Professional Documents

Culture Documents

Advance Chapter 1

Uploaded by

abel habtamuCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Advance Chapter 1

Uploaded by

abel habtamuCopyright:

Available Formats

RIFT VALLEY UNIVESITY

CHAPTER ONE: ACCOUNTING FOR JOINT VENTURE

1.1 Introduction

Complexities of a business as huge funds requirements, lack of technical expertise, sometimes

make it difficult to undertake a business assignment individually like constructing a big building.

The alternative available is that two or more persons join hand to take up that assignment.

Joining hand may be for finance, for technical know-how, for sharing risk etc. When two or

more companies/ persons join together to carry out a specific business and share the profits on

predetermined basis, it is known as a Joint Venture. Joint venture is defined as a partnership

confined to a particular adventure, speculation, course of trade or voyage, and in which partners,

either latent or known use no firm or social name, and incur no responsibility beyond the limits

of the adventure.

1.2 Meaning of Joint Venture

A joint venture is usually a temporary partnership without the use of a firm name, limited to

carrying out a particular business plan in which the persons concerned agree to contribute capital

and to share profits or losses. The parties in a joint venture are known as co-venturers and their

liability is limited to the adventure concerned for which they agree to contribute capital and share

profits or losses. A joint venture may consist of a joint consignment of goods, speculation in

shares, underwriting of shares or debentures, construction of a building, or any similar form of

enterprise.

In today’s business community, joint ventures are less common but still employed for many

projects such as:

The acquisition, development, and sale of real property

Exploration for oil and gas

Construction of bridges, buildings, and dams

Advanced Accounting Page 1

RIFT VALLEY UNIVESITY

1.3 Nature of a Joint Venture business

The main features of a joint venture are specifically as follows:

Two or more persons are needed.

It is an agreement to execute a particular venture or a project.

The joint venture business may not have a specific name.

It is of temporary nature.

The co-ventures share profit and loss in an agreed ratio. The profits and losses are to be

shared equally if not agreed otherwise.

The co-ventures are free to continue with their own business unless agreed otherwise

during the life of joint venture.

venture.

Accounting for joint venture did not follow the accrual basis

Net income not determined at regular intervals

Measurement and reporting of net income or loss awaited completion of the venture

1.4 The Differences between Joint Venture and Partnership.

Joint Venture is a temporary partnership; partnership is a long term Joint Venture. The following

are the differences between Joint Venture and Partnership.

No Basis Joint venture Partnership

1 Name of the Venture Joint Venture does not have any Partnership has its own name of

name of running business. running business.

2 Name of the members Members in Joint Venture are Co- Members in partnership firm are

Ventures partners

3 Nature of objectives Temporary / short term objectives are Long term objectives are set in

set in joint venture partnership firm

4 Registration of firm No registration of business under any Registration is optional, but available

law

5 Books of accounts No separate set of books are Separate sets of books are maintained

maintained in the books of joint in the books of partnership firm.

venture

6 Freedom for additional Co-ventures have freedom to do Partners do not have a freedom to do

business similar business and complete similar business and complete

7 Dissolution Joint venture is dissolved as soon as Partnership is dissolved only at the

its work has been completed mutual opinion of partners

8 Maintenance of Not necessary Mandatory

separate set of books

9 Status of Minor A minor cannot become a coventurer. A minor can become a partner to the

benefits of the firms

Advanced Accounting Page 2

RIFT VALLEY UNIVESITY

1.5 Types of Joint Ventures

Considering the nature of joint venture arrangements, joint ventures can be classified as

belonging to one of the following types:

a) Jointly controlled operations

A jointly controlled operation is a joint venture that involves the use of the assets and other

resources of the ventures. A venture uses its own assets and incurs its own expenses and

liabilities. Profits are shared among the ventures in accordance with the contractual agreement.

To illustrate assume that Company X and Company Y decides to enter into a joint venture

arrangement to produce a new product. Company X undertakes one manufacturing process and

Company Y undertakes the other. X and Y each bear their own expenses and take an agreed

share of the sales revenue from the product. Furthermore, they jointly market and distribute the

finished product using each venture'sda resources such as its property, plant and equipment,

technical expertise and employees.

In this specific example we can understand that the two venturers (X and Y) are simply agreed to

contribute perform the undertaking without contributing any assets to form a new business. The

ventures at the end of the venture agreed to share profit and losses according to their agreement.

b) Jointly controlled assets

A jointly controlled asset is a joint venture in which the venturers control jointly (and often own

jointly) an asset contributing to or acquired for the purpose of the joint venture. The each

venturer takes a share of the profit or income from the asset and each bears a share of the

expenses involved. This type of joint venture arrangement is prevalent in the oil and gas

extractive industries.

To illustrate assume that ABC-Company and XYZ-Company enter into a contract to undertake

oil exploration and to build an oil pipeline. ABC-Company is responsible to purchase

machineries and construct buildings for office purposes, while XYZ-Company is responsible to

build the oil pipeline.

As you can see from the illustration the two companies agreed to contribute assets to the joint

venture under taking but not have any intention to form a new business organization. In simple

talking, the venturers perform the activities of the joint venture by using the contributed assets of

the venture. The income generated from the operations of the joint venture is shared between

them according to their agreements.

c) Jointly controlled entities

Advanced Accounting Page 3

RIFT VALLEY UNIVESITY

A jointly controlled enterprise is a joint venture that involves the establishment of an enterprise,

partnership, or other enterprise in which each venture has an interest. The venturers agreed to

make an agreement profit sharing, and the capital contribution.

Generally, jointly controlled entities may be divided into two forms:

i) Incorporated joint ventures.

This type of jointly controlled entities type of joint ventures has the same features with a formal

corporate form of business organizations. Among others it includes separate legal entities,

limited legal liabilities, separate accounting records and reports and the like etc.

ii) Unincorporated joint ventures

This type of joint ventures more or less similar with that of partnerships and trusts. Thus, the

following major features that includes no separate legal entities, unlimited legal liabilities,

separate accounting records, reports etc.

To illustrate,

illustrate, assuming that DAN-Company and LAN-Company enter into a joint venture

agreement to manufacture and sell a new product. They set up an enterprise that carries out these

activities. DAN-Company and LAN-Company each own 50% of the equity share capital of the

enterprise and are its only directors. They share equally in major policy decisions and are each

entitled to 50% of the profits of the enterprise.

According to the illustration, the two venture companies contribute resources for the operation of

the joint venture and at the same time they have formed a new organization that would take the

responsibility to run the operations of the joint venture.

1.6 Methods of Recording Joint Venture Transactions

It is necessary to maintain proper accounts of all transactions of joint venture so that correct

profit or loss on joint venture may be ascertained. The following are main methods of recording

joint venture transactions:

1) When a separate set of books is not maintained for recording joint venture transactions

2) When joint venture transactions are recorded through the memorandum joint venture

account

3) When a separate set of books is kept for the joint venture

1.)When

1.)When a separate set of books is not maintained for recording Joint Venture transactions

Under this method, each co-venture will prepare two accounts namely:

Joint venture account

The personal account of other co-ventures

Here each venturer prepares joint venture account to find out the profit or loss and other

venturers accounts to ascertain the amount due to or due by the venturer.

Advanced Accounting Page 4

RIFT VALLEY UNIVESITY

The usual entries under this method are as follows:

follows:

Advanced Accounting Page 5

RIFT VALLEY UNIVESITY

1 When the venturer maintaining the accounts Joint venture A/c xxx

supplies goods to the venture Purchase A/c xxx

2 When the venturer maintaining the accounts to Joint venture A/c xxx

incurs expenses for the venture Bank A/c xxx

3 When the co-venturer Purchases or supplies goods Joint venture A/c xxx

for the venture Co-venturer A/c xxx

4 When the co-venturer meet any expenses for the Joint venture A/c xxx

venture Co -venturer A/c xxx

5 When goods are sold by the venturer maintaining Bank A/c xxx

the accounts Joint venture A/c xxx

6 When goods are sold by the co-venturer Co -venturer A/c xxx

Joint venture A/c xxx

7 When the venturer maintaining the accounts is Joint venture A/c xxx

entitled to commission Commission A/c xxx

8 When the co-venturer is entitled to certain Joint venture A/c xxx

commission Co -venturer A/c xxx

9 When the venturer maintaining the accounts is Joint venture A/c xxx

entitled to interest on his investment Interest A/c xxx

10 When the co-venturer is entitled to interest on his Joint venture A/c xxx

investment Co -venturer A/c xxx

11 If the unsold stock is taken over by venturer Purchase A/c xxx

maintaining the accounts Joint venture A/c xxx

12 If the unsold stock is taken over by co-venturer Co -venturer A/c xxx

Joint venture A/c xxx

13 For profit on Joint venture

a) For the share of profit of venturer maintaing Joint venture A/c xxx

accounts Profit & loss A /c xxx

b) For the share of profit of co- venture Joint venture A/c xxx

Co -venturer A/c xxx

For loss on Joint venture

a) For the share of loss of venturer maintaing Profit & loss A /c xxx

accounts Joint venture A/c xxx

b) For the share of loss of co- venture Co -venturer A/c xxx

Joint venture A/c xxx

14 On settling the co-venturer‘s account

a) In case of credit balance Co -venturer A/c xxx

Bank A/c xxx

b) In case of debit balance Bank A/c xxx

Advanced Accounting Page 6

RIFT VALLEY UNIVESITY

Co -venturer A/c xxx

Example 1: Aji and Giji entered into a joint venture to purchase and sell goods, and to share

profits and losses equally. Aji supplied goods for Br. 20000 and Giji supplied for Br. 15000. Aji

paid Br.1000 for rent while Giji paid Br. 500 for advertisement. Aji sold some of the goods for

Br. 23000 and Giji sold for Br. 22000. On closing the venture, Aji took over the unsold goods for

Br. 1500.

Required:

Required: Pass journal entries and prepare ledger account in the books of both Aji and Giji.

Solution:

Journal Entries in the books of Aji

Description Dr Cr

Joint venture A/c 20,000

Purchase A/c 20000

(The value of goods supplied)

Joint venture A/c 1000

Bank A/c 1000

(paid expenses for rent)

Joint venture A/c 15000

Giji‘s A/c 15000

(The value of goods supplied by Giji)

Joint venture A/c 500

Giji‘s A/c 500

(Paid advertisement expenses)

Bank A/c 23,000

Joint venture A/c 23000

(The amount of sales made venture or Aji)

Giji‘s A/c 22000

Joint venture A/c 22000

(The amount of sales made by Giji)

Purchase A/c 1500

Joint venture A/c 1500

(The unsold goods taken over on closing the venturer)

Joint venture A/c 10000

Profit & loss A /c 5000

Giji‘s A/c 5000

(The amount of profit on joint venture)

Bank A/c 1500

Giji‘s A/c 1500

Advanced Accounting Page 7

RIFT VALLEY UNIVESITY

(The amount received from Giji on settlement of

account

Joint venture A/c

Particulars Amount Particulars Amount

Purchase A/c (Goods Supplied) 20000 Bank A/c (Sales) 23000

Bank A/c (Expenses) 1000 Giji (Sales) 22000

Giji (Goods Supplied) 15000 Purchases (unsold goods taken) 1500

Giji (Expenses) 500

Profit and loss A/c 5000

Giji 5000 10000

Total 46,500 46,500

Giji A/c

Particulars Amount Particulars Amount

Joint venture A/c (Sales) 22000 Joint venture A/c

(Goods Supplied) 15000

Joint venture A/c

(Expenses) 500

Joint venture A/c (Profit) 5000

Bank A/c 1500

Total 22000 22000

Journal Entries in the books of Giji

Description Dr Cr

Joint venture A/c 15,000

Purchase A/c 15000

(The value of goods supplied)

Joint venture A/c 500

Bank A/c 500

(paid expenses on rent)

Joint venture A/c 20000

Aji‘s A/c 20000

(The value of goods supplied by Aji)

Joint venture A/c 1000

Aji‘s A/c 1000

(Paid advertisement expenses

Bank A/c 22,000

Joint venture A/c 22000

Advanced Accounting Page 8

RIFT VALLEY UNIVESITY

(The amount of sales made)

Aji‘s A/c 23000

Joint venture A/c 23000

(The amount of sales made by Aji)

Aji A/c 1500

Joint venture A/c 1500

(The unsold goods taken over on closing the venture)

Joint venture A/c 10000

Profit & loss A /c 5000

Aji‘s A/c 5000

(The amount of profit on joint venture)

Aji‘s A/c 1500

Bank A/c 1500

(The amount due paid on closing the venture)

Joint Venture A/c

Particulars Amount Particulars Amount

Purchase A/c 15000 Bank A/c (Sales) 22000

Bank A/c (Expenses) 500 Aji (Sales) 23000

Aji (Goods Supplied) 20000 Purchases (unsold goods taken) 1500

Aji (Expenses) 1000

Profit and loss A/c 5000

Aji 5000 10000

Total 46,500 46,500

Aji A/c

Particulars Amount Particulars Amount

Joint venture A/c (Sales) 23000 Joint venture A/c

(Goods Supplied) 20000

Joint venture A/c (unsold goods 1500 Joint venture A/c

taken) (Expenses) 1000

Bank A/c 1500 Joint venture A/c (Profit) 5000

Total 26000 26000

Advanced Accounting Page 9

RIFT VALLEY UNIVESITY

2. Memorandum Joint venture account

When joint venture transactions are recorded through the Memorandum Joint Venture

Account., the venurer record only his part of joint venture transactions in his books of

accounts or a co-venturer records only those transactions in which he himself features.

Example goods given for the venture, expenses incurred for the venture, sales made for the

venture, goods taken over from the venture etc. the recording mechanism involves making

only one account called Joint Venture With Co-Venturer Investment Account. Hence, A will

prepare Joint Venture with B Investment Account and B will prepare Joint Venture with A

Investment Account. The account is personal account and is used to effect settlement with

the co-venturer. (Hence it will not disclose the profit or loss of the venture) All transactions

are recorded from the perspective as if the co-venturer is the debtor of the business. The

profit or loss of the venture is computed in an account which is not part of the double entry

mechanism and hence is appropriately termed as Memorandum Joint Venture Account”

(pattern of profit and loss account). The term Memorandum is prefixed as this account does

not form part of the double entry system. The memorandum joint venture account is prepared

exactly like a joint venture account prepared under the method B and this method is an

alternative method of (B) method.

The following entries will be recorded in the books of A

Advanced Accounting Page 10

RIFT VALLEY UNIVESITY

1 For goods supplied by A Joint venture with B a/c xxx

Purchase account xxx

2 For expenses incurred by A Joint venture with B a/c xxx

Bank account xxx

3 When a bill of exchange is received from B Bills receivables a/c xxx

Joint venture with B a/c xxx

4 If a bill of exchange is given for B Joint venture with B a/c xxx

Bills payable a/c xxx

5 When a bill is discounted by A Bank account xxx

Joint venture with B a/c xxx

Bills receivable a/c xxx

6 When goods are sold by A Bank account xxx

Joint venture with B a/c xxx

7 When certain commission is earned by A Joint venture with B a/c xxx

Commission account xxx

8 When unsold stock is taken over by A Purchase account xxx

Joint venture with B a/c xxx

9 If there is any profit from joint venture to A Joint venture with B A/c xxx

Profit and loss A/c xxx

10 If there is any loss from joint venture to A Profit and loss A/c xxx

Joint venture with B A/c xxx

11 In case any payment is received by A Bank A/c xxx

Joint venture with B A/c xxx

12 In case any payment is made by A Joint venture with B A/c xxx

Bank A/c xxx

Advanced Accounting Page 11

RIFT VALLEY UNIVESITY

Example 2: On January 1st, 2005, Anu and Sunu entered into a joint venture to deal in second-

hand bicycles for a period of twelve months and to share profits and losses equally. Anu

purchased cycles for Br 30,000 and Sunu purchased for Br. 35,000. Repairing and other charges

paid by Anu was Br. 6000 and that by Sunu was Br. 4,000. Anu sold cycles for Br. 40,000 and

Sunu sold for Br. 45,000. On closing the books on June 30, the unsold cycles of the purchase

price of Br. 7,500 were taken over by Anu at cost plus 10%.

Required:

a. Give journal entries in the books of Anu and Sunu.

b. Show joint venture with Sunu account‘ in the books of Anu

c. Shaw joint venture with Anu account‘ in the books of Sunu

Assuming that the final settlement of accounts was made between Anu and Sunu.

Solution

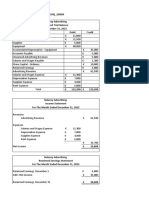

Memorandum Joint venture account

Particulars Amounts Particular Amounts

in Br in Br

Anu A/c: Anu A/c:

Cost of cycles 30,000 Sales price 40000

Repairing 6,000 36,000

Sanu A/c: Sunu A/c:

Cost of cycles 35,000 Sales price 45,000

Repairing 4,000 39,000

Profits: Anu A/c:

Anu A/c 9,125 Cycles (taken over) 8250

Sunu A/c 9,125 18,250

Total 93,250 93,250

Advanced Accounting Page 12

RIFT VALLEY UNIVESITY

Journal entries in the Books of Anu

Descriptions Dr Cr

Joint venture with Sunu A/c 30000

Purchase A/c 30000

(The cost of goods bought)

Joint venture with Sunu A/c 6000

Bank A/c 6000

(Paid repairing and other charges)

Bank A/c 40000

Joint venture with Sunu A/c 40000

(Sales price of cycles sold)

Purchase A/c 8250

Joint venture with Sunu A/c 8250

(Unsold goods taken over at cost plus 10%)

Joint venture with Sunu A/c 9150

Profit and loss A/c 9150

(The portion of profit)

Joint venture with Sunu A/c 3125

Bank A/c 3125

(Made payment on settlement of the account

Joint Venture with Sanu Account

Particulars Amounts Particular Amounts

in Br in Br

Purchase A/c Bank A/c

(Cost of goods bought) 30,000 (sales) 40000

Bank A/c Purchases A/c

(Repair and other charges) 6,000 (Cycles taken over) 8250

Profit/loss A/c 9125

Bank A/c 3125

Total 48250 48,250

Advanced Accounting Page 13

RIFT VALLEY UNIVESITY

Journal entries in the Books of Sanu

Descriptions Dr Cr

Joint venture with Anu A/c 35000

Purchase A/c 35000

(The cost of goods bought)

Joint venture with Anu A/c 4000

Bank A/c 4000

(Paid repairing and other charges)

Bank A/c 45000

Joint venture with Anu A/c 45000

(Sales price of cycles sold)

Joint venture with Sanu A/c 9150

Profit and loss A/c 9150

(The portion of profit)

Bank A/c 3125

Joint venture with Anu A/c 3125

(Made payment on settlement of the account

Joint Venture with Anu Account

Particulars Amounts in Particular Amounts

Br in Br

Purchase A/c Bank A/c

(Cost of goods bought) 35,000 (sales) 45000

Bank A/c Bank A/c

(Repair and other charges) 4,000 (final settlement) 3125

Profit/loss A/c 9125

Total 48,125 48,125

Advanced Accounting Page 14

RIFT VALLEY UNIVESITY

3). When a separate set of books is kept for the joint venture

Normally the joint venture activities are undertaken by the person in addition to his normal

business activity.

For example a building contractor (say A) who is independently handling a big business is

awarded a contract jointly with another builder (say B). These persons may not like to disturb

their accounting records for this specific activity and may decide to open a separate set of books

for the venture.

The co-venturers jointly open a bank account and contribute for the requirements of the venture

in money / non-money terms. The main accounts maintained under the system are:

Joint Bank Account

Joint venture Account

Co-venturers Account

Joint Bank Account is a real account like the ordinary bank account. All the venturers deposit a

certain amount into the account. While the joint venture account shows the profits or loss from

the venture, the venturers‘ accounts give the amount due to or due by them.

The usual entries under this method are as follows:

Advanced Accounting Page 15

RIFT VALLEY UNIVESITY

1 Contribution of co-venturers Joint Bank A/c xxx

Co-venturer‘s personal A/c xxxx

2 Goods or any other item contributed Joint venture A/c xxx

by a co-venturer or expenses paid by Co-venturer‘s personal A/c. xxx

him.

3 For purchase of goods for cash. Joint venture A/c xxx

Joint Bank A/c xxx

4 For purchase of goods on Credit Joint venture A/c xxx

Creditors /suppliers xxx

5 For expenses on Joint Venture Joint venture A/c xxx

Joint Bank A/c xxx

For good sold (Cash). Joint Bank A/c xxx

Joint venture A/c xxx

Sale on Credit Debtor‘s A/c xxx

Joint venture A/c xxx

Payment to creditors in cash or issue Creditors‘ A/c xxx

Bills payable Joint Bank A/c xxx

Bills Payable A/c xxx

Cash or Bills Receivable received Joint Bank A/c xxx

from debtors Bills Receivable A/c xxx

Debtor‘s A/c xxx

Any Commission, salary, interest etc. Joint venture A/c xxx

payable to any Co-Venturer Co-venturer‘s personal A/c xxx

Part of the stock taken by Co-Venturer Co-venturer‘s personal A/c xxx

Joint venture A/c xxx

For profit on joint venture. Joint venture A/c xxx

Co-venturer‘s personal A/c xxx

For loss on joint venture Co-venturer‘s personal A/c xxx

Joint venture A/c xxx

For payment of the amount due to Co-venturer‘s personal A/c xxx

venturers Joint Bank A/c xxx

For receipt of any amount due by Joint Bank A/c xxx

venturers Co-venturer‘s personal A/c xxx

Note: Discount received should be debited to Creditor‘s Account and credited to Joint

Venture Account. Similarly discount allowed and bad debts should be debited to Joint

Venture Account and credited to Debtor‘s Account.

Account.

Advanced Accounting Page 16

You might also like

- Cost Quizlet 3Document13 pagesCost Quizlet 3agm25No ratings yet

- E-14 AfrDocument5 pagesE-14 AfrInternational Iqbal ForumNo ratings yet

- CH 4 Classpack With SolutionsDocument24 pagesCH 4 Classpack With SolutionsjimenaNo ratings yet

- Controlling Payroll Cost - Critical Disciplines for Club ProfitabilityFrom EverandControlling Payroll Cost - Critical Disciplines for Club ProfitabilityNo ratings yet

- Music and BrainDocument158 pagesMusic and BrainEmma100% (1)

- October 2016 Auditing Problems Final Pre BoardDocument13 pagesOctober 2016 Auditing Problems Final Pre BoardJeanette FormenteraNo ratings yet

- An Independent Correspondent Member ofDocument10 pagesAn Independent Correspondent Member ofRizwanChowdhury100% (1)

- 04 - Accounts ReceivableDocument3 pages04 - Accounts Receivablejaymark canayaNo ratings yet

- The Guitar Technique Book PDFDocument32 pagesThe Guitar Technique Book PDFLuca BaroniNo ratings yet

- SAP Question and AnswerDocument13 pagesSAP Question and AnswerDurga Tripathy DptNo ratings yet

- Bank Audit Process and TypesDocument33 pagesBank Audit Process and TypesVivek Tiwari50% (2)

- A Joint VentureDocument38 pagesA Joint Venturesweety7677No ratings yet

- Ifrs 7Document5 pagesIfrs 7alkhaqiNo ratings yet

- IAS 33 - Earnings Per ShareDocument26 pagesIAS 33 - Earnings Per ShareTD2 from Henry HarvinNo ratings yet

- SAP S - 4HANA Parallel Accounting in New Asset AccountingDocument15 pagesSAP S - 4HANA Parallel Accounting in New Asset Accountingsateesh konatamNo ratings yet

- Pakistan Govt Accounting ManualDocument335 pagesPakistan Govt Accounting ManualAnabia JanetNo ratings yet

- Sn53sup 20170331 001 2200147134Document4 pagesSn53sup 20170331 001 2200147134Henry LowNo ratings yet

- Chapter 2 Forensic Auditing and Fraud InvestigationDocument92 pagesChapter 2 Forensic Auditing and Fraud Investigationabel habtamuNo ratings yet

- Week 1 Conceptual Framework For Financial ReportingDocument17 pagesWeek 1 Conceptual Framework For Financial ReportingSHANE NAVARRONo ratings yet

- Chapter 3-4 QuestionsDocument5 pagesChapter 3-4 QuestionsMya B. Walker0% (1)

- AFA2e Chapter03 PPTDocument50 pagesAFA2e Chapter03 PPTIzzy BNo ratings yet

- Day 1Document11 pagesDay 1Abdullah EjazNo ratings yet

- CHAPTER 2 Joint VentureDocument5 pagesCHAPTER 2 Joint VentureAkkamaNo ratings yet

- Consolidated Financial Statements ExplainedDocument77 pagesConsolidated Financial Statements ExplainedMisganaw DebasNo ratings yet

- Prepared by Coby Harmon University of California, Santa Barbara Westmont CollegeDocument38 pagesPrepared by Coby Harmon University of California, Santa Barbara Westmont Collegee s tNo ratings yet

- Joint Arrangement & Investment in Associate, Suger 2ndDocument36 pagesJoint Arrangement & Investment in Associate, Suger 2ndnatiNo ratings yet

- F8 Workbook Questions & Solutions 1.1 PDFDocument188 pagesF8 Workbook Questions & Solutions 1.1 PDFLinkon PeterNo ratings yet

- Wiley - Chapter 11: Depreciation, Impairments, and DepletionDocument39 pagesWiley - Chapter 11: Depreciation, Impairments, and DepletionIvan BliminseNo ratings yet

- 13 SolutionDocument55 pages13 Solutiontisha10rahman100% (1)

- Financial Reporting and Changing PricesDocument6 pagesFinancial Reporting and Changing PricesFia RahmaNo ratings yet

- Ch18 - 2 - Accounting For Revenue Recognition IssuesDocument45 pagesCh18 - 2 - Accounting For Revenue Recognition Issuesselvy anaNo ratings yet

- Module 1 PDFDocument13 pagesModule 1 PDFWaridi GroupNo ratings yet

- Chapter-1 Introduction To Cost and Management AccountingDocument14 pagesChapter-1 Introduction To Cost and Management AccountingJatin DhingraNo ratings yet

- Chapter-Six Accounting For General, Special Revenue and Capital Project FundsDocument31 pagesChapter-Six Accounting For General, Special Revenue and Capital Project FundsMany Girma100% (1)

- Formation of a Partnership AccountsDocument27 pagesFormation of a Partnership Accountssamuel debebeNo ratings yet

- Financial AccountingDocument3 pagesFinancial AccountingManal Elkhoshkhany100% (1)

- ch03 SM Leo 10eDocument72 pagesch03 SM Leo 10ePyae PhyoNo ratings yet

- Chapter-2: Information For Budgeting, Planning and Control Purposes (Master Budget) BudgetDocument35 pagesChapter-2: Information For Budgeting, Planning and Control Purposes (Master Budget) Budgetፍቅር እስከ መቃብርNo ratings yet

- Financial Management IDocument58 pagesFinancial Management Igelango124419No ratings yet

- Segment Reporting Due ProcessDocument8 pagesSegment Reporting Due ProcessDhaneletcumi Naidu VijayakumarNo ratings yet

- CH 12 Intangible AssetsDocument57 pagesCH 12 Intangible AssetsSamiHadadNo ratings yet

- Lease Problems Hw1Document6 pagesLease Problems Hw1Vi NguyenNo ratings yet

- Accounting For LeasesDocument4 pagesAccounting For LeasesSebastian MlingwaNo ratings yet

- Mutual Funds: Answer Role of Mutual Funds in The Financial Market: Mutual Funds Have Opened New Vistas ToDocument43 pagesMutual Funds: Answer Role of Mutual Funds in The Financial Market: Mutual Funds Have Opened New Vistas ToNidhi Kaushik100% (1)

- P 6 DepresiasiDocument101 pagesP 6 DepresiasiRaehan RaesaNo ratings yet

- CH 11Document51 pagesCH 11Nguyen Ngoc Minh Chau (K15 HL)No ratings yet

- Advanced FA I - Chapter 01, Accounting For Investment in JADocument58 pagesAdvanced FA I - Chapter 01, Accounting For Investment in JAKalkidan G/wahidNo ratings yet

- Chap 006Document51 pagesChap 006kel458100% (1)

- Ratio Analysis of Eastern Bank LtdDocument19 pagesRatio Analysis of Eastern Bank LtdshadmanNo ratings yet

- IFRS 2 - Share Based Payment1Document7 pagesIFRS 2 - Share Based Payment1EmmaNo ratings yet

- Chapter Three: Valuation of Financial Instruments & Cost of CapitalDocument68 pagesChapter Three: Valuation of Financial Instruments & Cost of CapitalAbrahamNo ratings yet

- R175367E Tinashe Mambodza BSFB401 AssignmentDocument8 pagesR175367E Tinashe Mambodza BSFB401 AssignmentTinasheNo ratings yet

- AfPS&CS Ch-01Document10 pagesAfPS&CS Ch-01Amelwork AlchoNo ratings yet

- Intermediate Accounting IFRS Edition: Kieso, Weygandt, WarfieldDocument34 pagesIntermediate Accounting IFRS Edition: Kieso, Weygandt, WarfieldPaulina RegginaNo ratings yet

- Chapter 10 - Fixed Assets and Intangible AssetsDocument94 pagesChapter 10 - Fixed Assets and Intangible AssetsAsti RahmadaniaNo ratings yet

- FM CH 1natureoffinancialmanagement 120704104928 Phpapp01 PDFDocument28 pagesFM CH 1natureoffinancialmanagement 120704104928 Phpapp01 PDFvasantharao100% (1)

- Chapter One Accounting For Public SectorDocument10 pagesChapter One Accounting For Public SectorFasil MillionNo ratings yet

- Deegan5e SM Ch28Document20 pagesDeegan5e SM Ch28Rachel Tanner100% (2)

- Advanced Accounting Part 2 Business Combinations (Ifrs 3)Document10 pagesAdvanced Accounting Part 2 Business Combinations (Ifrs 3)ClarkNo ratings yet

- Ch2 4e - Recording ProcessDocument59 pagesCh2 4e - Recording ProcessChâu HàNo ratings yet

- Consolidated Financial Statements: On Date of Business CombinationDocument53 pagesConsolidated Financial Statements: On Date of Business Combinationankursharma06No ratings yet

- Statement of Cash Flows: HOSP 2110 (Management Acct) Learning CentreDocument6 pagesStatement of Cash Flows: HOSP 2110 (Management Acct) Learning CentrePrima Rosita AriniNo ratings yet

- ch05 SM Leo 10eDocument31 pagesch05 SM Leo 10ePyae Phyo100% (2)

- CH 21Document11 pagesCH 21Hanif MusyaffaNo ratings yet

- Corporate Financial Analysis with Microsoft ExcelFrom EverandCorporate Financial Analysis with Microsoft ExcelRating: 5 out of 5 stars5/5 (1)

- The Four Walls: Live Like the Wind, Free, Without HindrancesFrom EverandThe Four Walls: Live Like the Wind, Free, Without HindrancesRating: 5 out of 5 stars5/5 (1)

- Adfa I & II Module NewDocument36 pagesAdfa I & II Module NewEyob EyobaNo ratings yet

- Financial Accounting CIA - 1Document31 pagesFinancial Accounting CIA - 1shriyanshu padhiNo ratings yet

- DownloadDocument8 pagesDownloadMithilesh KumarNo ratings yet

- Joint VentureDocument42 pagesJoint Ventureadityaupreti2003No ratings yet

- Page 1 of 20 Chapter 6 - Accounting For PartnershipsDocument20 pagesPage 1 of 20 Chapter 6 - Accounting For PartnershipsELLAINE MA EBLACASNo ratings yet

- Chapter Four Information Technology and AuditingDocument78 pagesChapter Four Information Technology and Auditingabel habtamuNo ratings yet

- Introduction To Management Control SystemesDocument20 pagesIntroduction To Management Control SystemesHabtamu mamoNo ratings yet

- Cost M PDFDocument30 pagesCost M PDFabel habtamuNo ratings yet

- Chapter 3. International Standards For Supreme Audit InstitutionsDocument58 pagesChapter 3. International Standards For Supreme Audit Institutionsabel habtamuNo ratings yet

- Chapter 1 PPT Specialized Audit and The Environment of Public Sector AuditingDocument45 pagesChapter 1 PPT Specialized Audit and The Environment of Public Sector Auditingabel habtamuNo ratings yet

- Advanced Auditing CH 5Document34 pagesAdvanced Auditing CH 5abel habtamuNo ratings yet

- Chapter Four Information Technology and AuditingDocument78 pagesChapter Four Information Technology and Auditingabel habtamuNo ratings yet

- Advance Audit Chapter TwoDocument4 pagesAdvance Audit Chapter Twoabel habtamuNo ratings yet

- Chapter 3. International Standards For Supreme Audit InstitutionsDocument58 pagesChapter 3. International Standards For Supreme Audit Institutionsabel habtamuNo ratings yet

- Chapter 1 PPT Specialized Audit and The Environment of Public Sector AuditingDocument45 pagesChapter 1 PPT Specialized Audit and The Environment of Public Sector Auditingabel habtamuNo ratings yet

- Advanced Auditing CH 5Document34 pagesAdvanced Auditing CH 5abel habtamuNo ratings yet

- Advance Chaper 7 & 8Document27 pagesAdvance Chaper 7 & 8abel habtamuNo ratings yet

- Advance Chapter 3Document12 pagesAdvance Chapter 3abel habtamuNo ratings yet

- Advance Chapter 4Document17 pagesAdvance Chapter 4abel habtamuNo ratings yet

- Extended DominantDocument1 pageExtended Dominantabel habtamuNo ratings yet

- Advance Chaper 5 & 6Document27 pagesAdvance Chaper 5 & 6abel habtamuNo ratings yet

- Advance Chapter 6Document18 pagesAdvance Chapter 6abel habtamuNo ratings yet

- Vertical Melodic Analysis: Vertically Means You Are Paying Strict Attention To Everything That Is Going On RIGHTDocument4 pagesVertical Melodic Analysis: Vertically Means You Are Paying Strict Attention To Everything That Is Going On RIGHTabel habtamuNo ratings yet

- Learn How To Play The Jazz 251 Chord Progression On Piano!Document4 pagesLearn How To Play The Jazz 251 Chord Progression On Piano!abel habtamuNo ratings yet

- Horizontal & Vertical Music AnalysisDocument5 pagesHorizontal & Vertical Music Analysisabel habtamuNo ratings yet

- Basic Accounting Concepts and Principles/Rules in Tally ERP 9Document4 pagesBasic Accounting Concepts and Principles/Rules in Tally ERP 9NICET COMPUTER EDUCATIONNo ratings yet

- Ts Grewal Solutions Class 12 Accountancy Vol 1 Chapter 3 GoodwillDocument28 pagesTs Grewal Solutions Class 12 Accountancy Vol 1 Chapter 3 GoodwillblessycaNo ratings yet

- Finacle Menu Options in Alphabetical OrderDocument96 pagesFinacle Menu Options in Alphabetical Orderakshay2orionNo ratings yet

- Cash Receipt: Project 1 Shopu Shopu CorporationDocument15 pagesCash Receipt: Project 1 Shopu Shopu CorporationWilfred TanNo ratings yet

- BSF 4Document17 pagesBSF 4api-158285296No ratings yet

- Std XI COM Ujjwal Academy Time 2 hrs BK Q1-4 Journal EntriesDocument2 pagesStd XI COM Ujjwal Academy Time 2 hrs BK Q1-4 Journal EntriesObaid KhanNo ratings yet

- CBSE Class XI Accountancy - Rectification of ErrorDocument3 pagesCBSE Class XI Accountancy - Rectification of ErrorYash GuptaNo ratings yet

- General AccountingDocument70 pagesGeneral AccountingPenn CollinsNo ratings yet

- Karnatka Vat RulesDocument49 pagesKarnatka Vat RulesshanoboghNo ratings yet

- User Manual for eGRAS e-Government Receipts Accounting SystemDocument29 pagesUser Manual for eGRAS e-Government Receipts Accounting Systemjhapad100% (1)

- Introduction To Textile Industry WaqasDocument80 pagesIntroduction To Textile Industry Waqasghufran-jamsheed-864No ratings yet

- Accounting concepts guide recordingDocument8 pagesAccounting concepts guide recordingDeepu LuvesNo ratings yet

- Accounting Is The Process of Keeping Track of A Business' FinancesDocument52 pagesAccounting Is The Process of Keeping Track of A Business' FinancesJowjie TV100% (1)

- SBI Acc InsDocument11 pagesSBI Acc InsAnonymous UjEPpvYDNo ratings yet

- Utf8''Chapter 7-Lecture NotesDocument52 pagesUtf8''Chapter 7-Lecture NotesHoang HaNo ratings yet

- Calculate total job cost using direct labor hours and machine hoursDocument2 pagesCalculate total job cost using direct labor hours and machine hourselsana philipNo ratings yet

- Y1 2012 MayDocument36 pagesY1 2012 MayMathewsNo ratings yet

- Tally Hindi NotesDocument40 pagesTally Hindi NotesGaurav JacobNo ratings yet

- BSBFIM501 Assessment Instructions V1 1219Document10 pagesBSBFIM501 Assessment Instructions V1 1219Lucy RegaladoNo ratings yet

- AccauntingDocument37 pagesAccauntingSamurai JackNo ratings yet

- Akuntansi, DavidDocument11 pagesAkuntansi, DavidTema Exaudi DaeliNo ratings yet

- Devina Yulia 20221539 2EB09 AKM TM#3Document3 pagesDevina Yulia 20221539 2EB09 AKM TM#3rully movizarNo ratings yet