Professional Documents

Culture Documents

Apollo Hospitals Enterprise Companyname: Sets The Stage For Expansion

Uploaded by

akumar4uOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Apollo Hospitals Enterprise Companyname: Sets The Stage For Expansion

Uploaded by

akumar4uCopyright:

Available Formats

RESULT UPDATE

APOLLO HOSPITALS

Sets the stage for expansion

ENTERPRISE

India Equity Research| Healthcare

COMPANYNAME

Apollo Hospitals (APHS) is our top pick in the healthcare sector, and its EDELWEISS 4D RATINGS

Q1FY20 performance reaffirms our conviction that the company is on track

Absolute Rating BUY

to achieve healthy earnings growth. Key highlights: i) Overall EBITDA grew Rating Relative to Sector Outperform

by 21% YoY and margin expanded by 45bps to 12.3% - 200bps margin Risk Rating Relative to Sector Low

expansion at new hospitals and 40bps at mature hospitals. ii) A 50% Sector Relative to Market None

sequential reduction in AHLL losses to INR47mn, on track to break even in

FY20. iii) Pharmacy revenue grew by 18% YoY and operating margin rose by

90bps YoY to 5.6%. Management has guided for INR6bn in debt reduction MARKET DATA (R: APLH.BO, B: APHS IN)

to INR25bn in FY20 on the back of: i) savings following the Pharmacy CMP : INR 1,360

Target Price : INR 1,700

business spinoff; ii) liquidation of investments; and iii) internal accruals. As

52-week range (INR) : 1,445 / 997

the capex cycle concludes and loss-making ventures break even, the stage

Share in issue (mn) : 139.1

is set for APHS to expand EBITDA margin and RoCE to mid-teens over the M cap (INR bn/USD mn) : 189 / 2,592

next three years. Maintain ‘BUY’ with a TP of INR1,700 (20x December Avg. Daily Vol.BSE/NSE(‘000) : 807.8

2020E EBITDA).

SHARE HOLDING PATTERN (%)

Strong show across geographies Current Q4FY19 Q3FY19

Chennai cluster, largest geographical region, grew 14% YoY, led by 4% volume growth. Promoters * 34.4 34.4 34.4

Hyderabad region grew 12% with flat volume growth and Bangalore region grew 14% MF's, FI's & BK’s 13.3 13.1 11.2

led by 10% volume growth. Proton EBITDA losses were INR81mn (from INR47mn in FII's 44.0 44.3 47.1

Q4FY19). Navi Mumbai contributed INR28mn to hospital EBITDA, and the company has Others 8.3 8.2 7.3

guided for INR300mn in FY20. The promoter pledge reduced to 71.26% from 78.13% at * Promoters pledged shares : NIL

(% of share in issue)

end-FY19.

PRICE PERFORMANCE (%)

RoCE to get a boost; pledging to reduce post-Munich transaction

EW Pharma

Two of APHS’s businesses are yet to fuel RoCE growth as: 1) new hospitals with about Stock Nifty

Index

INR21bn in capital employed are running at 63% occupancy; and 2) AHLL with about

1 month 0.8 (8.1) (1.3)

INR6bn in capital employed is clocking about 35% utilisation. Going forward: i) 3 months 13.1 (5.6) (10.5)

profitable growth at Navi Mumbai; ii) AHLL breakeven; and iii) disciplined cost control 12 months 36.1 (4.7) (13.7)

would drive margin expansion. As capex moderates to maintenance levels, we expect

RoCE to rise from 9.7% to 13.3% over FY19–21E. Besides, management upheld its

timeline to cut promoter pledge to 35% following stake sale in Munich.

Outlook and valuation: Attractive; maintain ‘BUY’

Over FY19–21, we estimate EBITDA CAGR will be about 14%, margin will expand about

100bps and RoCE would rise about 350bps to 13.3%. The stock is trading at 14.4x Deepak Malik

+91 22 6620 3147

FY21E EBITDA. We maintain ’BUY/SO’ with our SoTP-based target price of INR1,700. deepak.malik@edelweissfin.com

Financials (Consolidated) (INR mn) Ankit Hatalkar

Year to March Q1FY20 Q1FY19 % chg Q4FY19 % chg FY19 FY20E FY21E +91 22 2286 3097

ankit.hatalkar@edelweissfin.com

Net revenue 25,719 22,046 16.7 25,214 2.0 96,174 1,05,978 1,14,508

EBITDA 2,945 2,323 26.8 2,827 4.2 10,637 12,727 13,732 Aashita Jain

aashita.jain@edelweissfin.com

EBITDA margin (%) 11.5 10.5 11.2 11.1 12.0 12.0

EV/EBITDA (x) 20.6 17.4 15.6

ROACE (%) 9.7 12.3 13.3 August 14, 2019

Edelweiss Research is also available on www.edelresearch.com,

Bloomberg EDEL <GO>, Thomson First Call, Reuters and Factset. Edelweiss Securities Limited

Healthcare

Q1FY20 conference call: Key highlights

Performance highlights:

AHLL reported an EBITDA loss of INR47mn in Q1FY20 compared with an EBITDA loss of

INR191mn in Q1FY19.

With AHLL, the growth breakdown/outlook is: Cradle business: 30% YoY; Spectra: 17%

YoY; Clinics: 20% YoY; diagnostic:-42% YoY–expected to sustain; sugar: 10% YoY; dental:

growth expected in the coming quarters; dialysis: strong growth on a small base,

estimates are muted for the year.

Navi Mumbai (225 beds): 200 beds were occupied this month. It contributed INR28mn

to EBITDA, and the company has INR300mn EBITDA target for FY20.

No price increase was taken this quarter.

Contribution of private labels in standalone pharmacies (SAP) has risen from 6.7% in

FY19 to 7%. The plan is to move to 10% over the next two–three years.

Capping of trade margins in oncology drugs did not impact margins.

Debt and cash flow

Gross debt: standalone: INR31.29bn (decreased by INR700–800mn); consolidated:

INR37bn

Net debt stood at INR29.31bn and net debt/EBITDA at 2.79x.

Going forward, the company is targeting gross debt of INR25bn as:

o hiving-off of pharmacy should bring in savings worth INR3.5bn;

o liquidation of one of the investments should bring in INR2.5bn; and

o the balance will be funded from internal cash flows.

INR1.7bn in capex to be incurred in Q2FY20 on the proton therapy centre (150 beds).

Update on promoter pledge

APHS increased the pledge marginally to fund the Munich transaction.

The company expects a liquidity event in September–October 2019, which will reduce

pledge by 40–50%.

The company is on track to bring the promoter pledge below 20% by the end of the

year.

FY20 guidance

23% EBITDA margin for the mature health services.

High-teen RoCE for Tier 2 and 22% for Tier 1.

On the proton therapy centre, it is performing well and losses worth INR250mn are

likely.

2 Edelweiss Securities Limited

Apollo Hospitals Enterprise

Table 1: Revenue and EBITDA breakdown by segment

Q1FY18 Q2FY18 Q3FY18 Q4FY18 Q1FY19 Q2FY19 Q3FY19 Q4FY19 Q1FY20

Standalone hospitals (existing)

Revenue 7,478 8,029 7,897 7,949 8,064 8,864 9,002 8,924 8,064

EBITDA 1,507 1,758 1,692 2,411 1,742 1,923 1,960 1,968 1,742

EBITDA margin(%) 20.2 21.9 21.4 30.3 21.6 21.7 21.8 22.1 21.6

Standalone hospitals (new)

Revenue 1,724 1,956 2,058 2,050 2,120 2,399 2,570 2,558 2,120

EBITDA (91) 94 151 77 108 147 170 179 108

EBITDA margin(%) (5.3) 4.8 7.3 3.8 5.1 6.1 6.6 7.0 5.1

Standalone pharmacies

Revenue 7,642 7,805 8,606 9,383 8,921 9,637 10,119 10,183 10,568

EBITDA 320 357 252 550 417 508 549 557 417

EBITDA margin(%) 4.2 4.6 2.9 5.9 4.7 5.3 5.4 5.5 3.9

AHLL

Revenue 677 1,535 (198) 2,575 1,316 1,484 1,512 1,576 1,316

EBITDA (283) (231) (263) (369) (197) (138) (167) (97) (197)

Total consolidated revenue

Revenue 19,031 20,893 14,294 28,217 22,046 24,006 24,908 25,214 22,046

EBITDA 1,647 2,247 2,170 1,868 2,323 2,719 2,768 2,827 2,323

EBITDA margin(%) 8.7 10.8 15.2 6.6 10.5 11.3 11.1 11.2 10.5

Source: Company, Edelweiss research

Table 2: SOTP valuation on June 2020 financials

Valuation Dec-20

Hospital business

Multiple (EV/EBITDA) 20

EBITDA (June '20) 10,414

EV 208,281

Pharmacy business

Multiple (EV/EBITDA) 15

EBITDA (June '20) 2,550

EV 38,257

AHLL (71% stake) 11,017

Apollo Munich Health Insurance (10% stake) 358

Other JVs 6,327

Total EV 264,240

Less: net debt 27,771

Market Cap 236,469

No. of shares 139

Value per share 1,700

Source: Company, Edelweiss research

3 Edelweiss Securities Limited

Healthcare

Financial snapshot (INR mn)

Year to March Q1FY20 Q1FY19 % change Q4FY19 % change FY19 FY20E FY21E

Net revenues 22,292 19,104 16.7 21,671 2.9 96,174 105,978 114,508

Cost of revenue 11,631 10,092 15.2 11,262 3.3 46,609 50,869 54,964

Gross profit 10,661 9,012 18.3 10,410 2.4 49,566 55,109 59,544

EBITDA 3,258 2,267 43.7 2,658 22.6 10,637 12,727 13,732

EBITDA margin 14.6 11.9 12.3 11.1 12.0 12.0

Depreciation 1,098 724 51.7 770 42.5 3,955 3,925 3,896

EBIT 2,160 1,543 40.0 1,888 14.4 6,681 8,803 9,836

Interest 999 621 61.0 709 40.9 3,270 2,295 2,295

Other income 47 21 131.2 22 120.5 314 340 465

Add: Exceptional items

Profit before tax 1,208 942 28.2 1,200 0.7 3,726 6,848 8,006

Provision for taxes 415 341 21.8 433 (4.2) 1,734 3,187 3,725

Minority interest (359) (58) (110)

Associate profit share - - - 10 493 586

Reported net profit 793 602 31.8 767 3.4 2,361 4,212 4,977

Adjusted Profit 880 602 46.3 767 14.8 2,361 4,212 4,977

Diluted shares (mn) 139 139 139 139 139 139

Adjusted Diluted EPS 5.7 4.3 31.8 5.5 3.4 17.0 30.3 35.8

As % of net revenues

Cost of revenue 52.2 52.8 52.0 48.5 48.0 48.0

Gross profit 47.8 47.2 48.0 51.5 52.0 52.0

Total expenses 101.3 105.8 106.0 88.9 88.0 88.0

Operating profit 9.7 8.1 8.7 6.9 8.3 8.6

Reported net profit 3.6 3.1 3.5 2.5 4.0 4.3

Tax rate 34.4 36.2 36.1 46.5 46.5 46.5

4 Edelweiss Securities Limited

Apollo Hospitals Enterprise

Company Description

Apollo is widely recognised as the pioneer of private healthcare in India, and was the

country’s first corporate hospital. The Apollo Hospitals Group, which started as a 150-bed

hospital in Chennai in 1983 and today, operates 6,800 beds across 61 hospitals. The Group

has emerged as the foremost integrated healthcare provider in Asia, with mature group

companies that specialize in insurance, pharmacy, consultancy, clinics and many such key

touch points of the ecosystem.

The group includes Hospitals, pharmacies, primary care and diagnostic clinics, telemedicine

centres and Apollo Munich Insurance branches panning the length and breadth of India. As

an integrated healthcare service provider with health insurance services, global projects

consultancy capability, medical education centres and a research foundation with a focus on

global clinical trials, epidemiological studies, stem cell & genetic research, Apollo has been

at the forefront of new medical breakthroughs with the most recent investment being that

of commissioning the first Proton Therapy Center across Asia, Africa and Australia in

Chennai, India.

Investment Theme

Apollo is well positioned for RoCE improvement as its capex cycle comes to an end and they

sweat assets. Apollo has spent ~INR25.9bn (~50% of gross block) over the last 3 years,

majority being invested in its Navi Mumbai hospital and in Apollo Health and Lifestyle

Limited (AHLL), which are currently incurring losses. Apollo’s Navi Mumbai facility has been

ramping up well with 80% utilisation of 150 operational beds. We expect the facility to

breakeven in FY19 and believe it entails potential to generate INR1bn EBITDA by FY21. AHLL,

Apollo’s retail healthcare format, with INR5.5bn capital employed, is currently incurring

losses. With the diagnostic and clinics already ramping up well, AHLL is on track to

breakeven by FY20. Going forward, we believe capex will fall by 50%.

Key Risks

• Success of business depends on expansion of network

• Subsidiaries may be unable to sustain profitability in the future

• Specialist physicians could dis-associate

• Rising infrastructure costs could restrict investment

5 Edelweiss Securities Limited

Healthcare

Financial Statements

Key Assumptions Income statement (INR mn)

Year to March FY18 FY19 FY20E FY21E Year to March FY18 FY19 FY20E FY21E

Macro Income from operations 82,435 96,174 105,978 114,508

GDP(Y-o-Y %) 6.5 7.1 7.6 7.2 Materials costs 40,327 46,609 50,869 54,964

Inflation (Avg) 3.6 4.5 5.0 5.9 Employee costs 14,044 15,982 17,900 20,048

Repo rate (exit rate) 6.0 6.3 6.5 7.5 EBITDA 7,932 10,637 12,727 13,732

USD/INR (Avg) 64.5 70.0 72.0 72.0 Operating profit 7,932 10,637 12,727 13,732

EBIT 4,342 6,682 8,803 9,836

Less: Interest Expense 2,951 3,270 2,295 2,295

Add: Other income 321.5 314.39 340.29 465.00

Profit Before Tax 1,712 3,726 6,848 8,006

Less: Provision for Tax 1,119 1,734 3,187 3,725

Less: Minority Interest (579) (359) (58) (110)

Associate profit share 2 10 493 586

Reported Profit 1,174 2,361 4,212 4,977

Exceptional Items - - - -

Adjusted Profit 1,174 2,361 4,212 4,977

Shares o /s (mn) 139 139 139 139

Adjusted Basic EPS 8.4 17.0 30.3 35.8

Diluted shares o/s (mn) 139 139 139 139

Adjusted Diluted EPS 8.4 17.0 30.3 35.8

Adjusted Cash EPS 34.2 45.4 58.5 63.8

Dividend per share (DPS) 5.0 5.0 8.9 10.5

Dividend Payout Ratio(%) 59.2 29.5 29.5 29.5

Common size metrics

Year to March FY18 FY19 FY20E FY21E

Materials costs 48.9 48.5 48.0 48.0

Staff costs 17.0 16.6 16.9 17.5

Operating expenses 90.4 88.9 88.0 88.0

Depreciation 4.4 4.1 3.7 3.4

Interest Expense 3.6 3.4 2.2 2.0

EBITDA margins 9.6 11.1 12.0 12.0

Net Profit margins 0.7 2.1 3.9 4.3

Growth ratios (%)

Year to March FY18 FY19 FY20E FY21E

Revenues 13.6 16.7 10.2 8.0

EBITDA 8.9 34.1 19.7 7.9

PBT (4.7) 117.6 83.8 16.9

Adjusted Profit (46.9) 101.0 78.4 18.2

EPS (46.9) 101.0 78.4 18.2

6 Edelweiss Securities Limited

Apollo Hospitals Enterprise

Balance sheet (INR mn) Cash flow metrics

As on 31st March FY18 FY19 FY20E FY21E Year to March FY18 FY19 FY20E FY21E

Share capital 696 696 696 696 Operating cash flow 5,370 9,492 9,408 10,015

Reserves & Surplus 31,819 32,639 35,361 38,564 Financing cash flow (1,085) (2,632) (3,785) (4,070)

Shareholders' funds 32,515 33,334 36,057 39,259 Investing cash flow (4,049) (7,138) (3,500) (3,500)

Minority Interest 1,324 1,355 1,297 1,186 Net cash Flow 236 (279) 2,123 2,445

Long term borrowings 29,238 29,521 29,521 29,521 Capex (6,205) (7,138) (3,500) (3,500)

Short term borrowings 3,792 4,982 4,982 4,982

Total Borrowings 33,030 34,503 34,503 34,503 Profitability and efficiency ratios

Long Term Liabilities 4,813 4,918 4,918 4,918 Year to March FY18 FY19 FY20E FY21E

Def. Tax Liability (net) 2,393 2,975 2,975 2,975 ROAE (%) 1.7 5.8 11.5 12.5

Sources of funds 74,076 77,084 79,749 82,841 ROACE (%) 7.1 9.7 12.3 13.3

Depreciation 3,590 3,955 3,925 3,896 Inventory Days 47 45 44 43

Net Block 43,857 46,003 45,579 45,183 Debtors Days 36 36 36 35

Capital work in progress 7,122 8,218 8,218 8,218 Payable Days 50 51 52 50

Intangible Assets 3,872 3,813 3,813 3,813 Cash Conversion Cycle 33 30 28 28

Total Fixed Assets 54,851 58,034 57,609 57,213 Current Ratio 2.4 2.0 2.2 2.4

Non current investments 2,937 3,930 3,930 3,930 Gross Debt/EBITDA 4.2 3.2 2.7 2.5

Cash and Equivalents 4,751 4,156 6,279 8,724 Gross Debt/Equity 1.0 1.0 0.9 0.9

Inventories 5,658 5,848 6,279 6,784 Adjusted Debt/Equity 1.0 1.0 0.9 0.9

Sundry Debtors 8,846 10,232 10,511 11,358 Net Debt/Equity 0.8 0.9 0.8 0.6

Loans & Advances 7,572 8,165 8,266 8,932 Interest Coverage Ratio 1.5 2.0 3.8 4.3

Other Current Assets 1,341 1,293 1,451 1,568

Current Assets (ex cash) 23,418 25,537 26,508 28,642 Operating ratios

Trade payable 5,888 7,132 7,247 7,830 Year to March FY18 FY19 FY20E FY21E

Other Current Liab 5,994 7,441 7,330 7,838 Total Asset Turnover 1.1 1.3 1.4 1.4

Total Current Liab 11,882 14,573 14,578 15,669 Fixed Asset Turnover 1.7 2.0 2.1 2.3

Net Curr Assets-ex cash 11,536 10,964 11,930 12,973 Equity Turnover 2.4 2.8 2.9 2.9

Uses of funds 74,076 77,084 79,749 82,841

BVPS (INR) 233.7 239.6 259.2 282.2 Valuation parameters

Year to March FY18 FY19 FY20E FY21E

Free cash flow (INR mn) Adj. Diluted EPS (INR) 8.4 17.0 30.3 35.8

Year to March FY18 FY19 FY20E FY21E Y-o-Y growth (%) (46.9) 101.0 78.4 18.2

Reported Profit 1,174 2,361 4,212 4,977 Adjusted Cash EPS (INR) 34.2 45.4 58.5 63.8

Add: Depreciation 3,590 3,955 3,925 3,896 Diluted P/E (x) 161.2 80.2 44.9 38.0

Interest (Net of Tax) 1,022 1,748 1,227 1,227 P/B (x) 5.8 5.7 5.2 4.8

Others 1,654 2,909 (1,441) (616) EV / Sales (x) 2.6 2.3 2.1 1.9

Less: Changes in WC 2,071 1,481 (1,485) (531) EV / EBITDA (x) 27.6 20.8 17.2 15.7

Operating cash flow 5,370 9,492 9,408 10,015 Dividend Yield (%) 0.4 0.4 0.7 0.8

Less: Capex 6,205 7,138 3,500 3,500

Free Cash Flow (4,014) (917) 3,613 4,220

Peer comparison valuation

Market cap Diluted P/E (X) EV / EBITDA (X) ROAE (%)

Name (USD mn) FY20E FY21E FY20E FY21E FY20E FY21E

Apollo Hospitals Enterprise 2,592 44.9 38.0 17.2 15.7 11.5 12.5

FORTIS HEALTHCARE LTD 1,261 54.8 30.0 17.8 13.5 3.6 5.4

HealthCare Global Enterprises Limited 154 132.5 33.2 12.8 9.5 3.9 8.6

Max India Limited 231 (67.9) (55.1) 10.2 10.1 (4.6) (6.0)

Source: Edelweiss research

7 Edelweiss Securities Limited

Healthcare

Additional Data

Directors Data

Prathap C Reddy Founder, Chairman Preetha Reddy Executive Vice Chairperson

Suneeta Reddy Managing Director Sangita Reddy Joint Managing Director

Sanjay Nayar Non-executive Independent Director T Rajgopal Non-executive Independent Director

N Vaghul Non-executive Independent Director G Venkatraman Non-executive Independent Director

Shobana Kamineni Executive Vice Chairperson Deepak Vaidya Non-executive Independent Director

Murali Doraiswamy Non-executive Independent Director Vinayak Chatterjee Non-executive Independent Director

Shirish Moreshwar Apte Non Executive Director

Auditors - S Viswanathan

*as per last annual report

Holding – Top10

Perc. Holding Perc. Holding

Pcr investments ltd 19.57 Apollo hospitals ent 14.51

Life insurance corp 5.68 Reddy prathap c 3.91

Alliance bernstein 3.77 Schroders plc 3.57

Vanguard group 2.63 Reddy suneeta 2.43

Morgan stanley 1.99 Reddy sangita 1.75

*in last one year

Bulk Deals

Data Acquired / Seller B/S Qty Traded Price

No Data Available

*in last one year

Insider Trades

Reporting Data Acquired / Seller B/S Qty Traded

No Data Available

*in last one year

8 Edelweiss Securities Limited

RATING & INTERPRETATION

Company Absolute Relative Relative Company Absolute Relative Relative

reco reco risk reco reco Risk

Apollo Hospitals Enterprise BUY SO L Dr. Lal Pathlabs Ltd BUY SO L

FORTIS HEALTHCARE LTD BUY SP L HealthCare Global Enterprises BUY SP M

Limited

Max India Limited BUY SP M Thyrocare Technologies Ltd HOLD SU H

ABSOLUTE RATING

Ratings Expected absolute returns over 12 months

Buy More than 15%

Hold Between 15% and - 5%

Reduce Less than -5%

RELATIVE RETURNS RATING

Ratings Criteria

Sector Outperformer (SO) Stock return > 1.25 x Sector return

Sector Performer (SP) Stock return > 0.75 x Sector return

Stock return < 1.25 x Sector return

Sector Underperformer (SU) Stock return < 0.75 x Sector return

Sector return is market cap weighted average return for the coverage universe

within the sector

RELATIVE RISK RATING

Ratings Criteria

Low (L) Bottom 1/3rd percentile in the sector

Medium (M) Middle 1/3rd percentile in the sector

High (H) Top 1/3rd percentile in the sector

Risk ratings are based on Edelweiss risk model

SECTOR RATING

Ratings Criteria

Overweight (OW) Sector return > 1.25 x Nifty return

Equalweight (EW) Sector return > 0.75 x Nifty return

Sector return < 1.25 x Nifty return

Underweight (UW) Sector return < 0.75 x Nifty return

9 Edelweiss Securities Limited

Healthcare

Edelweiss Securities Limited, Edelweiss House, off C.S.T. Road, Kalina, Mumbai – 400 098.

Board: (91-22) 4009 4400, Email: research@edelweissfin.com

Digitally signed by ADITYA NARAIN

ADITYA

DN: c=IN, o=EDELWEISS SECURITIES

Aditya Narain LIMITED, ou=SERVICE,

2.5.4.20=3dc92af943d52d778c99d69c48

a8e0c89e548e5001b4f8141cf423fd58c07

b02, postalCode=400011,

Head of Research

NARAIN

st=MAHARASHTRA,

serialNumber=e0576796072ad1a3266c2

7990f20bf0213f69235fc3f1bcd0fa1c3009

aditya.narain@edelweissfin.com 2792c20, cn=ADITYA NARAIN

Date: 2019.08.14 18:18:41 +05'30'

Coverage group(s) of stocks by primary analyst(s): Healthcare

Apollo Hospitals Enterprise, Dr. Lal Pathlabs Ltd, FORTIS HEALTHCARE LTD, HealthCare Global Enterprises Limited, Max India Limited, Thyrocare

Technologies Ltd

Recent Research

Date Company Title Price (INR) Recos

14-Aug-19 Thyrocare Revival in growth; 444 Hold

Technologies Result Update

13-Aug-19 Dr Lal Good show on all fronts; 1,075 Buy

Pathlabs Result Update

09-Aug-19 Natco Muted performance; outlook 552 Buy

Pharma intact; Result Update

Distribution of Ratings / Market Cap

Edelweiss Research Coverage Universe Rating Interpretation

Buy Hold Reduce Total Rating Expected to

Rating Distribution* 161 67 11 240 Buy appreciate more than 15% over a 12-month period

* 1stocks under review

Hold appreciate up to 15% over a 12-month period

> 50bn Between 10bn and 50 bn < 10bn

743

Reduce depreciate more than 5% over a 12-month period

Market Cap (INR) 156 62 11

594

One year price chart

446

(INR)

1,500

297 1,380

149 1,260

(INR)

- 1,140

Apr-14

Sep-14

Feb-14

Mar-14

Jun-14

Dec-14

Jul-14

Aug-14

Oct-14

Nov-14

May-14

Jan-14

1,020

900

Dec-18

Oct-18

Aug-19

Aug-18

Apr-19

May-19

Nov-18

Jan-19

Sep-18

Feb-19

Jun-19

Mar-19

Jul-19

Apollo Hospitals Enterprise

10 Edelweiss Securities Limited

Apollo Hospitals Enterprise

DISCLAIMER

Edelweiss Securities Limited (“ESL” or “Research Entity”) is regulated by the Securities and Exchange Board of India (“SEBI”) and is

licensed to carry on the business of broking, depository services and related activities. The business of ESL and its Associates (list

available on www.edelweissfin.com) are organized around five broad business groups – Credit including Housing and SME

Finance, Commodities, Financial Markets, Asset Management and Life Insurance.

This Report has been prepared by Edelweiss Securities Limited in the capacity of a Research Analyst having SEBI Registration

No.INH200000121 and distributed as per SEBI (Research Analysts) Regulations 2014. This report does not constitute an offer or

solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Securities as

defined in clause (h) of section 2 of the Securities Contracts (Regulation) Act, 1956 includes Financial Instruments and Currency

Derivatives. The information contained herein is from publicly available data or other sources believed to be reliable. This report is

provided for assistance only and is not intended to be and must not alone be taken as the basis for an investment decision. The

user assumes the entire risk of any use made of this information. Each recipient of this report should make such investigation as it

deems necessary to arrive at an independent evaluation of an investment in Securities referred to in this document (including the

merits and risks involved), and should consult his own advisors to determine the merits and risks of such investment. The

investment discussed or views expressed may not be suitable for all investors.

This information is strictly confidential and is being furnished to you solely for your information. This information should not be

reproduced or redistributed or passed on directly or indirectly in any form to any other person or published, copied, in whole or in

part, for any purpose. This report is not directed or intended for distribution to, or use by, any person or entity who is a citizen or

resident of or located in any locality, state, country or other jurisdiction, where such distribution, publication, availability or use

would be contrary to law, regulation or which would subject ESL and associates / group companies to any registration or licensing

requirements within such jurisdiction. The distribution of this report in certain jurisdictions may be restricted by law, and persons

in whose possession this report comes, should observe, any such restrictions. The information given in this report is as of the date

of this report and there can be no assurance that future results or events will be consistent with this information. This information

is subject to change without any prior notice. ESL reserves the right to make modifications and alterations to this statement as

may be required from time to time. ESL or any of its associates / group companies shall not be in any way responsible for any loss

or damage that may arise to any person from any inadvertent error in the information contained in this report. ESL is committed

to providing independent and transparent recommendation to its clients. Neither ESL nor any of its associates, group companies,

directors, employees, agents or representatives shall be liable for any damages whether direct, indirect, special or consequential

including loss of revenue or lost profits that may arise from or in connection with the use of the information. Our proprietary

trading and investment businesses may make investment decisions that are inconsistent with the recommendations expressed

herein. Past performance is not necessarily a guide to future performance .The disclosures of interest statements incorporated in

this report are provided solely to enhance the transparency and should not be treated as endorsement of the views expressed in

the report. The information provided in these reports remains, unless otherwise stated, the copyright of ESL. All layout, design,

original artwork, concepts and other Intellectual Properties, remains the property and copyright of ESL and may not be used in

any form or for any purpose whatsoever by any party without the express written permission of the copyright holders.

ESL shall not be liable for any delay or any other interruption which may occur in presenting the data due to any reason including

network (Internet) reasons or snags in the system, break down of the system or any other equipment, server breakdown,

maintenance shutdown, breakdown of communication services or inability of the ESL to present the data. In no event shall ESL be

liable for any damages, including without limitation direct or indirect, special, incidental, or consequential damages, losses or

expenses arising in connection with the data presented by the ESL through this report.

We offer our research services to clients as well as our prospects. Though this report is disseminated to all the customers

simultaneously, not all customers may receive this report at the same time. We will not treat recipients as customers by virtue of

their receiving this report.

ESL and its associates, officer, directors, and employees, research analyst (including relatives) worldwide may: (a) from time to

time, have long or short positions in, and buy or sell the Securities, mentioned herein or (b) be engaged in any other transaction

involving such Securities and earn brokerage or other compensation or act as a market maker in the financial instruments of the

subject company/company(ies) discussed herein or act as advisor or lender/borrower to such company(ies) or have other

potential/material conflict of interest with respect to any recommendation and related information and opinions at the time of

publication of research report or at the time of public appearance. ESL may have proprietary long/short position in the above

mentioned scrip(s) and therefore should be considered as interested. The views provided herein are general in nature and do not

consider risk appetite or investment objective of any particular investor; readers are requested to take independent professional

advice before investing. This should not be construed as invitation or solicitation to do business with ESL.

11 Edelweiss Securities Limited

Healthcare

ESL or its associates may have received compensation from the subject company in the past 12 months. ESL or its associates may

have managed or co-managed public offering of securities for the subject company in the past 12 months. ESL or its associates

may have received compensation for investment banking or merchant banking or brokerage services from the subject company in

the past 12 months. ESL or its associates may have received any compensation for products or services other than investment

banking or merchant banking or brokerage services from the subject company in the past 12 months. ESL or its associates have

not received any compensation or other benefits from the Subject Company or third party in connection with the research report.

Research analyst or his/her relative or ESL’s associates may have financial interest in the subject company. ESL and/or its Group

Companies, their Directors, affiliates and/or employees may have interests/ positions, financial or otherwise in the

Securities/Currencies and other investment products mentioned in this report. ESL, its associates, research analyst and his/her

relative may have other potential/material conflict of interest with respect to any recommendation and related information and

opinions at the time of publication of research report or at the time of public appearance.

Participants in foreign exchange transactions may incur risks arising from several factors, including the following: ( i) exchange

rates can be volatile and are subject to large fluctuations; ( ii) the value of currencies may be affected by numerous market

factors, including world and national economic, political and regulatory events, events in equity and debt markets and changes in

interest rates; and (iii) currencies may be subject to devaluation or government imposed exchange controls which could affect the

value of the currency. Investors in securities such as ADRs and Currency Derivatives, whose values are affected by the currency of

an underlying security, effectively assume currency risk.

Research analyst has served as an officer, director or employee of subject Company: No

ESL has financial interest in the subject companies: No

ESL’s Associates may have actual / beneficial ownership of 1% or more securities of the subject company at the end of the month

immediately preceding the date of publication of research report.

Research analyst or his/her relative has actual/beneficial ownership of 1% or more securities of the subject company at the end of

the month immediately preceding the date of publication of research report: No

ESL has actual/beneficial ownership of 1% or more securities of the subject company at the end of the month immediately

preceding the date of publication of research report: No

Subject company may have been client during twelve months preceding the date of distribution of the research report.

There were no instances of non-compliance by ESL on any matter related to the capital markets, resulting in significant and

material disciplinary action during the last three years except that ESL had submitted an offer of settlement with Securities and

Exchange commission, USA (SEC) and the same has been accepted by SEC without admitting or denying the findings in relation to

their charges of non registration as a broker dealer.

A graph of daily closing prices of the securities is also available at www.nseindia.com

Analyst Certification:

The analyst for this report certifies that all of the views expressed in this report accurately reflect his or her personal views about

the subject company or companies and its or their securities, and no part of his or her compensation was, is or will be, directly or

indirectly related to specific recommendations or views expressed in this report.

Additional Disclaimers

Disclaimer for U.S. Persons

This research report is a product of Edelweiss Securities Limited, which is the employer of the research analyst(s) who has

prepared the research report. The research analyst(s) preparing the research report is/are resident outside the United States

(U.S.) and are not associated persons of any U.S. regulated broker-dealer and therefore the analyst(s) is/are not subject to

supervision by a U.S. broker-dealer, and is/are not required to satisfy the regulatory licensing requirements of FINRA or required

to otherwise comply with U.S. rules or regulations regarding, among other things, communications with a subject company, public

appearances and trading securities held by a research analyst account.

This report is intended for distribution by Edelweiss Securities Limited only to "Major Institutional Investors" as defined by Rule

15a-6(b)(4) of the U.S. Securities and Exchange Act, 1934 (the Exchange Act) and interpretations thereof by U.S. Securities and

Exchange Commission (SEC) in reliance on Rule 15a 6(a)(2). If the recipient of this report is not a Major Institutional Investor as

specified above, then it should not act upon this report and return the same to the sender. Further, this report may not be copied,

duplicated and/or transmitted onward to any U.S. person, which is not the Major Institutional Investor.

12 Edelweiss Securities Limited

Apollo Hospitals Enterprise

In reliance on the exemption from registration provided by Rule 15a-6 of the Exchange Act and interpretations thereof by the SEC

in order to conduct certain business with Major Institutional Investors, Edelweiss Securities Limited has entered into an

agreement with a U.S. registered broker-dealer, Edelweiss Financial Services Inc. ("EFSI"). Transactions in securities discussed in

this research report should be effected through Edelweiss Financial Services Inc.

Disclaimer for U.K. Persons

The contents of this research report have not been approved by an authorised person within the meaning of the Financial

Services and Markets Act 2000 ("FSMA").

In the United Kingdom, this research report is being distributed only to and is directed only at (a) persons who have professional

experience in matters relating to investments falling within Article 19(5) of the FSMA (Financial Promotion) Order 2005 (the

“Order”); (b) persons falling within Article 49(2)(a) to (d) of the Order (including high net worth companies and unincorporated

associations); and (c) any other persons to whom it may otherwise lawfully be communicated (all such persons together being

referred to as “relevant persons”).

This research report must not be acted on or relied on by persons who are not relevant persons. Any investment or investment

activity to which this research report relates is available only to relevant persons and will be engaged in only with relevant

persons. Any person who is not a relevant person should not act or rely on this research report or any of its contents. This

research report must not be distributed, published, reproduced or disclosed (in whole or in part) by recipients to any other

person.

Disclaimer for Canadian Persons

This research report is a product of Edelweiss Securities Limited ("ESL"), which is the employer of the research analysts who have

prepared the research report. The research analysts preparing the research report are resident outside the Canada and are not

associated persons of any Canadian registered adviser and/or dealer and, therefore, the analysts are not subject to supervision by

a Canadian registered adviser and/or dealer, and are not required to satisfy the regulatory licensing requirements of the Ontario

Securities Commission, other Canadian provincial securities regulators, the Investment Industry Regulatory Organization of

Canada and are not required to otherwise comply with Canadian rules or regulations regarding, among other things, the research

analysts' business or relationship with a subject company or trading of securities by a research analyst.

This report is intended for distribution by ESL only to "Permitted Clients" (as defined in National Instrument 31-103 ("NI 31-103"))

who are resident in the Province of Ontario, Canada (an "Ontario Permitted Client"). If the recipient of this report is not an

Ontario Permitted Client, as specified above, then the recipient should not act upon this report and should return the report to

the sender. Further, this report may not be copied, duplicated and/or transmitted onward to any Canadian person.

ESL is relying on an exemption from the adviser and/or dealer registration requirements under NI 31-103 available to certain

international advisers and/or dealers. Please be advised that (i) ESL is not registered in the Province of Ontario to trade in

securities nor is it registered in the Province of Ontario to provide advice with respect to securities; (ii) ESL's head office or

principal place of business is located in India; (iii) all or substantially all of ESL's assets may be situated outside of Canada; (iv)

there may be difficulty enforcing legal rights against ESL because of the above; and (v) the name and address of the ESL's agent for

service of process in the Province of Ontario is: Bamac Services Inc., 181 Bay Street, Suite 2100, Toronto, Ontario M5J 2T3 Canada.

Disclaimer for Singapore Persons

In Singapore, this report is being distributed by Edelweiss Investment Advisors Private Limited ("EIAPL") (Co. Reg. No.

201016306H) which is a holder of a capital markets services license and an exempt financial adviser in Singapore and (ii) solely to

persons who qualify as "institutional investors" or "accredited investors" as defined in section 4A(1) of the Securities and Futures

Act, Chapter 289 of Singapore ("the SFA"). Pursuant to regulations 33, 34, 35 and 36 of the Financial Advisers Regulations ("FAR"),

sections 25, 27 and 36 of the Financial Advisers Act, Chapter 110 of Singapore shall not apply to EIAPL when providing any

financial advisory services to an accredited investor (as defined in regulation 36 of the FAR. Persons in Singapore should contact

EIAPL in respect of any matter arising from, or in connection with this publication/communication. This report is not suitable for

private investors.

Copyright 2009 Edelweiss Research (Edelweiss Securities Ltd). All rights reserved

Access the entire repository of Edelweiss Research on www.edelresearch.com

13 Edelweiss Securities Limited

You might also like

- Initiating Coverage Report On Future Lifestyle FashionDocument54 pagesInitiating Coverage Report On Future Lifestyle Fashionsujay85No ratings yet

- Thematic India Strategy | January 2017! Get on track pleaseDocument100 pagesThematic India Strategy | January 2017! Get on track pleaseanurag70No ratings yet

- Consulting Proposal: Lorem Ipsum Dolor Sit AmetDocument20 pagesConsulting Proposal: Lorem Ipsum Dolor Sit AmetAnonymous AgBoRO9100% (2)

- Report On Sexual Abuse in The Catholic Church in FloridaDocument19 pagesReport On Sexual Abuse in The Catholic Church in FloridaABC Action NewsNo ratings yet

- Supreme Court of the Philippines upholds constitutionality of Act No. 2886Document338 pagesSupreme Court of the Philippines upholds constitutionality of Act No. 2886OlenFuerteNo ratings yet

- GICS Sector Classification HandbookDocument26 pagesGICS Sector Classification HandbookAndrewNo ratings yet

- Oil & Gas Industry in Libya 3Document16 pagesOil & Gas Industry in Libya 3Suleiman BaruniNo ratings yet

- Design Thinking EbookDocument850 pagesDesign Thinking Ebookakumar4uNo ratings yet

- PPE, Intangibles, Natural ResourcesDocument43 pagesPPE, Intangibles, Natural ResourcesBrylle TamañoNo ratings yet

- Fortis Healthcare: Performance In-Line With ExpectationsDocument13 pagesFortis Healthcare: Performance In-Line With Expectationsratan203No ratings yet

- Aarti Industries: All Round Growth ImminentDocument13 pagesAarti Industries: All Round Growth ImminentPratik ChhedaNo ratings yet

- Adani Ports and Sez Economic Zone Companyname: Strong Quarter Encouraging GuidanceDocument13 pagesAdani Ports and Sez Economic Zone Companyname: Strong Quarter Encouraging GuidanceAmey TiwariNo ratings yet

- Kalpataru Power - 1QFY20 Result - EdelDocument14 pagesKalpataru Power - 1QFY20 Result - EdeldarshanmadeNo ratings yet

- Ipca RRDocument9 pagesIpca RRRicha P SinghalNo ratings yet

- Aditya Birla Fashion and Retail - Result Update-Aug-18-EDEL PDFDocument14 pagesAditya Birla Fashion and Retail - Result Update-Aug-18-EDEL PDFDeepak SharmaNo ratings yet

- CCL Products Edelweiss Report AUG16Document12 pagesCCL Products Edelweiss Report AUG16arif420_999No ratings yet

- Angel One: Revenue Misses Estimates Expenses in LineDocument14 pagesAngel One: Revenue Misses Estimates Expenses in LineRam JaneNo ratings yet

- Laurus MoslDocument10 pagesLaurus MoslAlokesh PhukanNo ratings yet

- ICICI - Piramal PharmaDocument4 pagesICICI - Piramal PharmasehgalgauravNo ratings yet

- Edel - EQDocument13 pagesEdel - EQarhagarNo ratings yet

- Himatsingka Seide - 1QFY20 Result - EdelDocument12 pagesHimatsingka Seide - 1QFY20 Result - EdeldarshanmadeNo ratings yet

- Reliance Industries - Q1FY23 - HSIE-202207250637049258859Document9 pagesReliance Industries - Q1FY23 - HSIE-202207250637049258859tmeygmvzjfnkqcwhgpNo ratings yet

- Apollo TyreDocument12 pagesApollo TyrePriyanshu GuptaNo ratings yet

- Asian Paints JefferiesDocument12 pagesAsian Paints JefferiesRajeev GargNo ratings yet

- RIL 4QFY20 Results Update | Sector: Oil & GasDocument34 pagesRIL 4QFY20 Results Update | Sector: Oil & GasQUALITY12No ratings yet

- Indiabulls Housing Finance: CMP: INR514Document12 pagesIndiabulls Housing Finance: CMP: INR514Tanya SinghNo ratings yet

- Indiabulls Housing Finance: CMP: INR949 TP: INR1,150 (+21%)Document12 pagesIndiabulls Housing Finance: CMP: INR949 TP: INR1,150 (+21%)Veronika AkheevaNo ratings yet

- Jyothy Laboratories Q4FY17 revenue up 4Document5 pagesJyothy Laboratories Q4FY17 revenue up 4Viju K GNo ratings yet

- Voltas Fy07Document7 pagesVoltas Fy07hh.deepakNo ratings yet

- SH Kelkar: All-Round Performance Outlook Remains StrongDocument8 pagesSH Kelkar: All-Round Performance Outlook Remains StrongJehan BhadhaNo ratings yet

- Equity Research BritaniaDocument8 pagesEquity Research BritaniaVaibhav BajpaiNo ratings yet

- AIA Engineering Q1FY19 Result Update: Volume Growth Key Positive, Margins to Recover GraduallyDocument6 pagesAIA Engineering Q1FY19 Result Update: Volume Growth Key Positive, Margins to Recover GraduallyVipin GoelNo ratings yet

- Reliance Capital: Reliance Home Finance: A Deep Dive Into Business ModelDocument15 pagesReliance Capital: Reliance Home Finance: A Deep Dive Into Business Modelsharkl123No ratings yet

- Ganesha Ecosphere 3QFY20 Result Update - 200211 PDFDocument4 pagesGanesha Ecosphere 3QFY20 Result Update - 200211 PDFdarshanmadeNo ratings yet

- Britannia Industries - Initiating coverage-Jan-16-EDEL PDFDocument58 pagesBritannia Industries - Initiating coverage-Jan-16-EDEL PDFRecrea8 EntertainmentNo ratings yet

- HCL Technologies Organic Growth Remains TepidDocument13 pagesHCL Technologies Organic Growth Remains TepidS IlavarasuNo ratings yet

- Supreme Industries: Margin Surprises PositivelyDocument12 pagesSupreme Industries: Margin Surprises Positivelysaran21No ratings yet

- Spanco Telesystems Initiating Cov - April 20 (1) .Document24 pagesSpanco Telesystems Initiating Cov - April 20 (1) .KunalNo ratings yet

- ABFRL-20240215-MOSL-RU-PG012Document12 pagesABFRL-20240215-MOSL-RU-PG012krishna_buntyNo ratings yet

- Indian Hotels Company: Cost Optimization - Driver of ProfitabilityDocument6 pagesIndian Hotels Company: Cost Optimization - Driver of ProfitabilityArjun TalwarNo ratings yet

- HUL Beats Estimates on Sales and MarginsDocument14 pagesHUL Beats Estimates on Sales and MarginsUTSAVNo ratings yet

- DCB Bank Limited: Investing For Growth BUYDocument4 pagesDCB Bank Limited: Investing For Growth BUYdarshanmadeNo ratings yet

- Teamlease: Near Term Impact To Be ManageableDocument8 pagesTeamlease: Near Term Impact To Be ManageableAnand KNo ratings yet

- Aarti Industries - 3QFY20 Result - RsecDocument7 pagesAarti Industries - 3QFY20 Result - RsecdarshanmaldeNo ratings yet

- Motilal Oswal May 2020Document8 pagesMotilal Oswal May 2020BINNo ratings yet

- State Bank of India Stock Update: Strong Asset Quality and Earnings RecoveryDocument12 pagesState Bank of India Stock Update: Strong Asset Quality and Earnings Recoverysatyendragupta0078810No ratings yet

- HSIE Results DailyDocument5 pagesHSIE Results DailyJd DodiaNo ratings yet

- Endurance Technologies: CMP: INR1,400 TP: INR1,750 (+25%)Document10 pagesEndurance Technologies: CMP: INR1,400 TP: INR1,750 (+25%)Live NIftyNo ratings yet

- Sobha - Update - Oct23 - HSIE-202310052150043697257Document12 pagesSobha - Update - Oct23 - HSIE-202310052150043697257sankalp111No ratings yet

- Shriram City Union Finance Limited - 204 - QuarterUpdateDocument12 pagesShriram City Union Finance Limited - 204 - QuarterUpdateSaran BaskarNo ratings yet

- Rel in HDFC SecuritiesDocument9 pagesRel in HDFC Securitiesopemperor06No ratings yet

- P.I. Industries (PI IN) : Q1FY21 Result UpdateDocument7 pagesP.I. Industries (PI IN) : Q1FY21 Result UpdatewhitenagarNo ratings yet

- CCL Products India: Better Product Mix Flavours ProfitabilityDocument11 pagesCCL Products India: Better Product Mix Flavours ProfitabilityAshokNo ratings yet

- Apollo Hospitals Enterprise 180817Document14 pagesApollo Hospitals Enterprise 180817anjugaduNo ratings yet

- HSIE Results Daily - 03 May 22-202205030828515687851Document5 pagesHSIE Results Daily - 03 May 22-202205030828515687851prateeksri10No ratings yet

- ICICI Prudential Life Insurance 27-07-2018Document10 pagesICICI Prudential Life Insurance 27-07-2018zmetheuNo ratings yet

- London Sumatra Indonesia TBK: Still Positive But Below ExpectationDocument7 pagesLondon Sumatra Indonesia TBK: Still Positive But Below ExpectationHamba AllahNo ratings yet

- Dabur India's strong domestic volume growth lifts revenues 18Document9 pagesDabur India's strong domestic volume growth lifts revenues 18Raghavendra Pratap SinghNo ratings yet

- Ramco Cement Q2FY24 ResultsDocument8 pagesRamco Cement Q2FY24 ResultseknathNo ratings yet

- UltratechCement Edel 190118Document15 pagesUltratechCement Edel 190118suprabhattNo ratings yet

- Arihant May PDFDocument4 pagesArihant May PDFBook MonkNo ratings yet

- Apcotex Industries 230817 PDFDocument7 pagesApcotex Industries 230817 PDFADNo ratings yet

- DivisLabs MotilalOswal Feb9-2016Document10 pagesDivisLabs MotilalOswal Feb9-2016rohitNo ratings yet

- S Chand and Company (SCHAND IN) : Q3FY20 Result UpdateDocument6 pagesS Chand and Company (SCHAND IN) : Q3FY20 Result UpdateanjugaduNo ratings yet

- INFY - NoDocument12 pagesINFY - NoSrNo ratings yet

- Boi 250108Document5 pagesBoi 250108api-3836349No ratings yet

- CMP: INR141 TP: INR175 (+24%) Biggest Beneficiary of Improved PricingDocument10 pagesCMP: INR141 TP: INR175 (+24%) Biggest Beneficiary of Improved PricingPratik PatilNo ratings yet

- Economic Indicators for East Asia: Input–Output TablesFrom EverandEconomic Indicators for East Asia: Input–Output TablesNo ratings yet

- Annual Report 2017 2018Document220 pagesAnnual Report 2017 2018akumar4uNo ratings yet

- Lead PM JioMart JDDocument2 pagesLead PM JioMart JDakumar4uNo ratings yet

- Market Roundup - Online Learning Platforms in India: Edition - 1Document24 pagesMarket Roundup - Online Learning Platforms in India: Edition - 1akumar4uNo ratings yet

- Delta Corp Annual Report FY 2021-22Document241 pagesDelta Corp Annual Report FY 2021-22akumar4uNo ratings yet

- Notice of 27th AgmDocument14 pagesNotice of 27th Agmakumar4uNo ratings yet

- System Design Interview PrepDocument122 pagesSystem Design Interview Prepmukul_manglaNo ratings yet

- How To (Actually) Calculate CAC - Interactive SpreadsheetsDocument8 pagesHow To (Actually) Calculate CAC - Interactive Spreadsheetsakumar4uNo ratings yet

- ZScaler FY 2020 - Annual ReportDocument236 pagesZScaler FY 2020 - Annual Reportakumar4uNo ratings yet

- Zscaler Inc - Form 10-K (Sep-18-2019)Document164 pagesZscaler Inc - Form 10-K (Sep-18-2019)akumar4uNo ratings yet

- Value Chain by SlidesgoDocument34 pagesValue Chain by SlidesgoCarlos ChacónNo ratings yet

- Employee Attrition Study of Hospital SectorDocument8 pagesEmployee Attrition Study of Hospital Sectorakumar4uNo ratings yet

- The Startup's Guide To Google CloudDocument18 pagesThe Startup's Guide To Google Cloudakumar4uNo ratings yet

- IBEF IT-and-BPM-January-2021Document34 pagesIBEF IT-and-BPM-January-2021akumar4u100% (1)

- Zscaler Inc - Form 10-K (Sep-17-2020)Document186 pagesZscaler Inc - Form 10-K (Sep-17-2020)akumar4uNo ratings yet

- PitchDocument11 pagesPitchakumar4uNo ratings yet

- Indian IT and ITeS Industry Report 170708Document32 pagesIndian IT and ITeS Industry Report 170708workosaurNo ratings yet

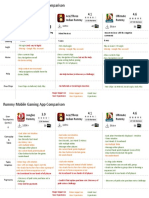

- Junglee Rummy provides the most intuitive gameplay but lacks helpful featuresDocument2 pagesJunglee Rummy provides the most intuitive gameplay but lacks helpful featuresakumar4uNo ratings yet

- 1bcf4f2c 17cc 4759 9081 Dcc0f5beeb6Document158 pages1bcf4f2c 17cc 4759 9081 Dcc0f5beeb6divya mNo ratings yet

- IBEF Report Mobile GamingDocument5 pagesIBEF Report Mobile Gamingakumar4uNo ratings yet

- IBEF Healthcare-March-2021Document39 pagesIBEF Healthcare-March-2021akumar4uNo ratings yet

- Kovai Medical Center and Hospital Limited BSE 523323 FinancialsDocument39 pagesKovai Medical Center and Hospital Limited BSE 523323 Financialsakumar4uNo ratings yet

- Junglee Rummy provides the most intuitive gameplay but lacks helpful featuresDocument2 pagesJunglee Rummy provides the most intuitive gameplay but lacks helpful featuresakumar4uNo ratings yet

- IBEF Healthcare-March-2021Document39 pagesIBEF Healthcare-March-2021akumar4uNo ratings yet

- KMC Speciality Hospitals India Limited BSE 524520 FinancialsDocument38 pagesKMC Speciality Hospitals India Limited BSE 524520 Financialsakumar4uNo ratings yet

- Apollo Hospitals Enterprise Limited NSEI APOLLOHOSP FinancialsDocument40 pagesApollo Hospitals Enterprise Limited NSEI APOLLOHOSP Financialsakumar4uNo ratings yet

- Fortis Healthcare Limited BSE 532843 FinancialsDocument44 pagesFortis Healthcare Limited BSE 532843 Financialsakumar4uNo ratings yet

- Coleridge's Gothic Style Revealed in PoemsDocument2 pagesColeridge's Gothic Style Revealed in PoemsarushiNo ratings yet

- Answer Sheet Answer Sheet: SY 2019-2020 SY 2019-2020Document2 pagesAnswer Sheet Answer Sheet: SY 2019-2020 SY 2019-2020Toga MarMarNo ratings yet

- Solved Table 2 5 Shows Bushels of Wheat and Yards of ClothDocument1 pageSolved Table 2 5 Shows Bushels of Wheat and Yards of ClothM Bilal SaleemNo ratings yet

- KFCDocument1 pageKFCJitaru Liviu MihaitaNo ratings yet

- London Stock ExchangeDocument15 pagesLondon Stock ExchangeZakaria Abdullahi MohamedNo ratings yet

- IataDocument2,002 pagesIataJohn StanleyNo ratings yet

- New Customer? Start Here.: The Alchemical Body: Siddha Traditions in Medieval India by David Gordon WhiteDocument2 pagesNew Customer? Start Here.: The Alchemical Body: Siddha Traditions in Medieval India by David Gordon WhiteBala Ratnakar KoneruNo ratings yet

- Ban Social Media Debate CardsDocument1 pageBan Social Media Debate CardsSyrah YouNo ratings yet

- Attitude StrengthDocument3 pagesAttitude StrengthJoanneVivienSardinoBelderolNo ratings yet

- PDocument151 pagesPfallstok311No ratings yet

- Market StructuresDocument5 pagesMarket StructuresProfessor Tarun DasNo ratings yet

- ASEAN India RelationsDocument13 pagesASEAN India RelationsVihaan KushwahaNo ratings yet

- Effects of Result-Based Capability Building Program On The Research Competency, Quality and Productivity of Public High School TeachersDocument11 pagesEffects of Result-Based Capability Building Program On The Research Competency, Quality and Productivity of Public High School TeachersGlobal Research and Development ServicesNo ratings yet

- 11 Republic vs. Marcopper Mining Corp Cd1Document2 pages11 Republic vs. Marcopper Mining Corp Cd1Leigh AllejeNo ratings yet

- Sunnah Salah of FajrDocument8 pagesSunnah Salah of FajrAbdullah100% (2)

- Essay USP B. Inggris 21-22 PDFDocument3 pagesEssay USP B. Inggris 21-22 PDFMelindaNo ratings yet

- Case StudyDocument2 pagesCase StudyPragya BiswasNo ratings yet

- Metaphysical Foundation of Sri Aurobindo's EpistemologyDocument25 pagesMetaphysical Foundation of Sri Aurobindo's EpistemologyParul ThackerNo ratings yet

- Marang, TerengganuaDocument2 pagesMarang, TerengganuaCharles M. Bélanger NzakimuenaNo ratings yet

- Main Suggestions With MCQ Gaps AnswersDocument4 pagesMain Suggestions With MCQ Gaps Answersapi-275444989No ratings yet

- MKTG FormsDocument4 pagesMKTG FormsMarinellie Estacio GulapaNo ratings yet

- Eo BCPCDocument3 pagesEo BCPCRohaina SapalNo ratings yet

- Accounting for Foreign Currency TransactionsDocument32 pagesAccounting for Foreign Currency TransactionsMisganaw DebasNo ratings yet

- Guerrero v. Director Land Management BureauDocument12 pagesGuerrero v. Director Land Management BureauJam NagamoraNo ratings yet

- FS Pimlico: Information GuideDocument11 pagesFS Pimlico: Information GuideGemma gladeNo ratings yet

- Student portfolio highlights work immersion experiencesDocument28 pagesStudent portfolio highlights work immersion experiencesJohn Michael Luzaran ManilaNo ratings yet