Professional Documents

Culture Documents

Chapter 4 Governmental Accounting

Uploaded by

mohamad ali osmanCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Chapter 4 Governmental Accounting

Uploaded by

mohamad ali osmanCopyright:

Available Formats

CHAPTER 4

ACCOUNTS OF STATE CORPORATION

State corporations are established in every Country according to the provision of state

corporation account. Some state corporations have been established by special acts of parliament.

State corporations established in every country include the following:-

1. Airways

2. Ports Authority

3. Post Office Saving Bank

4. Posts and Telecommunications

5. Railways

6. Power and Lighting Company Ltd.

Some of these corporations may be privatized in near future. At present, state corporations enjoy

monopolistic rights in their business or rendering service to the community. These under takings

require a huge amount of capital which is mostly fixed and sunk i.e. once invested in fixed assets

can’t ordinarily be got back. As a greater part of this capital is raised from the public, hence such

concerns are normally bound to give full information to the public in order to show how the

amount of capital was utilized in acquiring fixed assets.

Main provisions of the state corporations account in respected of annual accounts are stated as

under:-

1. States that every state corporation should prepare its revenue and expenditure account for the

financial year not later than the end of in every year. This account should be accompanied by

proposals for funding all projects to be undertaken by the corporation in the following year.

All annual estimates and proposals for funding projects should not be implemented until they

have been approved by the ministry and the treasury.

2. Every state corporation should keep proper books in order to record the property,

undertakings, funds, activities contracts, transactions and other business of the state

GOVERNMENTAL ACCOUNTING Page 1

corporation.

3. The accounts of every state corporation should be audited and reported on annually by the

auditor general (Corporations) in accordance with of the Exchequer and Audit Act.

4. The board of State Corporation is responsible for the proper management of the affairs of a

state corporation and accountable for the moneys.

5. Every state corporation should make provision for the renewal of depreciating assets by the

establishment of the sinking funds and for the contributions to such reserve and stabilization

funds as may be necessary.

Final accounts of state corporations

Final accounts of the state corporations consist of the following:-

1. Revenue Account

This account is also called as revenue and expenditure Account. This account shows the details

of total income and expenditure of a state corporation for particular financial year. It is prepared

in lieu of Profit and Loss Account.

2. Net Revenue Account

This account is prepared by some corporations. It is prepared in lieu of appropriation of Profit

and Loss Account.

3. Balance sheet

Balance sheet of State Corporation gives the details of the assets and liabilities of the corporation

at a specific date. In some countries e.g. India, the balance sheet of State Corporation is divided

in to two parts viz. the Capital Account and General Balance Sheet. This way of presenting the

balance sheet is called the Double Accounting System. Capital account on the debit side shows

the capital expenditure incurred on the acquisition of fixed assets and on credit side shows the

receipt on capital account such as shares, debentures, and fixed loans e.t.s. The General Balance

sheet shows the balance of capital account and current liabilities side and current assets on the

asset side.

GOVERNMENTAL ACCOUNTING Page 2

Example 1: The following balances were extracted from the books of African post and

Telecommunication Corporation for the year ended 31st December 1997.

Trial Balance

Particular Dr Cr

$(000) $(000)

Equity 75,200

General reserve- surplus retained 1,278,600

Pension liability fund 151,300

Loans 10,253,500

Land and buildings 2,451,700

Plant and machinery 10,695,900

Motor vehicles 451,700

Furniture and office equipment 252,750

Investment 572,850

Pension liability fund (cost) 271,400

Debtors – services 551,900

Short term deposits 351,600

Cash and cash balance 250,700

Creditors – services 1,312,400

Stock – stores 545,600

Depreciation provision of fixed assets 2,421,400

Postal revenue 451,500

Telephone revenue 2,252,800

Miscellaneous revenue 842,700

Administration expenses 254,700

Operational expenses 670,500

International services expenses 845,700

Miscellaneous expenses 421,500

Maintenance expenses 78,200

Loan interest 372,800

19,039,500 19,039,500

Additional information

Provisions are to be made as under:-

a. Depreciation $453,400

b. Pension liability $175,600

c. Provision for corporation tax $535,400

d. Dividends $238,500

Required:

Prepare the revenue account, net revenue account of African post and Telecommunication

Corporation for the year ended 31st December 1997 and a balance sheet on that date.

GOVERNMENTAL ACCOUNTING Page 3

Solution

African post and Telecommunication Corporation

Revenue Account

For the year ended 31st December 1997

Expenditure $(000) Revenue $(000)

Administration 535,400 Postal 451,500

Operational 670,500 Telephone 2,252,500

International services 845,700 Miscellaneous 842,700

Miscellaneous expenses 421,500

Maintenance 78,200

Loan interest 372,800

Depreciation 453,800

Pension liability 175,600

Surplus c/d t net

revenue account 274,600

3,547,000 3,547,000

Working

1. Surplus c/d to net revenue account = revenue – expenses

3,547,000 – 3,272,400 = 274,400

Net Revenue Account

For the year ended 31st December 1997

$ $

(000) (000)

Corporation tax 535,400 Surplus transferred from

Dividend – proposed 238,500 revenue account 274,600

Retained surplus bal: c/f 779,300 Retained surplus bal: b/f 1,278,600

1,553,200 1,553,200

Working

1. Retained surplus bal: c/f = 1,553,300 – 773,900 = 779,300

GOVERNMENTAL ACCOUNTING Page 4

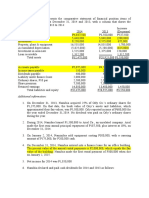

Balance sheet

As at 31st December 1997

$ (000) $ (000)

Fixed Assets

Land and buildings 2,451,700 Equity 75,200

Plant & machinery 10,695,900 General reserve

Motor vehicles 451,700 - Retained surplus 779,300

Furniture & office Loans 10,253,500

equipment 251,750 Pension liability fund 326,900

13,852,050 Current liabilities

Less depreciation (2,874,900) Creditors 1,312,400

10,977,150 Corporation tax 535,400

Investment 572,850 Proposed dividends 238,500

Pension liability

fund (cost) 271,400

Current Assets

Stock store 545,600

Debtors 55,900

Short term deposit 351,600

Cash and bank balance 250,700 13,521,200

13,521,200

Working

1. Depreciation provision = 2,421,500 + 453,400 = 2,874,900

2. Pension liability fund = 151,300 + 175,600 = 326,900

GOVERNMENTAL ACCOUNTING Page 5

You might also like

- Chapter 4 Governmental AccountingDocument8 pagesChapter 4 Governmental Accountingmohamad ali osmanNo ratings yet

- Cash ExampleDocument1 pageCash ExampleFRANCIS IAN ALBARACIN IINo ratings yet

- ACCT 2105 Tutorial Exercises - Topic 4 - Income StatementDocument8 pagesACCT 2105 Tutorial Exercises - Topic 4 - Income StatementHoàng Trọng HiếuNo ratings yet

- Complete Financial Statements With SCF Direcdt MethodDocument23 pagesComplete Financial Statements With SCF Direcdt MethodJuja FlorentinoNo ratings yet

- Template - MIDTERM EXAM INTERMEDIATE 1Document7 pagesTemplate - MIDTERM EXAM INTERMEDIATE 1Rani RahayuNo ratings yet

- Financial Reporting Tutorial QSN Solutions 2021 JC JaftoDocument31 pagesFinancial Reporting Tutorial QSN Solutions 2021 JC JaftoInnocent GwangwaraNo ratings yet

- Final Proj Sy2022-23 Agrigulay Corp.Document4 pagesFinal Proj Sy2022-23 Agrigulay Corp.Jan Elaine CalderonNo ratings yet

- Section B:: 1. Are The Following Balance Sheet Items (A) Assets, (L) Liabilities, or (E) Stockholders' Equity?Document11 pagesSection B:: 1. Are The Following Balance Sheet Items (A) Assets, (L) Liabilities, or (E) Stockholders' Equity?18071369 Nguyễn ThànhNo ratings yet

- Cash Flow Tutorial QnsDocument13 pagesCash Flow Tutorial QnsCristian Renatus100% (1)

- CH 5Document2 pagesCH 5tigger5191No ratings yet

- Additional InformationDocument6 pagesAdditional InformationBabylyn NavarroNo ratings yet

- Camille ManufacturingDocument4 pagesCamille ManufacturingChristina StephensonNo ratings yet

- Competency AssessmentDocument5 pagesCompetency AssessmentMiracle FlorNo ratings yet

- Cash Flows from Operating, Investing, & Financing Activities of Lesotho CoDocument4 pagesCash Flows from Operating, Investing, & Financing Activities of Lesotho CoKarlo D. ReclaNo ratings yet

- Acc 291 Acc 291 Acc 291 Acc 291 Acc 291 Acc 291Document201 pagesAcc 291 Acc 291 Acc 291 Acc 291 Acc 291 Acc 291290acc100% (2)

- ACC705 Corporate Accounting AssignmentDocument9 pagesACC705 Corporate Accounting AssignmentMuhammad AhsanNo ratings yet

- Bank AccountingDocument8 pagesBank Accountinggordonomond2022No ratings yet

- Forever Young Campsite Projected Trading Profit & Loss Account For The Period Ended 31St DecemberDocument4 pagesForever Young Campsite Projected Trading Profit & Loss Account For The Period Ended 31St DecembermwauracoletNo ratings yet

- Cash Flow AnalysisDocument4 pagesCash Flow AnalysisMargin Pason RanjoNo ratings yet

- 2 Exercises On FS 2023-2024 Additional For GformDocument2 pages2 Exercises On FS 2023-2024 Additional For GformAmelia Dela CruzNo ratings yet

- MC 2 - A201 - QuestionDocument6 pagesMC 2 - A201 - Questionlim qsNo ratings yet

- Advanced Accounting Part 2 Take Home Activity: - Total Present Value)Document3 pagesAdvanced Accounting Part 2 Take Home Activity: - Total Present Value)Airille CarlosNo ratings yet

- Soal Mojakoe-UTS Akuntansi Keuangan 1 Ganjil 2020-2021Document9 pagesSoal Mojakoe-UTS Akuntansi Keuangan 1 Ganjil 2020-2021Vincenttio le CloudNo ratings yet

- Corporate LiquidationDocument3 pagesCorporate LiquidationJasmine Marie Ng CheongNo ratings yet

- Excel Academy Financial StatementsDocument5 pagesExcel Academy Financial Statementsfaith olaNo ratings yet

- Class Problems CH 4Document9 pagesClass Problems CH 4Eduardo Negrete100% (2)

- 2020 1 Accounting in Organisations and Society Assignment-3Document7 pages2020 1 Accounting in Organisations and Society Assignment-3Abs PangaderNo ratings yet

- Incomplete Records MTQDocument5 pagesIncomplete Records MTQqas4476pubNo ratings yet

- SME Financial StatementsDocument15 pagesSME Financial StatementsJatha JamolodNo ratings yet

- CFAB - Accounting - QB - Chapter 13Document14 pagesCFAB - Accounting - QB - Chapter 13Huy NguyenNo ratings yet

- UAS PA 2020-2021 Ganjil - JawabanDocument27 pagesUAS PA 2020-2021 Ganjil - JawabanNuruddin AsyifaNo ratings yet

- Partnership Board ReviewerDocument13 pagesPartnership Board ReviewerRobert ApolinarNo ratings yet

- 17769cash Flow Practice QuestionsDocument8 pages17769cash Flow Practice QuestionsirmaNo ratings yet

- Financial Reporting and Analysis End-Term Examination Answer ALL Questions. Show Your WorkingsDocument5 pagesFinancial Reporting and Analysis End-Term Examination Answer ALL Questions. Show Your WorkingsUrvashi BaralNo ratings yet

- 8447809Document11 pages8447809blackghostNo ratings yet

- Balance SheetDocument18 pagesBalance SheetAndriaNo ratings yet

- Chapter 1 11 IA3Document10 pagesChapter 1 11 IA3ZicoNo ratings yet

- Corporate Liquidation DFCAMCLPDocument13 pagesCorporate Liquidation DFCAMCLPJessaNo ratings yet

- Cap III Group I RTP Dec 2023Document111 pagesCap III Group I RTP Dec 2023meme.arena786No ratings yet

- IA 3 Final Assessment PDFDocument5 pagesIA 3 Final Assessment PDFJoy Miraflor Alinood100% (1)

- Problem 1: Partially Secured UnsecuredDocument2 pagesProblem 1: Partially Secured UnsecuredYahlianah LeeNo ratings yet

- Chap 010Document19 pagesChap 010AshutoshNo ratings yet

- Ipsas 1 and Ipsas 2Document6 pagesIpsas 1 and Ipsas 2Esther AkpanNo ratings yet

- PIMSAT Financial Accounting Quiz Chapter IIDocument7 pagesPIMSAT Financial Accounting Quiz Chapter IIRavenna Dela CruzNo ratings yet

- AFAR Corporate LiquidationDocument4 pagesAFAR Corporate LiquidationAndres, Rebecca PaulaNo ratings yet

- Corporate LiquidationDocument4 pagesCorporate LiquidationBianca IyiyiNo ratings yet

- Fabm Peta 3Document4 pagesFabm Peta 3JEWEL LHIEME ARCILLANo ratings yet

- Menyusun Laporan KeuanganDocument18 pagesMenyusun Laporan KeuanganAngelaNo ratings yet

- ACW1120-Week 5 Practice Q-Topic 5-Prepare FSDocument8 pagesACW1120-Week 5 Practice Q-Topic 5-Prepare FSGan ZhengweiNo ratings yet

- I Fitness Venture StandaloneDocument15 pagesI Fitness Venture StandaloneThe keyboard PlayerNo ratings yet

- RequiredDocument11 pagesRequiredKean Brean GallosNo ratings yet

- Closing EntriesDocument10 pagesClosing EntriesFranco DexterNo ratings yet

- 5.2. Unit 5 AAB AP A2 Report SunDocument5 pages5.2. Unit 5 AAB AP A2 Report SunHằng Nguyễn ThuNo ratings yet

- Adjusting EntriesDocument5 pagesAdjusting EntriesM Hassan BrohiNo ratings yet

- Assignment 6 SolutionsDocument4 pagesAssignment 6 SolutionsjoanNo ratings yet

- Prelim Exam Part 2 SolutionsDocument4 pagesPrelim Exam Part 2 SolutionseaeNo ratings yet

- Item (A) Type of Adjustment (B) Accounts Before AdjustmentDocument11 pagesItem (A) Type of Adjustment (B) Accounts Before Adjustmentsuci monalia putriNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- J.K. Lasser's Small Business Taxes 2007: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2007: Your Complete Guide to a Better Bottom LineNo ratings yet

- Chapter 3 Quantitative Method Fo BusinessDocument11 pagesChapter 3 Quantitative Method Fo Businessmohamad ali osmanNo ratings yet

- Chapter 10 International Finance and AccountingDocument7 pagesChapter 10 International Finance and Accountingmohamad ali osmanNo ratings yet

- Advanced Management AccountingDocument204 pagesAdvanced Management Accountingmohamad ali osman100% (1)

- International Accounting and FinanceDocument101 pagesInternational Accounting and Financemohamad ali osmanNo ratings yet

- Acc6155 E1Document7 pagesAcc6155 E1mohamad ali osmanNo ratings yet

- Chapter 7 Governmental AccountingDocument6 pagesChapter 7 Governmental Accountingmohamad ali osmanNo ratings yet

- Chapter 3 Adavanced Managerail AccountingDocument7 pagesChapter 3 Adavanced Managerail Accountingmohamad ali osmanNo ratings yet

- Chapter 3 Intermediate AccountingDocument12 pagesChapter 3 Intermediate Accountingmohamad ali osmanNo ratings yet

- Calicut University Public FinanceDocument114 pagesCalicut University Public FinanceVishnu GirishNo ratings yet

- Overhead variances calculationDocument26 pagesOverhead variances calculationmohamad ali osmanNo ratings yet

- Chapter 4 Intermediate AccountingDocument5 pagesChapter 4 Intermediate Accountingmohamad ali osmanNo ratings yet

- Chapter 2 Problem Governmental AccountingDocument2 pagesChapter 2 Problem Governmental Accountingmohamad ali osmanNo ratings yet

- Chapter 3 Intermediate AccountingDocument12 pagesChapter 3 Intermediate Accountingmohamad ali osmanNo ratings yet

- The Effect of Mobile Banking on Customer Satisfaction in Selected Banks in MogadishuDocument64 pagesThe Effect of Mobile Banking on Customer Satisfaction in Selected Banks in Mogadishumohamad ali osmanNo ratings yet

- Job OrderCosting 000Document8 pagesJob OrderCosting 000raesharorooNo ratings yet

- Microsoft Excel: PreadsheetDocument4 pagesMicrosoft Excel: Preadsheetmohamad ali osmanNo ratings yet

- Chapter 5 Governmental AccountingDocument9 pagesChapter 5 Governmental Accountingmohamad ali osmanNo ratings yet

- Governamental Acounting - For LectureDocument94 pagesGovernamental Acounting - For Lecturemohamad ali osmanNo ratings yet

- Chapter 7 Governmental AccountingDocument6 pagesChapter 7 Governmental Accountingmohamad ali osmanNo ratings yet

- Chapter 2 Governmental AccountingDocument14 pagesChapter 2 Governmental Accountingmohamad ali osmanNo ratings yet

- UTH homework template for English exercisesDocument8 pagesUTH homework template for English exercisesCinthya Peña de MezaNo ratings yet

- Petroleum Research: Khalil Shahbazi, Amir Hossein Zarei, Alireza Shahbazi, Abbas Ayatizadeh TanhaDocument15 pagesPetroleum Research: Khalil Shahbazi, Amir Hossein Zarei, Alireza Shahbazi, Abbas Ayatizadeh TanhaLibya TripoliNo ratings yet

- IFCRecruitment Manual 2009Document52 pagesIFCRecruitment Manual 2009Oklahoma100% (3)

- Amelia Wills CV 2021 VDocument4 pagesAmelia Wills CV 2021 Vapi-446566858No ratings yet

- Architecture Floor Plan Abbreviations AnDocument11 pagesArchitecture Floor Plan Abbreviations AnGraphitti Koncepts and DesignsNo ratings yet

- MSDS Hygisoft Surface Disinfectant, Concentrate - PagesDocument5 pagesMSDS Hygisoft Surface Disinfectant, Concentrate - PagesDr. Omar Al-AbbasiNo ratings yet

- Evosys Fixed Scope Offering For Oracle Fusion Procurement Cloud ServiceDocument12 pagesEvosys Fixed Scope Offering For Oracle Fusion Procurement Cloud ServiceMunir AhmedNo ratings yet

- A. Pawnshops 4. B. Pawner 5. C. Pawnee D. Pawn 6. E. Pawn Ticket 7. F. Property G. Stock H. Bulky Pawns 8. I. Service Charge 9. 10Document18 pagesA. Pawnshops 4. B. Pawner 5. C. Pawnee D. Pawn 6. E. Pawn Ticket 7. F. Property G. Stock H. Bulky Pawns 8. I. Service Charge 9. 10Darwin SolanoyNo ratings yet

- Fabric Trademark and Brand Name IndexDocument15 pagesFabric Trademark and Brand Name Indexsukrat20No ratings yet

- CartridgeDocument26 pagesCartridgeMnavya SaiNo ratings yet

- Foreign AidDocument4 pagesForeign AidJesse JhangraNo ratings yet

- BS KashmiryatDocument67 pagesBS KashmiryatWaqas AhmedNo ratings yet

- Policy Based Routing On Fortigate FirewallDocument2 pagesPolicy Based Routing On Fortigate FirewalldanNo ratings yet

- QRT1 WEEK 8 TG Lesson 22Document5 pagesQRT1 WEEK 8 TG Lesson 22Bianca HernandezNo ratings yet

- Proposal to Enhance Science InstructionDocument4 pagesProposal to Enhance Science InstructionAzzel ArietaNo ratings yet

- Differentiated Lesson PlanningDocument2 pagesDifferentiated Lesson Planningapi-398854125No ratings yet

- MarketNexus Editor: Teri Buhl Character LetterDocument2 pagesMarketNexus Editor: Teri Buhl Character LetterTeri BuhlNo ratings yet

- Joyce2016 PDFDocument13 pagesJoyce2016 PDFAffan ArrizqiNo ratings yet

- Return Snowball Device SafelyDocument1 pageReturn Snowball Device SafelyNoneNo ratings yet

- Arts, Sciences& Technology University in Lebanon: Clinical Booking WebsiteDocument25 pagesArts, Sciences& Technology University in Lebanon: Clinical Booking WebsiteTony SawmaNo ratings yet

- OUM Human Anatomy Final Exam QuestionsDocument5 pagesOUM Human Anatomy Final Exam QuestionsAnandNo ratings yet

- Update in Living Legal Ethics - Justice Dela CruzDocument13 pagesUpdate in Living Legal Ethics - Justice Dela CruzRobert F Catolico IINo ratings yet

- 7) Set 3 Bi PT3 (Answer) PDFDocument4 pages7) Set 3 Bi PT3 (Answer) PDFTing ShiangNo ratings yet

- Types of Companies Classified by Incorporation, Membership, Liability and ControlDocument11 pagesTypes of Companies Classified by Incorporation, Membership, Liability and ControlPrasad BulbuleNo ratings yet

- ENGLISH 7 FIRST QUARTER EXAMDocument2 pagesENGLISH 7 FIRST QUARTER EXAMAlleli Faith Leyritana100% (1)

- Terms of Engagement - TMCS - GoldDocument14 pagesTerms of Engagement - TMCS - GoldPriyank KulshreshthaNo ratings yet

- Kepler's ProblemDocument21 pagesKepler's ProblemGustavo MiasatoNo ratings yet

- What Is The Time Value of MoneyDocument6 pagesWhat Is The Time Value of MoneySadia JuiNo ratings yet

- Emerson Field Tools Quick Start GuideDocument48 pagesEmerson Field Tools Quick Start Guidepks_2410No ratings yet

- Reliability and CredibilityDocument1 pageReliability and CredibilitycedrictuasonNo ratings yet