Professional Documents

Culture Documents

Accounting: Postings Updated

Uploaded by

Shoyo HinataOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Accounting: Postings Updated

Uploaded by

Shoyo HinataCopyright:

Available Formats

133

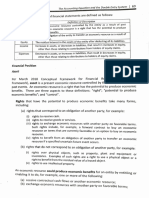

Recording Business Transactions

TRIAL BALANCE (Step 4)

The trial balance is a list of all accounts with their respective debit or credit balances. It

is prepared to verify the equality of debits and credits in the ledger at the end of each

accounting period or at any time the postings are updated.

The procedures in the preparation of a trial balance follow:

1. List the account titles in numerical order.

2. Obtain the account balance of each account from the ledger and enter the debit

balances in the debit column and the credit balances in the credit columh.

3 Add the debit and credit columns.

4. Compare the totals.

The trial balance is a control device that helps minimize accounting errors. When thee

totals are equal, the trial balance is in balance. This

equality provides an interim proof

of the accuracy of the records but it does not signify the absence of errors. For

example, if the bookkeeper failed to record payment of rent, the trial balance columns

are equal but in reality, the accounts are incorrect since rent expense is understated and

cash overstated.

The trial balance for the illustration followS:

Weddings "R" Us

Trial Balance

May 31, 2020

Cash P 22,200

Accounts Receivable 12,000

Supplies 18,000

Prepaid Rent 8,000

Prepaid Insurance 14,400

Service Vehicle 420,000

Office Equipment 60,000

Notes Payable P210,000

Accounts Payable 53,000

Utilities Payable 1,400

Unearned Referral Revenues 10,000

Besario, Capital 250,000

Besario, Withdrawals 14,000

Consulting Revenues 62,400

Salaries Expense 13,800

Utilities Expense 4,400

P586,800 P586,800

You might also like

- Accounting Principles and Practice: The Commonwealth and International Library: Commerce, Economics and Administration DivisionFrom EverandAccounting Principles and Practice: The Commonwealth and International Library: Commerce, Economics and Administration DivisionRating: 2.5 out of 5 stars2.5/5 (2)

- Basic Accounting Answer KeyDocument12 pagesBasic Accounting Answer KeyJASTINENo ratings yet

- B Exercises: E3-1B (Transaction Analysis-Service Company)Document8 pagesB Exercises: E3-1B (Transaction Analysis-Service Company)Saleh RaoufNo ratings yet

- ACCT2003 POAI - Assignment 2A - Qs OnlyDocument1 pageACCT2003 POAI - Assignment 2A - Qs Onlykjw 2No ratings yet

- Activity 2Document5 pagesActivity 2Ashley Timbreza BetitaNo ratings yet

- ACCT 490 Assignment 1Document7 pagesACCT 490 Assignment 1Saad FahadNo ratings yet

- AssessmentDocument20 pagesAssessmentJenecil JavierNo ratings yet

- FM 211 Preparation of Journal EntriesDocument9 pagesFM 211 Preparation of Journal EntriesJuvy Jane DuarteNo ratings yet

- Working Paper-Chapters 1-4 Naser AbdelkarimDocument5 pagesWorking Paper-Chapters 1-4 Naser AbdelkarimHasan NajiNo ratings yet

- Midterm Exam 2021 1Document3 pagesMidterm Exam 2021 1justinedeguzmanNo ratings yet

- A2.1 April2023Document7 pagesA2.1 April2023thuyhangg0209No ratings yet

- SdsasacsacsacsacsacDocument4 pagesSdsasacsacsacsacsacIden PratamaNo ratings yet

- Accounting Cycle of A Service Provider: Closing Entries, Post-Closing Trial Balance and Reversing EntriesDocument7 pagesAccounting Cycle of A Service Provider: Closing Entries, Post-Closing Trial Balance and Reversing EntriesRio GardoceNo ratings yet

- To Record The Purchase of EquipmentDocument13 pagesTo Record The Purchase of EquipmentShane Nayah100% (1)

- Unit 2 WorksheetDocument13 pagesUnit 2 WorksheetHhvvgg BbbbNo ratings yet

- Problem Sheet 4 Summer 22Document4 pagesProblem Sheet 4 Summer 22Md Tanvir AhmedNo ratings yet

- Jan David's Accounting Las 4Document9 pagesJan David's Accounting Las 4Cj ArquisolaNo ratings yet

- Chapter 4 - Complete The Accounting Cycle Practice Set A: Exercise 4.1A - Prepare Correcting EntriesDocument8 pagesChapter 4 - Complete The Accounting Cycle Practice Set A: Exercise 4.1A - Prepare Correcting EntriesBảo GiangNo ratings yet

- Acc 1 QuizDocument7 pagesAcc 1 QuizAyat MukahalNo ratings yet

- Accounting Cycle Week 2 ReviewerDocument11 pagesAccounting Cycle Week 2 ReviewerVinz Danzel BialaNo ratings yet

- Recording Business TransactionsDocument36 pagesRecording Business Transactionsnorman.washington378100% (10)

- Adjusting EntriesDocument5 pagesAdjusting EntriesM Hassan BrohiNo ratings yet

- AC121Document18 pagesAC121Kristian Jon PutalanNo ratings yet

- 1st Year - 5th SheetDocument3 pages1st Year - 5th SheetAhmed Ameen Nour EldinNo ratings yet

- Accounting Worksheet: Business Name: Accounting PeriodDocument5 pagesAccounting Worksheet: Business Name: Accounting Periodhgiang2308No ratings yet

- 05 - Completion of The Accounting Cycle (Notes) PDFDocument3 pages05 - Completion of The Accounting Cycle (Notes) PDFJamie ToriagaNo ratings yet

- Accounting CycleDocument8 pagesAccounting CycleRescopin LorraineNo ratings yet

- Completing The Accounting Cycle: Service Concern: Subject-Descriptive Title Subject - CodeDocument12 pagesCompleting The Accounting Cycle: Service Concern: Subject-Descriptive Title Subject - CodeRose LaureanoNo ratings yet

- Accounting and Financial Reporting: Master of Business Administration (MBA)Document49 pagesAccounting and Financial Reporting: Master of Business Administration (MBA)IBRAHEM OMARNo ratings yet

- Module 1 Key To CorrectionsDocument7 pagesModule 1 Key To CorrectionsPlame GaseroNo ratings yet

- Adjusting Entries Company A ExercisesDocument19 pagesAdjusting Entries Company A ExercisesRodolfo CorpuzNo ratings yet

- Assignment No 4Document3 pagesAssignment No 4analyngrace1No ratings yet

- Far Module 1 ApolDocument7 pagesFar Module 1 ApolJeraldine DejanNo ratings yet

- Chapter 08Document26 pagesChapter 08Dan ChuaNo ratings yet

- QUICKDocument8 pagesQUICKnissaNo ratings yet

- ABM - 111 - Final ExaminationDocument2 pagesABM - 111 - Final ExaminationTimothy JamesNo ratings yet

- Business Transactions and Their Analysis As Applied To The Accounting Cycle of A Service Business (Part Ii-A)Document9 pagesBusiness Transactions and Their Analysis As Applied To The Accounting Cycle of A Service Business (Part Ii-A)Tumamudtamud, JenaNo ratings yet

- 7 SynthesisDocument5 pages7 SynthesisCristine Jane Granaderos OppusNo ratings yet

- واجب محاسبة ٢Document1 pageواجب محاسبة ٢sp.shield.01No ratings yet

- Recording Business Transactio NSDocument13 pagesRecording Business Transactio NSAnonymousNo ratings yet

- Fabm SG 11 Q3 0903Document32 pagesFabm SG 11 Q3 0903James Kirby CuervoNo ratings yet

- Day 8 10DaysAccountingChallengeDocument4 pagesDay 8 10DaysAccountingChallengeElisa LandinginNo ratings yet

- Auditing Practice Problem 5Document2 pagesAuditing Practice Problem 5Maria Fe FerrarizNo ratings yet

- Adjusting Entries QuizDocument12 pagesAdjusting Entries QuizJuan Dela CruzNo ratings yet

- Businesses in PoblacionDocument29 pagesBusinesses in PoblacionnicoleshiNo ratings yet

- Completing The Accounting CycleDocument8 pagesCompleting The Accounting CycleMark Imel ManriqueNo ratings yet

- FundAcct I @2015 AssignmntDocument6 pagesFundAcct I @2015 AssignmntGedion FeredeNo ratings yet

- Reviewer Midterm Accounting Exercises in Financial and Accouting ReportingDocument20 pagesReviewer Midterm Accounting Exercises in Financial and Accouting ReportingFiel Marie SateraNo ratings yet

- Journal Entries - 1666100137Document12 pagesJournal Entries - 1666100137Van OneNo ratings yet

- 06 BTLE 30043 Santos Repair Shop Complete Cycle StudentDocument29 pages06 BTLE 30043 Santos Repair Shop Complete Cycle StudentnicoleshiNo ratings yet

- V1620034 - Dzaky FarhansyahDocument11 pagesV1620034 - Dzaky FarhansyahDzaky FarhansyahNo ratings yet

- Answer 1Document7 pagesAnswer 1Mylene HeragaNo ratings yet

- Notes Single Entry System c8fc1377 Aa41 4a83 8fa4 13677428260dDocument10 pagesNotes Single Entry System c8fc1377 Aa41 4a83 8fa4 13677428260dar5769584No ratings yet

- Solution Manual For Horngrens Financial and Managerial Accounting The Financial Chapters 4Th Edition Nobles Mattison Matsumura 970133255577 0133255573 Full Chapter PDFDocument36 pagesSolution Manual For Horngrens Financial and Managerial Accounting The Financial Chapters 4Th Edition Nobles Mattison Matsumura 970133255577 0133255573 Full Chapter PDFnorman.washington378100% (11)

- 2nd Summative TestDocument2 pages2nd Summative Testje-ann montejoNo ratings yet

- Additional Cash Flow ProblemsDocument3 pagesAdditional Cash Flow ProblemsChelle HullezaNo ratings yet

- Pakam, Khiezna E. Bsac-1b Assignment 3-FarDocument5 pagesPakam, Khiezna E. Bsac-1b Assignment 3-FarKhiezna PakamNo ratings yet

- Problem #1: Adjusting EntriesDocument5 pagesProblem #1: Adjusting EntriesShahzad AsifNo ratings yet

- Internal Management Information : Education/AcademeDocument1 pageInternal Management Information : Education/AcademeShoyo HinataNo ratings yet

- Qualified: Management AccountingDocument1 pageQualified: Management AccountingShoyo HinataNo ratings yet

- Oartnership: AccouDocument1 pageOartnership: AccouShoyo HinataNo ratings yet

- Equal The: Credits. These Are The Rules of Debit and Credit. The Following Summarizes The RulesDocument1 pageEqual The: Credits. These Are The Rules of Debit and Credit. The Following Summarizes The RulesShoyo HinataNo ratings yet

- Chap. 2Document1 pageChap. 2Shoyo HinataNo ratings yet

- Bus. TransactionsDocument1 pageBus. TransactionsShoyo HinataNo ratings yet

- AssetDocument1 pageAssetShoyo HinataNo ratings yet

- Accounting CycleDocument1 pageAccounting CycleShoyo HinataNo ratings yet

- Optimal Decisions Using Marginal AnalysisDocument6 pagesOptimal Decisions Using Marginal AnalysisShoyo Hinata100% (1)

- The JournalDocument1 pageThe JournalShoyo HinataNo ratings yet

- Registration For Campus Organizations: Kabacan, Cotabato PhilippinesDocument2 pagesRegistration For Campus Organizations: Kabacan, Cotabato PhilippinesShoyo HinataNo ratings yet

- Acc. QuestionsDocument1 pageAcc. QuestionsShoyo HinataNo ratings yet

- Partnership Liquidation 1Document17 pagesPartnership Liquidation 1Shoyo HinataNo ratings yet

- LiiiiiiiiiiittttDocument2 pagesLiiiiiiiiiiittttShoyo HinataNo ratings yet

- CASE PROBLEM: The Not-So-Harmless Cage DiversDocument2 pagesCASE PROBLEM: The Not-So-Harmless Cage DiversShoyo HinataNo ratings yet

- 2 NDDDDDDocument2 pages2 NDDDDDShoyo HinataNo ratings yet

- Module 3 Section 3 TaskDocument1 pageModule 3 Section 3 TaskShoyo Hinata0% (1)

- The Accounting Profession Definition of Accounting: Important PointsDocument9 pagesThe Accounting Profession Definition of Accounting: Important PointsShoyo HinataNo ratings yet

- Palm Manual EngDocument151 pagesPalm Manual EngwaterloveNo ratings yet

- In Comparison With Oracle 8i, 9i Is Have Lot Many New Features. Important IsDocument241 pagesIn Comparison With Oracle 8i, 9i Is Have Lot Many New Features. Important IsBalaji ShindeNo ratings yet

- Types of MemoryDocument3 pagesTypes of MemoryVenkatareddy Mula0% (1)

- 0063 - Proforma Accompanying The Application For Leave WITHOUT ALLOWANCE Is FORWARDED To GOVERNMEDocument4 pages0063 - Proforma Accompanying The Application For Leave WITHOUT ALLOWANCE Is FORWARDED To GOVERNMESreedharanPN100% (4)

- Design of Flyback Transformers and Filter Inductor by Lioyd H.dixon, Jr. Slup076Document11 pagesDesign of Flyback Transformers and Filter Inductor by Lioyd H.dixon, Jr. Slup076Burlacu AndreiNo ratings yet

- Pilot'S Operating Handbook: Robinson Helicopter CoDocument200 pagesPilot'S Operating Handbook: Robinson Helicopter CoJoseph BensonNo ratings yet

- Computer System Architecture: Pamantasan NG CabuyaoDocument12 pagesComputer System Architecture: Pamantasan NG CabuyaoBien MedinaNo ratings yet

- Dynamics of Interest Rate and Equity VolatilityDocument9 pagesDynamics of Interest Rate and Equity VolatilityZhenhuan SongNo ratings yet

- Codex Standard EnglishDocument4 pagesCodex Standard EnglishTriyaniNo ratings yet

- A Religious LeadershipDocument232 pagesA Religious LeadershipBonganiNo ratings yet

- Methods of Teaching Syllabus - FinalDocument6 pagesMethods of Teaching Syllabus - FinalVanessa L. VinluanNo ratings yet

- SettingsDocument3 pagesSettingsrusil.vershNo ratings yet

- Icom IC F5021 F6021 ManualDocument24 pagesIcom IC F5021 F6021 ManualAyam ZebossNo ratings yet

- Scope of Internet As A ICTDocument10 pagesScope of Internet As A ICTJohnNo ratings yet

- Economies and Diseconomies of ScaleDocument7 pagesEconomies and Diseconomies of Scale2154 taibakhatunNo ratings yet

- Digital Documentation Class 10 NotesDocument8 pagesDigital Documentation Class 10 NotesRuby Khatoon86% (7)

- Intro S4HANA Using Global Bike Solutions EAM Fiori en v3.3Document5 pagesIntro S4HANA Using Global Bike Solutions EAM Fiori en v3.3Thăng Nguyễn BáNo ratings yet

- Marley Product Catalogue Brochure Grease TrapsDocument1 pageMarley Product Catalogue Brochure Grease TrapsKushalKallychurnNo ratings yet

- Ramp Footing "RF" Wall Footing-1 Detail: Blow-Up Detail "B"Document2 pagesRamp Footing "RF" Wall Footing-1 Detail: Blow-Up Detail "B"Genevieve GayosoNo ratings yet

- ECO 101 Assignment - Introduction To EconomicsDocument5 pagesECO 101 Assignment - Introduction To EconomicsTabitha WatsaiNo ratings yet

- The Finley ReportDocument46 pagesThe Finley ReportToronto StarNo ratings yet

- Gravity Based Foundations For Offshore Wind FarmsDocument121 pagesGravity Based Foundations For Offshore Wind FarmsBent1988No ratings yet

- Analisa RAB Dan INCOME Videotron TrenggalekDocument2 pagesAnalisa RAB Dan INCOME Videotron TrenggalekMohammad Bagus SaputroNo ratings yet

- Application of ARIMAX ModelDocument5 pagesApplication of ARIMAX ModelAgus Setiansyah Idris ShalehNo ratings yet

- Bba Colleges in IndiaDocument7 pagesBba Colleges in IndiaSumit GuptaNo ratings yet

- UCAT SJT Cheat SheetDocument3 pagesUCAT SJT Cheat Sheetmatthewgao78No ratings yet

- (ENG) Visual Logic Robot ProgrammingDocument261 pages(ENG) Visual Logic Robot ProgrammingAbel Chaiña Gonzales100% (1)

- IEEE Conference Template ExampleDocument14 pagesIEEE Conference Template ExampleEmilyNo ratings yet

- E Nose IoTDocument8 pagesE Nose IoTarun rajaNo ratings yet

- Different Software Life Cycle Models: Mini Project OnDocument11 pagesDifferent Software Life Cycle Models: Mini Project OnSagar MurtyNo ratings yet