Professional Documents

Culture Documents

Cost Accounting & Control 1

Uploaded by

Mary Lace VidalCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Cost Accounting & Control 1

Uploaded by

Mary Lace VidalCopyright:

Available Formats

Cost Accounting & Control 1

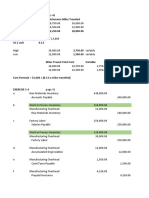

PROBLEM 1

Direct Materials

Purchases 430,000

Less: Increase in raw materials 15,000 415,000

Direct Labor 200,000

Factory Overhead 300,000

Manufacturing Cost 915,000

Add: Decrease in Finished Goods 35,000

Cost of Goods Sold 950,000

Answer: ₱950,000

PROBLEM 2

Cost of Good Manufactured for April :

Beginning Materials Inventory 32,400

Add: Direct Materials 40,000

Direct Labour 33,000

Factory Overhead 17,160

Beginning Work in Process Inventory 7,200

Finished Good Inventory (Beginning) 8,000

Less: Ending Materials Inventory 34,000

Ending Work In Process Inventory 16,240

Ending Good Inventory 6,000

81,520

Answer: ₱81, 520

PROBLEM 3

Cost of Materials Purchased= (Ending Materials- Beginning Materials) + Cost of Goods Sold

(17,000-16,000) + 100,600=101,600

Answer: ₱101,600

PROBLEM 4

Cost of Goods Sold in 2018:

Beginning Materials Inventory 44,000

Add: Raw Materials Purchased 600,000

Direct Labor Cost 240,000

Indirect Labor Cost 120,000

Taxes,utilities and depreciation 100,000

Sales and Officce Salaries 128,000

Beginning Work in Process Inventory 80,000

Finished Good Inventory (Beginning) 50,000

Less: Ending Materials Inventory 60,000

Ending Work In Process Inventory 96,000

Ending Good Inventory 36,000

Cost of Goods Sold 1,170,000

Answer: ₱1,170,000

PROBLEM 5

Direct Materials Inventory:

Prime Cost is equals to Direct Materials plus Direct Labor

Prime Cost 301,000

Less:Direct Labor 180,000

Material Used in Production 121,000

Materials Beg. 16,000

Direct Material Purchased 170,000

Available Materials used in the production 186,000

Materials Used in th Production 121,000

Materials Burned by fire 65,000

Work In Process Inventory:

Cost of Goods Manufactured:

Cost of Goods Available for Sale 460,000

Less: Finished Goods Beg. 30,000

Cost of Goods Manufactured 430,000

Beg. Balance 34,000

Prime Cost 301,000

Factory Overhead 120,000

Less: Cost of Goods Manufactured 430,000

Work in Process End 25,000

Finished Goods Inventory:

Gross Profit on sales is 20%

Finished Goods Beg. 30,000

Cost of Goods Manufactured 430,000

Less: COGS 400,000

Finished Goods Ending 60,000

Answer: (1) ₱65,000 (2) ₱ 25,000 (3) ₱60,000

PROBLEM 6

Amount of Materials Purchased (gross)

Ending Inventory-Beginning Inventory +Cost of Goods Sold

Indirect labor 12,160

Direct labor 32,640

Freight in 5,570

Materials inventory 9,640

Overhead expenses 31,730

Indirect materials 21,390

Work in process end 7,820

Factory costs 194,080

Less: Beg. Materials 11,620

Work in process beg 5,740

297,670

Gross Profit

Sales (15,000 units) 360,000

Amount purchased 297,670

62,330

Answer: (1) ₱297,670 (2) ₱62,330

PROBLEM 7

Cost of Goods Sold 111,000

Finished Goods Inventory, December 31 17,500

Cost of Goods Available for Sale 128,500

Sales 182,000

Cost of Goods Sold 111,000

Gross Profit 71,000

Less: Marketing Expenses 14,000

General and Administrative Expenses 22,900 36,900

Operating Income 34,100

Answer: (1) ₱ 128, 500 (2) ₱ 34,100

PROBLEM 8

Cost of Materials Purchased= 326,000 +85,000- 75,000= 336,000

Total of Direct Labor and Applied manufacturing overhead= 686,000- 326,000=360,000

Let labor cost be Y.

Y + 0.6Y= 360,000

1.6Y= 360,000

Y= 225,000

Labor Cost charged to production is 225,000

Total manufacturing cost 686,000

Add Beginning work in process 80,000

Less Ending work in process 30,000

Cost of Goods manufactured 736,000

Answer: (1) ₱336,000 (2) ₱225,000 (3) ₱736,000

PROBLEM 9

Beginning raw materials 24,000

Add: Raw materials purchased 56,000

Materials available for use 80,000

Less: Ending raw materials inventory 20,000

Materials used in production 60,000

Add: Direct labor used 40,000

Prime Cost 100,000

Direct labor 40,000

Factory overhead [(40,000/6.40) x 8] 50,000

Conversion Cost 90,000

Answer: (1) ₱100,000 (2) ₱ 90,000

PROBLEM 10

Direct Materials Accounts:

Beginning direct materials+direct material purchases-ending direct materials

Beg.=100,000 + 90,000-(180,000-20,000)

Beg.=190,000-160,000

Direct material= 30,000

Work In Process Account:

Beginning Work in process Inv. + Manufacturing Costs-Cost of Goods Sold

= 35,000+72,000+20,000+56,000-180,000

Work in Process End= 3,000

Answer: (1) ₱30,000 (2) ₱3,000

PROBLEM 11

Materials used 440,000

Direct labor 290,000

Applied factory overhead (290,000x30%) 87,000

Factory cost 817,000

Work in process inventory, april 1 19x7 41,200

Total 858,200

Work in process inventory, april 1, 19x8 42,500

Cost of goods manufactured 815,700

Unit Cost (815,700/18,000 units) 45.32

Applied factory overhead 87,000

Actual factory overhead

Indirect labor 46,000

Light and Power 4,260

Depreciation 4,700

Repairs 5,800

Miscellaneous 29,000

89,760

Under-applied factory overhead (2,760)

Answer: (1) ₱45.32 (2) (₱2,760)

PROBLEM 12

Direct labor (8,000hrs. x 5.60) + (4,600hrs. x 6.00) 72,400

Factory Overhead (8,000hrs. x 6.00) + (4,600hrs. x 8.00) 84,800

Conversion Cost 157,200

Materials 20,000

Conversion Cost 157,000

End Work in Process 17,600

Materials 60,000

Less:End Materials 18,000

Beg. Finished Goods 22,000

Cost of Goods Sold 214,600

Answer: (1) ₱157,200 (2) ₱214,600

You might also like

- Year6 - GLO-BUS Decisions & Reports - ResultsDocument16 pagesYear6 - GLO-BUS Decisions & Reports - ResultsYFAINNo ratings yet

- Multiple Choice Questions - Theoretical and ComputationalDocument276 pagesMultiple Choice Questions - Theoretical and ComputationalIzzy B75% (12)

- Cost Accounting (De Leon) Chapter 3 SolutionsDocument9 pagesCost Accounting (De Leon) Chapter 3 SolutionsLois Alveez Macam85% (26)

- Assignment 3 Accounting PDFDocument11 pagesAssignment 3 Accounting PDFjgfjhf arwtr100% (1)

- Muhammad Kashif Raheem 5212 Cost Accounting Sir Naveed AlamDocument8 pagesMuhammad Kashif Raheem 5212 Cost Accounting Sir Naveed AlamKashif RaheemNo ratings yet

- Bacolod, Queenie Rose C. BSA2-B Summary of Answers Problem 5-Chapter 3 Requirement 1-Journal EntriesDocument7 pagesBacolod, Queenie Rose C. BSA2-B Summary of Answers Problem 5-Chapter 3 Requirement 1-Journal EntriesQueenie Rose BacolodNo ratings yet

- Solution Prelim ExamDocument30 pagesSolution Prelim ExamMedalla NikkoNo ratings yet

- Tugas Week 3 Bryan Luke AkbiDocument2 pagesTugas Week 3 Bryan Luke AkbiBryan LukeNo ratings yet

- Problem 1-20: 1 JGG Manufacturing Company Manufacturing CostDocument9 pagesProblem 1-20: 1 JGG Manufacturing Company Manufacturing CostMackenzie Heart Obien0% (1)

- Shaina Camaganacan BSA-2 Year Cost AccountingDocument2 pagesShaina Camaganacan BSA-2 Year Cost AccountingShaina CamaganacanNo ratings yet

- Cost Accounting Chapter 3Document5 pagesCost Accounting Chapter 3Jenefer DianoNo ratings yet

- MCMCDocument6 pagesMCMCIT GAMINGNo ratings yet

- 625009eef26fe Cost Accounting and Cost Management 1 Quiz No. 2Document2 pages625009eef26fe Cost Accounting and Cost Management 1 Quiz No. 2El Jehn Grace Babor - Ledesma100% (1)

- Accounting For Managers Canadian 1st Edition Collier Solutions ManualDocument17 pagesAccounting For Managers Canadian 1st Edition Collier Solutions Manualnicholassmithyrmkajxiet100% (24)

- Chapter 04Document4 pagesChapter 04Nouman BaigNo ratings yet

- Module 3 Exercises - Costing Concepts and CalculationsDocument13 pagesModule 3 Exercises - Costing Concepts and Calculationsdiane camansagNo ratings yet

- Chapter 1 Question Review - 102Document5 pagesChapter 1 Question Review - 102Mark Joseph CanoNo ratings yet

- Jawaban Perhitungan Dan Akumulasi BiayaDocument7 pagesJawaban Perhitungan Dan Akumulasi BiayaEka OematanNo ratings yet

- Cost Accounting AnswersDocument10 pagesCost Accounting AnswersHaris KhanNo ratings yet

- Cost AccountingDocument3 pagesCost Accountingdisturbedguy048No ratings yet

- Costcon 1Document3 pagesCostcon 1Frances Clayne GonzalvoNo ratings yet

- Journal Entries and Cost of Goods SoldDocument23 pagesJournal Entries and Cost of Goods SoldCatherine OrdoNo ratings yet

- Test 1 ProblemsDocument48 pagesTest 1 ProblemsKaira Arora50% (2)

- Cost AcctngDocument3 pagesCost AcctngairaguevarraNo ratings yet

- Quiz 1 Answers KeyDocument3 pagesQuiz 1 Answers KeyDesiree100% (1)

- Cost Accounting. ActivityDocument6 pagesCost Accounting. ActivityReida DelmasNo ratings yet

- Chapter 1 ExercisesDocument18 pagesChapter 1 ExercisesJenny Brozas JuarezNo ratings yet

- Ending Balance 28,000Document2 pagesEnding Balance 28,000Christine Marie T. RamirezNo ratings yet

- Cost Concepts Exercises - Guide AnswersDocument10 pagesCost Concepts Exercises - Guide AnswersJohn Carlo CialanaNo ratings yet

- Acco 20073 Discussion Sy2122 (Bsma 2-4)Document81 pagesAcco 20073 Discussion Sy2122 (Bsma 2-4)Paul BandolaNo ratings yet

- Juarez, Jenny Brozas - Activity 1 MidtermDocument19 pagesJuarez, Jenny Brozas - Activity 1 MidtermJenny Brozas JuarezNo ratings yet

- JOC (Discussion)Document10 pagesJOC (Discussion)Luisa ColumbinoNo ratings yet

- Cost 1 and Cost 2 Compilation of Quizzes and Brain Teasers With Solutions in ProblemsDocument19 pagesCost 1 and Cost 2 Compilation of Quizzes and Brain Teasers With Solutions in ProblemsKieNo ratings yet

- Drill12 Drill13 Manufacturing BusinesDocument6 pagesDrill12 Drill13 Manufacturing BusinesAngelo FelizardoNo ratings yet

- Solution To Activity 2Document3 pagesSolution To Activity 2Lee Thomas Arvey FernandoNo ratings yet

- DG8C3UQW6Document16 pagesDG8C3UQW6gumbanaleahfateNo ratings yet

- Cost Accounting AssignmentDocument6 pagesCost Accounting AssignmentCharles BarcelaNo ratings yet

- Answer Key (SW1 To SW3)Document6 pagesAnswer Key (SW1 To SW3)MA. CRISSANDRA BUSTAMANTENo ratings yet

- Module 3 QuizDocument9 pagesModule 3 QuizjmjsoriaNo ratings yet

- 2 Manufacturing ProblemsDocument18 pages2 Manufacturing Problemsone dev onliNo ratings yet

- Set9 P3Document5 pagesSet9 P3Geriq Joeden PerillaNo ratings yet

- Cost AccountingDocument3 pagesCost AccountingRajibNo ratings yet

- CH 2 - SupplementDocument5 pagesCH 2 - SupplementCa WUNo ratings yet

- Task 1: Cost Classfication Task 1 Has 3 Questions in TotalDocument3 pagesTask 1: Cost Classfication Task 1 Has 3 Questions in TotalNgọc Trâm TrầnNo ratings yet

- UntitledDocument4 pagesUntitledJomar PenaNo ratings yet

- Lecture 3 Job Order CostingDocument20 pagesLecture 3 Job Order CostingTheresa RoqueNo ratings yet

- Assignment 3 Managerial Accounting: Submitted By-Ghayoor Zafar Submitted To - DR MohsinDocument11 pagesAssignment 3 Managerial Accounting: Submitted By-Ghayoor Zafar Submitted To - DR Mohsinjgfjhf arwtr100% (1)

- ACA 211: Calculating Ending Inventory After FireDocument2 pagesACA 211: Calculating Ending Inventory After FireRosethel Grace GallardoNo ratings yet

- Answers to Activity 1 WorksheetDocument5 pagesAnswers to Activity 1 WorksheetjangjangNo ratings yet

- Raw Materials Inventory Problem SetDocument2 pagesRaw Materials Inventory Problem SetVon Andrei MedinaNo ratings yet

- Multiple Choice Questions ReviewDocument46 pagesMultiple Choice Questions ReviewMarylorieanne CorpuzNo ratings yet

- Answer Question One: Assignment-1 Managerial AccountingDocument8 pagesAnswer Question One: Assignment-1 Managerial AccountingMina OsamaNo ratings yet

- Quiz Feb24Document5 pagesQuiz Feb24E RDNo ratings yet

- Reversing EntriesDocument4 pagesReversing EntriesCatherine GonzalesNo ratings yet

- Easy Northern Forest Products 90 Copy of 0 324 53131 1 Case 90DIRDocument5 pagesEasy Northern Forest Products 90 Copy of 0 324 53131 1 Case 90DIRPhạm Hà DươngNo ratings yet

- Polytechnic University of the Philippines Management Accounting Mid-Term ExamDocument12 pagesPolytechnic University of the Philippines Management Accounting Mid-Term ExamApril Roes Catimbang OrlinNo ratings yet

- Financial Accounting Module 6 SummaryDocument6 pagesFinancial Accounting Module 6 SummaryKashika LathNo ratings yet

- Properaite and Corporate Transaction AccountingDocument41 pagesProperaite and Corporate Transaction Accountingroheed100% (1)

- Classification of Accounts PDFDocument3 pagesClassification of Accounts PDFLuzz Landicho100% (1)

- Airport Development ProjectDocument21 pagesAirport Development ProjectDeepak NechlaniNo ratings yet

- Baton Rouge Real Estate Home Sales GBRMLS Area 53 August 2011 Versus August 2012Document21 pagesBaton Rouge Real Estate Home Sales GBRMLS Area 53 August 2011 Versus August 2012Bill CobbNo ratings yet

- Contoh Soal Uts Akm 2Document3 pagesContoh Soal Uts Akm 2doland gamingNo ratings yet

- Jurnal Eliminasi Dan Penyesuaian P5.1Document7 pagesJurnal Eliminasi Dan Penyesuaian P5.1Rizqi Shofia Az ZahraNo ratings yet

- Octorara Area School District - Financial and Compliance ReportDocument80 pagesOctorara Area School District - Financial and Compliance ReportTimothy AlexanderNo ratings yet

- Project Appraisal: Course No. ET ZC414Document45 pagesProject Appraisal: Course No. ET ZC414mohimran2002No ratings yet

- Financial Management R. KitDocument241 pagesFinancial Management R. KitDamaris100% (1)

- AccountingDocument72 pagesAccountingOmar SanadNo ratings yet

- Advanced Financial Accounting & Reporting AnswerDocument13 pagesAdvanced Financial Accounting & Reporting AnswerMyat Zar GyiNo ratings yet

- IFRS 1 First-time Adoption SummaryDocument2 pagesIFRS 1 First-time Adoption SummarypiyalhassanNo ratings yet

- FAR Problems and Exercises Part 7 FS Preparation Service Type With AnswersDocument4 pagesFAR Problems and Exercises Part 7 FS Preparation Service Type With AnswersReniella AllejeNo ratings yet

- CFAS SemiFinalDocument4 pagesCFAS SemiFinalJoy CastillonNo ratings yet

- Ubc SalaryDocument185 pagesUbc SalaryGary WangNo ratings yet

- Inventory Management TechniquesDocument41 pagesInventory Management TechniquesElizabeth HdzNo ratings yet

- Jamaica Broilers Group RatiosDocument93 pagesJamaica Broilers Group RatiosJasmine JacksonNo ratings yet

- 2 Income StatementDocument3 pages2 Income Statementapi-299265916No ratings yet

- BINI General Merchandise Answer Key 2Document19 pagesBINI General Merchandise Answer Key 2workwithericajaneNo ratings yet

- Accounting Terminologies FABM 2121Document5 pagesAccounting Terminologies FABM 2121Richard MerkNo ratings yet

- ENT300 - Module 11 - FINANCIAL PLANDocument56 pagesENT300 - Module 11 - FINANCIAL PLANMuhammad Nurazin Bin RizalNo ratings yet

- HO FS AnalsisDocument15 pagesHO FS AnalsisGva Umayam0% (2)

- Foreign Currency ValuationDocument12 pagesForeign Currency ValuationAhmed ElhawaryNo ratings yet

- Pelaporan Korporat - Pertemuan 1 - SAK Dan Conceptual FrameworkDocument82 pagesPelaporan Korporat - Pertemuan 1 - SAK Dan Conceptual FrameworkAlam HarahapNo ratings yet

- Corporate LiquidationDocument4 pagesCorporate LiquidationMae100% (1)