Professional Documents

Culture Documents

Important Government Schemes Related To Banking: 1) Pradhan Mantri Jan Dhan Yojana (PMJDY)

Important Government Schemes Related To Banking: 1) Pradhan Mantri Jan Dhan Yojana (PMJDY)

Uploaded by

Pikku SharmaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Important Government Schemes Related To Banking: 1) Pradhan Mantri Jan Dhan Yojana (PMJDY)

Important Government Schemes Related To Banking: 1) Pradhan Mantri Jan Dhan Yojana (PMJDY)

Uploaded by

Pikku SharmaCopyright:

Available Formats

IMPORTANT GOVERNMENT SCHEMES RELATED TO BANKING

1)Pradhan Mantri Jan Dhan Yojana (PMJDY)

Hon’ble Prime Minister announced Pradhan Mantri Jan Dhan Yojana on Independence Day address on 15th August 2014.

This will be accomplished by providing access to banking facilities with at least one basic bank account to every household,

financial literacy, access to credit, insurance and pension facility.

Under this, a person not having a savings account can open an account without the requirement of any minimum balance.

Benefits

Interest on deposit.

Accidental insurance cover of Rs. 1.00 lac

No minimum balance required.

The scheme provides life cover of Rs. 30,000/- payable on death of the beneficiary, subject to fulfillment of the eligibility

condition.

Easy Transfer of money across India

Beneficiaries of Government Schemes will get Direct Benefit Transfer.

After satisfactory operation of the account for 6 months, an overdraft facility will be permitted.

Access to Pension, insurance products.

JAIIB & CAIIB MADE SIMPLE Page 1

2. Pradhan Mantri Jeevan Jyoti Bima Yojana (PMJJBY)

Age Group: It is available to people in the age group of 18 to 50 years having a bank account who give their consent to join

enable auto-debit. Aadhar is the primary KYC for the bank account.

Life cover: The life cover of Rs. 2 lakh is for the one year period stretching from1st June to 31st May and is renewable. Risk

coverage under this scheme is for Rs. 2 lakh in case of death of the insured, due to any reason.

Premium is Rs. 330 per annum which is to be auto-debited in one installment from the subscriber’s bank account.

The scheme is being offered by the Life Insurance Corporation and all other life insurers who are willing to offer the product

on similar terms with necessary approvals and tie up with banks for this purpose.

3. Pradhan Mantri Suraksha Bima Yojana (PMSBY)

It is available to people in the age group 18 to 70 years with a bank account who give their consent to join/ enable auto-debit

on or before 31st May for the coverage period 1st June to 31st May on an annual renewal basis. Aadhar would be the primary

KYC for the bank account.

The risk coverage under the scheme is Rs. 2 lakh for accidental death and full disability and Rs. 1 lakh for partial disability.

The premium of Rs.12 per annum is to be deducted from the account holder’s bank account through ‘auto-debit’ facility in

one installment.

Offered By: The scheme is being offered by Public Sector General Insurance Companies or any other General Insurance

Company who are willing to offer the product on similar terms with necessary approvals and tie up with banks for this

purpose.

Facts and Figures: As on 31st March 2017, cumulative gross enrolment reported by Banks subject to verification of

eligibility etc. is over 9.94 crore under PMSBY. A total of 12,534 Claims were registered under PMSBY of which 9,403

have been disbursed.

JAIIB & CAIIB MADE SIMPLE Page 2

4. Atal Pension Yojana (APY)

APY was launched on 9th May 2015 by the Prime Minister.

APY is open to all saving bank/post office saving bank account holders in the age group of 18 to 40 years and the

contributions differ, based on pension amount chosen.

Subscribers would receive the guaranteed minimum monthly pension of Rs. 1,000 or Rs. 2,000 or Rs. 3,000 or Rs. 4,000 or

Rs. 5,000 at the age of 60 years. Under APY, the monthly pension would be available to the subscriber, and after him to his

spouse and after their death, the pension corpus, as accumulated at age 60 of the subscriber, would be returned to the

nominee of the subscriber.

The minimum pension would be guaranteed by the Government, i.e., if the accumulated corpus based on contributions earns

a lower than estimated return on investment and is inadequate to provide the minimum guaranteed pension, the Central

Government would fund such inadequacy. Alternatively, if the returns on investment are higher, the subscribers would get

enhanced pensionary benefits.

As on 31st March 2017, a total of 48.54 lakh subscribers have been enrolled under APY with a total pension wealth of Rs.

1,756.48 crore.

5. Pradhan Mantri Mudra Yojana:

The scheme was launched on 8th April 2015.

Under the scheme a loan of upto Rs. 50,000 is given under sub-scheme ‘Shishu’; between Rs. 50,000 to 5.0 Lakhs under sub-

scheme ‘Kishore’; and between 5.0 Lakhs to 10.0 Lakhs under sub-scheme ‘Tarun’.Loans taken do not require collaterals.

These measures are aimed at increasing the confidence of young, educated or skilled workers who would now be able to

aspire to become first generation entrepreneurs; existing small businesses, too, will be able to expand theirs activates.

JAIIB & CAIIB MADE SIMPLE Page 3

6. Pradhan Mantri Vaya Vandana Yojana

It is launched to protect elderly persons aged 60 years and above against a future fall in their interest income due to the

uncertain market conditions.

This is implemented through Life Insurance Corporation (LIC) of India.

As per the scheme, on payment of an initial lump sum amount ranging from a minimum purchase price of Rs. 1,50,000/- for

a minimum pension of Rs 1,000/- per month to a maximum purchase price of Rs. 7, 50,000/- for the maximum pension of

Rs. 5,000/- per month, subscribers will get an assured pension based on a guaranteed rate of return of 8% per annum, payable

monthly.

7. Atma Nirbhar Bharat Abhiyan

Announced by PM Narendra Modi on 12th May 2020

It is launched to make country independent and combat the competition in the global market.

Under the Abhiyan special economic package of Rs. 20 Lakh Crore was announced.

8. Pradhan Mantri Jan Arogya Yojana

Under the Ayushman Bharat Pradhan Mantri Jan Arogya Yojana (AB PM-JAY) approximately 20.32 lakh Covid-19 tests

and 7.08 lakh treatments were authorised from April 2020 to July 2021.

It offers a sum insured of Rs.5 lakh per family for secondary care (which doesn’t involve a super specialist) as well as

tertiary care (which involves a super specialist).

Under PMJAY, cashless and paperless accesses to services are provided to the beneficiaries at the point of service.

Health Benefit Packages covers surgery, medical and day care treatments, cost of medicines and diagnostics.

Packaged rates (Rates that include everything so that each product or service is not charged for separately).

They are flexible, but they can’t charge the beneficiary once fixed by the hospitals.

JAIIB & CAIIB MADE SIMPLE Page 4

9. Pradhan Mantri Kishan Samman Nidhi Yojana

The PM-KISAN was launched on February 24 in 2019.

The PM-KISAN Mobile App developed and designed by the National Informatics Centre in collaboration with the

Ministry of Electronics and Information Technology has been launched.

The farmers can view the status of their application, update or carry out corrections of their Aadhaar cards and also check

the history of credits to their bank accounts.

PM-KISAN

Pradhan Mantri Kisan Samman Nidhi (PM-KISAN) is a Central Sector Scheme with 100% funding from the Government

of India.

It is being implemented by the Ministry of Agriculture and Farmer’s Welfare

10. PM Svanidhi

Full-Form of PM SVANidhi Prime Minister Street Vendor’s Atmanirbhar Nidhi

Launch Date & Under which government ministry? 1st June 2020, Ministry of Housing and Urban Affairs (MoHUA)

Target Beneficiary Street Vendors or hawkers in urban areas

Street Vendors of peri-urban areas

Street Vendors of Rural areas

Mandatory Documents to Access Benefits Aadhar Card

Voter Identity Card

Tenure of the scheme June 2020 – March 2022

JAIIB & CAIIB MADE SIMPLE Page 5

11. Pradhan Mantra Fasal Bima Yojana

Pradhan Mantri Fasal Bima Yojana is the flagship scheme of the government for agricultural insurance in India in line

with the One Nation-One Scheme theme.

Annual Commercial / Annual Horticultural crops, oilseeds, and food crops (Cereals, Millets, and Pulses) are covered

under the scheme.

PMFBY is optional for the farmers who have not availed institutional credit, while all the farmers who have borrowed

institutional loans from banks are covered under the scheme mandatorily. (This was modified and enrolment was made

voluntary post-Kharif season 2020.)

The scheme is administered by the Ministry of Agriculture.

12. Pradhan Mantra Awaas Yojana-Gramin

To achieve the objective of “Housing for All” by 2022, the erstwhile rural housing scheme Indira Awaas Yojana

(IAY) was restructured to Pradhan Mantri Awaas Yojana-Gramin (PMAY-G) w.e.f 1st April, 2016.

Ministry Involved: Ministry of Rural development.

To provide a pucca house with basic amenities to all rural families, who are homeless or living in kutcha or diapidated

houses by the end of March 2022.To help rural people Below the Poverty Line (BPL) in construction of dwelling units

and upgradation of existing unserviceable kutcha houses by providing assistance in the form of a full grant.

Beneficiaries: People belonging to SCs/STs, freed bonded labourers and non-SC/ST categories, widows or next-of-kin of

defence personnel killed in action, ex-servicemen and retired members of the paramilitary forces, disabled persons and

minorities.

JAIIB & CAIIB MADE SIMPLE Page 6

You might also like

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (843)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5808)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (346)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1092)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- MGMT3065 Unit 2-CorrectedDocument20 pagesMGMT3065 Unit 2-CorrectedstacyannNo ratings yet

- Digital Connectivity Report - Low ResDocument170 pagesDigital Connectivity Report - Low ResDënnis DukeNo ratings yet

- Test P1 Chapter 10Document10 pagesTest P1 Chapter 10Prince PersiaNo ratings yet

- South Western Career College, Inc.: Quarter - Module 1Document19 pagesSouth Western Career College, Inc.: Quarter - Module 1Gessel Ann AbulocionNo ratings yet

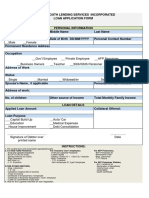

- For SSS/ GSIS Pensioner, For Teachers/ Gov't Employees For AFP PensionersDocument1 pageFor SSS/ GSIS Pensioner, For Teachers/ Gov't Employees For AFP PensionersJasmin QuarterozNo ratings yet

- GR 133079Document3 pagesGR 133079Karen Faye TorrecampoNo ratings yet

- IGCSE Economics Discuss Question NotesDocument12 pagesIGCSE Economics Discuss Question NotesAliya KNo ratings yet

- Payout PolicyDocument41 pagesPayout PolicyCFANo ratings yet

- Sampath SCM Unit 1 MBADocument43 pagesSampath SCM Unit 1 MBAd Vaishnavi OsmaniaUniversityNo ratings yet

- Cash Flow: AssumptionsDocument3 pagesCash Flow: AssumptionsGolamMostafaNo ratings yet

- U1 Week 4 The Monster in The Mountain: Exchange MoneyDocument3 pagesU1 Week 4 The Monster in The Mountain: Exchange MoneyStella YINNo ratings yet

- Business Process ReDocument3 pagesBusiness Process ReJithinNo ratings yet

- @csupdates RCD - Chapter - 1 - Dec - 22 - CS - ProfessionalDocument16 pages@csupdates RCD - Chapter - 1 - Dec - 22 - CS - ProfessionalAGHBALOUNo ratings yet

- Opera DuoDocument34 pagesOpera DuoJOEL ARMANDO GARATE PAREJANo ratings yet

- Certificate of EarningsDocument1 pageCertificate of Earningspemburu maniakNo ratings yet

- Martha StewartDocument2 pagesMartha StewartDenzin AkinNo ratings yet

- BOVONTOo 4Document3 pagesBOVONTOo 421auba032No ratings yet

- Blue Ocean Strategy Bachelor ThesisDocument4 pagesBlue Ocean Strategy Bachelor Thesisheduurief100% (2)

- Economic Development and Entrepreneurship in Transition Economies (PDFDrive)Document830 pagesEconomic Development and Entrepreneurship in Transition Economies (PDFDrive)Deepika SoniNo ratings yet

- Initial Pages of ReportDocument12 pagesInitial Pages of ReportDipta GhoshNo ratings yet

- P22250 - Siddhant Srivastava - PFP-HR01Document6 pagesP22250 - Siddhant Srivastava - PFP-HR01Siddhant SrivastavaNo ratings yet

- Fundamentals of Accounting IIDocument61 pagesFundamentals of Accounting IIMintayto TebekaNo ratings yet

- Cfas 12Document19 pagesCfas 12iantumpalan10No ratings yet

- (High Res Singles - Issuu) Market Technician Issue 88 (March 2020) PDFDocument60 pages(High Res Singles - Issuu) Market Technician Issue 88 (March 2020) PDFjoeNo ratings yet

- 220103196-Utkarsh Ashok TripathiDocument1 page220103196-Utkarsh Ashok TripathiAbhinav MishraNo ratings yet

- Identifying Hazards and RisksDocument31 pagesIdentifying Hazards and RisksIng Yng CoNo ratings yet

- 2019 IFRS Financial Results: Resources Create Opportunities Resources Create OpportunitiesDocument24 pages2019 IFRS Financial Results: Resources Create Opportunities Resources Create OpportunitiesVlad KremerNo ratings yet

- Assignment 1: Chapter 12 LiabilitiesDocument5 pagesAssignment 1: Chapter 12 LiabilitiesKarylle Ynah MalanaNo ratings yet

- Course Outline AFS Fall 2023Document5 pagesCourse Outline AFS Fall 2023ASIMLIBNo ratings yet

- IB GP StarbucksDocument4 pagesIB GP Starbucksme khudNo ratings yet