Professional Documents

Culture Documents

Midterm Exam 2021 1

Uploaded by

justinedeguzmanOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Midterm Exam 2021 1

Uploaded by

justinedeguzmanCopyright:

Available Formats

MIDTERM EXAMINATION IN ACCOUNTING

First Semester 2021-2022

December 9-14, 2021

Reminder Follow the instructions. Give the Answer only.

Example: Test I – (A) 1. True (B) 1. Asset

Test II - Use Tabulation Only

Test III – Trial Balance

TEST - I

A - TRUE OR FALSE (1-20 Items)

1. Journalizing is the process of transferring information from the journal to the ledger.

2. Expenses decreases owner’s equity and are recorded by a credit.

3. The balance sheet is prepared before the income statement.

4. Financial statements not disclosing relevant information are not acceptable.

5. The basic summary device of accounting is the account.

6. The itemized statement of assets, liabilities and capital of the business is an income statement.

7. Another variation of accounting equation is Capital – Liabilities = Assets.

8. A cash acquisition of land will cause total asset to increase.

9. The heading of any statements is composed of two lines of information.

10. The account use to journalize events determines the account to be included in the general ledger.

11. Accounting is essentially a process of accounting for valuation.

12. Accounting is another term for bookkeeping.

13. All businesses are carried on for profit.

14. The income statement is dated as of a given period of time.

15. PICPA is the national organization of certified public accountants which regulates the accounting practice.

16. Accounting is not only an art, but it is also a science.

17. A corporation is a business owned by its stockholders.

18. A partnership is owned by at least two persons.

19. A trading firm is the same as merchandising firm.

20. A business is considered as an entity separate and distinct from the personality of the owner.

B – IDENTIFICATION – (1-20 Items)

1. A journal entry that has more than one debit/credit entry.

2. The right side of an account.

3. The book or file that contains all or groups of the Company’s accounts.

4. The process of transferring information from the journal to the ledger.

5. A chronological record of all transactions, place where transactions are first recorded.

6. Any twelve-month accounting period used by a company.

7. The account used to record the distributions of assets to the owner for personal use.

8. Financial reporting is only concerned with information that is significant enough to affect evaluations and

decisions.

9. An artificial being created by the operation of law having the right of succession and the powers, attributes

and properties expressly authorized by law or incident to its existence.

10. A Statement that shows the challenges in capital of the business.

11. This principles state that acquired assets should be recorded at their actual cost and not at what they are

worth on the reporting date.

12. Revenue is to be recognized in the accounting period when goods are delivered or services are rendered or

performed.

13. Requires that all relevant information that would affect the user’s understandings and assessment of the

accounting entity be disclosed in the financial statements.

14. The business should use the same accounting method from period to period to achieved comparability over

time within a single Co.

15. Accountant generally chooses a method that yielded the lesser amount of income and asset value.

16. Debts or obligations evidenced by promissory notes.

17. Equity of the owner in the asset of the business.

18. Cost incurred in the process of producing revenue.

19. Real estate owned by the business or the site of the business.

20. Is any medium of exchange that the bank will accept at face value.

TEST II:

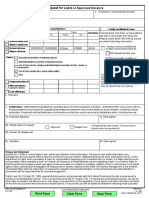

REQUIRED: For each of the transactions below fill in the Tabulation given below:

TRANSACTIONS:

a. Investment by Mr. Santos, P500,000.

b. Purchased supplies on account, P8,000.

c. Received cash P86,000 from clients on account.

d. Paid rent for 3 months in advance, P60,000.

e. Paid creditors on account, P8,000.

f. Billed customers for services rendered, P20,000.

g. Purchased equipment for P50,000, and issued a notes.

h. Received cash from clients on account, P20,000.

i. Paid taxes for the quarter, P18,000.

j. Paid utilities expenses for the month, P22,500.

NOS. ACCOUNTS AFFECTED TYPE OF INCREASE/ DEBIT/ INCOME

ACCOUNT DECREASE CREDIT STATEMENT/

BALANCE SHEET

a. 1.

2.

b. 1.

2.

c. 1.

2.

d. 1.

2.

e. 1.

2.

f. 1.

2.

g. 1.

2.

h. 1.

2.

i. 1.

2.

j. 1.

2.

TEST III – Required: Prepare Trial Balance in Good Form.

The Trial balances of MARIO PORTEM LAUNDRY SHOP at December 31, 2021 are as follows:

ACCOUNT TITLES DEBIT/CREDIT

Cash P118,500

Accounts Receivable 12,700

Laundry Supplies 10,000

Equipment 22,000

Accumulated Depreciation – Equipment 6,800

Laundry Equipment 80,000

Accumulated Depreciation – Laundry Equipment 14,000

Prepaid Insurance 5,000

Furniture and Fixture 95,000

Notes Payable 20,000

Mortgage Payable 88,000

Accounts Payable 15,000

Laundry Revenue 100,000

Wages Expense 38,000

Rent Expense 60,000

Commission Revenue 28,000

Interest Payable 4,400

Interest Revenue 3,200

Utilities Expense 12,800

Portem, Drawing 20,000

Portem, Capital 200,000

Miscellaneous Expense 4,000

Taxes Expense 1,400

“A DAY WITHOUT THE LORD IS A DAY WASTED”

END OF EXAMINATION

You might also like

- O CPA Review: Taxation PreweekDocument19 pagesO CPA Review: Taxation PreweekVanessa Anne Acuña DavisNo ratings yet

- Assets Liabilities + Equity + Income - Expenses: Oct. TransactionsDocument4 pagesAssets Liabilities + Equity + Income - Expenses: Oct. Transactionsalford sery Cammayo0% (1)

- Requirements in Fundamentals of AccountingDocument7 pagesRequirements in Fundamentals of AccountingMoises Macaranas JrNo ratings yet

- Acc 1 QuizDocument7 pagesAcc 1 QuizAyat MukahalNo ratings yet

- Addl Correction of TB Errors - 20200921 - 0002Document3 pagesAddl Correction of TB Errors - 20200921 - 0002Dalemma FranciscoNo ratings yet

- AFAR 1.3 - Corporate LiquidationDocument5 pagesAFAR 1.3 - Corporate LiquidationKile Rien MonsadaNo ratings yet

- Regina Mondi College, Inc.: Cost Accounting and Control Preliminary ExaminationDocument4 pagesRegina Mondi College, Inc.: Cost Accounting and Control Preliminary ExaminationJake Francis JarciaNo ratings yet

- Pakam, Khiezna E. Bsac-1b Assignment 3-FarDocument5 pagesPakam, Khiezna E. Bsac-1b Assignment 3-FarKhiezna PakamNo ratings yet

- AssessmentDocument20 pagesAssessmentJenecil JavierNo ratings yet

- Angelu M. Villalobos-Problem #2&3Document3 pagesAngelu M. Villalobos-Problem #2&3JeluMVNo ratings yet

- Ngli Ke ToanDocument121 pagesNgli Ke ToanJF FNo ratings yet

- Error in Recording & Posting: Fabm 2Document17 pagesError in Recording & Posting: Fabm 2Earl Hyannis Elauria0% (1)

- FA2 - SFP and SCI-Answers 1Document5 pagesFA2 - SFP and SCI-Answers 1Angel AtirazanNo ratings yet

- Tutorial 3Document14 pagesTutorial 3NURSUHAILI IZZATI ABU BAKARNo ratings yet

- Accounting: Postings UpdatedDocument1 pageAccounting: Postings UpdatedShoyo HinataNo ratings yet

- Fundamentals AnswerDocument12 pagesFundamentals AnswerRienalyn Dumlao Duldulao-DaligconNo ratings yet

- Practice Question Paper - Financial AccountingDocument6 pagesPractice Question Paper - Financial AccountingNaomi SaldanhaNo ratings yet

- 3 RdquarterDocument7 pages3 RdquarterRylan Yani OlshpNo ratings yet

- 3 RdquarterDocument7 pages3 RdquarterRylan Yani OlshpNo ratings yet

- Chapter 08Document26 pagesChapter 08Dan ChuaNo ratings yet

- Pembahasan Genap ACT Genap 2020 19 MarDocument12 pagesPembahasan Genap ACT Genap 2020 19 MarSoca NarendraNo ratings yet

- Exercise 9 - Trial BalanceDocument1 pageExercise 9 - Trial Balancetatoroyale2455No ratings yet

- Quizzes - Chapter 9 - Acctg Cycle of A Service BusinessDocument12 pagesQuizzes - Chapter 9 - Acctg Cycle of A Service BusinessAmie Jane Miranda50% (4)

- Corporate Liquidation (Integration) PDFDocument5 pagesCorporate Liquidation (Integration) PDFCatherine Simeon100% (1)

- Closing Entry and Reversing EntryDocument13 pagesClosing Entry and Reversing EntrymariejoyceaggabaoNo ratings yet

- PRACTICE QUESTIONS 1 (IA3) (Midterms) : AnswerDocument21 pagesPRACTICE QUESTIONS 1 (IA3) (Midterms) : AnswerShiena ApasNo ratings yet

- Assignment 1 Accounting Cycle For Service Business Part 2Document3 pagesAssignment 1 Accounting Cycle For Service Business Part 2Iya GarciaNo ratings yet

- Adjusting EntriesDocument5 pagesAdjusting EntriesM Hassan BrohiNo ratings yet

- INSTRUCTIONS: Select The Best Answer For Each of The Following Attempted. Mark Only One Answer For Each Item On The Answer SheetDocument13 pagesINSTRUCTIONS: Select The Best Answer For Each of The Following Attempted. Mark Only One Answer For Each Item On The Answer SheetMac Ferds100% (2)

- Assignment - J&RDocument6 pagesAssignment - J&RJie SapornaNo ratings yet

- Individual Assignment.123Document5 pagesIndividual Assignment.123Tsegaye BubamoNo ratings yet

- Accouncting ProblemDocument3 pagesAccouncting ProblemShaneNo ratings yet

- Sample Problems Part FormDocument4 pagesSample Problems Part FormkenivanabejuelaNo ratings yet

- University of Caloocan City: Name: Score: Course/Year & Section: DateDocument3 pagesUniversity of Caloocan City: Name: Score: Course/Year & Section: DatePatricia Camille Austria0% (1)

- FM 211 Preparation of Journal EntriesDocument9 pagesFM 211 Preparation of Journal EntriesJuvy Jane DuarteNo ratings yet

- AccountingDocument4 pagesAccountingAnne AlagNo ratings yet

- Problem #1: Adjusting EntriesDocument5 pagesProblem #1: Adjusting EntriesShahzad AsifNo ratings yet

- Chapter 4 - Complete The Accounting Cycle Practice Set A: Exercise 4.1A - Prepare Correcting EntriesDocument8 pagesChapter 4 - Complete The Accounting Cycle Practice Set A: Exercise 4.1A - Prepare Correcting EntriesBảo GiangNo ratings yet

- Name: - ScoreDocument2 pagesName: - ScoreFucio, Mark JeroldNo ratings yet

- Intermediate Accounting 3 Second Grading Quiz: Name: Date: Professor: Section: ScoreDocument2 pagesIntermediate Accounting 3 Second Grading Quiz: Name: Date: Professor: Section: ScoreGrezel NiceNo ratings yet

- Ministry of Education, Heritage and Arts: Strand One Nature of AccountingDocument3 pagesMinistry of Education, Heritage and Arts: Strand One Nature of AccountingShyam murtiNo ratings yet

- Accounts Home Test 2Document7 pagesAccounts Home Test 2Ashish RaiNo ratings yet

- T Accounts Trial BalanceDocument7 pagesT Accounts Trial BalanceCamille Pasion100% (1)

- Final - Unit - 10 - Financial Accounting - TrangDocument5 pagesFinal - Unit - 10 - Financial Accounting - TrangKevin PhạmNo ratings yet

- Fabm2 Learning-Activity-1Document7 pagesFabm2 Learning-Activity-1Cha Eun WooNo ratings yet

- FAR Activity Feb 19 With AnswersDocument16 pagesFAR Activity Feb 19 With AnswersCybill AiraNo ratings yet

- Cash Accrual Single EntryDocument3 pagesCash Accrual Single EntryJustine GuilingNo ratings yet

- FAR Midterm QuizDocument2 pagesFAR Midterm QuizAllyy DelacruzNo ratings yet

- Institute of Business Management: Lms Based Finalexaminations-Summer 2020 Analytical PartDocument3 pagesInstitute of Business Management: Lms Based Finalexaminations-Summer 2020 Analytical PartSafi SheikhNo ratings yet

- Test Bank 3 - Ia 1Document25 pagesTest Bank 3 - Ia 1JEFFERSON CUTE100% (1)

- FARAP-4518Document3 pagesFARAP-4518Accounting StuffNo ratings yet

- Acc 109 P3 Quiz No 2Document2 pagesAcc 109 P3 Quiz No 2Wilmz SalacsacanNo ratings yet

- Corporate Liquidation QuizDocument4 pagesCorporate Liquidation QuizMarinoNo ratings yet

- BA 99.1 Rodriguez LE 1 SamplexDocument6 pagesBA 99.1 Rodriguez LE 1 SamplexYsabella Beatriz SamsonNo ratings yet

- Acctg ConstantinoDocument6 pagesAcctg ConstantinoKyla Lyn OclaritNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- Accounting Principles and Practice: The Commonwealth and International Library: Commerce, Economics and Administration DivisionFrom EverandAccounting Principles and Practice: The Commonwealth and International Library: Commerce, Economics and Administration DivisionRating: 2.5 out of 5 stars2.5/5 (2)

- Wealth Management Planning: The UK Tax PrinciplesFrom EverandWealth Management Planning: The UK Tax PrinciplesRating: 4.5 out of 5 stars4.5/5 (2)

- Group 3 Money Banking and Monetary PolicyDocument46 pagesGroup 3 Money Banking and Monetary PolicyjustinedeguzmanNo ratings yet

- RIZAAALDocument1 pageRIZAAALjustinedeguzmanNo ratings yet

- Igot, Raissa-Lesson 3Document1 pageIgot, Raissa-Lesson 3justinedeguzmanNo ratings yet

- Artapp FinalssDocument11 pagesArtapp FinalssjustinedeguzmanNo ratings yet

- World Lit Group 4 Nine PalacesDocument1 pageWorld Lit Group 4 Nine PalacesjustinedeguzmanNo ratings yet

- QSM Final Activity 2Document2 pagesQSM Final Activity 2justinedeguzmanNo ratings yet

- Historical Essay LupaDocument4 pagesHistorical Essay LupajustinedeguzmanNo ratings yet

- Task #1: Justine E. de Guzman Bse 1-2Document3 pagesTask #1: Justine E. de Guzman Bse 1-2justinedeguzmanNo ratings yet

- General Journal General Journal Date Account Titles and Explanation P. R. Debit CreditDocument20 pagesGeneral Journal General Journal Date Account Titles and Explanation P. R. Debit CreditjustinedeguzmanNo ratings yet

- Marlon BalistaDocument4 pagesMarlon BalistajustinedeguzmanNo ratings yet

- Lupin Annual Report 2018 PDFDocument279 pagesLupin Annual Report 2018 PDFrio boseNo ratings yet

- Dudhsagar Dairy Mehsana District Co-Operative Milk Producers' Union LTDDocument10 pagesDudhsagar Dairy Mehsana District Co-Operative Milk Producers' Union LTDHarsh gamingNo ratings yet

- NASSCOM Annual Report 2015 0Document100 pagesNASSCOM Annual Report 2015 0hareshNo ratings yet

- Project Management Chapter 1 Gray N LarsonDocument12 pagesProject Management Chapter 1 Gray N LarsonDendy Wibisono94% (18)

- 10.1 A Comprehensice Look at The Empirical Performance of Equity Premium Prediction - Welch Und Goyal - 2008Document54 pages10.1 A Comprehensice Look at The Empirical Performance of Equity Premium Prediction - Welch Und Goyal - 2008PeterNo ratings yet

- Quarter 1 NO ANSWER KEY Visual Graphic Design Module 1Document35 pagesQuarter 1 NO ANSWER KEY Visual Graphic Design Module 1Matt Lhouie MartinNo ratings yet

- 16Document1 page16Babu babuNo ratings yet

- Agreement of Sale Cum General Power of Attorney: (With Possession)Document7 pagesAgreement of Sale Cum General Power of Attorney: (With Possession)DrSyed ShujauddinNo ratings yet

- The Company Man EssayDocument3 pagesThe Company Man Essayafhbhvlvx100% (2)

- Week 5 Managing A Service Related BusinessDocument20 pagesWeek 5 Managing A Service Related Businesskimberly dueroNo ratings yet

- Globe Life - AIL - Spotlight Magazine - 2022-04Document33 pagesGlobe Life - AIL - Spotlight Magazine - 2022-04Fuzzy PandaNo ratings yet

- Deming's Contribution To TQMDocument7 pagesDeming's Contribution To TQMMythily VedhagiriNo ratings yet

- JLN Pending, Kuching 1 30/11/22Document4 pagesJLN Pending, Kuching 1 30/11/22Jue tingsNo ratings yet

- Nature and Evolution of Corporate GovernanceDocument19 pagesNature and Evolution of Corporate GovernanceRashmi SinghNo ratings yet

- Chapter 12-Bond MarketDocument48 pagesChapter 12-Bond MarketIzat MrfNo ratings yet

- 3120 Project 2Document9 pages3120 Project 2Hakimuddin KotwalNo ratings yet

- Release PPDocument27 pagesRelease PPDaut PoloNo ratings yet

- Hospital Design Guide How To Get StartedDocument52 pagesHospital Design Guide How To Get StartedIulia Mihaela ScrobNo ratings yet

- Cashflow - 5crs & AboveDocument1 pageCashflow - 5crs & AboveNishant AhujaNo ratings yet

- Activity Sheets AE Week 1Document6 pagesActivity Sheets AE Week 1Dotecho Jzo EyNo ratings yet

- Stakeholder ProposalDocument15 pagesStakeholder ProposalEYOB AHMEDNo ratings yet

- Sick Leave Form For Rafiullah PDFDocument1 pageSick Leave Form For Rafiullah PDFRafiullahNo ratings yet

- PDF Installment Sales Reviewer Problems - CompressDocument43 pagesPDF Installment Sales Reviewer Problems - CompressMischievous Mae0% (1)

- Forex Systems: Types of Forex Trading SystemDocument35 pagesForex Systems: Types of Forex Trading SystemalypatyNo ratings yet

- Amulya Angel MungamuriDocument3 pagesAmulya Angel Mungamurisandeep NalluriNo ratings yet

- Rental Agreement - Trivik Developesr LLP On 18.12.2023Document4 pagesRental Agreement - Trivik Developesr LLP On 18.12.2023Vijay Varma RNo ratings yet

- Samsung DissertationDocument6 pagesSamsung DissertationPayToWritePaperSingapore100% (1)

- Acg Module 9 Thc5-LathDocument10 pagesAcg Module 9 Thc5-LathMeishein FanerNo ratings yet

- 9 4 Comparative Study and Decision Making For A FormworkDocument5 pages9 4 Comparative Study and Decision Making For A Formworknazi nazNo ratings yet

- The Hospitality Business ToolkitDocument17 pagesThe Hospitality Business ToolkitOanaa ComanNo ratings yet