Professional Documents

Culture Documents

BÀI TẬP KTQTE 2 Chapter 11

BÀI TẬP KTQTE 2 Chapter 11

Uploaded by

Hoàng Huy0 ratings0% found this document useful (0 votes)

10 views15 pagesOriginal Title

BÀI-TẬP-KTQTE-2-Chapter-11

Copyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

0 ratings0% found this document useful (0 votes)

10 views15 pagesBÀI TẬP KTQTE 2 Chapter 11

BÀI TẬP KTQTE 2 Chapter 11

Uploaded by

Hoàng HuyCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

You are on page 1of 15

ACCOUNTING FOR TAXES ON INCOME 973

CONCEPT QUESTIONS

CQILA1 Explain how a deferred tax liability and a deferred tax asset conform to the definitions of liability

and an asset in the IFRS Framework.

CQI1.2 Explain the concept of a taxable temporary difference.

CQI1.3 Explain the concept of a deductible temporary difference.

CQI14 In your view, is tax expense ain “expense or a “distribution of income"? Explain.

CQI1.5 Describe, in your own words, the methodology of deferred tax accounting,

CQI1.6 What may cause the “effective tax rate” of an entity to be different from the entity’s statutory

tax rate? :

CQI17 Provide examples of situations where the taxable or deductible temporary difference should not

be recognized.

cQ11.8 Explain the rationale for the treatment of tax losses under IAS 12,

C@11.9. How may an investor use the information on deferred taxes in financial analysis of an entity?

the information reported on deferred taxes relevant for decision-making?

Q11.10. In your opinion,

Explain.

PROBLEMS

PIi1_ Balance sheet liability approcch and anclytcal check

Details of assets and lisbilities of Company XYZ. are as follows:

(a) Fixed assets

Date purchased 1 January 20x1

Cost $1,000,000

Use fe sees io years

Residual value. $100,000

Scanned with CamScanner

een

974 ADVANCED FINANCIAL ACCOUNTING

Depreciation is on a straight line basis. Capital allowances of $1,000,000 are recognized in full in 20x1.

Recovery of residual value will be taxed when the fixed assets are disposed of.

(b) Development expenditures

Completion of development ... 1 January 20x)

Cost of development 600,000,

Useful life. 3 years from 1 January 20:3

Development expenditures qualify as an asset under IAS 38 Intangible Assets and are'not tax deductible.

Amortization is on a straight line basis.

(¢) Provision for warranties

Be eee

Balance at 1 Janury...cesesss $60.00 $75,000

Expense «. '50,000 60,000

Utilization eo... (35,000) (45,000)

Balance at 31 December... 375; 390,000

Warranties are deductible for tax purposes when claims are made.

(@) Interest receivable :

31 December 20:2° 31 December 20x3 .

Balance at 1 January $60,000 $75,000

Expense : 0,000 60,000

Usiization (35,000) (45,000)

Balance at 31 December...... $75,000 $90,000

Interest income is taxed when earned,

(€) Rental revenue received in advance

pL ee

Balance at 1 January. ‘360,000 $20,000

Cash receives ‘480,000 600,000

Revenue earned... (620,000) (680,000)

Balance at 31 December,

‘Revenue is taxed at the point of receipt.

Scanned with CamScanner

(© Investment property

Balance at 1 Januarye.ss++

‘Acquired at cost.

Fair value adjustment...

31 December 20x2 31 December 20x3

S80 $5,500,000

a 5,000,000 °

'500,000 (700,000)

S400

Balance at 31 December. 00,000

0

Investment property is carried at fair value. Changes in fair value are takeri to Income Statement.

Unrealized change in fair value is not taxed. Profit on sale is tax-exempt, Assume that the business

‘model is to primarily hold the property to collect rents.

(g) Disallowed items included in net income

Aer Poros

Capital expenses $60,000 $72,000

. (h) Tax exemptions and reliefs granted

Reed Pees)

‘Taxcexempt interest... $25,000 $30,000

(i) Profit before tax

Ae Pe

Profit before tax... $1,000,000 $1,200,000,

() Current tax payable and tax rates

pce Pees

03%

Current tax payable... $132,000 453,400

TK IMS. ass iee receeetee 2% 2

“Tax rates for 20x1 was also 22%

Required:

1. Using the balance sheet liability approach, and showing the carrying amount and the tax base for

each asset and liability, determine the deferred tax liability (asset) balance as at 31 December 20x1,

31 December 20x2, and 31 December 20x3 for Company XYZ. Explain the tax base in each instance.

2. Determine the tax expense for 20x2 and 20x3.

3, Perform the analytical check on tax expense for 20x2 and 20x3.

Scanned with CamScanner

ACCOUNTING FOR TAXES ON INCOME 975 |

|

\

|

|

976 ADVANCED FINANCIAL ACCOUNTING

PI1.2 Comprehensive problem

Company A recorded a profit before tax of $2,500,000 for the year ended 31 December 20x3, The tax rate

for 20x3 was 24% while that of 20x2 was 2296, Deferred tax liability as at 31 December 20x2 was $26,400.

(a) On 1 January 20x1, Company A purchased plant and machinery costing $120,000. The useful life of

the plant and machinery was five years, but the capital allowances were to be claimed over a three-

year period.

(b) On 1 July 20x2, Company A purchased specialized equipment costing $150,000. The useful life of the

equipment was five years from the date of acquisition. However, for tax purposes, capital allowances

were claimed in fall during 2022.

(©) Company A completed the development phase of a new drug on 1 January 20x2, which amounted to

$50,000. The expenditures were not deductible for tax purposes but were deemed to have an economic

useful life of five years for accounting purposes.

(4) The movement in the provision for impairment losses is as follows:

Bee

Balance at 1 January. $55,000

Expense .... 30,000

Utilization (60,000)

Balance at 31 December... $35,000

Impairment losses were allowable for tax purposes in the period of utilization.

(©) Dividends received during 20x3 amounted to $50,000 while dividend income for 20x3 was $60,000. ~

Dividends receivable as at 1 January 20x3 were $20,000. Dividend income was taxed when received.

(© Unearned revenue balance arising from service fees collected in advance as at 31 December 20x3 was

$14,000. Cash received during the year in respect of unearned revenue was $32,000. Earned revenue

from service fees for 20x3 was $30,000. Service fees were taxable during the year when the proceeds

were received.

(@) Disallowed items are as follows:

Entertainment expenses... $ 9,600

Donations to non-qualfying charities. 9500

Disallowed transport expenses.......cssseseee 13,000

(h) Tax-exempt income and reliefs granted are as follows:

Tax-exempt income. $14,000

Double-deductions 65,000

Scanned with CamScanner

ACCOUNTING FOR TAXES ON INCOME 977,

Required:

1. Prepare the tax

6 tax c

2 Using ane an computation for the year ended 31 December 20x3 bated onthe sbove information,

ice sheet liability approach, show the cumulative taxable (deductible)

: a jutible) tem

: perineal arising from each asset or liability as at 31 December 20x3. S a

Ae tmine the deferred tax liability as at 31 December 20x3.

form the analytical check ori tax expense. for 20x3.

PIL3 Accounting for tox losses

Refer t¢ ts

a fo Probie 11.2. If instead of a profit, Company A recorded a loss of $1,000,000 for 20x3, what

Words, cee ti exPense or credit for 20x3 assuming that future profitability is not asured? In your own

» explain how the accounting of deferred tax assets differ from that of deferred tax liabilities.

PI14 Comprehensive problem

You have been assigned to i

1ed to prepare the deferred tax computations for Co A for the years ended 31 December

20x2 and 20x3. The following details relate to Co As assets and liabilities.

(a) Fixed assets

Date purchased. 1 January 20x1

Cost... $100,000

Useful life, 5 years

Residual value... $10,000

Depreciation is on a straight line basis. Capital allowances of $100,000 are claimed in full in 20:1.

‘Since fall capital allowances are given on the cost of the asset, any residual value recovered on disposal

is taxable.

(b) Development expenditures

$200,000

Cost of development .

4 years from 1 January 203

Useful life...

Development expenditures ae capitalized as intangible assets. Amortization is on 2 straight line bass.

‘The following tax deductions are allowed:

(@_ $100,000 on 1 January 20x3

i) $100,000 on 1 January 20x4

Scanned with CamScanner

978 ADVANCED FINANCIAL ACCOUNTING

(©) Provision for warranties

Se ee I

Balance at 1 January.. é $30,000 $25,000 i

Expense . . 45,000 50,000

Usiization * (0600) (60,000) i

Balance at 31 December, 525.000 315,000 :

Warranties are deductible for tax purposes when claims are made:

(d) Interest receivable

Sue

Balance at 1 Januar

$200,000

Interest income... 100000

Interest received... (230,000)

Balance at 31 December 5 70900

Interest income is taxed when received,

(©) Unearned reventie

Balance at 1 January...

$100,000 $40,000 [

Cash received. * 60,000 60,000 t

Revenue earned........, (120,000) (70,000)

Balance at 31 December. 5 40,000 $30,000

Revenue is taxed at the point of receipt.

(f) Financial assets

peo pod

Balance, a cost...

$ 80,000 $ 80,000 |

Fair value adjustment 20,000 40,000 |

Balance, a far value 5100.000

Scanned with CamScanner

ACCOUNTING FOR TAXES ON INCOME 979°

‘The asset was acquired during 20x2. Fair value adjustment of $20,000 was taken to income statement

in each ofthe two years. Income from the sale of financial assets is taxable. As of 31 December 203,

no sale has been made of the financial assets. :

(@) Disallowed items included in net income

Bone Poe

Penalties and fines. $ 5,000 $ 1,400

Entertainment expenses .. 1,200 10,000

Motor vehicles expenses. 14000 12,000

(b) ‘Tax exemptions and reliefs granted

31 December 20x2 |) ) 31 December 20x3

Double deduction on trade fait

expenses... eee $16,200 $30,000

Taxcexempt interest. 5,700 12,000

(Profit before tax

Boers eee

Reported profit. $850,000 $900,000

@) Tax rates

Eien Pena!

SS 25% 20%

Current tax rates...

Deferred tax liability balance as at 31 December 20x1 was $38,000. The tax rate was 2596 as at 31

December 20x1.

Required: F

1, Prepare the tax computation for the years ended 31 December 20x2 and 20x3.

2. Using the balance sheet liability approach, and showing the carrying amount and the tax base for each

asset and liability, determine the deferred tax liability balance as at: i

(a) 31 December 20x2; and

(b) 31 December 20x3. :

3, Prepare the journal entries to record the tax expense for 20x2 and 20x3.

‘4, Perform the analytical check on tax expense for 20x2 and 20x3.

Scanned with CamScanner

980 ADVANCED FINANCIAL ACCOUNTING

P11.5 Comprehensive problem

Co X was incorporated on 1 January 20x0. Details of assets and liabilities of Co X as at 31 December

20x1 were as folléws:

(a) Fixed assets

Date purchased. 1 January 20x1

Gort cesses $240,000,

Useful life. S 10 years,

Residual value (taxable when sold) - $20,000

Depreciation is on a straight line basis. The capital allowances are as follows:

($80,000 in 20x1

Gi) $80,000 in 20x2

(ii) $80,000 in 20x3

(b) Intangible asset .

Date of purchase

Cost of development

Useful lie

1 January 20x1

$400,000

5 years

Amortization is on a straight line basis. No tax deductions are allowed on the asset.

(©) Accounts receivable

Bee Be eed

Balance at year-end $100,000 $200,000

Revenue is taxed in the year when sales are made,

(d) Provision for impairment losses

Beemer Bord

Balance at 1 January....+++ $ 20,000. § 25,000

Impairment expense. 30,000 60,000

Utilization of provision. (25,000) (70,000)

Balance at 31, December.......- § 25,000 § 15,000

‘Tax deduction is allowed on actual utilization of the provision.

Scanned with CamScanner

ACCOUNTING FOR TAXES ON INCOME 9B

(© Loan payable

pe Aro

Balance at yearend essesssese $1,000,000 $650,000

Repayment of loans is a capital transaction and is not tax deductible,

(O). Interest payable

Ae peed

Balance at 1 January $240,000 $130000

Interest expense. 190,000 60,000

Interest paid (300,000) (150,000)

Balance at 31 December... ‘5130000 $40,000

Interest expense is deductible when paid.

(6) Uniealized exchange gain

Bees

Unrealized exchange gain included

in year-end debtors $20,000 $18,000

Exchange gain is realized in the following year and is taxed in the period of realization.

(h) Profit before tax

$1,000,000

Profit before tax for 20x1 ..

Profit before tax for 20:2. 750,000

(@, Tax rates 5

{As at 31 December 20%0.....++ se 186

. {is at 31 December 20x1 20%

‘as at 31 December 20%2..... fee 2286

Required:

1. Prepare the tax computation for the years ended 31 December 201 and 20x2.

2. Using the balance sheet liability approach, and showing the carrying amount and the tax base for each

” eget and liability above, determiné the'deferred tax liability balance as at:

Scanned with CamScanner

982 ADVANCED FINANCIAL ACCOUNTING, :

(a) 31 December 203

(b) 31 December 20x1; and

(©) 31 December 20x2. ‘

3, Show the journal entries to record tax expense.

4, Show the analytical check on tax expense for 20x1 and 20x2,

P11.6 Accounting for tax losses

Refer to P11.5. If the financial statements for 20x2 showed a pre-tax loss of $600,000 instead of a profit of

$750,000, what would be the journal entry for tax expense for 20x2? Assume that there is no reasonable

assurance of future profitability and that the company will continue to be loss-making in the foreseeable

future.

PIL.7 Comprehensive problem

Co Q requires your assistance to complete its deferred tax and tax expense calculation for the year ended

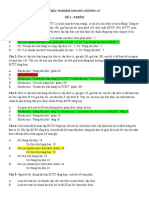

31 December 20x2. The following schedules are provided to you below:

(a) Tax computation for the year ended 31 December 20x2.

(b) Schedule of taxable (deductible) temporary differences for 20x2

Required:

1. Complete the schedule of taxable (deductible), temporary differences by indicating on the blanks

whether the item is a taxable temporary difference (TTD) or a deductible temporary difference (DTD)

and the amount for that item. If the temporary difference is not to be recognized under IAS 12 Income

Taxes, state clearly.

If the statutory tax rate for 201 is 20%, and if there are no additions or disposals of fixed assets, show

the journal entries for Co Q for.20x2.

3. If the profit before tax of $750,000 was’a loss of $1,000,000, show the journal entries for Co Q for

20x2.

EO ROR Secu tes :

Profit before taX...sscessseeesseeeee $750,000

‘Add back depreciation on plant and equipment ... $100,000

Less: Capital allowances 0 100,000

‘Add back depreciation on motor vehicles esses $12,000

Less: Capital allowances eaeettaeheeaea Q 12,000

‘Add back warranty expense.. $ 80,000

Less: Actual claims........ (100,000) (20,000)

Earned income......see016 sesee$(95;000)

‘Add: Unearned income received. = 45,000 (50,000)

Taxable income .. $792,000

Tax rate. 22%

$174,240

Current tax payable

Scanned with CamScanner

ACCOUNTING FOR TAXES ON INCOME 983

Ain

jeductible) temporary diff

1. Plant and equipment

31 Dec 2032

Carrying amount. ‘$300,000

Toxbase. ase

Captl allowances were fly camed inthe yar of purchase

2 Motor vehicles

31 Dec 20a

Canying amount $6,000

Tar base

Cepia atowances are not granted on these veils,

3. Loan payable

31 Dec 2022,

Carrying amount... $200,000

Tax base

Loan payable isthe principal amount repayable at the end of 20x6.

4. Provision for waranties

cary 31 Dec 2012

rrying amoun . s20.00|

‘Tax base... se

Tox deduction isclloned on acu utitzavon of the provon

5. Prepaid expense

31 Dec 202

Carrying amount. 7 $5,000

Tax base

The expenses deductible inthe year when expense.

6. Unearned revenue

: 31 Dec 2012

Carrying amount. 20000

Tax base

Revenue is taxed when received.

P11.8. Comprehensive. problem

Company X seeks your assistance to determine its tax expense under IAS 12 Income Taxes, The accountant

has provided you with a schedule below of carrying amounts of assets and liabilities and information

relating to the tax treatments of the items..The accountant also provided the: tax X computation for the

financial year ended 31 December 2033, .,

Scanned with CamScanner

984 ADVANCED FINANCIAL ACCOUNTING

Comp!

Item

1. Construction Work-In-progress

Construction costs to date .. $12,000,000

Construction profit to date... 700,000

512,700,000

Construction workin-progress.

Carrying amount... $12,700,000

Tax base ..

2. Provision for restructuring costs

Carrying amount.

Tax base ..

$150,000

3. Fixed assets

Net book value ...

Tax base «+.

$300,000,

4: Interest receivable

Carrying amount.

Tax base +...

$70,000

5. Rent receivable

Carrying amount.

Tax base ..

$80,000

6. Unearned income

Carrying amount.

Tax base sesso

$90,000

7. Financial assets at fair value through profit or loss

Carrying amount at fair value ... ea

Tax base ..

$150,000

8. Deferred development costs (FRS 38)

Carrying amount. .

Tax base

$40,000

ete the schedule dicatt ledly whither tAtable¢ deuueible temporary differerice exists for

t to be Fecognized ‘under LAS 12, state cleatly.

each item. If the temporafy ‘difference is not

‘Schedule of balances as at 31 December 20x3

‘Amount ‘Tax treatment

Construction profit is taxed at the

point of completion of project.

Restructuring costs are not

deductible for tax purposes.

Capital allowances were fully

claimed in the first year of purchase.

Original cost was $500,000.

Interest is tax-exempt.

Rental income is taxed in the

period when earned,

Unearned income is taxed at the

point of receipt.

Gains are taxed at the point of sale.

The original purchase price of the

asset is $120,000,

Non-deductible expense

Scanned with CamScanner

—_

ACCOUNTING FOR TAXES ON INCOME 985

‘The tax computation for Company X for the yea ended 31 Dec’ 2x3 is chown below:

‘Tax computation for the year ended 31 December 20x3

Profit before tax. + $1,000/000

Less: Construction profit. we (500,000)

‘Add back depreciation on fixed assets J00,000

‘Less: Capital allowances o

‘Taxexempt interest. are

Eamed income. . = £70,000)

‘dt: Unearned income received during the year vsvsccssesseee ‘90,000

‘Less: Gain in fair value of financlal assets... (30,000)

‘Add: Loss in fair value of financial assets. 10000

Taxable gain on sale of financial assets.

Disallowed amortization on deferred traning costs.

Disallowed charge for restructuring cost...

Taxable income

Tax rate...

Tax payable

10,000

Required:

1. Determine the tax expense of Company X for the yeat ended’31 Deceimber 2033, Tax rate for 2012 is

22%, Prepare the journal entry.

2. Perform an analytical check of the tax expense.

P11.9 Comprehensive problem and disclosures

Prismn Co, a magazine publisher, reported net profit before tax of $1,300,000 for the year ended 31 December

20x1, The only disallowed expenses were the depreciation on private motor vehicles and disallowed upkeep

and maintenance expenses on the motor vehicle of $3,000. Tax rate as at 31 December 20x1 was 17% while

the tax rate as at 31 December 20x0 was 18%,

Additional informatio

(2) Prism bought printing equipment on 1 January'20x0. The ofiginal cost was $480,000 and the

economic: useful life was five years. Capital allowances were claimed over three years from 1

January 20x0. ; : '

(2) A motot vehicle owned by Prism did not qualify for capital allowance claims. The economic iseful

life was ten years and the residual value was $50,000. As at 31 Decemiber 20x0, two years had

expired from its initial purchase date. :

(3) Prism Co received magazine subscriptions from customers in advance and recognized the receipts

‘as unearned revenue. Subscription revenues are taxable in the period when magazines are delivered.

Prism recorded the following in 20x0 and 20x1.

‘tof unearned revenue at 31 December....... $130,000 $140,000

$140,000 § 80,000

$120,000 § 90,000

Caring amour

Sa come rng the Ye

Revenue received during the year

Scanned with CamScanner

986

ADVANCED FINANCIAL ACCOUNTING _

Required:

P1110

Determine the taxable temporary differences and deductible temporary differences as at

31 December 20x0 and 31.December 20x1. 1

Determine the tax expense for the year ended 31 December 20x1.

Prepare the journal entry to record the tax expense for the year ended 31 December 20xl.

Prepare the disclosure requirements to show the following:

(a) An explanation of the relationship between tax expense and accounting income by way of a

numerical reconciliation between tax expense and the product of accounting profit multiplied

by the applicable tax rate; and

(b) The amount of the deferred tax assets’ and liabilities récognized ii the statement of financial

position for each type of temporary differerices.

Special situations

Co XYZ recognized isstied compound financial instruments in accordance with IAS 32 Financial Instruments:

Presentation, and purchased investment property in accordance with IAS 40 Investment Property using the

fair value model and elected to carry equity instruments at Fair Value through Other Comprehensive

Income

(FVOCI) in accordance with IFRS 9 Financial Instruments.

Compound financial instruments: :

Issue date . 1 January 20x1

Proceeds from issue of bonds — $12,000,000

Fair value of the bonds without the equity option ++, $10,200,000

Principal amount .. ce - $11,000,000

Effective interest rate 676%

Coupon interest rate 5%

Income tax rate. | 20%

Tax authorities do not recognize the separate equity options

Investment property:

Purchase date...... 15 July 20x0

Purchase price of investment property . $10,000,000

Fair value as at 31 December 20x0. $12,000,000

Fair value as at 31 December 20x1. $14,000,000

Basis of measurement . Fair value model

Income tax rate . 20%

io 10%

pital gains tax rate .....

Holding assumptions:

(1) Maintains rebuttable presumption that fair value is recovered through sale.

(2) Does not maintain rebuttable presumption. Fair value is recovered through rental income.

Scanned with CamScanner

ACCOUNTING FOR-TAXES ON INCOME 987,

FVOCI investment:

Purchase date .. ie parrot 23 July 2030

Purchase price of FVOCI equity investments ... $12,000,000

Fair value as at 31 December 20x0 . $16,000,000

Fair value as at 31 December 20x1 . re $14,000,000

20%

Income tax rate

Tax scenarios:

(1) Not taxable

(2) Taxed during year of fair value gain or loss

(3) Taxed during year of sale

Required: :

Prepare journal entries to record the deferred tax liability and/or current tax liability during 20x0 and 20x!

for each of the above three instruments under each holding assumption or tax scenario, where applicable

Scanned with CamScanner

You might also like

- E-Book - Performance AuditingDocument368 pagesE-Book - Performance AuditingNha Uyen NguyenNo ratings yet

- D130 Cash and Cash Equivalents Ok FinalDocument25 pagesD130 Cash and Cash Equivalents Ok FinalNha Uyen NguyenNo ratings yet

- D130 Cash and Cash EquivalentsDocument21 pagesD130 Cash and Cash EquivalentsNha Uyen NguyenNo ratings yet

- ÔN TẬP KIỂM TRA PHÂN TÍCH BCTCDocument4 pagesÔN TẬP KIỂM TRA PHÂN TÍCH BCTCNha Uyen Nguyen100% (1)

- TRẮC NGHIỆM ONLINE CHƯƠNG 27Document10 pagesTRẮC NGHIỆM ONLINE CHƯƠNG 27Nha Uyen Nguyen100% (1)

- KI1.K44C7.Nhóm 10 Chương 27Document43 pagesKI1.K44C7.Nhóm 10 Chương 27Nha Uyen Nguyen100% (1)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (843)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5808)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (346)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1092)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)