Professional Documents

Culture Documents

Case Study On: J. A. Sison vs. The Board of Accountancy and Robert Orr Ferguzon

Uploaded by

Regine Ann OlaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Case Study On: J. A. Sison vs. The Board of Accountancy and Robert Orr Ferguzon

Uploaded by

Regine Ann OlaCopyright:

Available Formats

CASE STUDY ON J. A. SISON vs.

THE BOARD OF ACCOUNTANCY and

ROBERT ORR FERGUZON.

J.A. Sison, the petitioner of the case contests the legality of the issuance of a

certificate by Board of Accountancy to Robert Orr Ferguson, a British national to practice

accountancy in the Philippines on the ground that there is no reciprocity between the

Philippines and the United Kingdom.

Upon knowing this lack of reciprocity, the Board of Accountancy decided to

suspend the certificate given to the respondent pending final revocation if ever they fail

to prove to the Board that (a) Filipinos are allowed to take the professional accountant

examination given by the British government, if any, and (b) Filipino certified public

accountants can, upon application, be registered as chartered accountants or granted

similar degrees by the British Government.

However, due to the fact that RA 9298 expressly states that the Board shall only

have the right to revoke a certificate on the grounds mentioned under section 23 of this

Act or for any unprofessional or unethical conduct, malpractice, violation of any of the

provisions of this Act, and its implementing rules and regulations, the Certified Public

Accountant’s Code of Ethics and the technical and professional standards of practice for

certified public accountants, the Secretary of Justice believed that "the change in

administrative interpretation with respect to the existence of reciprocity between the

Philippines and Great Britain as to the practice of accountancy," does not constitute

sufficient cause for the suspension or revocation of the certificates in question within the

meaning of said provision.

The British minister even emphasized the fact that fact that the Philippines and the

United Kingdom, are bound by a treaty of friendship and commerce, and each nation is

represented in the other by corresponding diplomatic envoy. Hence, the Supreme Court

ruled to deny the petitioner’s request to revoke the respondent’s certificate of registration

for it can be considered valid within the realm of comity under our laws.

Interpreting the law can be quite difficult and confusing. But apparently, as citizens

of this state we are under the obligation to know and understand such laws and

regulations that govern us. In this case, the petitioner failed to investigate further about

his claim. However, in my opinion the petitioner’s mistake was understandable as the Act

did not specify such circumstance wherein a foreign accountant can practice the

profession even if there exists no reciprocity as long as there is comity.

I am in the opinion that providing a more comprehensible and thorough discussion

about certain laws will surely be of great help in clearing out confusions to the public, I

also think that the Board of Accountancy should be firm in implementing the Accountancy

Act in order to avoid circumstances like this in the future.

You might also like

- Correction of Entry of BirthDocument18 pagesCorrection of Entry of BirthMaximo Isidro100% (2)

- New York Notary Public Prep Book with 3 Full Practice TestsFrom EverandNew York Notary Public Prep Book with 3 Full Practice TestsRating: 5 out of 5 stars5/5 (2)

- Brittney Ramos LawsuitDocument108 pagesBrittney Ramos LawsuitJoe BieskNo ratings yet

- Bar Review Companion: Taxation: Anvil Law Books Series, #4From EverandBar Review Companion: Taxation: Anvil Law Books Series, #4No ratings yet

- Court Documents in Deanne Mazzochi's Case Against DuPage County Clerk's OfficeDocument71 pagesCourt Documents in Deanne Mazzochi's Case Against DuPage County Clerk's OfficeDavid GiulianiNo ratings yet

- Class Digest - Legal Ethics PDFDocument56 pagesClass Digest - Legal Ethics PDFAnonymous PlK2KakJp100% (3)

- New York Notary Public Exam: Explore Essential Knowledge for Exam Mastery and Jumpstart Your New Career [II Edition]From EverandNew York Notary Public Exam: Explore Essential Knowledge for Exam Mastery and Jumpstart Your New Career [II Edition]No ratings yet

- 37.b. Digest Republic V ValenciaDocument2 pages37.b. Digest Republic V ValenciaWhoopi Jane MagdozaNo ratings yet

- People vs. HolgadoDocument1 pagePeople vs. HolgadoCherrie May OrenseNo ratings yet

- Case Digest Ethics NewDocument20 pagesCase Digest Ethics NewDeyowin BalugaNo ratings yet

- Agot Vs RiveraDocument3 pagesAgot Vs RiveraChelle BelenzoNo ratings yet

- Rule of LawDocument21 pagesRule of LawMehak SinglaNo ratings yet

- Fortunato, Julienne Wanason, Sandra JD2 Land Titles and Deeds December 8, 2016 Group 13 Quiz AnswersDocument9 pagesFortunato, Julienne Wanason, Sandra JD2 Land Titles and Deeds December 8, 2016 Group 13 Quiz AnswersjulyenfortunatoNo ratings yet

- PILA Case Digest MTDocument27 pagesPILA Case Digest MTMark Lester Lee Aure100% (1)

- Quileste Vs PeopleDocument3 pagesQuileste Vs PeopleManuel Joseph Franco100% (1)

- Session 4 Cases Digest - AllDocument30 pagesSession 4 Cases Digest - AllNeil Bryan C RamosNo ratings yet

- Tax DigestDocument19 pagesTax DigestCarolyn Clarin-BaternaNo ratings yet

- Commissioner of Internal Revenue vs. Philippine Daily Inquirer, IncDocument3 pagesCommissioner of Internal Revenue vs. Philippine Daily Inquirer, IncMich Lopez100% (1)

- Requirements For Admission To The Bar and The JudiciaryDocument15 pagesRequirements For Admission To The Bar and The Judiciaryboomblebee100% (1)

- Macalintal Vs ComelecDocument3 pagesMacalintal Vs ComelectinctNo ratings yet

- Civ Rev 1 Rowe Vs RepublicDocument2 pagesCiv Rev 1 Rowe Vs RepublicOM MolinsNo ratings yet

- Petition For Alteration and or Amendment of Certificates of Title NIICDocument6 pagesPetition For Alteration and or Amendment of Certificates of Title NIICDence Cris RondonNo ratings yet

- Spouses Pacquiao vs. CtaDocument3 pagesSpouses Pacquiao vs. CtaEM DOMINGO100% (2)

- Case Digest Tax Remedies 1Document23 pagesCase Digest Tax Remedies 1Carlos JamesNo ratings yet

- Cir V Basf CoatingDocument3 pagesCir V Basf CoatingRochelle Ann Reyes100% (1)

- 256 Rowe v. RepublicDocument2 pages256 Rowe v. RepublicMarichu Castillo HernandezNo ratings yet

- 02 Sison Vs Board of AccountancyDocument3 pages02 Sison Vs Board of AccountancyHiroshi CarlosNo ratings yet

- 37 Muntuerto vs. Atty. Alberto, AC#12289, 4 - 2 - 2019Document2 pages37 Muntuerto vs. Atty. Alberto, AC#12289, 4 - 2 - 2019Andy BNo ratings yet

- Sison Vs Boa and FergusonDocument1 pageSison Vs Boa and Fergusonpja_14No ratings yet

- (No. L-2529. December 31, 1949.) J. A. SISON, Petitioner, vs. THE BOARD of Accountancy and Robert Orr FERGUZON, RespondentsDocument15 pages(No. L-2529. December 31, 1949.) J. A. SISON, Petitioner, vs. THE BOARD of Accountancy and Robert Orr FERGUZON, RespondentsNia Coline Macala MendozaNo ratings yet

- PILA3 - Sison Vs Board of AccountancyDocument3 pagesPILA3 - Sison Vs Board of AccountancyMark Lester Lee AureNo ratings yet

- Prin. of ComityDocument5 pagesPrin. of ComityIrene CaneteNo ratings yet

- Legal Aspect ReflectionDocument4 pagesLegal Aspect ReflectionKim Nicole ReyesNo ratings yet

- Today Is Saturday, July 25, 2015Document5 pagesToday Is Saturday, July 25, 2015Ian InandanNo ratings yet

- 1 and 10Document3 pages1 and 10Mara VinluanNo ratings yet

- Quiz 13 LTDDocument7 pagesQuiz 13 LTDRalph John Alipio ValdezNo ratings yet

- RA 10172 - Correction of EntryDocument13 pagesRA 10172 - Correction of Entrybeta doronelaNo ratings yet

- Document 30Document6 pagesDocument 30Honeybeez TvNo ratings yet

- Cases Part 3Document128 pagesCases Part 3Angel CabanNo ratings yet

- Villanueva Vs JBCDocument47 pagesVillanueva Vs JBCJerome C obusanNo ratings yet

- Politial Law ExamDocument4 pagesPolitial Law Examشزغتحزع ىطشفم لشجخبهNo ratings yet

- A4 Agot vs. RiveraDocument3 pagesA4 Agot vs. RiveraJulie ArresNo ratings yet

- We Ruled ThatDocument1 pageWe Ruled ThatLhine KiwalanNo ratings yet

- Digest ElectiveDocument8 pagesDigest ElectivexxsunflowerxxNo ratings yet

- Nafteeday Gacalo2Document6 pagesNafteeday Gacalo2stpvpxdv5cNo ratings yet

- Civil Registrar of San Juan, Metro Manila, Et Al.: G.R. No. 179895 Carpio Morales, J.Document4 pagesCivil Registrar of San Juan, Metro Manila, Et Al.: G.R. No. 179895 Carpio Morales, J.junzNo ratings yet

- Freedom of SpeechDocument5 pagesFreedom of Speechhaley luyahNo ratings yet

- Paul Ambrose vs. AmbroseDocument38 pagesPaul Ambrose vs. Ambroserowela jane paanoNo ratings yet

- G.R. No. 189538 February 10, 2014 Republic of The Philippines, Petitioner, MERLINDA L. OLAYBAR, RespondentDocument4 pagesG.R. No. 189538 February 10, 2014 Republic of The Philippines, Petitioner, MERLINDA L. OLAYBAR, RespondentWhoopi Jane MagdozaNo ratings yet

- In Re Benjamin DacanayDocument4 pagesIn Re Benjamin Dacanayjeesup9No ratings yet

- Speccom Exam DungayagenesisDocument11 pagesSpeccom Exam DungayagenesisRowena DumalnosNo ratings yet

- 19 Labayo-Rowe Vs RepublicDocument3 pages19 Labayo-Rowe Vs RepublicGlenn caraigNo ratings yet

- 6 - Topacio v. OngDocument11 pages6 - Topacio v. OngGia MordenoNo ratings yet

- Third Division G.R. No. 189538, February 10, 2014 Republic of The Philippines, Petitioner, V. Merlinda L. Olaybar, Respondent. Decision Peralta, J.Document4 pagesThird Division G.R. No. 189538, February 10, 2014 Republic of The Philippines, Petitioner, V. Merlinda L. Olaybar, Respondent. Decision Peralta, J.rhodora exNo ratings yet

- 9 Paz Vs RepublicDocument3 pages9 Paz Vs RepublicElla B.No ratings yet

- Notarization CasesDocument6 pagesNotarization CasesRessie June PedranoNo ratings yet

- 256 Rowe V RepublicDocument2 pages256 Rowe V RepublicRobin PadaplinNo ratings yet

- B.M. 1678 Dacanay 2007Document2 pagesB.M. 1678 Dacanay 2007Kristell FerrerNo ratings yet

- Mayor Magtajas V Pryce CorporationDocument2 pagesMayor Magtajas V Pryce CorporationotthonrpolisisNo ratings yet

- Topacio vs. OngDocument9 pagesTopacio vs. OngJc IsidroNo ratings yet

- RP vs. Merlinda Olayvar (Rule 108)Document4 pagesRP vs. Merlinda Olayvar (Rule 108)Nomer M. GonzalesNo ratings yet

- Soriano Vs Offshore Shipping and Manning CorporationDocument2 pagesSoriano Vs Offshore Shipping and Manning CorporationTamara SmithNo ratings yet

- General Instructions for the Guidance of Post Office Inspectors in the Dominion of CanadaFrom EverandGeneral Instructions for the Guidance of Post Office Inspectors in the Dominion of CanadaNo ratings yet

- New York Notary Public Study Guide with 5 Practice Exams: 200 Practice Questions and 50+ Bonus Questions IncludedFrom EverandNew York Notary Public Study Guide with 5 Practice Exams: 200 Practice Questions and 50+ Bonus Questions IncludedNo ratings yet

- Article AbortionDocument19 pagesArticle AbortionJerlyn TuberaNo ratings yet

- WhatsApp v. Union of India Filing VersionDocument224 pagesWhatsApp v. Union of India Filing VersionVinayNo ratings yet

- Chapter - 3: Salient Features and Characteristics of The Constitution of IndiaDocument5 pagesChapter - 3: Salient Features and Characteristics of The Constitution of IndiaVaishal GoswamiNo ratings yet

- Indian Divorce Act ChristianDocument5 pagesIndian Divorce Act ChristianPramila A PhoenixNo ratings yet

- Aristotles Theory of JusticeDocument3 pagesAristotles Theory of JusticeDarshitaNo ratings yet

- CLJ 1 - PCJSDocument4 pagesCLJ 1 - PCJSSay DoradoNo ratings yet

- Law On EvidenceDocument4 pagesLaw On EvidenceVince Albert TanteNo ratings yet

- Petitioner Respondent: Second DivisionDocument52 pagesPetitioner Respondent: Second DivisionHADTUGINo ratings yet

- Bully-Proofing Final Exam-1Document2 pagesBully-Proofing Final Exam-1Malia GNo ratings yet

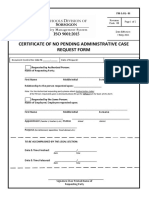

- Certificate of No Pending Administrative Case Request Form: Revision Code: 00 Page 1 of 2Document2 pagesCertificate of No Pending Administrative Case Request Form: Revision Code: 00 Page 1 of 2Allana Erica CortesNo ratings yet

- Postal Law Set 1Document5 pagesPostal Law Set 1ApilNo ratings yet

- WAH ChecklistDocument2 pagesWAH ChecklistLiko A. PaddingtoneNo ratings yet

- Intellectual Property Rights India Questions and Answers - ExamseggDocument20 pagesIntellectual Property Rights India Questions and Answers - ExamseggTkNo ratings yet

- The Bankers Books Evidence Act, 1891, Definitions, Applicability, Conditions in The PrintoutDocument6 pagesThe Bankers Books Evidence Act, 1891, Definitions, Applicability, Conditions in The Printoutvijayadarshini vNo ratings yet

- Judicial Custody & Police CustodyDocument13 pagesJudicial Custody & Police CustodyAjay JangidNo ratings yet

- People vs. Surio - TALAGADocument2 pagesPeople vs. Surio - TALAGAreginacarlatalagalawNo ratings yet

- Muslim Law 12Document6 pagesMuslim Law 12Apurva SingaraveluNo ratings yet

- Janet Redmond Case.Document6 pagesJanet Redmond Case.writing GuruNo ratings yet

- Writs Under Article 32 of Constitution 1. Habeas CorpusDocument4 pagesWrits Under Article 32 of Constitution 1. Habeas CorpusShahid SheikhNo ratings yet

- Session 1 - Intro To Managing People - 5f41fd1b67eb4Document27 pagesSession 1 - Intro To Managing People - 5f41fd1b67eb4IreshaNadeeshaniNo ratings yet

- AdmissionsDocument3 pagesAdmissionsJfrank Marcom100% (1)

- CA 2 Topic 1 MidtermsDocument5 pagesCA 2 Topic 1 MidtermsVince Diza SaguidNo ratings yet

- Tataamalan HIRARC 2020Document42 pagesTataamalan HIRARC 2020Khaty JahNo ratings yet

- 21 People vs. Abilong, 82 Phil. 172, November 26, 1948Document4 pages21 People vs. Abilong, 82 Phil. 172, November 26, 1948Doreen GarridoNo ratings yet

- U.S. vs. MolinaDocument2 pagesU.S. vs. MolinaPrince CayabyabNo ratings yet

- 13 BrddoDocument2 pages13 BrddoBarangay MagdapioNo ratings yet

![New York Notary Public Exam: Explore Essential Knowledge for Exam Mastery and Jumpstart Your New Career [II Edition]](https://imgv2-2-f.scribdassets.com/img/word_document/661176503/149x198/6cedb9a16a/1690336075?v=1)