Professional Documents

Culture Documents

ACCT2003 POAI - Assignment 2A - Qs Only

Uploaded by

kjw 2Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

ACCT2003 POAI - Assignment 2A - Qs Only

Uploaded by

kjw 2Copyright:

Available Formats

ACCT2003 Principles of Accounting I

Assignment #2A

This assignment consists of 1 question related to Chapter 4.

Instructions:

1. Type or hand-write the answers using A4 size white papers.

2. Use blue or black ball/ink pen. Assignment completed in pencil will not be graded and will earn

zero mark.

3. Answers should be supported by step-by-step/detailed calculations where appropriate.

4. Upload completed work to iSpace by 5 pm, Wednesday October 23, 2019 or another date

specified by your teacher. Late submission will not be graded.

Question: (25 marks)

Part A (20 marks)

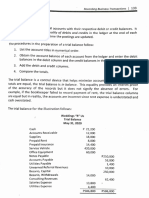

The completed financial statement columns of the worksheet for Vaina Electrics are shown below.

VAINA ELECTRICS

Worksheet

For the year ended 31 December 2018

income statement Statement of changes in

equity and statement of

financial position

Account Titles Dr. Cr. Dr. Cr.

Cash 19,140

Accounts Receivable 14,850

Prepaid Insurance 3,850

Equipment 28,600

Accumulated Depreciation 6,160

Accounts Payable 12,430

Salaries Payable 3,300

Mark Vaina, Capital 39,600

Mark Vaina, Withdrawals 15,400

Service revenue 70,400

Repair Expense 2,200

Depreciation Expense 2,860

Insurance Expense 2,420

Salaries Expense 40,700

Utilities Expense 1,870

totals 50,050 70,400 81,840 61,490

Profit 20,350 20,350

70,400 70,400 81,840 81,840

Required:

(a) Prepare an income statement, a statement of changes in equity and a classified statement of financial position.

(b) Prepare the closing entries. Mark Vaina did not make any additional investments during the year.

(c) Prepare a post-closing trial balance.

Part B (5 marks)

(a) Describe the nature of the Income Summary account and identify the types of summary data that may be

posted to this account.

(b) What are the content and purpose of a post-closing trial balance?

You might also like

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- 4 Completing The Accounting Cycle PartDocument1 page4 Completing The Accounting Cycle PartTalionNo ratings yet

- J.K. Lasser's Small Business Taxes 2007: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2007: Your Complete Guide to a Better Bottom LineNo ratings yet

- Accounting: Postings UpdatedDocument1 pageAccounting: Postings UpdatedShoyo HinataNo ratings yet

- Schaum's Outline of Bookkeeping and Accounting, Fourth EditionFrom EverandSchaum's Outline of Bookkeeping and Accounting, Fourth EditionRating: 5 out of 5 stars5/5 (1)

- Bab 4 Soal 4Document4 pagesBab 4 Soal 4Abel AbdallahNo ratings yet

- واجب محاسبة ٢Document1 pageواجب محاسبة ٢sp.shield.01No ratings yet

- B Exercises: E3-1B (Transaction Analysis-Service Company)Document8 pagesB Exercises: E3-1B (Transaction Analysis-Service Company)Saleh RaoufNo ratings yet

- Reviewer Midterm Accounting Exercises in Financial and Accouting ReportingDocument20 pagesReviewer Midterm Accounting Exercises in Financial and Accouting ReportingFiel Marie SateraNo ratings yet

- Problem Sheet 4 Summer 22Document4 pagesProblem Sheet 4 Summer 22Md Tanvir AhmedNo ratings yet

- I-04 01problem PDFDocument1 pageI-04 01problem PDFFarooq Sheikh Farooq SheikhNo ratings yet

- Exhibit 7. Revenue and Expense RecognitionDocument6 pagesExhibit 7. Revenue and Expense RecognitionЭниЭ.No ratings yet

- Accounting Cycle Week 2 ReviewerDocument11 pagesAccounting Cycle Week 2 ReviewerVinz Danzel BialaNo ratings yet

- ACCT 490 Assignment 1Document7 pagesACCT 490 Assignment 1Saad FahadNo ratings yet

- ACCT 2105 Tutorial Exercises - Topic 4 - Income StatementDocument8 pagesACCT 2105 Tutorial Exercises - Topic 4 - Income StatementHoàng Trọng HiếuNo ratings yet

- Rivera and Santos PartnershipDocument31 pagesRivera and Santos PartnershipDaneca GallardoNo ratings yet

- Practice Problems Corporate LiquidationDocument2 pagesPractice Problems Corporate LiquidationAllira OrcajadaNo ratings yet

- Chapter-04 Completing The Accounting Cycle (Maths)Document9 pagesChapter-04 Completing The Accounting Cycle (Maths)ShifatNo ratings yet

- Acc 1 QuizDocument7 pagesAcc 1 QuizAyat MukahalNo ratings yet

- Carlos CompanyDocument5 pagesCarlos Companymohitgaba19No ratings yet

- Homework 4題目Document2 pagesHomework 4題目劉百祥No ratings yet

- Tutorial 3Document14 pagesTutorial 3NURSUHAILI IZZATI ABU BAKARNo ratings yet

- FundAcct I @2015 AssignmntDocument6 pagesFundAcct I @2015 AssignmntGedion FeredeNo ratings yet

- MC 2 - A201 - QuestionDocument6 pagesMC 2 - A201 - Questionlim qsNo ratings yet

- Instructor Questionaire AccountingDocument4 pagesInstructor Questionaire AccountingjovelioNo ratings yet

- Sample Midterm Exam With SolutionDocument17 pagesSample Midterm Exam With Solutionq mNo ratings yet

- Completing The Accounting Cycle: Service Concern: Subject-Descriptive Title Subject - CodeDocument12 pagesCompleting The Accounting Cycle: Service Concern: Subject-Descriptive Title Subject - CodeRose LaureanoNo ratings yet

- Fa 6 Ans Key Q.P Code 75847 PDFDocument16 pagesFa 6 Ans Key Q.P Code 75847 PDFAmar ChapniyaNo ratings yet

- Accountancy Auditing 2016Document7 pagesAccountancy Auditing 2016Abdul basitNo ratings yet

- AFAR02 05 CORPORATE Liquidation HandoutDocument3 pagesAFAR02 05 CORPORATE Liquidation HandoutNicoleNo ratings yet

- 8905 Corporate Liquidation Answers PDFDocument14 pages8905 Corporate Liquidation Answers PDFYADAO, EloisaNo ratings yet

- 8905 Corporate Liquidation Answers PDFDocument14 pages8905 Corporate Liquidation Answers PDFJamaica David100% (2)

- Addtional Cash Flow Problems and SolutionsDocument7 pagesAddtional Cash Flow Problems and SolutionsHossein ParvardehNo ratings yet

- AFAR-02 Corporate LiquidationDocument2 pagesAFAR-02 Corporate LiquidationRamainne RonquilloNo ratings yet

- Adjusting EntriesDocument5 pagesAdjusting EntriesM Hassan BrohiNo ratings yet

- Midterms Problem SolvingDocument3 pagesMidterms Problem SolvingTRINA ARUTANo ratings yet

- Chapter 4 Question Review 11th EdDocument9 pagesChapter 4 Question Review 11th EdEmiraslan MhrrovNo ratings yet

- Christ University, Bangalore-560029: Sub: Advanced Financial Accounting Section ADocument5 pagesChrist University, Bangalore-560029: Sub: Advanced Financial Accounting Section AAnonymous eq1U5a4vCSNo ratings yet

- Preparing Financial Statements: Key Terms and Concepts To KnowDocument27 pagesPreparing Financial Statements: Key Terms and Concepts To KnowTrisha Monique VillaNo ratings yet

- Preparing Financial Statements: Key Terms and Concepts To KnowDocument27 pagesPreparing Financial Statements: Key Terms and Concepts To KnowMohammed AkramNo ratings yet

- 105 PrelimDocument10 pages105 PrelimEly DoNo ratings yet

- Exercise Chapter 3Document7 pagesExercise Chapter 3leen attilyNo ratings yet

- PSA-NAM App CGA SubDocument3 pagesPSA-NAM App CGA SubMuhammad TariqNo ratings yet

- Module 10 BAEN 1 Principles of Accounting BSBADocument13 pagesModule 10 BAEN 1 Principles of Accounting BSBARyan Joseph GoNo ratings yet

- Exercise 2BDocument2 pagesExercise 2Bmytu261105No ratings yet

- Assessment MerchandisingDocument2 pagesAssessment MerchandisingPauline BiancaNo ratings yet

- Chapter 5Document27 pagesChapter 5nadima behzadNo ratings yet

- Brianne Kylle Dela Cruz FSA3 10 20 21Document35 pagesBrianne Kylle Dela Cruz FSA3 10 20 21Kathlene JaoNo ratings yet

- Brianne Kylle Dela Cruz FSA3 111Document29 pagesBrianne Kylle Dela Cruz FSA3 111Kathlene JaoNo ratings yet

- IA 3 Final Assessment PDFDocument5 pagesIA 3 Final Assessment PDFJoy Miraflor Alinood100% (1)

- P64571RA Lcci Level 4 Certificate in Financial Accounting ASE20101 RB Sep 2020Document8 pagesP64571RA Lcci Level 4 Certificate in Financial Accounting ASE20101 RB Sep 2020Musthari KhanNo ratings yet

- Accounting Assignment 04A 207Document10 pagesAccounting Assignment 04A 207Aniyah's RanticsNo ratings yet

- 05 Completing The Accounting Cycle PROBLEMSDocument5 pages05 Completing The Accounting Cycle PROBLEMSbetlogNo ratings yet

- Statement of CashflowDocument9 pagesStatement of CashflowOwen Lustre50% (2)

- Spring Semester 2019 Final Exam Closed Notes: INSTRUCTOR: Marios MavridesDocument4 pagesSpring Semester 2019 Final Exam Closed Notes: INSTRUCTOR: Marios MavridesyandaveNo ratings yet

- Chapter 4 - Complete The Accounting Cycle Practice Set A: Exercise 4.1A - Prepare Correcting EntriesDocument8 pagesChapter 4 - Complete The Accounting Cycle Practice Set A: Exercise 4.1A - Prepare Correcting EntriesBảo GiangNo ratings yet

- Working Paper-Chapters 1-4 Naser AbdelkarimDocument5 pagesWorking Paper-Chapters 1-4 Naser AbdelkarimHasan NajiNo ratings yet

- 05 - Completion of The Accounting Cycle (Notes) PDFDocument3 pages05 - Completion of The Accounting Cycle (Notes) PDFJamie ToriagaNo ratings yet

- San Beda College Alabang: INSTRUCTION: Worksheet PreparationDocument1 pageSan Beda College Alabang: INSTRUCTION: Worksheet PreparationMarriel Fate CullanoNo ratings yet

- Class ExerciseDocument14 pagesClass ExerciseAbdul Basit MalikNo ratings yet

- Chapter 10 PPTDocument48 pagesChapter 10 PPTkjw 2No ratings yet

- Chapter - 03 - PPT (Supplementary To ISpace)Document43 pagesChapter - 03 - PPT (Supplementary To ISpace)kjw 2No ratings yet

- Structure of A Persuasive EssayDocument1 pageStructure of A Persuasive Essaykjw 2No ratings yet

- ACCT2003 POAI - Assignment 3 - Questions Only - REVISEDDocument2 pagesACCT2003 POAI - Assignment 3 - Questions Only - REVISEDkjw 2No ratings yet

- Hong Kong Taxation Unit 1 - SC - 08092020 (R)Document61 pagesHong Kong Taxation Unit 1 - SC - 08092020 (R)kjw 2No ratings yet

- Chapter 03 PPT 3Document39 pagesChapter 03 PPT 3kjw 2No ratings yet

- Muntindilaw National High School: School Grade Level: Teacher: Learning Area Teaching Date and Time: QuarterDocument7 pagesMuntindilaw National High School: School Grade Level: Teacher: Learning Area Teaching Date and Time: QuarterMaricel EspadillaNo ratings yet

- Gaap VS IfrsDocument4 pagesGaap VS IfrsPrasannaNo ratings yet

- (Document Title) : Sinta (COMPANY NAME) (Company Address)Document8 pages(Document Title) : Sinta (COMPANY NAME) (Company Address)sintaindraniNo ratings yet

- Acca Supplementary NotesDocument185 pagesAcca Supplementary NotesSuniel JamilNo ratings yet

- Introduction To AccountingDocument39 pagesIntroduction To AccountingVikash HurrydossNo ratings yet

- LD - Answer KeyDocument10 pagesLD - Answer KeyJeffrey Lois Sereño MaestradoNo ratings yet

- Financial Department: Hindustan Construction CompanyDocument7 pagesFinancial Department: Hindustan Construction CompanyRahul SwarraazNo ratings yet

- Thai GAAP Comparison GL IFRSDocument17 pagesThai GAAP Comparison GL IFRSBebe RithnakaNo ratings yet

- TB CHDocument77 pagesTB CHg202301230No ratings yet

- Statement of Financial Position As at 31st March 2015Document52 pagesStatement of Financial Position As at 31st March 2015Shameel IrshadNo ratings yet

- Part1 Topic 4 Reconstitution of PartnershipDocument21 pagesPart1 Topic 4 Reconstitution of PartnershipShivani ChoudhariNo ratings yet

- LVMH ValuationDocument56 pagesLVMH ValuationJosé Manuel EstebanNo ratings yet

- Assignment 02: Course: Finance and Accounting For EngineeringDocument7 pagesAssignment 02: Course: Finance and Accounting For EngineeringRaja Awais LiaqautNo ratings yet

- CH 08Document75 pagesCH 08Surabaya Lindungi 2021No ratings yet

- KIESODocument21 pagesKIESOMuhammad Faris100% (2)

- 1 - Cfa-2018-Quest-Bank-R21-Financial-Statement-Analysis-An-Introduction-Q-BankDocument7 pages1 - Cfa-2018-Quest-Bank-R21-Financial-Statement-Analysis-An-Introduction-Q-BankQuyen Thanh NguyenNo ratings yet

- Elimination Questions Elimination QuestionsDocument4 pagesElimination Questions Elimination QuestionsasffghjkNo ratings yet

- Chapter 2 FACADocument28 pagesChapter 2 FACAAnshumanSinghNo ratings yet

- Test Bank For Accounting Principles 13th Edition WeygandtDocument37 pagesTest Bank For Accounting Principles 13th Edition Weygandtbiolyticcrotonicvud19100% (29)

- C. I - A II - C: B. People Prefer To Keep Their Wealth in Relativel !table F Orei"n C#rrencDocument14 pagesC. I - A II - C: B. People Prefer To Keep Their Wealth in Relativel !table F Orei"n C#rrencRica RegorisNo ratings yet

- General Journal BestDocument12 pagesGeneral Journal BestNhatty WeroNo ratings yet

- Ias 27Document10 pagesIas 27Jona Mae MillaNo ratings yet

- Easton 6E Module 2 (7 Files Merged)Document445 pagesEaston 6E Module 2 (7 Files Merged)KhairulBasherSujonNo ratings yet

- CBSE Class 11 Accounting-End of Period AccountsDocument34 pagesCBSE Class 11 Accounting-End of Period AccountsRudraksh PareyNo ratings yet

- Mand CHODocument7 pagesMand CHOMichael BaguyoNo ratings yet

- Merged Income Statement and Balance Sheet of Pacific Grove Spice CompanyDocument9 pagesMerged Income Statement and Balance Sheet of Pacific Grove Spice CompanyArnab SarkarNo ratings yet

- Answer: D: ©cambridge Business Publishers, 2017 Quiz Solutions, Chapter 3 3-1Document5 pagesAnswer: D: ©cambridge Business Publishers, 2017 Quiz Solutions, Chapter 3 3-1Hendra SetiyawanNo ratings yet

- Consolidated Financial Statement-Part 3Document6 pagesConsolidated Financial Statement-Part 3JINKY TOLENTINONo ratings yet

- Diagram 1.1: (Book of Original Entry) Office Equipment XXXX Cash XXXX Accounts Payable XXXXDocument14 pagesDiagram 1.1: (Book of Original Entry) Office Equipment XXXX Cash XXXX Accounts Payable XXXXEfi of the IsleNo ratings yet

- AccountsDocument11 pagesAccountsaashishNo ratings yet