Professional Documents

Culture Documents

Strong demand outlook for Polycab India

Uploaded by

shankar alkotiOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Strong demand outlook for Polycab India

Uploaded by

shankar alkotiCopyright:

Available Formats

Stock Update

Polycab India Limited

Business dynamics strong, retain buy

Powered by the Sharekhan 3R Research Philosophy Capital Goods Sharekhan code: POLYCAB Company Update

3R MATRIX + = - Summary

Right Sector (RS) ü We retain a Buy on Polycab India Limited (Polycab) with a revised PT of Rs. 2050, given a rise in

demand in underlying user-industries and strong growth outlook.

Right Quality (RQ) ü

Polycab has outlined a five-year roadmap to achieve revenues of Rs 20,000 crore in FY26E with

Right Valuation (RV) ü a greater focus on brand positioning, operations and business growth and strong emphasis on

governance and sustainability outpacing industry growth.

+ Positive = Neutral - Negative A strong balance sheet and net cash position provide comfort in the present environment. The

company’s strong focus on expanding its distribution (currently at 4,100 dealers/distributors) will

What has changed in 3R MATRIX help deepen its presence in semi-urban and rural markets.

The management highlighted that it expects Q2FY22 to be better than Q1 and H2FY22 to be

Old New better than H1FY2022.

RS The company’s overall business dynamics remains strong charting way for the outlook outlining its

new initiative, Project Leap, through which it intends to achieve revenues of Rs. 20,000 crores by

RQ FY26E. The growth is expected to come from B2C followed by exports and B2B. The four focus areas

over next five years will be 1) B2B 2) B2C 3) Capability 4) Sustainability. It intends to strengthen the B2B

RV segment by growing 1.5x in the core segments and 2x in emerging product areas. There will also be

an increased focus on the exports business to improve its contribution to 10% from current 8%. For B2C

business, it plans to deliver EBITDA margins of more than 12% in the FMEG segment. Polycab also aims

Reco/View Change to continue to outpace the industry, with a 2x growth in the FMEG segment and 1.5x growth in retail

wires. The management highlighted that April-May 2021 were better than last year. It expects Q2FY22

Reco: Buy to be better than Q1 and H2FY22 to be better than H1FY2022. The company expects to maintain OPM

with a variance of 100bps. The company is cautious and agile but better placed as compared to last

CMP: Rs. 1,740

year. It does not foresee a significant disruption from COVID. The company will spend Rs. 150-200

Price Target: Rs. 2,050 á crore for FY2022 for A&P in FY22. During FY21, the company increased market share in B2C from

32.6% in FY20 to 40.2%. Wires & cables revenues increased by 35% y-o-y. It estimates to have gained

á Upgrade Maintain â Downgrade 200bps increase in market share. The company has Rs. 900 crore net cash as on FY2021 end. The

capex for FY2022 is estimated at Rs. 300 crore of which 35% would be towards FMEG segment and

Company details balance in cables & wires facilities for import substitute products. The company had spent Rs. 191 crore

in FY21. Overall, the outlook remains positive despite near-term challenges, which remains transient

Market cap: Rs. 25,947 cr given growth prospects through various initiatives the company has undertaken like Project Udaan

(cost-saving initiatives), Project Josh (on penetrating geographies) and now Project Leap (five-year

52-week high/low: Rs. 1,748/709 roadmap). Polycab’s strong balance sheet and net cash position which improved significantly, with

net cash of Rs. 906 crore as of FY21-end vs. net cash of Rs. 164 crore in FY20. The company is strongly

NSE volume: focusing on its distribution, currently at 4,100 dealers/distributors, catering to 1,65,000 retailers. Its

14.0 lakh

(No of shares) distribution enhancement program is on track, which will help deepen its presence in semi-urban and

rural markets. We introduce FY2024E earnings estimate in this note. The stock is currently trading at

BSE code: 542652 P/E of 23x/19x its FY2023E/FY2024E EPS. We believe the company is on a healthy growth trajectory

owing to its leadership position and a strong product portfolio both in the wires & cables and FMEG

NSE code: POLYCAB

businesses along with robust distribution, in-house manufacturing capabilities, strong balance sheet

Free float: and healthy cash position. Hence, we retain Buy on the stock with a revised price target (PT) of Rs.

4.7 cr 2050.

(No of shares)

Our Call

Shareholding (%) Valuation – Retain Buy with a revised PT of Rs. 2050: Polycab is expected to maintain a healthy

performance led by strong traction in the housing segment, input cost led price hikes undertaken

Promoters 68.4 in the C&W segment, rising exports, and scaling up the FMEG business with new product launches.

The company also has strong growth tailwinds in terms of rising infrastructure investments. Polycab’s

FII 9.3 strategy of deepening penetration in semi-urban and rural markets bodes well in providing a

sustainable long-term growth. Overall, we believe the company is on a healthy growth trajectory,

DII 7.4 owing to its leadership position and a strong product portfolio both in the wires & cables and FMEG

Others 14.9 businesses along with strong distribution and in-house manufacturing capabilities. We introduce

FY2024E earnings estimate this note. The stock is currently trading at P/E of 23x/19x its FY2023E/

FY2024E EPS. With a consistent improvement in balance sheet, market share gains and growth

Price chart acceleration, Project Leap remains constructive in medium to long term growth outlook. Hence, we

1,850 retain Buy on the stock with a revised PT of Rs. 2050.

1,400 Key risk

Fluctuations in raw-material prices would affect margins sharply.

950

500

Valuation (Consolidated) Rs cr

Particulars FY21 FY22E FY23E FY24E

50

Revenue 8,927 10,474 12,205 14,303

Jun-20

Jun-21

Oct-20

Feb-21

OPM (%) 13.1 13.2 13.3 13.6

Adjusted PAT 876 946 1,120 1,389

Price performance % y-o-y growth 14.4 8.0 18.4 24.0

Adjusted EPS (Rs.) 58.8 63.5 75.1 93.1

(%) 1m 3m 6m 12m

P/E (x) 29.6 27.4 23.2 18.7

Absolute 19 29 71 117 P/B (x) 5.5 4.6 4.0 3.3

Relative to EV/EBITDA (x) 19.3 15.9 13.8 11.1

85 96 135 169

Sensex RoNW (%) 20.4 18.3 18.5 19.5

Sharekhan Research, Bloomberg RoCE (%) 24.9 24.8 25.1 26.2

Source: Company; Sharekhan estimates

June 07, 2021 2

Stock Update

Powered by the Sharekhan

3R Research Philosophy

Business outlook positive: Polycab remains the market leader in the organized market witnessing a jump

and commanding a 20-22% market share (earlier 18-20% in FY20) and remains well-equipped to cater to

the demand across the underlying business with newer areas of focus (railways, metros, renewables etc.).

The company outlined its new initiative, Project Leap, thorough which it intends to achieve revenues of Rs.

20,000 crore by FY26E. It intends to strengthen the B2B segment by growing 1.5x in the core segments and

2x in emerging product areas. There will also be increased focus on the exports business to improve its

contribution to 10% from the current 8%. For the B2C business, it plans to deliver EBITDA margins of more

than 12% in the FMEG segment. Polycab also aims to continue to outpace the industry, with a 2x growth in

the FMEG segment and 1.5x growth in retail wires. Overall, the outlook remains positive despite near-term

challenges, which remains transient given growth prospects through various initiatives the company has

undertaken like Project Udaan (cost-saving initiatives) and now Project Leap (five-year roadmap). Polycab’s

strong balance sheet and net cash position which improved significantly, with net cash of Rs. 300 crore as of

FY21-end vs. net debt of Rs. 600 crore in FY20. The company is strongly focusing on its distribution, currently

at 4,100 dealers/distributors, catering to 1,65,000 retailers; and its distribution enhancement program is on

track, which will help deepen its presence in semi-urban and rural markets.

Polycab Q4FY21 Concall Highlights

FY26 guidance: The company targets to cross Rs. 20,000 crore revenue during FY26. The growth is

expected to come from B2C followed by exports and B2B. The four focus areas over next five years will

be 1) B2B 2) B2C 3) Capability 4) Sustainability.

Near term outlook: April-May 2021 were better than last year. It expects Q2 to be better than Q1 and

H2FY2022 to be better than H1FY2022. The company expects to maintain OPM with a variance of 100bps.

The company is cautious and agile but better placed compared to last year. It doesn’t foresee significant

disruption from covid. The company will spend Rs. 150-200 crore for FY2022 for A&P in FY22.

Q4 performance: The company had a strong Q4FY21 with market share gains. Infrastructure and

construction activities had picked up in full swing along with improvement in consumer sentiments in Q4.

B2B continued to outperform B2C. Lower A&P spends at 0.5% of sales was one-off which will increase

going ahead. FMEG grew by 89% y-o-y where fans posted healthy growth, lighting doubled and switches

& switch gears 2.5x.

FY2021 performance: The company increased market share in B2C from 32.6% in FY20 to 40.2%. Wires

& Cables revenues increased by 35% y-o-y. It estimates to have gained 200bps increase in market share.

The company has Rs. 900 crore net cash as on FY2021 end.

Projects: The company has planned Project Leap with BCG consultants one month ago which will help it

achieve Rs. 20,000 crore revenue in FY26. The OPM is expected to improve with a rise in B2B share. Project

Udaan was launched a year back to aid in cost optimisation. Project Josh on penetrating geographies.

Distribution reach: The company increased distributors & dealers by 17% y-o-y to 4100, electricians by

32% y-o-y to 165,000 and influencers by 33% y-o-y to 180,000.

Revenue mix: In FMEG, revenue mix product wise is 35-40% fans, 25-30% lighting, 15% switches & switch

gears and Pipes double digit.

Pricing: The raw material basket grew in double digit while prices were increased by lower teens during

Q4FY21.

Capex: The capex for FY2022 is estimated at Rs. 300 crore of which 35% would be towards FMEG segment

and balance in cables & wires facilities for import substitute products. The company had spent Rs. 191

crore in FY21.

June 07, 2021 3

Stock Update

Powered by the Sharekhan

3R Research Philosophy

Exports: US comprises 50% exports share followed by Asia & Australia and rest of the world.

R&D: The company has 100-150 people who look after R&D. It has picked up aGerman team for R&D

purpose.

Results (consolidated) Rs cr

Particulars Q3FY21 Q3FY20 YoY (%) Q2FY21 QoQ (%)

Revenue 2,798.8 2,507 11.6% 2,114 32.4%

Operating profit 376 339 10.8% 312 20.3%

Other Income 34 0 - 33 5.3%

Interest 9 9 2.9% 11 -22.4%

Depreciation 48 41 17.6% 46 4.9%

PBT 354 290 21.9% 288 22.7%

Tax 90 69 32.0% 66 36.2%

EO - - -

Reported PAT 263 219 20.0% 221 19.0%

Adj. PAT 263 219 20.0% 221 19.0%

Adj. EPS (Rs.) 17.6 14.7 20.0% 14.8 19.0%

Margin BPS BPS

OPM (%) 13.4 13.5 (10) 14.8 (136)

NPM (%) 9.4 8.7 65 10.4 (106)

Tax rate 25.6 23.6 - 23.0 -

Source: Company; Sharekhan Research

June 07, 2021 4

Stock Update

Powered by the Sharekhan

3R Research Philosophy

Financials in charts

Revenue trend EBITDA and Margin Trend

14,000 20.0 1700 14.0

12,000 1500 12.0

10,000 15.0 1300 10.0

1100

8,000 8.0

10.0 900

6,000 6.0

700

4,000 5.0 4.0

500

2,000 300 2.0

- 0.0 100 0.0

FY17 FY18 FY19 FY20 FY21 FY22E FY23E FY17 FY18 FY19 FY20 FY21 FY22E FY23E

Revenue(Rs cr) Growth Y-o-Y (%) EBITDA (Rs cr) OPM (%)

Source: Company, Sharekhan Research Source: Company, Sharekhan Research

Net Profit Trend FMEG revenue trend

1,300 60.0 1800 1655

1600

1,100 50.0 1303

1400

900 40.0 1200 1034

1000 836

700 30.0

800 643

500 20.0 600 485

328

400

300 10.0

200

100 0.0 0

FY17 FY18 FY19 FY20 FY21 FY22E FY23E FY17 FY18 FY19 FY20E FY21 FY22E FY23E

Net Profit(in Rs.cr) Growth Y-o-Y (%) FMEG

Source: Company, Sharekhan Research Source: Company, Sharekhan Research

RoE Trend RoCE Trend

25% 23% 35%

30.5%

20% 28.3%

19% 30%

18% 18.5% 25.1%

20% 24.9% 24.8%

17%

25% 22.0%

15% 12% 20% 15.8%

10% 15%

10%

5%

5%

0% 0%

FY17 FY18 FY19E FY20E FY21 FY22E FY23E FY17 FY18 FY19E FY20E FY21 FY22E FY23E

RoE RoCE

Source: Company, Sharekhan Research Source: Company, Sharekhan Research

June 07, 2021 5

Stock Update

Powered by the Sharekhan

3R Research Philosophy

Outlook and Valuation

n Sector View – Ample scope for growth

Domestic demand side is improving with unlocking, infrastructure, and construction back in action with labour issues

largely resolved, which provides a positive outlook ahead. The wires & cables industry contributes 40%-45% to India’s

electrical equipment industry. In terms of volumes, the Indian wires & cables industry (including exports) has grown from

6.3million km in FY2014 to 14.5million km in FY2018, posting a ~23% CAGR over the period. The industry registered

an ~11% CAGR in value terms, from Rs. 34,600 crores in FY2014 to Rs. 52,500 crores in FY2018. The C&W industry was

expected to register a CAGR of 14.5% from Rs. 52,500 crores in FY2018 to Rs. 1,03,300 crore by FY2023. However,

a slowdown in infrastructure growth and uncertainty in real estate will lead to moderation in growth for the C&W

segment. Gradual resumption of normal economic activity and infrastructure projects will push recovery to H2FY2021.

The government has envisaged Rs. 111 lakh crore capital expenditure in infrastructure sectors in India during FY2020

to FY2025. Sectors such as energy (24%), roads (18%), urban (17%), and railways (12%) amount to ~71% of the projected

infrastructure investment. The continued thrust of the government on infrastructure investment is expected to improve

the demand environment for the W&C industry. The Indian FMEG industry has many growth opportunities, led by macro

drivers such as evolving consumer aspirations, increasing awareness, rising income, rural electrification, urbanisation,

and digital connectivity. Products such as energy-efficient fans, modular switches, building and home automation, and

LED lights are riding an ever-increasing wave of consumer demand. There is also a rising demand for various electrical

appliances.

n Company Outlook – Growth prospects bright

Overall, the outlook remains positive despite near-term challenges, which remains transient given the growth prospects

ahead the through the various initiatives the company has taken like Project Udaan and Project Leap. Polycab has gained

market share in the organized market (20-22% from 18% in FY20), auguring well for growth. The company outlined its new

initiative ‘Project Leap’ through which it intends to achieve Rs. 20,000 crore in revenues by FY26E on superior growth versus

the industry in B2C segments (2x in FMEG and 1.5x in retail wires) and stronger position in B2B segments. Polycab remains

better-placed considering its consistent focus on balance sheet improvement, healthy free cash flows and potential margin

improvement as ‘Project Udaan’ is yet to fully reap benefits.

n Valuation – Retain Buy with a revised PT of Rs. 2050

Polycab is expected to maintain healthy performance led by strong traction in the housing segment, input cost led price

hikes undertaken in the C&W segment, rising exports, and scaling up the FMEG business with new product launches. The

company also has strong growth tailwinds in terms of rising infrastructure investments. Polycab’s strategy of deepening

penetration in semi-urban and rural markets bodes well in providing a sustainable long-term growth. Overall, we believe

the company is on a healthy growth trajectory, owing to its leadership position and a strong product portfolio both in the

wires & cables and FMEG businesses along with strong distribution and in-house manufacturing capabilities. We have

introduced FY2024E earnings estimate in this note. The stock is currently trading at P/E of 23x/19x its FY2023E/FY2024E

EPS. With consistent improvement in balance sheet, market share gains and growth acceleration with Project Leap remains

constructive in medium to long term growth outlook. Hence, we retain Buy on the stock with a revised PT of Rs. 2050.

One-year forward P/E (x) band

30.0

25.0

20.0

15.0

10.0

5.0

-

Dec-20

Jun-21

Jun-20

Oct-20

Nov-20

Jul-20

Apr-21

Sep-20

Feb-21

Mar-21

Jan-21

Aug-20

May-21

1yr Fwd PE (x) Avg 1yr fwd PE Peak Trough

Source: Sharekhan Research

June 07, 2021 6

Stock Update

Powered by the Sharekhan

3R Research Philosophy

About company

Polycab manufactures and sells wires and cables and FMEGs, besides executing a few EPC projects. The

company has 25 manufacturing facilities, including two joint ventures with Techno and Trafigura, located

across Gujarat, Maharashtra, Uttarakhand, and the union territory of Daman and Diu. Polycab strives to

deliver customised and innovative products with speed and quality service.

Investment theme

Polycab is the market leader in the wires and cables space with an extensive product portfolio and distribution

reach coupled with accelerated growth in the FMEG space, which augurs well for growth visibility. The

company’s market position and success are driven by its robust distribution network, wide range of product

offerings, efficient supply chain management, and strong brand image. Polycab’s five-year roadmap to

achieve to achieve Rs 20000 crore in FY26E with more focus towards brand positioning, operations and

business growth along with strong emphasis on governance and sustainability outpacing industry growth

provides healthy visibility ahead. Revenue from the wires and cable segment has seen a decent 9% CAGR

during FY2017-FY2021 and FMEG grew by 33% CAGR during the same period. Further, increasing market

share of organised players, which grew from 61% in FY2014 to 66% in FY2018, is expected to touch 74% in

FY2023E, which augurs well for the industry leader.

Key Risks

Fluctuations in raw-material prices pose a key challenge: Any sharp increase or decrease in the prices

of key raw material (copper and aluminium) will sharply impact margins.

Currency risk: Polycab faces forex risks as a significant portion of its raw-material purchases, particularly

aluminum, copper, and PVC compound, are priced with reference to benchmarks quoted in US Dollar

terms. Hence, expenditure is largely influenced by the value of US Dollar.

Additional Data

Key management personnel

Inder T. Jaisinghani Chairman and Managing Director

Ajay T. Jaisinghani Whole-Time Director

R. Ramakrishnan Chief Executive Officer

Bharat A. Jaisinghani Director – FMEG Business (Non-board member)

Manoj Verma Executive President and Chief Operating Officer (CE)

Gandharv Tongia Deputy Chief Financial Officer

Source: Company Website

Top 10 shareholders

Sr. No. Holder Name Holding (%)

1 Jaisinghani Inder 14.41

2 Jaisinghani Girdhari T 14.34

3 Jaisinghani Ajay T 14.29

4 Jaisinghani Ramesh T 14.29

5 IFC 9.48

6 International Finance Corp 9.48

7 Jaisinghani Kunal 3.91

8 Jaisinghani Bharat 3.68

9 Jaisinghani Nikhil 3.68

10 Hariani Anil 3.57

Source: Bloomberg

Sharekhan Limited, its analyst or dependant(s) of the analyst might be holding or having a position in the companies mentioned in the article.

June 07, 2021 7

Understanding the Sharekhan 3R Matrix

Right Sector

Positive Strong industry fundamentals (favorable demand-supply scenario, consistent

industry growth), increasing investments, higher entry barrier, and favorable

government policies

Neutral Stagnancy in the industry growth due to macro factors and lower incremental

investments by Government/private companies

Negative Unable to recover from low in the stable economic environment, adverse

government policies affecting the business fundamentals and global challenges

(currency headwinds and unfavorable policies implemented by global industrial

institutions) and any significant increase in commodity prices affecting profitability.

Right Quality

Positive Sector leader, Strong management bandwidth, Strong financial track-record,

Healthy Balance sheet/cash flows, differentiated product/service portfolio and

Good corporate governance.

Neutral Macro slowdown affecting near term growth profile, Untoward events such as

natural calamities resulting in near term uncertainty, Company specific events

such as factory shutdown, lack of positive triggers/events in near term, raw

material price movement turning unfavourable

Negative Weakening growth trend led by led by external/internal factors, reshuffling of

key management personal, questionable corporate governance, high commodity

prices/weak realisation environment resulting in margin pressure and detoriating

balance sheet

Right Valuation

Positive Strong earnings growth expectation and improving return ratios but valuations

are trading at discount to industry leaders/historical average multiples, Expansion

in valuation multiple due to expected outperformance amongst its peers and

Industry up-cycle with conducive business environment.

Neutral Trading at par to historical valuations and having limited scope of expansion in

valuation multiples.

Negative Trading at premium valuations but earnings outlook are weak; Emergence of

roadblocks such as corporate governance issue, adverse government policies

and bleak global macro environment etc warranting for lower than historical

valuation multiple.

Source: Sharekhan Research

Know more about our products and services

For Private Circulation only

Disclaimer: This document has been prepared by Sharekhan Ltd. (SHAREKHAN) and is intended for use only by the person or entity

to which it is addressed to. This Document may contain confidential and/or privileged material and is not for any type of circulation

and any review, retransmission, or any other use is strictly prohibited. This Document is subject to changes without prior notice.

This document does not constitute an offer to sell or solicitation for the purchase or sale of any financial instrument or as an official

confirmation of any transaction. Though disseminated to all customers who are due to receive the same, not all customers may

receive this report at the same time. SHAREKHAN will not treat recipients as customers by virtue of their receiving this report.

The information contained herein is obtained from publicly available data or other sources believed to be reliable and SHAREKHAN

has not independently verified the accuracy and completeness of the said data and hence it should not be relied upon as such. While

we would endeavour to update the information herein on reasonable basis, SHAREKHAN, its subsidiaries and associated companies,

their directors and employees (“SHAREKHAN and affiliates”) are under no obligation to update or keep the information current. Also,

there may be regulatory, compliance, or other reasons that may prevent SHAREKHAN and affiliates from doing so. This document is

prepared for assistance only and is not intended to be and must not alone be taken as the basis for an investment decision. Recipients

of this report should also be aware that past performance is not necessarily a guide to future performance and value of investments

can go down as well. The user assumes the entire risk of any use made of this information. Each recipient of this document should

make such investigations as it deems necessary to arrive at an independent evaluation of an investment in the securities of companies

referred to in this document (including the merits and risks involved), and should consult its own advisors to determine the merits and

risks of such an investment. The investment discussed or views expressed may not be suitable for all investors. We do not undertake to

advise you as to any change of our views. Affiliates of Sharekhan may have issued other reports that are inconsistent with and reach

different conclusions from the information presented in this report.

This report is not directed or intended for distribution to, or use by, any person or entity who is a citizen or resident of or located in any

locality, state, country or other jurisdiction, where such distribution, publication, availability or use would be contrary to law, regulation

or which would subject SHAREKHAN and affiliates to any registration or licensing requirement within such jurisdiction. The securities

described herein may or may not be eligible for sale in all jurisdictions or to certain category of investors. Persons in whose possession

this document may come are required to inform themselves of and to observe such restriction.

The analyst certifies that the analyst has not dealt or traded directly or indirectly in securities of the company and that all of the

views expressed in this document accurately reflect his or her personal views about the subject company or companies and its or

their securities and do not necessarily reflect those of SHAREKHAN. The analyst further certifies that neither he or its associates

or his relatives has any direct or indirect financial interest nor have actual or beneficial ownership of 1% or more in the securities of

the company at the end of the month immediately preceding the date of publication of the research report nor have any material

conflict of interest nor has served as officer, director or employee or engaged in market making activity of the company. Further, the

analyst has also not been a part of the team which has managed or co-managed the public offerings of the company and no part

of the analyst’s compensation was, is or will be, directly or indirectly related to specific recommendations or views expressed in this

document. Sharekhan Limited or its associates or analysts have not received any compensation for investment banking, merchant

banking, brokerage services or any compensation or other benefits from the subject company or from third party in the past twelve

months in connection with the research report.

Either SHAREKHAN or its affiliates or its directors or employees / representatives / clients or their relatives may have position(s), make

market, act as principal or engage in transactions of purchase or sell of securities, from time to time or may be materially interested

in any of the securities or related securities referred to in this report and they may have used the information set forth herein before

publication. SHAREKHAN may from time to time solicit from, or perform investment banking, or other services for, any company

mentioned herein. Without limiting any of the foregoing, in no event shall SHAREKHAN, any of its affiliates or any third party involved

in, or related to, computing or compiling the information have any liability for any damages of any kind.

Compliance Officer: Mr. Joby John Meledan; Tel: 022-61150000; email id: compliance@sharekhan.com;

For any queries or grievances kindly email igc@sharekhan.com or contact: myaccount@sharekhan.com

Registered Office: Sharekhan Limited, 10th Floor, Beta Building, Lodha iThink Techno Campus, Off. JVLR, Opp. Kanjurmarg

Railway Station, Kanjurmarg (East), Mumbai – 400042, Maharashtra. Tel: 022 - 61150000. Sharekhan Ltd.: SEBI Regn. Nos.: BSE

/ NSE / MSEI (CASH / F&O / CD) / MCX - Commodity: INZ000171337; DP: NSDL/CDSL-IN-DP-365-2018; PMS: INP000005786;

Mutual Fund: ARN 20669; Research Analyst: INH000006183;

Disclaimer: Client should read the Risk Disclosure Document issued by SEBI & relevant exchanges and the T&C on www.sharekhan.com;

Investment in securities market are subject to market risks, read all the related documents carefully before investing.

You might also like

- Journal Entries For Merchandising Business Problem 1Document12 pagesJournal Entries For Merchandising Business Problem 1Arn Manuyag88% (24)

- Plan for Optimal Product CapacityDocument13 pagesPlan for Optimal Product CapacityHashir Khan0% (1)

- Role of The Accounting Information Systems in Modern OrganizationsDocument4 pagesRole of The Accounting Information Systems in Modern OrganizationsNoora Al Shehhi100% (7)

- KEI Q1 Result UpdateDocument7 pagesKEI Q1 Result UpdateAryan SharmaNo ratings yet

- TCI Express SharekhanDocument7 pagesTCI Express SharekhanAniket DhanukaNo ratings yet

- P.I. Industries (PI IN) : Q1FY21 Result UpdateDocument7 pagesP.I. Industries (PI IN) : Q1FY21 Result UpdatewhitenagarNo ratings yet

- Radico Khaitan-Oct06 2021 3R StockIdeaDocument30 pagesRadico Khaitan-Oct06 2021 3R StockIdeaOwners EstateNo ratings yet

- Diwali Picks 2019Document23 pagesDiwali Picks 2019Ravi RajanNo ratings yet

- P.I. Industries (PI IN) : Q1FY20 Result UpdateDocument7 pagesP.I. Industries (PI IN) : Q1FY20 Result UpdateMax BrenoNo ratings yet

- Ashok Leyland LTD: ESG Disclosure ScoreDocument8 pagesAshok Leyland LTD: ESG Disclosure ScoreRomelu MartialNo ratings yet

- HSIE Results Daily: Result ReviewsDocument13 pagesHSIE Results Daily: Result ReviewsKiran KudtarkarNo ratings yet

- Gati Q1 Result UpdateDocument7 pagesGati Q1 Result UpdateAryan SharmaNo ratings yet

- Affle Stock PricingDocument8 pagesAffle Stock PricingSandyNo ratings yet

- Jyothy - Lab Sharekhan PDFDocument7 pagesJyothy - Lab Sharekhan PDFAniket DhanukaNo ratings yet

- CCL Products - Pick of The Week - Axis Direct - 06112021 - 08-11-2021 - 08Document5 pagesCCL Products - Pick of The Week - Axis Direct - 06112021 - 08-11-2021 - 08Tanishk OjhaNo ratings yet

- BP Wealth On Hikal - 06.11.2020Document7 pagesBP Wealth On Hikal - 06.11.2020VM ONo ratings yet

- Divis RRDocument10 pagesDivis RRRicha P SinghalNo ratings yet

- Britannia Industries LTD: Take A Bite of This Growth StoryDocument11 pagesBritannia Industries LTD: Take A Bite of This Growth StoryHemanshu GhanshaniNo ratings yet

- Dixon Q1 Result UpdateDocument7 pagesDixon Q1 Result UpdateshrikantbodkeNo ratings yet

- BIBA Apparels Private - R - 22022019Document7 pagesBIBA Apparels Private - R - 22022019swapnil solankiNo ratings yet

- GNA Axles Q1 Result UpdateDocument8 pagesGNA Axles Q1 Result UpdateshrikantbodkeNo ratings yet

- Orient Electric IC Jun22Document44 pagesOrient Electric IC Jun22nishantNo ratings yet

- PSP Projects LTD - Q1FY24 Result Update - 28072023 - 28-07-2023 - 10Document8 pagesPSP Projects LTD - Q1FY24 Result Update - 28072023 - 28-07-2023 - 10samraatjadhavNo ratings yet

- S H Kelkar & Co - Initiating CoverageDocument24 pagesS H Kelkar & Co - Initiating Coveragejignesh100% (2)

- P.I. Industries (PI IN) : Q3FY20 Result UpdateDocument8 pagesP.I. Industries (PI IN) : Q3FY20 Result UpdateanjugaduNo ratings yet

- Avenue Supermarts: CMP: INR5,360 TP: INR4,900 (-9%) Continuing To Deliver On GrowthDocument10 pagesAvenue Supermarts: CMP: INR5,360 TP: INR4,900 (-9%) Continuing To Deliver On GrowthLucifer GamerzNo ratings yet

- Aarti Industries Q1 FY22 Results Present Record PerformanceDocument24 pagesAarti Industries Q1 FY22 Results Present Record PerformancerohitnagrajNo ratings yet

- WPIL Company Report Highlights Growth OutlookDocument2 pagesWPIL Company Report Highlights Growth OutlookRajeev GargNo ratings yet

- Colgate-Palmolive (India) : Elevated Margins To SustainDocument7 pagesColgate-Palmolive (India) : Elevated Margins To SustainJayant312002 ChhabraNo ratings yet

- Upll 2 8 20 PL PDFDocument9 pagesUpll 2 8 20 PL PDFwhitenagarNo ratings yet

- Varroc Engineering BUY rating maintained on improving outlookDocument4 pagesVarroc Engineering BUY rating maintained on improving outlookAmit Kumar AgrawalNo ratings yet

- Top Recommendation - 140911Document51 pagesTop Recommendation - 140911chaltrikNo ratings yet

- 354466122018909bharat Forge LTD Q4FY18 Result Updates - SignedDocument5 pages354466122018909bharat Forge LTD Q4FY18 Result Updates - Signedakshara pradeepNo ratings yet

- HSIE Results Daily - 10 Feb 24-202402100803391611264Document11 pagesHSIE Results Daily - 10 Feb 24-202402100803391611264adityazade03No ratings yet

- MNCL-La - Opala - November 2023 - Update - 012630 - 13882Document9 pagesMNCL-La - Opala - November 2023 - Update - 012630 - 13882Sriram RanganathanNo ratings yet

- Indian Hotels Company: Cost Optimization - Driver of ProfitabilityDocument6 pagesIndian Hotels Company: Cost Optimization - Driver of ProfitabilityArjun TalwarNo ratings yet

- Diwalipicks 2020Document4 pagesDiwalipicks 2020Vimal SharmaNo ratings yet

- Supreme Industries LTD: ESG Disclosure ScoreDocument7 pagesSupreme Industries LTD: ESG Disclosure ScoreGrim ReaperNo ratings yet

- Vaibhav Global Research ReportDocument4 pagesVaibhav Global Research ReportVikrant SadanaNo ratings yet

- Tata Motors Stock Update Maintains Buy With Revised Rs 430 TargetDocument9 pagesTata Motors Stock Update Maintains Buy With Revised Rs 430 TargetAniket DhanukaNo ratings yet

- Nirmal Bang On CCL Products - Upside of 20%Document7 pagesNirmal Bang On CCL Products - Upside of 20%Alok DashNo ratings yet

- Ashok Leyland Q3FY19 Result UpdateDocument4 pagesAshok Leyland Q3FY19 Result Updatekapil bahetiNo ratings yet

- Abfrl IcDocument26 pagesAbfrl IcKhush GosraniNo ratings yet

- DCB Bank Limited: Investing For Growth BUYDocument4 pagesDCB Bank Limited: Investing For Growth BUYdarshanmadeNo ratings yet

- Britannia Industries: Steady Performance in Tough EnvironmentDocument6 pagesBritannia Industries: Steady Performance in Tough EnvironmentdarshanmadeNo ratings yet

- ABB India: Strong Margin Expansion Valuations Remain ExpensiveDocument5 pagesABB India: Strong Margin Expansion Valuations Remain ExpensiveAmar DoshiNo ratings yet

- Esearch Eport: Riddhi Siddhi Gluco Biols LTDDocument9 pagesEsearch Eport: Riddhi Siddhi Gluco Biols LTDanny2k1No ratings yet

- Godrej Consumer: Investment Rationale IntactDocument24 pagesGodrej Consumer: Investment Rationale IntactbradburywillsNo ratings yet

- IEA Report 10th May 2017Document28 pagesIEA Report 10th May 2017narnoliaNo ratings yet

- Vinati Organics LTD: Growth To Pick-Up..Document5 pagesVinati Organics LTD: Growth To Pick-Up..Bhaveek OstwalNo ratings yet

- Arvind Fashions IC ICICI Sec 19jun19Document23 pagesArvind Fashions IC ICICI Sec 19jun19chetankvoraNo ratings yet

- GCPL Recovery Likely Q1FY21Document5 pagesGCPL Recovery Likely Q1FY21anjugaduNo ratings yet

- AngelBrokingResearch QuickHeal IPONote 060216Document14 pagesAngelBrokingResearch QuickHeal IPONote 060216durgasainathNo ratings yet

- RSPL Limited - R - 16102020Document8 pagesRSPL Limited - R - 16102020DarshanNo ratings yet

- PNC - Infra Q1 Result UpdateDocument7 pagesPNC - Infra Q1 Result UpdateAryan SharmaNo ratings yet

- IDirect ABFRL Q3FY22Document7 pagesIDirect ABFRL Q3FY22Parag SaxenaNo ratings yet

- Ipca 3R Aug11 - 2022Document7 pagesIpca 3R Aug11 - 2022Arka MitraNo ratings yet

- State Bank of India Stock Update: Strong Asset Quality and Earnings RecoveryDocument12 pagesState Bank of India Stock Update: Strong Asset Quality and Earnings Recoverysatyendragupta0078810No ratings yet

- Strong Performance, Margins Surprise Positively Improving OutlookDocument7 pagesStrong Performance, Margins Surprise Positively Improving OutlookayushNo ratings yet

- Deepak Nitrite - FinalDocument24 pagesDeepak Nitrite - Finalvajiravel407No ratings yet

- CapitalGoods SectorUpdate2Mar23 ResearchDocument6 pagesCapitalGoods SectorUpdate2Mar23 Researchavinashpathak777No ratings yet

- Westlife Dev JM 180618 PDFDocument9 pagesWestlife Dev JM 180618 PDFADNo ratings yet

- Policies to Support the Development of Indonesia’s Manufacturing Sector during 2020–2024: A Joint ADB–BAPPENAS ReportFrom EverandPolicies to Support the Development of Indonesia’s Manufacturing Sector during 2020–2024: A Joint ADB–BAPPENAS ReportNo ratings yet

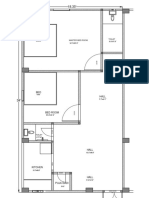

- Two Bed RoomDocument1 pageTwo Bed Roomshankar alkotiNo ratings yet

- ICICI Direct Balkrishna IndustriesDocument9 pagesICICI Direct Balkrishna Industriesshankar alkotiNo ratings yet

- AEC Ds ARC 0001Document1 pageAEC Ds ARC 0001shankar alkotiNo ratings yet

- Maruthi (Teacher) HomeDocument1 pageMaruthi (Teacher) Homeshankar alkotiNo ratings yet

- 2BHK PlanDocument1 page2BHK Planshankar alkotiNo ratings yet

- Two Bedroom PlanDocument1 pageTwo Bedroom Planshankar alkotiNo ratings yet

- Two Bed Room PlanDocument1 pageTwo Bed Room Planshankar alkotiNo ratings yet

- Suresh HomeDocument1 pageSuresh Homeshankar alkotiNo ratings yet

- Suri Two Bedroom HOME PlanDocument1 pageSuri Two Bedroom HOME Planshankar alkotiNo ratings yet

- Home Plan 2bhkDocument1 pageHome Plan 2bhkshankar alkotiNo ratings yet

- Two Bedroom HOME PlanDocument1 pageTwo Bedroom HOME Planshankar alkotiNo ratings yet

- 2 Bedroom HOME PlanDocument1 page2 Bedroom HOME Planshankar alkotiNo ratings yet

- 2 Bed HOME PlanDocument1 page2 Bed HOME Planshankar alkotiNo ratings yet

- HOME Plan 2bedDocument1 pageHOME Plan 2bedshankar alkotiNo ratings yet

- Home Plan BHKDocument1 pageHome Plan BHKshankar alkotiNo ratings yet

- 2bhk Home PlanDocument1 page2bhk Home Planshankar alkotiNo ratings yet

- 2BHK HomeDocument1 page2BHK Homeshankar alkotiNo ratings yet

- HOME 2bhk Model PRDocument1 pageHOME 2bhk Model PRshankar alkotiNo ratings yet

- Maruti HOMEDocument1 pageMaruti HOMEshankar alkotiNo ratings yet

- 2BHK HOME Plan Local-1Document1 page2BHK HOME Plan Local-1shankar alkotiNo ratings yet

- 1BHK HOME Plan Local-1Document1 page1BHK HOME Plan Local-1shankar alkotiNo ratings yet

- 1BHK HomeDocument1 page1BHK Homeshankar alkotiNo ratings yet

- Suresh Home Model PRDocument1 pageSuresh Home Model PRshankar alkotiNo ratings yet

- Logical unit of work ensures database consistencyDocument6 pagesLogical unit of work ensures database consistencyMohd ArifNo ratings yet

- Revision notes on group accounts consolidationDocument11 pagesRevision notes on group accounts consolidationEhsanulNo ratings yet

- Intermediate Accounting Vol 1 Canadian 3Rd Edition Lo Solutions Manual Full Chapter PDFDocument61 pagesIntermediate Accounting Vol 1 Canadian 3Rd Edition Lo Solutions Manual Full Chapter PDFwilliambrowntdoypjmnrc100% (6)

- Ms Archana. Wali MBA II Semester Exam No. MBA0702009Document78 pagesMs Archana. Wali MBA II Semester Exam No. MBA0702009vijayakooliNo ratings yet

- Asset Inventory Management TemplateDocument85 pagesAsset Inventory Management TemplateM Monjur MobinNo ratings yet

- Case Study - Lean Accounting - Traditional Accounting PracticesDocument29 pagesCase Study - Lean Accounting - Traditional Accounting Practicescustomwriter100% (1)

- Agbo Emmanuel ObandeDocument3 pagesAgbo Emmanuel ObandeObande AgboNo ratings yet

- Long-Term Financial Planning and Growth AnswersDocument32 pagesLong-Term Financial Planning and Growth AnswersThảo NhiNo ratings yet

- Questions About The Case Study: ELE PLCDocument2 pagesQuestions About The Case Study: ELE PLCMicaela Hidalgo RamírezNo ratings yet

- Homework 1Document2 pagesHomework 1Ladie Tiger100% (2)

- A Review On Lean Manufacturing Implementation Techniques A Conceptual Model of Lean Manufacturing DimensionsDocument12 pagesA Review On Lean Manufacturing Implementation Techniques A Conceptual Model of Lean Manufacturing DimensionsfaizanNo ratings yet

- Fundamentals To Lodging Industry MIDTERMDocument3 pagesFundamentals To Lodging Industry MIDTERMHany Dyanne Andica TeopeNo ratings yet

- Cost Volume Profit Analysis & Job Order Costing 11 9Document50 pagesCost Volume Profit Analysis & Job Order Costing 11 9Elmin ValdezNo ratings yet

- Full Download Solution Manual For Fundamentals of Investing 14th Edition Scott B Smart Chad J Zutter PDF Full ChapterDocument12 pagesFull Download Solution Manual For Fundamentals of Investing 14th Edition Scott B Smart Chad J Zutter PDF Full Chapterscazontucht45nm0100% (17)

- Pre Final Quiz 1Document2 pagesPre Final Quiz 1Xiu MinNo ratings yet

- Amazon's Lean Management SuccessDocument7 pagesAmazon's Lean Management SuccessAkash KankalNo ratings yet

- Advanced Financial Accounting and ReportingDocument2 pagesAdvanced Financial Accounting and ReportingLiza CaluagNo ratings yet

- Fintech in The Banking System of Russia Problems ADocument13 pagesFintech in The Banking System of Russia Problems Amy VinayNo ratings yet

- De La Salle University Course Checklist for Bachelor of Science in Applied Economics and Business ManagementDocument3 pagesDe La Salle University Course Checklist for Bachelor of Science in Applied Economics and Business ManagementJacobNo ratings yet

- Summary (Commercial and Non Commercial Entities in Indonesia)Document3 pagesSummary (Commercial and Non Commercial Entities in Indonesia)savira ramadhantyNo ratings yet

- Ch.13 Accounting StandardsDocument33 pagesCh.13 Accounting StandardsMalayaranjan PanigrahiNo ratings yet

- Problem Set #2 - The Gains From Trade: This Document Contains 7 PagesDocument4 pagesProblem Set #2 - The Gains From Trade: This Document Contains 7 PagesJBNo ratings yet

- TQM Practices and Product Quality Performance in the Food and Beverage IndustryDocument2 pagesTQM Practices and Product Quality Performance in the Food and Beverage IndustryShakilNo ratings yet

- Chap002 - Competitivness, Strategy & ProductivityDocument76 pagesChap002 - Competitivness, Strategy & ProductivityMohamed GalbatNo ratings yet

- Mutual Funds FATCA & CRS InformationDocument2 pagesMutual Funds FATCA & CRS InformationHoaccounts AuNo ratings yet

- SAPEWM01Document127 pagesSAPEWM01Mick LeeNo ratings yet

- Centre Sales JDDocument3 pagesCentre Sales JDSarahNo ratings yet