Professional Documents

Culture Documents

Estate Tax Return Preparation

Uploaded by

JoongCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Estate Tax Return Preparation

Uploaded by

JoongCopyright:

Available Formats

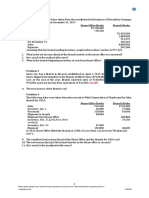

Activity #2 Estate Tax Return Preparation

Problem

Mr. Pim Musay. Filipino and married, died in 2019, leaving his estate in favor of his

surviving spouse. The following information were made available:

Real property in Quezon City, acquired during marriage. Said property is supported by a

barangay certification that the spouses resided in this property at the time of Mr. Musay's death.

The market value of this property as per latest tax declaration is P15,000,000 while the zonal

value at the time of death is P 20,000,000. Said real property was held as a mortgage in a loan

applied by the spouses. As of the time of death, the outstanding balance of the mortgage

payable amounted to P5,000,000.

Real property in Batangas, inherited by Mr. Musay during marriage, two and half years

ago, from his late father. The fair market value per tax declaration as of his death is P8,000,000

while the zonal valuation is P12,000,000. Said property was previously taxed at a value of

P10,000,000 when Mr. Musay inherited the property from his father.

Real property in Cavite, donated to Mrs. Musay, 10 years ago (before marriage) by his

parents-in-law The fair market value as per latest tax declaration as of the time of Mr. Musay's

death is P3,000,000 while the zonal valuation is P4,000,000.

Other exclusive properties of Mr. Musay P1,000.000, Other properties of Mr. and Mrs.

Musay P3,000,000. Funeral expenses incurred by the estate during the wake and burial of Mr.

Musay amounted to P1,900,000.

Personal details of Mr. Musay

TIN: 423-942-365

Address: 80 MAHUSAY ST. SAMPAGUITA SUB, INOCENCIO, TRECE MARTIRES CITY

CAVITE

Email: PIMUSAY@ gmail.com

Questions

1. How much is the total common property?

2. Compute for the vanishing deduction.

3. Compute for the share of the surviving spouse.

Requirements.

A. Answer the above questions.

B. Prepare the income tax return of Mr Musay, with you as the executor

You might also like

- Quiz - Act 07A: I. Theories: ProblemsDocument2 pagesQuiz - Act 07A: I. Theories: ProblemsShawn Organo0% (1)

- PNB's Centennial Journey from Government Bank to Leading Private Universal BankDocument9 pagesPNB's Centennial Journey from Government Bank to Leading Private Universal BankAlliah SomidoNo ratings yet

- Accounting policies, estimates and errors quizDocument2 pagesAccounting policies, estimates and errors quizkim cheNo ratings yet

- Business Combination-Acquisition of Net AssetsDocument2 pagesBusiness Combination-Acquisition of Net AssetsMelodyLongakitBacatanNo ratings yet

- Chapter 11 Intagible AssetsDocument5 pagesChapter 11 Intagible Assetsmaria isabellaNo ratings yet

- BMBE Survey QuestionnaireDocument5 pagesBMBE Survey QuestionnairePrince GueseNo ratings yet

- Mas Drills Weeks 1 5Document28 pagesMas Drills Weeks 1 5Hermz ComzNo ratings yet

- Audit of Shareholders' Equity: Auditing ProblemsDocument4 pagesAudit of Shareholders' Equity: Auditing ProblemsKenneth Adrian AlabadoNo ratings yet

- FAR-01 Contributed CapitalDocument3 pagesFAR-01 Contributed CapitalKim Cristian MaañoNo ratings yet

- Reflection Paper #3 - Overview of Mining IndustryDocument3 pagesReflection Paper #3 - Overview of Mining IndustrynerieroseNo ratings yet

- Quiz No. 2Document5 pagesQuiz No. 2VernnNo ratings yet

- Consolidation at Acquisition DateDocument29 pagesConsolidation at Acquisition DateLee DokyeomNo ratings yet

- Auditing Theories and Problems Quiz WEEK 2Document16 pagesAuditing Theories and Problems Quiz WEEK 2Van MateoNo ratings yet

- VatDocument7 pagesVatCharla SuanNo ratings yet

- Updates in Philippine Accounting and Financial Reporting StandardsDocument9 pagesUpdates in Philippine Accounting and Financial Reporting StandardsChin FiguraNo ratings yet

- Exam Reviwer in GbermicDocument23 pagesExam Reviwer in GbermicMary Elisha PinedaNo ratings yet

- 7.3.1 Topic Test Questions AnswersDocument34 pages7.3.1 Topic Test Questions AnswersliamdrlnNo ratings yet

- Risk-Based Internal Auditing and Identifying Operational RisksDocument5 pagesRisk-Based Internal Auditing and Identifying Operational RisksMaricar PinedaNo ratings yet

- Ventura, Mary Mickaella R - Comprehensive Income p.85 - Group3Document2 pagesVentura, Mary Mickaella R - Comprehensive Income p.85 - Group3Mary VenturaNo ratings yet

- Academic Performance of BSA Students and Their Qualifying Examination Result Correlational StudyDocument17 pagesAcademic Performance of BSA Students and Their Qualifying Examination Result Correlational Studykarl cruzNo ratings yet

- Bus Tax Chap 6Document3 pagesBus Tax Chap 6yayayaNo ratings yet

- Summative Assessment 2 ITDocument9 pagesSummative Assessment 2 ITJoana Trinidad100% (1)

- Audit Theory Case AnalysisDocument2 pagesAudit Theory Case AnalysisSheila Mary GregorioNo ratings yet

- Shareholder's Equity ProblemsDocument4 pagesShareholder's Equity ProblemsKHAkadsbdhsgNo ratings yet

- CHAPTER 8 - Audit of Liabilities: Problem 1Document27 pagesCHAPTER 8 - Audit of Liabilities: Problem 1Mikaela Gale CatabayNo ratings yet

- Case Digest: PartnershipDocument3 pagesCase Digest: PartnershipKsetsNo ratings yet

- Differentiate Confirmation and InquiryDocument3 pagesDifferentiate Confirmation and InquiryJasmine LimNo ratings yet

- Pre Week NewDocument30 pagesPre Week NewAnonymous wDganZNo ratings yet

- 2019 PFRS Pas PicDocument4 pages2019 PFRS Pas PicAron Vicente100% (1)

- BLT Quizzer Unknown Donors TaxDocument6 pagesBLT Quizzer Unknown Donors TaxtrishaNo ratings yet

- Correction of Errors: Identify The Letter of The Choice That Best Completes The Statement or Answers The QuestionDocument5 pagesCorrection of Errors: Identify The Letter of The Choice That Best Completes The Statement or Answers The QuestionmaurNo ratings yet

- Estate Tax Guide for PhilippinesDocument50 pagesEstate Tax Guide for PhilippinesLea JoaquinNo ratings yet

- Quiz - 5B 2Document3 pagesQuiz - 5B 2Jao FloresNo ratings yet

- 04.1 S4 VAT PPT AquinoDocument112 pages04.1 S4 VAT PPT Aquinosaeloun hrdNo ratings yet

- Practical Accounting 1: 2011 National Cpa Mock Board ExaminationDocument7 pagesPractical Accounting 1: 2011 National Cpa Mock Board Examinationcacho cielo graceNo ratings yet

- Chapter 3 & 4 Tax ProblemsDocument3 pagesChapter 3 & 4 Tax ProblemsCorazon Lim LeeNo ratings yet

- Chapter 14Document47 pagesChapter 14darylleNo ratings yet

- Basic Eps Praac Valix 2018pdf DDDocument20 pagesBasic Eps Praac Valix 2018pdf DDCaptain ObviousNo ratings yet

- Chapter I Iii Revision 115Document49 pagesChapter I Iii Revision 115Jamie Rose AragonesNo ratings yet

- Tandem Activity GE Allowable DeductionsDocument6 pagesTandem Activity GE Allowable DeductionsErin CruzNo ratings yet

- Donors TaxDocument5 pagesDonors TaxHana Grace MamangunNo ratings yet

- Year Sales Actual Warranty ExpendituresDocument5 pagesYear Sales Actual Warranty ExpendituresMinie KimNo ratings yet

- Audit of Investment, Do It Yourself - DiyDocument4 pagesAudit of Investment, Do It Yourself - Diymark100% (1)

- Audit of Receivable Wit Ans KeyDocument19 pagesAudit of Receivable Wit Ans Keyalexis pradaNo ratings yet

- AC 3101 Discussion ProblemDocument1 pageAC 3101 Discussion ProblemYohann Leonard HuanNo ratings yet

- Module No. 2 - Special CorporationsDocument8 pagesModule No. 2 - Special CorporationsJohn Russel PacunNo ratings yet

- Lesson 10 Assignment 4Document4 pagesLesson 10 Assignment 4marcied357No ratings yet

- Importance of Understanding Regulations for International TradeDocument5 pagesImportance of Understanding Regulations for International TradeJoanne DawangNo ratings yet

- Advacc DecDocument8 pagesAdvacc DecJerico CastilloNo ratings yet

- 02 Conceptual FrameworkDocument13 pages02 Conceptual FrameworkShey INFTNo ratings yet

- DeductionsDocument4 pagesDeductionsDianna RabadonNo ratings yet

- Quiz - Intangible Assets With QuestionsDocument3 pagesQuiz - Intangible Assets With Questionsjanus lopezNo ratings yet

- Group Quiz On Documentary Stamp TaxDocument2 pagesGroup Quiz On Documentary Stamp TaxRowena RogadoNo ratings yet

- Ar&Inventory ManagementDocument10 pagesAr&Inventory ManagementKarlo D. ReclaNo ratings yet

- Q2 Sce, Sci AkDocument6 pagesQ2 Sce, Sci AkGraceila CalopeNo ratings yet

- Accounting For Special Transactions:: Corporate LiquidationDocument28 pagesAccounting For Special Transactions:: Corporate LiquidationKim EllaNo ratings yet

- Cordillera Career Development College problems and solutionsDocument10 pagesCordillera Career Development College problems and solutionsapatosNo ratings yet

- Revised Excercises On Estate TaxDocument3 pagesRevised Excercises On Estate TaxAgayatak Sa ManenNo ratings yet

- Unlawful Detainer and Rescission of Contract CasesDocument4 pagesUnlawful Detainer and Rescission of Contract Casesjorem matayabasNo ratings yet

- Finn 22 - Financial Management Questions For Chapter 2 QuestionsDocument4 pagesFinn 22 - Financial Management Questions For Chapter 2 QuestionsJoongNo ratings yet

- CASE STUDY Presentation Case Study Evaluation:: - 50%-Professor Evaluation - 50% - Peer EvaluationDocument1 pageCASE STUDY Presentation Case Study Evaluation:: - 50%-Professor Evaluation - 50% - Peer EvaluationJoongNo ratings yet

- Itec30 - Activity #1 Entity Relationship Diagram: Activity1.Docx) in Your Own Folder in The GdriveDocument1 pageItec30 - Activity #1 Entity Relationship Diagram: Activity1.Docx) in Your Own Folder in The GdriveJoongNo ratings yet

- Activity 1 - Research PaperDocument1 pageActivity 1 - Research PaperJoongNo ratings yet

- FINANCIAL MANAGEMENT Learning Assessment Ch1 & Ch3Document3 pagesFINANCIAL MANAGEMENT Learning Assessment Ch1 & Ch3JoongNo ratings yet

- Business Compliance Requirements GuideDocument3 pagesBusiness Compliance Requirements GuideJoongNo ratings yet

- MACHATE Ch4 Learning AssessmentDocument2 pagesMACHATE Ch4 Learning AssessmentJoongNo ratings yet

- People Development Policies Chapter SummaryDocument22 pagesPeople Development Policies Chapter SummaryJoongNo ratings yet

- MACHATE - Case Analysis 1 - Tax AssessmentDocument1 pageMACHATE - Case Analysis 1 - Tax AssessmentJoongNo ratings yet

- NewsDocument29 pagesNewsJoongNo ratings yet

- Chapter 5 - Problems of The Third World CountriesDocument2 pagesChapter 5 - Problems of The Third World CountriesNikki Coleen SantinNo ratings yet

- NewsDocument29 pagesNewsJoongNo ratings yet

- Chapter 4 - EconDocument4 pagesChapter 4 - EconJoongNo ratings yet

- Chapter 5 - Problems of The Third World CountriesDocument2 pagesChapter 5 - Problems of The Third World CountriesNikki Coleen SantinNo ratings yet

- Chapter 3 - ECONDocument3 pagesChapter 3 - ECONJoongNo ratings yet

- Chapter 5 - Problems of The Third World CountriesDocument2 pagesChapter 5 - Problems of The Third World CountriesJoongNo ratings yet