Professional Documents

Culture Documents

Hikal LTD: Crop Protection Propels Growth But Margins Miss

Uploaded by

Rakesh KumarOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Hikal LTD: Crop Protection Propels Growth But Margins Miss

Uploaded by

Rakesh KumarCopyright:

Available Formats

Hikal Ltd (HIKAL)

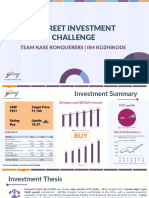

CMP: | 147 Target: | 190 (29%) Target Period: 12 months BUY

August 2, 2019

Crop protection propels growth but margins miss…

Q1 revenues grew 23.8% YoY to | 403.2 crore (I-direct estimate: | 368.4

crore) on account of 15.2% YoY growth in pharma segment to | 203.9 crore

Particulars

Result Update

(I-direct estimate: | 212.4 crore) and 34.1% YoY growth in crop protection

segment to | 199.3 crore (I-direct estimate: | 156.1 crore). EBITDA margins Particular Amount

contracted 163 bps YoY to 17.0%, (I-direct estimate: 18.5%), fall in gross Market Cap | 1811 crore

margins (43.4% vs. 49.4% in Q1FY19) was partly offset by decline in other Debt (FY19) | 661 crore

Cash (FY19) | 32 crore

expenditure. EBITDA grew 13% YoY to | 68.5 crore (I-direct estimate: | 68.1

EV | 2440 crore

crore. Net profit grew 58.4% YoY to | 25.2 crore (I-direct estimate of | 18.5

52 week H/L (|) 207/135

crore). Delta vis-à-vis EBITDA was mainly due to lower interest cost and Equity capital | 24.7 crore

depreciation. Face value |2

Key Highlights

Expertise in APIs to drive pharma growth

Q1FY20 results were higher than I-

Hikal ventured into the pharma API business by virtue of acquisition of direct estimates on revenues and net

Novartis’ Panoli plant in 2000. In a short span of time, banking on its profit front while EBITDA margins

chemistry skills, the company has been able to tap incremental customers were lower mainly due to lower-than-

via the CDMO route. Hikal also operates as a dedicated API supplier as it expected margins reported in crop

expands its portfolio. We expect the pharma segment to grow at a CAGR of protection segment

13.0% in FY19-21E to | 1199 crore on the back of new offerings and repeat

business from CDMO customers. The company has been dealing with

high profile MNCs

Crop protection growth to piggyback on client relationship

ICICI Securities – Retail Equity Research

With proven capabilities and

Hikal started operations as a crop protection company in 1991 after

management pedigree, we believe

acquiring Merck’s facility in Mahad. Since then, it has come a long way with

Hikal offers a compelling value

a predominantly CDMO focused business model catering mainly to global

proposition as it continues to expand

innovators. Over the years, the company has increased its product offerings

in both pharma and crop protection

with a foray into niche products and specialty chemicals. We expect crop

segments

protection segment to grow at 17.8% CAGR in FY19-21E to | 903 crore due

to sustained product offerings and optimum capacity utilisation. This bodes well in the current

scenario when Chinese supply

Valuation & Outlook disturbances are likely to create

opportunities for Indian players

Key takeaways from Q1 numbers were strong growth in crop protection,

steady growth in pharma but lower blended level margins that are Maintain BUY

attributable to a product mix and plant related expenses. The management

Research Analyst

still remains conservative on the revenue growth guidance front (10-15% in

FY20 maintained) as the focus is likely to be on high margin products Siddhant Khandekar

besides a close watch on capacities. With proven capabilities and siddhant.khandekar@icicisecurities.com

management pedigree, we believe Hikal offers a compelling value Mitesh Shah

proposition as it continues to expand in both pharma and crop protection mitesh.sha@icicisecurities.com

segments with separate focus and a calibrated approach. This bodes well in

the current scenario when Chinese supply disturbances are likely to create

opportunities for Indian players both in APIs and crop protection CDMO. We

arrive at a valuation of | 190 based on 14x FY21E EPS of | 13.6.

Key Financial Summary

(| Crore) FY18 FY19 FY20E FY21E CAGR (FY19-21E) %

Revenues 1296.1 1589.6 1827.6 2127.0 15.7

EBITDA 241.7 298.1 317.6 403.0 16.3

EBITDA Margins (%) 18.6 18.8 17.4 18.9

Adjusted PAT 77.2 103.1 125.0 167.2 27.3

EPS (|) 6.3 8.4 10.1 13.6

PE (x) 23.5 17.6 14.5 10.8

EV to EBITDA (x) 10.0 8.2 7.9 6.2

Price to book (x) 2.7 2.4 2.1 1.8

RoE (%) 11.5 13.6 14.5 16.5

RoCE (%) 12.2 14.3 14.8 17.2

Result Update | Hikal Ltd ICICI Direct Research

Exhibit 1: Variance Analysis

| crore Q1FY20 Q1FY20E Q1FY19 Q4FY19 YoY (%) QoQ (%) Comments

YoY growth and beat vis-à-vis I-direct estimates mainly due to robust

Revenue 403.2 368.4 325.6 457.5 23.8 -11.9

growth in crop protection segment

Raw Material Expenses 228.3 188.0 164.7 260.3 38.6 -12.3

Gross Margins (%) 43.4 49.0 49.4 43.1 -602 bps 27 bps YoY decline mainly due to change in product mix

Employee Expenses 42.2 40.5 36.2 36.2 16.4 16.4

Other Expenditure 64.2 71.8 64.0 77.0 0.3 -16.6

Operating Profit (EBITDA) 68.5 68.1 60.6 84.0 13.0 -18.4

YoY decline and miss vis-à-vis I-direct estimates due to 1) change in

EBITDA (%) 17.0 18.5 18.6 18.4 -163 bps -136 bps product mix, 2) increase in insurance premium and 3) plant related

expanses

Interest 12.1 13.7 16.0 12.6 -24.7 -4.7

Depreciation 20.3 27.1 22.6 23.2 -10.0 -12.5

Other Income 0.7 0.0 1.4 0.1 -50.4 1,260.0

PBT 36.8 27.4 23.4 48.2 57.2 -23.5

Tax 11.6 8.9 7.5 14.8 54.7 -21.8

Tax Rate (%) 31.5 32.5 32.0 30.8 -1.6 2.3

Reported PAT 25.2 18.5 15.9 33.3 58.4 -24.3

Adjusted PAT 25.2 18.5 15.9 33.3 58.4 -24.3

Delta vis-à-vis EBITDA and beat on I-direct estimates mainly due to

EPS (|) 2.0 1.5 1.3 2.7 58.4 -24.3

lower interest cost and depreciation

Key Metrics

Pharma 203.9 212.4 177.0 259.2 15.2 -21.3 YoY growth mainly driven by volume gains

YoY growth and beat on I-direct estimates mainly due to strong volume

Crop Protection 199.3 156.1 148.6 198.4 34.1 0.5

growth

Source: ICICI Direct Research

Exhibit 2: Change in Estimates

FY20E FY21E Comments

(| Crore) Old New % Change Old New % Change

Revenue 1,822.0 1,827.6 0.3 2,124.4 2,127.0 0.1

EBITDA 344.1 317.6 -7.7 424.4 403.0 -5.0

EBITDA Margin (%) 18.9 17.4 -151 bps 20.0 18.9 -103 bps Changed as per management guidance

PAT 122.3 125.0 2.2 170.9 167.2 -2.2

EPS (|) 9.9 10.1 2.2 13.9 13.6 -2.2

Source: ICICI Direct Research

Exhibit 3: Change in Estimates

Current Earlier Comments

(| crore) FY18 FY19 FY20E FY21E FY20E FY21E

Pharma 752.8 939.1 1,042.2 1,198.6 1,088.9 1,252.2

Crop Protection 547.3 650.5 785.4 903.2 733.2 843.2 Changed mainly due to better-than-expected sales in Q1FY20

Source: ICICI Direct Research

ICICI Securities | Retail Research 2

Result Update | Hikal Ltd ICICI Direct Research

Exhibit 4: Trends in quarterly performance

(| Crore) Q1FY17 Q2FY17 Q3FY17 Q4FY17 Q1FY18 Q2FY18 Q3FY18 Q4FY18 Q1FY19 Q2FY19 Q3FY19 Q4FY19 Q1FY20 YoY (%) QoQ (%)

Total Operating Income 221.2 232.3 250.8 309.6 262.7 292.3 350.6 390.5 325.6 394.8 406.0 457.5 403.2 23.8 -11.9

Raw Material Expenses 106.9 111.5 123.2 167.5 130.3 155.3 195.6 217.8 164.7 205.8 223.0 260.3 228.3 38.6 -12.3

% of revenue 48.3 48.0 49.1 54.1 49.6 53.1 55.8 55.8 50.6 52.1 54.9 56.9 56.6

Gross Profit 114.3 120.8 127.7 142.1 132.4 136.9 155.1 172.7 160.9 189.0 183.0 197.3 174.9 8.7 -11.3

Gross Profit Margin (%) 51.7 52.0 50.9 45.9 50.4 46.9 44.2 44.2 49.4 47.9 45.1 43.1 43.4 -602 bps 27 bps

Employee Expenses 30.1 28.2 29.0 29.4 33.2 30.2 32.6 32.1 36.2 38.6 39.3 36.2 42.2 16.4 16.4

% of revenue 13.6 12.1 11.6 9.5 12.6 10.3 9.3 8.2 11.1 9.8 9.7 7.9 10.5

Other Expenses 40.7 45.4 50.4 54.5 49.6 53.0 55.6 69.1 64.0 75.2 71.0 77.0 64.2 0.3 -16.6

% of revenue 18.4 19.5 20.1 17.6 18.9 18.1 15.9 17.7 19.7 19.1 17.5 16.8 15.9

Total Expenditure 177.6 185.1 202.6 251.5 213.0 238.5 283.8 319.0 265.0 319.6 333.4 373.5 334.7 26.3 -10.4

% of revenue 80.3 79.7 80.8 81.2 81.1 81.6 80.9 81.7 81.4 81.0 82.1 81.6 83.0

EBITDA 43.6 47.2 48.3 58.1 49.7 53.8 66.9 71.5 60.6 75.2 72.6 84.0 68.5 13.0 -18.4

EBITDA Margins (%) 19.7 20.3 19.2 18.8 18.9 18.4 19.1 18.3 18.6 19.0 17.9 18.4 17.0 -163 bps -136 bps

Depreciation 17.8 17.2 17.1 17.1 21.3 21.5 21.5 21.4 22.6 23.6 23.5 23.2 20.3 -10.0 -12.5

Interest 13.2 11.3 13.7 10.0 11.7 13.1 11.9 12.5 16.0 16.4 13.4 12.6 12.1 -24.7 -4.7

Other Income 0.9 0.9 0.5 1.2 1.6 0.4 0.9 1.6 1.4 0.3 0.5 0.1 0.7 -50.4 1260.0

Forex & EO 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0

PBT 13.6 19.6 18.0 32.1 18.3 19.7 34.4 39.2 23.4 35.5 36.3 48.2 36.8 57.2 -23.5

Total Tax 2.0 3.3 4.1 3.2 5.0 4.3 11.1 13.9 7.5 11.1 12.6 14.8 11.6 54.7 -21.8

Tax rate (%) 14.8 16.6 23.0 9.9 27.2 22.0 32.4 35.3 32.0 31.3 34.7 30.8 31.5 -50.4 70.5

PAT 11.5 16.3 13.8 28.9 13.3 15.3 23.2 25.3 15.9 24.4 23.7 33.3 25.2 58.4 -24.3

EPS (|) 0.9 1.3 1.1 2.3 1.1 1.2 1.9 2.1 1.3 2.0 1.9 2.7 2.0 58.4 -24.3

Source: ICICI Direct Research

ICICI Securities | Retail Research 3

Result Update | Hikal Ltd ICICI Direct Research

Company background

Established in 1988, Hikal is predominantly a B2B player that provides

intermediates and active ingredients to global pharmaceutical, animal

health, crop protection and specialty chemical companies. For 9MFY19, Hikal is predominantly a B2B player that provides

pharma and crop protection accounted for 60% and 40%, respectively, of intermediates and active ingredients to global

operating revenues. The pharma business is currently divided almost pharmaceuticals, animal health, crop protection and

equally between generic active pharma ingredients (APIs) and contract specialty chemicals companies

development and manufacturing organisation (CDMO) businesses. Animal

health business accounts for 20-25% of CDMO business. In crop protection,

70% of revenues are derived from CDMO with the remaining from

proprietary products, specialty chemicals and specialty biocides. Hikal owns

five manufacturing facilities: Taloja, Mahad (Maharashtra), Panoli (Gujarat)

Jigani (Karnataka) and an R&D centre at Pune.

Exhibit 5: Flow chart (gross revenues of FY19)

Hikal (| 1590 crore)

Pharma (API) (| 939 Crop Protection (| 651

crore; ~60%) crore; ~40%)

Proprietary, Agro Chem

Generic (| 469 crore; CDMO (| 469 crore; CDMO (| 427 crore;

and Biocide (| 183

~30%) ~30%) ~28%)

crore; ~12%)

Source: ICICI Direct Research, Company

Exhibit 6: Time Line

Year Milestone

1988 Hikal incorporated

1991 First manufacturing at Mahad, begins operations - signs long term agreement with Hoechst India

1995 Signs long term manufacturing and supply agreement with Merck, US for large volume Agrovet active ingredient

1997 Manufacturing of active ingredient for Merck begins at Taloja site

2000 Acquires manufacturing site from Novartis in Panoli, Gujarat

2001 Acquires R&D and manufacturing site in Bangalore. Maiden entry in pharmaceutical business

2002 First pharmaceutical API DMF filed in US

2003 New API plant commissioned at Bangalore. Multi-purpose pharmaceutical intermediate plant commissioned at Panoli

2005 Signs long term supply agreement with a multinational crop protection company

2006 Signs long term supply contract with global innovator company for commercial supply of APls

2007 Signs long term contract API manufacturing supply agreement with leading animal health company

2008 IFC (World Bank) invests 8.27% equity into company

2009 Acoris (R&D centre), Pune becomes operational

2009 Signs long term supply contract for on patent molecule with global crop protection innovator company

2013 Signs long term supply agreement for human health products with global biopharmaceutical company

2014 Pharmaceutical sites Panoli & Bangalore receive EUGMP approval

2015 New development & launch plant in Bangalore commissioned for new products from pharmaceutical division

2017 Commissions new state-of-the-art plant at Mahad for leading global crop protection innovator company

Source: ICICI Direct Research, Company

ICICI Securities | Retail Research 4

Result Update | Hikal Ltd ICICI Direct Research

Exhibit 7: Revenues to grow at CAGR of 16% over FY19-21E Exhibit 8: Pharma to grow at CAGR of 13% over FY19-21E

2500 1400

CAGR 15.7% 2127.0 CAGR 13.0% 1198.6

CAGR 19.8% 1200 CAGR 18.2% 1042.2

2000 1827.6

1589.6 939.1

1000

1500 1296.1 752.8

800

1013.9 569.1 610.7

925.7 600

1000

400

500

200

0 0

FY16 FY17 FY18 FY19 FY20E FY21E FY16 FY17 FY18 FY19 FY20E FY21E

Revenues (| crore) Pharma (| crore)

Source: ICICI Direct Research, Company Source: ICICI Direct Research, Company

Exhibit 9: Crop to grow at CAGR of 18% over FY19-21E Exhibit 10: EBITDA & margins

1000 903.2 450 403.0 20.0

CAGR 17.8%

785.4 400 19.5 19.5

CAGR 22.2% 317.6

800 350 19.2 298.1

650.5 18.9 19.0

300 18.8

547.3 241.718.6 18.5

600 250 194.3

423.3 180.8 18.0

200

356.5 17.5

400 150 17.4

100 17.0

200 50 16.5

0 16.0

0 FY16 FY17 FY18 FY19 FY20E FY21E

FY16 FY17 FY18 FY19 FY20E FY21E

EBITDA (| crore) EBITDA Margins (%)

Crop Protection (| crore)

Source: ICICI Direct Research, Company Source: ICICI Direct Research, Company

Exhibit 11: PAT & margins Exhibit 12: RoE & RoCE trend

180 9.0 167.2 20

160 7.9 8.0 18

17.2

140 125.06.8 7.0 16 14.5 16.5

6.7 6.5 14 14.3 14.8

120 6.0 103.1 6.0 11.2 13.6

12 12.2

100 5.0 10.7 10.6 11.5

4.5 67.7 77.2 10

80 4.0 8 7.3

60 41.2 3.0 6

40 2.0 4

20 1.0 2

0 0.0 0

FY16 FY17 FY18 FY19 FY20E FY21E FY16 FY17 FY18 FY19 FY20E FY21E

Net Profit (| crore) NPM (%) RoCE (%) RoE (%)

Source: ICICI Direct Research, Company Source: ICICI Direct Research, Company

ICICI Securities | Retail Research 5

Result Update | Hikal Ltd ICICI Direct Research

Exhibit 13: Recommendation history vs. Consensus

250 120.0

200 100.0

80.0

150

(|)

60.0

(%)

100

40.0

50 20.0

0 0.0

Jul-16 Oct-16 Dec-16 Mar-17 May-17 Jul-17 Oct-17 Dec-17 Mar-18 May-18 Jul-18 Oct-18 Dec-18 Mar-19 May-19 Aug-19

Price Idirect target Consensus Target Mean % Consensus with BUY

Source: ICICI Direct Research; Reuters

Exhibit 14: Top 10 Shareholders

RankInves tor Name Filing Date % O/S Pos ition Change

1 Kalyani Group 31-Mar 0.3 41.9m 0.0m

2 Shri Badrinath Investment Pvt. Ltd. 31-Mar 0.2 19.9m 0.0m

3 Shri Rameshwara Investment Pvt. Ltd. 31-Mar 0.1 9.8m 0.0m

4 Hiremath (Sugandha) 31-Mar 0.1 9.7m 0.0m

5 Government Pension Fund 31-Mar 0.0 2.2m 0.3m

6 Kacholia (Ashish) 31-Mar 0.0 2.1m 0.1m

7 Agarwal (Madhulika) 31-Mar 0.0 2.0m 0.1m

8 Norges Bank Investment Management (NBIM) 31-Dec 0.0 1.9m 0.0m

9 Canara Robeco Asset Management Company Ltd. 31-Mar 0.0 1.7m 0.2m

10 Hiremath (Jai) 31-Mar 0.0 1.3m 0.0m

Source: ICICI Direct Research, Reuters

Exhibit 15: Recent Activity

Buy s Sells

Inv es tor name Value ($) Shares Inv es tor name Value ($) Shares

Government Pension Fund 0.6m 0.3m IDFC Asset Management Company Private Limited -1.3m -0.5m

Agarwal (Madhulika) 0.2m 0.1m Norges Bank Investment Management (NBIM) 0.0m 0.0m

Kacholia (Ashish) 0.1m 0.1m

Source: ICICI Direct Research, Reuters

Exhibit 16: Shareholding pattern

(in %) Jun-18 Sep-18 Dec-18 Mar-19 Jun-19

Promoter 68.8 68.8 68.8 68.8 68.8

Others 31.2 31.2 31.2 31.2 31.2

Source: ICICI Direct Research, Company

ICICI Securities | Retail Research 6

Result Update | Hikal Ltd ICICI Direct Research

Financial Highlights

Exhibit 17: Profit & Loss (| crore) Exhibit 18: Cash Flow Statement (| crore)

(Year-end March) FY18 FY19 FY20E FY21E (Year-end March) FY18 FY19 FY20E FY21E

Revenues 1, 296. 1 1, 589. 6 1, 827. 6 2, 127. 0 Profit/(Loss) after taxation 85.6 116.5 125.0 167.2

Growth (%) 27.8 22.6 15.0 16.4 Add: Depreciation & Amortization 85.6 92.9 82.3 102.0

Raw Material Expenses 699.0 853.8 1,032.8 1,160.3 Add: Interest Cost 46.1 56.5 52.8 54.4

Employee Expenses 128.1 150.4 174.7 212.7 Net Increase in Current Assets -140.6 -121.2 -115.3 -143.7

Other Manufacturing Expenses 227.3 287.3 302.5 351.0 Net Increase in Current Liabilities 53.5 31.6 32.0 38.9

Total Operating Expenditure 1, 054. 4 1, 291. 5 1, 510. 0 1, 724. 0 Others 8.7 9.45 0 0

EBITDA 241. 7 298. 1 317. 6 403. 0 CF from operating activities 138. 8 185. 6 176. 7 218. 7

Growth (%) 24.4 23.3 6.5 26.9 (Inc)/dec in Fixed Assets -106.0 -128.1 -160.0 -160.0

Interest 49.1 58.4 52.8 54.4 (Inc)/dec in Investments 0.0 0.0 0.0 0.0

Depreciation 85.6 92.9 82.3 102.0 Others 17.2 2.5 -0.3 -0.1

Other Income 4.5 2.3 2.1 1.1 CF from inves ting activities -88. 7 -125. 6 -160. 3 -160. 1

PBT before Exceptional Items 111. 5 149. 1 184. 6 247. 6 Inc / (Dec) in Equity Capital 0.0 0.0 0.0 0.0

Less: Forex & Exceptional Items 0.0 0.0 0.0 0.0 Inc / (Dec) in sec. Loan 37.7 19.3 50.0 0.0

PBT 111. 5 149. 1 184. 6 247. 6 Dividend & Dividend Tax -12.9 -16.4 -17.8 -17.8

Total Tax 34.3 46.0 59.6 80.5 Others -49.7 -58.4 -52.8 -54.4

PAT before MI 77.2 103.1 125.0 167.2 CF from financing activities -24. 8 -55. 4 -20. 6 -72. 2

Minority Interest 0.0 0.0 0.0 0.0 Net Cash flow 25.3 4.5 -4.2 -13.6

PAT 77. 2 103. 1 125. 0 167. 2 Opening Cash 1.9 27.2 31.7 27.5

Adjus ted PAT 77. 2 103. 1 125. 0 167. 2 Clos ing Cas h 27. 2 31. 7 27. 5 13. 9

Growth (%) 14.0 33.5 21.2 33.8 Free Cas h Flow 32. 8 57. 5 16. 7 58. 7

EPS 6.3 8.4 10.1 13.6 Source: ICICI Direct Research

Source: ICICI Direct Research

Exhibit 19: Balance Sheet (| crore) Exhibit 20: Key Ratios (| crore)

(Year-end March) FY18 FY19 FY20E FY21E (Year-end March) FY18 FY19 FY20E FY21E

Equity Capital 16.4 24.7 24.7 24.7 Per s hare data (|)

Reserve and Surplus 653.0 731.6 838.7 988.1 EPS 6.3 8.4 10.1 13.6

Total Shareholders funds 669.4 756.2 863.4 1,012.7 Cash EPS 5.0 6.9 8.7 12.1

Total Debt 635.1 660.9 710.9 710.9 BV 54.3 61.3 70.0 82.1

Others Liabilities 15.7 28.9 31.8 34.9 DPS 1.3 1.4 1.4 1.4

Source of Funds 1, 320. 1 1, 446. 0 1, 606. 1 1, 758. 6 Cash Per Share 12.5 20.1 26.7 35.0

Gross Block - Fixed Assets 788.3 960.3 1,040.3 1,200.3 Operating Ratios (%)

Accumulated Depreciation 154.7 247.3 329.6 431.6 Gross Margins 46.1 46.3 43.5 45.4

Net Block 633.6 713.0 710.7 768.7 EBITDA margins 18.6 18.8 17.4 18.9

Capital WIP 117.9 78.7 158.7 158.7 Net Profit margins 6.0 6.5 6.8 7.9

Net Fixed Assets 751.5 791.6 869.4 927.4 Inventory days 85.3 83.6 83.6 83.6

Investments 2.6 1.0 1.0 1.0 Debtor days 80.9 80.3 80.3 80.3

Inventory 303.1 364.2 418.8 487.4 Creditor days 50.0 37.0 37.0 37.0

Cash 27.2 31.7 27.5 13.9 Asset Turnover 1.6 1.7 1.8 1.8

Debtors 287.4 349.7 402.1 467.9 Return Ratios (%)

Loans & Advances & Other CA 0.0 0.0 0.0 0.0 RoE 11.5 13.6 14.5 16.5

Total Current Assets 690.0 830.0 941.2 1,071.3 RoCE 12.2 14.3 14.8 17.2

Creditors 177.6 161.0 185.2 215.5 RoIC 13.3 15.4 16.6 19.0

Provisions & Other CL 44.0 78.4 86.3 94.8 Valuation Ratios (x)

Total Current Liabilities 221.6 239.5 271.4 310.3 P/E 23.5 17.6 14.5 10.8

Net Current Assets 468.4 590.5 669.7 761.0 EV / EBITDA 10.0 8.2 7.9 6.2

LT L& A, Other Assets 97.2 62.8 65.9 69.2 EV / Revenues 1.9 1.5 1.4 1.2

Deferred Tax Assets (Net) 0.5 0.0 0.0 0.0 Market Cap / Revenues 1.4 1.1 1.0 0.9

Application of Funds 1, 320. 1 1, 446. 0 1, 606. 1 1, 758. 6 Price to Book Value 2.7 2.4 2.1 1.8

Source: ICICI Direct Research Source: ICICI Direct Research

ICICI Securities | Retail Research 7

Result Update | Hikal Ltd ICICI Direct Research

Exhibit 21: ICICI direct Coverage Universe (Healthcare)

Company I-Direct CMP TP Rating M Cap EPS (|) PE(x) RoCE (%) RoE (%)

Code (|) (|) (| cr) FY18 FY19 FY20E FY21E FY18 FY19 FY20E FY21E FY18 FY19 FY20E FY21E FY18 FY19FY20EFY21E

Ajanta Pharma AJAPHA 924 1,010 Hold 8377 53.0 43.5 47.5 60.2 17.4 21.2 19.4 15.4 30.0 21.8 20.8 22.4 23.0 17.1 16.4 18.0

Alembic Pharma

ALEMPHA 525 560 Hold 9671 21.9 31.4 29.9 24.7 24.0 16.7 17.6 21.3 18.0 19.6 17.5 15.8 18.6 21.7 17.1 14.2

Apollo Hospitals APOHOS 1387 1,450 Buy 17968 8.5 17.7 35.3 48.1 164.0 78.4 39.3 28.8 6.3 8.8 12.1 15.7 3.6 7.4 13.2 15.7

Aurobindo Pharma

AURPHA 581 715 Buy 31918 41.6 42.1 48.6 54.3 14.0 13.8 11.9 10.7 20.0 15.9 14.6 15.3 20.7 17.7 17.1 16.5

Biocon BIOCON 258 330 Buy 26160 3.1 6.2 8.2 9.1 83.2 41.6 31.6 28.4 8.1 10.9 13.4 16.1 7.2 12.2 13.4 15.2

Cadila HealthcareCADHEA 246 272 Hold 22983 17.5 18.1 16.3 18.7 14.0 13.6 15.1 13.2 16.7 13.0 11.4 12.3 20.5 17.8 14.2 14.5

Cipla CIPLA 552 580 Hold 41557 18.3 18.8 24.0 29.1 30.1 29.4 23.0 19.0 9.6 10.9 13.7 14.5 10.4 10.1 12.0 12.5

Divi's Lab DIVLAB 1635 1,760 Hold 41989 33.3 51.0 56.2 67.8 49.1 32.1 29.1 24.1 20.0 25.5 23.0 24.4 14.9 19.4 17.8 18.8

Dr Reddy's LabsDRREDD 2656 2,770 Hold 41681 57.0 114.8 163.4 157.7 46.6 23.1 16.2 16.8 6.1 11.1 16.1 15.6 7.2 13.6 16.6 14.2

Glenmark PharmaGLEPHA 455 565 Hold 11933 28.5 26.9 34.2 40.3 15.9 16.9 13.3 11.3 14.6 14.5 15.3 16.1 15.6 13.5 14.8 15.0

Hikal HIKCHE 164 190 Buy 2022 6.3 8.4 10.1 13.6 26.2 19.6 16.2 12.1 12.2 14.3 14.8 17.2 11.5 13.6 14.5 16.5

Ipca Laboratories IPCLAB 958 1,130 Buy 12271 19.0 35.1 45.6 56.4 50.5 27.3 21.0 17.0 9.1 15.4 21.3 20.5 8.9 14.2 18.2 17.1

Jubilant Life JUBLIF 469 710 Buy 6902 41.3 52.1 54.1 64.9 11.4 9.0 8.7 7.2 14.9 14.4 15.9 17.1 15.7 16.9 15.8 16.5

Lupin LUPIN 774 810 Hold 34255 20.8 16.5 30.6 40.4 37.3 46.8 25.3 19.1 10.4 9.4 12.1 13.9 6.9 5.4 9.3 11.1

Narayana Hrudalaya

NARHRU 222 250 Buy 4536 2.5 2.3 6.2 9.0 88.7 97.9 35.6 24.6 6.3 7.6 11.9 14.7 4.9 4.3 10.5 13.3

Natco Pharma NATPHA 520 595 Hold 9265 37.7 34.9 37.1 26.7 13.8 14.9 14.0 19.5 27.4 21.3 19.8 13.4 22.7 18.5 16.5 10.9

Sun Pharma SUNPHA 429 460 Hold 100890 13.0 15.9 17.9 23.4 33.1 27.1 24.0 18.3 9.8 10.4 10.5 12.8 8.2 9.2 8.4 11.2

Syngene Int. SYNINT 319 358 Hold 12000 7.6 8.3 9.9 10.3 40.6 37.4 31.3 30.0 15.1 14.8 14.5 13.8 17.7 16.8 16.8 15.0

Torrent Pharma TORPHA 1598 1,940 Buy 28243 40.1 48.9 57.9 77.6 39.9 32.7 27.6 20.6 11.2 14.2 16.0 19.8 14.7 17.5 17.1 20.1

Source: ICICI Direct Research, Bloomberg

ICICI Securities | Retail Research 8

Result Update | Hikal Ltd ICICI Direct Research

RATING RATIONALE

ICICI Direct endeavours to provide objective opinions and recommendations. ICICI Direct assigns ratings to its

stocks according to their notional target price vs. current market price and then categorises them as Buy, Hold,

Reduce and Sell. The performance horizon is two years unless specified and the notional target price is defined as

the analysts' valuation for a stock

Buy: >15%;

Hold: -5% to 15%;

Reduce: -5% to -15%;

Sell: <-15%

Pankaj Pandey Head – Research pankaj.pandey@icicisecurities.com

ICICI Direct Research Desk,

ICICI Securities Limited,

1st Floor, Akruti Trade Centre,

Road No 7, MIDC,

Andheri (East)

Mumbai – 400 093

research@icicidirect.com

ICICI Securities | Retail Research 9

Result Update | Hikal Ltd ICICI Direct Research

ANALYST CERTIFICATION

We /I, Siddhant Khandekar, Inter CA, Mitesh Shah, MS (Finance), CFA (ICFAI), Research Analysts, authors and the names subscribed to this report, hereby certify that all of the views expressed in this research

report accurately reflect our views about the subject issuer(s) or securities. We also certify that no part of our compensation was, is, or will be directly or indirectly related to the specific

recommendation(s) or view(s) in this report. It is also confirmed that above mentioned Analysts of this report have not received any compensation from the companies mentioned in the report

in the preceding twelve months and do not serve as an officer, director or employee of the companies mentioned in the report.

Terms & conditions and other disclosures:

ICICI Securities Limited (ICICI Securities) is a full-service, integrated investment banking and is, inter alia, engaged in the business of stock brokering and distribution of financial products. ICICI

Securities Limited is a SEBI registered Research Analyst with SEBI Registration Number – INH000000990. ICICI Securities Limited SEBI Registration is INZ000183631 for stock broker. ICICI

Securities is a subsidiary of ICICI Bank which is India’s largest private sector bank and has its various subsidiaries engaged in businesses of housing finance, asset management, life insurance,

general insurance, venture capital fund management, etc. (“associates”), the details in respect of which are available on www.icicibank.com

ICICI Securities is one of the leading merchant bankers/ underwriters of securities and participate in virtually all securities trading markets in India. We and our associates might have investment

banking and other business relationship with a significant percentage of companies covered by our Investment Research Department. ICICI Securities generally prohibits its analysts, persons

reporting to analysts and their relatives from maintaining a financial interest in the securities or derivatives of any companies that the analysts cover.

Recommendation in reports based on technical and derivative analysis centre on studying charts of a stock's price movement, outstanding positions, trading volume etc as opposed to focusing

on a company's fundamentals and, as such, may not match with the recommendation in fundamental reports. Investors may visit icicidirect.com to view the Fundamental and Technical

Research Reports.

Our proprietary trading and investment businesses may make investment decisions that are inconsistent with the recommendations expressed herein.

ICICI Securities Limited has two independent equity research groups: Institutional Research and Retail Research. This report has been prepared by the Retail Research. The views and opinions

expressed in this document may or may not match or may be contrary with the views, estimates, rating, target price of the Institutional Research.

The information and opinions in this report have been prepared by ICICI Securities and are subject to change without any notice. The report and information contained herein is strictly

confidential and meant solely for the selected recipient and may not be altered in any way, transmitted to, copied or distributed, in part or in whole, to any other person or to the media or

reproduced in any form, without prior written consent of ICICI Securities. While we would endeavour to update the information herein on a reasonable basis, ICICI Securities is under no

obligation to update or keep the information current. Also, there may be regulatory, compliance or other reasons that may prevent ICICI Securities from doing so. Non-rated securities indicate

that rating on a particular security has been suspended temporarily and such suspension is in compliance with applicable regulations and/or ICICI Securities policies, in circumstances where

ICICI Securities might be acting in an advisory capacity to this company, or in certain other circumstances.

This report is based on information obtained from public sources and sources believed to be reliable, but no independent verification has been made nor is its accuracy or completeness

guaranteed. This report and information herein is solely for informational purpose and shall not be used or considered as an offer document or solicitation of offer to buy or sell or subscribe

for securities or other financial instruments. Though disseminated to all the customers simultaneously, not all customers may receive this report at the same time. ICICI Securities will not treat

recipients as customers by virtue of their receiving this report. Nothing in this report constitutes investment, legal, accounting and tax advice or a representation that any investment or strategy

is suitable or appropriate to your specific circumstances. The securities discussed and opinions expressed in this report may not be suitable for all investors, who must make their own

investment decisions, based on their own investment objectives, financial positions and needs of specific recipient. This may not be taken in substitution for the exercise of independent

judgment by any recipient. The recipient should independently evaluate the investment risks. The value and return on investment may vary because of changes in interest rates, foreign

exchange rates or any other reason. ICICI Securities accepts no liabilities whatsoever for any loss or damage of any kind arising out of the use of this report. Past performance is not necessarily

a guide to future performance. Investors are advised to see Risk Disclosure Document to understand the risks associated before investing in the securities markets. Actual results may differ

materially from those set forth in projections. Forward-looking statements are not predictions and may be subject to change without notice.

ICICI Securities or its associates might have managed or co-managed public offering of securities for the subject company or might have been mandated by the subject company for any other

assignment in the past twelve months.

ICICI Securities or its associates might have received any compensation from the companies mentioned in the report during the period preceding twelve months from the date of this report

for services in respect of managing or co-managing public offerings, corporate finance, investment banking or merchant banking, brokerage services or other advisory service in a merger or

specific transaction.

ICICI Securities encourages independence in research report preparation and strives to minimize conflict in preparation of research report. ICICI Securities or its associates or its analysts did

not receive any compensation or other benefits from the companies mentioned in the report or third party in connection with preparation of the research report. Accordingly, neither ICICI

Securities nor Research Analysts and their relatives have any material conflict of interest at the time of publication of this report.

Compensation of our Research Analysts is not based on any specific merchant banking, investment banking or brokerage service transactions.

ICICI Securities or its subsidiaries collectively or Research Analysts or their relatives do not own 1% or more of the equity securities of the Company mentioned in the report as of the last day

of the month preceding the publication of the research report.

Since associates of ICICI Securities are engaged in various financial service businesses, they might have financial interests or beneficial ownership in various companies including the subject

company/companies mentioned in this report.

ICICI Securities may have issued other reports that are inconsistent with and reach different conclusion from the information presented in this report.

Neither the Research Analysts nor ICICI Securities have been engaged in market making activity for the companies mentioned in the report.

We submit that no material disciplinary action has been taken on ICICI Securities by any Regulatory Authority impacting Equity Research Analysis activities.

This report is not directed or intended for distribution to, or use by, any person or entity who is a citizen or resident of or located in any locality, state, country or other jurisdiction, where such

distribution, publication, availability or use would be contrary to law, regulation or which would subject ICICI Securities and affiliates to any registration or licensing requirement within such

jurisdiction. The securities described herein may or may not be eligible for sale in all jurisdictions or to certain category of investors. Persons in whose possession this document may come

are required to inform themselves of and to observe such restriction.

ICICI Securities | Retail Research 10

You might also like

- A New Dawn for Global Value Chain Participation in the PhilippinesFrom EverandA New Dawn for Global Value Chain Participation in the PhilippinesNo ratings yet

- Divis RRDocument10 pagesDivis RRRicha P SinghalNo ratings yet

- IDirect Biocon Q3FY17Document16 pagesIDirect Biocon Q3FY17Jagadish TangiralaNo ratings yet

- Aarti Industries: All Round Growth ImminentDocument13 pagesAarti Industries: All Round Growth ImminentPratik ChhedaNo ratings yet

- ICICI Prudential Life Insurance 27-07-2018Document10 pagesICICI Prudential Life Insurance 27-07-2018zmetheuNo ratings yet

- IFB IndustriesDocument5 pagesIFB IndustriesPrashanth SagarNo ratings yet

- ICICI - Piramal PharmaDocument4 pagesICICI - Piramal PharmasehgalgauravNo ratings yet

- About Syngene InternationalDocument15 pagesAbout Syngene Internationalalkanm750No ratings yet

- Syngene International: Discovery Services Driving Growth Outlook UpbeatDocument11 pagesSyngene International: Discovery Services Driving Growth Outlook Upbeatsanketsabale26No ratings yet

- Apollo Hospitals: Numbers Continue To StrengthenDocument13 pagesApollo Hospitals: Numbers Continue To StrengthenanjugaduNo ratings yet

- Pidilite Industries (PIDIND) : High Raw Material Prices Hit MarginDocument10 pagesPidilite Industries (PIDIND) : High Raw Material Prices Hit MarginSiddhant SinghNo ratings yet

- Cipla LTD: High Base, Covid Impact Weigh On NumbersDocument12 pagesCipla LTD: High Base, Covid Impact Weigh On NumbersHarsh GandhiNo ratings yet

- PI Industries LTD - Q1FY23 Result Update - 10082022 - 10!08!2022 - 13Document8 pagesPI Industries LTD - Q1FY23 Result Update - 10082022 - 10!08!2022 - 13SandeepNo ratings yet

- Cipla - 2QFY19 Results - ICICI DirectDocument13 pagesCipla - 2QFY19 Results - ICICI DirectSheldon RodriguesNo ratings yet

- Dabur India's strong domestic volume growth lifts revenues 18Document9 pagesDabur India's strong domestic volume growth lifts revenues 18Raghavendra Pratap SinghNo ratings yet

- Cipla Q3FY22ResultReview26Jan22 ResearchDocument8 pagesCipla Q3FY22ResultReview26Jan22 ResearchPrajwal JainNo ratings yet

- Pidilite CompanyDocument6 pagesPidilite Companykhalsa.taranjitNo ratings yet

- ABBOTT INDIA LTD - ICICI Direct - Co Update - 260819 - Strong Revenue Growth With Margin ImprovementDocument4 pagesABBOTT INDIA LTD - ICICI Direct - Co Update - 260819 - Strong Revenue Growth With Margin ImprovementShanti RanganNo ratings yet

- ABBOTT INDIA LTD Centrum 0620 QTR Update 020920 Growing Amid LockdownDocument12 pagesABBOTT INDIA LTD Centrum 0620 QTR Update 020920 Growing Amid LockdownShanti RanganNo ratings yet

- IDirect MarutiSuzuki Q2FY19Document12 pagesIDirect MarutiSuzuki Q2FY19Rajani KantNo ratings yet

- P.I. Industries (PI IN) : Q1FY21 Result UpdateDocument7 pagesP.I. Industries (PI IN) : Q1FY21 Result UpdatewhitenagarNo ratings yet

- Clean Science and Technology LTD: SubscribeDocument12 pagesClean Science and Technology LTD: SubscribechiduNo ratings yet

- GSK Consumer Healthcare Coverage InitiationDocument26 pagesGSK Consumer Healthcare Coverage InitiationChaitanya JagarlapudiNo ratings yet

- Aarti Industries LTDDocument5 pagesAarti Industries LTDViju K GNo ratings yet

- CCL Products India: Better Product Mix Flavours ProfitabilityDocument11 pagesCCL Products India: Better Product Mix Flavours ProfitabilityAshokNo ratings yet

- HCL Technologies (HCLT IN) : Management Meet UpdateDocument14 pagesHCL Technologies (HCLT IN) : Management Meet UpdateSagar ShahNo ratings yet

- Wipro LTD (WIPRO) : Growth and Margin Visibility Improving..Document13 pagesWipro LTD (WIPRO) : Growth and Margin Visibility Improving..ashok yadavNo ratings yet

- Jyothy Laboratories Q4FY17 revenue up 4Document5 pagesJyothy Laboratories Q4FY17 revenue up 4Viju K GNo ratings yet

- Itc (Itc In) : Analyst Meet UpdateDocument18 pagesItc (Itc In) : Analyst Meet UpdateTatsam Vipul100% (1)

- R-STREET INVESTMENT CHALLENGE - BUY GODREJ CONSUMER PRODUCTSDocument12 pagesR-STREET INVESTMENT CHALLENGE - BUY GODREJ CONSUMER PRODUCTSApoorva JainNo ratings yet

- Corporate Presentation - August 2018Document22 pagesCorporate Presentation - August 2018nehal00284No ratings yet

- KRChoksey CreditAccess Grameen LTD ReportDocument25 pagesKRChoksey CreditAccess Grameen LTD ReportspryaaNo ratings yet

- Edel - EQDocument13 pagesEdel - EQarhagarNo ratings yet

- PVR LTD: Healthy PerformanceDocument9 pagesPVR LTD: Healthy PerformanceGaurav KherodiaNo ratings yet

- Fortis Healthcare: Performance In-Line With ExpectationsDocument13 pagesFortis Healthcare: Performance In-Line With Expectationsratan203No ratings yet

- Glaxosmithkline Pharmaceuticals LTD: Revenue De-GrowthDocument7 pagesGlaxosmithkline Pharmaceuticals LTD: Revenue De-GrowthGuarachandar ChandNo ratings yet

- RIL 4Q FY18 Analyst Presentation 27apr18 PDFDocument110 pagesRIL 4Q FY18 Analyst Presentation 27apr18 PDFneethuNo ratings yet

- Marico (MARLIM) : Soft Copra Prices To Drive Earnings GrowthDocument10 pagesMarico (MARLIM) : Soft Copra Prices To Drive Earnings GrowthAshokNo ratings yet

- Hikal Ini CovDocument24 pagesHikal Ini CovSiddharthNo ratings yet

- Page Industries: Revenue Growth Improves While Margins DeclineDocument8 pagesPage Industries: Revenue Growth Improves While Margins DeclinePuneet367No ratings yet

- Jyothy Laboratories LTD Accumulate: Retail Equity ResearchDocument5 pagesJyothy Laboratories LTD Accumulate: Retail Equity Researchkishor_warthi85No ratings yet

- Dabur India maintains margins despite sales declineDocument9 pagesDabur India maintains margins despite sales declineHitendra PanchalNo ratings yet

- Rallis India (RALIND) : Poised For Growth Buy To Reap Rich GainsDocument12 pagesRallis India (RALIND) : Poised For Growth Buy To Reap Rich GainsJatin SoniNo ratings yet

- Aarti Industries - 3QFY20 Result - RsecDocument7 pagesAarti Industries - 3QFY20 Result - RsecdarshanmaldeNo ratings yet

- ITC 020822 MotiDocument12 pagesITC 020822 Motinitin sonareNo ratings yet

- BP Wealth On Hikal - 06.11.2020Document7 pagesBP Wealth On Hikal - 06.11.2020VM ONo ratings yet

- IDirect Lupin Q3FY17Document16 pagesIDirect Lupin Q3FY17dipshi92No ratings yet

- April 2022Document43 pagesApril 2022Indraneel MahantiNo ratings yet

- Ambuja Cement: Volume Push Drives Topline Maintain HOLDDocument9 pagesAmbuja Cement: Volume Push Drives Topline Maintain HOLDanjugaduNo ratings yet

- Nestlé India: Upbeat Volume Growth, Tax Cuts Aid ProfitabilityDocument9 pagesNestlé India: Upbeat Volume Growth, Tax Cuts Aid ProfitabilityVishakha RathodNo ratings yet

- Apollo Hospitals Enterprise Companyname: Sets The Stage For ExpansionDocument13 pagesApollo Hospitals Enterprise Companyname: Sets The Stage For Expansionakumar4uNo ratings yet

- Wipro LTD: Profitable Growth Focus of New CEODocument11 pagesWipro LTD: Profitable Growth Focus of New CEOPramod KulkarniNo ratings yet

- UltratechCement Edel 190118Document15 pagesUltratechCement Edel 190118suprabhattNo ratings yet

- Asian Paints: Volume Led Growth ContinuesDocument9 pagesAsian Paints: Volume Led Growth ContinuesanjugaduNo ratings yet

- Bodal Chemicals (BODCHE) : Expansion in Place, Volume Led Growth Ahead!Document9 pagesBodal Chemicals (BODCHE) : Expansion in Place, Volume Led Growth Ahead!P.B VeeraraghavuluNo ratings yet

- Cipla 07092021Document6 pagesCipla 07092021gbNo ratings yet

- Golden Midcap Portfolio: October 18, 2019Document7 pagesGolden Midcap Portfolio: October 18, 2019Arvind MeenaNo ratings yet

- Glenmark Pharmaceuticals Limited_Investor Presentation_Q3 FY24Document19 pagesGlenmark Pharmaceuticals Limited_Investor Presentation_Q3 FY24SHREYA NAIRNo ratings yet

- PB Fintech Icici SecuritiesDocument33 pagesPB Fintech Icici SecuritieshamsNo ratings yet

- File 1686286056102Document14 pagesFile 1686286056102Tomar SahaabNo ratings yet

- Role of PQ GraftDocument12 pagesRole of PQ GraftRakesh KumarNo ratings yet

- Master ChartDocument6 pagesMaster ChartRakesh KumarNo ratings yet

- IntroductionDocument1 pageIntroductionRakesh KumarNo ratings yet

- Background:: Abstract PageDocument2 pagesBackground:: Abstract PageRakesh KumarNo ratings yet

- Master ChartDocument1 pageMaster ChartRakesh KumarNo ratings yet

- Treatment of Scaphoid Non-Union With 1,2 Intercompartmental Supraretinacular Artery (1,2 ICSRA) Vascularised GraftDocument4 pagesTreatment of Scaphoid Non-Union With 1,2 Intercompartmental Supraretinacular Artery (1,2 ICSRA) Vascularised GraftRakesh KumarNo ratings yet

- 149 JKSSH 17 4 159Document9 pages149 JKSSH 17 4 159Rakesh KumarNo ratings yet

- A Capsular-Based Vascularized Distal Radius Graft For Proximal Pole Scaphoid PseudarthrosisDocument8 pagesA Capsular-Based Vascularized Distal Radius Graft For Proximal Pole Scaphoid PseudarthrosisRakesh KumarNo ratings yet

- ResultsDocument2 pagesResultsRakesh KumarNo ratings yet

- Orthopedic Department, Faculty of Medicine, Al-Azhar University, Cairo and Anesthesia Department, Faculaty of Medicine, Al-Azharuniversity, CairoDocument10 pagesOrthopedic Department, Faculty of Medicine, Al-Azhar University, Cairo and Anesthesia Department, Faculaty of Medicine, Al-Azharuniversity, CairoRakesh KumarNo ratings yet

- 829 FullDocument3 pages829 FullRakesh KumarNo ratings yet

- 1413 7852 Aob 24 03 00159Document5 pages1413 7852 Aob 24 03 00159Rakesh KumarNo ratings yet

- 1413 7852 Aob 24 03 00159Document5 pages1413 7852 Aob 24 03 00159Rakesh KumarNo ratings yet

- Orthopedic Department, Faculty of Medicine, Al-Azhar University, Cairo and Anesthesia Department, Faculaty of Medicine, Al-Azharuniversity, CairoDocument10 pagesOrthopedic Department, Faculty of Medicine, Al-Azhar University, Cairo and Anesthesia Department, Faculaty of Medicine, Al-Azharuniversity, CairoRakesh KumarNo ratings yet

- 21 JMSCRDocument6 pages21 JMSCRRakesh KumarNo ratings yet

- Treatment of Scaphoid Non-Union With 1,2 Intercompartmental Supraretinacular Artery (1,2 ICSRA) Vascularised GraftDocument4 pagesTreatment of Scaphoid Non-Union With 1,2 Intercompartmental Supraretinacular Artery (1,2 ICSRA) Vascularised GraftRakesh KumarNo ratings yet

- 1 s2.0 S1877056811002325 MainDocument7 pages1 s2.0 S1877056811002325 MainRakesh KumarNo ratings yet

- 21 JMSCRDocument6 pages21 JMSCRRakesh KumarNo ratings yet

- 829 FullDocument3 pages829 FullRakesh KumarNo ratings yet

- 1 s2.0 S1877056811002325 MainDocument7 pages1 s2.0 S1877056811002325 MainRakesh KumarNo ratings yet

- A Capsular-Based Vascularized Distal Radius Graft For Proximal Pole Scaphoid PseudarthrosisDocument8 pagesA Capsular-Based Vascularized Distal Radius Graft For Proximal Pole Scaphoid PseudarthrosisRakesh KumarNo ratings yet

- Screws in OrthopaedicsDocument6 pagesScrews in OrthopaedicsRakesh KumarNo ratings yet

- 149 JKSSH 17 4 159Document9 pages149 JKSSH 17 4 159Rakesh KumarNo ratings yet

- Nobody Knows II PDFDocument9 pagesNobody Knows II PDFharishNo ratings yet

- Surgeon Is MDocument1 pageSurgeon Is MRakesh KumarNo ratings yet

- 2008 Article 40Document8 pages2008 Article 40Rakesh KumarNo ratings yet

- Gold As InvestmentDocument4 pagesGold As InvestmentRakesh KumarNo ratings yet

- Success Comes With A PricetDocument1 pageSuccess Comes With A PricetRakesh KumarNo ratings yet

- Ey Study Opportunities in The Consolidating Cdmo IndustryDocument16 pagesEy Study Opportunities in The Consolidating Cdmo IndustryRakesh KumarNo ratings yet

- Aerospace Coatings Quality ManualDocument89 pagesAerospace Coatings Quality ManualhenryNo ratings yet

- E-Commerce in Afghanistan: Department of Management SciencesDocument12 pagesE-Commerce in Afghanistan: Department of Management SciencesEnamNo ratings yet

- Economics: Introduction To Applied EconomicsDocument22 pagesEconomics: Introduction To Applied EconomicsJoy ChoiNo ratings yet

- Marketing Research Project On Nike ShoesDocument8 pagesMarketing Research Project On Nike ShoesRi TalzNo ratings yet

- Iso-Dis-10009-2023 enDocument15 pagesIso-Dis-10009-2023 enSandro GarcíaNo ratings yet

- Making and Acknowledging Payment DocumentsDocument12 pagesMaking and Acknowledging Payment DocumentsAlif Viana RachmawatiNo ratings yet

- 05-Huawei Storage Reliability TechnologiesDocument38 pages05-Huawei Storage Reliability TechnologiesAgustin GarciaNo ratings yet

- Pad381 - Am1104b - Group 1 ReportDocument19 pagesPad381 - Am1104b - Group 1 ReportNOR EZALIA HASBINo ratings yet

- Galfar MS 000-ZX-E-77758Document22 pagesGalfar MS 000-ZX-E-77758Ramaraju RNo ratings yet

- Sales Quiz 4Document3 pagesSales Quiz 4bantucin davooNo ratings yet

- Unit II: Absorption, Variable, and Throughput Costing: Multiple Choice QuestionsDocument43 pagesUnit II: Absorption, Variable, and Throughput Costing: Multiple Choice QuestionsJosh EspirituNo ratings yet

- Large Scale Behavioural Change: Viral Change™ Leandro HerreroDocument22 pagesLarge Scale Behavioural Change: Viral Change™ Leandro Herrerooscar moraNo ratings yet

- Amazon Supply ChainDocument18 pagesAmazon Supply Chainyatendra13288100% (2)

- FTMRDocument77 pagesFTMRSarang RokadeNo ratings yet

- AUD 2 Audit of Cash and Cash EquivalentDocument14 pagesAUD 2 Audit of Cash and Cash EquivalentJayron NonguiNo ratings yet

- Award Letter For Contract Dec 21, 2009Document1 pageAward Letter For Contract Dec 21, 2009massieguy0% (1)

- Syllabus Fundamentals of Accounting 2021Document19 pagesSyllabus Fundamentals of Accounting 2021John Lucky MacalaladNo ratings yet

- COMPARISON OF PHILIPPINE TAX RATESDocument3 pagesCOMPARISON OF PHILIPPINE TAX RATESKevin JugaoNo ratings yet

- A brief history of how brands and place branding evolvedDocument7 pagesA brief history of how brands and place branding evolvedSalma wahbiNo ratings yet

- 3.5 An Integrated Fuzzy Multi-Criteria Decision Making Approach For Evaluating Suppliers' Co-Design Ability in New Product DevelopmentDocument32 pages3.5 An Integrated Fuzzy Multi-Criteria Decision Making Approach For Evaluating Suppliers' Co-Design Ability in New Product DevelopmentFredy Francisco Sapiéns LópezNo ratings yet

- HISTORICAL ORIGINS AND FORMS OF UNDERDEVELOPMENT AND DEPENDENCE IN AFRICADocument21 pagesHISTORICAL ORIGINS AND FORMS OF UNDERDEVELOPMENT AND DEPENDENCE IN AFRICAJuma DutNo ratings yet

- SBR Practice Questions 2019 - QDocument86 pagesSBR Practice Questions 2019 - QALEX TRANNo ratings yet

- Planning of Bank Branch AuditDocument9 pagesPlanning of Bank Branch AuditAshutosh PathakNo ratings yet

- Qoutation: Date: 22/02/2019 Quotation No: QUOT.2019.SET.01Document1 pageQoutation: Date: 22/02/2019 Quotation No: QUOT.2019.SET.01Taqiyuddin Abdul RahmanNo ratings yet

- Dragon Fruit Greek Yogurt Feasibility StudyDocument16 pagesDragon Fruit Greek Yogurt Feasibility StudyJamie HaravataNo ratings yet

- Credit Card Application Form: Personal InformationDocument5 pagesCredit Card Application Form: Personal InformationHansi PereraNo ratings yet

- National Pension System One Pager V2Document2 pagesNational Pension System One Pager V2ramboNo ratings yet

- CHAPTER THREE - Operations ManagementDocument1 pageCHAPTER THREE - Operations ManagementPattraniteNo ratings yet

- CBAP Application Worksheet: Activities by KADocument7 pagesCBAP Application Worksheet: Activities by KADivya SaravananNo ratings yet

- Cccu Babs l5 t1 DB Assignment 202304Document14 pagesCccu Babs l5 t1 DB Assignment 202304Dinu Anna-MariaNo ratings yet