or after the beginning of the first annual

Disclosures (This BFRS reporting the period beginning on or after 1

supersedes BAS 30 Disclosures January 2010.

in the Financial Statements of

Bank and Similar Financial

Institutions)

IFRS 8 BFRS-8: Operating Segments. On or after the beginning of the first annual

(This BFRS supersedes BAS reporting period beginning on or after 1

14 Segment Reporting) January 2010.

Source: The Institute of Chartered Accountants of Bangladesh (ICAB).

Copyright 2018 GMP Press and Printing (http://buscompress.com/journal-home.html)

ISSN: 2304-1013 (Online); 2304-1269 (CDROM); 2414-6722 (Print)

Electronic copy available at: https://ssrn.com/abstract=3222277

Review of Integrative Business and Economics Research, Vol. 7, Supplementary Issue 3 224

The rest of the paper is organized as follows: Section two Overview real estate sector in

Bangladesh & Section three is devoted to overview the relevant literature of the selected

factors. Then, Section four is the methodology adopted & section five outlines the relevant

factor analysis of the study. Next, the result and discussion are documented in Section six and

the overall conclusions regarding these results are presented in Section seven.

1. OVERVIEW REAL ESTATE SECTOR IN BANGLADESH

Real estate business took off in Bangladesh in 1970 with 5 registered firms. From the

early 1980s, the commercial enterprise started out to flourish and confirmed sturdy boom.

With the aid of 1988, there have been 42 developers in the business. At present, more than

1500 companies are active inside the actual property region with 1081 of them registered

with REHAB (Seraj, 2012). Within the last four decades, non-public builders have provided

more than 100000 units of residences to the nation and will be providing 25000 extra units

within the subsequent three years.

From 1994-95, during the last 10 years, Bangladesh real estate sector grew at an average

of 3.64% achieving the highest at 3.83% in 1999-00. Although it had a fall in 2000-01, there

has been a recovery in 2001-02. For the remaining five years this sector grew impressively

and showed a smooth rising trend. The comparative situation of GDP indicates a steady 6%

increase for Bangladesh. Consistent with the real estate professionals, as GDP of Bangladesh

remains below that of other neighboring nations, Bangladesh has extra to develop which can

be fostered with the aid of the non-stop increase in the share and increase of real estate sector

within the country. This contribution of real estate and production in GDP of Bangladesh

became 16.20% in 1994-95, which became at 16.69% in 2000-01 and attained 17.22% in

2004-05. This proportion slowed down to around 8% in FY 2008 that is due to the excessive

price barrier for the larger portion of the population to buy real estate apartments, and also the

almost saturation of the already existing excessive quit population marketplace. The housing

real property business's untapped ability is pretty evident from the real property rental

penetration in neighboring countries in comparison to Bangladesh. Islam M. S. and Hossain

A. (2008) depicted the value addition of the overall housing sector including the real estate's

falls in different other regions which are quite simply. A number of the 21 subsectors under

the housing industry steel (29%), workforce labor (20%) and Cement (11%) are the highest

contributing subsectors (Islam M. S. and Hossain A, 2008). As a result, the real estate is the

most important housing facilitating non-public channel has extremely vital and large

backward supply chain.

2. PRIOR LITERATURE WORK

Below provide prior literature work of the relevant studies:

“Interviews with large institutional investors... reveal the following areas where

international disclosure practices are considered most wanting: ...method of asset valuation...”

According to Frederic Choi,-Professor of Accounting and Business. “...Widely accepted

norms have not been developed for asset valuation despite its importance for financial

stability” (G10 Working Party Report on Financial Stability in Emerging Market Economies,

1997). IFRS could facilitate cross-border comparability and increase reporting transparency,

enabling stakeholders to understand the financial results of firms in the whole world (Ball,

Copyright 2018 GMP Press and Printing (http://buscompress.com/journal-home.html)

ISSN: 2304-1013 (Online); 2304-1269 (CDROM); 2414-6722 (Print)

Electronic copy available at: https://ssrn.com/abstract=3222277

Review of Integrative Business and Economics Research, Vol. 7, Supplementary Issue 3 225

2006). IAS/IFRS information has affected the perception of firm’s business performance, and

firms have been enabled to produce IAS/IFRS financial statements that allow them to adopt a

global financial reporting language as well as to be evaluated in a global marketplace

(PricewaterhouseCoopers, 2004).As a consequence, depending on the accounting standards

used, and their interpretation, costing real estate may differ according to asset classification

(Eccles and Holt, 2000, 2001 and Holt and Eccles, 2003).

Muller et al. (2002) examine the valuation method for investment property applied

by the European real estate sector after IFRS adoption.They find that most companies in

their sample use fair value accounting and argue that measurement at fair value is associated

with reduced information asymmetry. Cairns et al. (2011) study valuation method used by

228 companies in the UK and Australia after IFRS adoption. They find that IFRS adoption

increased comparability among companies. Several researchers (Goodrich, 1982; Nobes,

1992) have found several reasons that caused international differences in financial reporting

systems by various jurisdictions. As noted by Lazar et al. (2006), a common set of reporting

standards will allow more transparency, understandability, competitiveness and

comparability of financial statements presented by various jurisdictions. A study by Barth,

Landsman, and Lang (2005) in the USA found out that IFRS adoption increases firms'

financial reporting quality.

Jermakowicz, Kinsey and Wulf (2007) investigated whether adoption of IFRS brought

challenges and benefits on the value relevance of earnings and book values of DAX-30

companies listed at NYSE. The analysis of their study based on the annual data which

covered a period between 1995 and 2004 and found out that value relevance of earnings and

book value significantly increased. Empirical work of Filip and Raffournier (2010) in

Romania and Hellström (2006) in Czech reported an increased on earnings after IFRS

regime. However, other empirical studies of Bartov et al. (2005), Karampinis and Hevas

(2011) report a decreased on the value relevance of both book value of equity and earnings in

the period of implementing IFRS, consistent with the study of Ahmed and Goodwin

(2006).Another study in Turkey by Bilgic and Ibis (2013) analyses whether adoption of IFRS

increased value relevance or not and reported accounting information to be more relevant

during the period covered for the study and after the introduction new financial accounting

reporting standards.

Meeks and Swann (2009) revealed that firms adopting IFRS exhibited higher

accounting quality in the post-adoption period than in the pre-adoption period. In a study of

financial data of firms covering 21 countries, Barth (2008), confirmed that firms applying

IAS/IFRS experienced an improvement in accounting quality between the pre-adoption and

post-adoption periods. Latridis (2010), concluded on the basis of data collected from firms

listed on the London Stock Exchange that IFRS implementation has favorably affected the

financial performance (measured by profitability and growth potentials).IFRS compliant

financial statements have the tendency to make comparability and company performance

assessment across nations easier and result of such assessment more acceptable by

stakeholders and highly reliable.

Accounting is considered the contemporary language of business, as it is the

communication tool between financial statement preparers and users of all categories, which

requires that financial statements be clear, understandable, complete, and presented in a way

Copyright 2018 GMP Press and Printing (http://buscompress.com/journal-home.html)

ISSN: 2304-1013 (Online); 2304-1269 (CDROM); 2414-6722 (Print)

Electronic copy available at: https://ssrn.com/abstract=3222277

Review of Integrative Business and Economics Research, Vol. 7, Supplementary Issue 3 226

that helps users understand and benefit from them. The objectives of the IASB include

developing global accounting standards that require transparent and comparable information

and financial statements around the world (Cairns, 2002) and across companies in the same

industry. IFRS have been developed intentionally as a global language for accounting across

international boundaries, a significant achievement in a process that began in the 1960s, saw

the formation of the International Accounting Standards Committee (IASC) in 1973 to

address concerns about the lack of comparability of financial reports between countries

(Alfred son et al, 2005, p. 7), and still continues as the reconstituted IASC, now the

International Accounting Standard Board (IASB) seeks to make partnerships with national

accounting standard-setters and encourage the adoption of IFRS.

The implementation of the IFRS affects the business operations where the business

organizations have to migrate from their existing accounting practices to a new set of

standards (Cope and Clark, 2003). The convergence of accounting practices requires effective

implementation and enforcement of accounting standards (2006; Ball et al. 2003; Burgstahler

et al. 2006; Daske et al. 2007a, 2007b).

3. RESEARCH METHODOLOGY

3.1.Data collection

The study has adopted Bangladeshi real estate company with full-time employees

exceeding 260 & annual sales turnover of exceeding $45 million which extend into 4

divisional cities namely Dhaka, Chittagong, Rajshahi & Sylhet. The research

population consists of two categories responder such as (a) employer & (b) employee

of the real estate company which numerically 439.

3.2.Data analysis

A different statistical model such as correlation matrix, KMO and Bartlett's Test,

Total Variance Explained, Component Matrix, Rotated Component Matrix used to

analyze data. For hypothesis testing, this study has used Pearson Chi-Square &

Fisher's Exact Test to develop null hypothesis & alternative hypothesis.

3.3.Questionnaire design

The questionnaire composed of two parts; demographic profile & factors that

show benefits to adopt IFRS. Demographic profile used to obtain information about

respondent's background, gender, age, race, educational level and occupation. A set of

a closed-minded questionnaire developed on the basis of IFRS to focus real estate

company of Bangladesh. The questionnaire used 3 point rating scale that used1 yes, 0

no & 9 don't know point scale according to responder feedback.

4. DATA ANALYSIS

Copyright 2018 GMP Press and Printing (http://buscompress.com/journal-home.html)

ISSN: 2304-1013 (Online); 2304-1269 (CDROM); 2414-6722 (Print)

Electronic copy available at: https://ssrn.com/abstract=3222277

Review of Integrative Business and Economics Research, Vol. 7, Supplementary Issue 3 227

Table 1.3: Correlation Matrixa

valuation

asset

method

comparability

Earnings

Book values

IFRS

adopting

performance

financial

n tool

communicatio

practices

of accounting

convergence

of

method of asset

1.000 -.004 .059 .059 .047 .066 .063 .430

valuation

comparability -.004 1.000 .298 .295 .237 .331 .314 .612

Earnings .059 .298 1.000 .988 .760 .881 .947 .221

Book values .059 .295 .988 1.000 .772 .871 .937 .219

Correlation

adopting IFRS .047 .237 .760 .772 1.000 .708 .760 .176

financial performance .066 .331 .881 .871 .708 1.000 .937 .249

communication tool .063 .314 .947 .937 .760 .937 1.000 .233

convergence of

.430 .612 .221 .219 .176 .249 .233 1.000

accounting practices

a. Determinant = 4.616E-005

The above top half of correlation matrix table includes the Pearson correlation

coefficient between all pairs of variables. The correlation coefficient of a variable and itself is

constantly 1; right here the fundamental diagonal of the correlation matrix contains 1s. The

correlation matrix may be used to test the pattern of relationships. For this, the study has to

consider the significance values and search for any variable for which the majority of values

are greater than 0.05. The determinant value (lies at the bottom) for the correlation matrix is

4.616E-005 (0.00004616) that's greater than the essential value of 0.00001 (beneath the table

value). The correlation matrix table additionally gives correlation coefficients and p-values

for each pair of variables covered within the analysis. Close inspections of these correlations

can frequently insights into the variable shape. Above correlation matrix is the correlation

matrix for the variables included. Therefore, multicollinearity isn't always a problem for these

variables & above correlation matrix provide dependable variables analysis.

Table 1.4: KMO and Bartlett's Test

Kaiser-Meyer-Olkin Measure of Sampling Adequacy. .793

Approx. Chi-Square 4337.793

Bartlett's Test of Sphericity df 28

Sig. .000

Above KMO and Bartlett's Test table provide some reliable output for Kaiser-Meyer-

Olkin to measure sampling adequacy & Bartlett's test of sphericity to test the adequacy of the

correlation matrix. For the KMO statistic, Kaiser (1974) recommends below .50

unacceptable, .50 miserable, .60 mediocre, .70 middling, .80 meritorious, & .90 marvelous.

Copyright 2018 GMP Press and Printing (http://buscompress.com/journal-home.html)

ISSN: 2304-1013 (Online); 2304-1269 (CDROM); 2414-6722 (Print)

Electronic copy available at: https://ssrn.com/abstract=3222277

Review of Integrative Business and Economics Research, Vol. 7, Supplementary Issue 3 228

Here the KMO value is 0.793, which is close to meritorious that is variable analysis is

appropriate for the study.

Another hand, Bartlett's test of Sphericity measures the null hypothesis that the

original correlation matrix is an identification matrix. For this, the study has to ascertain some

relationships among variables and if the R-matrix had been an identity matrix then all

correlation coefficients could be zero. Here, Bartlett's test of Sphericity is significant since

significance value < 0.05. A significant test indicates that the R-matrix isn't an identification

matrix; therefore, there are some effective relationships among the variables. For these data,

Bartlett's test is exceptionally widespread (p < 0.001) that is variable analysis is appropriate.

Consequently, Bartlett's test of sphericity is significant & yielded a value of 4337.793 & an

association level of significance smaller than 0.01, hence the hypothesis that the

intercorrelation matrix regarding those variables is an identity matrix is rejected that is the

correlation matrix has significant correlations among at least some of the variables.

Table 1.5: Total Variance Explained

Component

Initial Eigenvalues

Squared Loadings Total

Extraction Sums of

Squared Loadings Total

Rotation Sums of

Total

% of Variance

Cumulative %

% of Variance

Cumulative %

% of Variance

Cumulative %

1 4.669 58.362 58.362 4.669 58.362 58.362 4.451 55.632 55.632

2 1.546 19.319 77.682 1.546 19.319 77.682 1.764 22.049 77.682

3 .977 12.213 89.894

4 .347 4.336 94.231

5 .248 3.101 97.332

6 .161 2.009 99.341

7 .041 .516 99.857

8 .011 .143 100.000

Extraction Method: Principal Component Analysis.

The total variance explained table presents the number of common variables

extracted, the eigenvalues associated with these variables, the percentage of total

variance accounted for by each variable, & the cumulative percentage of total

variance accounted for by the variables. On the basis of Varimax Rotation with Kaiser

Normalization, 2 factors have extracted in the initial solution. Each factor constituted

of all those variables that have factor loading greater than 1. Only two factors in the

initial solution have eigenvalues greater than 1. The 1st factor has an eigenvalue =

4.669. Since this is greater than 1.0, it explains more variance than a single variable,

in fact, 4.669 times as much. The 2nd factor has an eigenvalue = 1.546. It is also

Copyright 2018 GMP Press and Printing (http://buscompress.com/journal-home.html)

ISSN: 2304-1013 (Online); 2304-1269 (CDROM); 2414-6722 (Print)

Electronic copy available at: https://ssrn.com/abstract=3222277

Review of Integrative Business and Economics Research, Vol. 7, Supplementary Issue 3 229

greater than 1.0 and therefore explains more variance than a single variable. Another

side, rest of the factors have eigenvalues less that1, and therefore explain less variance

that a single variable. The sum of the eigenvalues associated with each factor

(component) sums (4.669+ 1.546+ .977+ .347+ … + .011) = 8. The cumulative % of

variance explained by the first two factors is 77.682%. In other words, 77.682% of the

common variance shared by the 8 variables accounted for by the 2 factors. The second

section of this table shows the variance explained by the extracted factors before

rotation. Cumulative variability explained by these two factors in the extracted

solution is about 77.682%. & there is no difference from the initial solution. The

rightmost section of this table shows the variance explained by the extracted factors

after rotation. Notices that initial solution, unrotated and rotated factor have same

cumulative value.

Table 1.6: Component Matrixa

Component

1 2

method of asset valuation .184 .939

comparability .805 .411

Earnings .936 -.185

Book values .937 -.183

adopting IFRS .891 -.072

financial performance .955 -.145

communication tool .964 -.145

convergence of accounting practices .954 .192

Extraction Method: Principal Component Analysis.

a. 2 components extracted.

Table 1.7: Rotated Component Matrixa

Component

1 2

method of asset valuation -.029 .956

comparability .694 .579

Earnings .954 .028

Book values .954 .029

adopting IFRS .885 .128

financial performance .963 .071

communication tool .972 .072

convergence of accounting practices .888 .400

Extraction Method: Principal Component Analysis.

Rotation Method: Varimax with Kaiser

Normalization.

a. Rotation converged in 3 iterations.

The rotated component matrix presents two variables after rotation. To identify what

these variables represent, it would be necessary to consider what items loaded on each of the

two variables. Eight items loaded on variable 1. Inspection of these items clearly shows that

majority of these items reflect a Comparative motive. Variable 1 dictates that every item

(loaded items on variable 1) significantly influence real estate accounting elements to be

Copyright 2018 GMP Press and Printing (http://buscompress.com/journal-home.html)

ISSN: 2304-1013 (Online); 2304-1269 (CDROM); 2414-6722 (Print)

Electronic copy available at: https://ssrn.com/abstract=3222277

Review of Integrative Business and Economics Research, Vol. 7, Supplementary Issue 3 230

comparable. From the table, we can see that variable communication tool correlates 0.972

with factor 1 & correlate 0.072 with factor 2. Variable accounting quality correlates 0.963

with factor 1 & correlate 0.071 with factor 2. Note that, variable method of asset valuation

(v1) highly loadings in component 2 (loadings value=.956) & change its value in component

1(loadings value=-.029). So, we can conclude that costing real estate accounting elements

will vary if there is no proper asset valuation method. Then, earnings, book values equally

explained 94.5% in component 1 & sequentially contribute convergence of accounting

practices (v8=.888), adopting IFRS (v5=.885) & comparability (v2=.694) to influence

comparable real estate accounting elements. Therefore, it can refer that all the variables

strongly associated with comparable motives where v1 works as a dependent variable. On the

basis of loadings value, we can classify above variables into three categories,

a. Highly associated variables

b. Moderately associated variables

c. Negatively associated variables

Highly associated variables

Rotated component matrix =

(communication tool +financial performance +Earnings+Book values ) (.972+.963+.954+.954)

= =

4 4

3.821

= .95525 (Mean value)

4

Above Mean value (.95525) indicate that rotated components' matrix has

above 95% high degree positive relation between dependent variables & independent

variables (Highly associated variables) or we can say that 95.5525% relation of

dependent variables described by Perfectly explained variables & rest of 4.475%

relationship assumed on the basis of probable relation.

So, it can be referred that most of the Bangladeshi Real Estate company do not

measure earnings& book values under IFRS & ignore to implement IFRS where

accounting quality create a conflict between users.

Moderately associated variables

Rotated component matrix =

(convergence of accounting standard +adopting IFRS +comparability) (.888+.885+.694)

= =

3 3

2.467

= .8223 (Mean value)

3

From the above-rotated component matrix analysis, it is found out that all the

moderate associated variables have high degree positive relation among v8, v5& v2

(all variable positively relate as a complement). Moderately associated variables

explained 82.23% under rotated component matrix that is dependent variables

explained by independent variables 82.23% under rotated component matrix.

Therefore, high positive variables significantly influence comparability by

adopting IFRS to convergence real estate accounting elements.

Negatively associated variables

From rotated component matrix, we can see that variable method of asset valuation

negatively associated (loadings value=-.029) with other variables which change its value in

component 2(loadings value=.956). That is 95.6% relation explained by method of asset

Copyright 2018 GMP Press and Printing (http://buscompress.com/journal-home.html)

ISSN: 2304-1013 (Online); 2304-1269 (CDROM); 2414-6722 (Print)

Electronic copy available at: https://ssrn.com/abstract=3222277

Review of Integrative Business and Economics Research, Vol. 7, Supplementary Issue 3 231

valuation & rest of the 4.4% relation assumed on the basis of probable relation. Therefore, it

can conclude that depending on asset valuation, costing real estate accounting elements will

vary.

5. RESULT & DISCUSSION

Table 1.8: Method of asset valuation * Comparability Cross tabulation

Comparability Total

No Yes Don't

know

Count 14 0 85 99

Expected Count 24.8 52.3 21.9 99.0

% within Method of asset

No 14.1% 0.0% 85.9% 100.0%

valuation

% within comparability 12.7% 0.0% 87.6% 22.6%

% of Total 3.2% 0.0% 19.4% 22.6%

Count 95 224 0 319

Expected Count 79.9 168.6 70.5 319.0

Method of asset % within Method of asset

Yes 29.8% 70.2% 0.0% 100.0%

valuation valuation

% within comparability 86.4% 96.6% 0.0% 72.7%

% of Total 21.6% 51.0% 0.0% 72.7%

Count 1 8 12 21

Expected Count 5.3 11.1 4.6 21.0

Don't % within Method of asset

4.8% 38.1% 57.1% 100.0%

know valuation

% within comparability 0.9% 3.4% 12.4% 4.8%

% of Total 0.2% 1.8% 2.7% 4.8%

Count 110 232 97 439

Expected Count 110.0 232.0 97.0 439.0

% within Method of asset

Total 25.1% 52.8% 22.1% 100.0%

valuation

% within comparability 100.0% 100.0% 100.0% 100.0%

% of Total 25.1% 52.8% 22.1% 100.0%

This empirical study found most responders feedback are consistent with the

findings of prior research work (Eccles and Holt, 2000, 2001 and Holt and Eccles,

2003) which indicate that depending on the asset valuation methods costing real estate

accounting elements will differ. They refer that a common set of accounting standards

used can increase reporting transparency and business performance.

However, the study found most of the responder (table-1.6) emphasize on a

common set of accounting standards by suggesting that internationally accepted

standard such as IFRS adoptions increased comparability of real estate accounting

elements (Goodrich, 1982; Nobes, 1992; Barth, Landsman and Lang, 2005). Real

estate company must be adopted internationally accepted accounting standard (IFRS)

Copyright 2018 GMP Press and Printing (http://buscompress.com/journal-home.html)

ISSN: 2304-1013 (Online); 2304-1269 (CDROM); 2414-6722 (Print)

Electronic copy available at: https://ssrn.com/abstract=3222277

Review of Integrative Business and Economics Research, Vol. 7, Supplementary Issue 3 232

to allow more transparency, understandability, competitiveness and comparability

(Lazar et al. 2006). Therefore, based on these research findings; we can develop the

following hypothesis:

H0 -: There is no association between method of asset valuation &

comparability to faithfully present real estate accounting elements.

H1 -: There is an association between method of asset valuation &

comparability to faithfully present real estate accounting elements.

Table 1.9: Chi-Square Tests

Value df Asymp. Sig. Exact Sig. Exact Sig. Point

(2-sided) (2-sided) (1-sided) Probability

a

Pearson Chi-Square 346.724 4 .000 .000

Likelihood Ratio 389.116 4 .000 .000

Fisher's Exact Test 377.632 .000

Linear-by-Linear

.007b 1 .935 .938 .486 .003

Association

N of Valid Cases 439

a.1 cells (11.1%) have expected count less than 5. The minimum expected count is 4.64.

b. The standardized statistic is -.081.

According to Yates, Moore & McCabe, (1999, p. 734), each observation is

independent of all the others ( one observation per subject) & no more than 20% of the

expected counts are less than 5 and all individual expected counts are 1 or greater. If both

conditions are met then chi-square test (p-value) will be reliable for cross tabulation. If this is

not meet, then Fisher's exact test (when the cell count is less than 5) will be used for reliable

p-value. From the bottom of Table 1.9, we can see that 11.1% (1) cells have expected count

less than 5 & the minimum expected count is 4.64. This is satisfy both conditions (expected

cells count =11.1% & minimum expected count=4.64), therefore; Pearson’s chi-square test (p-

value) will be reliable. The table 1.9indicate that Pearson Chi-Square =346.724 & p<0.05

under 2 tailed significance test imply a very small probability of the observed data under the

null hypothesis of no relationship. The null hypothesis is rejected, since p < 0.05.We can

reject null hypothesis by accepting alternative hypothesis that there is an association between

method of asset valuation & comparability to faithfully presents real estate accounting

elements.

This empirical study found most of the responder's feedbacks are consistent with the

findings of earlier research work (Jermakowicz, Kinsey and Wulf,2007) which imply that

earnings and book value positively associated with IFRS. They agree that effective

implementation of IFRS significantly increased value-relevance of earnings and book value

(Filip and Raffournier,2010, Hellström,2006 Bilgic and Ibis, 2013). However, the findings of

the study are not confirmed with the findings of some studies (Bartov et al. 2005, Karampinis

and Hevas,2011; Ahmed and Goodwin,2006) which shows that adopting IFRS decrease

earnings & book value. Therefore, based on these research findings; we can develop the

following hypothesis:

Copyright 2018 GMP Press and Printing (http://buscompress.com/journal-home.html)

ISSN: 2304-1013 (Online); 2304-1269 (CDROM); 2414-6722 (Print)

Electronic copy available at: https://ssrn.com/abstract=3222277

Review of Integrative Business and Economics Research, Vol. 7, Supplementary Issue 3 233

Table 2: Earnings * Book values Cross tabulation

Book values Total

No Yes Don't

know

Count 55 0 2 57

Expected Count 7.7 10.3 39.1 57.0

No % within Earnings 96.5% 0.0% 3.5% 100.0%

% within Book values 93.2% 0.0% 0.7% 13.0%

% of Total 12.5% 0.0% 0.5% 13.0%

Count 4 79 0 83

Expected Count 11.2 14.9 56.9 83.0

Earnings Yes % within Earnings 4.8% 95.2% 0.0% 100.0%

% within Book values 6.8% 100.0% 0.0% 18.9%

% of Total 0.9% 18.0% 0.0% 18.9%

Count 0 0 299 299

Expected Count 40.2 53.8 205.0 299.0

Don’t

% within Earnings 0.0% 0.0% 100.0% 100.0%

Know

% within Book values 0.0% 0.0% 99.3% 68.1%

% of Total 0.0% 0.0% 68.1% 68.1%

Count 59 79 301 439

Expected Count 59.0 79.0 301.0 439.0

Total % within Earnings 13.4% 18.0% 68.6% 100.0%

% within Book values 100.0% 100.0% 100.0% 100.0%

% of Total 13.4% 18.0% 68.6% 100.0%

H0: Earnings & book value negatively associated with IFRS.

H1: Earnings & book value positively associated with IFRS.

Table 2.1: Chi-Square Tests

Value df Asymp. Sig. Exact Sig. Exact Sig. Point

(2-sided) (2-sided) (1-sided) Probability

a

Pearson Chi-Square 811.341 4 .000 .000

Likelihood Ratio 685.595 4 .000 .000

Fisher's Exact Test 664.331 .000

Linear-by-Linear

427.346b 1 .000 .000 .000 .000

Association

N of Valid Cases 439

a. 0 cells (0.0%) have expected count less than 5. The minimum expected count is 7.66.

c. The standardized statistic is 20.672.

From the top row of the table2.1, Pearson Chi-Square statistic, c2= 811.341,

and p < 0.05(2 tailed significance test); that is a very small probability of the observed

data under the null hypothesis of no relationship. The null hypothesis is rejected, since

p < 0.05. Therefore, we can reject null hypothesis by accepting alternative hypothesis

that earnings & book value positively associated with IFRS.

Copyright 2018 GMP Press and Printing (http://buscompress.com/journal-home.html)

ISSN: 2304-1013 (Online); 2304-1269 (CDROM); 2414-6722 (Print)

Electronic copy available at: https://ssrn.com/abstract=3222277

Review of Integrative Business and Economics Research, Vol. 7, Supplementary Issue 3 234

Table 2.2: Adopting IFRS * Financial performance Cross tabulation

Financial performance Total

No Yes Don’t

Know

Count 21 0 0 21

Expected Count 3.3 4.4 13.3 21.0

% within adopting IFRS 100.0% 0.0% 0.0% 100.0%

No

% within financial

30.0% 0.0% 0.0% 4.8%

performance

% of Total 4.8% 0.0% 0.0% 4.8%

Count 19 60 0 79

Expected Count 12.6 16.4 50.0 79.0

Adopting % within adopting IFRS 24.1% 75.9% 0.0% 100.0%

Yes

IFRS % within financial

27.1% 65.9% 0.0% 18.0%

performance

% of Total 4.3% 13.7% 0.0% 18.0%

Count 30 31 278 339

Expected Count 54.1 70.3 214.7 339.0

Don't % within adopting IFRS 8.8% 9.1% 82.0% 100.0%

know % within financial

42.9% 34.1% 100.0% 77.2%

performance

% of Total 6.8% 7.1% 63.3% 77.2%

Count 70 91 278 439

Expected Count 70.0 91.0 278.0 439.0

% within adopting IFRS 15.9% 20.7% 63.3% 100.0%

Total

% within financial

100.0% 100.0% 100.0% 100.0%

performance

% of Total 15.9% 20.7% 63.3% 100.0%

Copyright 2018 GMP Press and Printing (http://buscompress.com/journal-home.html)

ISSN: 2304-1013 (Online); 2304-1269 (CDROM); 2414-6722 (Print)

Electronic copy available at: https://ssrn.com/abstract=3222277

Review of Integrative Business and Economics Research, Vol. 7, Supplementary Issue 3 235

The study has found relevant feedback with the findings of earlier research

work (Meeks and Swann, 2009& Barth, 2008) which suggest that adopting IFRS

exhibited higher accounting quality. Real estate Company that adopts IFRS enjoys

better accounting quality than those who do not adopt IFRS.

Regarding financial performance, the findings of the study are consistent with

the findings of Latridis (2010) which imply that IFRS implementation enhances

financial performance of real estate accounting elements. They measured financial

performance on the basis of profitability and growth potentials. Therefore, based on

these research findings; we can develop the following hypothesis:

H0 -: There is no association between adopting IFRS & financial performance

to faithfully present real estate accounting elements.

H1 -: There is an association between adopting IFRS & financial performance

to faithfully present real estate accounting elements.

Table 2.3:Chi-Square Tests

Value df Asymp. Sig. Exact Sig. Exact Sig. Point

(2-sided) (2-sided) (1-sided) Probability

a

Pearson Chi-Square 331.525 4 .000 .000

Likelihood Ratio 306.213 4 .000 .000

Fisher's Exact Test 295.141 .000

Linear-by-Linear

219.575b 1 .000 .000 .000 .000

Association

N of Valid Cases 439

a. 2 cells (22.2%) have expected count less than 5. The minimum expected count is 3.35.

b. The standardized statistic is 14.818.

The footnote for this table 2.3 pertains to the expected cell count assumption (

expected cell counts are all greater than 1); 22.2% cells had an expected count less

than 5(more than 20%), which is against Yates, Moore & McCabe (1999, p. 734)

assumption. Therefore, Fisher's Exact Test will be used for reliable p-value. The table

2.3indicate that Fisher's Exact Test =295.141& p<0.05 under 2 tailed significance test

imply a very small probability of the observed data under the null hypothesis of no

relationship. The null hypothesis is rejected, since p < 0.05.We can reject null

hypothesis by accepting alternative hypothesis that there is an association between

adopting IFRS & financial performance to faithfully present real estate accounting

elements.

The findings of this empirical study are consistent with the findings of earlier

research works (Roberts et al., 2002) which suggest that IFRS works as

communication tools between financial statement preparers and users of all

categories. Most of the responder agrees that globally accepted accounting standard

such as IFRS comparably present real estate accounting elements & increase

comparability across the same industry (Cairns, 2002; IASCF, 2004).

Copyright 2018 GMP Press and Printing (http://buscompress.com/journal-home.html)

ISSN: 2304-1013 (Online); 2304-1269 (CDROM); 2414-6722 (Print)

Electronic copy available at: https://ssrn.com/abstract=3222277

Review of Integrative Business and Economics Research, Vol. 7, Supplementary Issue 3 236

Findings of convergence of accounting standard are relevant to earlier studies

(Cope and Clark, 2003; Alfredson et al, 2005, p. 7) which imply that harmonization

between national accounting standard & IFRS develops comparability of real estate

accounting elements. They emphasize on effective implementation and enforcement

of accounting standards to harmonize accounting practices (Ball 1995, 2006; Ball et

al. 2003; Burgstahler et al. 2006; Daske et al. 2007a, 2007b). Therefore, based on

these research findings; we can develop the following hypothesis:

H0: There is no association between communication tool & convergence of

accounting standard to enhance comparability.

H1: There is an association between communication tool & convergence of

accounting standard to enhance comparability.

Table 2.4: Communication tool * Convergence of accounting standard Cross tabulation

Convergence of Total

accounting standard

No Yes Don't

know

Count 0 19 0 19

Expected Count 3.3 13.1 2.6 19.0

% within communication tool 0.0% 100.0% 0.0% 100.0%

No

% within convergence of

0.0% 6.3% 0.0% 4.3%

accounting standard

% of Total 0.0% 4.3% 0.0% 4.3%

Count 0 131 0 131

Expected Count 22.7 90.4 17.9 131.0

Communication % within communication tool 0.0% 100.0% 0.0% 100.0%

Yes

tool % within convergence of

0.0% 43.2% 0.0% 29.8%

accounting standard

% of Total 0.0% 29.8% 0.0% 29.8%

Count 76 153 60 289

Expected Count 50.0 199.5 39.5 289.0

Don’t % within communication tool 26.3% 52.9% 20.8% 100.0%

Know % within convergence of

100.0% 50.5% 100.0% 65.8%

accounting standard

% of Total 17.3% 34.9% 13.7% 65.8%

Count 76 303 60 439

Expected Count 76.0 303.0 60.0 439.0

% within communication tool 17.3% 69.0% 13.7% 100.0%

Total

% within convergence of

100.0% 100.0% 100.0% 100.0%

accounting standard

% of Total 17.3% 69.0% 13.7% 100.0%

Copyright 2018 GMP Press and Printing (http://buscompress.com/journal-home.html)

ISSN: 2304-1013 (Online); 2304-1269 (CDROM); 2414-6722 (Print)

Electronic copy available at: https://ssrn.com/abstract=3222277

Review of Integrative Business and Economics Research, Vol. 7, Supplementary Issue 3 237

Table 2.5: Chi-Square Tests

Value df Asymp. Sig. Exact Sig. Exact Sig. Point

(2-sided) (2-sided) (1-sided) Probability

a

Pearson Chi-Square 102.271 4 .000 .000

Likelihood Ratio 143.788 4 .000 .000

Fisher's Exact Test 129.598 .000

Linear-by-Linear

23.787b 1 .000 .000 .000 .000

Association

N of Valid Cases 439

a. 2 cells (22.2%) have expected count less than 5. The minimum expected count is 2.60.

b. The standardized statistic is 4.877.

The footnote for this table 2.5 pertains to the expected cell count assumption

(expected cell counts are all greater than 1); 22.2% cells had an expected count less

than 5(more than 20%), so this assumption was not met Yates, Moore & McCabe,

(1999, p. 734). Therefore, Fisher's Exact Test will be used for reliable p-value. The

table 2.5indicate that Fisher's Exact Test =29.598 & p<0.05 under 2 tailed

significance test imply a very small probability of the observed data under the null

hypothesis of no relationship. Since the p-value is smaller than the significance level

(α = 0.05), we do not accept the null hypothesis. Rather, we conclude that there is

enough evidence to suggest an association between communication tool &

convergence of accounting standard.

Based on the results, we can state the following:

• A positive association was found between communication tool & convergence

of accounting standard (Fisher's Exact Test = 129.598, p = 0.000).

So, there is association between communication tool & convergence of accounting

standard to enhance comparability

6. CONCLUSION

The study shows that adopting IFRS not only increase financial performance but

also enhance comparability of real estate accounting elements. It is also shown that

depending on the asset valuation methods costing real estate accounting elements will

differ. The findings of the study indicate that a common set of accounting standards

used can increase reporting transparency and business performance. Here, one

wonders what the outcome may be if real estate company does not adopt IFRS.

Concerning earnings and book value, the study shows that adopting IFRS

positively increase value-relevance of earnings and book value. Adopting IFRS

exhibited higher accounting quality. Real estate Company that adopts IFRS enjoys

better accounting quality than those who do not adopt IFRS.

IFRS implementation enhances financial performance of real estate accounting

elements. Therefore, IFRS works as communication tools between financial statement

preparers and users of all categories. Convergence of accounting standard &

Copyright 2018 GMP Press and Printing (http://buscompress.com/journal-home.html)

ISSN: 2304-1013 (Online); 2304-1269 (CDROM); 2414-6722 (Print)

Electronic copy available at: https://ssrn.com/abstract=3222277

Review of Integrative Business and Economics Research, Vol. 7, Supplementary Issue 3 238

harmonization between national accounting standard & IFRS develops comparability

of real estate accounting elements.

REFERENCES

[1] Ahmed, K. and Goodwin, J. (2006). Effects of international financial reporting

standards on the accounts and accounting quality of Australian firms. Retrieved

October 2006, from

http://www.unisa.edu.au/commerce/events/docs/2006/IFRS_impact%20

[2] Alfredson, K., Leo, K., Picker, R., Pacter, P. & Radford, J. (2005). Applying

International Accounting Standards, John Wiley & Sons Australia, Ltd, Milton,

Queensland.

[3] Ball, R. (2006). IFRS: Pros and Cons for Investors', Accounting and Business

Research International Accounting Policy Forum pp 5-27.

[4] Bartov, S.R., Goldberg and M. Kim (2005). Comparative value relevance among

German, US, and International Accounting Standards: A German stock market

perspective, Journal of Accounting Auditing & Finance, 20(2), 95-119

[5] Bilgic, F, and Ibis (2013). Effects of new financial reporting standards on value

relevance–A study about Turkish stock markets. International Journal of

Economics and Finance, 5(10)

[6] Barth, Mary E., Landsman, R. Wayne & H. Lang, Mark, 2005.

International Accounting Standards and Accounting quality, retrieved on 2

April 2007, from http://ssrn.com/abstract=688041

[7] Burgstahler, D., Hail, L. and Leuz, C. (2006) The importance of reporting

incentives: earnings management in European private and public firms, The

Accounting Review, 81(5), pp. 983–1016.

[8] Barth, M., Landsman, W.R, Lang, M. (2008).International Accounting

Standards and Accounting quality. Journal of Accounting Research, (46), 467-

498.

[9] Ball, R. (2006). IFRS: Pros and Cons for Investors', Accounting and Business

Research International Accounting Policy Forum pp 5-27.

[10] Ball, 2006R. Ball IFRS: Pros and cons for investors Accounting and Business

Research, International Accounting Policy Forum, 36 (1) (2006), pp. 5–27

[11] Ball, R., Robin, A. and Wu, J. S. (2003), ‘Incentives Versus Standards:

Properties of Accounting Income in Four East Asian Countries', Journal of

Accounting Research, 36: 235 –70.

[12] Cope, A. & C. Clarke, 2003. Financial Reporting: IFRS Conversion –

Managing the people impact, Accountancy: London, September, 132: 1321.

[13] Cairns, D. (2002). Applying International Accounting Standards (3rd Edition).

Edinburgh: Tolley's Accountancy Series, LexisNexis Butterworths Tolley, Reed

Elsevier.

[14] Cairns, D., Massoudi, D., Taplin, R., & Tarca, A. (2011). IFRS fair value

measurement and accounting policy choice in the United Kingdom and Australia.

The British Accounting Review, 43, 1-21.

[15] Daske, H., Hail, L., Leuz, C., and Verdi. R. (2007b), ‘Mandatory IFRS

Reporting Around the World: Early Evidence on the Economic Consequences',

Working paper (University of Chicago).

Copyright 2018 GMP Press and Printing (http://buscompress.com/journal-home.html)

ISSN: 2304-1013 (Online); 2304-1269 (CDROM); 2414-6722 (Print)

Electronic copy available at: https://ssrn.com/abstract=3222277

Review of Integrative Business and Economics Research, Vol. 7, Supplementary Issue 3 239

[16] Daske, H., Hail, L., Leuz, C. and Verdi, R. (2007a), ‘Adopting a Label:

Heterogeneity in the Economic Consequences of IFRS Adoption', Working paper

(University of Chicago).

[17] Eccles, T. and A. Holt (2001), "Accounting for investment properties in the UK:

Problems of definition and implementation". Briefings in Real Estate Finance, 1

(2): pp. 122-134. Journal of International Financial Management and Accounting,

18(3).http://dx.doi.org/10.1111/j.1467-646X.2007.01011.x

[18] Eccles, T. and A. Holt (2000), "Accounting for property in the UK: The legal and

professional framework".Journal of Corporate Real Estate, 3 (2): pp. 132-149.

[19] Filip A, Raffournier B (2010).The value relevance of earnings in a transition

economy: The case of Romania. Int J Account, 45, 77-103.

[20] Group of Ten. Financial Stability in the Emerging Market Economies. Bank

for International Settlements. Basle, 1997.

[21] Goodrich, P.S., 1982. A typology of international accounting principles and

policies, AUTA Review, 14: 37-61.

[22] Holt, A. and T. Eccles (2003), "Accounting practice in the post-Enron era: The

implications of financial statements in the property industry". Briefings in Real

Estate Finance, 2 (4): pp. 326-340.

[23] Islam M. S. and Hossain A., 2008, Operations of Bangladesh Housing Industry:

An Uncertain Supply Chain Model, The AIUB Journal of Business and

Economics (AJBE), Vol.7, No.2, August.

[24] Jermakowicz, E., Prather-Kinsey. J., & Wulf, I. (2007). The Value Relevance of

Accounting Income Reported by DAX-30 German Companies.

[25] Karampinis, N. and Hevas, D, (2009).The effect of the mandatory application of

IFRS on the value relevance of accounting data: Some Evidence from Greece,

European Research Studies, 12 (1), 73-100.

[26] Lazar, J., L.L. Tay, & R. Othman, 2006. Adoption of International

Financial Reporting Standards an overview. Accountants Today, June, 18-21.

[27] Latridis, G. (2010). IFRS Adoption and Financial Statement Effect: The Case of

UK. International Research

Journal of Finance and Economics.38, http://www.eurojournals.com/finance.htm.

[28] Meeks G, Swann P (2009). "Accounting standards and the economics of

standards." Account. Bus. Res. 39(3): 191-210.

[29] Mir, M. Z., Rahman, A. S., 2005. The adoption of international accounting

standards in Bangladesh. Accounting Auditing and Accountability Journal, 18

(6), 816-841.

[30] Muller III, K. A, & Riedl, E. J. (2002). External monitoring of property appraisal

estimates and information asymmetry. Journal of Accounting Research, 40(3),

865-881.

[31] Nobes, C.W., 1992. International classification of financial reporting (2nd

ed).London: Routledge.

[32] PricewaterhouseCoopers (2004). Ready for take-off? www.pwc.com/ifrs

[33] REHAB, Leo Vashkor Dewri, 2012, A Comprehensive Study on the Real Estate

Sector in Bangladesh [Real Estate and Housing Association of Bangladesh]

[34] Shil, N C. Das, B & Pramanik, AK 2009, „Harmonization of Accounting

Standards through Internationalization‟, International Business Research, vol. 2,

no. 2. viewed 1 September 2014,

Copyright 2018 GMP Press and Printing (http://buscompress.com/journal-home.html)

ISSN: 2304-1013 (Online); 2304-1269 (CDROM); 2414-6722 (Print)

Electronic copy available at: https://ssrn.com/abstract=3222277

Review of Integrative Business and Economics Research, Vol. 7, Supplementary Issue 3 240

[35] The Institute of Chartered Accountants of Bangladesh 2007, „Current Status of

Bangladesh Accounting Standards (BASs) vis-a-vis IASs/IFRSs‟, Bangladesh,

viewed 1 September 2014,

[36] The Institute of Chartered Accountants of Bangladesh 2009, „Action Plans‟,

viewed 15 September 2014,

[37] UNCTAD 2006, ‘International Accounting and Reporting Issues: 2005 Review‟,

United Nations, New York and Geneva, viewed 10 September 2014,

[38] Yates, D., Moore, Moore, D., McCabe, G. (1999). The Practice of Statistics (1st

Ed.). New York: W.H. Freeman.

Copyright 2018 GMP Press and Printing (http://buscompress.com/journal-home.html)

ISSN: 2304-1013 (Online); 2304-1269 (CDROM); 2414-6722 (Print)

View publication stats Electronic copy available at: https://ssrn.com/abstract=3222277

You might also like

- Regulatory Impact Analysis Report on the Current Customs Regulatory Framework in BangladeshFrom EverandRegulatory Impact Analysis Report on the Current Customs Regulatory Framework in BangladeshNo ratings yet

- Literature ReviewDocument4 pagesLiterature ReviewpalashndcNo ratings yet

- International Public Sector Accounting Standards Implementation Road Map for UzbekistanFrom EverandInternational Public Sector Accounting Standards Implementation Road Map for UzbekistanNo ratings yet

- IFRSDocument5 pagesIFRSRoki HassanNo ratings yet

- IFRS Update: Topics Discussed in Monthly MeetingDocument2 pagesIFRS Update: Topics Discussed in Monthly MeetingAbdullah Hish ShafiNo ratings yet

- Overview of Ifrs Convergence Process in IndonesiaDocument14 pagesOverview of Ifrs Convergence Process in IndonesiaAngga PramadaNo ratings yet

- A Project ON: (Impact On Banking Sector)Document21 pagesA Project ON: (Impact On Banking Sector)Akshay BhandeNo ratings yet

- IFRSs and Their Adoption in BangladeshIFRSs and Their Adoption in BangladeshDocument52 pagesIFRSs and Their Adoption in BangladeshIFRSs and Their Adoption in BangladeshEddyEddwaard CullenNo ratings yet

- BOS 2.0 Supplemental Guidance 2024 - TT - F01Document9 pagesBOS 2.0 Supplemental Guidance 2024 - TT - F01Gleh Huston AppletonNo ratings yet

- 01.introductory Materia... 03-07-2020 7.32 PMDocument20 pages01.introductory Materia... 03-07-2020 7.32 PMوليد محمد فكري عبيدNo ratings yet

- PFRS Updates For The Year 2018Document7 pagesPFRS Updates For The Year 2018nenette cruzNo ratings yet

- Closing The GAAP: New IFRS Pronouncements Closing The GAAP: New Pronouncements Closing The GAAP: NewDocument6 pagesClosing The GAAP: New IFRS Pronouncements Closing The GAAP: New Pronouncements Closing The GAAP: NewMark Ronnier VedañaNo ratings yet

- Research Paper: Standard To Reform EnvironmentDocument10 pagesResearch Paper: Standard To Reform EnvironmentHasiba Binte HannanNo ratings yet

- Paper 1: AccountingDocument6 pagesPaper 1: AccountingzydusNo ratings yet

- Implementation IFRS in BDDocument9 pagesImplementation IFRS in BDAbdullah Hish ShafiNo ratings yet

- Convergence With If RsDocument12 pagesConvergence With If RsAbdelfattahHabibNo ratings yet

- Interim Financial Reporting & Compliance With SEBIs Guidelines The Case of India's Financial Industry - GIBS Bangalore - Top B-School in BangaloreDocument10 pagesInterim Financial Reporting & Compliance With SEBIs Guidelines The Case of India's Financial Industry - GIBS Bangalore - Top B-School in BangalorePradeep KhadariaNo ratings yet

- ICAI Suggestions On Tax Issues IFRSDocument25 pagesICAI Suggestions On Tax Issues IFRSGaurav JiNo ratings yet

- IFRS Update PDFDocument13 pagesIFRS Update PDFFrodouard ManirakizaNo ratings yet

- UBL Annual Report 2018-81Document1 pageUBL Annual Report 2018-81IFRS LabNo ratings yet

- GenesisDocument55 pagesGenesismuskan kundra100% (1)

- Ey Ctools Interim Ifrs Disclosure Checklist May 2020Document31 pagesEy Ctools Interim Ifrs Disclosure Checklist May 2020sona abrahamyanNo ratings yet

- MFRS 1Document42 pagesMFRS 1hyraldNo ratings yet

- LIBOR Benchmark StatementDocument25 pagesLIBOR Benchmark StatementKarimFathNo ratings yet

- Application of IAS 12 Income Taxes Substantively Enacted Tax RatesDocument6 pagesApplication of IAS 12 Income Taxes Substantively Enacted Tax RatesLerato MagoroNo ratings yet

- Bangladesh: Report On The Observance of Standards and Codes (Rosc)Document16 pagesBangladesh: Report On The Observance of Standards and Codes (Rosc)Shahid MahmudNo ratings yet

- Corp. Compliance Calendar - May 23 - CS Lalit RajputDocument43 pagesCorp. Compliance Calendar - May 23 - CS Lalit RajputAyushman PatnaikNo ratings yet

- Ey Ctools Ifrs Update September 2023Document19 pagesEy Ctools Ifrs Update September 2023Terrance MawondeNo ratings yet

- Navigating The Changes To International Financial Reporting StandardsDocument48 pagesNavigating The Changes To International Financial Reporting StandardsCANo ratings yet

- Template EKOMA - M Fauzan Aziz1, Elina Syafitri2, M Luthfy Abdul K3, Fajar Panji G4, M Shafta Putra5Document10 pagesTemplate EKOMA - M Fauzan Aziz1, Elina Syafitri2, M Luthfy Abdul K3, Fajar Panji G4, M Shafta Putra5yovieNo ratings yet

- BV2021CR - MFRS1 First-Time Adoption of Malaysian Financial Reporting StandardsDocument43 pagesBV2021CR - MFRS1 First-Time Adoption of Malaysian Financial Reporting StandardsChee Juan PhangNo ratings yet

- Ifrsnotes Ind As Itfg 15 Clarifications Transition Facilitation PDFDocument11 pagesIfrsnotes Ind As Itfg 15 Clarifications Transition Facilitation PDFJosh MedinaNo ratings yet

- Adv AccDocument42 pagesAdv Accadityatiwari122006No ratings yet

- 2 Rita JainDocument5 pages2 Rita JainRavi ModiNo ratings yet

- IFRS Illustrative Financial Statements (Dec 2023)Document286 pagesIFRS Illustrative Financial Statements (Dec 2023)Vamsi Krishna GaragaNo ratings yet

- ContentServer Asp-12 PDFDocument17 pagesContentServer Asp-12 PDFharunraajNo ratings yet

- GSTDocument55 pagesGSTShifali Shetty100% (1)

- The Impact of IFRS Convergence On Market Liquidity: Evidence From IndiaDocument20 pagesThe Impact of IFRS Convergence On Market Liquidity: Evidence From IndiaEllen AgustinNo ratings yet

- BV2018 - MFRS 1Document41 pagesBV2018 - MFRS 1imieNo ratings yet

- SACMDD OS June 2020Document66 pagesSACMDD OS June 2020sandhyadbhaleraoNo ratings yet

- Convergence With Accounting Standards: Compiled by CA Saurabh PatniDocument11 pagesConvergence With Accounting Standards: Compiled by CA Saurabh PatniCA Raj KanwalNo ratings yet

- IFRS Illustrative Financial Statements (Dec 2021)Document292 pagesIFRS Illustrative Financial Statements (Dec 2021)bacha436No ratings yet

- BDO - Annual Improvements Exposure Draft (Proposed Amendments To IFRSs)Document2 pagesBDO - Annual Improvements Exposure Draft (Proposed Amendments To IFRSs)memoNo ratings yet

- Annual Report MCADocument69 pagesAnnual Report MCARahul BhanNo ratings yet

- Accounts Project IFRSDocument27 pagesAccounts Project IFRSShivam SenNo ratings yet

- IFRS Document WordDocument21 pagesIFRS Document WordHabte DebeleNo ratings yet

- Perkembangan Ifrs Di IndonesiaDocument8 pagesPerkembangan Ifrs Di IndonesiaFajar D. yuliantaNo ratings yet

- Far410 Chapter 1 Fin Regulatory FrameworkDocument19 pagesFar410 Chapter 1 Fin Regulatory Frameworkafdhal50% (4)

- Publikasi Ketujuh TF-CCRDocument6 pagesPublikasi Ketujuh TF-CCRRiny AgustinNo ratings yet

- Conceptual Framework: Amendments To IFRS 3 - Reference To TheDocument3 pagesConceptual Framework: Amendments To IFRS 3 - Reference To TheteguhsunyotoNo ratings yet

- 73150bos58999 p5Document42 pages73150bos58999 p5Laxmi SharmaNo ratings yet

- Directors Report: Tanzania Financial Reporting Standard (TFRS) 1Document15 pagesDirectors Report: Tanzania Financial Reporting Standard (TFRS) 1Dafrosa Honor100% (1)

- Joint ArrangementDocument7 pagesJoint ArrangementMariam AlraeesiNo ratings yet

- Assignment On Regulatory Framework of Financial Reporting in BangladeshDocument11 pagesAssignment On Regulatory Framework of Financial Reporting in BangladeshMd Ashraful RahmanNo ratings yet

- 2009 Model Fs HongkongDocument164 pages2009 Model Fs HongkongYennyNo ratings yet

- Disclosure Checklist For Interim Condensed Financial StatementsDocument31 pagesDisclosure Checklist For Interim Condensed Financial StatementsBeatrice Serafica CoronelNo ratings yet

- IFRS Pocket Book 2010Document132 pagesIFRS Pocket Book 2010Ramesh KrishnamoorthyNo ratings yet

- Financial Statements FormatDocument80 pagesFinancial Statements FormatSarowar AlamNo ratings yet

- International Accounting Standard 1 (IAS 1), Presentation of Financial StatementsDocument12 pagesInternational Accounting Standard 1 (IAS 1), Presentation of Financial StatementsHeliani sajaNo ratings yet

- Ifrs BankingDocument11 pagesIfrs Bankingsharanabasappa1No ratings yet

- 8 Policy, Estimate, ErrorDocument16 pages8 Policy, Estimate, ErrorChelsea Anne VidalloNo ratings yet

- PDF Functional Stickers Rainbow Circles 0.25 - by Lovely PlannerDocument1 pagePDF Functional Stickers Rainbow Circles 0.25 - by Lovely Plannerjam linganNo ratings yet

- Practice Multiple Choice For Internal ControlDocument5 pagesPractice Multiple Choice For Internal ControlJn Fancuvilla LeañoNo ratings yet

- Fruit Basket Printable by Note&WishDocument2 pagesFruit Basket Printable by Note&Wishjam linganNo ratings yet

- Mountain View - Printable Note & Wish: NotesDocument1 pageMountain View - Printable Note & Wish: Notesjam linganNo ratings yet

- IntroductionDocument1 pageIntroductionjam linganNo ratings yet

- Exploration For and Evaluation of Mineral Resources: Ifrs 6Document12 pagesExploration For and Evaluation of Mineral Resources: Ifrs 6Saad Abu AlhaijaNo ratings yet

- PortersDocument1 pagePortersjam linganNo ratings yet

- AudTheo Salosagcol 2018ed AnsKeyDocument13 pagesAudTheo Salosagcol 2018ed AnsKeyjam linganNo ratings yet

- FIN 301 B Porter Larac 3-4 Key2Document4 pagesFIN 301 B Porter Larac 3-4 Key2Sunny RajesthNo ratings yet

- MCQ - Assurance ServicesDocument13 pagesMCQ - Assurance Servicesemc2_mcv67% (30)

- Terracotta Minimalist Business Finance PresentationDocument15 pagesTerracotta Minimalist Business Finance Presentationjam linganNo ratings yet

- Lecture Notes Mid2Document28 pagesLecture Notes Mid2dadahahaNo ratings yet

- FM11 CH 09 Test BankDocument15 pagesFM11 CH 09 Test BankFrances Ouano Ponce100% (1)

- Ss11 646 Corporate FinanceDocument343 pagesSs11 646 Corporate Financed-fbuser-32825803100% (12)

- Colorful Collage Best Friends Slam Book Fun PresentationDocument15 pagesColorful Collage Best Friends Slam Book Fun Presentationjam linganNo ratings yet

- Compliance With IFRS 15 Mandatory Disclosures: An Exploratory Study in Telecom and Construction SectorsDocument22 pagesCompliance With IFRS 15 Mandatory Disclosures: An Exploratory Study in Telecom and Construction Sectorsjam linganNo ratings yet

- Compliance With IFRS 15 Mandatory Disclosures: An Exploratory Study in Telecom and Construction SectorsDocument22 pagesCompliance With IFRS 15 Mandatory Disclosures: An Exploratory Study in Telecom and Construction Sectorsjam linganNo ratings yet

- The Institute of Internal Auditors Red Flags of Fraud: Situational Pressures That Contribute To Management FraudDocument2 pagesThe Institute of Internal Auditors Red Flags of Fraud: Situational Pressures That Contribute To Management Fraudjam linganNo ratings yet

- Brown Collage Two Truths One Lie Fun PresentationDocument7 pagesBrown Collage Two Truths One Lie Fun Presentationjam linganNo ratings yet

- Purple and Pink Stickers and Badges Never Have I Ever Girls Night Edition Fun PresentationDocument18 pagesPurple and Pink Stickers and Badges Never Have I Ever Girls Night Edition Fun Presentationjam linganNo ratings yet

- SLI 2020 Annual ReportDocument335 pagesSLI 2020 Annual Reportjam linganNo ratings yet

- Sustainability 10 02679 v2Document14 pagesSustainability 10 02679 v2Louie Angelo C. ColleraNo ratings yet

- 2019legislation - RA 11232 REVISED CORPORATION CODE 2019 PDFDocument73 pages2019legislation - RA 11232 REVISED CORPORATION CODE 2019 PDFCris Anonuevo100% (1)

- ESSAY: in Rizal's Letter To "The Young Women of Malolos," Rizal Enumerated Some of The Qualities Mothers Need To PossessDocument1 pageESSAY: in Rizal's Letter To "The Young Women of Malolos," Rizal Enumerated Some of The Qualities Mothers Need To Possessjam linganNo ratings yet

- PrizalDocument1 pagePrizaljam linganNo ratings yet

- The Institute of Internal Auditors Red Flags of Fraud: Situational Pressures That Contribute To Management FraudDocument1 pageThe Institute of Internal Auditors Red Flags of Fraud: Situational Pressures That Contribute To Management Fraudjam linganNo ratings yet

- Preview: How To Cite This ThesisDocument18 pagesPreview: How To Cite This Thesisjam linganNo ratings yet

- The Institute of Internal Auditors Red Flags of FraudDocument3 pagesThe Institute of Internal Auditors Red Flags of Fraudjam linganNo ratings yet

- Gemuruh Jiwa: Far Away From HomeDocument1 pageGemuruh Jiwa: Far Away From HomeIvy TingNo ratings yet

- ASTM Manual Series, MNL 52 An IntroductionDocument73 pagesASTM Manual Series, MNL 52 An IntroductionPabel Gil Ramirez CamonesNo ratings yet

- Northern Cebu Colleges, Inc. San Vicente ST., Bogo City, Cebu Flexible Instruction Delivery Plan (FIDP)Document6 pagesNorthern Cebu Colleges, Inc. San Vicente ST., Bogo City, Cebu Flexible Instruction Delivery Plan (FIDP)Jilmore Caseda Cantal100% (1)

- Propositions: A. Learning Outcome Content StandardDocument9 pagesPropositions: A. Learning Outcome Content StandardMarc Joseph NillasNo ratings yet

- ADMN-2-002, Issue 01, Procedure For Personal Hygiene, Employee Facility and HousekeepingDocument4 pagesADMN-2-002, Issue 01, Procedure For Personal Hygiene, Employee Facility and HousekeepingSmsajid WaqasNo ratings yet

- Aliquat-336 As A Novel Collector For Quartz FlotationDocument8 pagesAliquat-336 As A Novel Collector For Quartz FlotationMaicol PérezNo ratings yet

- Hirac (Manhole Installation)Document7 pagesHirac (Manhole Installation)tana50% (2)

- Appraisal Goals and AttributesDocument3 pagesAppraisal Goals and AttributesRasheed Ahamad0% (1)

- Models of Cultural Heritage Management: Transformations in Business and Economics January 2014Document23 pagesModels of Cultural Heritage Management: Transformations in Business and Economics January 2014aaziNo ratings yet

- Fractional DistillationDocument7 pagesFractional DistillationInspector Chulbul PandayNo ratings yet

- Mark Scheme (Results) : Summer 2017Document22 pagesMark Scheme (Results) : Summer 2017Khalid AhmedNo ratings yet

- Book Review Doing Action Research in Your Own OrganisationDocument5 pagesBook Review Doing Action Research in Your Own OrganisationJeronimo SantosNo ratings yet

- Context of ArtDocument20 pagesContext of ArtFerdinand Fremista JrNo ratings yet

- PreviewpdfDocument51 pagesPreviewpdfZang100% (1)

- As Sci 10 SLG Week 5 Quarter IiDocument6 pagesAs Sci 10 SLG Week 5 Quarter IiDarwin BondocNo ratings yet

- Monitoring and Evaluation On School ReadinessDocument3 pagesMonitoring and Evaluation On School ReadinessArlene TubanNo ratings yet

- Declaration KitDocument4 pagesDeclaration KitJITANSHUCHAMPNo ratings yet

- Critical Study of Richard Dawkins, The God DelusionDocument10 pagesCritical Study of Richard Dawkins, The God DelusionJuan Pablo Pardo BarreraNo ratings yet

- 11.22 Elastic Settlement of Group Piles: RumusDocument1 page11.22 Elastic Settlement of Group Piles: RumusHilda MaulizaNo ratings yet

- Institute of Southern Punjab Multan: Syed Zohair Quain Haider Lecturer ISP MultanDocument47 pagesInstitute of Southern Punjab Multan: Syed Zohair Quain Haider Lecturer ISP MultanCh MaaanNo ratings yet

- PINOYBIX1Document5 pagesPINOYBIX1andreareyesmalinao7No ratings yet

- Critically Discuss About Major Features of Water Resource Act, 2049 B.SDocument12 pagesCritically Discuss About Major Features of Water Resource Act, 2049 B.SPurple DreamNo ratings yet

- Exhibitorlist Interz20 enDocument42 pagesExhibitorlist Interz20 enLindsay CatariNo ratings yet

- 101 Positive Comments For Assesment 1Document7 pages101 Positive Comments For Assesment 1ranjit biswasNo ratings yet

- Lecture 01 ADVANCED ANIMATION AS3Document11 pagesLecture 01 ADVANCED ANIMATION AS3Febb RoseNo ratings yet

- Theory of Corporate PersonalityDocument7 pagesTheory of Corporate PersonalityKabita SharmaNo ratings yet

- Introducing Python Programming For Engineering Scholars: Zahid Hussain, Muhammad Siyab KhanDocument8 pagesIntroducing Python Programming For Engineering Scholars: Zahid Hussain, Muhammad Siyab KhanDavid C HouserNo ratings yet

- Top Renewable Energy Trends of 2018: Madeleine HoweDocument4 pagesTop Renewable Energy Trends of 2018: Madeleine HowedubryNo ratings yet

- Past Simple WH Questions Word Order Exercise 2Document3 pagesPast Simple WH Questions Word Order Exercise 2karen oteroNo ratings yet

- 7 Ways To Better Your LetteringDocument5 pages7 Ways To Better Your LetteringLuciana Freire0% (2)

- Love Your Life Not Theirs: 7 Money Habits for Living the Life You WantFrom EverandLove Your Life Not Theirs: 7 Money Habits for Living the Life You WantRating: 4.5 out of 5 stars4.5/5 (146)

- LLC Beginner's Guide: The Most Updated Guide on How to Start, Grow, and Run your Single-Member Limited Liability CompanyFrom EverandLLC Beginner's Guide: The Most Updated Guide on How to Start, Grow, and Run your Single-Member Limited Liability CompanyRating: 5 out of 5 stars5/5 (1)

- The One-Page Financial Plan: A Simple Way to Be Smart About Your MoneyFrom EverandThe One-Page Financial Plan: A Simple Way to Be Smart About Your MoneyRating: 4.5 out of 5 stars4.5/5 (37)

- Finance Basics (HBR 20-Minute Manager Series)From EverandFinance Basics (HBR 20-Minute Manager Series)Rating: 4.5 out of 5 stars4.5/5 (32)

- Getting to Yes: How to Negotiate Agreement Without Giving InFrom EverandGetting to Yes: How to Negotiate Agreement Without Giving InRating: 4 out of 5 stars4/5 (652)

- The Science of Prosperity: How to Attract Wealth, Health, and Happiness Through the Power of Your MindFrom EverandThe Science of Prosperity: How to Attract Wealth, Health, and Happiness Through the Power of Your MindRating: 5 out of 5 stars5/5 (231)

- I Will Teach You to Be Rich: No Guilt. No Excuses. No B.S. Just a 6-Week Program That Works (Second Edition)From EverandI Will Teach You to Be Rich: No Guilt. No Excuses. No B.S. Just a 6-Week Program That Works (Second Edition)Rating: 4.5 out of 5 stars4.5/5 (13)

- How to Start a Business: Mastering Small Business, What You Need to Know to Build and Grow It, from Scratch to Launch and How to Deal With LLC Taxes and Accounting (2 in 1)From EverandHow to Start a Business: Mastering Small Business, What You Need to Know to Build and Grow It, from Scratch to Launch and How to Deal With LLC Taxes and Accounting (2 in 1)Rating: 4.5 out of 5 stars4.5/5 (5)

- 7 Financial Models for Analysts, Investors and Finance Professionals: Theory and practical tools to help investors analyse businesses using ExcelFrom Everand7 Financial Models for Analysts, Investors and Finance Professionals: Theory and practical tools to help investors analyse businesses using ExcelNo ratings yet

- The Accounting Game: Learn the Basics of Financial Accounting - As Easy as Running a Lemonade Stand (Basics for Entrepreneurs and Small Business Owners)From EverandThe Accounting Game: Learn the Basics of Financial Accounting - As Easy as Running a Lemonade Stand (Basics for Entrepreneurs and Small Business Owners)Rating: 4 out of 5 stars4/5 (33)

- Profit First for Therapists: A Simple Framework for Financial FreedomFrom EverandProfit First for Therapists: A Simple Framework for Financial FreedomNo ratings yet

- Tax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesFrom EverandTax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesNo ratings yet

- I'll Make You an Offer You Can't Refuse: Insider Business Tips from a Former Mob Boss (NelsonFree)From EverandI'll Make You an Offer You Can't Refuse: Insider Business Tips from a Former Mob Boss (NelsonFree)Rating: 4.5 out of 5 stars4.5/5 (24)

- Bookkeeping: A Beginner’s Guide to Accounting and Bookkeeping for Small BusinessesFrom EverandBookkeeping: A Beginner’s Guide to Accounting and Bookkeeping for Small BusinessesRating: 5 out of 5 stars5/5 (4)

- Ledger Legends: A Bookkeeper's Handbook for Financial Success: Navigating the World of Business Finances with ConfidenceFrom EverandLedger Legends: A Bookkeeper's Handbook for Financial Success: Navigating the World of Business Finances with ConfidenceNo ratings yet

- Warren Buffett and the Interpretation of Financial Statements: The Search for the Company with a Durable Competitive AdvantageFrom EverandWarren Buffett and the Interpretation of Financial Statements: The Search for the Company with a Durable Competitive AdvantageRating: 4.5 out of 5 stars4.5/5 (109)

- Accounting Principles: Learn The Simple and Effective Methods of Basic Accounting And Bookkeeping Using This comprehensive Guide for Beginners(quick-books,made simple,easy,managerial,finance)From EverandAccounting Principles: Learn The Simple and Effective Methods of Basic Accounting And Bookkeeping Using This comprehensive Guide for Beginners(quick-books,made simple,easy,managerial,finance)Rating: 4.5 out of 5 stars4.5/5 (5)

- Financial Accounting - Want to Become Financial Accountant in 30 Days?From EverandFinancial Accounting - Want to Become Financial Accountant in 30 Days?Rating: 5 out of 5 stars5/5 (1)

- Financial Intelligence: A Manager's Guide to Knowing What the Numbers Really MeanFrom EverandFinancial Intelligence: A Manager's Guide to Knowing What the Numbers Really MeanRating: 4.5 out of 5 stars4.5/5 (79)

- Overcoming Underearning(TM): A Simple Guide to a Richer LifeFrom EverandOvercoming Underearning(TM): A Simple Guide to a Richer LifeRating: 4 out of 5 stars4/5 (21)