Professional Documents

Culture Documents

The Ledger

Uploaded by

Shoyo HinataCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

The Ledger

Uploaded by

Shoyo HinataCopyright:

Available Formats

Entry Increase in assets is recorded by a debit to cash.

Decrease in

assets is recorded by a credit to accounts receivable.

Dr. Cr.

Cash (A) 24,000

Accounts Receivable (A) 24,000

Expenses Incurred and Paid (Use of Assets)

May 31 Settled the electricity bill of P3,000 for the month.

Analysis Assets decreased. Owner's equity decreased.

Rules Decreases in assets are recorded by credits. Decreases in owner

equity are recorded by debits.

Entry Decrease in owner's equity is recorded by a debit to utilities

expense. Decrease in assets is recorded by a credit to cash.

Dr. Cr.

Utilities Expense (OE:E) 3,000

Cash (A) 3,000

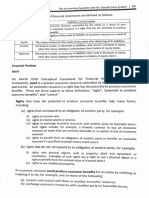

THE LEDGER

A grouping of the entity's accounts is referred to as a ledger. Although some firms may

use various ledgers to accumulate certain detailed information, all firms have a general

ledger. A general ledger is the "reference book" of the accounting system and is used to

classify and summarize transactions, and to prepare data for basic financial statements.

The accounts in the general ledger are classified into two general groups:

1. balance sheet or permanent accounts (assets, liabilities and owner's equity).

2. income statement or temporary accounts (income and expenses). Temporary

or nominal accounts are used to gather information for a particular accounting

period. At the end of the period, the balances of these accounts are transferred

to a permanent owner's equity account.

Each account has its own record in the ledger. Every account in the ledger maintains

the basic format of the T-account but offers more information (e.g. the account number

at the upper right corner and the journal reference column). Compared to a journal, a

edger organizes information by account

You might also like

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5795)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Optimal Decisions Using Marginal AnalysisDocument6 pagesOptimal Decisions Using Marginal AnalysisShoyo Hinata100% (1)

- Internal Management Information : Education/AcademeDocument1 pageInternal Management Information : Education/AcademeShoyo HinataNo ratings yet

- Chap. 2Document1 pageChap. 2Shoyo HinataNo ratings yet

- Oartnership: AccouDocument1 pageOartnership: AccouShoyo HinataNo ratings yet

- Qualified: Management AccountingDocument1 pageQualified: Management AccountingShoyo HinataNo ratings yet

- Equal The: Credits. These Are The Rules of Debit and Credit. The Following Summarizes The RulesDocument1 pageEqual The: Credits. These Are The Rules of Debit and Credit. The Following Summarizes The RulesShoyo HinataNo ratings yet

- The JournalDocument1 pageThe JournalShoyo HinataNo ratings yet

- AssetDocument1 pageAssetShoyo HinataNo ratings yet

- CASE PROBLEM: The Not-So-Harmless Cage DiversDocument2 pagesCASE PROBLEM: The Not-So-Harmless Cage DiversShoyo HinataNo ratings yet

- Bus. TransactionsDocument1 pageBus. TransactionsShoyo HinataNo ratings yet

- Accounting: Postings UpdatedDocument1 pageAccounting: Postings UpdatedShoyo HinataNo ratings yet

- Accounting CycleDocument1 pageAccounting CycleShoyo HinataNo ratings yet

- Acc. QuestionsDocument1 pageAcc. QuestionsShoyo HinataNo ratings yet

- Registration For Campus Organizations: Kabacan, Cotabato PhilippinesDocument2 pagesRegistration For Campus Organizations: Kabacan, Cotabato PhilippinesShoyo HinataNo ratings yet

- 2 NDDDDDDocument2 pages2 NDDDDDShoyo HinataNo ratings yet

- Module 3 Section 3 TaskDocument1 pageModule 3 Section 3 TaskShoyo Hinata0% (1)

- LiiiiiiiiiiittttDocument2 pagesLiiiiiiiiiiittttShoyo HinataNo ratings yet

- The Accounting Profession Definition of Accounting: Important PointsDocument9 pagesThe Accounting Profession Definition of Accounting: Important PointsShoyo HinataNo ratings yet

- Partnership Liquidation 1Document17 pagesPartnership Liquidation 1Shoyo HinataNo ratings yet