Professional Documents

Culture Documents

Example:: Source of Assets (SA) - An Asset Account Increases and A Corresponding Claims 1

Uploaded by

Shoyo HinataOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Example:: Source of Assets (SA) - An Asset Account Increases and A Corresponding Claims 1

Uploaded by

Shoyo HinataCopyright:

Available Formats

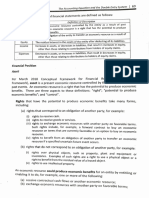

1. Source of Assets (SA).

An asset account increases and a corresponding claims

(liabilities or owner's equity) account increases. Examples: (1) Purchase of supplies

on account; (2) Sold goods on cash on delivery basis. A OE

2 Exchange of Assets (EA). One asset account increases and another asset account

decreases. Example: Acquired equipment for cash.

3. Use of Assets (UA). An asset accout decreases and a corresponding claims

(liabilities or equity) account decreases. Example: (1) Settled accounts payable; (2)

Paid salaries of employees. A

4. Exchange of Claims (EC). One claims (liabilities or owner's equity) account increases

and another claims (liabilities or owner's equity) account decreases. Example:

Received utilities bill but did not pay.

Every accountable event has a dual but self-balancing effect on the accounting equation.

Recognizing these events will not in any manner affect the equality of the basic

accounting model. The four types of transactions above may be further expanded into

nine types of effects as follows:

Increase in Assets = Increase in Liabilities (SA)

2. Increase in Assets = Increase in Owner's Equity (SA)

3.

3. Increase in one Asset = Decrease in another Asset (EA)

4. Decrease in Assets Decrease in Liabilities (UA)

5.

5. Decrease in Assets = Decrease in Owner's Equity (UA)

6. Increase in Liabilities = Decrease in Owners Equity (EC)

7. Increase in Owner's Equity = Decrease in Liabilities (EC)

8. Increase in one Liability Decrease in another Liability (EC)

9 Increase in one Owner's Equity Decrease in another Owner's Equity (EC)

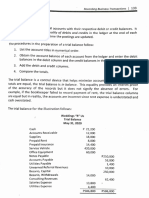

TYPICAL ACCOUNT TITLES USED

STATEMENT OF FINANCIAL POSITION

Assets

Assets are should be classified only into two: current assets and non-current assets. Per

revised Philippine Accounting Standards (PAS) No. 1, an entity shall classify assets as

Current when:

a. it expects to realize the asset, or intends to sell or consume it, in its normal

operating cycle;

b, it holds the asset primarily for the purpose of trading;

C. it expects to realize the asset within twelve months after the reporting period; or

d. the asset is cash or à cash equivalent (as defined in PAS No. 7) unless the asset is

restricted from being exchanged or used to settle a liability for at least twelve

months after the reporting period.

All other assets should be classified as non-current assets. Operating cycle is the time

between the acquisition of assets for processing and their realization in cash or cash

equivalents. When the entity's normal operating cycle is not clearly identifiable, it is

assumed to be twelve months.

You might also like

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Internal Management Information : Education/AcademeDocument1 pageInternal Management Information : Education/AcademeShoyo HinataNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5795)

- Qualified: Management AccountingDocument1 pageQualified: Management AccountingShoyo HinataNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Chap. 2Document1 pageChap. 2Shoyo HinataNo ratings yet

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Oartnership: AccouDocument1 pageOartnership: AccouShoyo HinataNo ratings yet

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Equal The: Credits. These Are The Rules of Debit and Credit. The Following Summarizes The RulesDocument1 pageEqual The: Credits. These Are The Rules of Debit and Credit. The Following Summarizes The RulesShoyo HinataNo ratings yet

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- AssetDocument1 pageAssetShoyo HinataNo ratings yet

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The JournalDocument1 pageThe JournalShoyo HinataNo ratings yet

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Accounting CycleDocument1 pageAccounting CycleShoyo HinataNo ratings yet

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Optimal Decisions Using Marginal AnalysisDocument6 pagesOptimal Decisions Using Marginal AnalysisShoyo Hinata100% (1)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Accounting: Postings UpdatedDocument1 pageAccounting: Postings UpdatedShoyo HinataNo ratings yet

- LiiiiiiiiiiittttDocument2 pagesLiiiiiiiiiiittttShoyo HinataNo ratings yet

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Bus. TransactionsDocument1 pageBus. TransactionsShoyo HinataNo ratings yet

- Acc. QuestionsDocument1 pageAcc. QuestionsShoyo HinataNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- CASE PROBLEM: The Not-So-Harmless Cage DiversDocument2 pagesCASE PROBLEM: The Not-So-Harmless Cage DiversShoyo HinataNo ratings yet

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Registration For Campus Organizations: Kabacan, Cotabato PhilippinesDocument2 pagesRegistration For Campus Organizations: Kabacan, Cotabato PhilippinesShoyo HinataNo ratings yet

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Accounting Profession Definition of Accounting: Important PointsDocument9 pagesThe Accounting Profession Definition of Accounting: Important PointsShoyo HinataNo ratings yet

- Module 3 Section 3 TaskDocument1 pageModule 3 Section 3 TaskShoyo Hinata0% (1)

- 2 NDDDDDDocument2 pages2 NDDDDDShoyo HinataNo ratings yet

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Partnership Liquidation 1Document17 pagesPartnership Liquidation 1Shoyo HinataNo ratings yet

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Brooks FM PPT Ch06 BBDocument33 pagesBrooks FM PPT Ch06 BBghj9818No ratings yet

- Horngren Ima16 Tif 07 GEDocument59 pagesHorngren Ima16 Tif 07 GEasem shaban100% (3)

- Grievance SGDocument41 pagesGrievance SGsandipgargNo ratings yet

- Financial Accounting The Impact On Decision Makers 10th Edition Porter Solutions ManualDocument41 pagesFinancial Accounting The Impact On Decision Makers 10th Edition Porter Solutions Manualhildabacvvz100% (27)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Senior Deal Officer-JDDocument2 pagesSenior Deal Officer-JDgitarista007No ratings yet

- China Policy Financial Bonds PrimerDocument39 pagesChina Policy Financial Bonds PrimerbondbondNo ratings yet

- Medical Group: 1-888-236-2263. Our Office Hours Are Monday Through Friday 8:00a.m.to 4:30p.mDocument3 pagesMedical Group: 1-888-236-2263. Our Office Hours Are Monday Through Friday 8:00a.m.to 4:30p.menergizerabbyNo ratings yet

- Mathoot Finanace ProjectsDocument32 pagesMathoot Finanace ProjectsMayank Jain NeerNo ratings yet

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- August 19, 2016Document16 pagesAugust 19, 2016Anonymous KMKk9Msn5No ratings yet

- Accomplishment Report 1ST Sem Ay 16 17Document5 pagesAccomplishment Report 1ST Sem Ay 16 17JPIA MSU-IITNo ratings yet

- Course DetailDocument3 pagesCourse DetailNajlaNo ratings yet

- Master Budget AssignmentDocument11 pagesMaster Budget AssignmentShivam Dhawan0% (1)

- The Sales ProcessDocument19 pagesThe Sales ProcessHarold Dela FuenteNo ratings yet

- Gold Price PredictionDocument14 pagesGold Price Predictionswetha reddy100% (1)

- Pta Financial StatementDocument2 pagesPta Financial StatementDecember Cool100% (1)

- Overview of Financial Statement Analysis: Mcgraw-Hill/Irwin ©2007, The Mcgraw-Hill Companies, All Rights ReservedDocument45 pagesOverview of Financial Statement Analysis: Mcgraw-Hill/Irwin ©2007, The Mcgraw-Hill Companies, All Rights ReservedMutiara RamadhaniNo ratings yet

- Algorithmic Trading and Quantitative StrategiesDocument7 pagesAlgorithmic Trading and Quantitative StrategiesSelly YunitaNo ratings yet

- Consolidated Statements of Changes in Equity: Samsung Electronics Co., Ltd. and Its SubsidiariesDocument4 pagesConsolidated Statements of Changes in Equity: Samsung Electronics Co., Ltd. and Its SubsidiarieschirahotoNo ratings yet

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- BAUTISTA BAFIMARX ACT181, Activity 2Document3 pagesBAUTISTA BAFIMARX ACT181, Activity 2Joshua BautistaNo ratings yet

- Performance Evaluation of Mutual Funds" Conducted at EMKAY GLOBAL FINANCIAL SERVICES PRIVATE LTDDocument74 pagesPerformance Evaluation of Mutual Funds" Conducted at EMKAY GLOBAL FINANCIAL SERVICES PRIVATE LTDPrashanth PBNo ratings yet

- Factors Affecting The Success Failure of PDFDocument12 pagesFactors Affecting The Success Failure of PDFavishain1No ratings yet

- Financial Planning and ForecastingDocument25 pagesFinancial Planning and ForecastingAhsan100% (2)

- Final Project SBI (SIP)Document35 pagesFinal Project SBI (SIP)shwetanksetu50% (4)

- Accounting For Business Combination PART 1Document30 pagesAccounting For Business Combination PART 1Niki DimaanoNo ratings yet

- Explanation of SecuritizationDocument15 pagesExplanation of SecuritizationForeclosure Fraud100% (15)

- RM48,000 X 9% X 90/365Document4 pagesRM48,000 X 9% X 90/365Nurul SyakirinNo ratings yet

- Welcome Letter BonanzzaDocument3 pagesWelcome Letter BonanzzaNimish MethiNo ratings yet

- Tanjore Chattram Endowments (Utilization) Act, 1942Document4 pagesTanjore Chattram Endowments (Utilization) Act, 1942Latest Laws TeamNo ratings yet

- Capital Budgeting: Workshop Questions: Finance & Financial ManagementDocument12 pagesCapital Budgeting: Workshop Questions: Finance & Financial ManagementJuan SanguinetiNo ratings yet

- Chapter One 1.1 Background of The StudyDocument3 pagesChapter One 1.1 Background of The StudyAnjana NagarkotiNo ratings yet